IQX Trade 2025 Review: Everything You Need to Know

Executive Summary

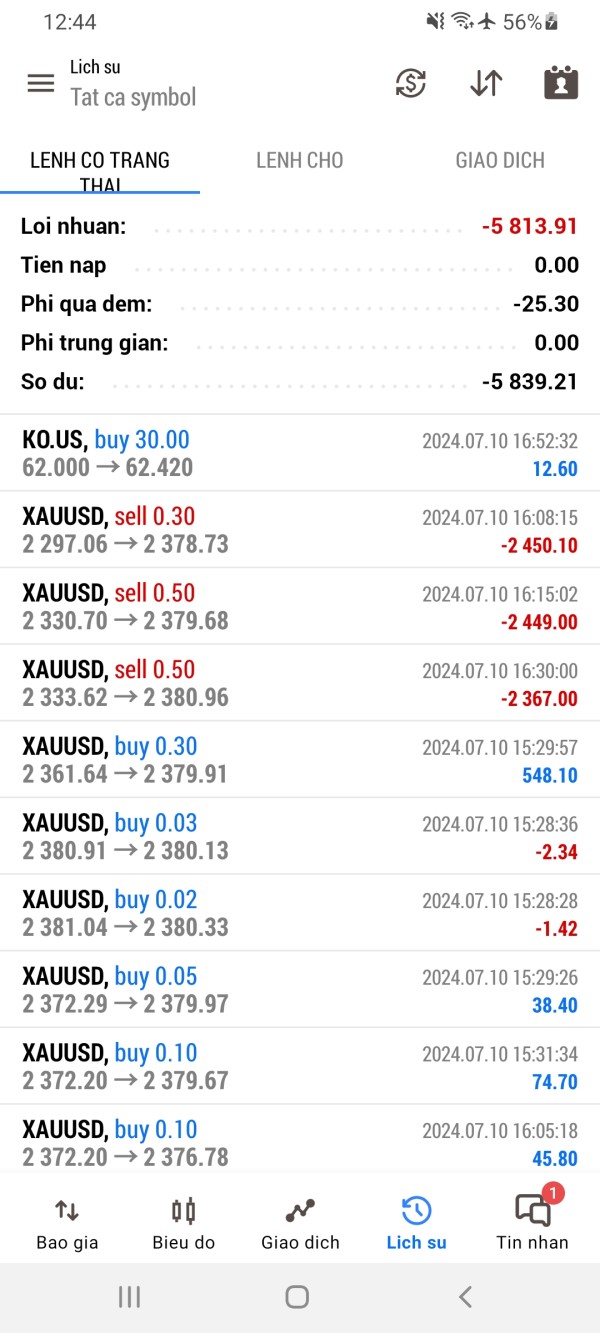

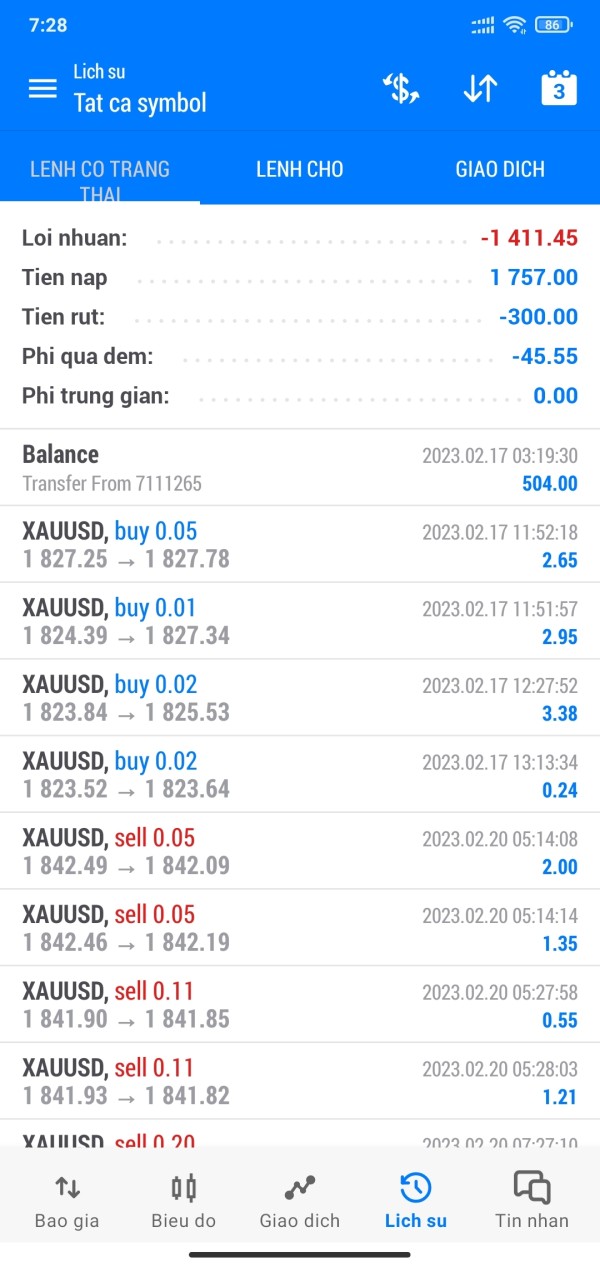

This comprehensive iqx trade review examines a broker that has raised serious concerns within the trading community. IQX Trade's legitimacy and safety are highly questionable, with user ratings showing major trust issues that cannot be ignored. The broker operates under Seychelles registration, which falls under offshore regulation that does not properly cover forex trading activities.

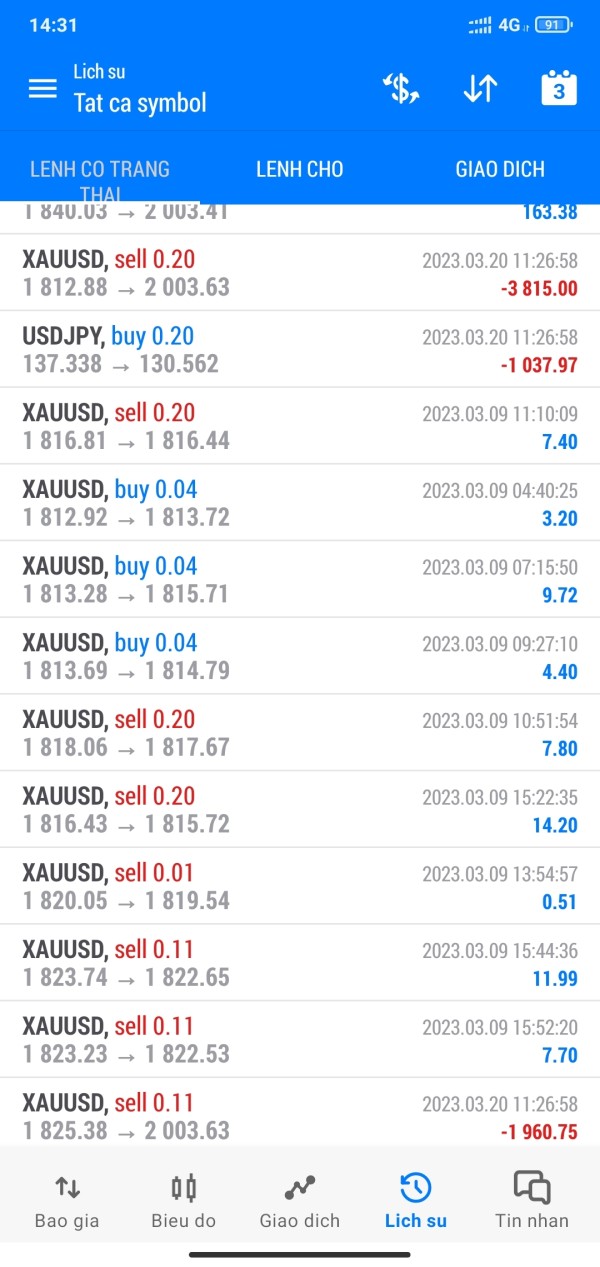

Despite these concerns, IQX Trade does offer some features that may appeal to certain traders. These include leverage up to 1:500 and the MT5 trading platform supporting multiple asset types. The broker provides access to forex, commodities, indices, stock CFDs, and cryptocurrencies, giving traders a wide range of options. However, these potential benefits are significantly overshadowed by the substantial regulatory and safety concerns.

