Vlom 2025 Review: Everything You Need to Know

Executive Summary

Vlom is an emerging online forex broker that has attracted attention in the trading community. This attention is not always for positive reasons. This vlom review reveals a platform that presents itself as a comprehensive trading solution while raising significant concerns about transparency and reliability.

Based on available information and user feedback, Vlom operates as an offshore trading platform with limited regulatory oversight. This has led many industry experts to question its legitimacy. The broker offers its proprietary VlomTrader platform, supporting trading across multiple asset classes including forex, commodities, stocks, and indices.

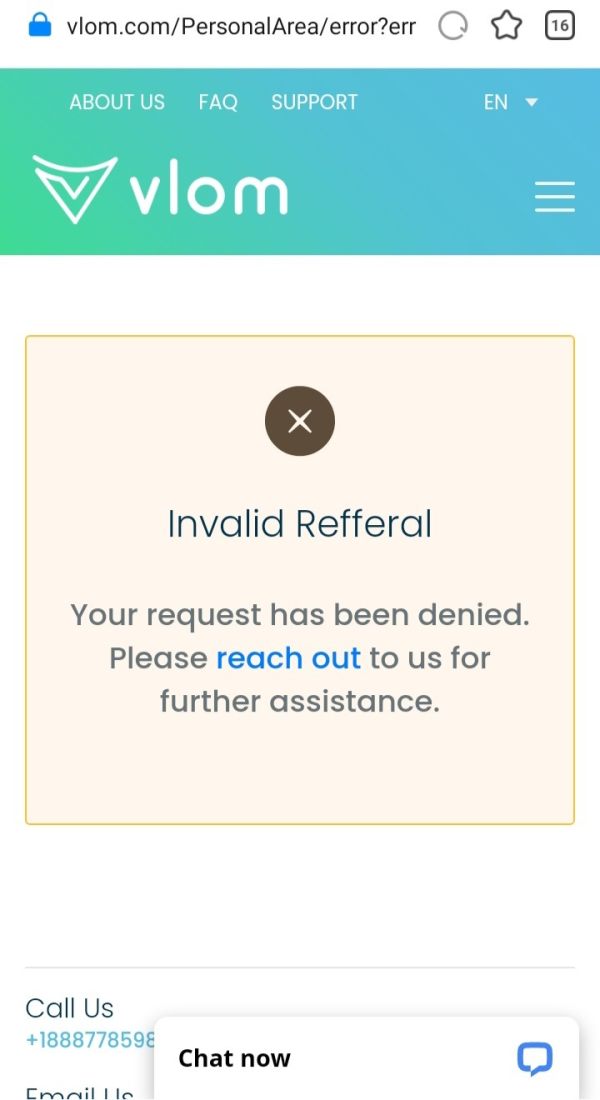

However, the lack of detailed information about trading conditions, fees, and regulatory compliance creates substantial uncertainty for potential clients. User reviews consistently highlight trust issues and concerns about the platform's operational practices. Many describe it as a "shady offshore trading platform."

While Vlom claims to provide access to over 50 trading instruments and multi-device platform support, the overwhelming negative sentiment from users and the absence of transparent regulatory information make it a high-risk choice for traders seeking a reliable broker.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Readers should note that offshore brokers like Vlom may operate under different regulatory frameworks or lack proper oversight entirely.

The regulatory situation for Vlom remains unclear, with limited verification of claimed licensing from Saint Vincent and the Grenadines authorities. Our evaluation methodology incorporates user testimonials, available platform information, and industry standards for broker assessment. However, due to the limited transparency from Vlom itself, some aspects of this review rely on third-party observations and user reports rather than official broker documentation.

Rating Framework

Broker Overview

Company Background and Establishment

Vlom emerged in the forex trading landscape around 2019. It positioned itself as an online trading platform offering access to global financial markets. The company claims to operate from Saint Vincent and the Grenadines, a jurisdiction known for hosting numerous offshore financial services providers.

