Global Markets Group 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive global markets group review looks at a UK-based financial services provider that has been running since 2015. Global Markets Group, also known as GMG UK, shows itself as a boutique FCA-regulated brokerage made by traders for traders, and it places itself in the competitive forex and CFD trading world.

The broker gives access to over 50 trading assets across multiple types including forex currency pairs, indices, commodities, oil, gold, and silver. With a minimum deposit of 100 GBP and leverage up to 1:30, GMG targets smaller investors and those who want to enter the market with modest capital needs. Operating under the watch of the UK's Financial Conduct Authority, Global Markets Group uses both STP and ECN business models.

The company keeps its headquarters in London and works with a lean team of 2-10 employees, showing its boutique approach to financial services. The trading environment works through the MetaTrader 5 platform, giving traders access to advanced charting tools and automated trading features. This global markets group review finds the broker right for beginner and intermediate traders who want regulated market access with competitive entry needs.

Important Notice

This review uses publicly available information and regulatory disclosures. Trading conditions and services may change across different areas due to local regulatory requirements. The FCA regulation applies specifically to UK operations, and traders from other regions should check their local regulatory status and applicable trading conditions.

This global markets group review relies on information taken from official sources and publicly available data. Potential clients should do their own research and verify current terms and conditions directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

Global Markets Group started in the financial services sector in 2015, setting up its operations in London's prestigious financial district. According to LinkedIn data, the company keeps a compact structure with 2-10 employees and has attracted 558 followers on the professional network. This boutique approach lets GMG focus on personalized service delivery while keeping operational efficiency.

The brokerage places itself uniquely in the market with the tagline "formed by traders for traders," suggesting an insider understanding of market participant needs. The company's specialization includes FX brokerage, CFD brokerage, FX and CFD trading services, and direct market access solutions, all delivered through the MetaTrader 4 and MetaTrader 5 platforms. According to regulatory filings, Global Markets Group operates under both STP and ECN business models, giving clients direct market access and electronic communication network connectivity.

This dual approach allows the broker to serve different trading preferences and execution requirements. The FCA regulation provides a solid regulatory foundation, ensuring compliance with strict UK financial services standards. The broker's asset portfolio spans over 50 instruments across major asset classes.

Forex trading forms the core offering with multiple currency pairs, complemented by indices that track major global markets. Commodities trading includes precious metals such as gold and silver, alongside energy products including oil derivatives.

Regulatory Framework: Global Markets Group operates under the supervision of the UK's Financial Conduct Authority, one of the world's most respected financial regulators. This regulatory oversight ensures following strict capital adequacy requirements, client fund separation protocols, and operational transparency standards.

Minimum Deposit Requirements: The broker keeps an accessible entry threshold with a minimum deposit requirement of 100 GBP. This relatively low barrier to entry makes the platform suitable for retail traders and those beginning their trading journey with limited capital.

Available Trading Assets: The trading portfolio includes over 50 instruments across multiple asset categories. Forex pairs include major, minor, and exotic currency combinations. Index trading provides exposure to global equity markets, while commodities coverage includes precious metals and energy products.

Leverage Specifications: Maximum leverage is capped at 1:30, aligning with European Securities and Markets Authority regulations for retail clients. This conservative leverage approach puts client protection first while still providing meaningful trading opportunities.

Trading Platform: MetaTrader 5 serves as the primary trading platform, offering advanced charting capabilities, automated trading support, and comprehensive market analysis tools. The platform supports multiple order types and provides real-time market data across all available instruments.