The broker appears to target experienced traders seeking high-leverage trading opportunities. The associated risks make it unsuitable for most investors, especially those new to trading. With a TrustScore of just 1.19 and widespread user concerns about legitimacy, potential clients should exercise extreme caution when considering this broker. The minimum deposit requirement starts at $100 for standard accounts, while ECN accounts offer spreads from 0 pips, though commission structures lack transparency.

Important Notice

Regional Entity Differences: IQX Trade operates under Seychelles registration, which constitutes offshore regulation. According to available information, this regulatory status does not properly cover forex trading activities, raising serious questions about the broker's legal standing and client protection measures that should concern any potential investor.

Review Methodology: This evaluation is based on user feedback, public information, and available regulatory data. The assessment may not apply to all potential investors, and individuals should conduct their own research before making any investment decisions. Given the concerns surrounding this broker's legitimacy, potential clients are strongly advised to seek alternatives with proper regulatory oversight.

Rating Framework

Broker Overview

Company Background and Establishment

IQX Trade was established in 2023, making it a relatively new player in the forex and CFD trading space. The company's background information remains limited, with the broker mainly focusing on providing forex and CFD trading services through an offshore regulatory framework that raises immediate red flags. According to available sources, the company positions itself as a provider of leveraged trading opportunities across multiple asset classes.

The broker operates under a business model that relies on offshore regulation to provide forex and CFD trading services to international clients. However, the lack of detailed company background information and limited operational history raises serious concerns about transparency and corporate governance. The company's recent establishment combined with regulatory uncertainties creates additional risk factors for potential clients.

Trading Platform and Asset Coverage

IQX Trade uses the MetaTrader 5 (MT5) platform as its primary trading interface, which is recognized as an industry-standard platform. The platform offers comprehensive trading tools and technical analysis capabilities that most traders will find familiar. The platform supports multiple asset classes including forex pairs, commodities, stock indices, individual stock CFDs, and cryptocurrency instruments.

The broker's asset coverage spans major currency pairs, precious metals, energy commodities, global stock indices, and popular cryptocurrencies. However, the specific number of available instruments and the quality of execution across these asset classes remain unclear from available information. The MT5 platform integration suggests access to advanced charting tools, automated trading capabilities through Expert Advisors, and comprehensive market analysis features, though the actual implementation quality requires further verification.

Regulatory Status and Jurisdiction

IQX Trade operates under Seychelles registration, which falls under offshore regulatory jurisdiction. This regulatory framework does not properly cover forex trading activities, creating significant gaps in client protection and regulatory oversight that should alarm potential users.

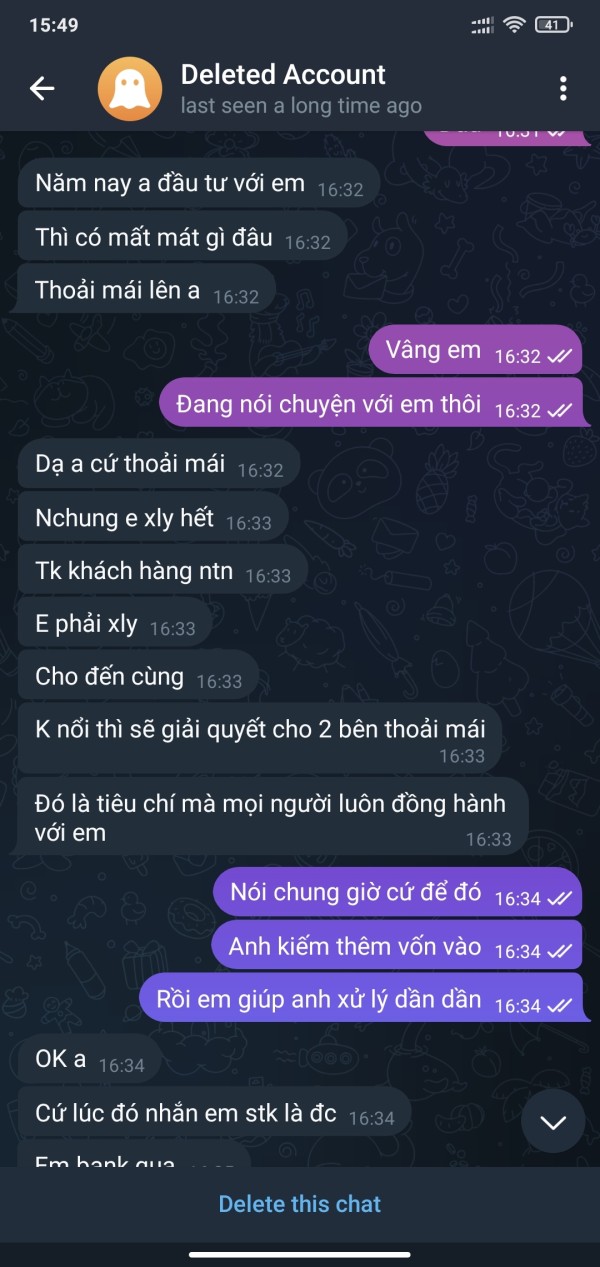

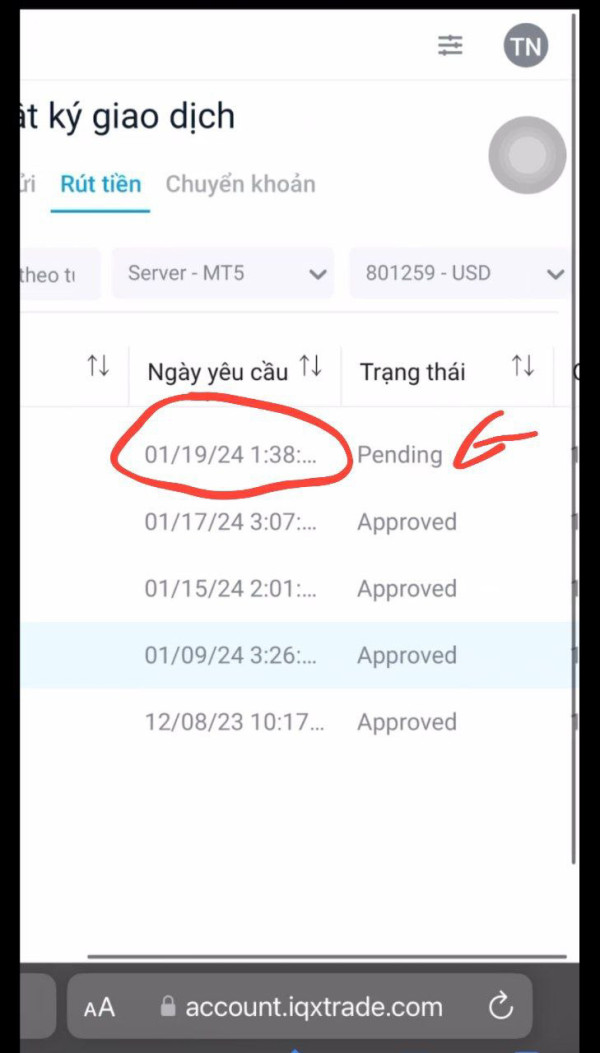

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods is not detailed in available sources. This lack of transparency regarding payment processing represents a serious concern for potential clients seeking reliable fund management options.

