Executive Summary

This zheng da international review looks at a new forex broker. The company has been running for about four years. Zheng Da International calls itself a special foreign exchange and futures trading service provider, and its main office is in Hong Kong.

The broker says it works under the rules of the Hong Kong Securities and Futures Commission with license number BOP620. Some users worry that this regulatory status might not be real. The broker mainly focuses on forex and futures contracts, including both commodity and financial futures, and it targets traders who want emerging market opportunities.

The platform does not offer the standard MetaTrader 4 and MetaTrader 5 platforms. Zheng Da International says it is a real trading company, but there is not much information about their trading conditions, fees, and customer service. This review gives traders a complete analysis based on public information, though detailed operational data is hard to find.

Important Notice

This review of Zheng Da International uses publicly available information and user feedback from various sources. As a Hong Kong-based broker, Zheng Da International operates under different rules compared to European or US-based brokers, which may mean different levels of investor protection and compliance requirements.

Traders should know that regulatory standards and enforcement can be very different across countries. This review uses accessible data, and some information gaps may exist because the broker does not share much information. All assessments and ratings should be considered along with individual trading needs and risk tolerance levels.

Rating Framework

Broker Overview

Zheng Da International started in the forex trading world about four years ago. The company set up its operations from Hong Kong with a focus on providing special foreign exchange and futures trading services. The company has positioned itself to serve traders who want to access international currency markets and various futures contracts, including both commodity and financial derivatives.

The broker operates under a business model that focuses on forex trading along with futures contract offerings. The company's headquarters in Hong Kong suggests an Asian market focus, though how far they reach globally is unclear from public information. Zheng Da International claims regulatory oversight from the Hong Kong Securities and Futures Commission under license number BOP620, which would place it within one of Asia's more established financial regulatory frameworks.

