Hedge Market 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Hedge Market review reveals concerning findings that potential traders must understand before considering this platform. Our research and user feedback analysis show that Hedge Market is a high-risk platform with significant red flags that require serious caution from the trading community.

Hedge Market operates without effective regulatory oversight. This represents a fundamental concern for trader safety and fund security. Multiple user reports and industry warnings have emerged, cautioning potential clients about the risks associated with this platform. The lack of transparent regulatory credentials and mounting user complaints suggest that Hedge Market may not meet the standards expected of legitimate forex brokers.

The platform appears to target novice traders who may be less familiar with regulatory requirements and industry standards. This targeting strategy creates a potentially dangerous environment for inexperienced investors. Combined with the absence of proper licensing, this approach puts new traders at serious risk. Our analysis strongly recommends that traders exercise extreme caution and consider well-regulated alternatives instead of engaging with Hedge Market.

Important Notice

Regional Disclaimer: Hedge Market may present different operational structures across various jurisdictions. However, our research indicates a consistent lack of effective regulatory oversight across all regions where the platform claims to operate. The absence of proper licensing appears to be a systemic issue rather than a regional variation.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, industry reports, and available public information. Our assessment prioritizes trader safety and regulatory compliance as fundamental criteria for broker evaluation. All findings presented reflect the current available information and should be considered alongside independent research before making any trading decisions.

Overall Rating Framework

Broker Overview

Hedge Market presents itself as a trading platform in the competitive forex market. Critical information about its establishment date and corporate background remains notably absent from publicly available sources. The lack of transparent company information raises immediate concerns about the platform's legitimacy and operational history. Legitimate brokers typically provide comprehensive details about their founding, corporate structure, and business development timeline.

The platform's business model and operational framework lack the transparency expected from established forex brokers. Without clear information about the company's background, trading infrastructure, or business partnerships, potential clients face significant uncertainty. This uncertainty affects the platform's capabilities and long-term viability. This opacity contrasts sharply with industry standards where reputable brokers maintain detailed corporate disclosure and operational transparency.

Most concerning is Hedge Market's regulatory status, which appears to be non-existent or inadequately documented. The platform lacks association with recognized financial regulatory authorities. This creates substantial risks for trader fund protection and legal recourse. This Hedge Market review emphasizes that the absence of proper regulatory oversight represents a critical deficiency that should deter potential clients from engaging with the platform.

Regulatory Status: Hedge Market operates without effective regulatory supervision from recognized financial authorities. No valid licensing information has been identified through major regulatory databases, including FCA, ASIC, CySEC, or other prominent supervisory bodies.

Deposit and Withdrawal Methods: Specific information regarding payment processing methods remains undisclosed in available documentation. This raises concerns about transaction transparency and fund accessibility.

Minimum Deposit Requirements: The platform has not clearly communicated minimum deposit thresholds. This represents poor disclosure practices compared to industry standards.

Promotional Offers: Details about bonus structures and promotional campaigns are not adequately documented. This prevents proper evaluation of terms and conditions.

Available Trading Assets: The range of tradeable instruments and asset classes offered by Hedge Market lacks comprehensive documentation in publicly available sources.

Cost Structure: Trading costs remain unclear due to insufficient disclosure from the platform. This includes spreads, commissions, and additional fees.

Leverage Options: Maximum leverage ratios and margin requirements are not transparently communicated to potential clients.

Platform Technology: Information about trading platform options is notably absent. This includes MetaTrader availability or proprietary software features.

Geographic Restrictions: Specific jurisdictional limitations and service availability by region lack proper documentation.

Customer Support Languages: Available support languages and communication channels are not clearly specified in accessible materials.

This comprehensive Hedge Market review highlights the concerning lack of transparency across fundamental operational aspects. Legitimate brokers typically disclose these details prominently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The evaluation of Hedge Market's account conditions reveals significant deficiencies that contribute to our lowest possible rating. The platform fails to provide transparent information about account types, tier structures, or specific features that traders can expect. This lack of clarity prevents potential clients from making informed decisions about account selection and suitability for their trading needs.

Minimum deposit requirements remain undisclosed. This represents poor business practice compared to industry standards where legitimate brokers clearly communicate entry-level investment thresholds. The absence of this fundamental information suggests either inadequate customer communication or potential flexibility that could lead to unexpected financial demands on clients.