Minimum Deposit Requirements

The broker offers different account types with varying minimum deposit requirements that may appeal to different trader levels. Standard accounts require a minimum deposit of $100, making entry relatively accessible for new traders. However, swap-free accounts require a substantially higher minimum deposit of $5,000, which may limit accessibility for many traders.

Promotional Offers and Bonuses

Available information does not mention any specific bonus promotions or incentive programs offered by the broker. This absence of promotional details may indicate either a conservative approach to marketing or lack of comprehensive service offerings.

Available Trading Assets

IQX Trade provides access to multiple asset classes including forex currency pairs, commodity CFDs, stock index CFDs, individual stock CFDs, and cryptocurrency trading instruments. The diversity of available assets suggests comprehensive market coverage, though specific instrument counts and market depth remain unspecified in available documentation.

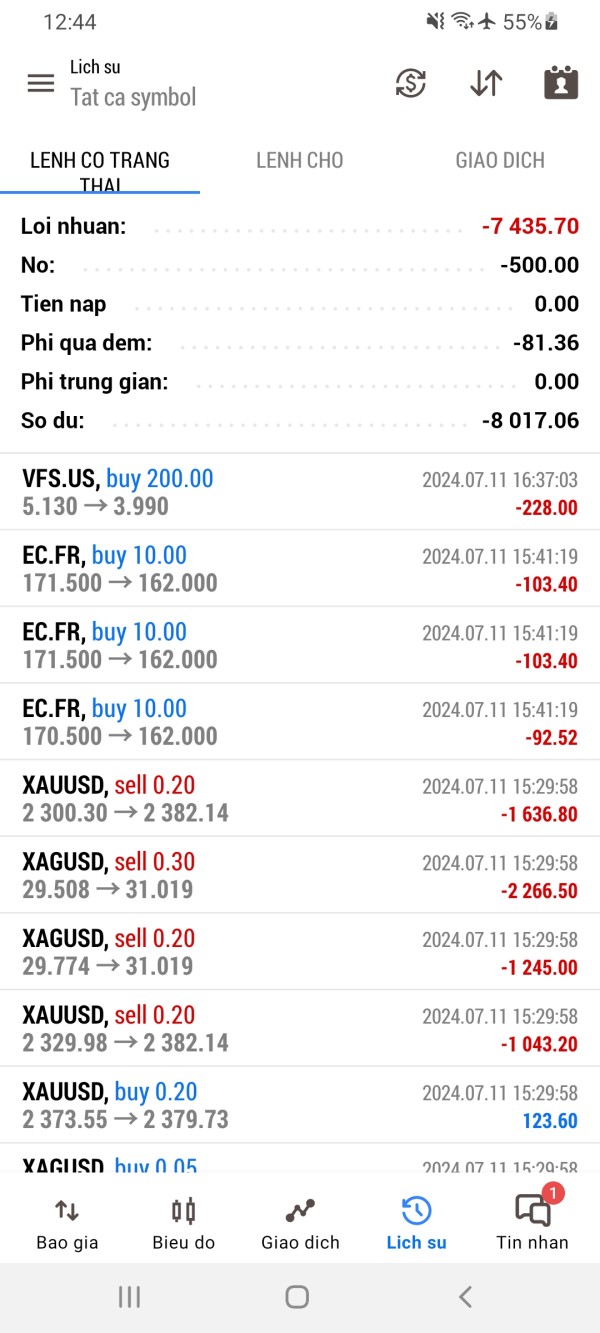

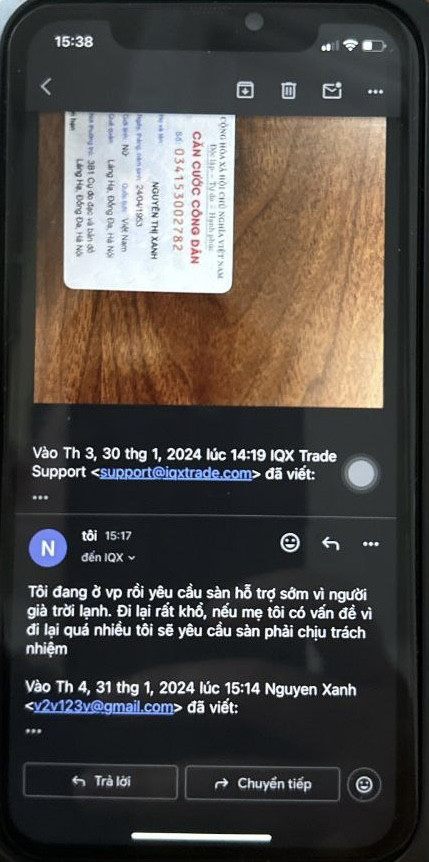

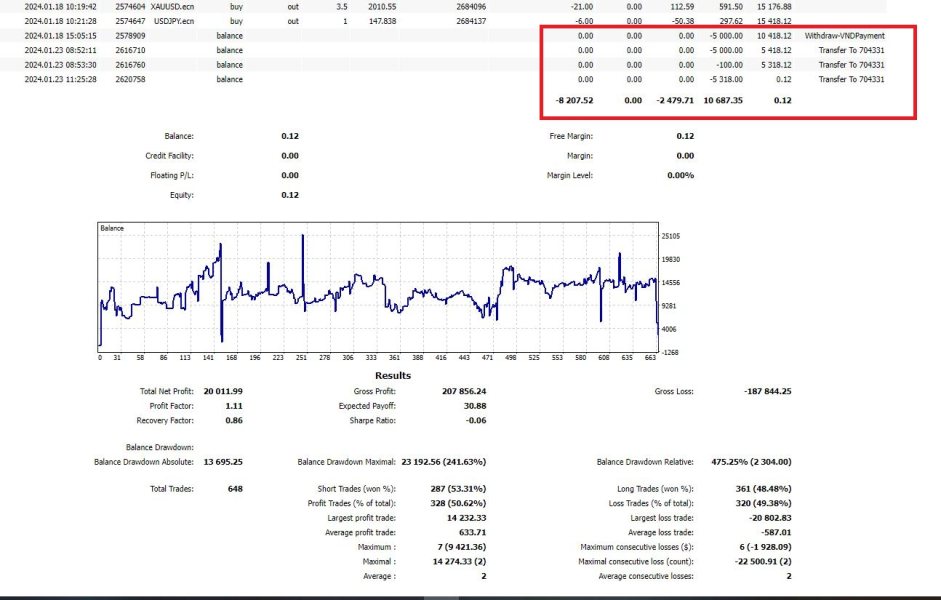

Cost Structure and Fees

ECN accounts offer spreads starting from 0 pips, which appears competitive on the surface for experienced traders. However, commission information is not clearly specified, creating uncertainty about the true cost of trading. This lack of fee transparency represents a significant concern for cost-conscious traders.

Leverage Ratios

The broker offers leverage up to 1:500, which provides significant trading power but also substantially increases risk exposure. Such high leverage ratios require careful risk management and are generally suitable only for experienced traders who understand the risks involved.

Platform Options

MT5 serves as the primary trading platform, supporting multi-asset trading capabilities that most traders expect. The platform choice suggests access to advanced trading tools, though specific customization options and additional platform features remain unspecified in available sources.

Geographic Restrictions

Specific information regarding geographic restrictions and service availability is not detailed in available sources. This creates uncertainty about global accessibility and may affect traders in certain regions.

Customer Support Languages

Available information does not specify supported customer service languages or communication options. This may impact international client support quality and accessibility for non-English speaking traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

Account Types and Features

This iqx trade review reveals that the broker offers multiple account types including standard accounts with a $100 minimum deposit and swap-free accounts requiring $5,000. While the lower entry threshold appears accessible for new traders, the significant jump to premium account levels may limit options for intermediate investors who fall between these categories.

The lack of detailed commission information significantly impacts transparency and makes it difficult for traders to accurately calculate trading costs. This opacity in fee structures represents a major weakness in account conditions, as traders cannot make informed decisions about the true cost of their trading activities.

