Fenghe 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Fenghe review examines a financial services company that operates across multiple jurisdictions with varying business models. Based on available information from industry sources and user feedback, Fenghe presents a complex picture in the financial services sector. The company appears to operate through different entities, including Fenghe Fund Management in Asia and Fenghe Limited. Each entity serves distinct market segments.

According to JobStreet reports, Fenghe Fund Management positions itself as "a leading Asian investment platform built on extensive knowledge, experience and networks, uncovering the best opportunities in rising Asia." However, limited regulatory transparency and mixed user feedback raise questions about the overall reliability of their services. The company targets investors seeking exposure to Asian markets. Potential clients should carefully evaluate the regulatory framework and operational transparency before engaging with their services.

The evaluation reveals significant information gaps regarding trading conditions, regulatory compliance, and customer protection measures. These are crucial factors for potential clients to consider.

Important Notice

This review analyzes publicly available information about Fenghe's various business entities across different regions. Due to the company's multi-jurisdictional presence, services and regulatory status may vary significantly between different Fenghe entities. Our assessment methodology combines user feedback analysis, regulatory database searches, and industry report evaluation to provide an objective overview of Fenghe's operations. Readers should verify current regulatory status and service availability in their specific jurisdiction before making any investment decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Fenghe operates through multiple business entities across different regions. Fenghe Fund Management is prominently featured in Asian markets according to JobStreet company profiles. The company presents itself as an investment platform focusing on Asian market opportunities. However, the exact establishment date and corporate structure remain unclear from available public information. Different Fenghe entities appear to offer varying services, from fund management to potential brokerage operations. This creates a complex organizational landscape for potential clients to navigate.

The lack of clear corporate transparency regarding founding dates, key personnel, and operational history presents challenges for conducting thorough due diligence. This opacity is particularly concerning for potential investors seeking comprehensive background information before committing funds.

Service Portfolio and Market Focus

According to available information, Fenghe positions itself in the Asian investment space. The company claims extensive knowledge and networks in rising Asian markets. However, specific details about trading platforms, asset classes, and service offerings remain largely undisclosed in publicly available materials. The company's website presence appears limited, with FengHe Asia maintaining a basic online presence that lacks comprehensive service descriptions or detailed operational information.

This Fenghe review finds that the company's service portfolio lacks the transparency typically expected from established financial service providers. This makes it difficult for potential clients to assess whether the offered services align with their investment objectives and risk tolerance.

Regulatory Status and Compliance

Specific regulatory information for Fenghe entities remains unclear from available sources. The company's multi-jurisdictional presence suggests potential regulatory complexity. However, concrete licensing details, regulatory numbers, and compliance frameworks are not readily available in public databases. This lack of transparent regulatory information represents a significant concern for potential clients seeking regulated financial services.

