XHK 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xhk review examines a Hong Kong-based forex broker that has established itself as a specialized platform for professional investors. XHK Limited operates with a clear focus on delivering institutional-grade trading services to sophisticated market participants. The company is regulated by the Hong Kong Securities and Futures Commission under license number BNN565.

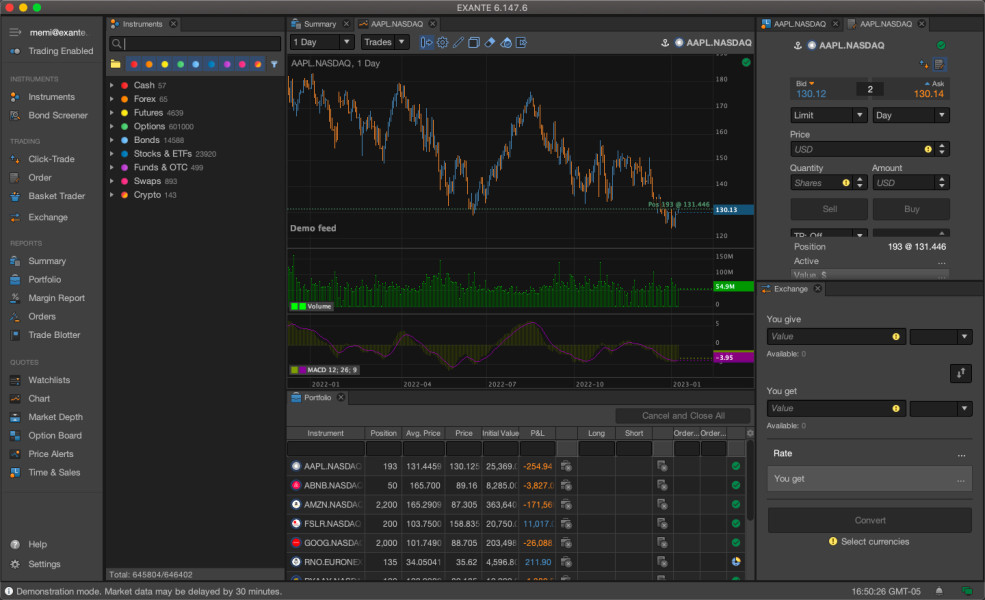

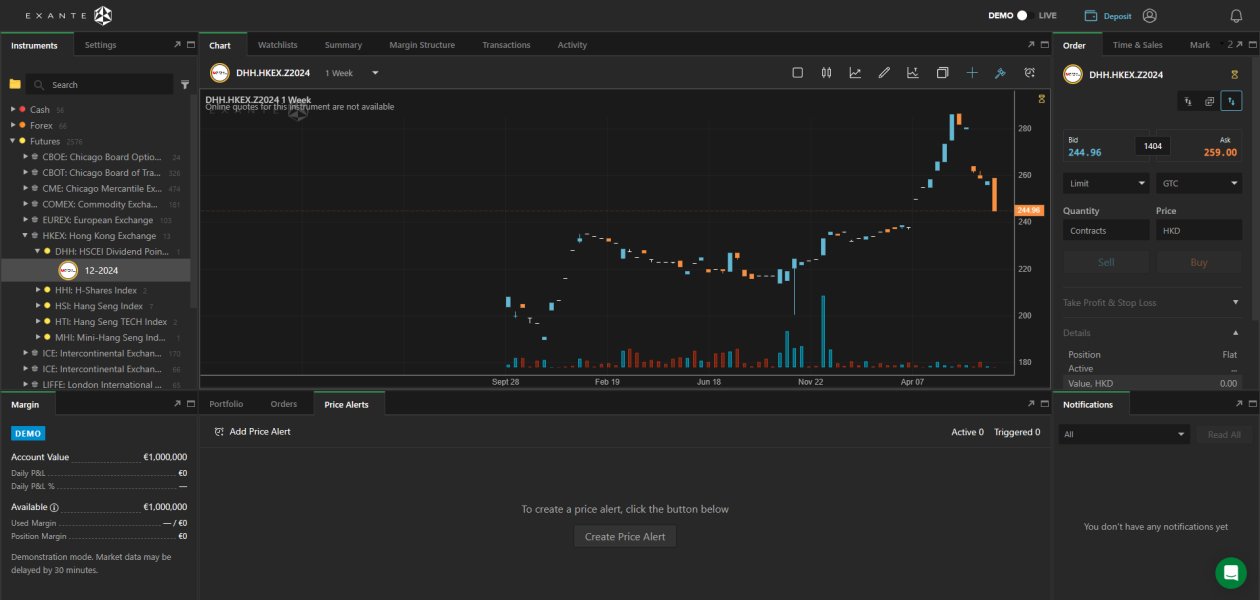

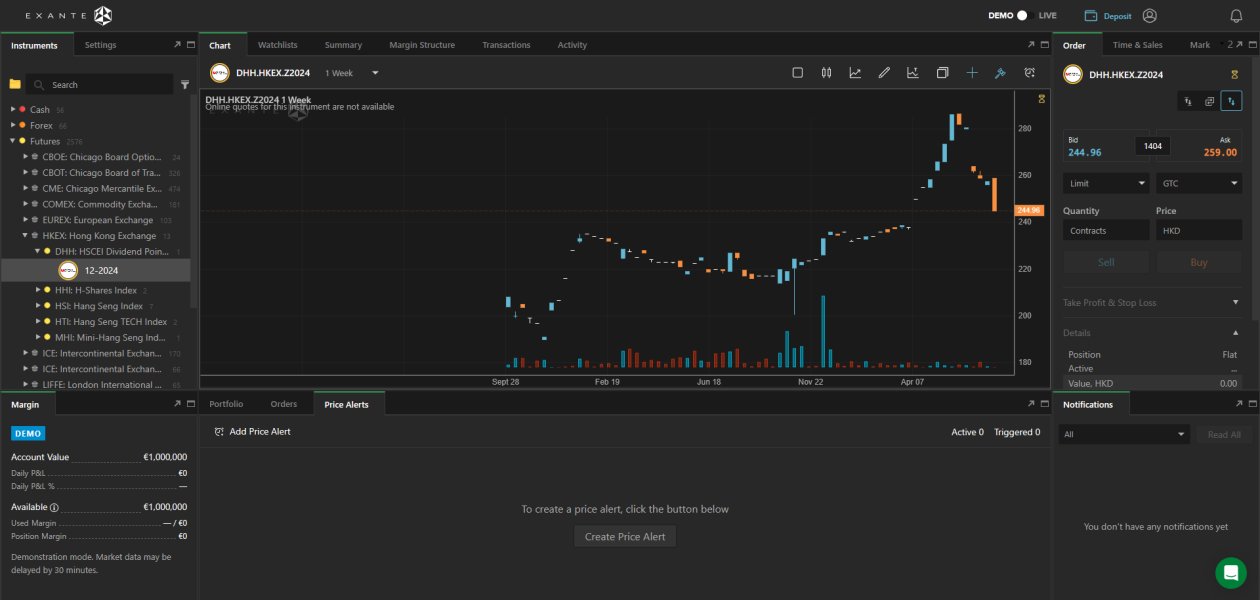

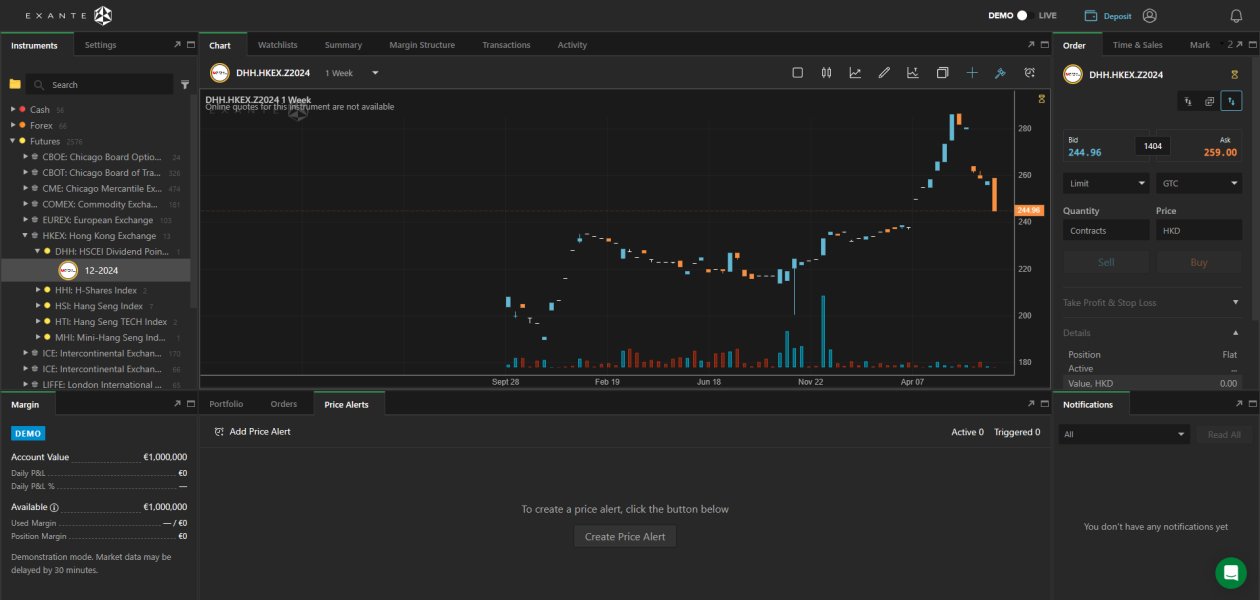

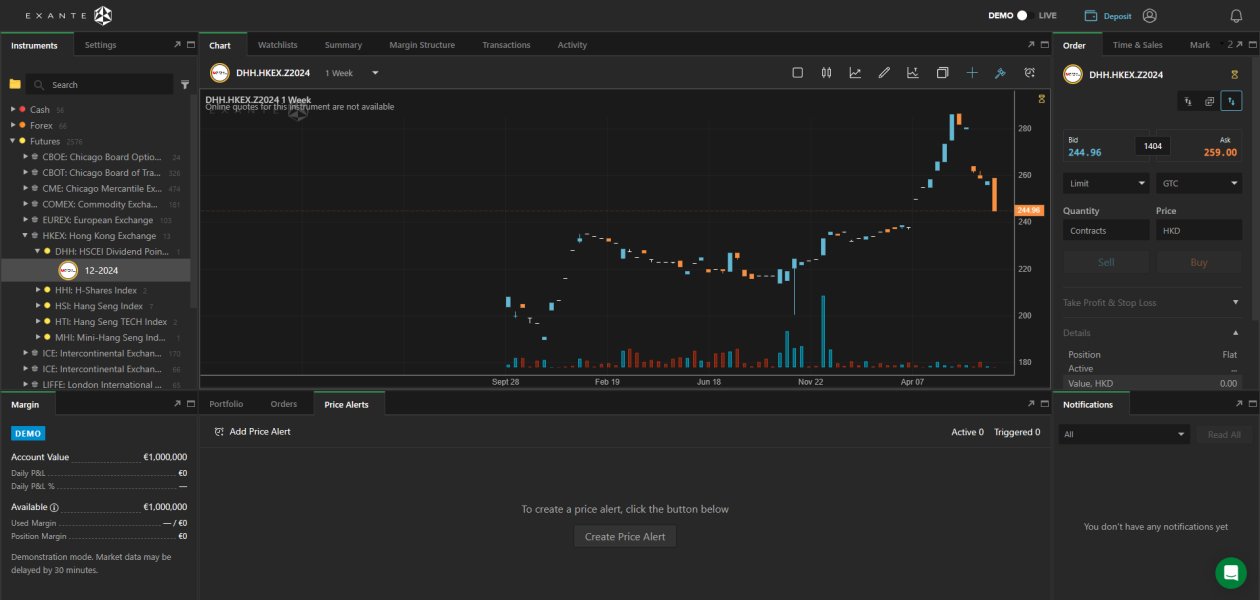

The broker distinguishes itself through its partnership with the EXANTE trading platform. This partnership provides access to over 1,000,000 financial instruments across more than 50 global markets. The extensive product range encompasses stocks, ETFs, bonds, futures, options, precious metals, and currencies, all accessible through a single multi-currency account. The platform's availability in 10 languages demonstrates XHK's commitment to serving an international clientele of professional traders and institutional clients.

