HDG Markets 2025 Review: Everything You Need to Know

Executive Summary

HDG Markets is a new forex broker that started in 2019. The company has raised big concerns in the trading community. While HDG Markets claims to be regulated by multiple authorities including FCA, NFA, and ASIC, our hdg markets review shows troubling regulatory problems.

The broker's ASIC regulatory status has been revoked. It lacks proper FCA authorization, which seriously hurts its credibility. The platform advertises very low spreads for forex and CFD trading, but this comes with a clear lack of transparency about trading conditions and company operations.

User complaints have been growing. Many traders express dissatisfaction with the broker's services. The WikiFX rating of 1.54 out of 10 reflects the broader market sentiment about HDG Markets' trustworthiness.

This broker may appeal to intermediate traders interested in forex and CFD trading because of its claimed competitive spreads. However, potential users must carefully consider the significant regulatory and trust issues before putting money in. The lack of proper oversight and negative user feedback suggest that traders should be extremely careful when considering HDG Markets as their trading partner.

Important Disclaimer

Traders should know that HDG Markets operates across different areas with varying regulatory claims. The company's ASIC regulatory status has been revoked, and it has not received proper FCA authorization despite claims of regulation.

Users must verify the regulatory status in their specific region before opening an account. This review is based on publicly available information and user feedback to provide an objective analysis of HDG Markets' services. All assessments are conducted using standardized evaluation criteria to ensure fair comparison with other brokers in the market.

Rating Overview

Broker Overview

HDG Markets entered the online trading scene in 2019. The company positioned itself as a UK-based online broker specializing in forex and CFD trading services. HDG Markets has tried to establish itself in the competitive retail trading market by offering what it claims to be ultra-competitive spreads and comprehensive trading solutions.

However, the broker's short operational history combined with regulatory uncertainties has created skepticism within the trading community. The business model centers around providing online trading services primarily focused on currency pairs and contracts for difference. HDG Markets targets retail traders seeking access to global financial markets through digital platforms.

Despite its ambitious market positioning, the company has struggled to build a solid reputation due to transparency issues and regulatory complications that have emerged since its inception. Our hdg markets review indicates that while the broker offers access to popular asset classes including forex and CFDs, specific details about trading platforms, account structures, and operational procedures remain unclear. The company's regulatory status presents the most significant concern, with revoked ASIC authorization and questionable FCA claims undermining its credibility in key markets where retail traders seek properly regulated brokers.

Regulatory Jurisdictions: HDG Markets claims regulation under FCA, NFA, and ASIC authorities. However, verification reveals that ASIC regulatory status has been revoked and FCA authorization has not been granted, creating serious compliance concerns.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This represents a transparency gap for potential clients.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit requirements across different account types. This makes it difficult for traders to understand entry barriers.

Bonus and Promotions: Available materials do not specify current bonus structures or promotional offerings. This suggests either absence of such programs or lack of marketing transparency.

Available Trading Assets: The primary focus appears to be on forex currency pairs and CFDs. However, comprehensive asset lists and specific instruments are not publicly detailed.

Cost Structure: HDG Markets advertises ultra-low spreads starting from zero, but the lack of transparency regarding specific trading assets and commission structures raises questions about the true cost of trading. Hidden fees and execution costs remain unclear without proper disclosure documentation.

Leverage Ratios: Specific leverage offerings across different asset classes and account types are not detailed in available public information.

Platform Options: Available documentation does not specify which trading platforms are offered or their respective features and capabilities.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not clearly outlined in accessible materials.

Customer Support Languages: The range of supported languages for customer service is not specified in available broker information.

This hdg markets review highlights significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

HDG Markets receives a below-average rating for account conditions primarily due to insufficient transparency regarding account structures and requirements. The broker has failed to provide clear information about different account types, their respective features, and associated costs.

This lack of clarity makes it extremely difficult for potential traders to make informed decisions about which account might suit their trading style and capital requirements. The absence of detailed minimum deposit information across various account tiers represents a significant shortcoming in the broker's client communication strategy. Most reputable brokers clearly outline their account hierarchy, from basic retail accounts to premium or VIP offerings, along with the benefits and requirements for each level.

HDG Markets' failure to provide this fundamental information raises questions about their commitment to transparency and client service. Account opening procedures and verification requirements are not clearly documented, creating uncertainty for prospective clients about the onboarding process. Additionally, there is no mention of specialized account features such as Islamic accounts for Muslim traders, which are standard offerings among established brokers serving diverse international markets.

User feedback regarding account conditions has been limited, but available comments suggest frustration with the lack of clear information and unexpected conditions that emerge during the account opening process. When compared to established brokers in the market, HDG Markets falls significantly short in providing the transparency and detailed account information that traders expect from a professional trading platform.

This hdg markets review emphasizes that the broker needs substantial improvement in communicating account conditions and requirements to meet industry standards and client expectations.

The tools and resources category receives one of the lowest scores in our evaluation due to the significant lack of information about HDG Markets' trading infrastructure and support systems. Available documentation provides virtually no details about the specific trading platforms offered, their features, or the technological capabilities that traders can expect when using the broker's services.

Research and analytical resources, which are crucial for informed trading decisions, are not mentioned in any available materials about HDG Markets. Most reputable brokers provide market analysis, economic calendars, technical indicators, and research reports to support their clients' trading activities. The absence of such information suggests either a lack of these essential services or poor communication about available resources.

Educational resources, including tutorials, webinars, trading guides, and market education materials, appear to be non-existent based on available information. This represents a significant disadvantage for traders, particularly those who are developing their skills and knowledge. Educational support has become a standard expectation in the retail trading industry, and its absence reflects poorly on the broker's commitment to client development.

Automated trading support, including Expert Advisors, algorithmic trading capabilities, and API access, is not documented. Modern traders increasingly rely on automated solutions, and the lack of information about such capabilities limits the broker's appeal to sophisticated trading strategies.

User feedback consistently indicates disappointment with the limited tools and resources available through HDG Markets. The broker's offering appears significantly inferior to industry standards, making it difficult to recommend for traders who require comprehensive analytical and educational support.