Account Opening Process

Available sources do not provide specific details about the account opening process, including required documentation, verification procedures, or timeline for account activation. This lack of procedural transparency raises concerns about operational efficiency and regulatory compliance that potential clients should consider carefully.

Special Account Features

While swap-free accounts are mentioned, suggesting some accommodation for Islamic trading principles, comprehensive details about special account features are not available. Information about any VIP or institutional account options is also missing from the source material.

Trading Tools Quality and Variety

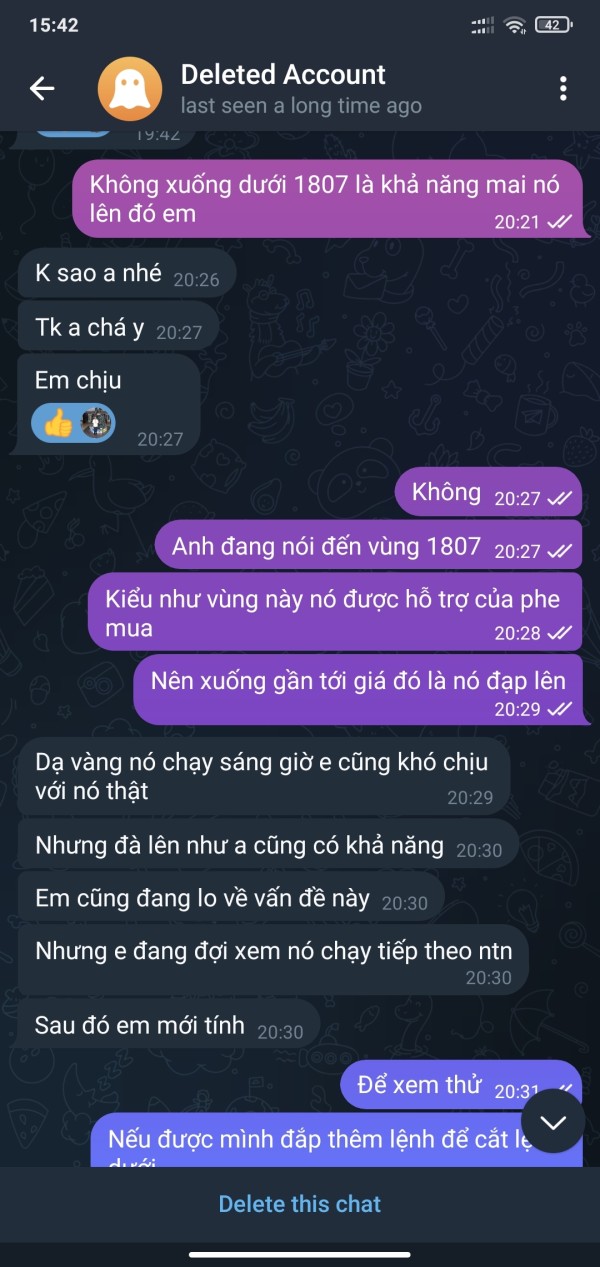

IQX Trade provides access to multiple trading instruments across various asset classes, including forex, commodities, and indices. The MT5 platform integration suggests availability of comprehensive technical analysis tools, automated trading capabilities, and advanced charting features that experienced traders typically require.

However, the quality and reliability of these tools remain questionable given the overall concerns about the broker's legitimacy. Users have expressed dissatisfaction with tool effectiveness, suggesting that while the platform may offer standard MT5 functionality, the implementation or execution quality may be substandard.

Research and Analysis Resources

Available information does not detail the quality or comprehensiveness of research and analysis resources provided by the broker. This absence of analytical support represents a significant limitation for traders who rely on broker-provided market insights and research to make informed trading decisions.

Educational Resources

The lack of information about educational resources indicates potential deficiencies in trader support and development programs. For a broker targeting experienced traders, the absence of comprehensive educational materials represents a missed opportunity for client development and support.

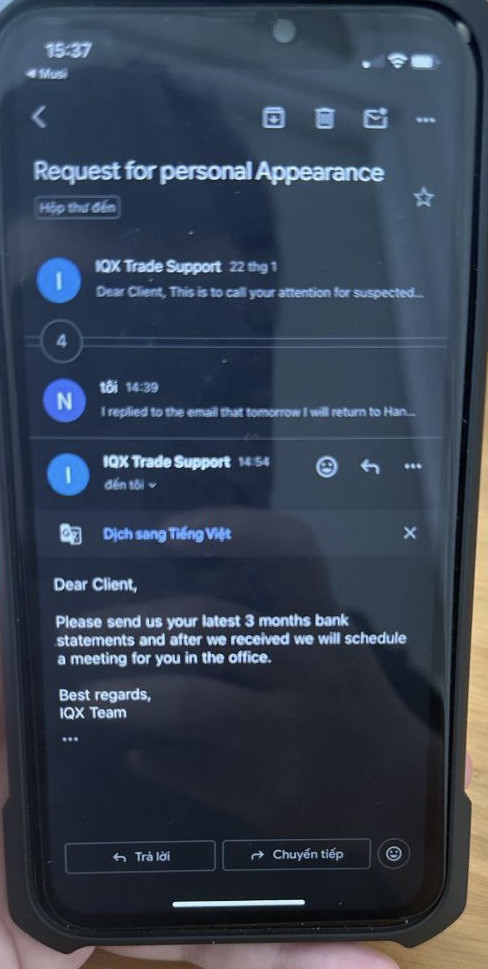

Customer Service and Support Analysis (Score: 4/10)

Service Channels and Availability

Available sources do not specify the customer service channels offered by IQX Trade, including whether support is available through phone, email, live chat, or other communication methods. This lack of clarity about support accessibility represents a significant service weakness that could affect trader satisfaction.