Founded by professional investors specifically for professional investors, XHK emphasizes best execution practices, personalized user experiences, and premier service delivery. The broker's minimum deposit requirement of €10,000 clearly signals its target demographic of well-capitalized traders. These traders require sophisticated trading infrastructure and direct market access capabilities.

Important Disclaimers

XHK operates under Hong Kong jurisdiction and is regulated by the Hong Kong Securities and Futures Commission. This may result in different regulatory standards and service offerings compared to brokers operating in other jurisdictions. Potential clients should carefully consider the implications of trading with a Hong Kong-based entity, particularly regarding investor protection schemes and dispute resolution mechanisms that may differ from their home country's regulations.

This evaluation is based on publicly available company information, regulatory filings, and user feedback collected from various sources. The assessment aims to provide prospective users with a comprehensive understanding of XHK's services, capabilities, and positioning within the competitive forex and multi-asset trading landscape.

Overall Rating Framework

Broker Overview

XHK Limited represents a distinctive approach to forex and multi-asset brokerage. The company was established by professional investors with the explicit goal of serving their peer group. The company's headquarters in Hong Kong's Wan Chai district positions it strategically within one of Asia's premier financial centers, providing proximity to major institutional clients and regulatory oversight from the respected Hong Kong Securities and Futures Commission.

The broker's business model centers on delivering institutional-quality execution and personalized service to professional traders and institutional clients. This focus manifests in their partnership with EXANTE, a sophisticated trading platform that provides direct market access across a remarkable breadth of financial instruments. According to available information, XHK received its SFC license on January 29, 2019. This established its regulatory foundation for serving professional market participants.

The company's commitment to serving international clients is evident through its multi-language platform support. The platform accommodates traders across diverse geographical regions. The EXANTE platform serves as XHK's primary trading infrastructure, offering access to stocks, ETFs, bonds, futures, options, precious metals, and currencies from a unified account structure. This comprehensive approach eliminates the need for multiple broker relationships, streamlining the trading experience for sophisticated investors who require exposure across various asset classes and global markets.

Regulatory Jurisdiction: XHK operates under Hong Kong Securities and Futures Commission regulation with license number BNN565. This provides clients with oversight from one of Asia's most respected financial regulators.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available source materials.

Minimum Deposit Requirements: The broker maintains a minimum deposit threshold of €10,000. This reflects its positioning toward professional and institutional clients rather than retail traders.

Bonus and Promotional Offers: Information regarding promotional offers or bonus structures was not available in the reviewed materials.

Available Trading Assets: XHK provides access to an extensive range of financial instruments including stocks, ETFs, bonds, futures, options, precious metals, and currencies. The total number of available instruments exceeds 1,000,000 across more than 50 different markets.

Cost Structure and Fees: Specific details regarding spreads, commissions, and other trading costs were not provided in the available source materials. Potential clients must contact the broker directly for pricing information.

Leverage Ratios: Information regarding maximum leverage ratios was not specified in the reviewed materials.

Platform Options: XHK exclusively offers the EXANTE trading platform. This platform provides comprehensive multi-asset trading capabilities and direct market access functionality.

Geographic Restrictions: Specific information about geographic limitations or restricted territories was not detailed in available source materials.

Customer Support Languages: The platform supports 10 different languages. This demonstrates XHK's commitment to serving an international client base.

This xhk review reveals a broker positioned firmly in the professional segment of the market. The infrastructure and requirements reflect its institutional focus.

Account Conditions Analysis

XHK's account structure reflects its clear positioning toward professional and institutional traders. The most notable feature is its substantial minimum deposit requirement of €10,000. This threshold significantly exceeds typical retail broker requirements, effectively filtering for well-capitalized traders who can meet the financial prerequisites for professional-grade services. The high minimum deposit aligns with the broker's stated mission of serving professional investors, ensuring that clients possess sufficient capital to engage meaningfully with institutional-quality trading infrastructure.