Account opening procedures and verification requirements are not properly documented. This creates uncertainty about the onboarding process and compliance standards. Legitimate brokers typically provide detailed guidance about required documentation, verification timelines, and account activation procedures. The lack of such information raises questions about the platform's operational maturity and customer service capabilities.

Special account features appear to be absent or inadequately documented. This includes Islamic accounts for Sharia-compliant trading or professional trader classifications. This limitation restricts the platform's appeal to diverse trading communities and suggests a lack of comprehensive service development. The overall account conditions framework demonstrates insufficient attention to client needs and industry best practices, warranting our lowest evaluation score in this Hedge Market review.

Hedge Market's trading tools and resources demonstrate substantial inadequacies that significantly impact trader success potential. The platform lacks documentation of essential trading instruments including technical analysis tools, charting capabilities, and market research resources. Experienced traders require these tools for informed decision-making.

Educational resources appear to be non-existent or poorly developed. This particularly disadvantages novice traders who require comprehensive learning materials. Legitimate brokers typically offer extensive educational libraries including webinars, tutorials, market analysis, and trading guides. The absence of such resources suggests that Hedge Market may not prioritize client education and development.

Research and analysis capabilities are not adequately provided or documented. This includes economic calendars, market news, and expert commentary. These tools are essential for fundamental analysis and staying informed about market-moving events. The lack of comprehensive research resources places traders at a significant disadvantage compared to platforms offering robust analytical support.

Automated trading support and algorithmic trading capabilities remain unclear. This limits advanced traders' ability to implement sophisticated trading strategies. The absence of clear information about Expert Advisor support, API access, or copy trading features suggests limited platform sophistication and technological development.

Customer Service and Support Analysis (Score: 1/10)

Customer service evaluation reveals concerning deficiencies in support infrastructure and client communication capabilities. Available contact channels are not clearly documented or may be inadequately staffed based on user feedback patterns observed in the market. This includes phone, email, and live chat options.

Response time expectations and service level commitments lack proper documentation. This creates uncertainty about support availability during critical trading situations. Legitimate brokers typically guarantee specific response times and maintain 24/7 support during market hours. The absence of such commitments suggests potential service limitations that could impact trader experience.

Service quality indicators appear to be below industry standards based on available information. This includes staff expertise, problem resolution effectiveness, and multilingual capabilities. Professional customer support requires trained staff capable of addressing technical, account, and trading-related inquiries promptly and accurately.

Support availability during different market sessions and time zones lacks clear documentation. This potentially leaves traders without assistance during critical trading periods. The overall customer service framework demonstrates insufficient investment in client support infrastructure and service quality standards.

Trading Experience Analysis (Score: 1/10)

The trading experience evaluation reveals significant concerns about platform performance, reliability, and user interface quality. Platform stability and execution speed are fundamental requirements for successful forex trading. Yet Hedge Market lacks documented performance metrics or user testimonials supporting reliable platform operation.

Order execution quality remains undocumented. This includes slippage rates, requote frequency, and execution speed during volatile market conditions. These factors directly impact trading profitability and trader satisfaction. The absence of transparent execution statistics suggests potential issues with trade processing efficiency and market access quality.

Platform functionality completeness appears to be limited based on available information. This includes advanced order types, risk management tools, and portfolio analysis features. Professional traders require comprehensive platform capabilities to implement sophisticated trading strategies and manage risk effectively.

Mobile trading experience and cross-device synchronization capabilities lack proper documentation. This potentially limits traders' ability to monitor and manage positions while away from desktop computers. Modern trading requires seamless mobile access and real-time portfolio management capabilities.

The overall trading environment assessment indicates substantial deficiencies in platform development, performance optimization, and user experience design. These limitations significantly impact trader success potential and platform competitiveness. This results in our lowest possible rating for this Hedge Market review.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness evaluation reveals the most critical concerns about Hedge Market's legitimacy and trader safety. The platform operates without effective regulatory oversight from recognized financial authorities. This creates substantial risks for client fund protection and legal recourse options. Regulatory compliance represents the foundation of broker trustworthiness and trader security.

