FXD Review 1

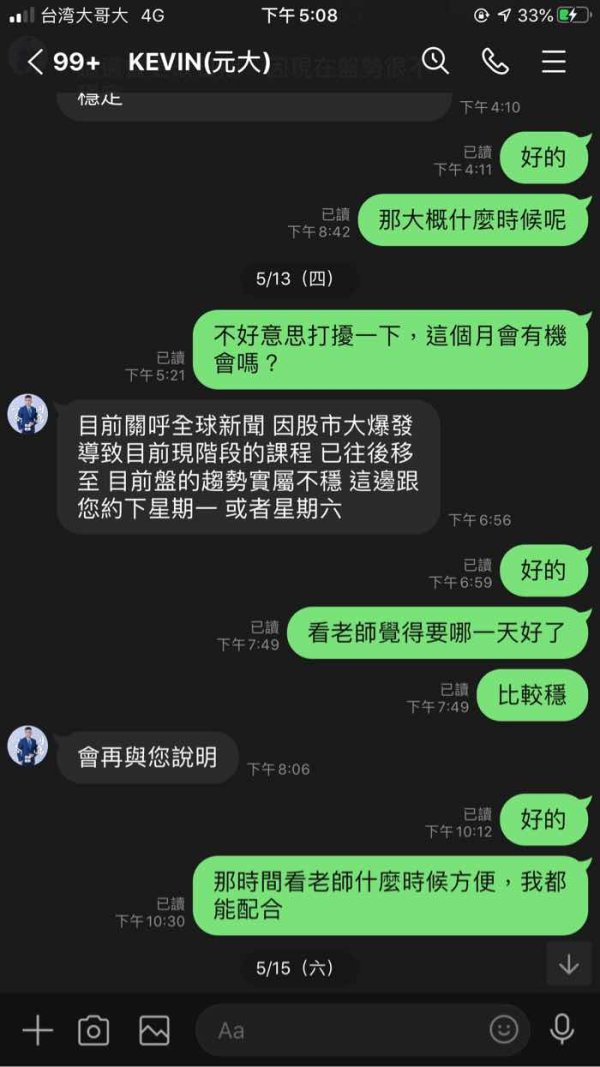

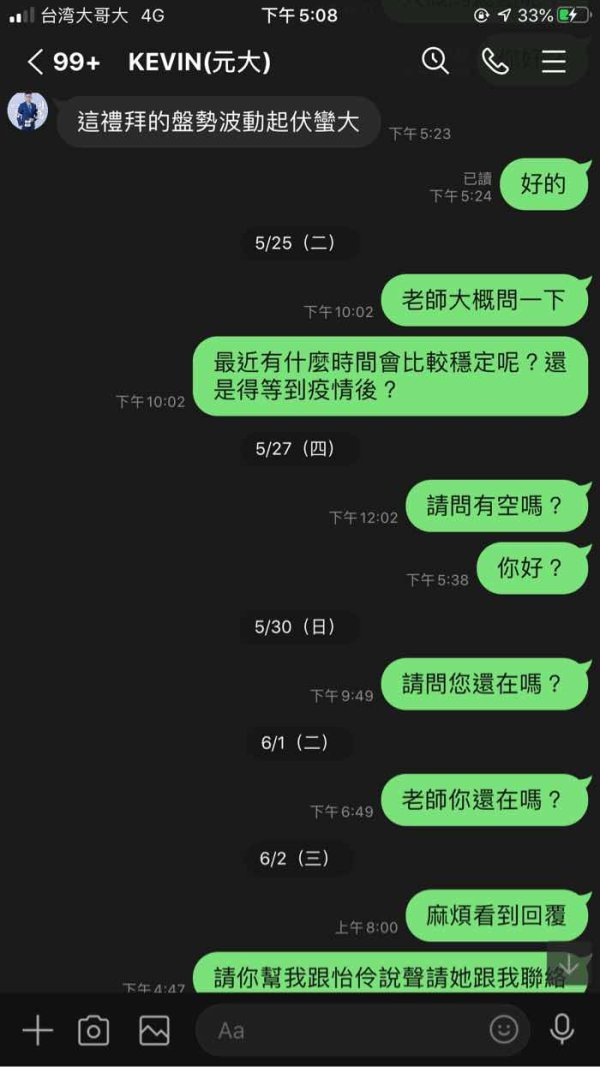

