Regarding the legitimacy of Hedge Market forex brokers, it provides FSPR and WikiBit, .

Is Hedge Market safe?

Business

License

Is Hedge Market markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Hedge Market Inc. Limited

Effective Date:

2013-07-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2018-08-22Address of Licensed Institution:

6 Eglinton Avenue, Mount Eden, Auckland, 1024, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Hedge Market Safe or Scam?

Introduction

Hedge Market is a forex broker that claims to provide a wide range of trading services to its clients. Established in 2017 and based in New Zealand, it aims to cater to both novice and experienced traders in the foreign exchange market. However, the forex trading landscape is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams in this industry necessitates thorough evaluations of brokers to ensure that they are legitimate and trustworthy. This article aims to assess the safety of Hedge Market through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory environment is a crucial aspect of any forex broker's credibility. A broker's regulatory status can significantly impact the safety of traders' funds and the integrity of its trading practices. Hedge Market is registered with the Financial Service Providers Register (FSPR) in New Zealand, but it has faced scrutiny regarding its regulatory compliance. Below is a summary of Hedge Market's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 302806 | New Zealand | Revoked |

The FSPR is a regulatory body that oversees financial service providers in New Zealand; however, the revocation of Hedge Market's license raises concerns about its legitimacy. A revoked license indicates that the broker may have failed to meet certain regulatory requirements, which can jeopardize the safety of traders' funds. Furthermore, the absence of a robust regulatory framework can expose traders to higher risks, including fraud and mismanagement.

Company Background Investigation

Hedge Market's history and ownership structure provide insights into its reliability. Founded in 2017, the broker has positioned itself as a player in the forex market. However, its relatively short history raises questions about its stability and longevity. The management team's background is another critical factor in evaluating the company's credibility. A strong management team with relevant experience can enhance a broker's reputation and operational efficiency.

Despite its claims of providing exceptional trading services, there is limited information available regarding Hedge Market's management and ownership. The lack of transparency in this regard is concerning, as it hinders potential clients from fully understanding the broker's operational framework and ethical standards. Moreover, the absence of detailed disclosures about the company's financial health and performance history further diminishes its credibility.

Trading Conditions Analysis

An evaluation of trading conditions is essential for understanding the cost implications and overall trading experience with a broker. Hedge Market offers various trading options, but its fee structure has raised eyebrows among traders. The following table summarizes the key trading costs associated with Hedge Market:

| Fee Type | Hedge Market | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Model | Variable | Fixed |

| Overnight Interest Rates | Unclear | Standard |

The high spreads on major currency pairs can significantly affect trading profitability, especially for frequent traders. Additionally, the variable commission model may lead to unexpected costs for clients. This lack of clarity regarding fees poses a risk for traders, who may find themselves incurring higher costs than anticipated. A transparent and competitive fee structure is essential for fostering trust between brokers and their clients.

Customer Funds Safety

The safety of customer funds is paramount for any forex broker. Hedge Market claims to implement various measures to protect client funds, including segregated accounts and risk management protocols. However, the effectiveness of these measures is questionable given the broker's regulatory issues. The following points outline Hedge Market's approach to fund safety:

Segregation of Funds: The broker states that it keeps client funds in separate accounts, which is a standard practice in the industry. However, the lack of regulatory oversight raises concerns about the actual implementation of this practice.

Investor Protection: There is no clear indication that Hedge Market participates in any investor protection schemes that would compensate clients in the event of insolvency. This absence of a safety net increases the risk for traders.

Negative Balance Protection: The broker has not provided clear information regarding negative balance protection policies. This is crucial for traders who utilize leverage, as it can prevent them from owing more money than they initially deposited.

Historical issues related to fund safety and client complaints further exacerbate concerns about Hedge Market's reliability.

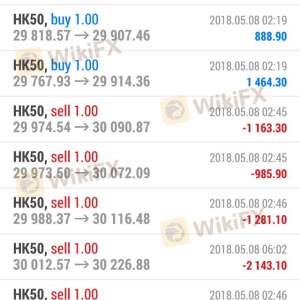

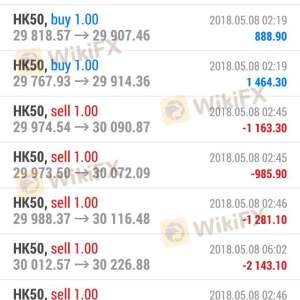

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's performance and reliability. Reviews regarding Hedge Market have been mixed, with several users expressing dissatisfaction with the broker's services. Common complaints include issues with fund withdrawals, unresponsive customer service, and inconsistent pricing. The following table summarizes the primary types of complaints associated with Hedge Market:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Pricing Inconsistencies | Medium | Inconsistent |

| Customer Service Response | High | Slow |

One notable complaint involved a trader who reported difficulties withdrawing funds, claiming that the broker's customer service was unresponsive during the process. Such experiences can significantly impact a trader's confidence in the broker and highlight potential operational weaknesses.

Platform and Execution

The trading platform is a critical component of the trading experience. Hedge Market primarily operates on the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust trading tools. However, the platform's performance has faced scrutiny. Users have reported issues related to execution delays and slippage, which can adversely affect trading outcomes.

Furthermore, there are concerns about potential platform manipulation, as some traders have indicated discrepancies between market prices and the prices offered by Hedge Market. Such practices can lead to significant financial losses and raise questions about the broker's integrity.

Risk Assessment

The overall risk of trading with Hedge Market is a culmination of various factors, including regulatory issues, customer complaints, and trading conditions. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked license raises concerns. |

| Customer Fund Safety | High | Lack of investor protection schemes. |

| Trading Costs | Medium | High spreads and unclear fees. |

| Customer Service | High | Poor response to complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with Hedge Market. It is advisable to start with a demo account to assess the platform's performance and customer service quality.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Hedge Market raises several red flags that warrant caution. The revoked regulatory license, mixed customer feedback, and unclear trading conditions suggest that the broker may not be a safe choice for traders.

For traders seeking reliable forex brokers, it is recommended to consider alternatives with robust regulatory frameworks, transparent fee structures, and positive user experiences. Brokers such as IG, OANDA, and Forex.com have established reputations for safety and reliability in the industry.

In summary, while Hedge Market may offer certain trading services, potential clients should exercise caution and thoroughly evaluate their options before committing their funds.

Is Hedge Market a scam, or is it legit?

The latest exposure and evaluation content of Hedge Market brokers.

Hedge Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hedge Market latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.