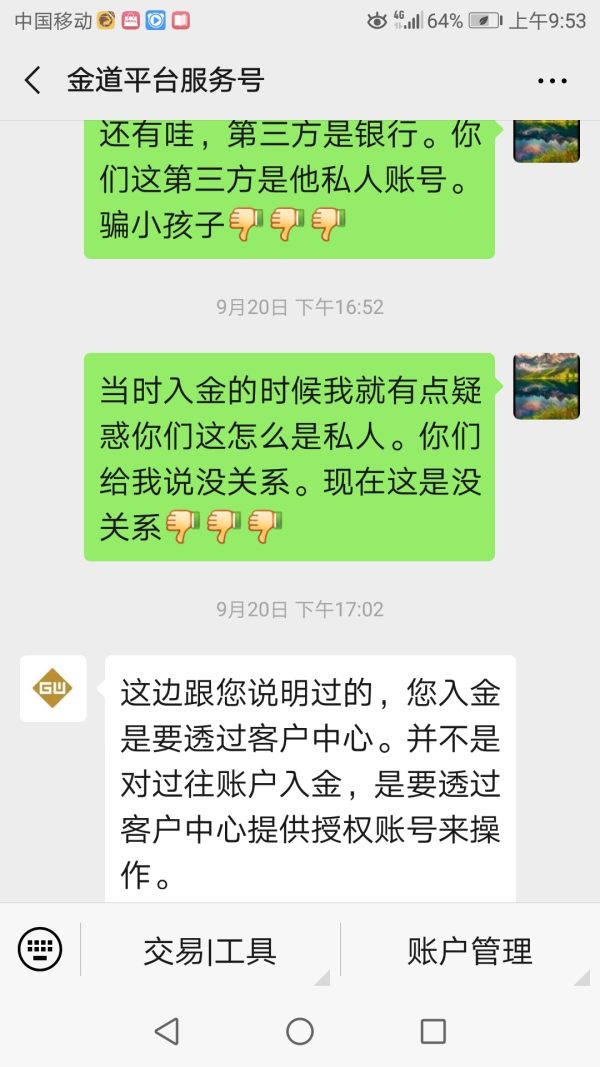

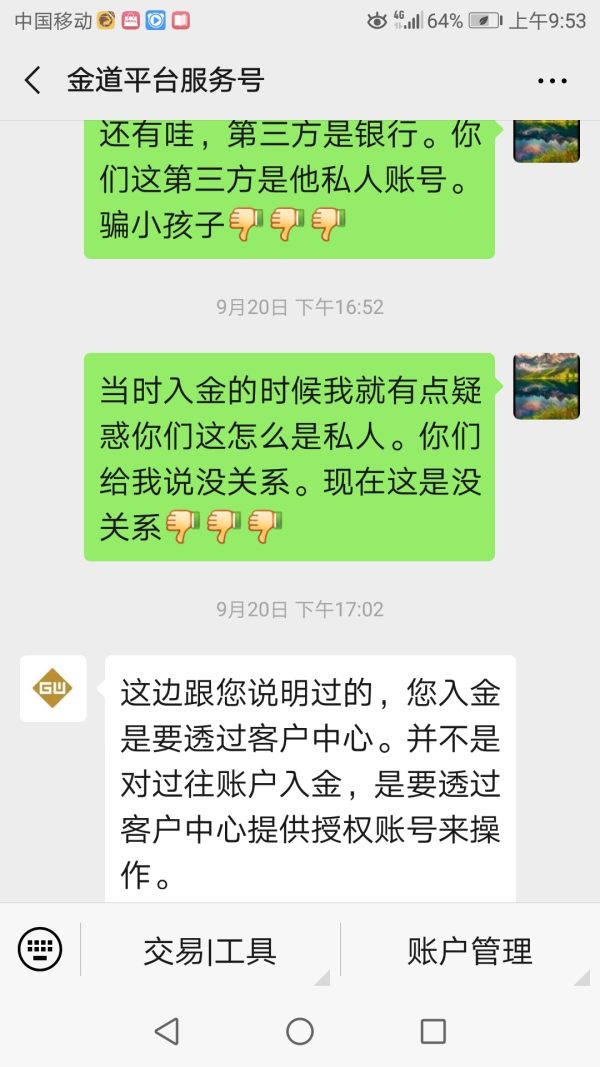

GWFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive gwfx review examines a broker that has struggled to establish credibility in the competitive forex market. GWFX was established in 2017 with headquarters in the UK. The broker presents a mixed picture for potential traders. With a WikiFX score of just 2 out of 10, the broker faces significant challenges in building trader confidence. However, GWFX does offer some basic features that may appeal to certain user segments. These features include MT4 trading platform access and simplified Chinese customer service support.