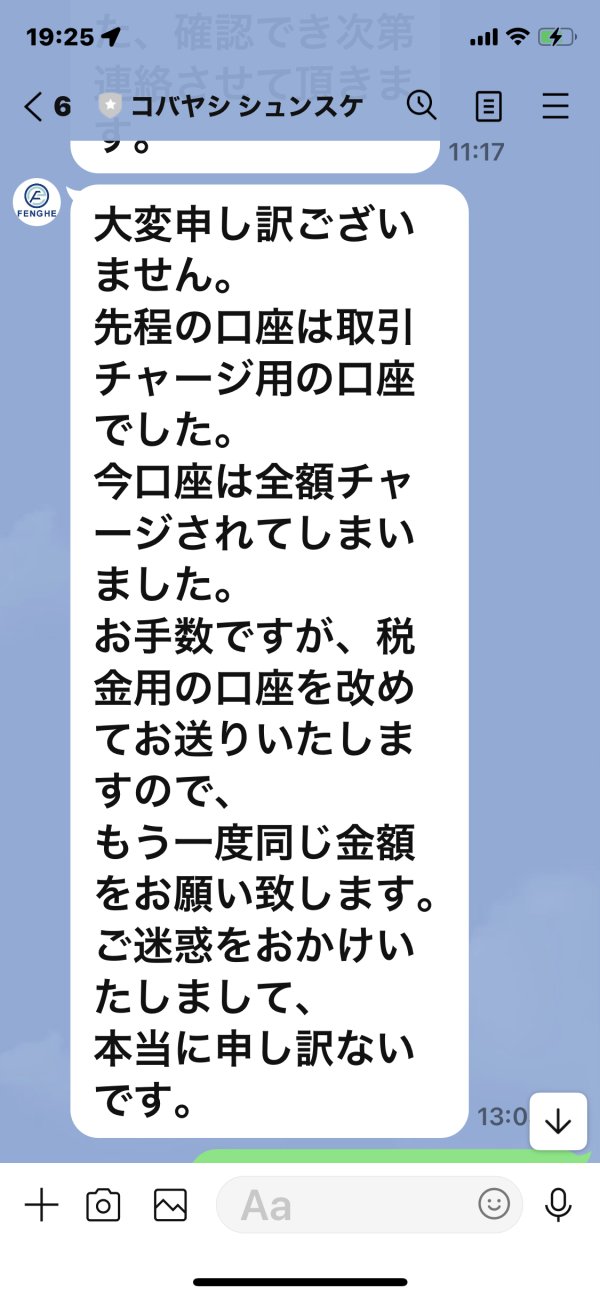

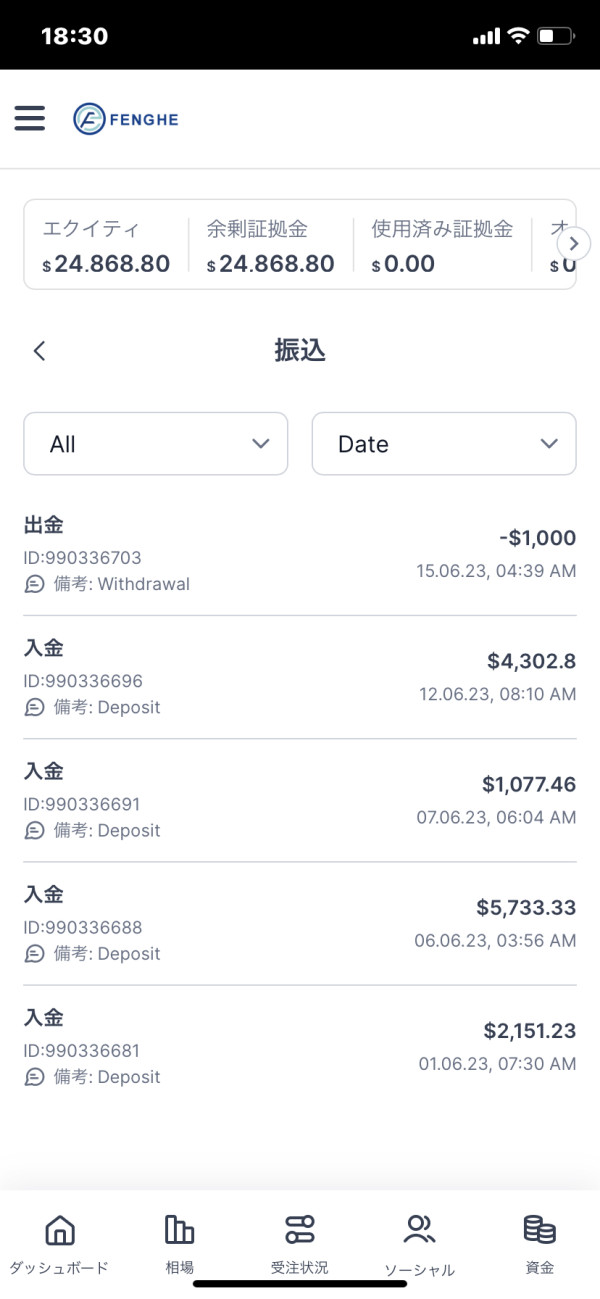

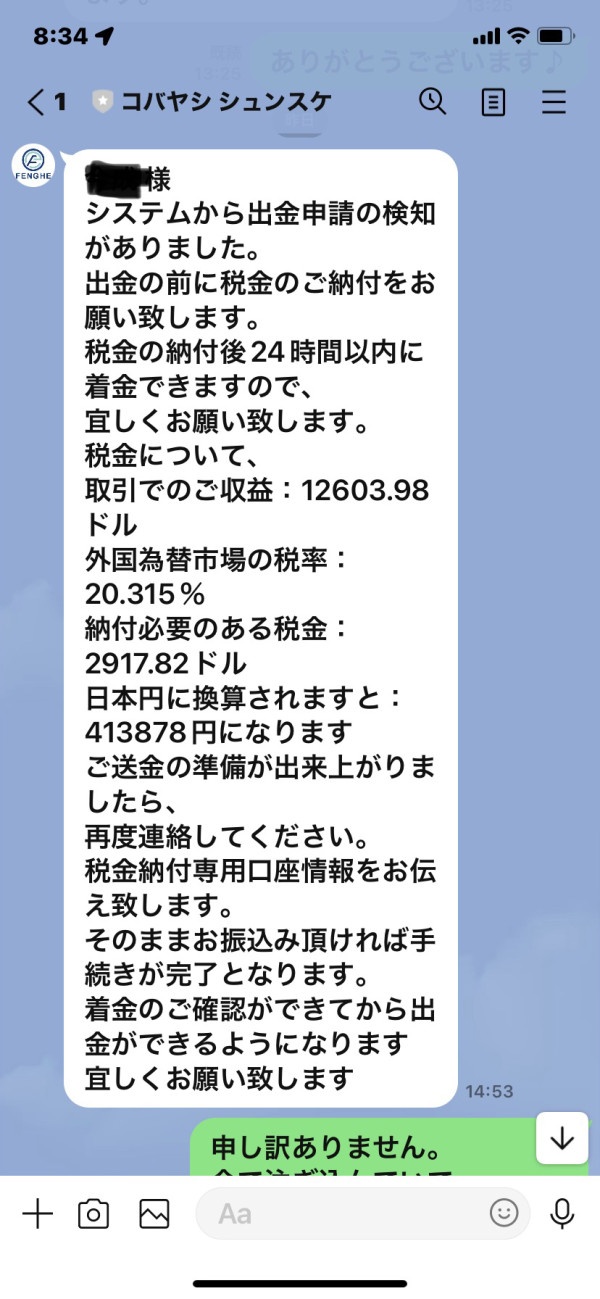

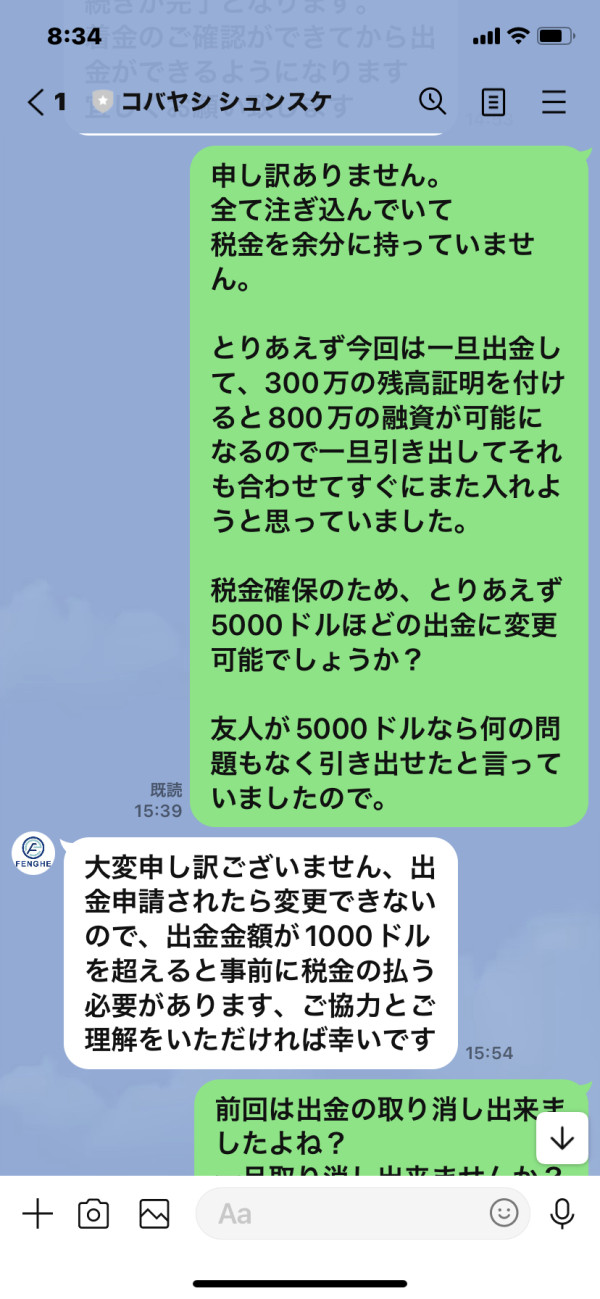

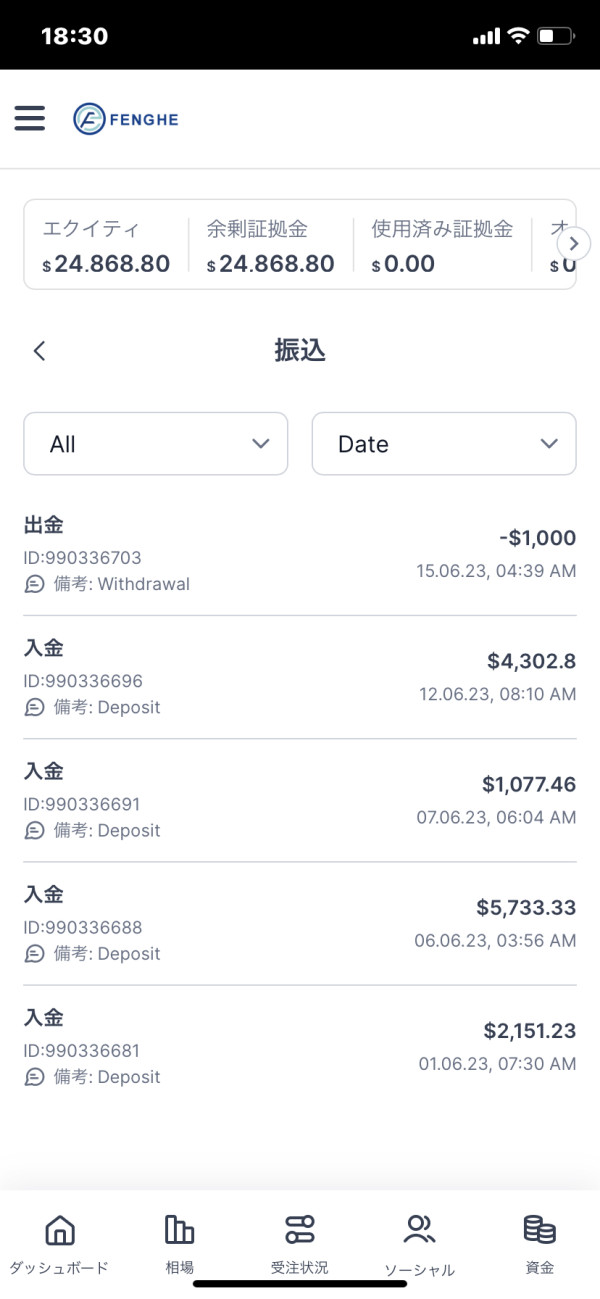

Deposit and Withdrawal Methods

Detailed information about funding methods, processing times, and associated fees is not available in current public sources. This absence of transparent financial transaction information makes it difficult for potential clients to understand the practical aspects of account funding and profit withdrawal.

Minimum Deposit Requirements

Specific minimum deposit thresholds are not disclosed in available materials. This prevents potential clients from understanding entry-level investment requirements.

Available Trading Assets

While Fenghe Fund Management claims focus on Asian market opportunities, specific asset classes, trading instruments, and market access details remain undisclosed in publicly available information.

Cost Structure and Fees

Comprehensive fee schedules, including management fees, trading costs, and administrative charges, are not transparently disclosed in available sources. This creates uncertainty about the true cost of engaging with Fenghe services.