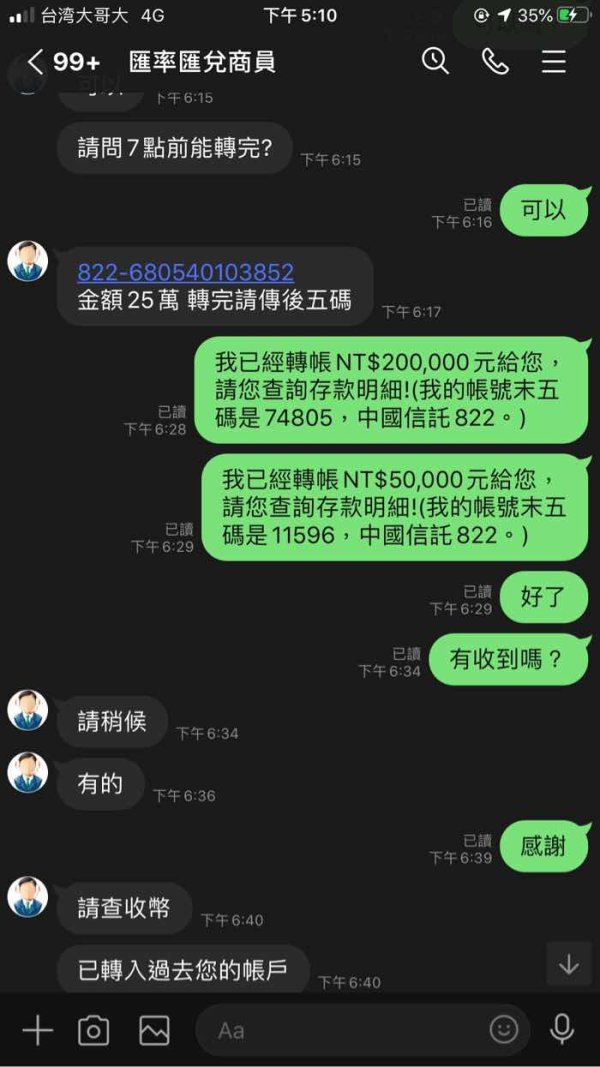

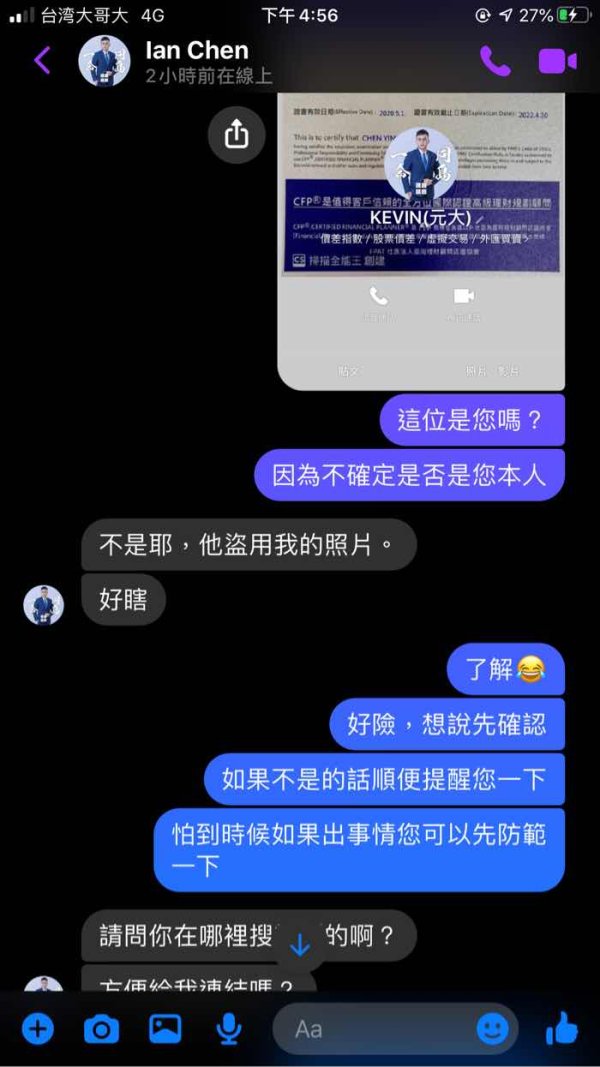

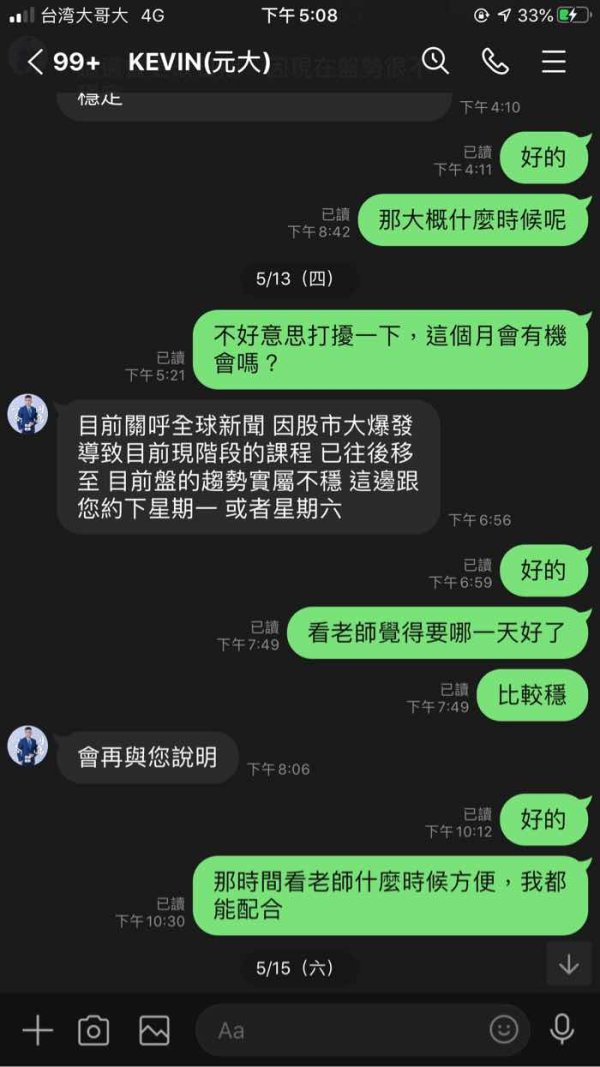