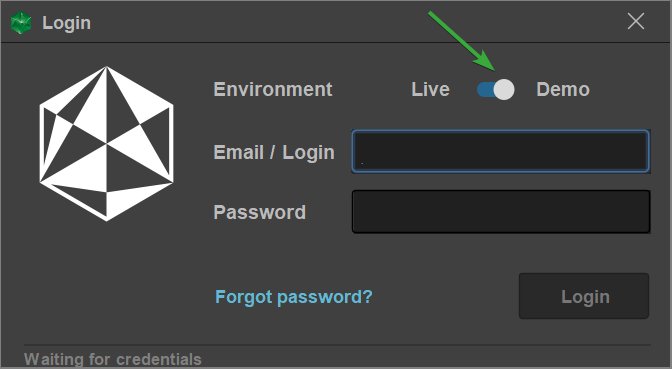

While specific information about different account tiers or variations was not available in the reviewed materials, the singular focus on professional clients suggests a streamlined account structure rather than multiple retail-oriented options. The absence of detailed information regarding account opening procedures, verification requirements, or special account features such as Islamic accounts indicates that potential clients must engage directly with XHK. This direct engagement is necessary to understand the full scope of available account configurations.

The broker's partnership with EXANTE for platform provision suggests that account holders benefit from sophisticated trading infrastructure typically reserved for institutional participants. However, the lack of publicly available information about account-specific features, trading conditions, or special accommodations represents a limitation for potential clients. These clients seek comprehensive details before initiating contact with the broker.

This xhk review assessment of account conditions reflects the broker's professional orientation while highlighting the need for direct communication to fully understand available options and requirements.

XHK's partnership with EXANTE represents one of its strongest value propositions. This partnership provides clients with access to institutional-grade trading infrastructure that spans over 1,000,000 financial instruments across more than 50 global markets. The extensive coverage encompasses major asset classes including equities, fixed income, derivatives, commodities, and foreign exchange, delivered through a unified platform architecture that eliminates the complexity of managing multiple broker relationships.

The EXANTE platform's multi-currency account functionality enables traders to hold and trade in various currencies without the friction of constant conversions. This feature is particularly valuable for international portfolio strategies. The platform's direct market access capabilities provide professional traders with the execution quality and market depth typically available only to institutional participants, representing a significant advantage over standard retail trading platforms.

However, the available source materials did not provide detailed information about specific research and analysis tools, educational resources, or automated trading support that might be available through the platform. The absence of information regarding charting capabilities, fundamental analysis tools, or algorithmic trading support represents a gap in this evaluation. Potential clients must investigate these features directly with the broker.

The platform's availability in 10 languages demonstrates technical sophistication and international market focus. However, specific details about mobile trading capabilities, API access, or third-party integrations were not available in the reviewed materials. Despite these information limitations, the scale and scope of available instruments through EXANTE positions XHK favorably for professional traders requiring broad market access.

Customer Service and Support Analysis

The evaluation of XHK's customer service capabilities is limited by the absence of specific information regarding support channels, response times, and service quality metrics in the available source materials. While the platform's support for 10 languages indicates an international service orientation and suggests multilingual support capabilities, detailed information about customer service hours, available communication channels, or typical response times was not provided.

The broker's focus on professional and institutional clients typically implies higher service standards and more direct relationship management compared to retail-oriented brokers. Professional trading environments often feature dedicated account managers, priority support channels, and specialized technical assistance. However, specific confirmation of these services at XHK was not available in the reviewed materials.

The absence of user testimonials or service quality feedback in the available sources prevents a comprehensive assessment of actual customer experience with XHK's support infrastructure. Professional traders and institutional clients generally have elevated expectations for support quality, technical expertise, and problem resolution speed. This makes the information gap particularly significant for potential clients evaluating the broker.

Without specific information about support availability outside Hong Kong business hours, emergency trading support, or technical assistance capabilities, potential clients must engage directly with XHK to evaluate whether the support infrastructure meets their operational requirements and geographic considerations.

Trading Experience Analysis

The trading experience at XHK centers around the EXANTE platform, which provides professional-grade functionality designed for sophisticated market participants. The platform's ability to provide access to over 1,000,000 instruments across 50+ markets from a single account represents a significant operational advantage. This advantage benefits traders requiring diverse market exposure without the complexity of multiple broker relationships.