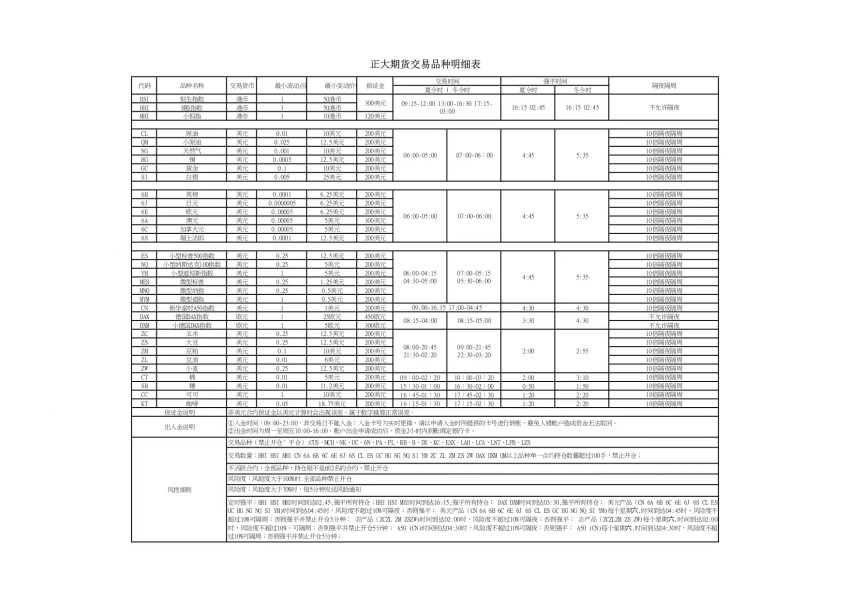

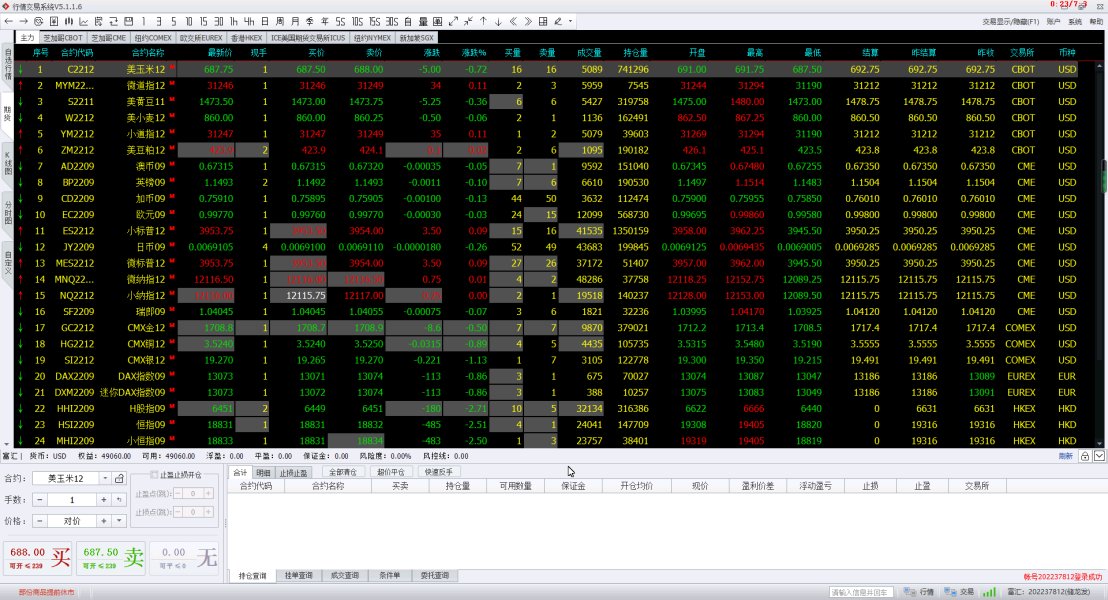

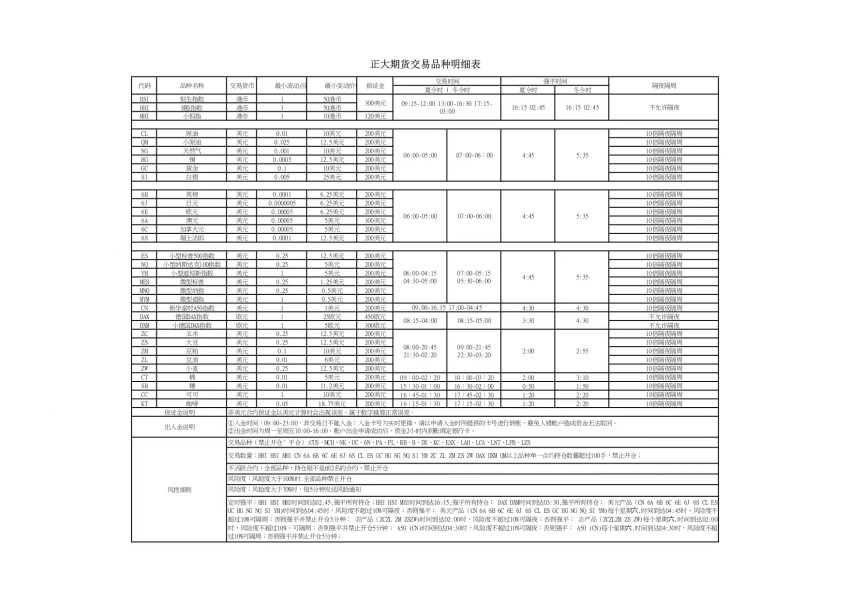

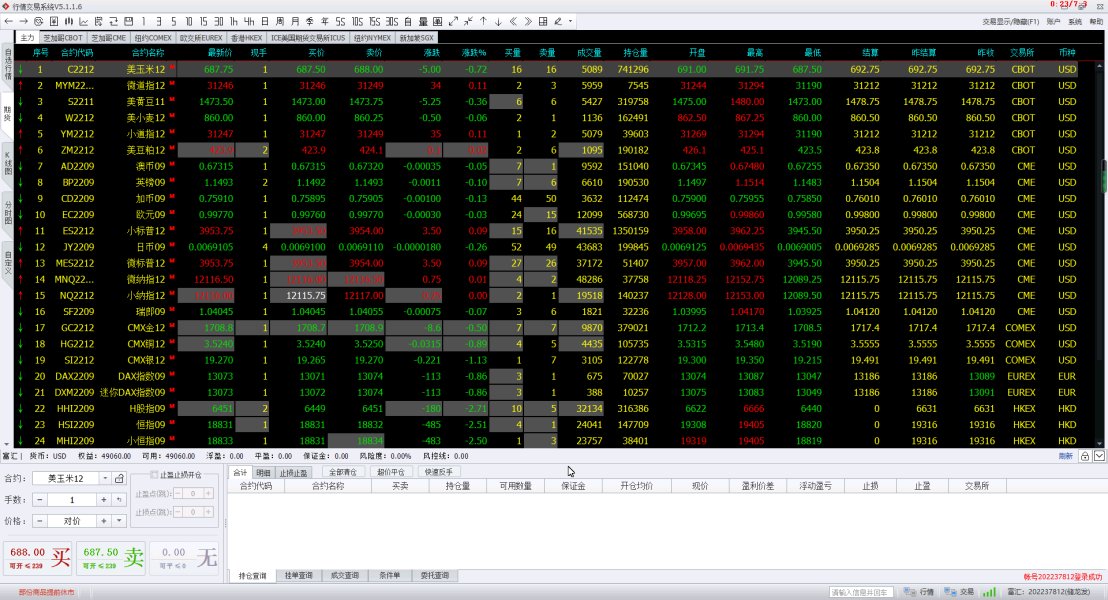

The broker's service portfolio centers on foreign exchange trading and futures contracts. They specifically highlight commodity futures and financial futures as core offerings. However, unlike many modern forex brokers, Zheng Da International does not use the popular MetaTrader 4 or MetaTrader 5 platforms, instead operating through their own or alternative trading systems.

This platform choice may affect trader familiarity and the availability of third-party tools and expert advisors commonly found with MT4/MT5 environments.

Regulatory Jurisdiction: Zheng Da International claims regulatory oversight from the Hong Kong Securities and Futures Commission under license number BOP620. However, some users have expressed doubt about whether this regulatory status is real, so careful verification is needed before working with the broker.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available materials. This leaves potential clients without clear guidance on funding methods or processing procedures.

Minimum Deposit Requirements: The broker has not publicly shared minimum deposit amounts for opening accounts. This may indicate flexible entry requirements or simply limited transparency in their terms.

Bonuses and Promotions: No information about promotional offers or bonus programs is available in current public materials.

Tradable Assets: The broker's asset portfolio focuses on foreign exchange pairs and futures contracts, including both commodity futures and financial futures. However, specific instruments and market coverage details remain unspecified.

Cost Structure: Important information about spreads, commissions, and other trading costs is not publicly available. This makes it difficult for traders to assess how competitive the broker's pricing model is.

Leverage Ratios: Leverage offerings and maximum ratios are not specified in available documentation.

Platform Options: The broker does not offer MetaTrader 4 or MetaTrader 5 platforms. Details about their actual trading platform remain undisclosed.

Geographic Restrictions: Information about regional limitations or restricted territories is not available in current materials.

Customer Support Languages: Specific language support options for customer service are not detailed in this zheng da international review.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Zheng Da International's account conditions faces big challenges because of limited publicly available information. The broker has not shared specific account types or their features, making it impossible to evaluate the variety and suitability of options for different trader profiles. Without clear information about minimum deposit requirements, traders cannot determine how accessible the broker's services are or plan their initial investment accordingly.