This location choice immediately raises questions about regulatory oversight and client protection measures. The broker's business model centers around providing retail traders with access to forex markets, commodities, stocks, and indices through their proprietary trading platform. However, the company's background information remains notably sparse, with limited details about founding members, corporate structure, or operational history available to the public.

Platform and Services

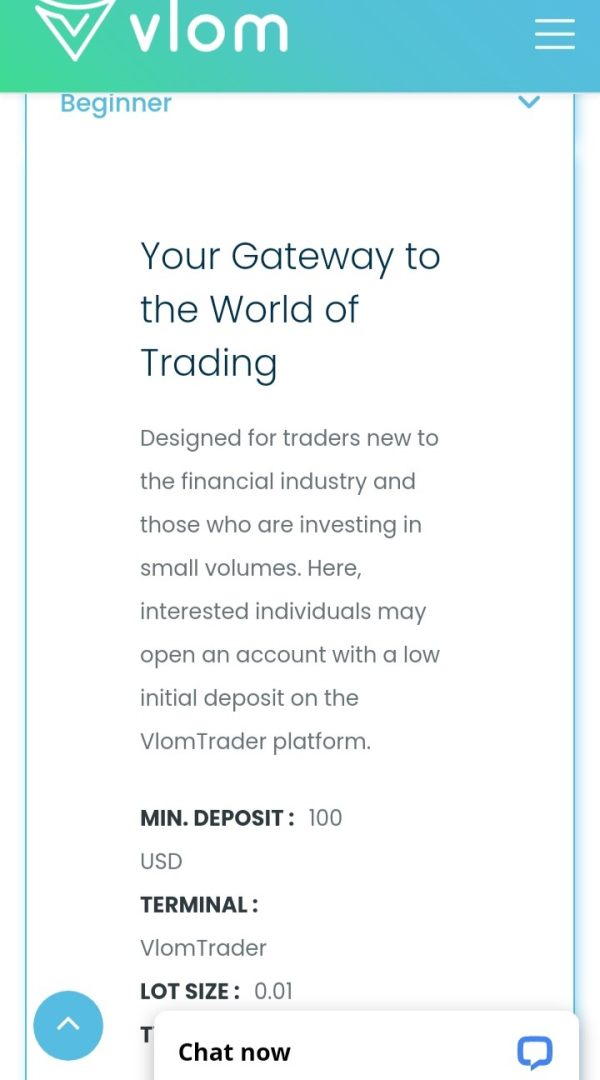

Vlom operates primarily through its VlomTrader platform. The company describes this as a comprehensive trading solution supporting desktop, web-based, and mobile trading environments. According to available information, the platform provides access to over 50 different trading instruments across multiple asset categories.

The broker claims to offer competitive trading conditions, though specific details about spreads, commissions, and execution models are not readily available in public documentation. This vlom review finds that the lack of transparent pricing information represents a significant concern for potential clients seeking to understand the true cost of trading with this broker.

Regulatory Status and Licensing

Vlom claims authorization from authorities in Saint Vincent and the Grenadines. However, specific license numbers or regulatory details are not prominently displayed. This jurisdiction provides minimal investor protection compared to major regulatory bodies like the FCA, ASIC, or CySEC.

The absence of clear regulatory information in available materials raises immediate red flags for trader safety.