Response Quality and Timeliness

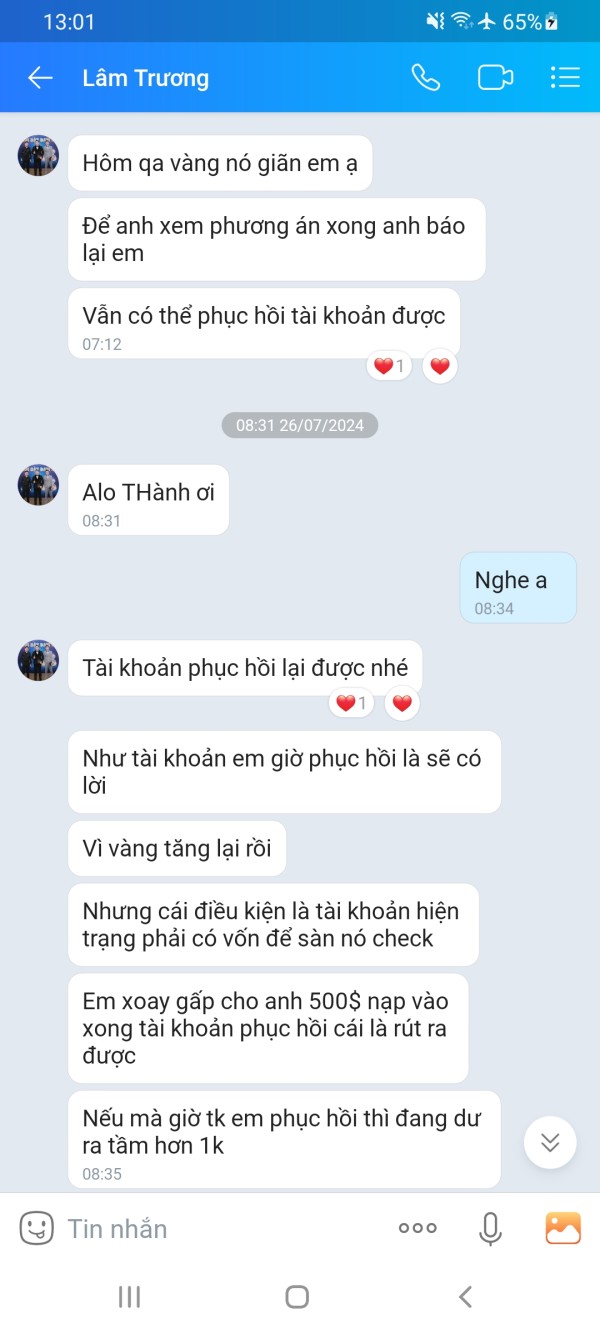

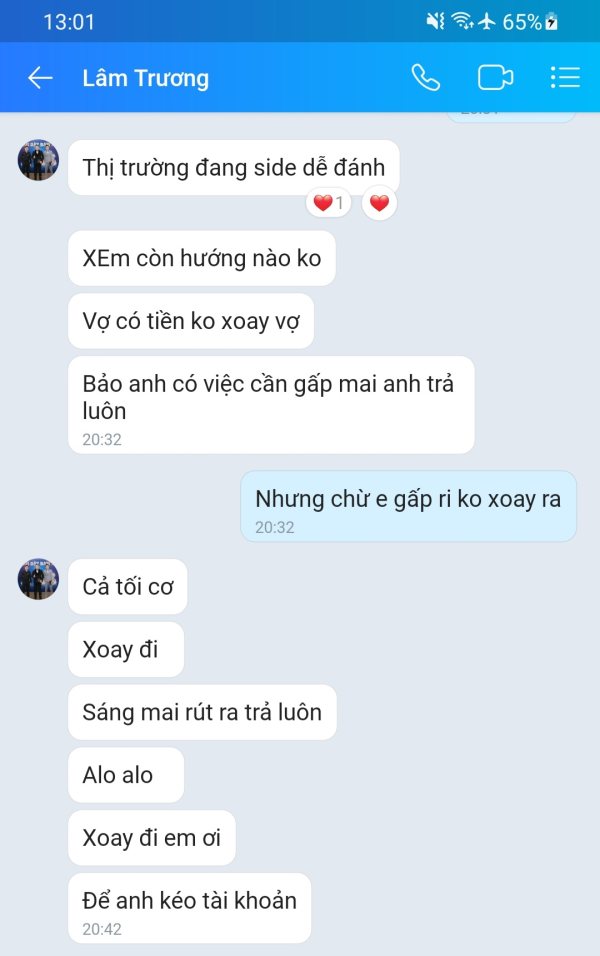

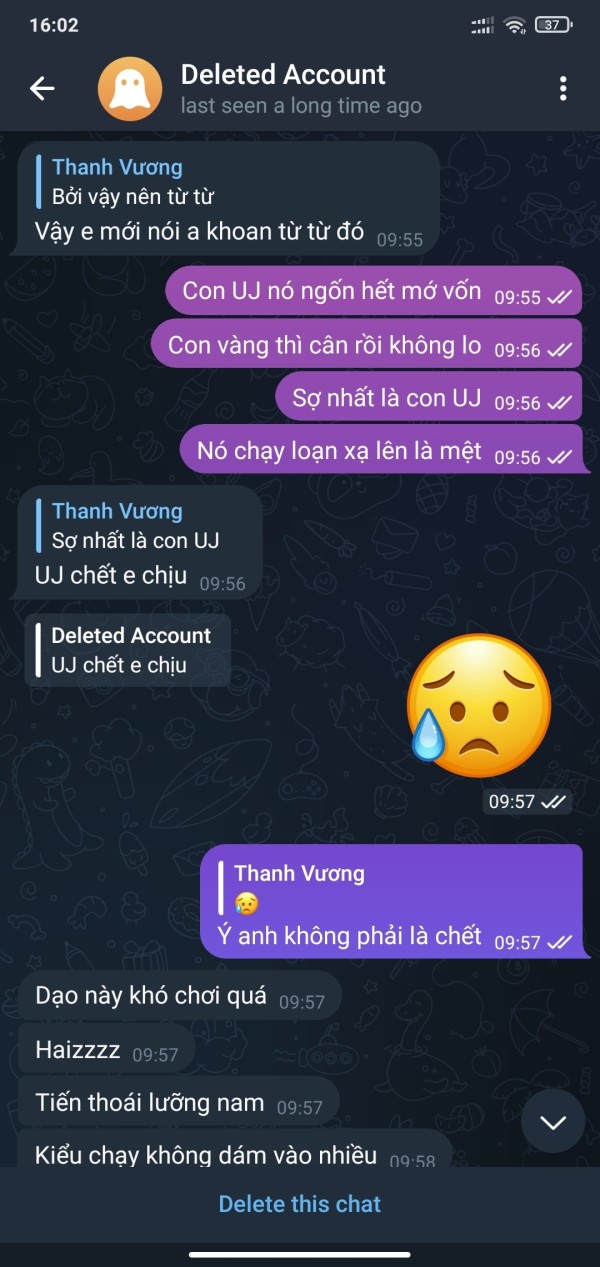

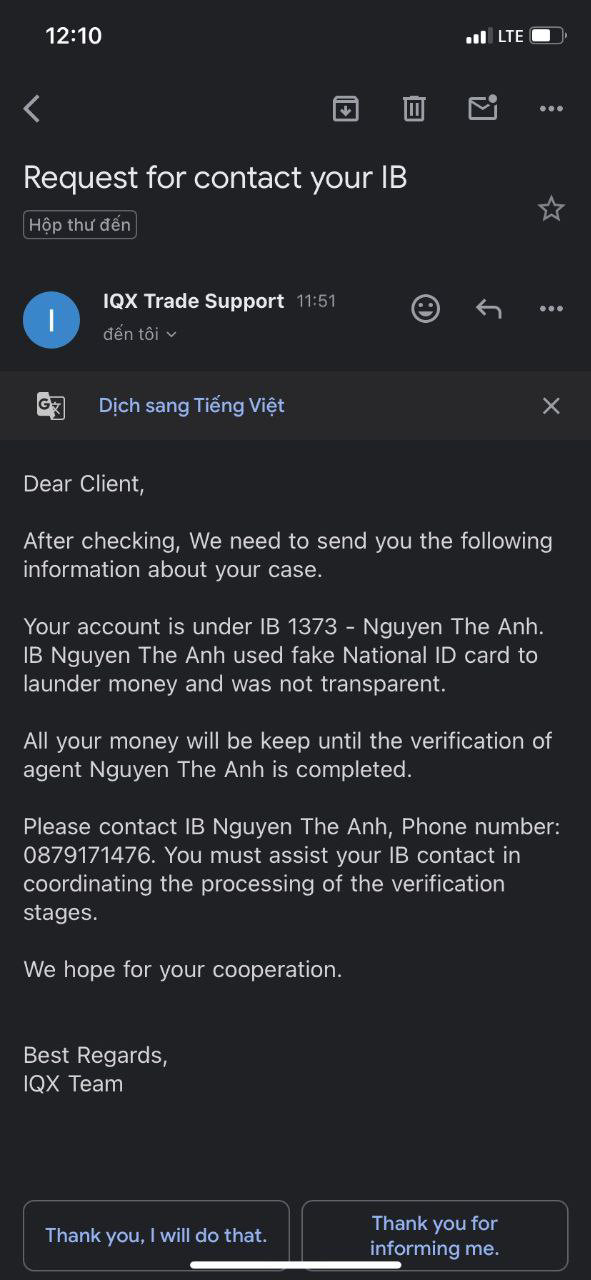

User feedback suggests poor customer service quality, with indications of slow response times and inadequate problem resolution that frustrate clients. The low user ratings reflect systematic issues with customer support that appear to be ongoing concerns rather than isolated incidents.

Multilingual Support

Information about language support for customer service is not available in the source material. This potentially limits accessibility for international clients who require support in languages other than English.

