Grand FT Market 2025 Review: Everything You Need to Know

Summary

Grand FT Market works as an unregulated forex broker registered in Saint Vincent and the Grenadines. This grand ft market review shows a broker that offers multiple account types and claims to provide no deposit or withdrawal fees, targeting cost-conscious forex traders. However, serious concerns come from user feedback about withdrawal problems and fraud claims.

The broker gives desktop, mobile, and web-based trading apps, focusing mainly on forex trading. Despite offering various account options including standard, professional, raw spread, sub-accounts, and insurance accounts, the lack of regulatory oversight creates serious questions about trader protection and fund security. Based on available information and user stories, Grand FT Market might work for traders seeking low-cost trading solutions, though extreme caution is advised due to regulatory concerns and negative user experiences.

The platform's credibility is seriously hurt by multiple user complaints about withdrawal issues and potential fraudulent activities.

Important Notice

Regional Entity Differences: Grand FT Market operates without regulatory supervision, which may expose traders to varying legal risks across different jurisdictions. The broker's registration in Saint Vincent and the Grenadines provides minimal regulatory protection for international clients.

Review Methodology: This evaluation is based on user feedback, publicly available information, and industry reports. Due to limited official documentation and the broker's unregulated status, this assessment may not fully reflect all operational aspects of the platform.

Rating Framework

Broker Overview

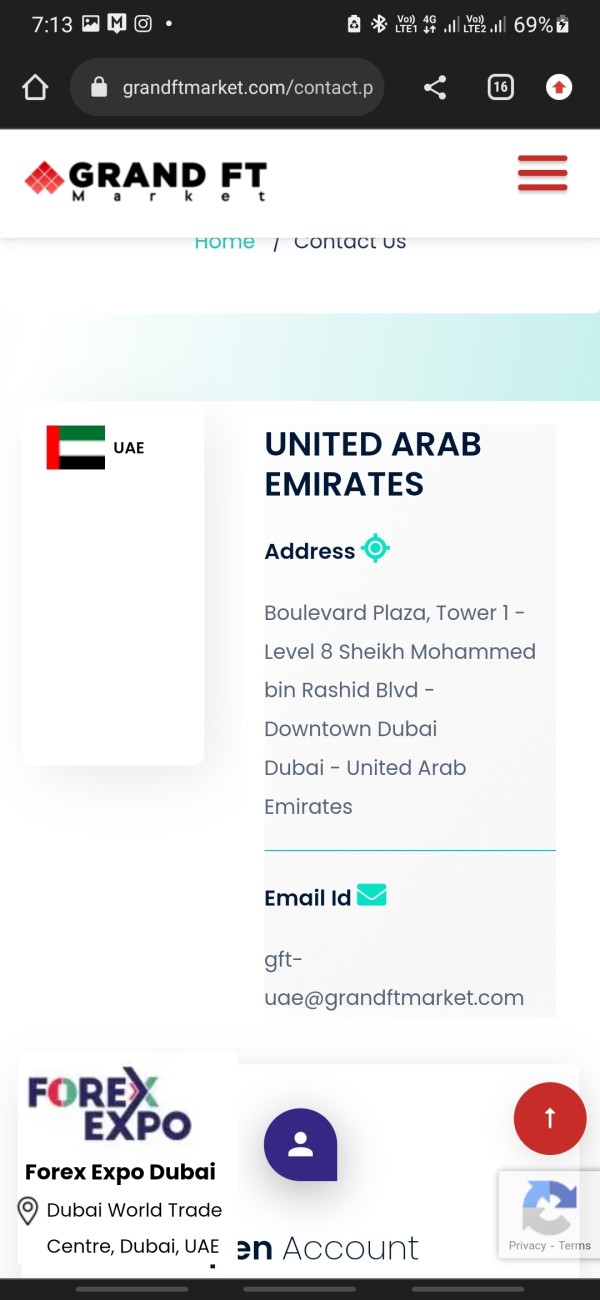

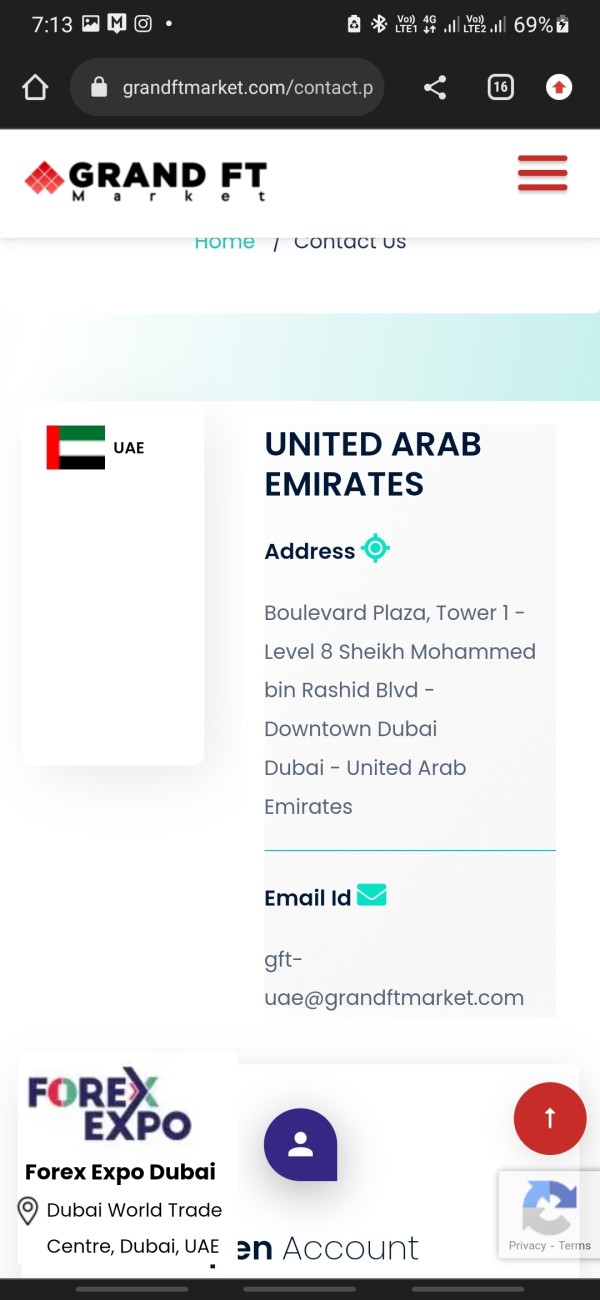

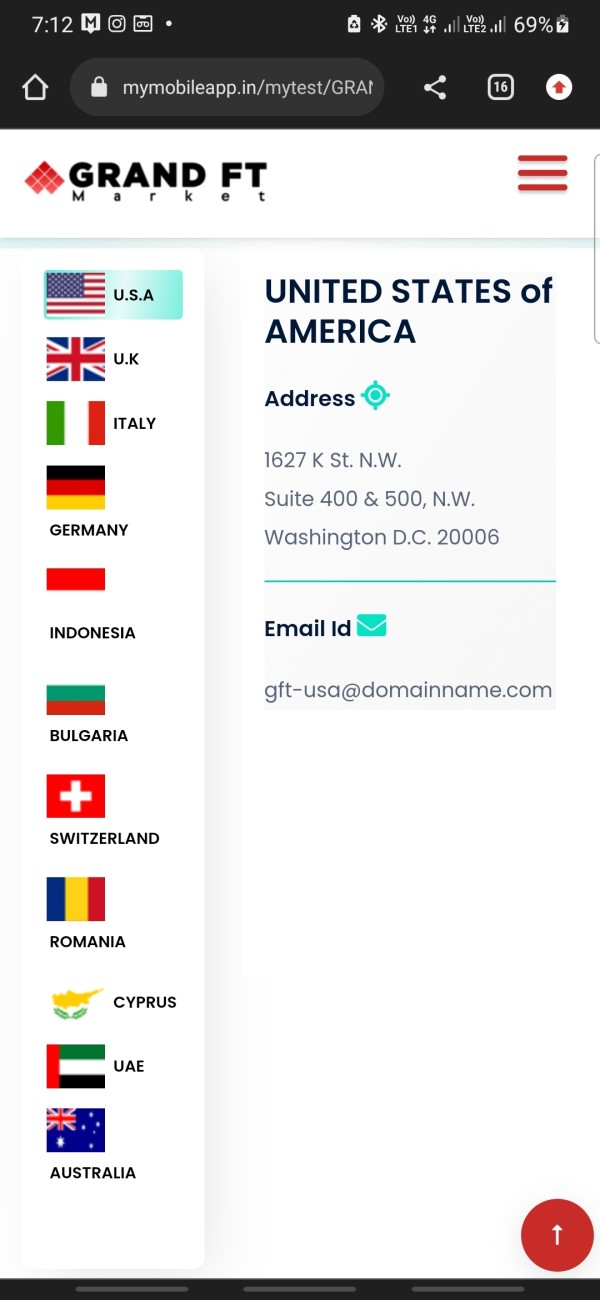

Grand FT Market entered the forex brokerage market in 2021. The company established itself as GRAND FT Market Limited with registration in Saint Vincent and the Grenadines, operating without regulatory oversight from major financial authorities and positioning itself as an offshore broker targeting international traders seeking alternative trading solutions.