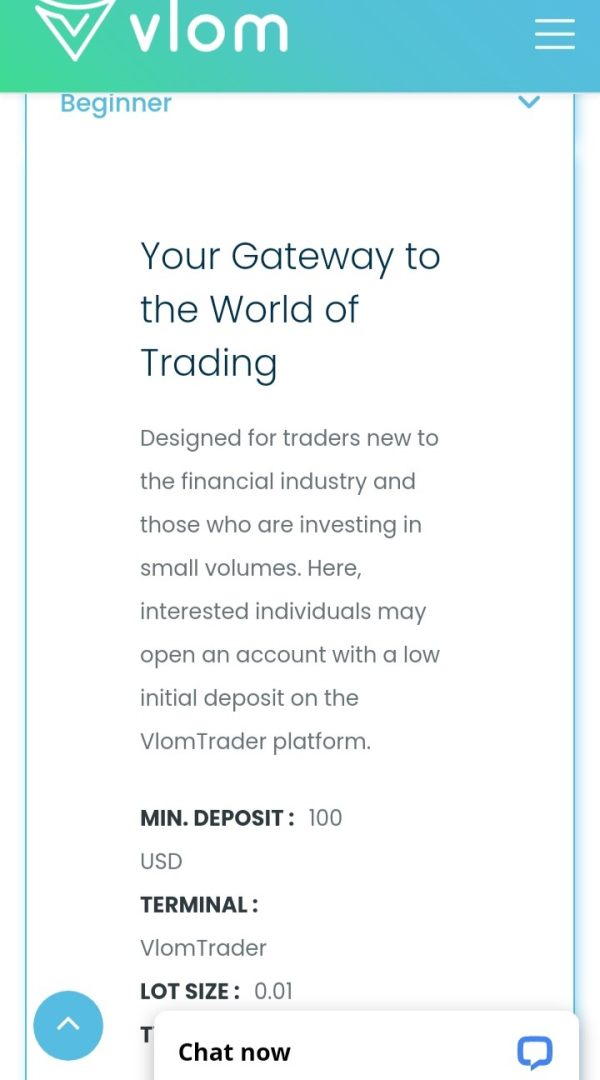

Account Types and Minimum Deposits

Specific information about account types and minimum deposit requirements is not detailed in available materials. This lack of transparency makes it difficult for potential clients to understand the broker's account structure or entry requirements for different service levels.

Trading Assets and Markets

The broker advertises access to over 50 trading instruments. These include major and minor forex currency pairs, commodities such as gold and oil, stock indices, and individual equities. However, the exact list of available instruments and their trading conditions remain unclear from public sources.