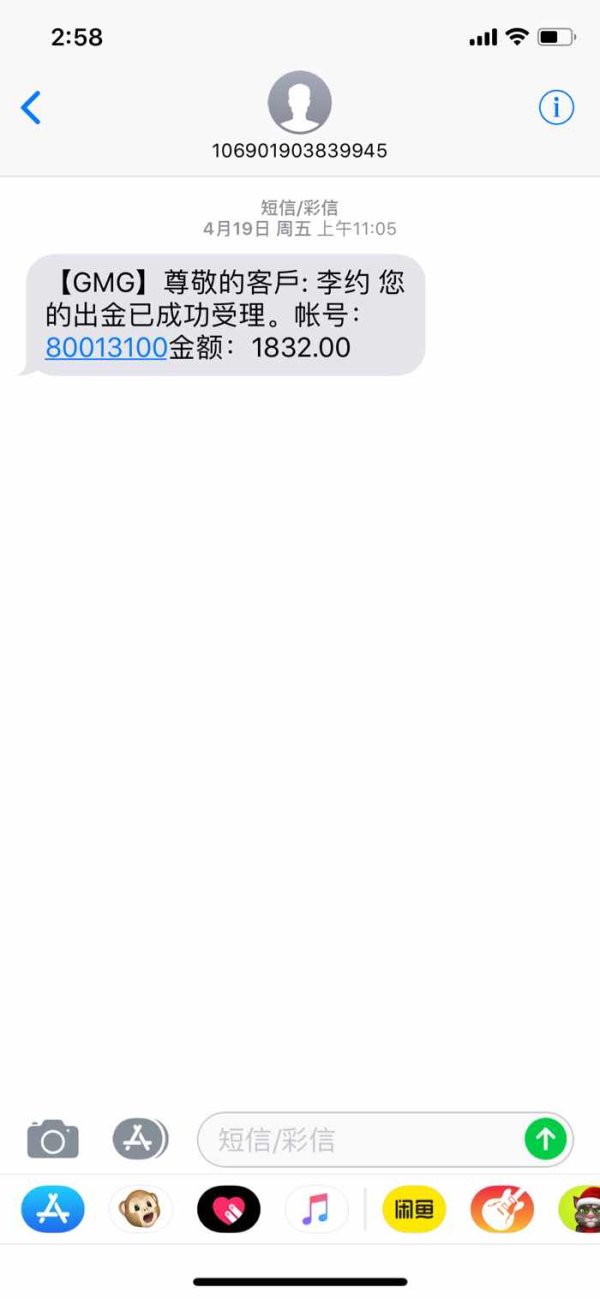

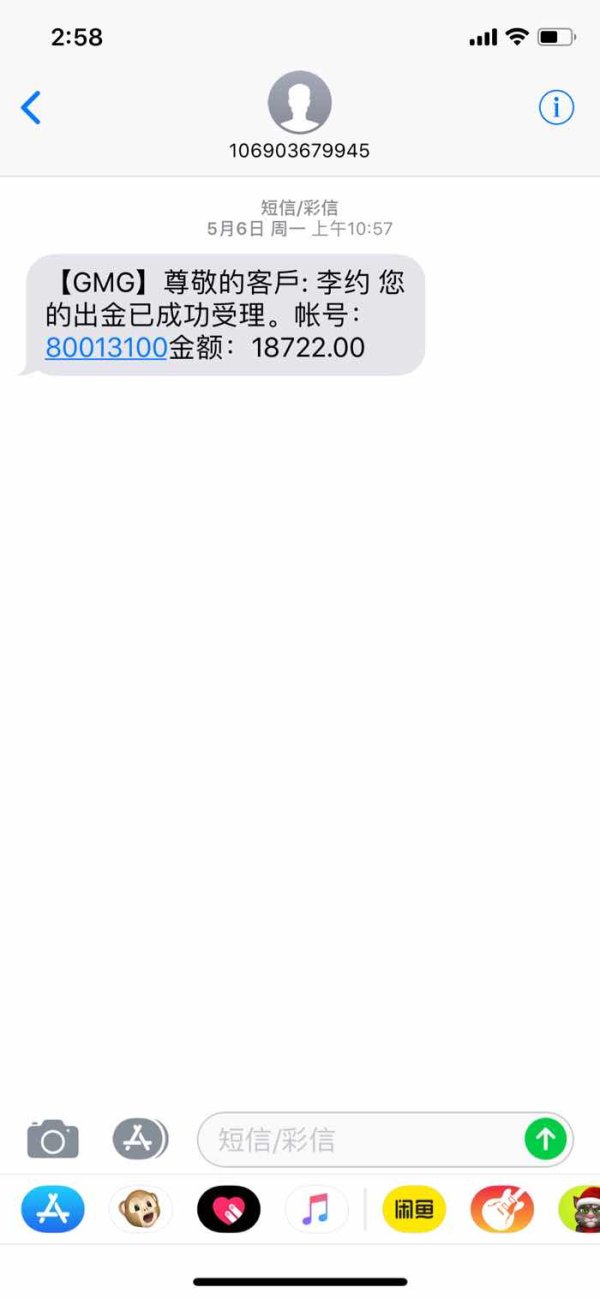

Payment Methods: Specific information regarding deposit and withdrawal methods was not detailed in available source materials. Prospective clients should verify current payment options directly with the broker.

Customer Support: Details regarding customer service channels, availability, and language support were not specified in the reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The global markets group review reveals a straightforward account structure designed to accommodate retail traders with varying experience levels. The 100 GBP minimum deposit requirement positions GMG competitively within the retail brokerage space, particularly for UK-based traders dealing in their domestic currency.

Leverage limitations at 1:30 reflect compliance with ESMA regulations, which put client protection over high-risk trading opportunities. While this may limit potential returns, it significantly reduces the risk of substantial losses for inexperienced traders. The leverage structure applies uniformly across major asset classes, providing consistency in risk management.

The regulatory framework under FCA supervision adds credibility to account safety measures. UK regulations mandate client fund separation, meaning trader deposits are held separately from company operational funds. This provides an additional layer of security for client capital.

However, the available information does not specify different account tiers or specialized account types such as Islamic accounts for Sharia-compliant trading. The absence of detailed account feature information suggests a simplified account structure, which may appeal to traders seeking straightforward access without complex tier systems.

MetaTrader 5 serves as the cornerstone of GMG's trading infrastructure, providing traders with a sophisticated yet user-friendly trading environment. The platform offers advanced charting capabilities with multiple timeframes, technical indicators, and drawing tools essential for comprehensive market analysis.

Automated trading support through Expert Advisors enables systematic trading strategies and removes emotional decision-making from the trading process. The platform's MQL5 programming language allows for custom indicator development and strategy automation, appealing to technically sophisticated traders.

Market access spans over 50 instruments across forex, indices, commodities, and precious metals, providing sufficient diversification opportunities for portfolio construction. The variety of available assets allows traders to implement cross-market strategies and hedge positions across different asset classes.

However, the evaluation reveals limited information regarding additional research resources, market analysis, or educational materials. Educational content and market commentary are increasingly important differentiators in the competitive brokerage landscape, and the absence of detailed information in this area represents a potential service gap.