Customer Service and Support Analysis (5/10)

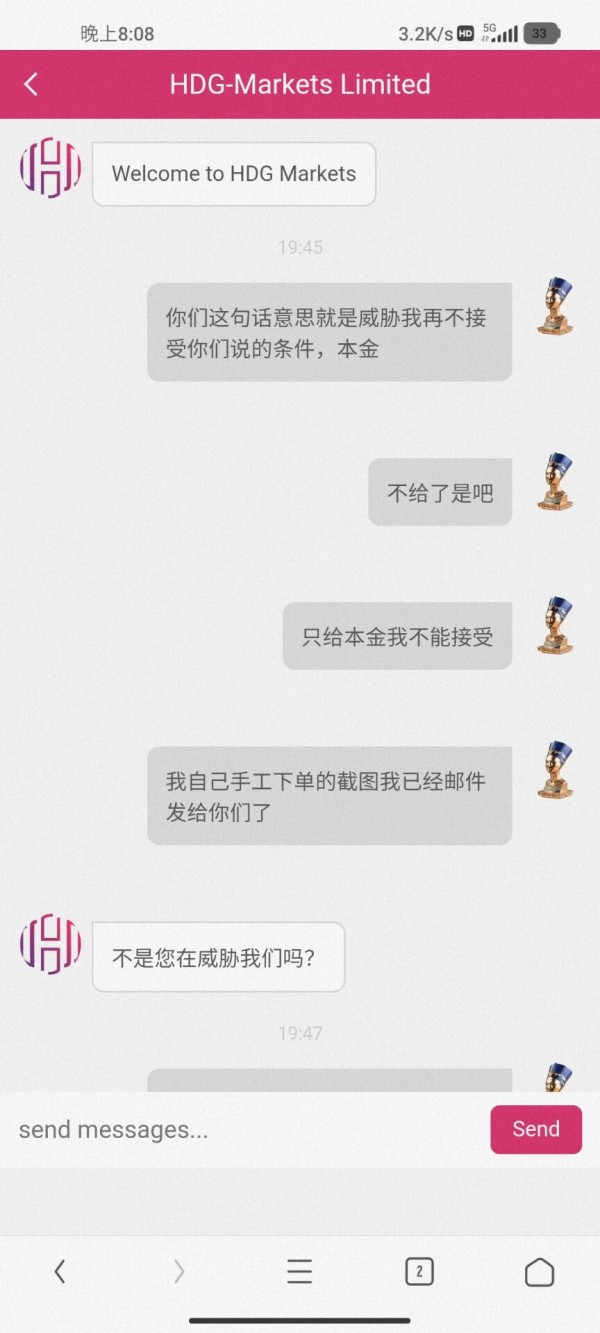

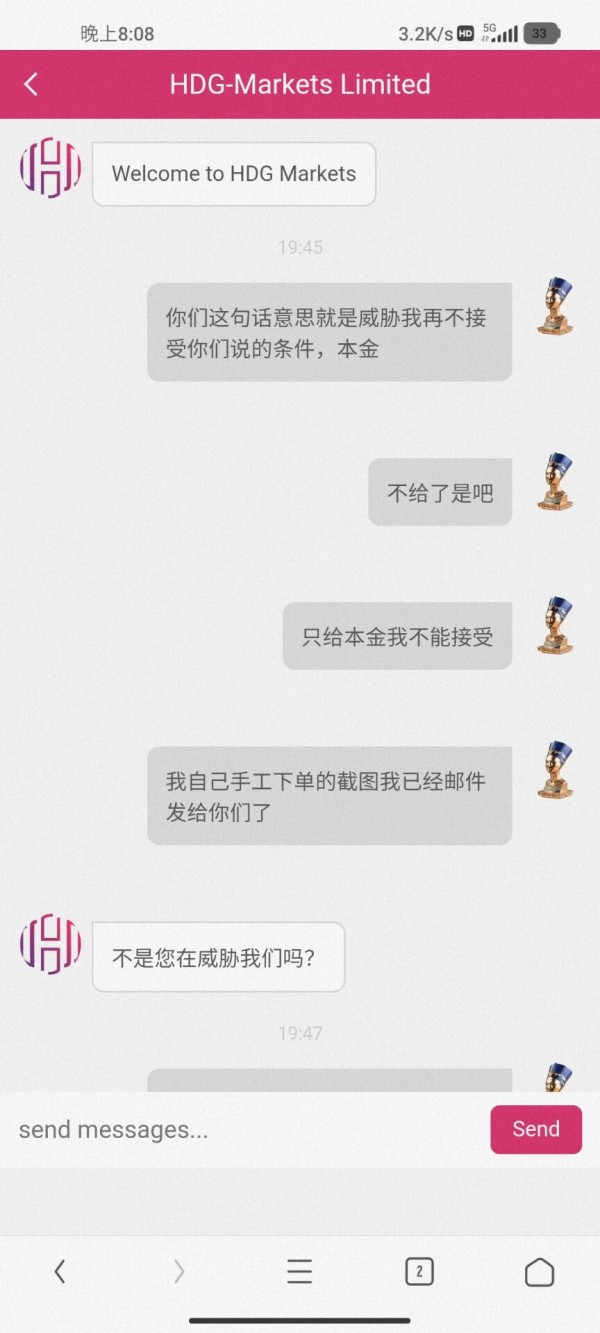

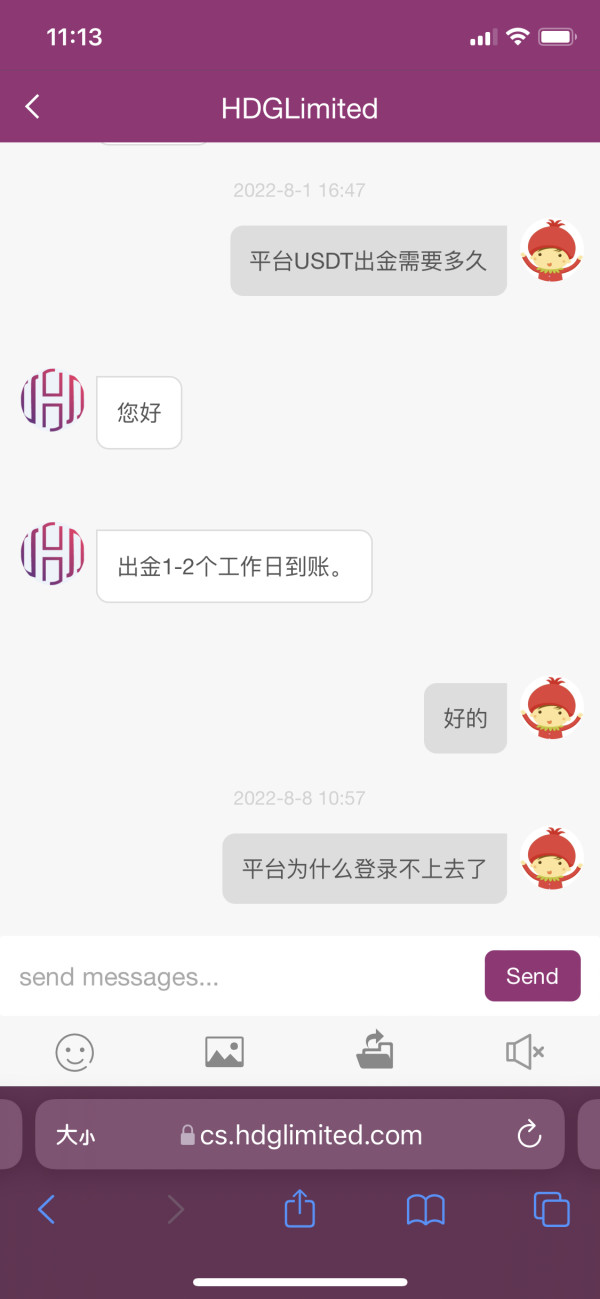

Customer service receives a mediocre rating based on available user feedback and the broker's apparent communication limitations. While specific customer service channels are not clearly documented, user experiences suggest that support quality and responsiveness fall short of industry standards.

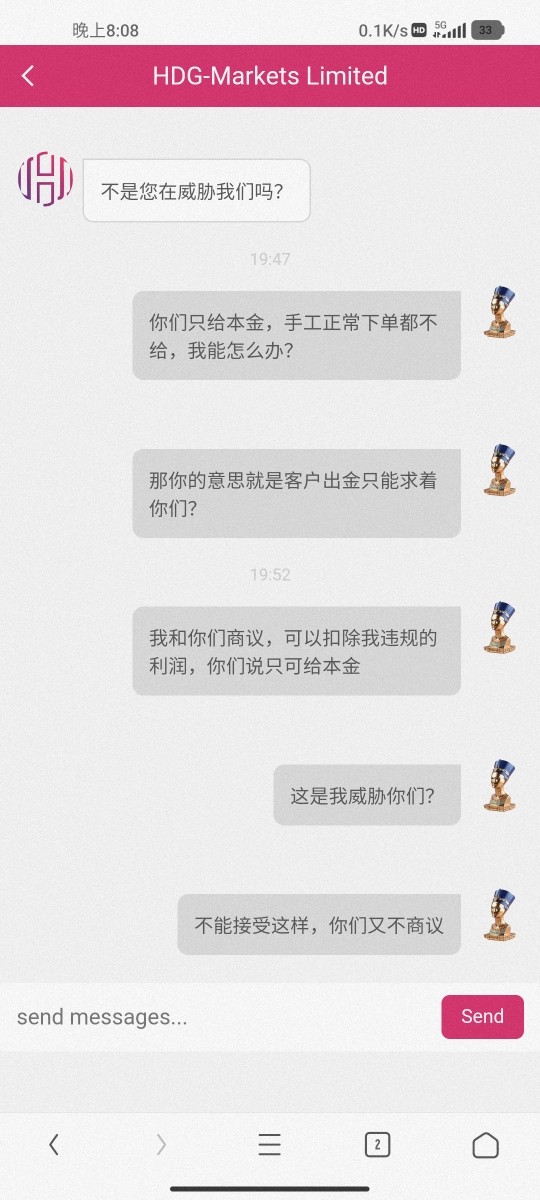

Many traders have reported difficulties in reaching customer service representatives and receiving timely responses to their inquiries. Response times appear to be a significant concern based on user feedback, with many clients expressing frustration about delayed responses to urgent trading-related questions and account issues. In the fast-paced trading environment, quick and efficient customer support is crucial for resolving technical problems and addressing account concerns that could impact trading activities.

Service quality assessments from users indicate inconsistent support experiences, with some reporting unhelpful responses and others noting that representatives lack sufficient knowledge about the platform's features and trading conditions. This inconsistency in service quality suggests inadequate training or staffing issues within the customer support department.

The availability of multilingual support is not clearly documented, which could pose challenges for international traders who prefer to communicate in their native languages. Most established brokers provide support in multiple languages to serve their diverse client base effectively.

Customer service hours and availability are not specified in available materials, creating uncertainty about when traders can expect to receive assistance. This lack of clarity about support availability adds to the overall concerns about the broker's commitment to client service and support infrastructure.

Trading Experience Analysis (4/10)

