Is HDG MARKETS safe?

Business

License

Is HDG Markets Safe or Scam?

Introduction

HDG Markets, a forex broker established in 2019, positions itself within the competitive landscape of the foreign exchange market. It aims to provide trading services using the popular MetaTrader 4 (MT4) platform. However, the rise of online trading has also led to an increase in fraudulent activities, prompting traders to conduct thorough evaluations of brokers before committing their funds. Given the complexities of the forex market and the potential risks involved, it is essential for traders to assess the credibility and safety of brokers like HDG Markets. This article investigates the legitimacy of HDG Markets through a comprehensive analysis of its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. HDG Markets claims to operate under several regulatory frameworks, including the Australian Securities and Investments Commission (ASIC) and the National Futures Association (NFA). However, a deeper investigation reveals concerning findings.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001295273 | Australia | Revoked |

| NFA | 0545805 | USA | Unauthorized |

The above table highlights that HDG Markets ASIC license has been revoked, indicating that it no longer meets the necessary regulatory requirements to operate legally. Furthermore, the NFA has no record of HDG Markets as an approved member, raising significant red flags for potential investors. The absence of valid regulation suggests that clients' funds are not protected by any legal framework, making it crucial for traders to consider the risks before engaging with this broker.

Company Background Investigation

HDG Markets is registered in the United Kingdom and has been operational since 2019. Despite its relatively short history, the company has faced scrutiny regarding its ownership structure and management team. Limited information is available about the individuals behind HDG Markets, which raises questions about transparency and accountability.

The management teams professional experience is a vital aspect of a broker's credibility. A well-experienced team can offer better services and more reliable trading conditions. However, the lack of publicly available information about the management team of HDG Markets leads to concerns about their qualifications and expertise. Additionally, the company's transparency is questionable, as it has not provided adequate disclosures regarding its operational practices or financial health, which is a critical aspect for traders evaluating the safety of their investments.

Trading Conditions Analysis

When assessing whether HDG Markets is safe, it is crucial to examine its trading conditions, including fees and spreads. The broker claims to offer competitive trading conditions, but discrepancies in their fee structure have been reported by users.

| Fee Type | HDG Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.7 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Typically 0.5% - 3% |

The table illustrates that HDG Markets spreads on major currency pairs are higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of clear information regarding commission structures and overnight interest rates raises further concerns about transparency. Traders may find themselves facing unexpected costs that could affect their overall trading experience, making it essential to scrutinize these conditions carefully.

Customer Fund Security

Customer fund security is paramount for any broker, and HDG Markets claims to implement various measures to protect client funds. However, the lack of clear information regarding fund segregation, investor protection schemes, and negative balance protection raises significant concerns.

Traders need to know whether their funds are held in segregated accounts, which would ensure that client money is kept separate from the broker's operational funds. Moreover, the absence of robust investor protection mechanisms suggests that users may not have recourse in the event of a broker failure or misconduct. Historical issues regarding fund withdrawals and customer complaints about being unable to access their funds further underscore the importance of assessing the safety of HDG Markets.

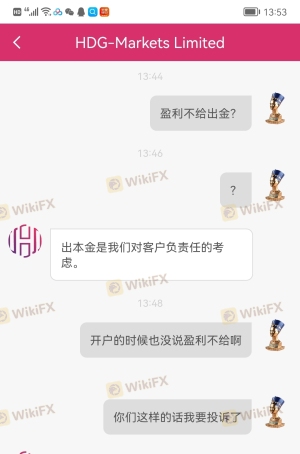

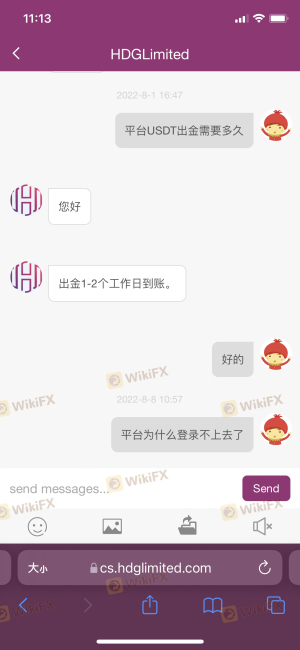

Customer Experience and Complaints

User feedback is an invaluable resource for evaluating a broker's reputation. In the case of HDG Markets, numerous complaints have surfaced, particularly concerning withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Account Access Issues | High | Poor |

| Customer Service Response | Medium | Slow |

The table above summarizes the primary complaints against HDG Markets, indicating a pattern of high-severity issues. Users have reported being unable to withdraw their funds, with many expressing frustration over the company's lack of responsiveness. Such complaints highlight significant operational weaknesses and raise serious doubts about whether HDG Markets is safe for traders.

Platform and Trade Execution

The trading platform is a crucial component of any broker's offering. HDG Markets utilizes the MT4 platform, known for its user-friendly interface and extensive features. However, user experiences indicate that the platform may suffer from stability issues and execution delays.

Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. Additionally, any signs of platform manipulation, such as sudden price changes or unexplainable trading halts, can further undermine confidence in the broker's integrity. Evaluating the platform's performance and reliability is essential for determining whether HDG Markets can be trusted.

Risk Assessment

Using HDG Markets presents several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated and revoked licenses. |

| Fund Security Risk | High | Lack of segregation and protection. |

| Execution Risk | Medium | Issues with slippage and order rejections. |

The risk assessment table illustrates that engaging with HDG Markets involves high regulatory and fund security risks. Traders must be aware of these risks and should consider implementing risk mitigation strategies, such as setting strict limits on investments and diversifying their trading portfolios.

Conclusion and Recommendations

In conclusion, the investigation into HDG Markets raises significant concerns regarding its safety and reliability. The revoked regulatory status, coupled with numerous customer complaints and a lack of transparency, suggests that HDG Markets may not be a trustworthy broker.

For traders seeking to invest in the forex market, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight, transparent fee structures, and positive user experiences should be prioritized to ensure a safer trading environment. Ultimately, the question "Is HDG Markets safe?" leans towards a cautious 'no,' and traders should exercise extreme caution before engaging with this broker.

Is HDG MARKETS a scam, or is it legit?

The latest exposure and evaluation content of HDG MARKETS brokers.

HDG MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HDG MARKETS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.