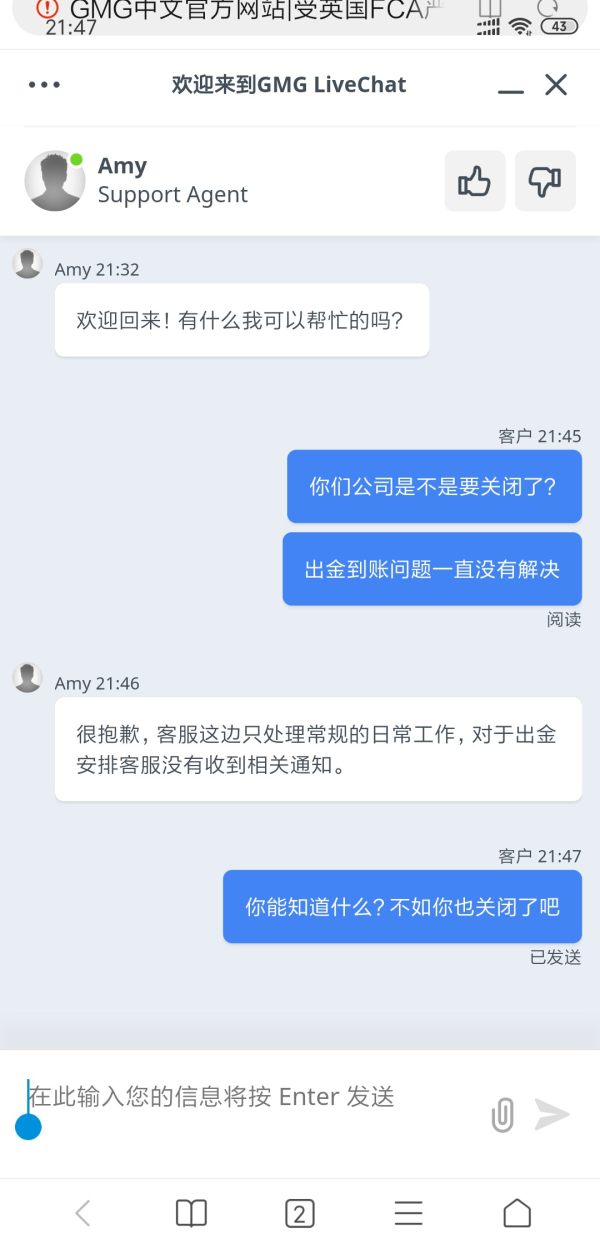

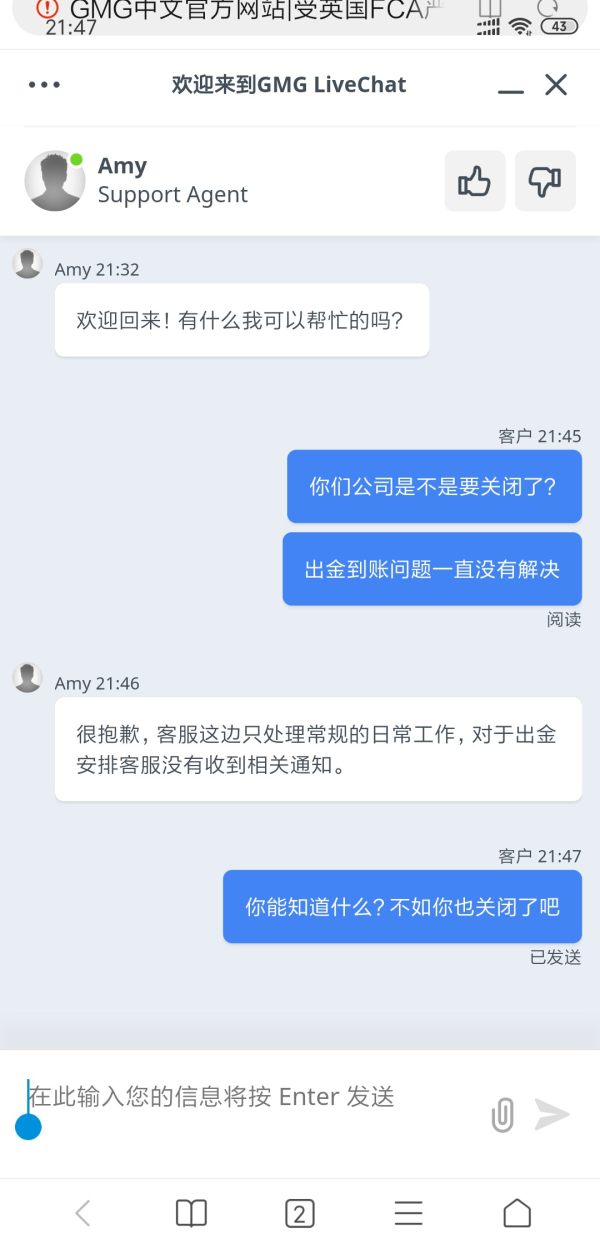

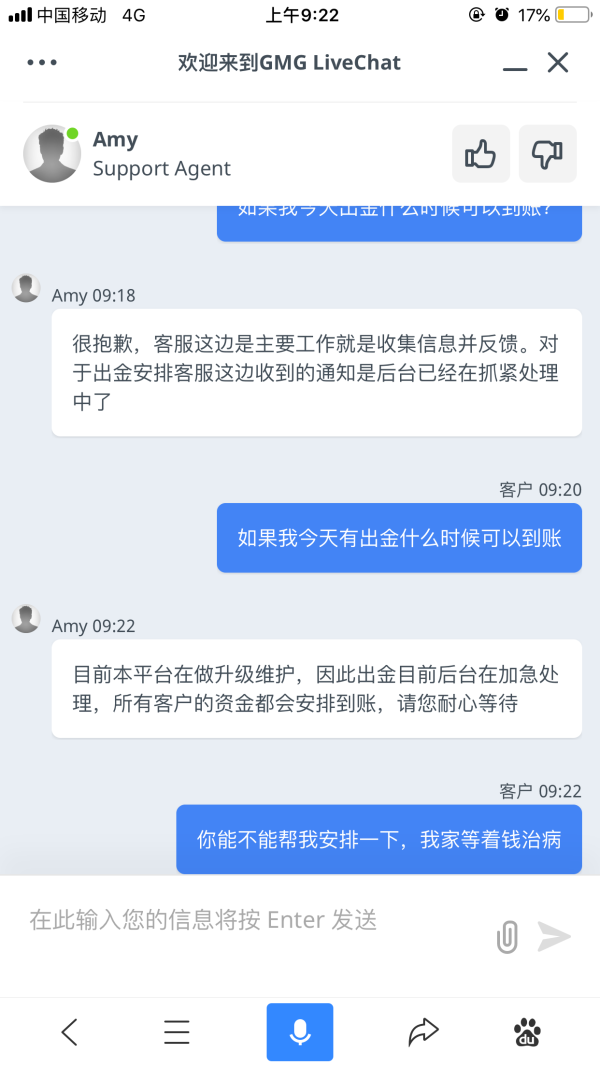

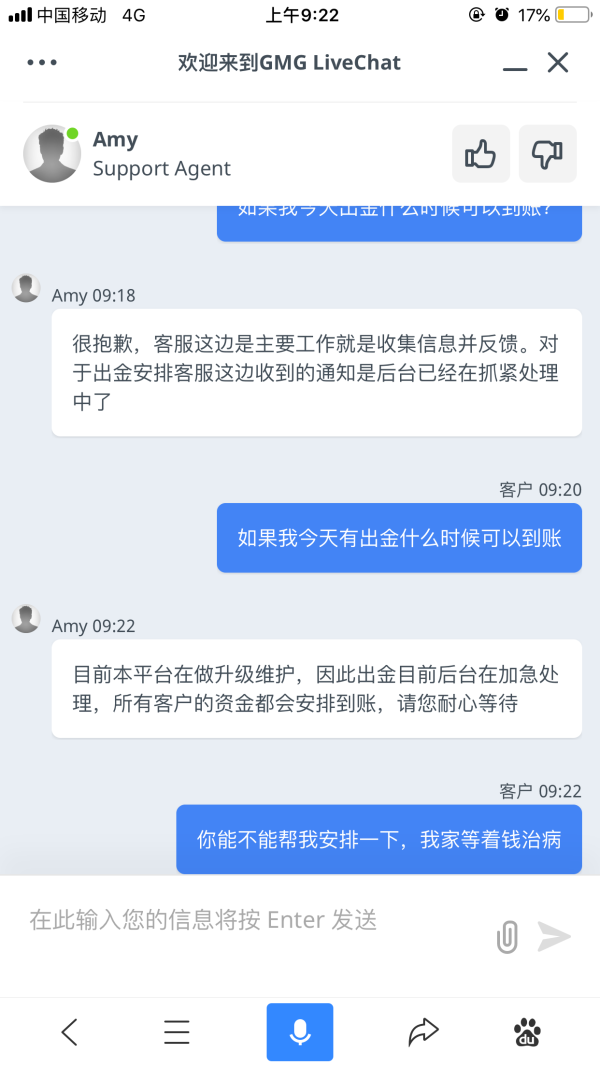

Customer Service and Support Analysis

The available source materials provide insufficient detail regarding Global Markets Group's customer service infrastructure. Critical information such as support channel availability, response times, and service quality metrics were not documented in the reviewed sources.