Direct market access functionality typically associated with institutional platforms suggests that XHK clients benefit from superior execution quality compared to standard retail broker offerings. However, specific information about execution speeds, slippage characteristics, or requote frequency was not available in the reviewed materials. This limits the ability to assess actual trading performance metrics.

The multi-currency account structure eliminates conversion friction for international trading strategies. The platform's support for various asset classes enables sophisticated portfolio construction and risk management approaches. The absence of specific information about order types, trading algorithms, or advanced order management features represents a limitation in evaluating the platform's suitability for complex trading strategies.

Mobile trading capabilities, platform stability metrics, and system uptime data were not provided in the available source materials. This requires potential clients to investigate these critical operational aspects directly. The professional positioning suggests robust infrastructure, though specific performance data would strengthen confidence in the platform's reliability for active trading strategies.

Trust and Regulation Analysis

XHK's regulatory foundation rests on its Hong Kong Securities and Futures Commission license number BNN565, obtained on January 29, 2019. The SFC maintains rigorous standards for financial services firms, requiring compliance with capital adequacy requirements, client money protection rules, and operational oversight. This provides substantial protection for professional clients. Hong Kong's regulatory framework is widely respected in international financial markets, offering credible oversight for cross-border trading activities.

The broker's corporate structure as XHK Limited with company number 2643270 provides transparency regarding its legal entity. Its physical presence at Unit A, 6/F CNT Tower in Hong Kong's Wan Chai district demonstrates substantial operational commitment rather than a virtual presence. This combination of regulatory oversight and physical infrastructure supports confidence in the broker's legitimacy and operational stability.

However, specific information about client fund segregation practices, insurance coverage, or compensation schemes was not detailed in the available source materials. While SFC regulation typically requires client money protection measures, the absence of specific details about these safeguards represents an information gap. This gap affects potential clients evaluating counterparty risk.

The broker's focus on professional and institutional clients suggests adherence to higher operational standards. However, specific information about financial reporting transparency, management team credentials, or third-party auditing was not available. The absence of information regarding any regulatory actions, client complaints, or industry recognition limits the ability to assess the broker's operational track record comprehensively.

User Experience Analysis

The assessment of user experience at XHK is significantly limited by the absence of detailed user feedback and satisfaction metrics in the available source materials. The broker's clear positioning toward professional and institutional clients suggests a user base with sophisticated requirements. These users have elevated expectations for platform functionality, execution quality, and support services.

The EXANTE platform's multi-language support across 10 languages indicates attention to international user accessibility. The extensive instrument coverage suggests that experienced traders can implement complex strategies without platform limitations. However, specific information about interface design, navigation efficiency, or user workflow optimization was not available for evaluation.

Registration and account verification processes, critical elements of initial user experience, were not detailed in the reviewed materials. Similarly, information about funding and withdrawal experiences, platform learning curves, or common user challenges was not available to inform this assessment. The high minimum deposit requirement naturally limits the user base to well-capitalized traders, potentially resulting in a more sophisticated and demanding client profile.

The absence of user testimonials, satisfaction surveys, or detailed platform reviews in the available sources prevents comprehensive evaluation of actual user experience quality. Professional traders typically have specific requirements for platform reliability, execution speed, and advanced functionality that standard retail feedback may not adequately address. This makes direct broker communication essential for thorough evaluation.

Conclusion

This xhk review reveals a specialized broker that operates with clear focus on professional and institutional market participants. XHK's regulatory foundation through the Hong Kong Securities and Futures Commission, combined with its partnership with the EXANTE platform providing access to over 1,000,000 instruments across 50+ markets, positions it as a credible option for sophisticated traders. These traders require institutional-grade infrastructure and broad market access.

The broker's strengths lie in its regulatory credibility, extensive instrument coverage, and professional positioning that eliminates many retail-oriented limitations. However, significant information gaps regarding specific trading conditions, customer service details, and user experience metrics require potential clients to engage directly with XHK for comprehensive evaluation. The high minimum deposit requirement of €10,000 clearly defines the target market while potentially limiting accessibility for smaller professional traders.