Is Fake IG safe?

Business

License

Is Fake IG A Scam?

Introduction

Fake IG, a name that has recently surfaced in discussions about forex trading, claims to offer a range of trading services, including forex, commodities, and indices. However, in an industry rife with scams and fraudulent activities, it is crucial for traders to exercise caution when evaluating brokers. The significance of assessing the legitimacy of a trading platform cannot be overstated, as it directly impacts the safety of traders' funds and the overall trading experience. This article employs a structured evaluation framework, combining narrative analysis and factual data, to determine whether Fake IG is a scam or a legitimate trading entity.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in assessing its legitimacy. A well-regulated broker is typically subject to strict oversight, which helps protect traders' interests. In the case of Fake IG, there are significant concerns regarding its regulatory compliance. The broker does not appear to be registered with any reputable financial authority, raising red flags about its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulatory oversight means that traders engaging with Fake IG are exposed to considerable risks. Legitimate brokers are often required to adhere to stringent capital requirements and maintain client funds in segregated accounts. Fake IG's lack of transparency in this regard further heightens concerns about its trustworthiness. Historically, unregulated brokers have a higher propensity for fraudulent activities, making it imperative for traders to remain vigilant.

Company Background Investigation

Fake IG's background is shrouded in ambiguity, which is typical of many fraudulent brokers. Established claims about its operational history, ownership structure, and management team often lack substantial evidence. Unlike reputable brokers that provide detailed information about their founders and corporate structure, Fake IG appears to operate with minimal transparency.

The management team's background is another critical aspect that requires scrutiny. A credible broker usually boasts a team of professionals with extensive experience in finance and trading. However, Fake IG does not provide any verifiable information about its team, which is a common tactic used by scammers to avoid accountability. The lack of transparency and information disclosure raises serious doubts about the broker's legitimacy and reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Fake IG claims to provide competitive trading costs; however, the specifics of these costs remain unclear. A lack of transparency in fee structures can often indicate potential hidden costs that may adversely affect traders.

| Fee Type | Fake IG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.6 - 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight fees is concerning. Traders may find themselves facing unexpected charges, which could significantly impact their trading profitability. Additionally, the lack of a transparent fee structure is a common characteristic of fraudulent brokers, making it difficult for traders to assess their potential trading costs accurately.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Legitimate brokers implement stringent measures to protect traders' investments, such as segregating client funds and offering investor protection schemes. However, the situation with Fake IG raises significant concerns.

Fake IG does not provide any information regarding its fund safety measures. Without clear indications of fund segregation or investor protection, traders are left vulnerable to potential losses. Historical records indicate that many unregulated brokers have been involved in fund misappropriation, leading to substantial financial losses for their clients. Hence, the absence of such critical safety measures further solidifies the argument that Fake IG poses significant risks to traders.

Customer Experience and Complaints

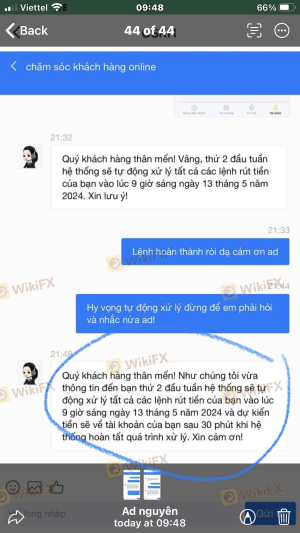

Analyzing customer feedback is essential for understanding the real-world experiences associated with a broker. Fake IG has garnered negative reviews from users who have reported issues ranging from unresponsive customer service to difficulties in withdrawing funds. Common complaint patterns often indicate systemic problems within a brokerage.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

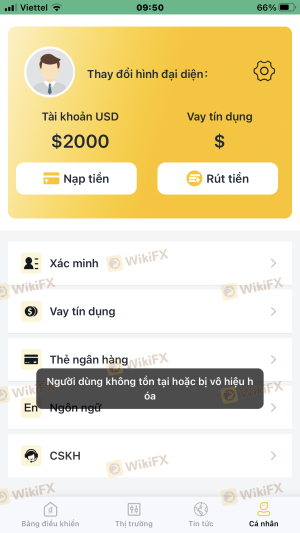

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Account Freezing | High | No Response |

The severity of complaints regarding withdrawal issues and unresponsive customer service raises significant concerns about the broker's operational integrity. For instance, some users have reported being unable to access their funds, leading to frustrations and financial losses. These patterns of complaints are often indicative of a broader issue of trust and reliability within the broker's operations.

Platform and Trade Execution

The performance of a trading platform is a critical factor in determining a broker's legitimacy. Traders expect a stable, fast, and user-friendly environment to execute their trades effectively. However, Fake IG's platform performance has been criticized for its instability and execution issues.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Such issues are often associated with brokers that prioritize their interests over those of their clients. The presence of these problems raises concerns about potential manipulation of trades, further solidifying the argument that Fake IG may not be a trustworthy broker.

Risk Assessment

Engaging with Fake IG presents various risks that traders must consider. The lack of regulation, transparency, and customer support coupled with widespread negative feedback creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of client fund protection measures. |

| Execution Risk | High | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to seek out well-regulated platforms that offer clear information about their operations, fees, and customer support.

Conclusion and Recommendations

In conclusion, the evidence presented strongly suggests that Fake IG operates as a scam. The broker's lack of regulatory oversight, transparency regarding trading conditions, and numerous customer complaints indicate a high level of risk for potential traders.

For traders seeking reliable alternatives, it is recommended to consider well-established brokers that are regulated by reputable authorities, offer transparent fee structures, and have positive customer feedback. Some reputable alternatives include IG Group, OANDA, and Forex.com, which have demonstrated a commitment to regulatory compliance and customer satisfaction.

In summary, given the numerous red flags associated with Fake IG, it is prudent for traders to exercise caution and seek safer trading environments.

Is Fake IG a scam, or is it legit?

The latest exposure and evaluation content of Fake IG brokers.

Fake IG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fake IG latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.