Professional customer support typically includes multiple contact methods such as live chat, telephone support, and email assistance. Service availability hours and multilingual support capabilities are particularly important for international clients operating across different time zones.

The company's boutique structure with 2-10 employees may enable more personalized service delivery compared to larger institutional brokers. However, this smaller scale could potentially limit 24/7 support availability and specialized service capabilities.

Resolution procedures for disputes and technical issues represent critical service components that require clarification. Prospective clients should verify current customer service standards and availability before committing to the platform.

Trading Experience Analysis

Platform performance represents a crucial factor in trading success, particularly for strategies requiring precise timing and execution. MetaTrader 5's reputation for stability and functionality provides a solid foundation for the trading experience, though specific performance metrics for GMG's implementation were not available.

The combination of STP and ECN execution models suggests competitive order processing with direct market access capabilities. ECN connectivity typically provides tighter spreads and faster execution, while STP processing ensures orders are passed directly to liquidity providers without dealer intervention.

Mobile trading capabilities through MetaTrader 5's mobile applications enable trading flexibility and portfolio monitoring from any location. The platform's cross-device synchronization ensures consistent access to trading positions and market data.

However, this global markets group review lacks specific data on execution speeds, slippage rates, and platform uptime statistics. These technical performance indicators significantly impact the overall trading experience and should be verified through demo testing or direct broker consultation.

Trust and Security Analysis

FCA regulation provides the primary foundation for trust and security at Global Markets Group. The UK's Financial Conduct Authority maintains stringent oversight requirements including capital adequacy standards, operational transparency, and client fund protection protocols.

Regulatory compliance includes mandatory participation in the Financial Services Compensation Scheme, which provides protection for eligible deposits up to £85,000 per person per firm. This protection offers significant security for retail traders operating within the coverage limits.

The broker's establishment in 2015 provides nearly a decade of operational history, though specific information regarding regulatory violations, client disputes, or operational incidents was not available in the reviewed materials. Transparency regarding company ownership, financial statements, and operational procedures would strengthen the trust profile.

Third-party verification of regulatory status can be confirmed through the FCA's register, providing independent validation of the broker's authorized status. Prospective clients should verify current regulatory standing before opening accounts.

User Experience Analysis

The user experience evaluation is limited by insufficient information regarding client feedback and platform usability assessments. MetaTrader 5's industry-standard interface provides familiarity for experienced traders while offering educational resources for newcomers to the platform.

Account opening and verification procedures were not detailed in available sources, though FCA regulations require comprehensive know-your-customer and anti-money laundering compliance. These processes typically involve identity verification, address confirmation, and source of funds documentation.

The boutique nature of GMG's operations may provide more personalized onboarding and support experiences compared to larger institutional brokers. However, this global markets group review cannot provide specific user satisfaction metrics or common user concerns due to limited source material.

Platform accessibility across desktop, web, and mobile environments through MetaTrader 5 ensures consistent user experience across different devices and operating systems.

Conclusion

This global markets group review reveals a regulated UK broker offering straightforward access to forex and CFD trading through the established MetaTrader 5 platform. The FCA regulation provides a solid foundation for trust and security, while the 100 GBP minimum deposit makes the platform accessible to smaller retail traders.

Primary strengths include regulatory compliance, competitive minimum deposit requirements, and access to a diverse range of trading instruments. The boutique operational model may appeal to traders seeking personalized service from a smaller, specialized firm.

Key limitations identified in this evaluation include insufficient information regarding customer service standards, trading costs, and user experience metrics. Prospective clients should conduct thorough due diligence and verify current terms before committing capital to the platform.