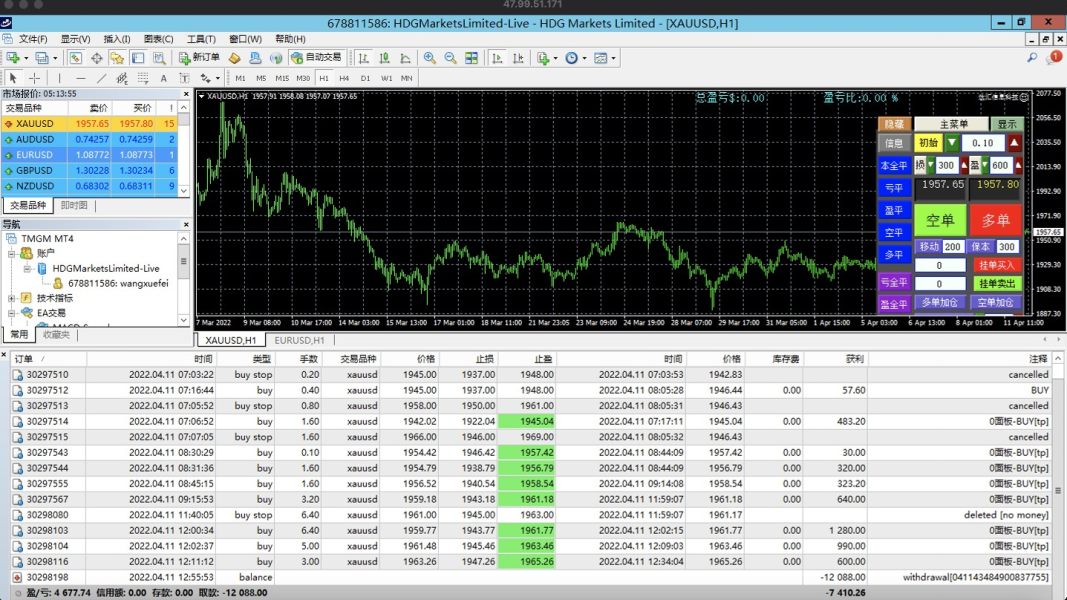

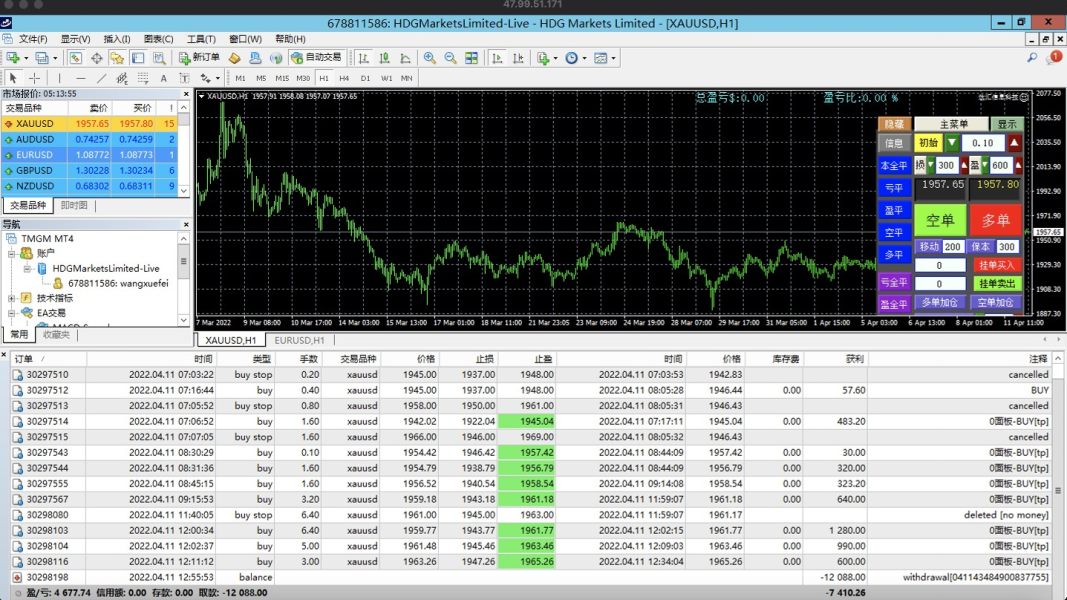

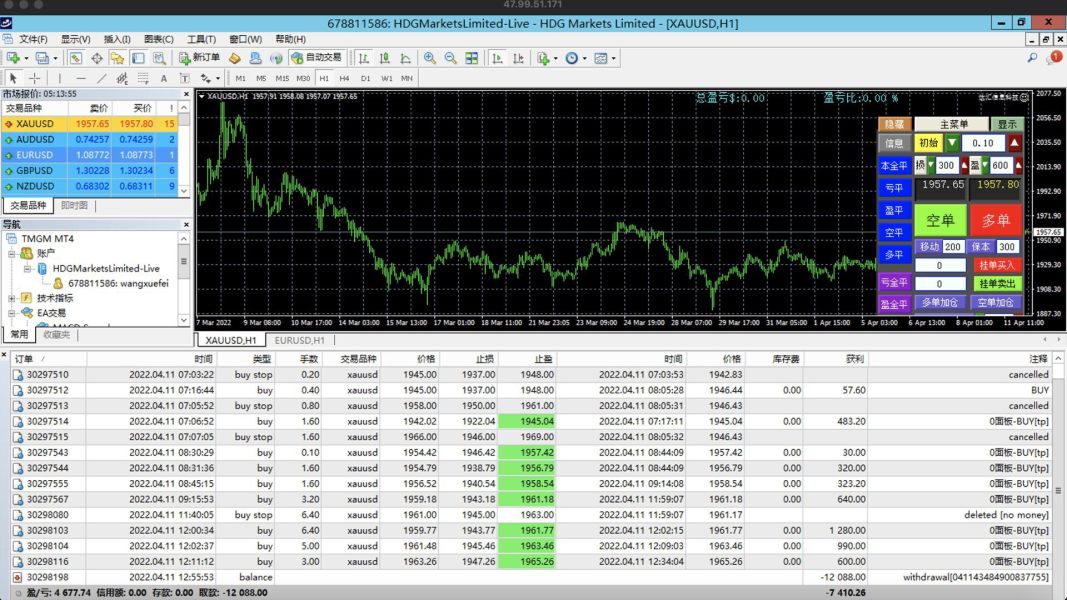

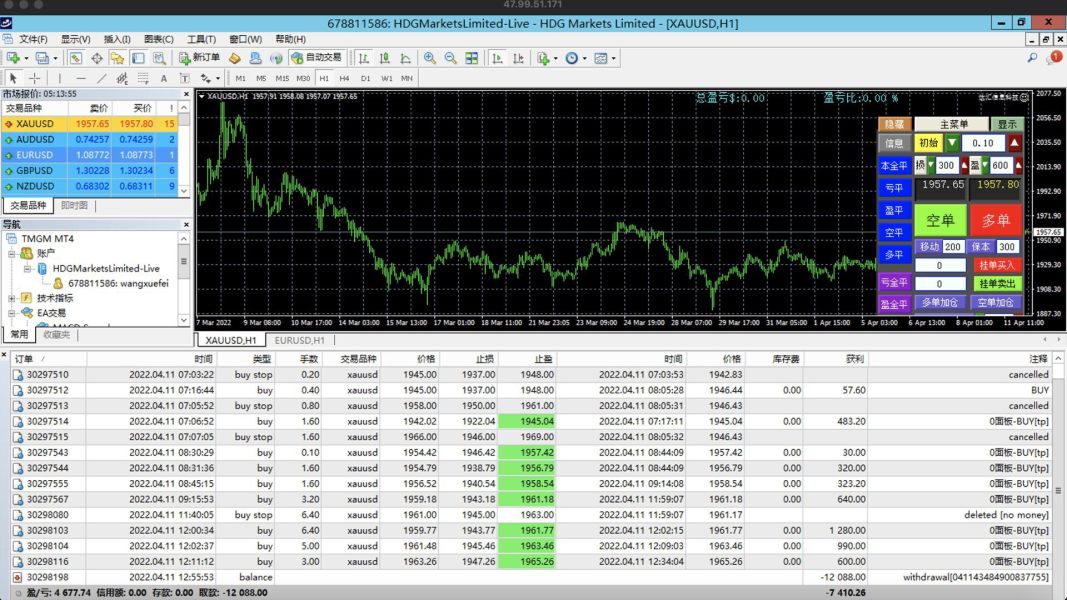

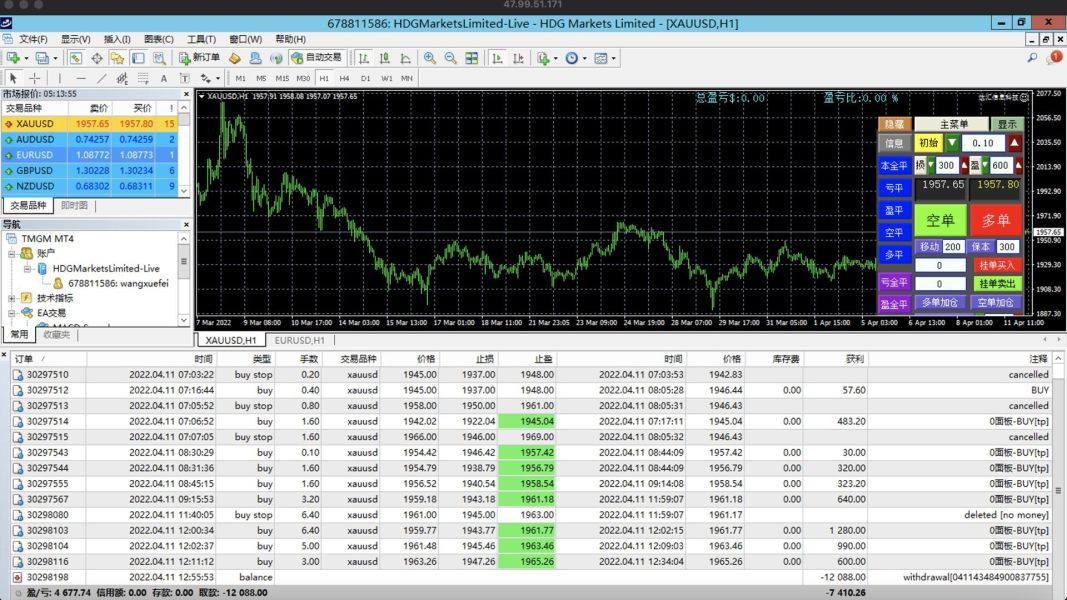

The trading experience with HDG Markets receives a below-average rating due to user concerns about platform stability and execution quality. Available feedback suggests that traders have experienced issues with platform reliability, which is crucial for successful trading operations.

Platform outages or technical difficulties can result in missed trading opportunities and potential financial losses for active traders. Order execution quality has been questioned by users, with some reporting concerns about slippage, requotes, and delays in order processing. These execution issues are particularly problematic in volatile market conditions where quick and accurate order execution is essential for implementing trading strategies effectively.

The broker's claimed ultra-low spreads lose their appeal if execution quality is compromised. Platform functionality completeness is difficult to assess due to limited available information about the specific trading platforms offered. Without clear documentation about platform features, charting capabilities, order types, and technical analysis tools, it's challenging for traders to evaluate whether the platform meets their trading requirements.

Mobile trading experience is not documented in available materials, which represents a significant gap considering that mobile trading has become essential for many traders who need to manage positions while away from their desktop computers. Most modern brokers provide comprehensive mobile trading solutions with full platform functionality.

The overall trading environment, including access to liquidity and market depth, remains unclear based on available information. User complaints about spreads and execution suggest that the actual trading conditions may not match the broker's marketing claims, creating disappointment among clients who expected better performance.

This hdg markets review indicates that significant improvements in platform stability and execution quality are needed to provide a satisfactory trading experience for clients.

Trust and Security Analysis (3/10)