The broker's business model centers on providing multiple account types to accommodate different trading preferences and experience levels. However, the absence of regulatory supervision and limited transparency about company leadership and operational headquarters creates serious concerns about the broker's legitimacy and long-term viability in the competitive forex market. This grand ft market review indicates that the platform offers desktop, mobile, and web-based trading applications, focusing primarily on forex trading instruments.

The broker tries to attract clients through promotional offers of no deposit or withdrawal fees, though user experiences suggest these promises may not always be honored in practice.

Regulatory Status: Grand FT Market operates without regulation from recognized financial authorities. The company's registration in Saint Vincent and the Grenadines provides minimal oversight and limited protection for traders' funds and interests.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials, though the broker claims to offer no fees for these transactions. The minimum deposit requirements for different account types are not specified in available documentation, creating uncertainty for potential clients.

Bonuses and Promotions: No specific bonus or promotional offers are mentioned in available information, though the broker advertises no deposit and withdrawal fees as a key benefit.

Trading Assets: The platform primarily focuses on forex trading, though specific currency pairs and additional asset classes are not detailed in available materials. Detailed information about spreads, commissions, and other trading costs is not provided in available sources, making it difficult to assess the true cost of trading with this broker.

Leverage Ratios: Specific leverage offerings are not mentioned in available information, which is concerning for traders seeking to understand their potential risk exposure.

Platform Options: Grand FT Market provides trading through desktop, mobile, and web-based applications, offering flexibility for different trading preferences and devices. Specific regional restrictions are not detailed in available materials, though the lack of regulation may limit access in certain jurisdictions.

Customer Support Languages: Available customer support languages are not specified in the provided information.

This grand ft market review highlights the significant lack of transparency in operational details, which is a major red flag for potential clients.