The broker's target demographic appears to be beginner traders who have basic platform technical support requirements. The low overall rating raises important questions about service quality and reliability. While GWFX provides a fully digital account opening process that simplifies getting started, the lack of comprehensive regulatory information and limited platform compatibility present notable concerns. Traders considering GWFX should carefully weigh these factors against their trading needs and risk tolerance.

Important Notice

Due to the absence of detailed regulatory information in available sources, users must independently assess trading risks associated with GWFX. The broker operates across different jurisdictions. Regulatory standards may vary significantly between regions. This review is based on publicly available information and user feedback. Comprehensive data may not be fully available for all aspects of the broker's operations.

Potential traders should conduct additional due diligence and verify current regulatory status before making any investment decisions. Information accuracy may be limited due to the broker's transparency practices and available disclosure materials.

Rating Framework

Broker Overview

GWFX entered the forex market in 2017. The company positioned itself as a UK-based broker serving international clients. The company has focused on providing basic trading services through established platforms. Detailed information about its business model and strategic positioning remains limited in available public sources. Despite operating for several years, GWFX has struggled to build the comprehensive service portfolio typically expected from established brokers.

The broker's primary offering centers around MT4 platform access. This platform represents one of the industry's most widely recognized trading environments. However, GWFX's approach appears to prioritize simplicity over comprehensive feature sets. This may explain both its appeal to certain beginner segments and its limitations for more advanced traders. The company's UK headquarters suggests operation under European business standards. Specific regulatory compliance details require further verification from official sources.

Regulatory Status: Specific regulatory information is not detailed in available sources. Users need independent verification.

Deposit and Withdrawal Methods: Comprehensive information about funding options is not specified in current available materials.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in accessible documentation.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in available sources.

Tradeable Assets: The range of available trading instruments requires verification directly with the broker. This gwfx review could not locate comprehensive asset listings.

Cost Structure: Critical pricing information including spreads, commissions, and overnight fees is not readily available. This represents a significant transparency gap for potential traders.

Leverage Ratios: Maximum leverage offerings are not specified in current public information.

Platform Options: MT4 serves as the primary trading platform. Mobile and web-based access limitations exist.

Regional Restrictions: Specific geographic limitations are not detailed in available sources.

Customer Service Languages: Simplified Chinese support is confirmed as available for client communications.

Detailed Rating Analysis

Account Conditions Analysis 5/10

GWFX's account conditions present a mixed picture that reflects both accessibility and information gaps. The broker offers a fully digital account opening process. This streamlined approach removes traditional barriers and allows users to begin the onboarding process without extensive paperwork or complex verification procedures.

However, critical details about account types, their specific features, and associated requirements remain unclear in available documentation. The absence of transparent information about minimum deposit requirements makes it difficult for potential traders to assess whether GWFX aligns with their financial capacity. Similarly, the lack of detailed account tier structures leaves questions about what services and features are available at different investment levels.

This gwfx review found that while the simplified onboarding process represents a positive aspect for beginners, the information gaps create uncertainty for traders who need to understand full terms and conditions before committing funds. The digital-first approach suggests modern infrastructure. Transparency improvements would significantly enhance the account conditions evaluation.

The platform's tool portfolio centers primarily around MT4 access. This provides traders with a familiar and widely-supported trading environment. MT4's inclusion represents a solid foundation. It offers basic charting capabilities, technical analysis tools, and automated trading support that many forex traders expect as standard features.

However, beyond MT4 provision, comprehensive information about additional trading tools, research resources, and educational materials is not readily available in current sources. Modern forex trading often requires access to economic calendars, market analysis, trading signals, and educational content that helps traders develop their skills and stay informed about market conditions.