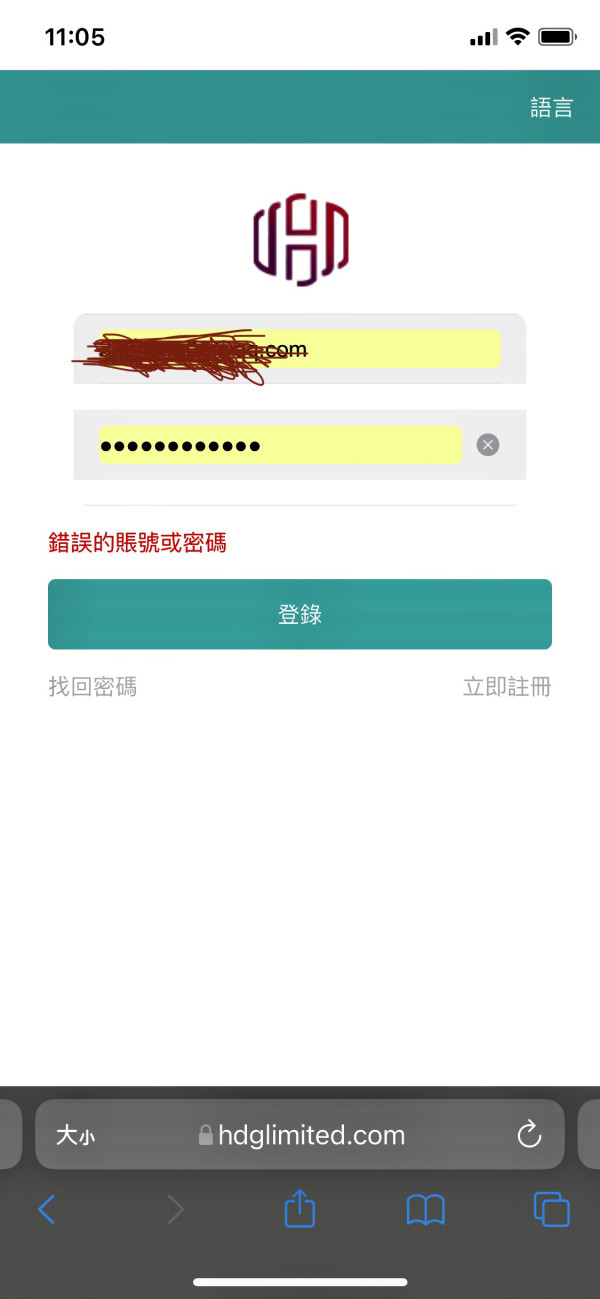

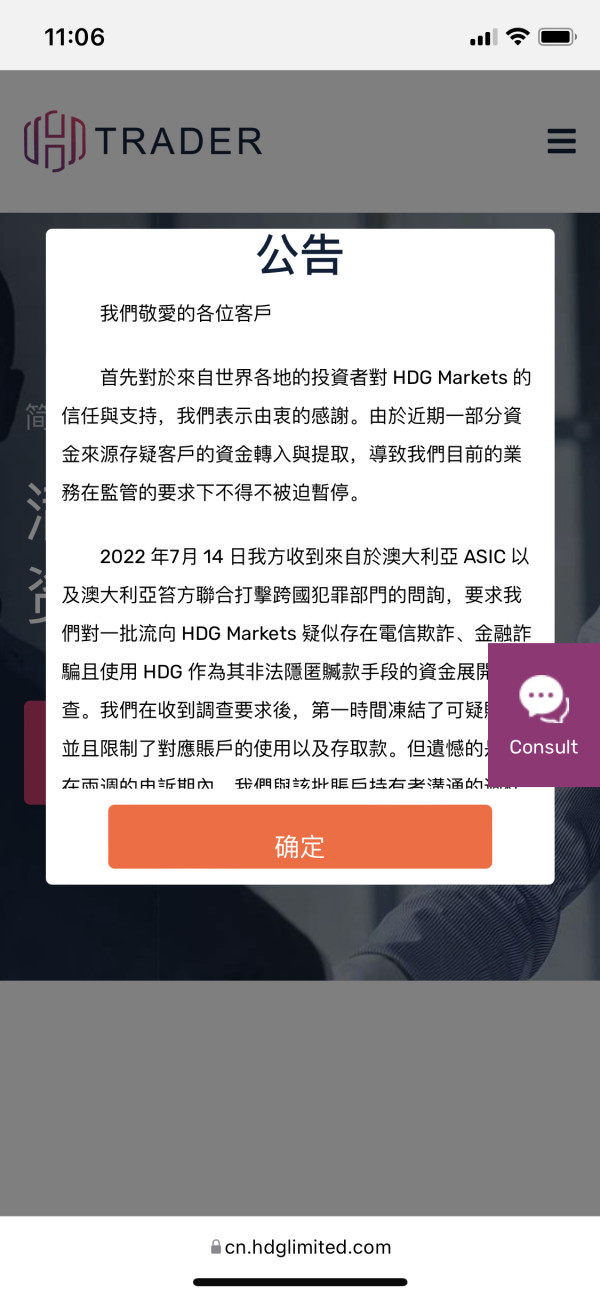

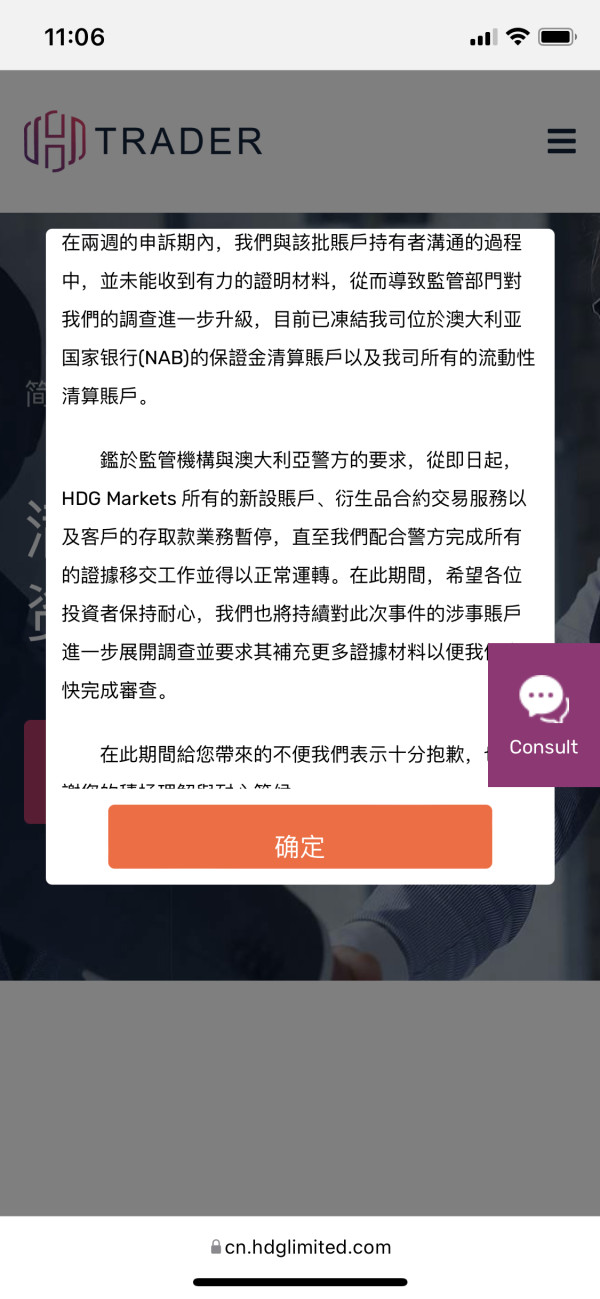

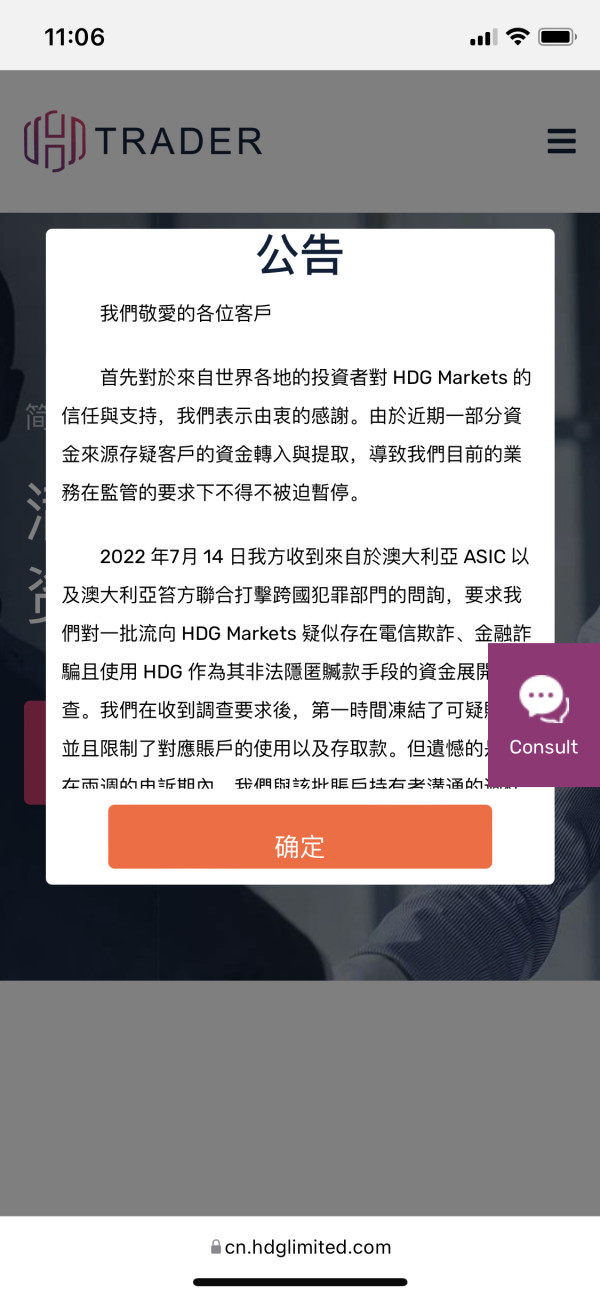

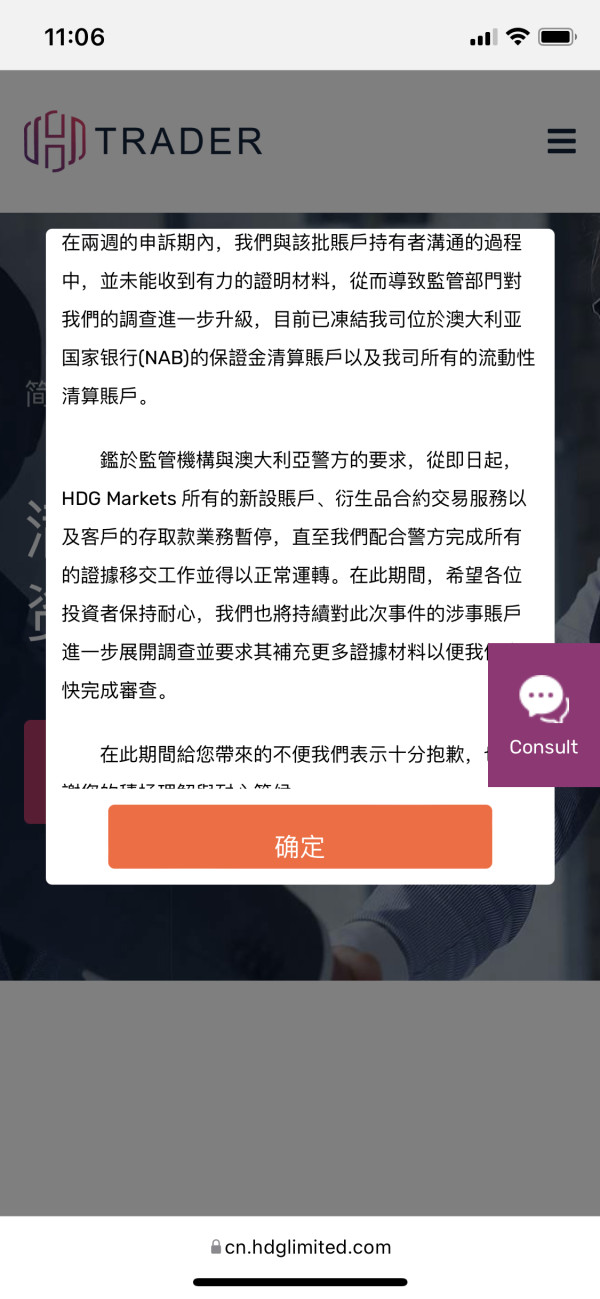

Trust and security represent the most concerning aspects of HDG Markets' operations, earning one of the lowest scores in our evaluation. The broker's regulatory credentials are highly questionable, with ASIC regulatory status having been revoked and no proper FCA authorization despite claims of regulation under these authorities.

This regulatory confusion creates serious doubts about the broker's legitimacy and compliance with financial services standards. Fund safety measures are not clearly documented, leaving clients uncertain about how their deposits are protected and whether funds are segregated from company operational accounts. Reputable brokers typically provide detailed information about client fund protection, including segregated accounts and insurance coverage, which appears to be absent in HDG Markets' documentation.

Company transparency is significantly lacking, with limited information available about the company's ownership structure, management team, and operational procedures. This opacity is concerning for traders who want to understand the organization they're entrusting with their capital. Transparent communication about company operations is a hallmark of trustworthy financial service providers.

Industry reputation is poor, as evidenced by the WikiFX rating of 1.54 out of 10, which indicates extremely low user trust and confidence. This rating reflects broader market sentiment and suggests that experienced traders and industry observers have serious concerns about the broker's operations and reliability.