The account opening process details remain unspecified. This leaves potential clients uncertain about documentation requirements, verification procedures, and timeline expectations. Additionally, there is no mention of specialized account features such as Islamic accounts for Muslim traders, educational accounts for beginners, or premium accounts for high-volume traders.

This lack of transparency in account structure information significantly hurts the ability to provide a meaningful evaluation. The absence of detailed terms and conditions in public materials raises concerns about the broker's commitment to transparency. Professional forex brokers typically provide complete information about account types, features, and requirements to help traders make informed decisions.

This zheng da international review cannot properly assess account conditions without such basic information being readily available.

The evaluation of trading tools and resources offered by Zheng Da International is severely limited by the lack of available information. The broker has not provided details about analytical tools, charting capabilities, or technical indicators available on their platform. Without knowledge of the specific trading platform used, it's impossible to assess the quality and completeness of built-in trading tools.

Research and market analysis resources appear to be undisclosed. This leaves traders without understanding of whether the broker provides market commentary, economic calendars, or fundamental analysis materials. Educational resources, which are important for trader development, are not mentioned in available materials, suggesting either their absence or poor marketing of such services.

The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities represents a significant gap in service transparency. Given that the broker does not offer MT4/MT5 platforms, which are known for extensive third-party tool ecosystems, the availability of alternative automated trading solutions becomes even more important to evaluate.

Customer Service and Support Analysis

Customer service evaluation for Zheng Da International faces big limitations because of the absence of publicly available information about support channels, availability, and service quality. The broker has not shared whether they offer phone support, live chat, email assistance, or other communication methods, making it impossible to assess accessibility and convenience for traders.