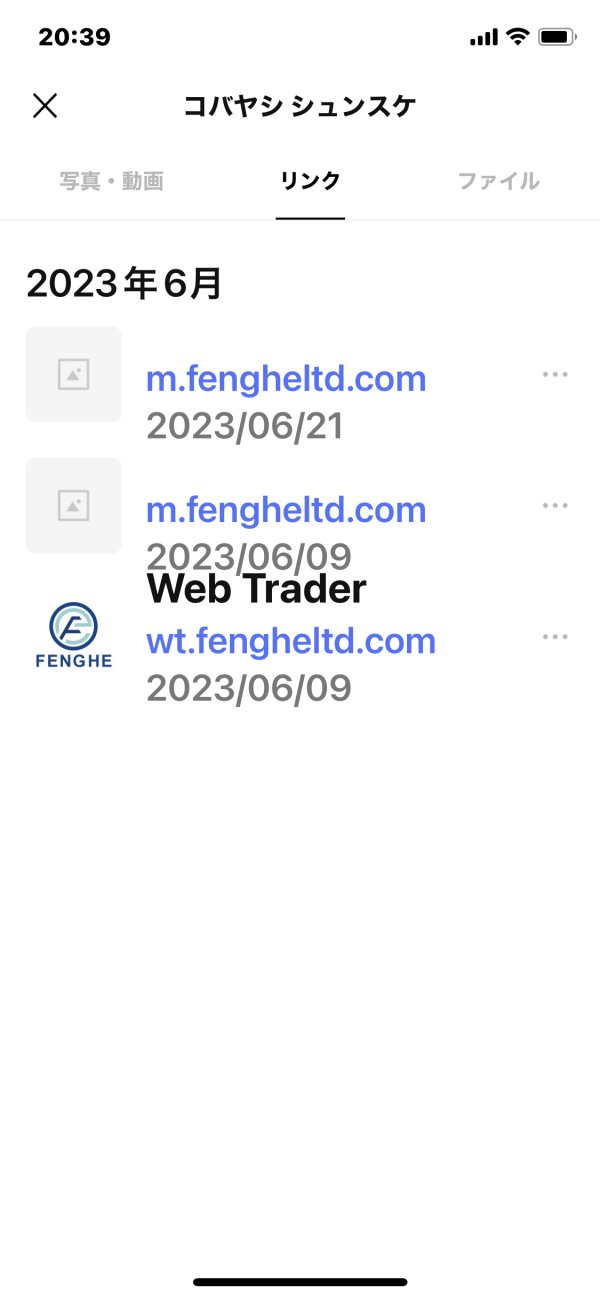

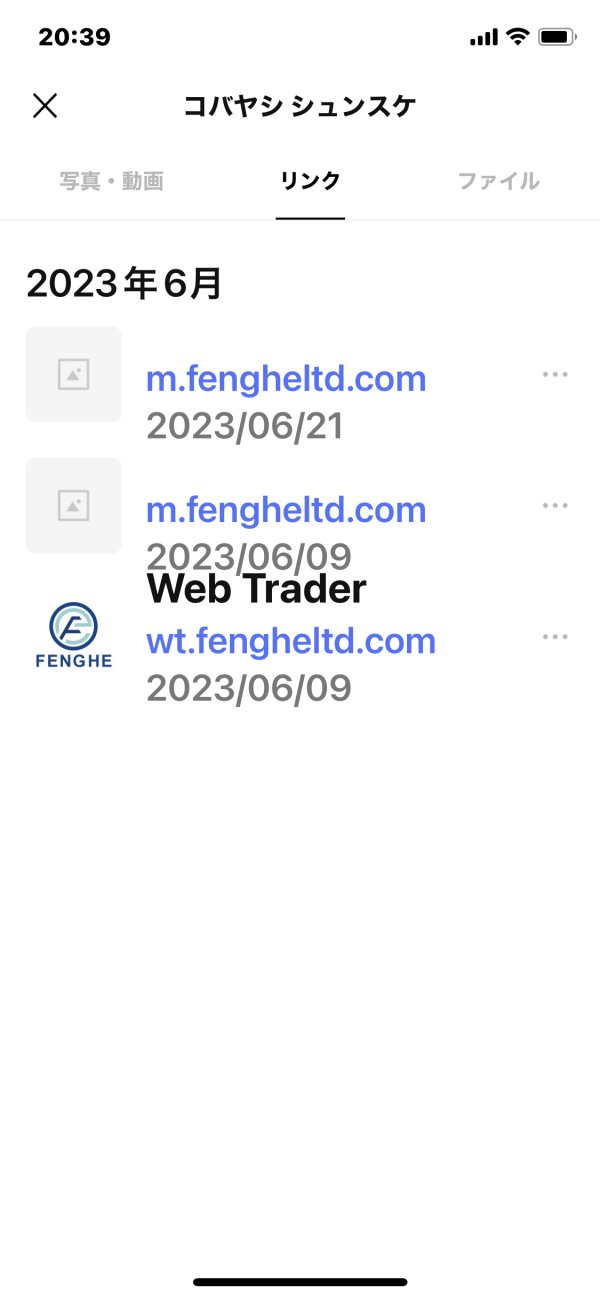

Platform Technology

Technical specifications about trading platforms, mobile applications, and analytical tools are not detailed in current public information. This limits assessment of the technological infrastructure supporting client services.

This Fenghe review identifies significant information gaps across multiple operational areas that are typically transparent with established financial service providers.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions evaluation for Fenghe reveals substantial transparency issues that significantly impact the overall rating. Without clear information about account types, minimum deposits, or specific terms and conditions, potential clients face considerable uncertainty when attempting to understand what services they would actually receive. The absence of detailed account specifications in publicly available materials suggests either limited service offerings or concerning lack of operational transparency.