Service Hours and Coverage

Available sources do not specify customer service operating hours or global coverage areas. This makes it difficult for potential clients to understand support availability in their time zones.

Trading Experience Analysis (Score: 5/10)

Platform Stability and Performance

User feedback indicates concerns about platform stability and overall performance quality that affect daily trading activities. While the MT5 platform is generally reliable, the implementation by IQX Trade appears to have issues that negatively impact the trading experience.

Order Execution Quality

Available information does not provide specific details about order execution speed, slippage rates, or requote frequency. This lack of execution quality data makes it difficult to assess the actual trading environment provided by the broker.

Platform Functionality

The MT5 platform typically offers comprehensive functionality including advanced technical indicators, automated trading support, and multi-timeframe analysis. However, the specific implementation and customization options available through IQX Trade remain unclear from available sources.

Mobile Trading Experience

Information about mobile trading capabilities and mobile platform performance is not detailed in available sources. This represents a gap in understanding the complete trading experience offered by the broker, which this iqx trade review cannot fully assess based on current information.

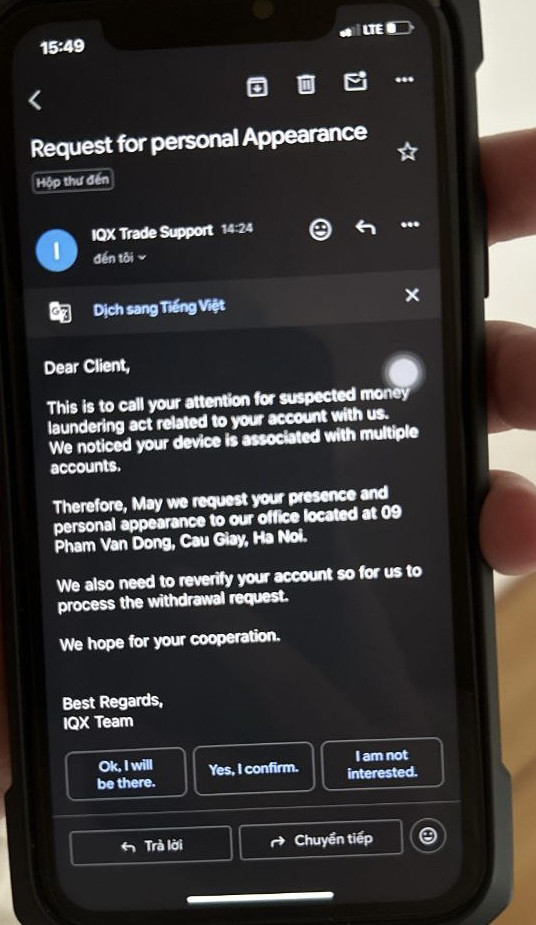

Trust and Safety Analysis (Score: 2/10)

Regulatory Compliance

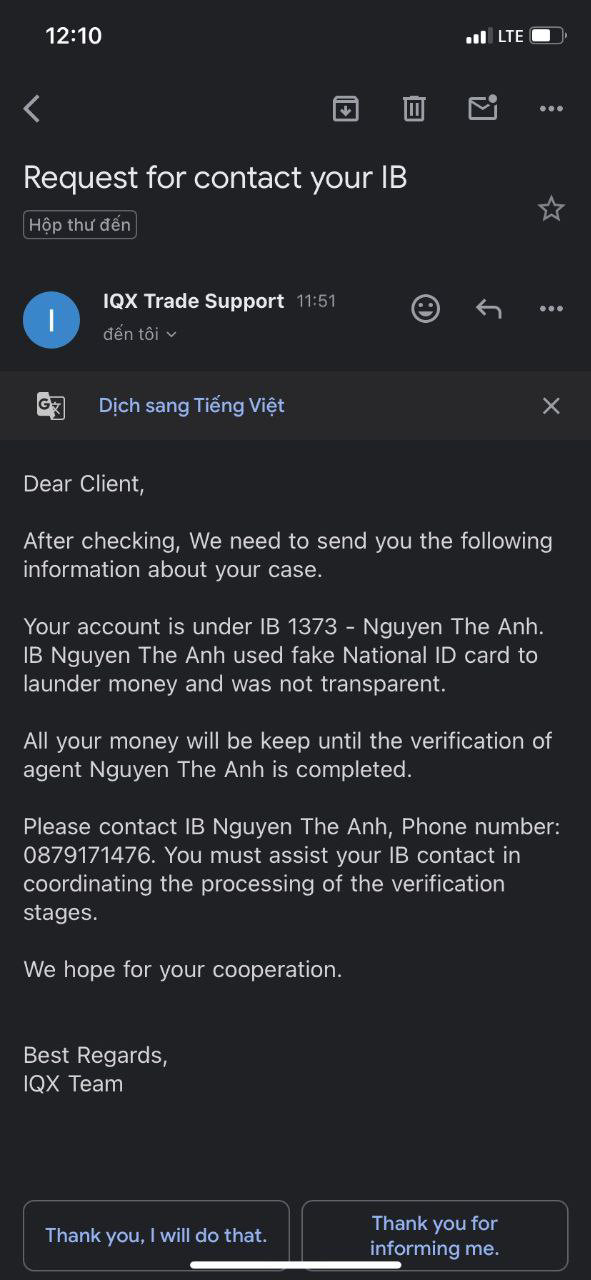

IQX Trade's registration under Seychelles jurisdiction presents significant regulatory concerns, as this framework does not properly cover forex trading activities. The absence of proper regulatory oversight creates substantial risks for client fund safety and dispute resolution that cannot be overlooked.

Fund Security Measures

Available information does not detail specific fund security measures, including segregated account policies, insurance coverage, or client money protection protocols. This lack of transparency about fund safety represents a critical concern for potential clients who need assurance about their investment security.

Company Transparency

The limited availability of comprehensive company information, including management details, operational history, and corporate governance structures, significantly undermines transparency and trustworthiness. This opacity raises red flags about the broker's commitment to open business practices.

Industry Reputation

User ratings and feedback indicate severely damaged industry reputation, with widespread concerns about legitimacy and safety that extend across multiple review platforms. The 1.19 TrustScore reflects systematic trust issues that extend beyond isolated incidents.

User Experience Analysis (Score: 3/10)

Overall User Satisfaction

Based on available user feedback, overall satisfaction levels are extremely low, with users expressing significant concerns about safety, legitimacy, and service quality. The consistently negative reviews suggest systemic issues rather than isolated problems that could be easily resolved.

Interface Design and Usability

While MT5 typically offers user-friendly interface design, specific customization options and interface optimization by IQX Trade are not detailed in available sources. The overall user experience appears to be negatively impacted by concerns about broker reliability rather than platform functionality.

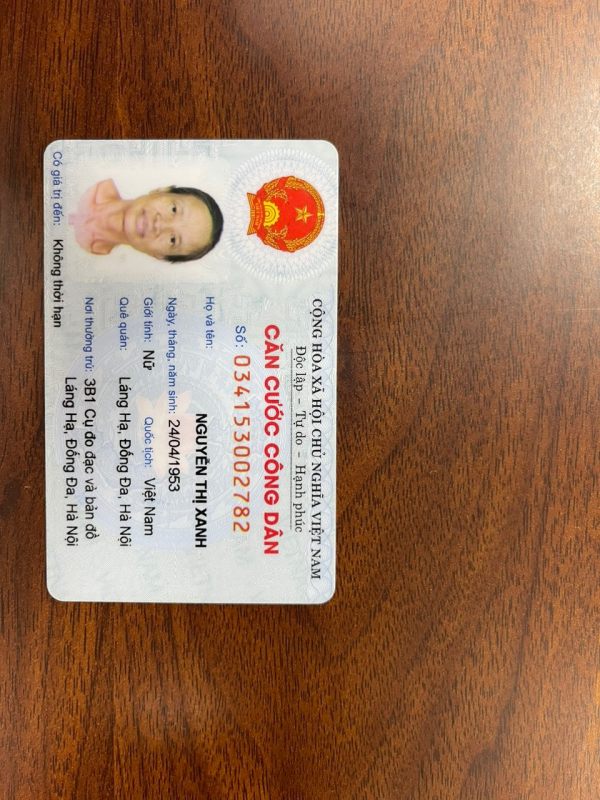

Registration and Verification Process

Detailed information about the registration and verification process is not available in source materials. This makes it difficult to assess the efficiency and user-friendliness of account setup procedures.