Detailed Rating Analysis

Account Conditions Analysis

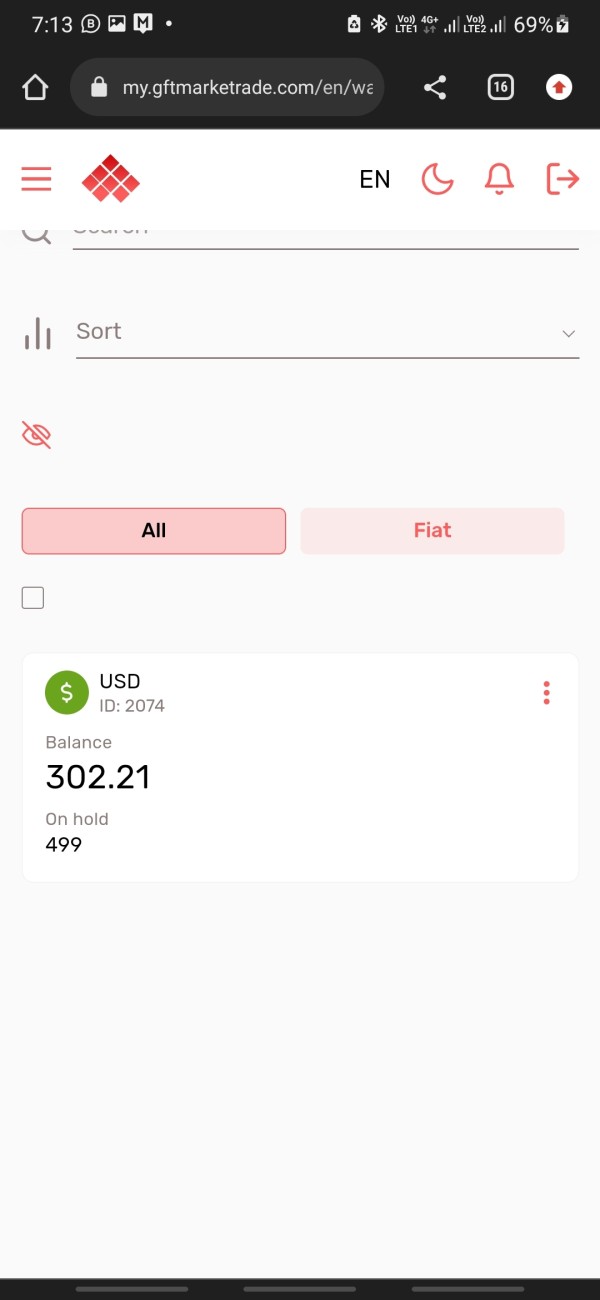

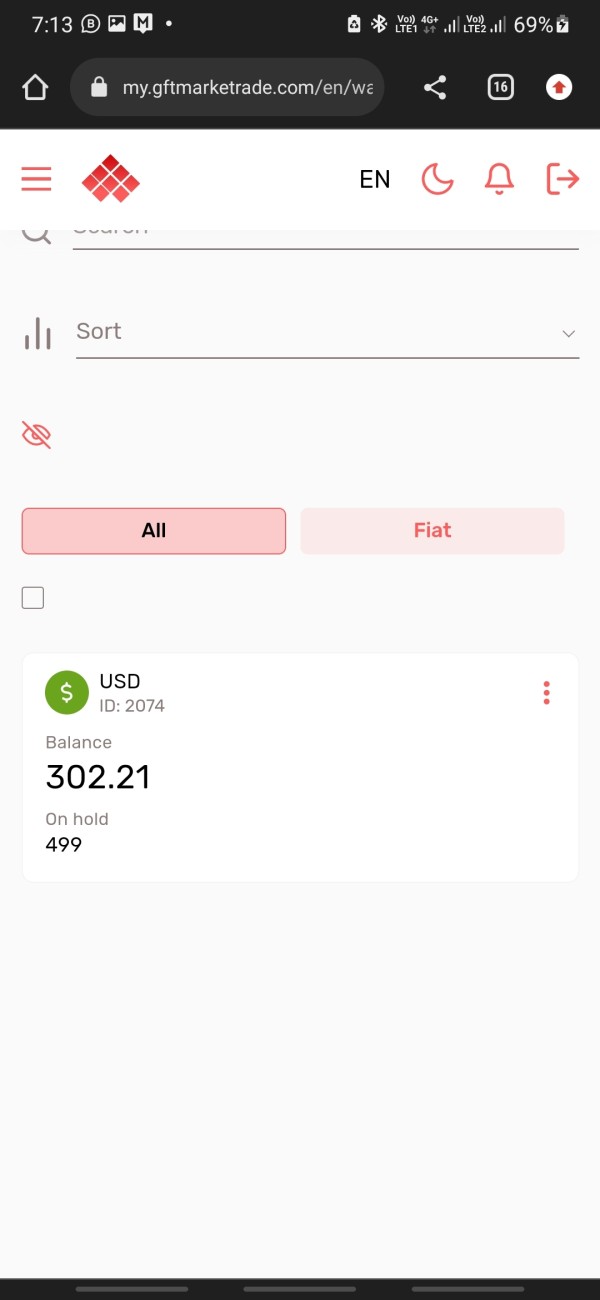

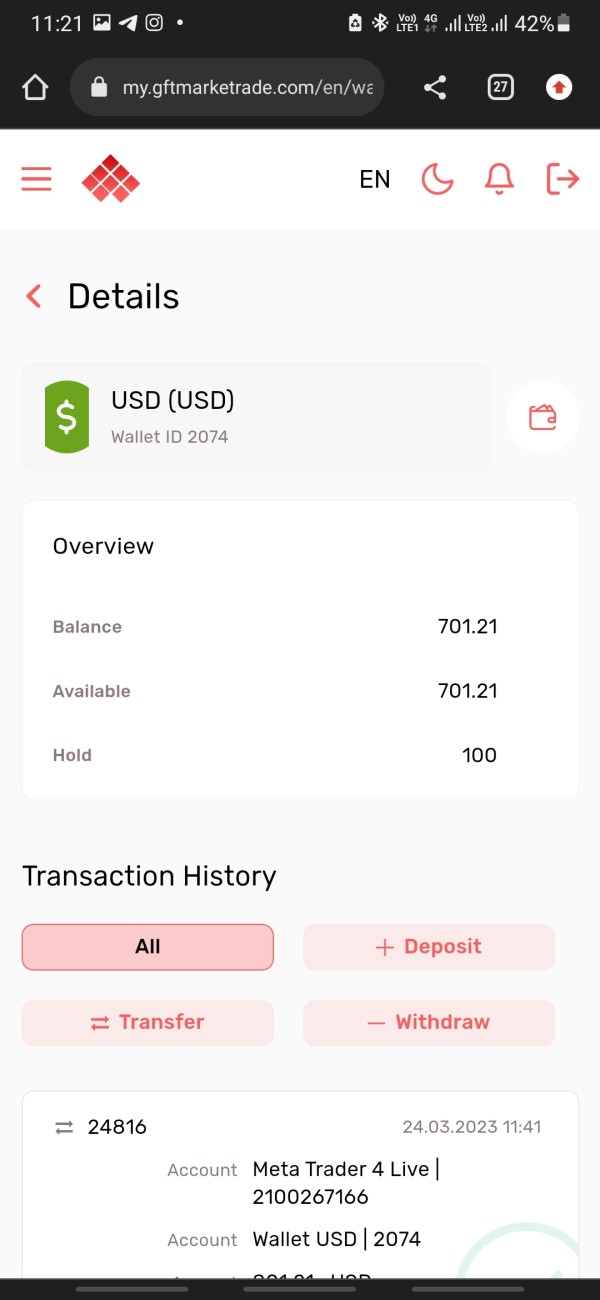

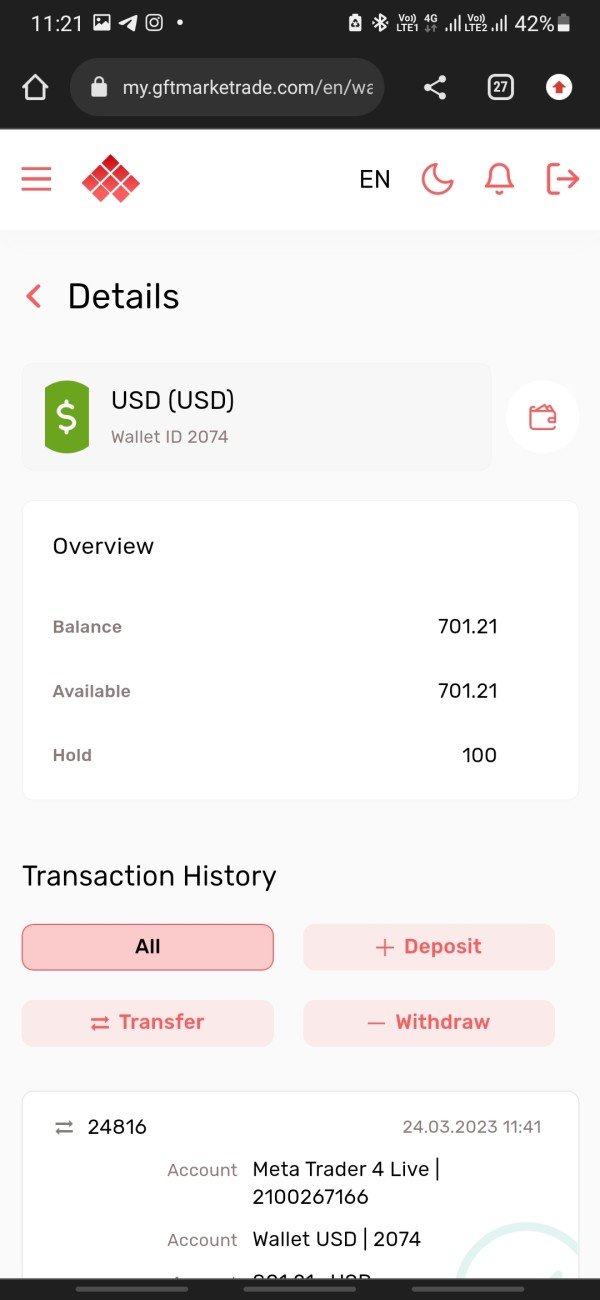

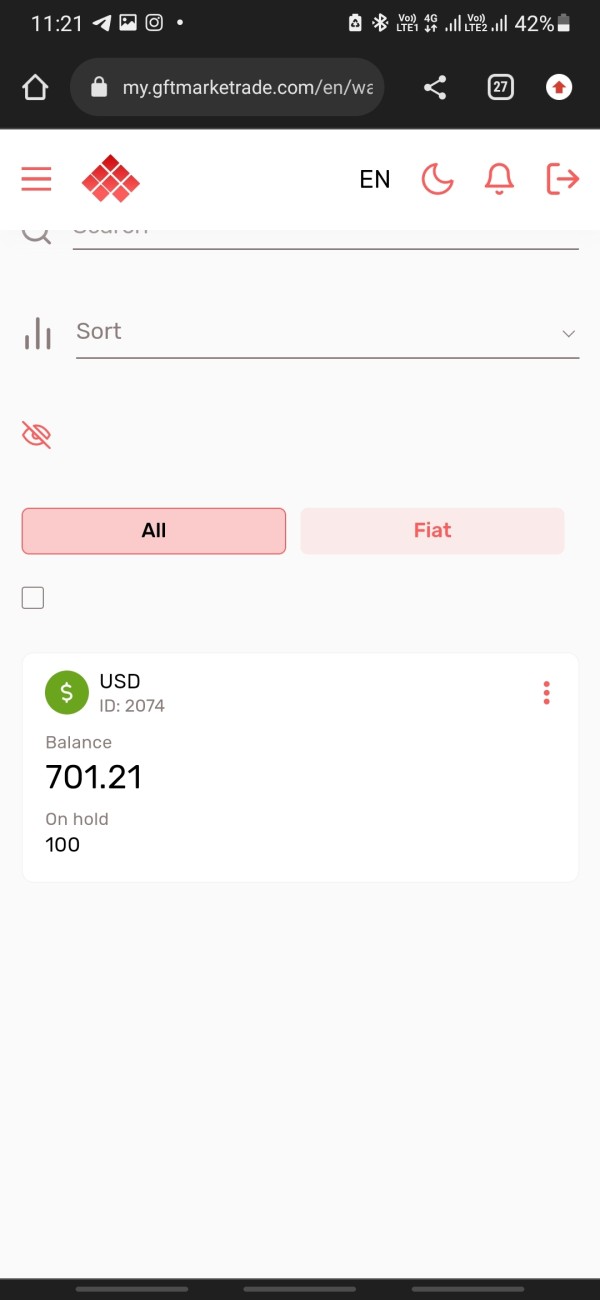

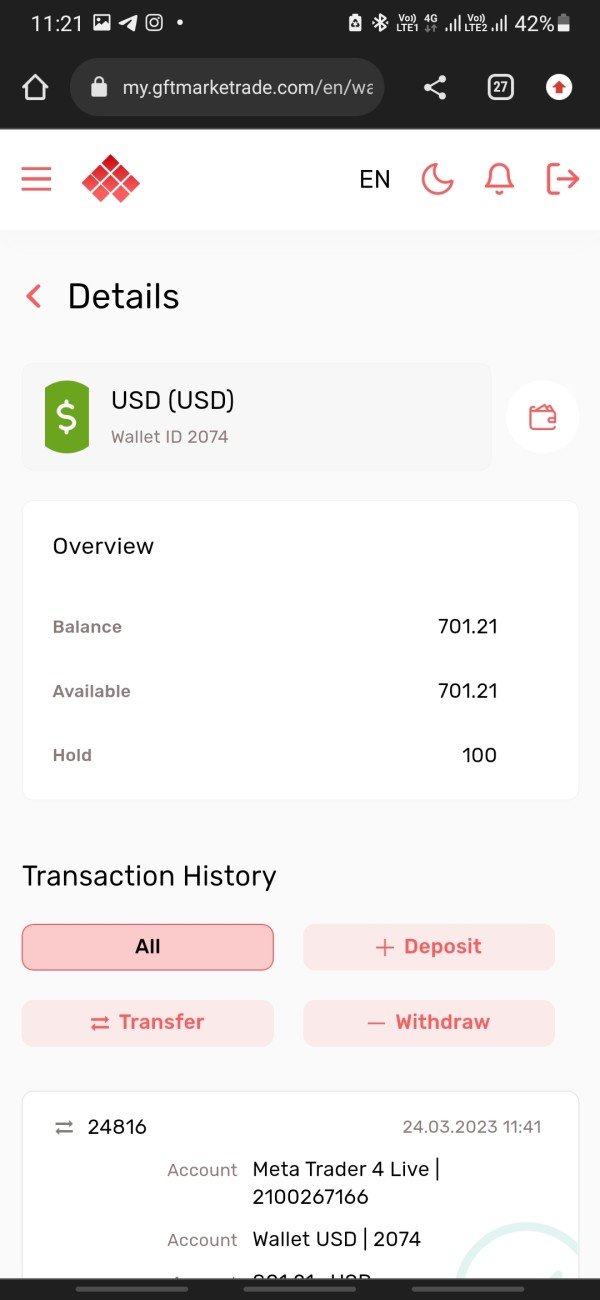

Grand FT Market offers multiple account types including standard accounts, professional accounts, raw spread accounts, sub-accounts, and insurance accounts. This variety suggests an attempt to cater to different trader needs and experience levels, but the lack of detailed information about minimum deposit requirements, account features, and specific benefits seriously hurts the value proposition.