Industry standards typically require clear disclosure of account features, fee structures, and service levels to enable informed decision-making. Fenghe's apparent lack of such transparency falls well below expected industry practices. The company's website and public materials fail to provide the comprehensive account information that sophisticated investors require for proper due diligence.

The limited information available through third-party sources like JobStreet provides only general business descriptions without specific account terms, conditions, or pricing structures. This Fenghe review finds that the opacity surrounding account conditions represents a significant barrier to client confidence and informed decision-making.

Fenghe's tools and resources receive a moderate rating based on their claimed focus on Asian market expertise and networks. According to JobStreet profiles, the company positions itself as having "extensive knowledge, experience and networks" in Asian markets, which could potentially provide value to investors seeking regional exposure. However, the lack of specific details about research capabilities, analytical tools, or educational resources limits the assessment.

The company's emphasis on "uncovering the best opportunities in rising Asia" suggests some level of research and analysis capability. However, concrete evidence of research quality, frequency, or depth is not available in public materials. Without access to sample research reports, market analysis, or educational content, it's difficult to verify the actual quality and utility of these claimed resources.

The absence of detailed platform features, charting tools, or technical analysis capabilities in available information suggests either limited technological infrastructure or poor communication of available resources to potential clients. Professional investors typically require comprehensive analytical tools and research support, which Fenghe has not clearly demonstrated in their public presence.

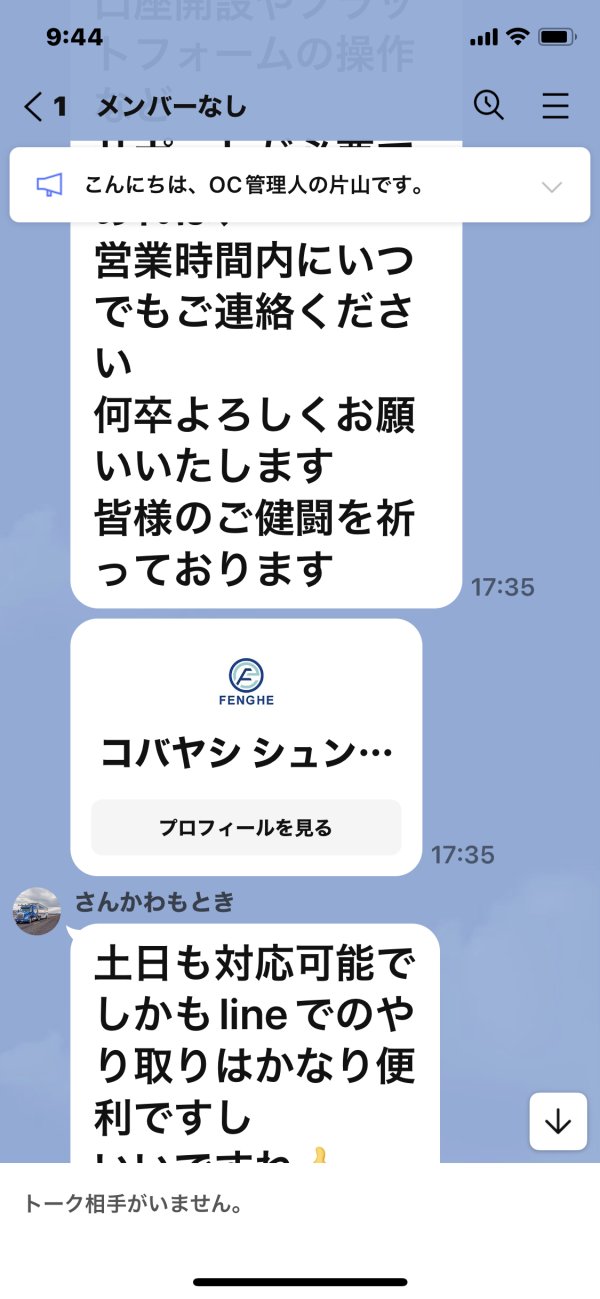

Customer Service Analysis (4/10)

Customer service evaluation for Fenghe is hampered by the lack of transparent contact information, support channels, and service level commitments in publicly available materials. The limited online presence and absence of detailed customer support information raise questions about the company's commitment to client service and support accessibility.

Industry-standard customer service typically includes multiple contact channels, clear response time commitments, and comprehensive support documentation. Fenghe's public materials do not provide evidence of such service infrastructure, which is concerning for potential clients who may require assistance with account management, technical issues, or investment guidance.