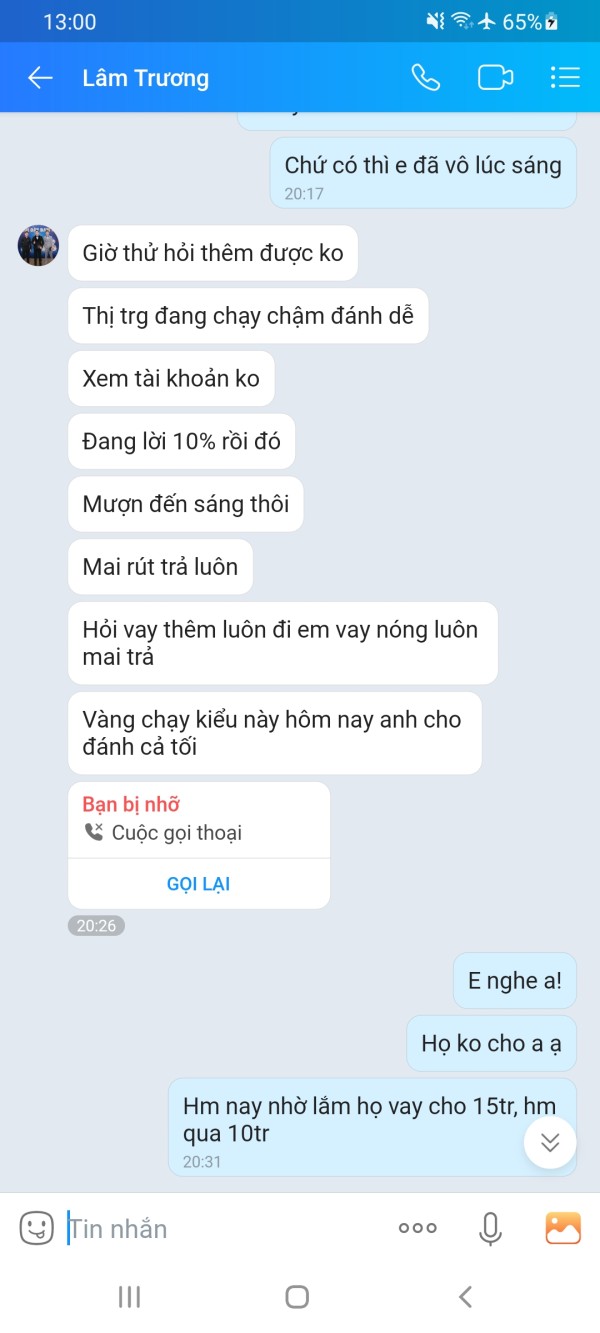

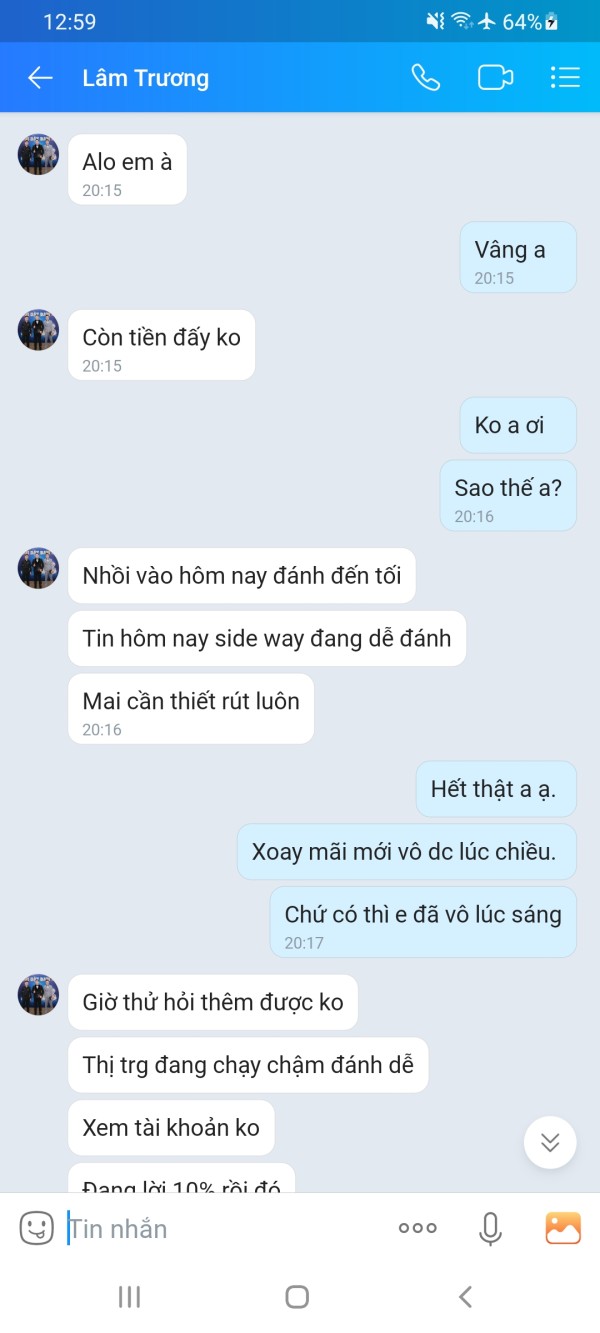

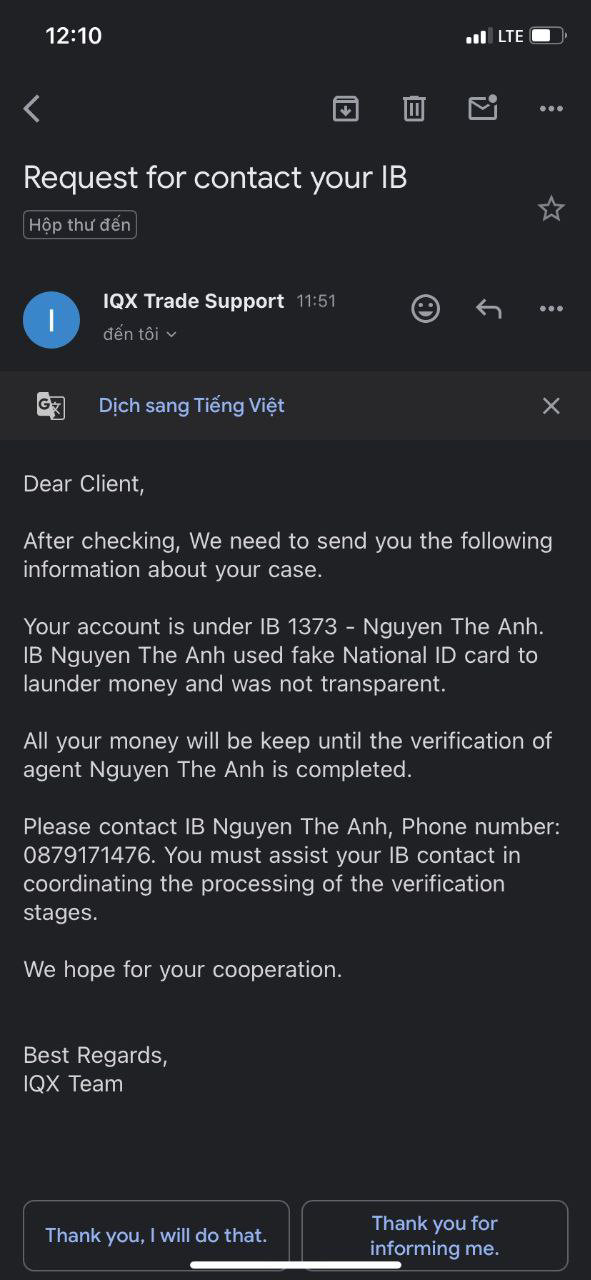

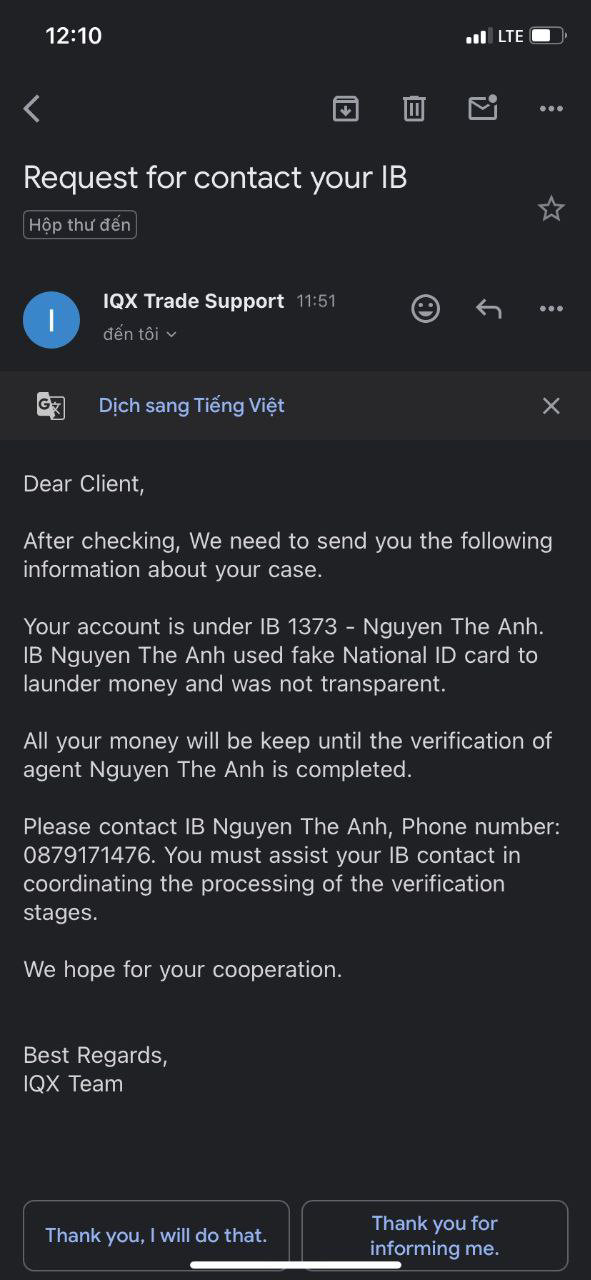

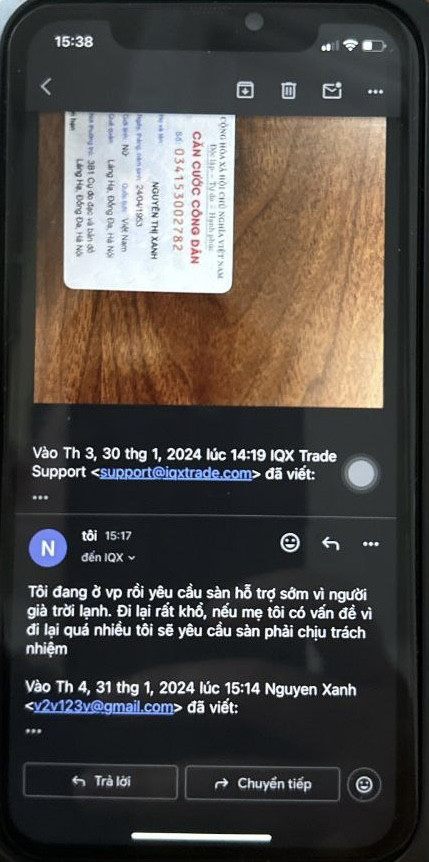

Common User Complaints

Users consistently express concerns about legitimacy, safety, and regulatory status that dominate online discussions about the broker. These fundamental trust issues dominate user feedback and significantly impact the overall user experience regardless of platform functionality.

Conclusion

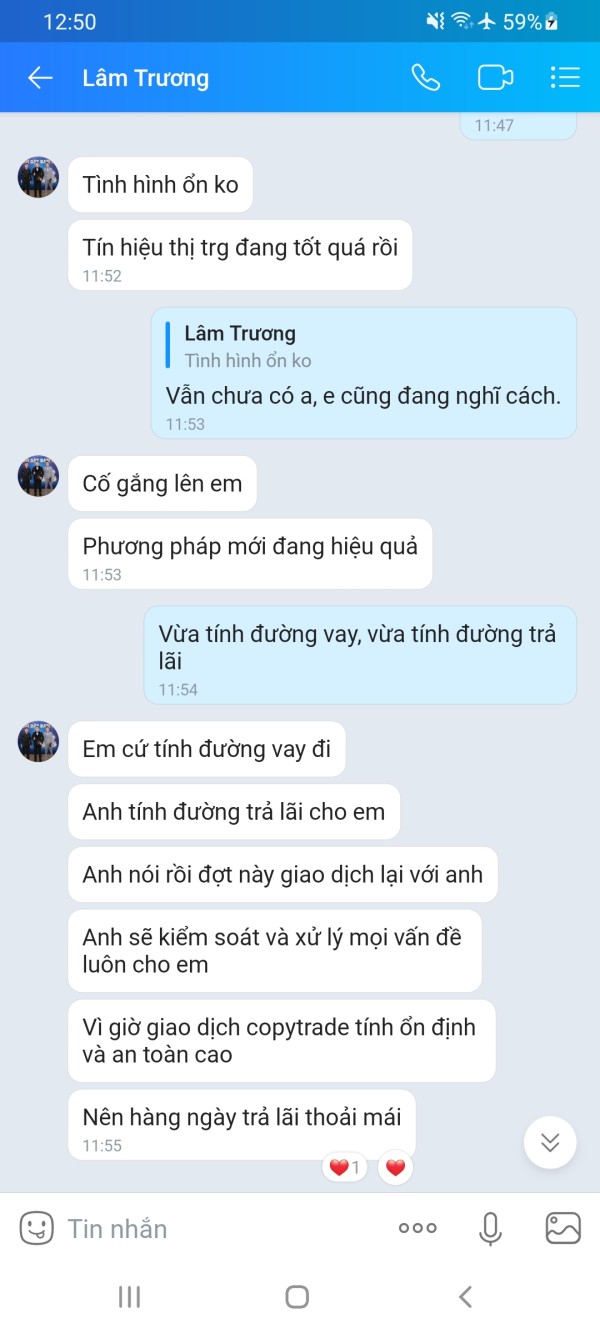

This comprehensive iqx trade review reveals a broker with significant regulatory and trust concerns that outweigh any potential trading benefits. While IQX Trade offers high leverage up to 1:500 and access to multiple asset classes through the MT5 platform, the fundamental issues surrounding regulatory compliance and user trust make it unsuitable for most traders who prioritize safety and reliability.

The broker may appeal to experienced traders specifically seeking high-leverage opportunities, but the associated risks are substantial and potentially dangerous. The offshore regulatory status, combined with extremely low user trust ratings and widespread legitimacy concerns, creates an unacceptable risk environment for most investors.

Key advantages include competitive leverage ratios and diverse asset coverage, while major disadvantages encompass poor regulatory oversight, extremely low user trust scores, and significant transparency issues. Potential clients are strongly advised to consider well-regulated alternatives with established track records and proper client protection measures.