Fund safety measures are not documented or verified through regulatory sources. This includes segregated client accounts, deposit protection schemes, and third-party fund custody arrangements. These protections are essential for trader confidence and financial security. The absence of clear fund safety protocols represents a significant red flag for potential clients.

Corporate transparency remains inadequate. This includes detailed company information, management disclosure, and operational location verification. Legitimate brokers maintain comprehensive corporate disclosure and regulatory filing accessibility. The lack of transparent corporate information raises questions about operational legitimacy and accountability.

Industry reputation and peer recognition appear to be limited or negative based on available feedback and warning sources. Professional trading communities and regulatory bodies have raised concerns about platform legitimacy and trader safety. These warnings represent critical information for potential clients considering platform engagement.

Negative event handling and dispute resolution capabilities lack documentation and verified processes. The absence of clear complaint procedures and regulatory oversight creates significant risks. Traders facing account or withdrawal issues have limited recourse options.

User Experience Analysis (Score: 1/10)

User experience evaluation demonstrates substantial deficiencies across multiple interaction points that impact trader satisfaction and platform usability. Overall user satisfaction indicators suggest significant concerns about platform performance and service quality. This assessment is based on available feedback sources.

Interface design and usability assessment reveals potential limitations in platform navigation, feature accessibility, and visual design quality. Modern trading platforms require intuitive interfaces that enable efficient market analysis and trade execution. The lack of positive user feedback about platform design suggests possible usability challenges.

Registration and verification processes lack clear documentation and user guidance. This creates potential confusion during account opening procedures. Streamlined onboarding experiences are essential for user satisfaction and platform adoption. The absence of clear process documentation suggests possible procedural complications.