Response times, service hours, and the geographical coverage of customer support remain unknown. This lack of transparency is particularly concerning for international traders who may need assistance across different time zones. The absence of information about multilingual support capabilities also raises questions about the broker's ability to serve a diverse client base effectively.

Without user testimonials or feedback about customer service experiences, this review cannot provide insights into problem resolution effectiveness or overall service satisfaction. Professional forex brokers typically highlight their customer service capabilities as a competitive advantage, making the absence of such information notable and potentially concerning for prospective clients.

Trading Experience Analysis

The assessment of trading experience with Zheng Da International is significantly hurt by the lack of available user feedback and technical performance data. Without information about platform stability, execution speeds, or order processing quality, traders cannot make informed decisions about the broker's operational reliability.

The absence of details about the actual trading platform used by the broker creates uncertainty about user interface design, functionality, and overall usability. Since the broker does not offer MT4/MT5 platforms, which many traders are familiar with, the learning curve and adaptation requirements for their system remain unknown.

Mobile trading capabilities, which are essential in today's market environment, are not detailed in available materials. The lack of information about trading environment features such as one-click trading, advanced order types, or risk management tools further limits the ability to assess the overall zheng da international review trading experience completely.

Trust and Reliability Analysis

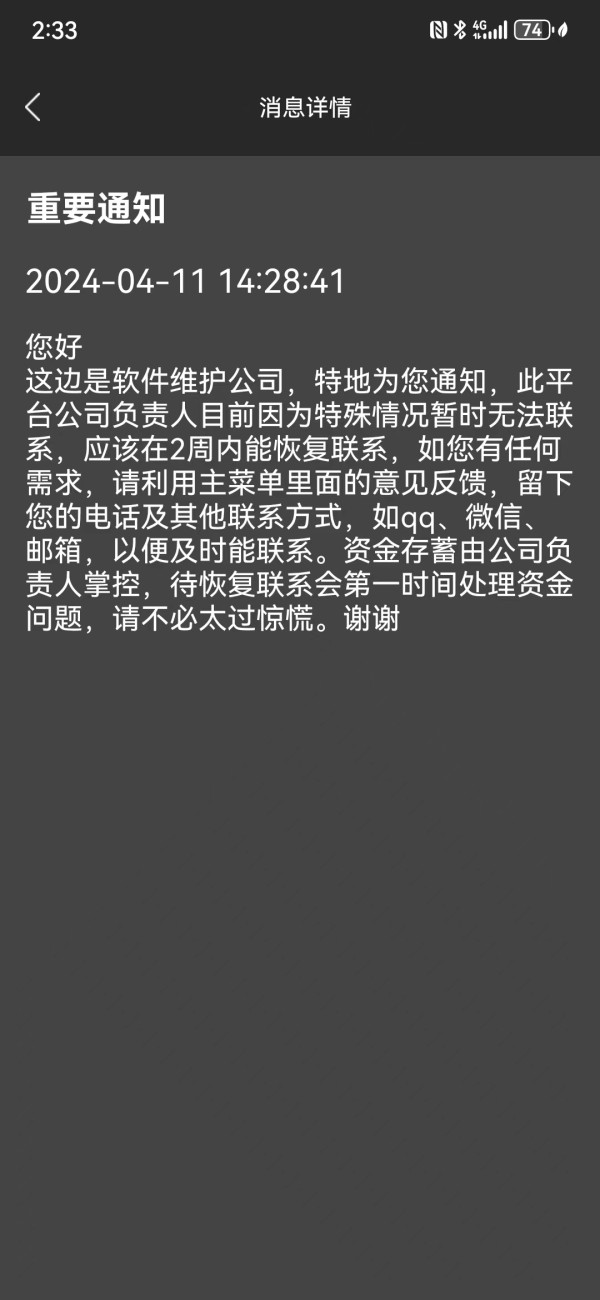

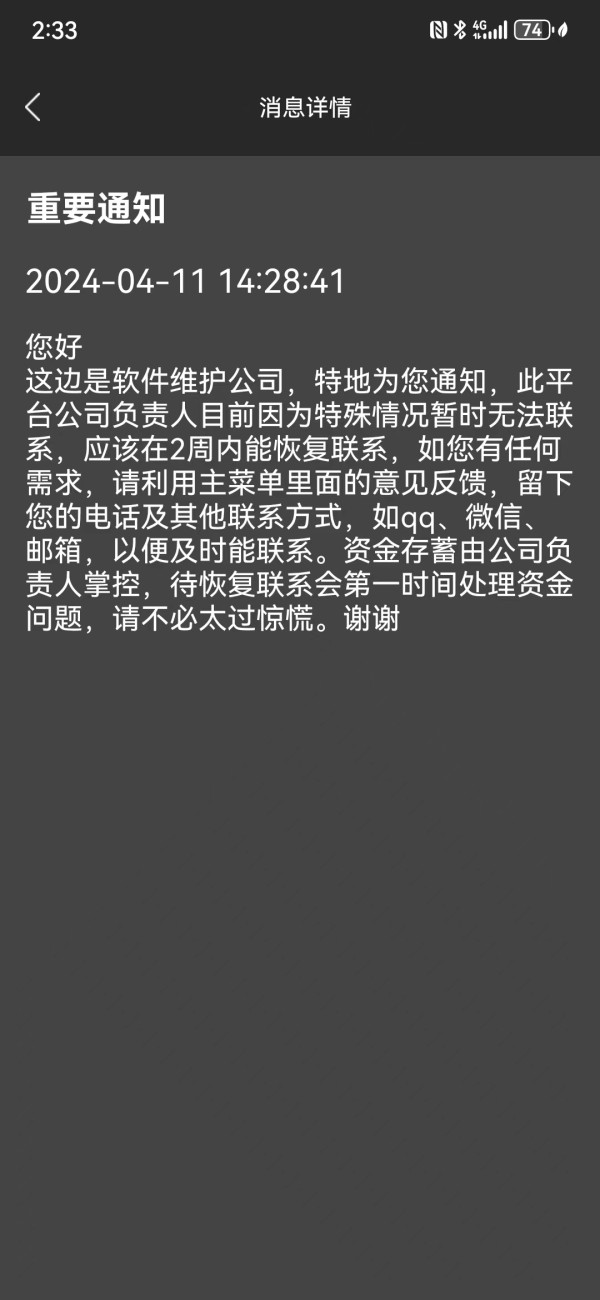

The trust and reliability assessment of Zheng Da International reveals mixed signals that need careful consideration. The broker claims regulatory oversight from the Hong Kong Securities and Futures Commission under license number BOP620, which would represent a legitimate regulatory framework if verified. However, some users have expressed doubt about whether this regulatory status is real, creating uncertainty about the broker's actual compliance standing.

The Hong Kong SFC is generally recognized as a credible regulatory authority with established oversight mechanisms for financial services providers. If the claimed regulatory status is accurate, it would provide some level of investor protection and operational oversight. However, the user concerns about license authenticity highlight the importance of independent verification before working with the broker.