The absence of detailed information about supplementary tools and resources suggests either limited offerings or inadequate communication about available features. For traders who rely heavily on research and analysis support, this represents a notable limitation that may affect overall trading effectiveness and decision-making capabilities.

Customer Service and Support Analysis 8/10

GWFX demonstrates notable strength in customer service accessibility. The broker particularly excels through its simplified Chinese language support. This multilingual capability addresses an important market segment. It suggests the broker's commitment to serving diverse international clientele with appropriate language assistance.

The availability of Chinese-language support indicates infrastructure investment in customer service capabilities and recognition of global market needs. For traders who prefer conducting business in their native language, this represents a significant advantage. It can improve communication effectiveness and problem resolution efficiency.

However, comprehensive information about service hours, response times, available communication channels, and overall service quality metrics is not detailed in current available sources. While language support represents a positive feature, the complete customer service evaluation would benefit from additional transparency about service standards and performance metrics.

Trading Experience Analysis 4/10

The trading experience evaluation reveals significant information gaps that impact overall assessment. While MT4 platform provision suggests access to standard trading functionality, critical details about execution quality, platform stability, and performance metrics are not available in current sources.

A major limitation identified in this gwfx review is the lack of support for iOS, Android, MacOS, and web platforms. This restriction significantly limits trading flexibility and accessibility. It particularly affects traders who rely on mobile trading or prefer web-based access. Modern forex trading increasingly demands multi-platform compatibility to accommodate diverse user preferences and trading styles.

The absence of detailed information about spreads, execution speeds, slippage rates, and other performance indicators makes it difficult to assess the actual trading environment quality. Without transparent pricing and performance data, traders cannot effectively evaluate whether GWFX provides competitive trading conditions compared to alternative brokers in the market.

Trust and Reliability Analysis 2/10

Trust and reliability represent GWFX's most significant challenges. This is evidenced by the WikiFX score of 2 out of 10. This low rating indicates substantial concerns about the broker's credibility and operational standards within the forex trading community.

The absence of comprehensive regulatory information compounds trust concerns. Traders typically rely on regulatory oversight to ensure broker compliance with industry standards and client protection measures. Without clear regulatory disclosure, potential clients cannot adequately assess the safety and security of their funds or trading activities.

Industry reputation appears to be negatively affected by these transparency and credibility issues. The combination of low third-party ratings and limited regulatory information creates a challenging environment for building trader confidence. This confidence is essential for long-term business success in the competitive forex market.

User Experience Analysis 5/10

User experience reflects the broader challenges identified throughout this evaluation. While GWFX offers a simplified account opening process that appeals to beginners, the overall user satisfaction appears limited based on available ratings and feedback indicators.

The WikiFX score of 2 suggests that users have encountered significant issues or dissatisfaction with various aspects of the service. However, specific user complaints and feedback details are not comprehensively available in current sources. This makes it difficult to identify particular problem areas or service gaps.

The broker's positioning as suitable for users with basic platform technical support requirements suggests a focus on simplicity over comprehensive features. While this approach may serve certain beginner segments, it may also limit appeal for traders seeking more advanced capabilities and comprehensive service offerings. Improvements in transparency, platform compatibility, and service quality would likely enhance overall user experience significantly.

Conclusion

This comprehensive gwfx review reveals a broker facing substantial challenges across multiple operational dimensions. While GWFX offers some basic features including MT4 platform access and simplified Chinese customer service, the overall evaluation indicates significant areas requiring improvement before it can compete effectively with established market leaders.

The broker may be suitable for absolute beginners who prioritize simple account opening and basic platform access. Potential users must carefully consider the credibility and transparency concerns highlighted throughout this analysis. The combination of low industry ratings, limited regulatory disclosure, and information gaps creates a risk profile that requires careful evaluation.

GWFX's main advantages include MT4 platform provision and multilingual customer support. Primary disadvantages encompass low credibility ratings, limited platform compatibility, and insufficient transparency about trading conditions and regulatory compliance. Potential traders should conduct thorough additional research and consider alternative brokers with stronger track records and more comprehensive service offerings.