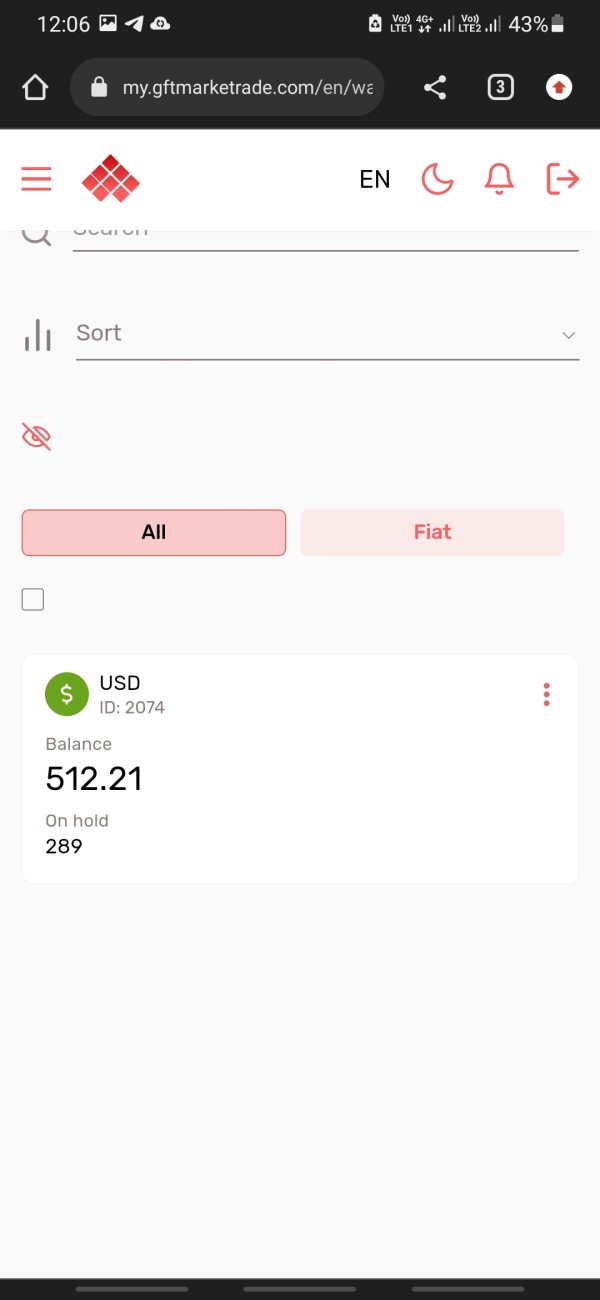

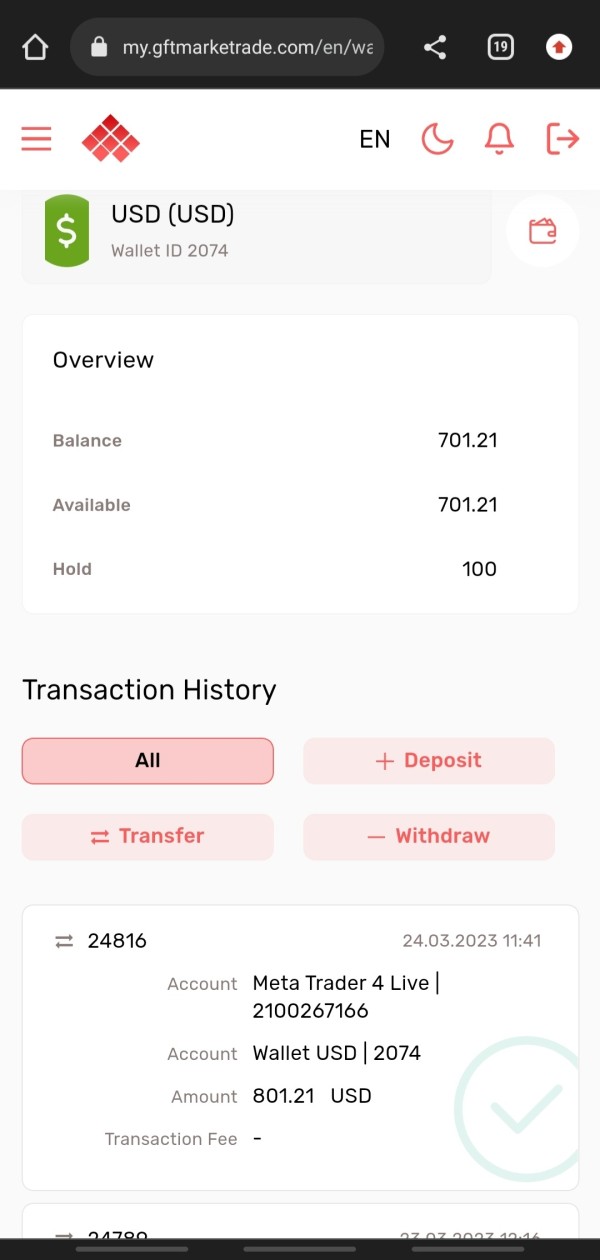

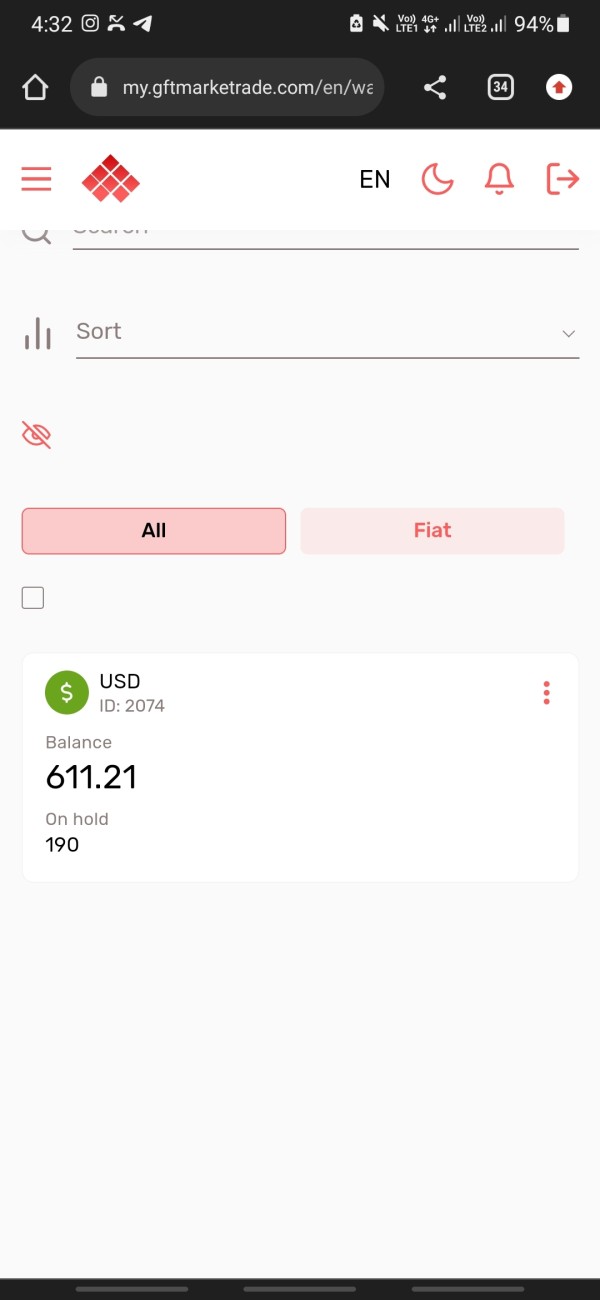

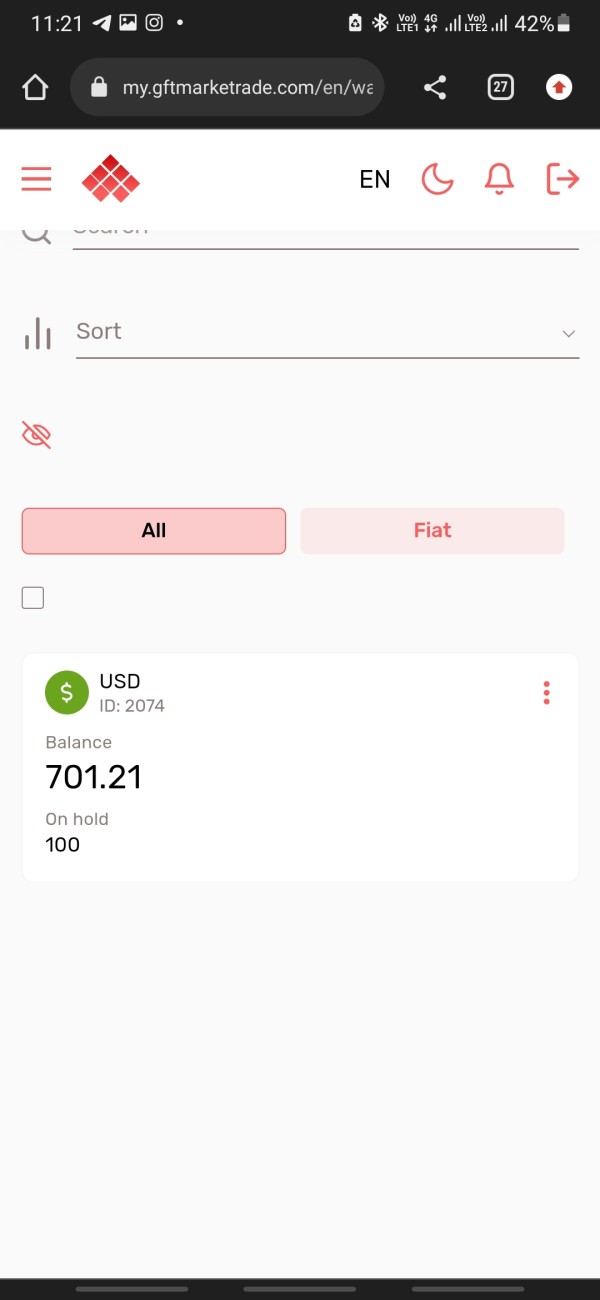

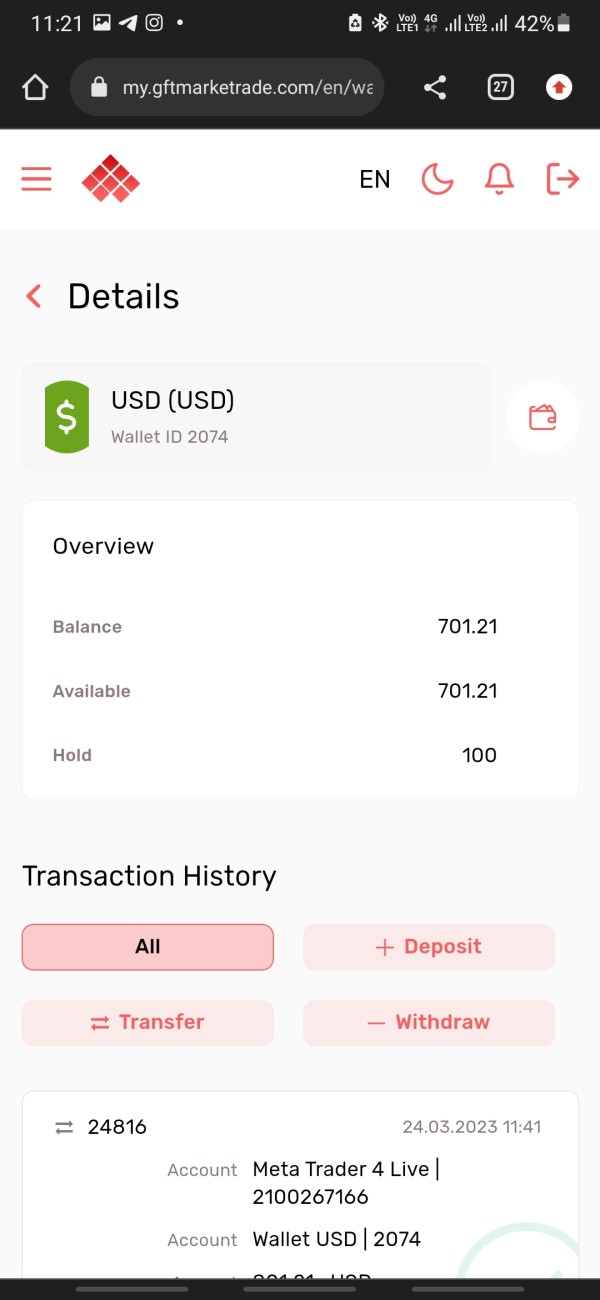

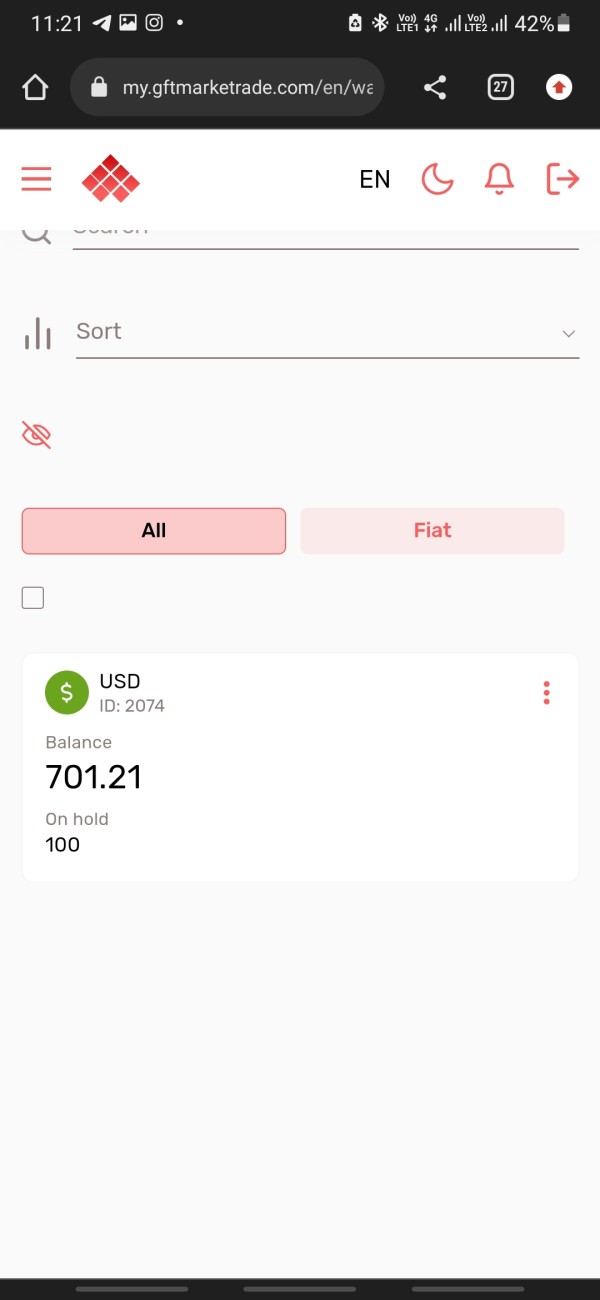

The absence of clear account opening procedures and verification requirements creates concerns about the broker's operational standards. User feedback shows problems in account management, particularly regarding withdrawal processes, which directly impacts the practical utility of these account options. The broker's claim of no deposit and withdrawal fees could be attractive for cost-conscious traders, but user experiences suggest these promises are not consistently honored.

The lack of information about special account features, such as Islamic accounts for Muslim traders, further limits the appeal for diverse client bases.

This grand ft market review finds that while account variety exists, the lack of transparency and negative user experiences seriously reduce the overall account conditions rating.

The available information provides limited details about Grand FT Market's trading tools and resources. While the broker offers multiple platform options including desktop, mobile, and web-based applications, specific information about analytical tools, charting capabilities, and trading indicators is notably absent. Research and analysis resources appear to be minimal or non-existent based on available information.

The lack of educational materials, market analysis, and trading guides suggests that the broker provides limited support for trader development and market understanding. Automated trading support and expert advisor capabilities are not mentioned in available materials, which could be a serious limitation for traders seeking algorithmic trading solutions. The absence of detailed platform specifications makes it difficult to assess the quality and functionality of the trading environment.

User feedback about tools and resources is limited, but the overall lack of information suggests that Grand FT Market may not prioritize providing comprehensive trading resources to its clients.

This is reflected in this grand ft market review rating.