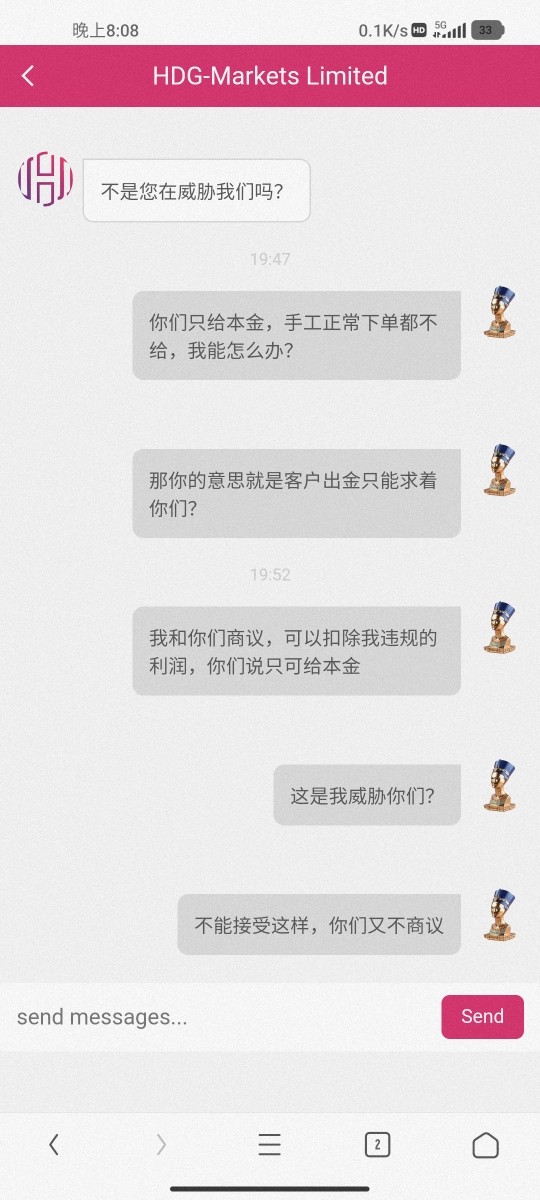

The handling of negative events and user complaints appears inadequate based on the high number of unresolved issues reported by users. Effective complaint resolution and transparent communication during difficulties are essential for maintaining client trust, areas where HDG Markets appears to fall short of industry standards.

User Experience Analysis (4/10)

Overall user satisfaction with HDG Markets is notably poor based on available feedback and reviews. The majority of user comments reflect negative experiences across various aspects of the broker's services, from account opening to ongoing trading operations.

This pattern of dissatisfaction suggests systemic issues with the broker's service delivery and client management. Interface design and usability information is not available in current documentation, making it impossible to assess the user-friendliness of the trading platforms. However, user feedback suggests that the overall experience is frustrating and below expectations, indicating potential issues with platform design and functionality.

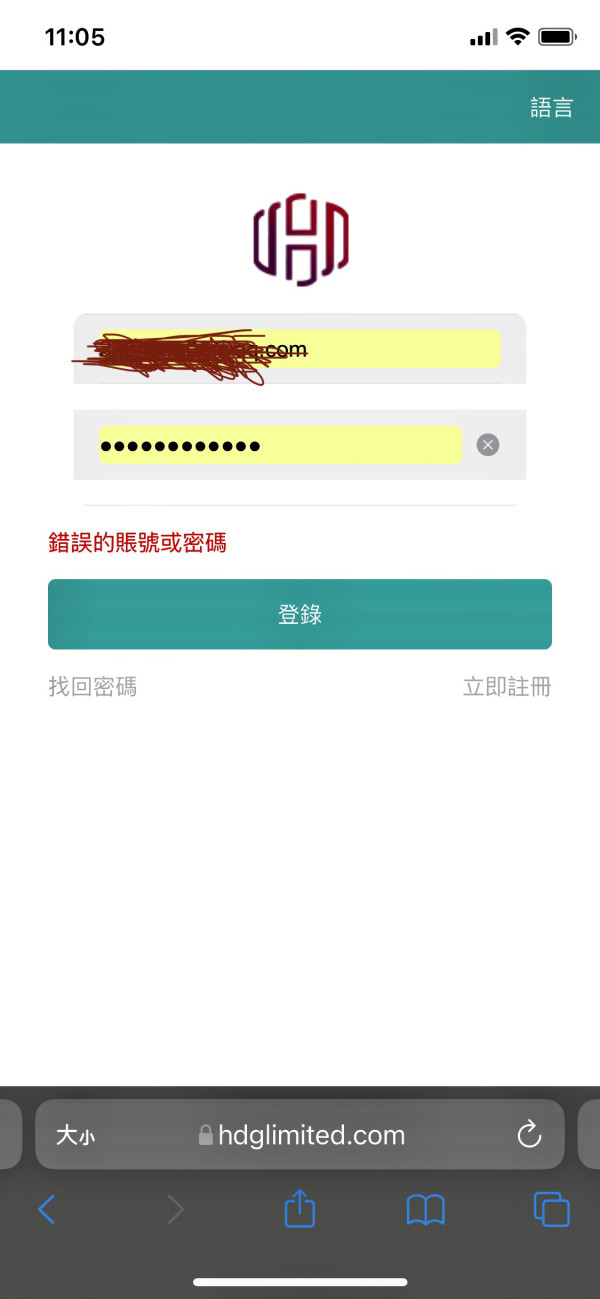

Registration and verification processes have received criticism from users who report difficulties and delays in account opening procedures. Smooth onboarding is crucial for client satisfaction, and problems in this area create immediate negative impressions that can affect the entire client relationship.

Fund operation experiences are not well-documented, but user complaints suggest issues with deposit and withdrawal processes. Efficient and transparent fund operations are essential for client confidence, and any problems in this area significantly impact user satisfaction and trust.

Common user complaints center around the broker's lack of transparency, poor communication, and failure to meet advertised service levels. Users frequently express regret about choosing HDG Markets and warn others to consider alternative brokers with better reputations and more transparent operations.

The target user profile appears to be traders with some forex and CFD experience who are attracted by advertised low spreads, but even experienced traders report disappointment with the actual service quality. The broker's appeal is limited by its poor reputation and operational issues that affect traders regardless of their experience level.

Conclusion

Our comprehensive hdg markets review reveals significant concerns about this broker's operations, regulatory status, and overall service quality. HDG Markets demonstrates substantial deficiencies across multiple evaluation criteria, particularly in trust and security, regulatory compliance, and transparency.

The revoked ASIC regulatory status and questionable FCA authorization claims represent fundamental red flags that potential traders cannot ignore. While the broker may attract some traders with promises of ultra-low spreads and forex/CFD trading access, the lack of proper regulatory oversight and poor user feedback suggest that these potential benefits are overshadowed by significant risks. The broker appears most suitable for experienced traders who fully understand the risks associated with dealing with inadequately regulated entities, though even experienced traders should exercise extreme caution.

The main advantages include advertised competitive spreads and access to popular trading instruments, but these are heavily outweighed by serious disadvantages including poor regulatory status, low user trust ratings, lack of transparency, and inadequate customer support. Based on our analysis, traders would be better served by choosing established brokers with proper regulatory credentials and positive user feedback rather than risking their capital with HDG Markets.