The limited transparency regarding operational details, fee structures, and business practices raises additional questions about the broker's commitment to open communication with clients. Professional and trustworthy brokers typically provide complete information about their services, regulatory status, and business operations to build client confidence and meet regulatory disclosure requirements.

User Experience Analysis

The evaluation of user experience with Zheng Da International faces significant constraints because of the scarcity of available user feedback and testimonials. Without substantial user reviews or experience reports, it's impossible to assess overall client satisfaction levels or identify common user concerns and preferences.

The absence of information about website usability, account registration processes, and general interface design limits the ability to evaluate the broker's commitment to user-friendly service delivery. Modern forex traders expect intuitive platforms and streamlined processes, but the lack of user experience data makes it difficult to determine whether Zheng Da International meets these expectations.

The limited availability of user feedback also prevents the identification of common complaint patterns or areas where the broker excels in service delivery. This information gap is particularly concerning given the competitive nature of the forex brokerage industry, where user experience often serves as a key differentiator between service providers.

Conclusion

This comprehensive zheng da international review reveals a broker operating with limited transparency and questionable market positioning. While Zheng Da International claims regulatory oversight from the Hong Kong SFC, the combination of user doubt about license authenticity and the substantial lack of operational information creates significant concerns for potential traders.

The broker may be suitable for traders willing to accept higher levels of uncertainty and conduct extensive independent research before engaging. However, the absence of important information about trading conditions, fee structures, and platform capabilities makes it difficult to recommend Zheng Da International for most trader profiles.

The primary advantages appear to be the claimed regulatory background and focus on Asian markets. Significant disadvantages include transparency concerns, limited available information, and user doubts about regulatory authenticity. Traders considering this broker should prioritize thorough due diligence and verification of all claims before committing funds.