Customer Service and Support Analysis

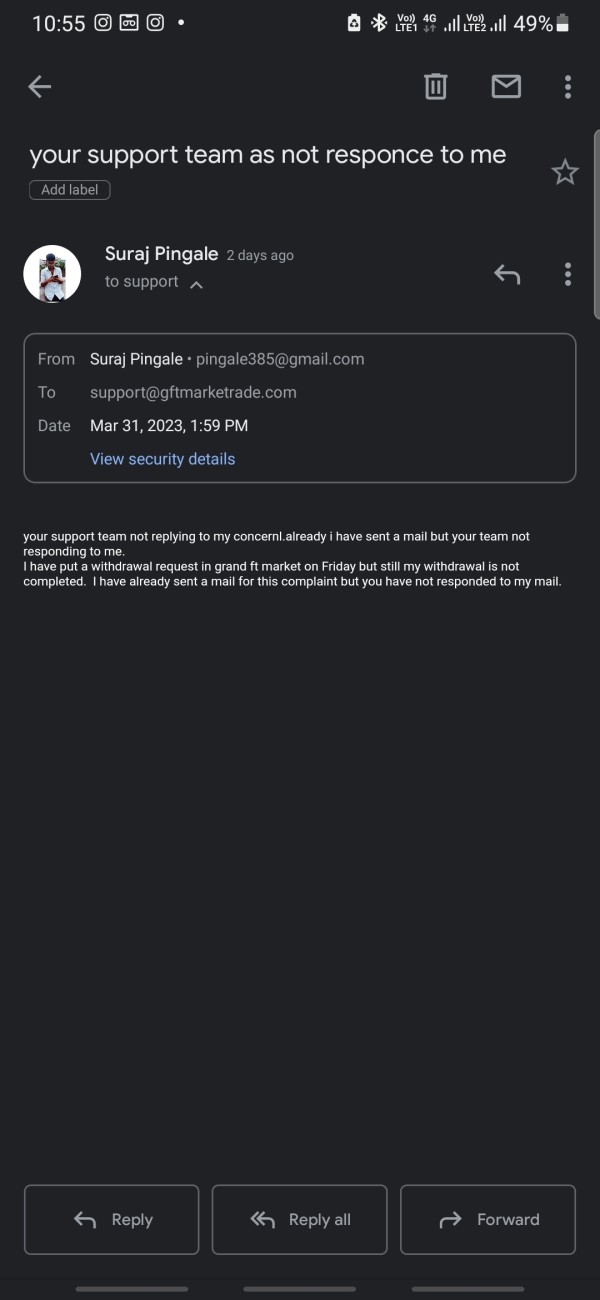

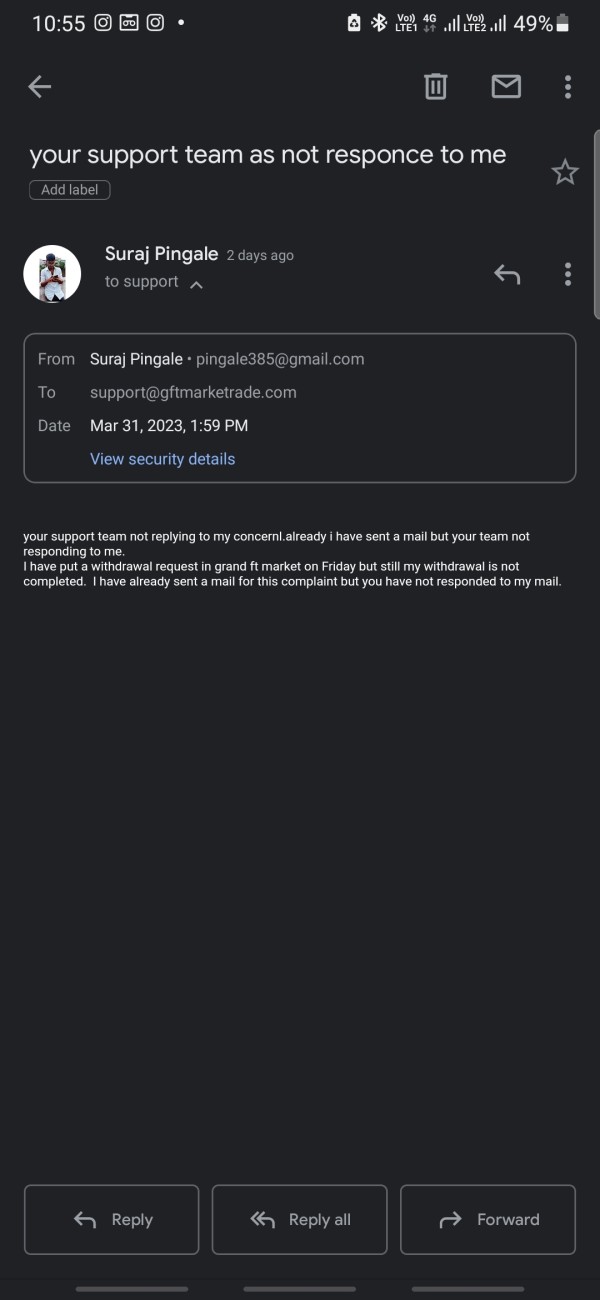

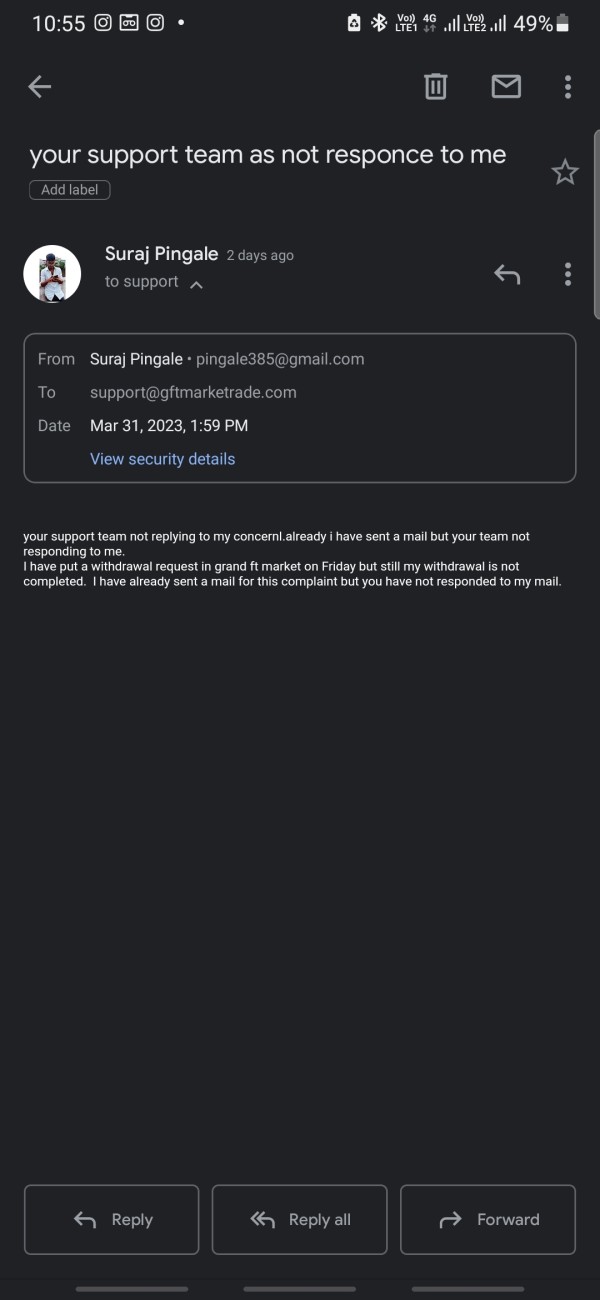

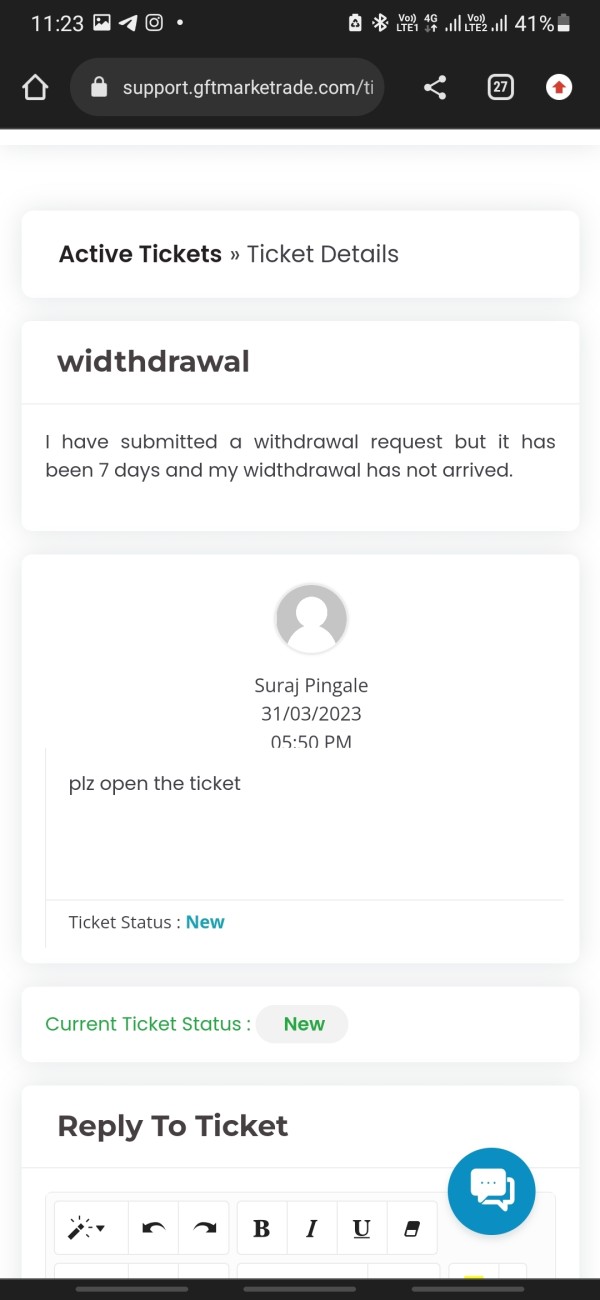

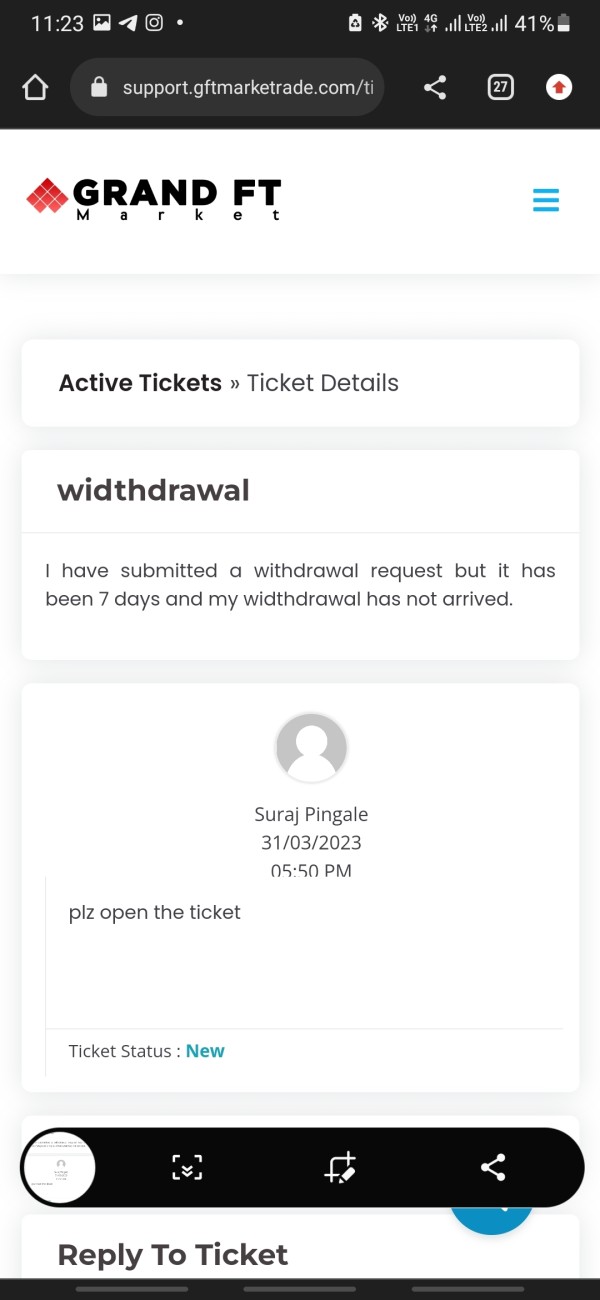

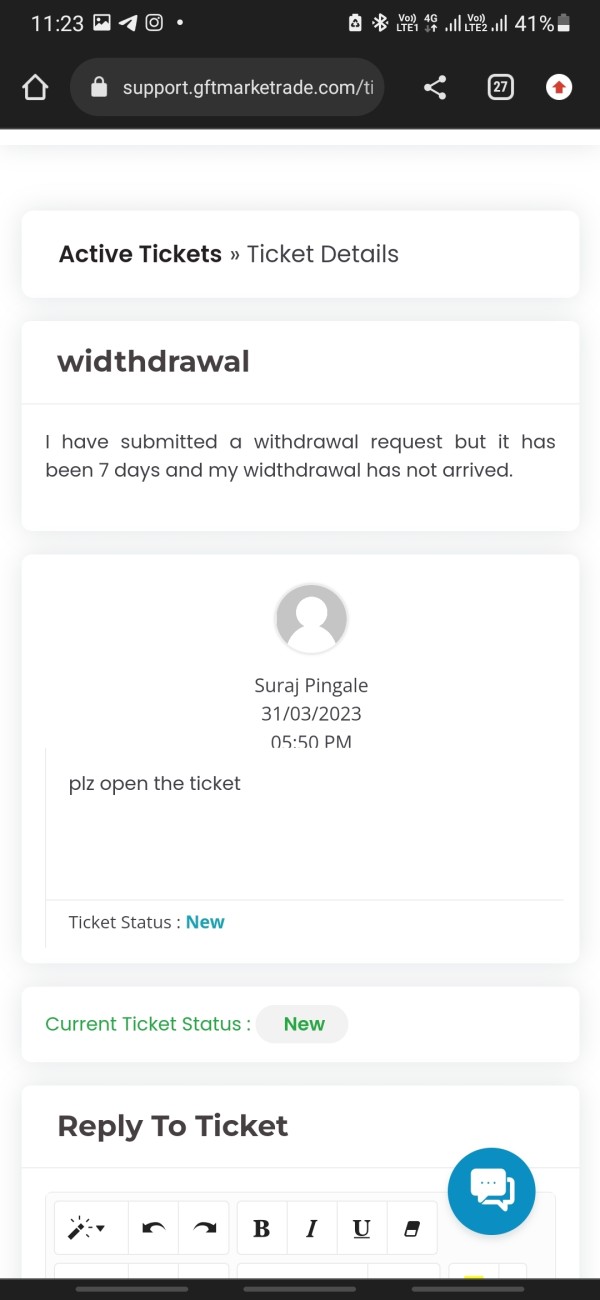

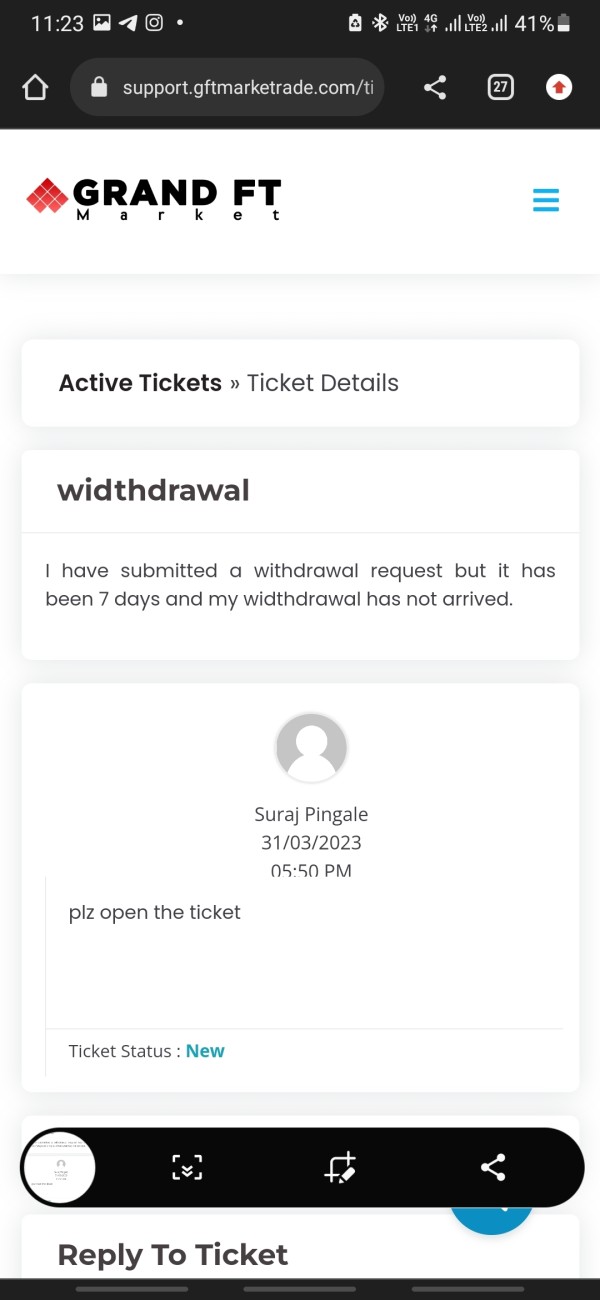

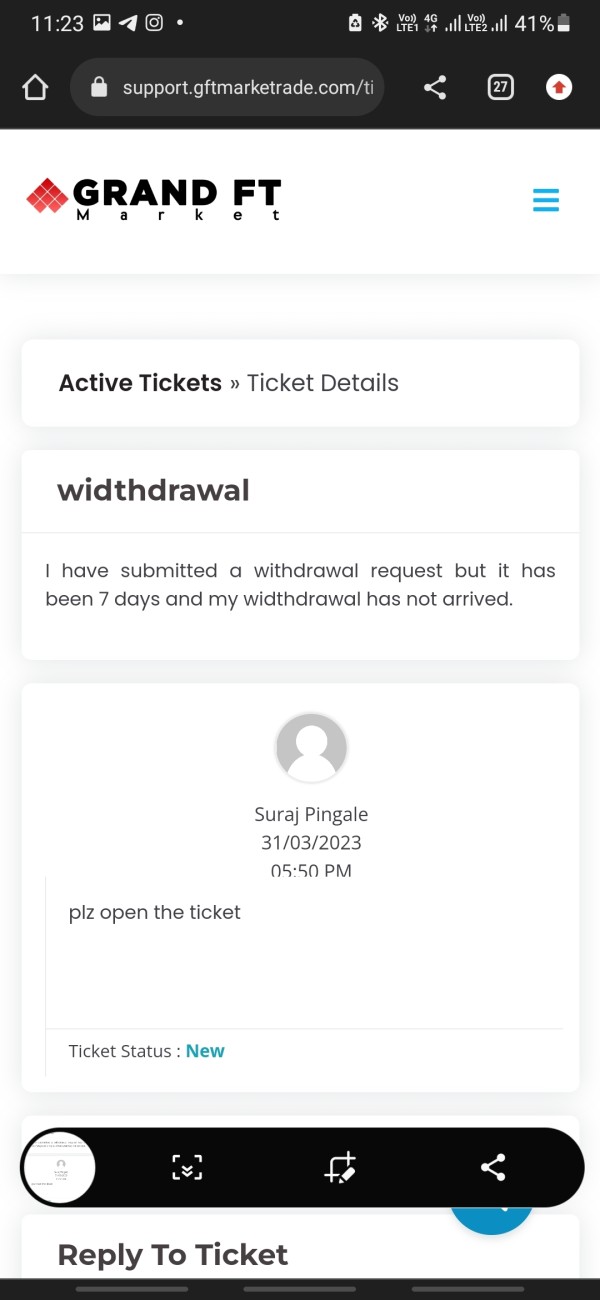

Customer service represents one of Grand FT Market's most serious weaknesses based on available user feedback. Multiple complaints show poor responsiveness and inadequate support for client issues, particularly regarding withdrawal difficulties and account problems. Specific customer service channels, availability hours, and response time commitments are not detailed in available materials.

This lack of transparency about support options creates uncertainty for potential clients about how their concerns would be addressed. User testimonials consistently highlight problems with withdrawal processing, with one reviewer specifically stating that the broker failed to process withdrawals even after one month. This suggests systemic issues with customer support and operational procedures that directly impact client satisfaction and trust.

The absence of multilingual support information further limits accessibility for international clients.

The combination of poor user feedback and limited support transparency results in a low rating for customer service in this evaluation.

Trading Experience Analysis