The lack of user testimonials, service reviews, or detailed support information in available sources prevents comprehensive assessment of actual service quality. Without clear evidence of robust customer support capabilities, potential clients face uncertainty about whether they would receive adequate assistance when needed.

Trading Experience Analysis (3/10)

The trading experience assessment for Fenghe is significantly limited by the absence of detailed platform information, execution quality data, and user experience feedback in available sources. Without specific details about trading platforms, order execution methods, or system reliability, it's impossible to provide a comprehensive evaluation of the actual trading experience clients might expect.

Industry-standard trading services typically provide detailed information about platform features, execution speeds, system uptime, and user interface capabilities. Fenghe's apparent lack of such transparency suggests either limited trading infrastructure or concerning communication gaps with potential clients. The absence of platform demonstrations, feature lists, or technical specifications makes it difficult for traders to assess whether the service would meet their operational requirements.

This Fenghe review notes that professional traders require reliable platforms with advanced features, fast execution, and comprehensive analytical tools. Without clear evidence of such capabilities, Fenghe's trading experience rating remains poor due to uncertainty and lack of demonstrated competency in this critical area.

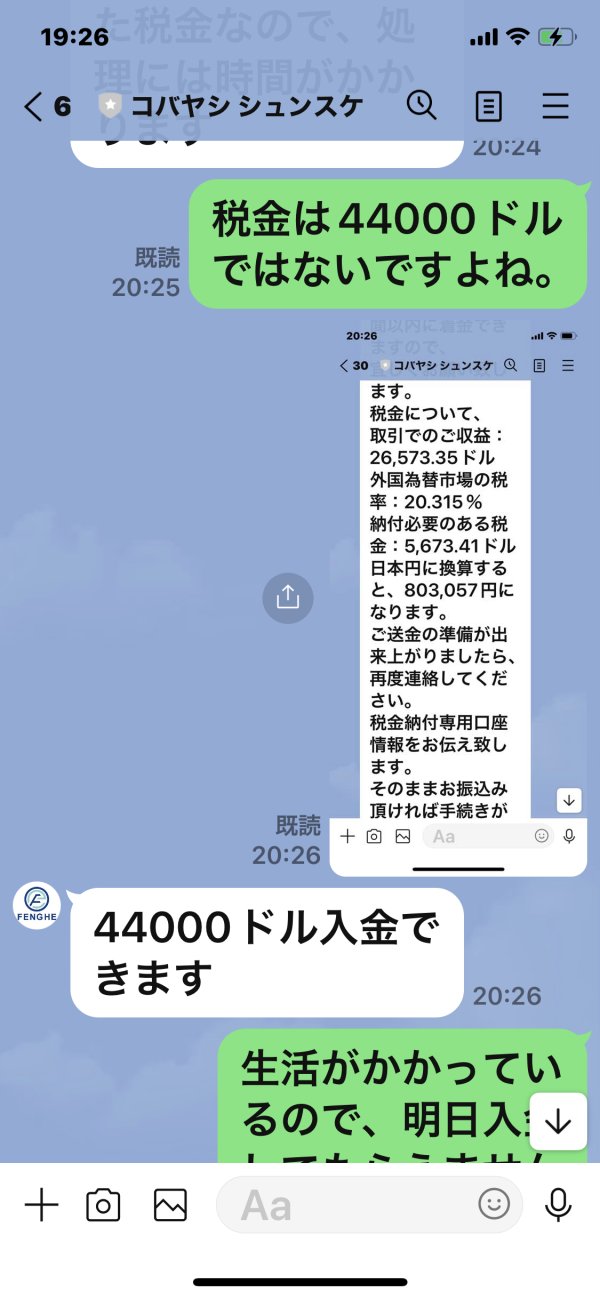

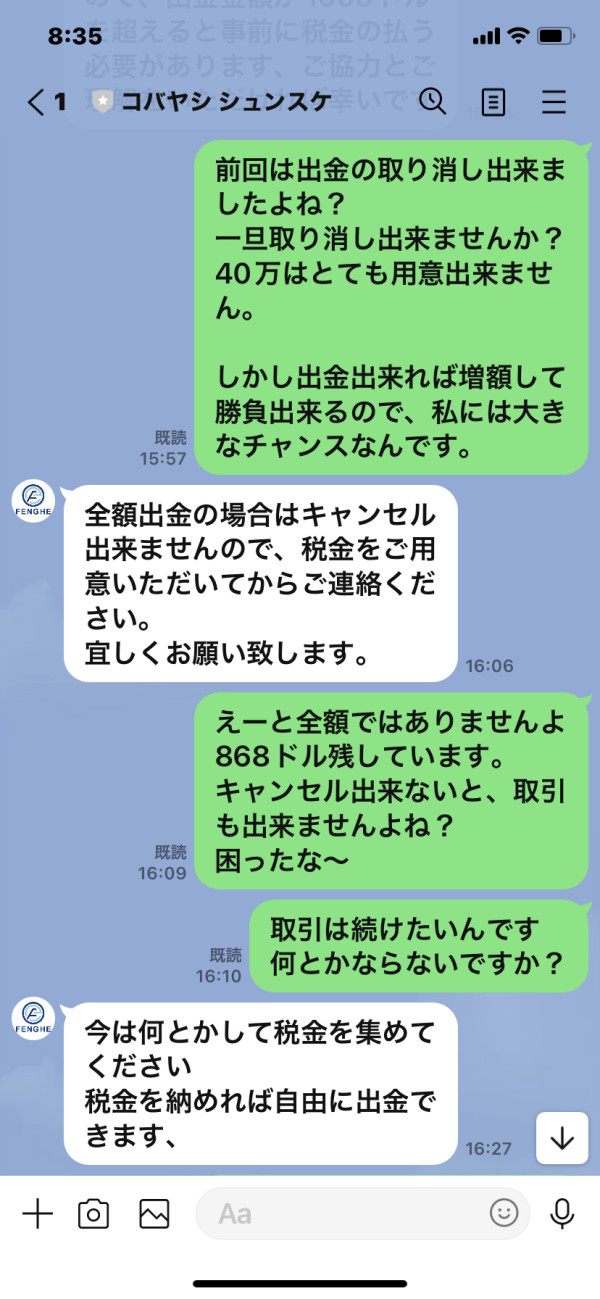

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of this Fenghe evaluation. The lack of clear regulatory information, limited corporate transparency, and absence of verifiable operational history significantly undermine confidence in the company's reliability. Professional financial services require robust regulatory oversight, transparent corporate governance, and clear accountability mechanisms, none of which are clearly evident in Fenghe's public presence.

The multi-jurisdictional nature of Fenghe's operations, combined with unclear regulatory status, creates additional complexity and potential risk for clients. Without clear regulatory oversight and client protection measures, investors face elevated risks regarding fund security and dispute resolution capabilities.

The limited online presence, absence of detailed corporate information, and lack of third-party verification or endorsements further compound trust concerns. Established financial service providers typically maintain comprehensive public disclosure, regulatory compliance documentation, and clear corporate governance structures, which Fenghe has not demonstrated in available materials.