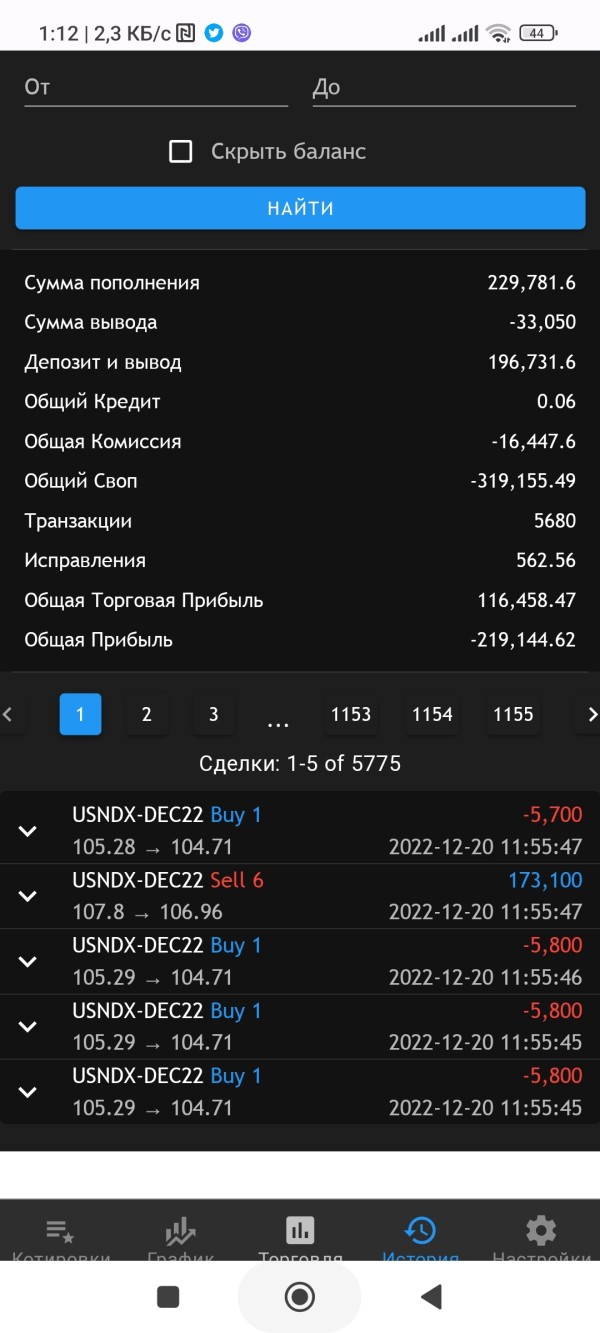

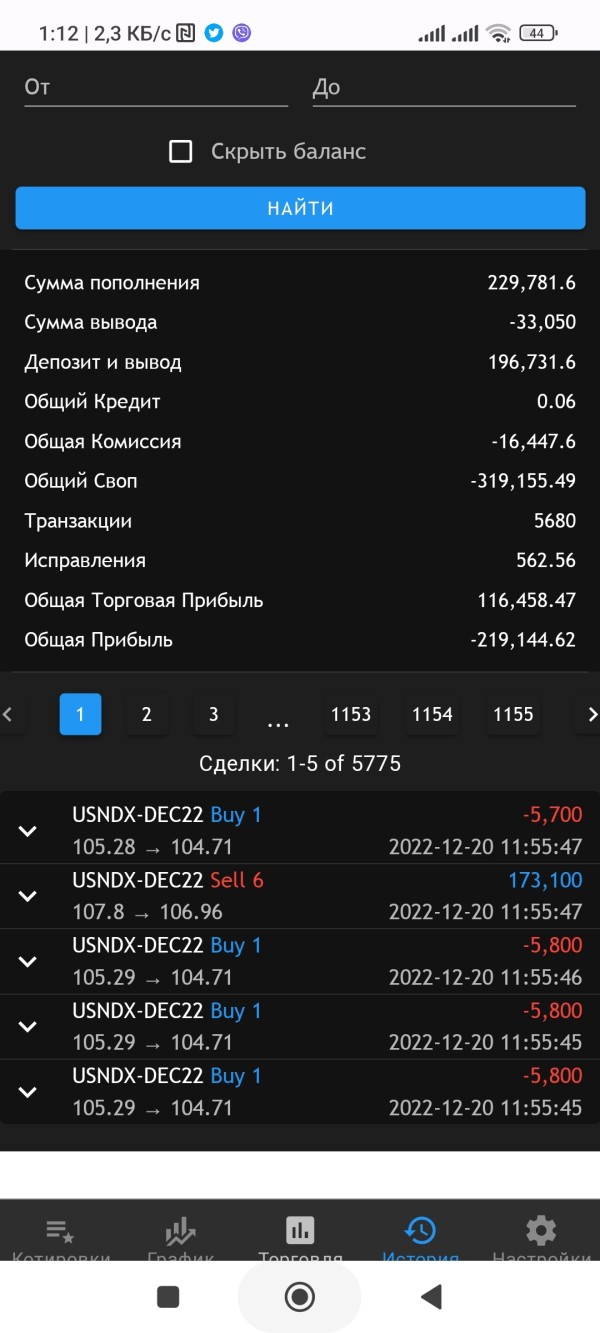

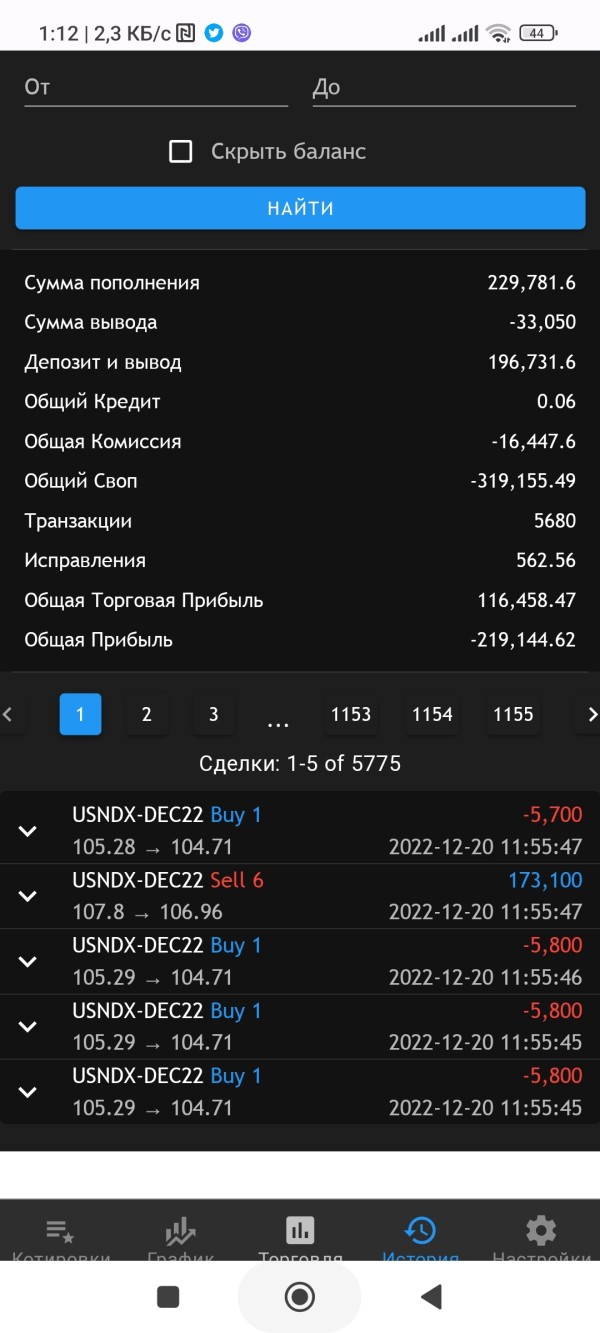

Cost Structure and Fees

Critical information about spreads, commissions, overnight fees, and other trading costs is not readily available in this vlom review. The absence of clear fee disclosure represents a major transparency issue that potential clients should consider carefully.

Platform Technology

The VlomTrader platform reportedly supports multiple devices and operating systems. It offers chart analysis tools and order management capabilities. However, detailed technical specifications and platform features are not comprehensively documented in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Vlom remain largely opaque, which significantly impacts the broker's rating in this category. Available materials do not provide clear information about account types, minimum deposit requirements, or specific trading conditions for different client categories.

This lack of transparency makes it impossible for potential traders to make informed decisions about whether the broker's account structure meets their needs. Industry standards typically require brokers to clearly outline their account offerings, including demo accounts, standard accounts, and premium service tiers. The absence of such information in Vlom's public materials suggests either poor marketing practices or intentional opacity.

User feedback indicates confusion about account opening procedures and unclear terms of service, further highlighting deficiencies in this area. The scoring of 4/10 reflects these transparency issues while acknowledging that the broker does appear to offer some form of account structure, albeit poorly documented. This vlom review emphasizes that traders should demand clear account information before committing funds to any broker.

Vlom's proprietary VlomTrader platform represents the primary tool offering for clients. It supports multiple devices and provides basic trading functionality. The platform appears to include standard charting capabilities and order management features typical of modern trading software.

However, the depth and quality of analytical tools, market research resources, and educational materials remain unclear from available documentation. Professional traders typically require access to advanced charting packages, economic calendars, market analysis, and educational resources to support their trading activities. While Vlom claims to provide a comprehensive trading environment, user feedback suggests limitations in the platform's analytical capabilities and research offerings.