Grand FT Market's trading experience receives a moderate rating due to mixed factors and limited available information. While the broker provides multiple platform options including desktop, mobile, and web applications, specific details about platform stability, execution speed, and order processing quality are not available. User feedback suggests inconsistent trading experiences, with some clients expressing dissatisfaction with overall platform performance.

The lack of detailed information about spreads, execution models, and liquidity providers makes it difficult to assess the quality of the trading environment. Platform functionality and feature completeness cannot be adequately evaluated due to insufficient technical specifications in available materials. Mobile trading capabilities are mentioned but not detailed, limiting assessment of the broker's technological offerings.

The absence of information about trading environment factors such as spread stability, slippage rates, and execution reliability contributes to uncertainty about the actual trading experience clients can expect from this platform.

Trust and Safety Analysis

Trust and safety represent Grand FT Market's most critical weaknesses. The broker operates without regulation from recognized financial authorities, eliminating essential protections typically available to traders through regulated brokers, and this unregulated status creates serious risks for client fund security and dispute resolution.

Fund safety measures, segregated account policies, and client money protection protocols are not detailed in available information. The absence of regulatory oversight means there are no independent mechanisms to ensure proper handling of client funds or adherence to industry standards. Company transparency is severely limited, with minimal information available about leadership, operational procedures, or business practices.