User Experience Analysis (3/10)

User experience evaluation for Fenghe is constrained by the limited availability of actual user feedback and detailed service descriptions in public sources. The company's minimal online presence and lack of comprehensive service documentation suggest potential challenges in user accessibility and service clarity. Professional investors typically require intuitive interfaces, comprehensive documentation, and seamless service delivery, which Fenghe has not clearly demonstrated.

The absence of detailed platform screenshots, user guides, or service walkthroughs in available materials indicates either limited user experience focus or poor communication of available features. Without evidence of user-centered design principles or comprehensive onboarding processes, potential clients face uncertainty about service accessibility and ease of use.

The lack of user testimonials, case studies, or detailed service reviews in available sources prevents comprehensive assessment of actual user satisfaction levels. This information gap represents a significant limitation in evaluating whether Fenghe's services would provide satisfactory user experiences for different client segments.

Conclusion

This comprehensive Fenghe review reveals a financial services entity with significant transparency and reliability concerns that potential clients should carefully consider. While the company claims expertise in Asian markets and positions itself as an investment platform, the substantial lack of operational transparency, unclear regulatory status, and limited public information create considerable uncertainty about service quality and reliability.

The evaluation identifies Fenghe as potentially suitable for investors specifically seeking Asian market exposure who are comfortable with elevated due diligence requirements and operational uncertainty. However, the company's poor performance across multiple evaluation dimensions, particularly in trust and reliability, suggests that most investors would be better served by more established and transparent financial service providers.

Key concerns include the absence of clear regulatory oversight, limited operational transparency, and lack of comprehensive service documentation that professional investors typically require for informed decision-making. Potential clients should conduct extensive additional due diligence and consider alternative service providers with stronger transparency and regulatory compliance records before engaging with Fenghe's services.