The 6/10 rating acknowledges the existence of a proprietary platform while reflecting concerns about the limited information available regarding advanced tools and resources. The broker's failure to prominently showcase sophisticated trading tools or educational content suggests these may be limited or non-existent.

Customer Service and Support Analysis

Customer service quality emerges as a significant weakness in user feedback about Vlom. Available reviews consistently mention difficulties in reaching support representatives and unsatisfactory responses to client inquiries.

The broker's support channels, response times, and service quality appear inadequate based on user testimonials collected for this analysis. Effective customer support requires multiple contact channels, reasonable response times, and knowledgeable staff capable of addressing technical and account-related issues. User reports suggest Vlom falls short in these areas, with some clients describing frustrating experiences when seeking assistance with platform issues or account problems.

The 3/10 rating reflects these service quality concerns while acknowledging that some form of customer support structure exists. However, the consistently negative user feedback regarding support experiences represents a major red flag for potential clients considering this broker.

Trading Experience Analysis

The trading experience with Vlom appears problematic based on available user feedback and platform analysis. While the VlomTrader platform supports multiple devices and claims to offer comprehensive trading functionality, user reports suggest issues with platform stability, execution quality, and overall trading environment reliability.

Critical aspects of trading experience include order execution speed, price accuracy, platform uptime, and the absence of technical disruptions during market hours. User feedback indicates concerns in several of these areas, with some traders reporting difficulties executing orders and questions about price transparency. The 5/10 rating for this vlom review category reflects the mixed nature of available information, acknowledging the existence of a trading platform while noting significant user concerns about execution quality and platform reliability.

These issues represent serious considerations for active traders who require dependable execution.

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of Vlom's operations, earning the lowest rating in this comprehensive review. The broker's offshore jurisdiction, limited regulatory oversight, and consistently negative user feedback create a profile that raises serious questions about operational integrity and client fund safety.

Multiple user reviews describe Vlom as a "shady offshore trading platform," indicating widespread concerns about the company's business practices. The lack of transparent regulatory information, combined with unclear corporate structure and limited operational history, compounds these trust issues significantly. The 2/10 rating reflects these fundamental concerns about the broker's reliability and trustworthiness.

The absence of proper regulatory oversight and the prevalence of negative user experiences suggest significant risks for potential clients considering this platform for their trading activities.

User Experience Analysis

Overall user satisfaction with Vlom appears consistently poor based on available feedback and reviews. Users report difficulties with account management, unclear terms and conditions, and general dissatisfaction with the broker's services.

The combination of platform issues, poor customer support, and trust concerns creates a negative user experience profile. Successful brokers typically maintain positive user satisfaction ratings through transparent operations, reliable platforms, and responsive customer service. Vlom appears to fall short in all these areas, resulting in widespread user dissatisfaction and negative reviews across multiple evaluation platforms.

The 4/10 rating acknowledges that some users may have neutral experiences while reflecting the predominantly negative feedback pattern observed in this analysis. The consistent nature of user complaints suggests systemic issues rather than isolated problems, representing a significant concern for potential clients.

Conclusion

This comprehensive vlom review reveals a broker that presents significant risks and concerns for potential traders. While Vlom offers access to multiple trading instruments through its proprietary platform, the overwhelming issues with transparency, regulatory oversight, and user satisfaction make it difficult to recommend this broker for serious trading activities.

The combination of offshore jurisdiction, limited regulatory information, poor customer service feedback, and widespread user trust concerns creates a risk profile that most traders should avoid. The lack of transparent pricing, unclear account conditions, and questionable business practices further compound these concerns. Traders seeking a reliable forex broker should prioritize platforms with clear regulatory oversight, transparent pricing structures, positive user feedback, and comprehensive customer support.

Vlom's current profile suggests it does not meet these fundamental requirements for a trustworthy trading partner.