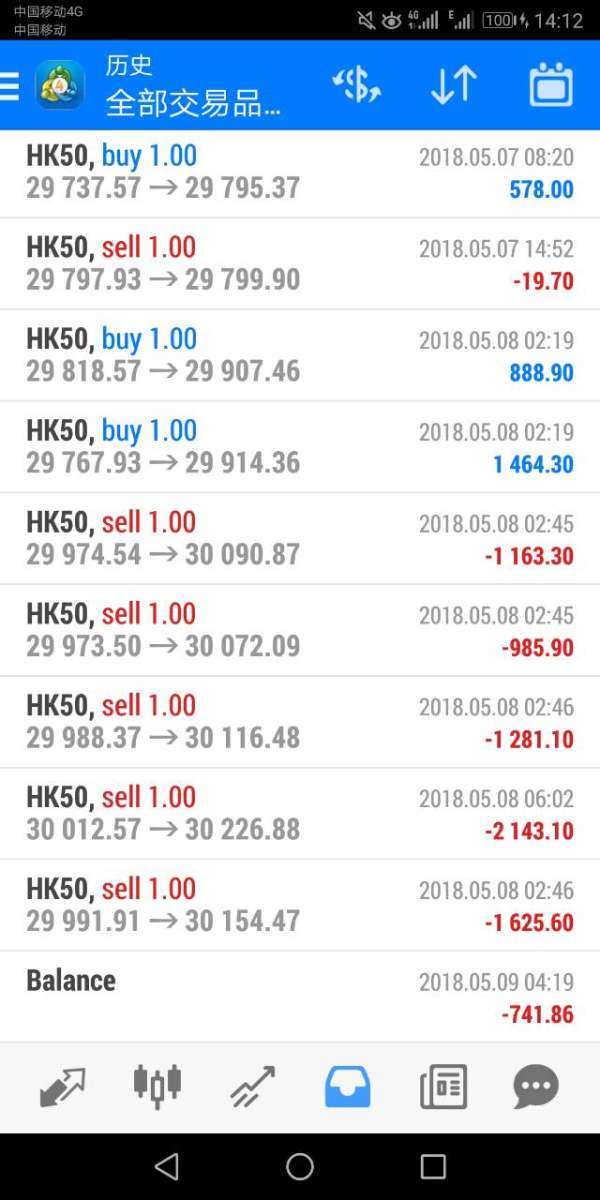

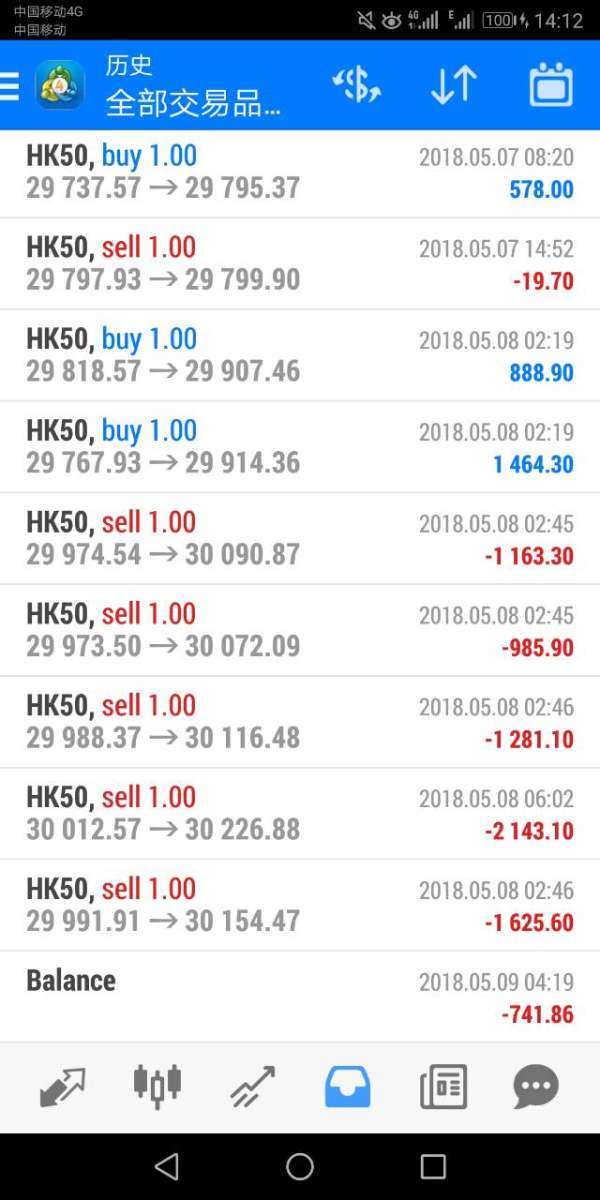

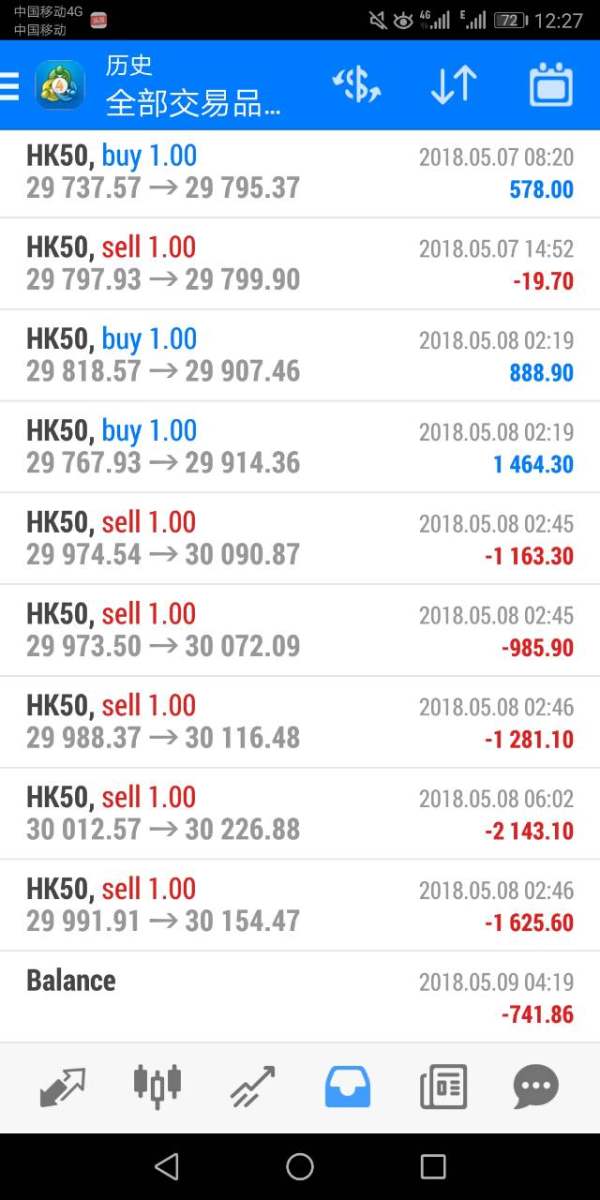

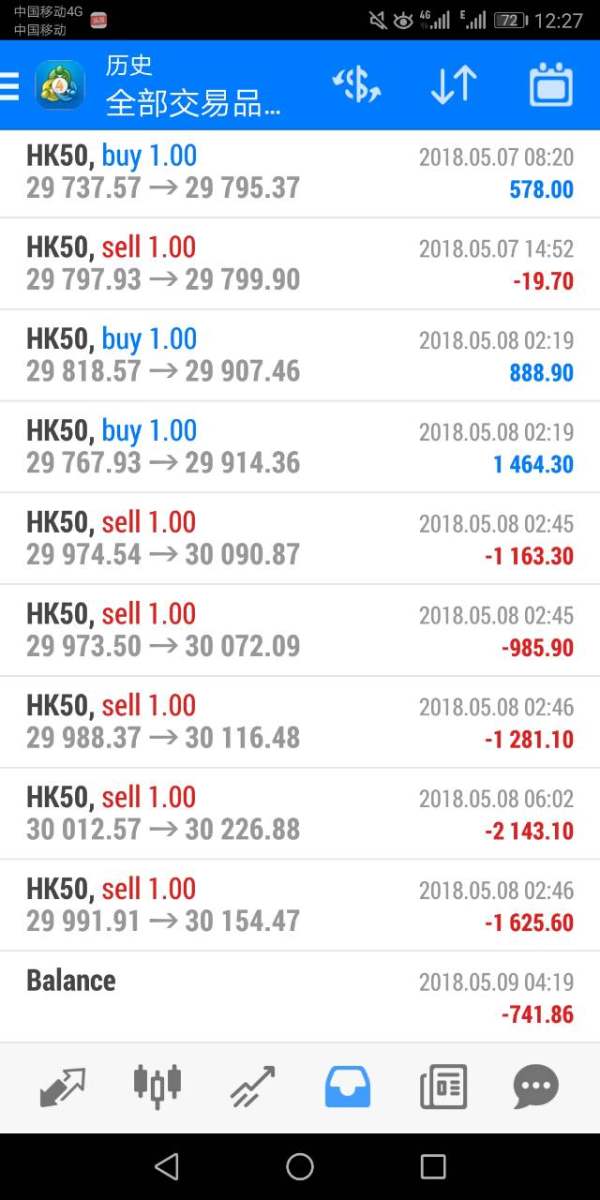

Fund operation experiences appear to be problematic based on user warnings and feedback patterns. This includes deposit processing, withdrawal procedures, and transaction transparency. Reliable fund operations are fundamental to trader confidence and platform trustworthiness.

Common user complaints focus on platform legitimacy concerns and withdrawal difficulties. These represent serious red flags for potential clients. The pattern of negative feedback and user warnings suggests systematic issues with platform operation and client treatment. These concerns significantly impact user experience quality and platform recommendation potential.

Conclusion

This comprehensive Hedge Market review concludes with a strong caution against platform engagement due to multiple critical deficiencies. These deficiencies pose substantial risks to trader safety and financial security. The platform's lack of effective regulatory oversight represents a fundamental disqualification that should deter potential clients from considering account opening.

The absence of transparent operational information creates serious concerns for potential traders. Combined with concerning user feedback patterns, this indicates that Hedge Market does not meet the standards expected of legitimate forex brokers. Our evaluation strongly recommends that traders seek well-regulated alternatives that provide proper client protections and transparent business practices. This recommendation applies particularly to beginners who may be more vulnerable to platform risks.

The platform demonstrates significant shortcomings across all evaluation criteria. This results in our lowest possible overall rating. These deficiencies include inadequate regulatory compliance, poor transparency, limited customer support, and concerning user experience feedback. Potential traders should prioritize broker selection based on proper regulatory oversight, transparent operations, and positive user testimonials. They should avoid engaging with platforms that present substantial legitimacy concerns like those identified in this Hedge Market review.