This lack of transparency, combined with negative user reports about withdrawal difficulties and fraud allegations, creates serious trust concerns. The broker's industry reputation is damaged by multiple user complaints and exposure reports. The handling of negative feedback and client disputes appears inadequate, with users reporting unresolved withdrawal issues and poor communication from the company.

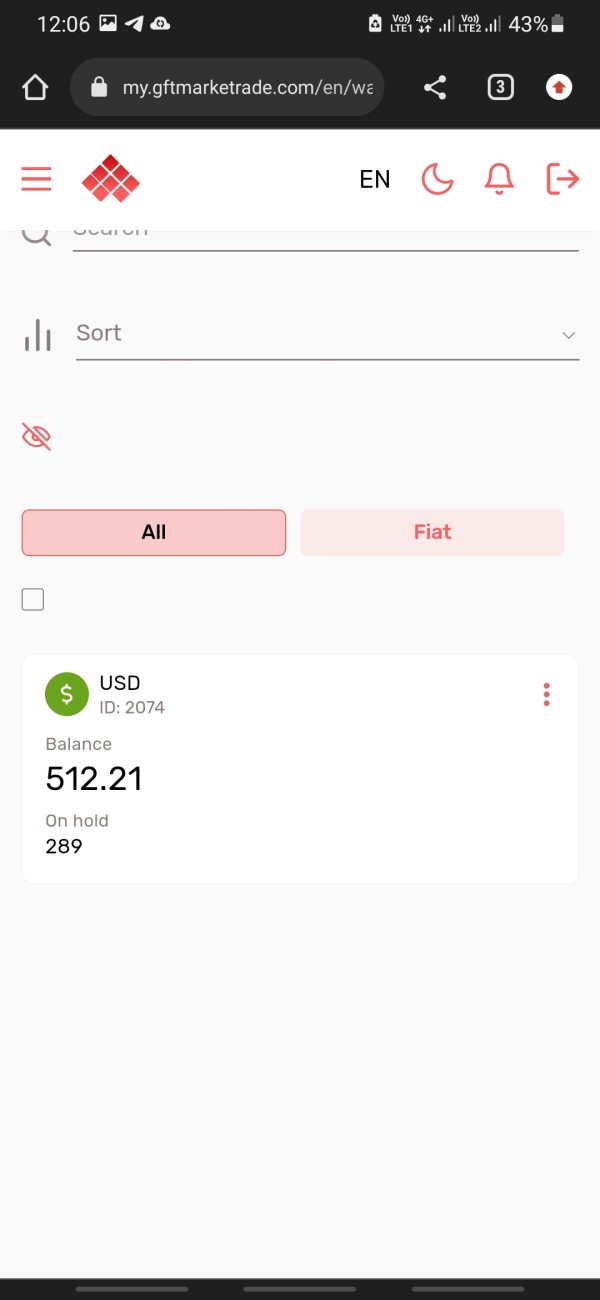

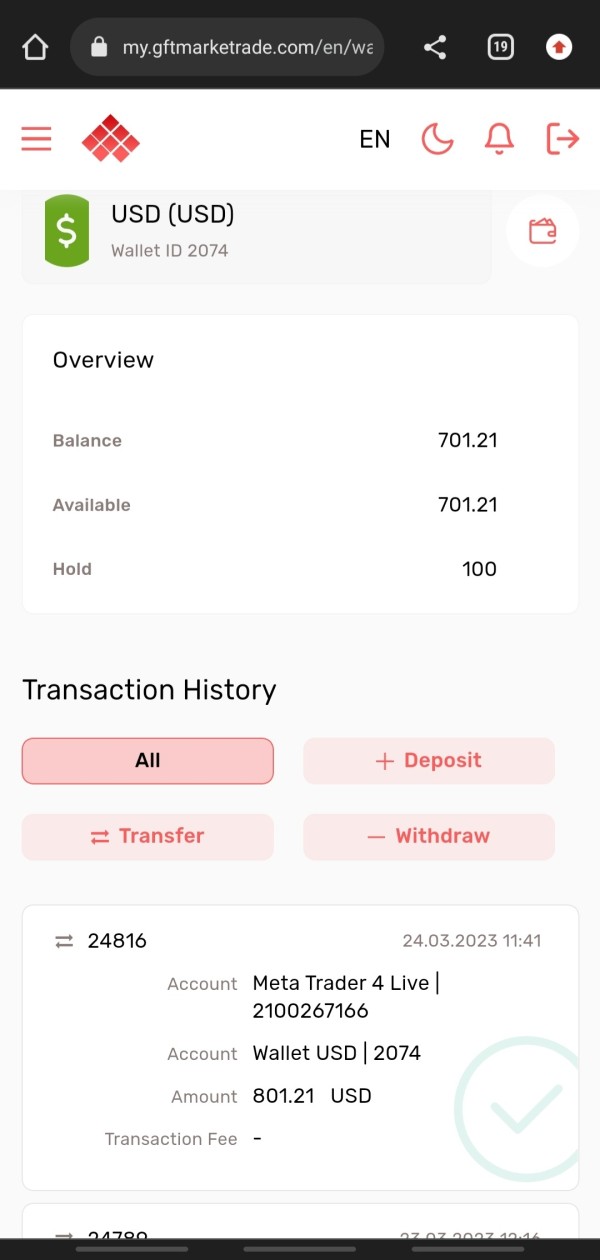

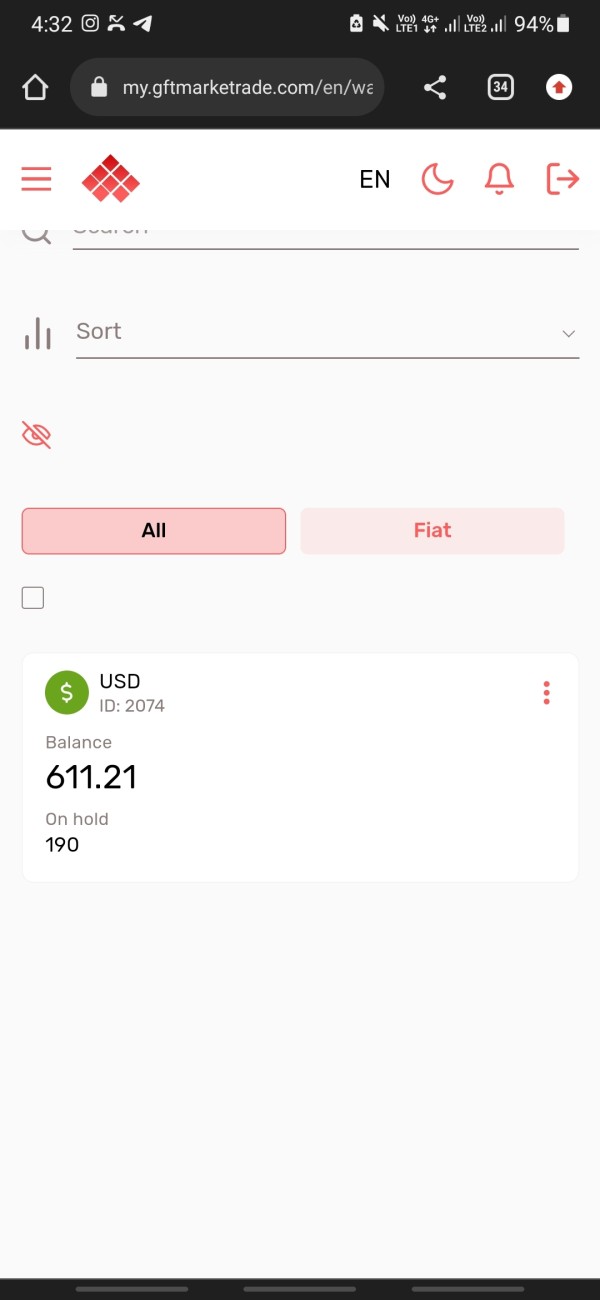

User Experience Analysis

Overall user satisfaction with Grand FT Market appears low based on available feedback and reviews. Users have expressed serious concerns about withdrawal processing, customer service quality, and overall platform reliability, indicating systemic issues with the user experience. Interface design and platform usability information is not detailed in available materials, making it difficult to assess the technical aspects of user experience.

The registration and verification processes are not clearly documented, creating uncertainty for potential clients about account opening procedures. Fund operation experiences are particularly problematic, with multiple users reporting withdrawal difficulties that seriously impact their ability to access their trading profits and deposits. These issues represent fundamental failures in basic broker services that directly affect user satisfaction.

Common user complaints center on withdrawal problems, poor customer service, and concerns about the broker's legitimacy.

The concentration of negative feedback on these critical operational areas suggests that Grand FT Market struggles to meet basic user expectations for reliable broker services.

Conclusion

This grand ft market review reveals a broker with serious operational and regulatory concerns that outweigh its potential benefits. While Grand FT Market offers multiple account types and claims to provide no deposit or withdrawal fees, the lack of regulatory oversight and numerous user complaints about withdrawal difficulties create substantial risks for potential clients. The broker may be suitable for experienced traders who prioritize low trading costs and are willing to accept high risks, but extreme caution is advised.

The absence of regulatory protection, combined with negative user experiences, makes this broker unsuitable for most retail traders seeking reliable and secure trading environments. The main advantages include account variety and claimed cost benefits, while serious disadvantages include regulatory absence, withdrawal difficulties, poor customer service, and limited transparency. Traders considering this broker should carefully weigh these substantial risks against any potential benefits and consider regulated alternatives for safer trading experiences.