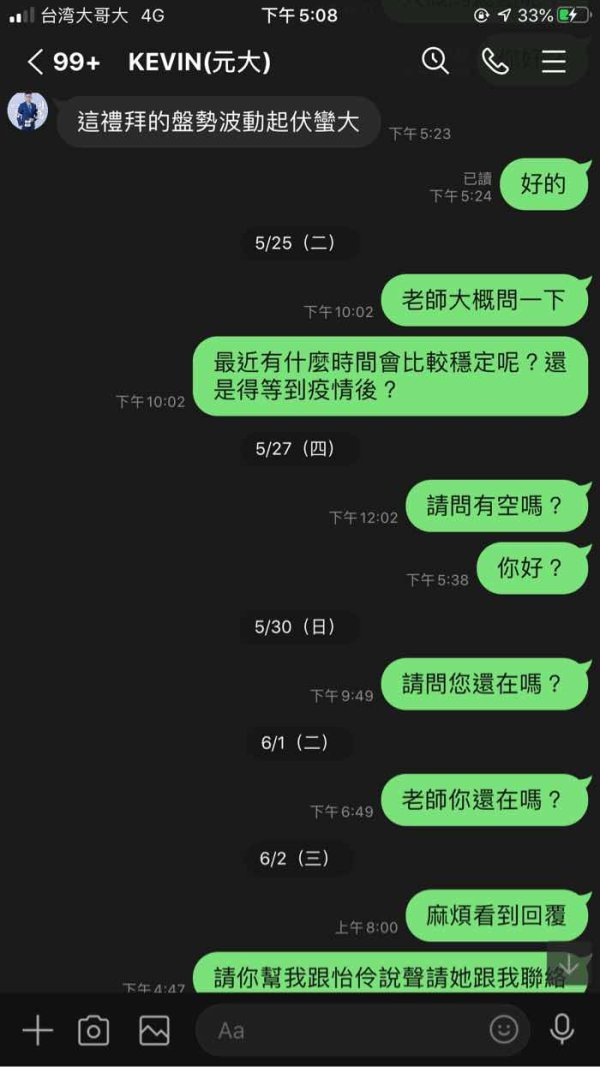

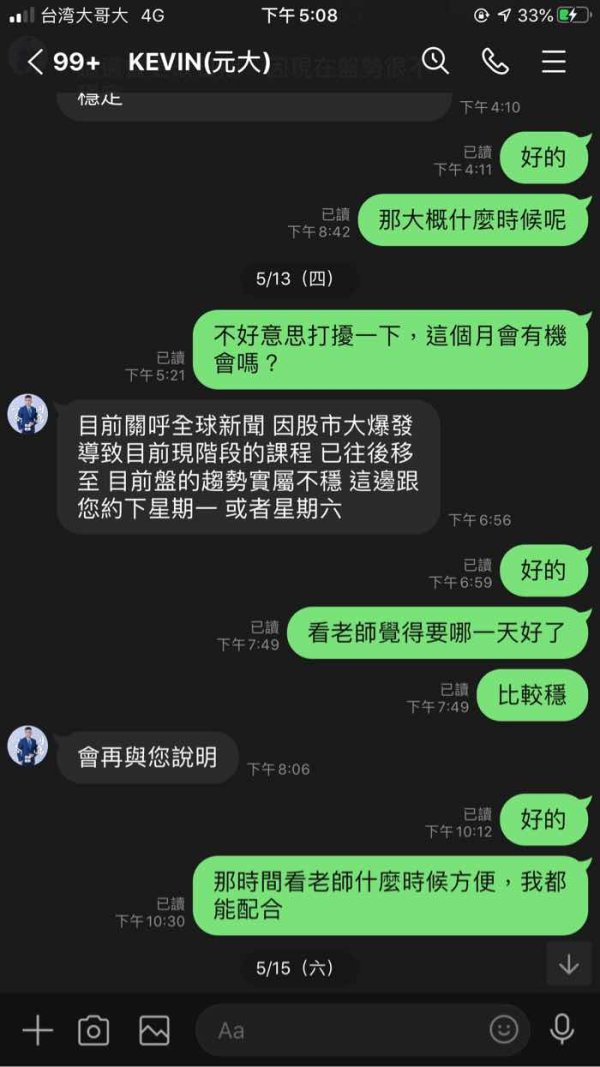

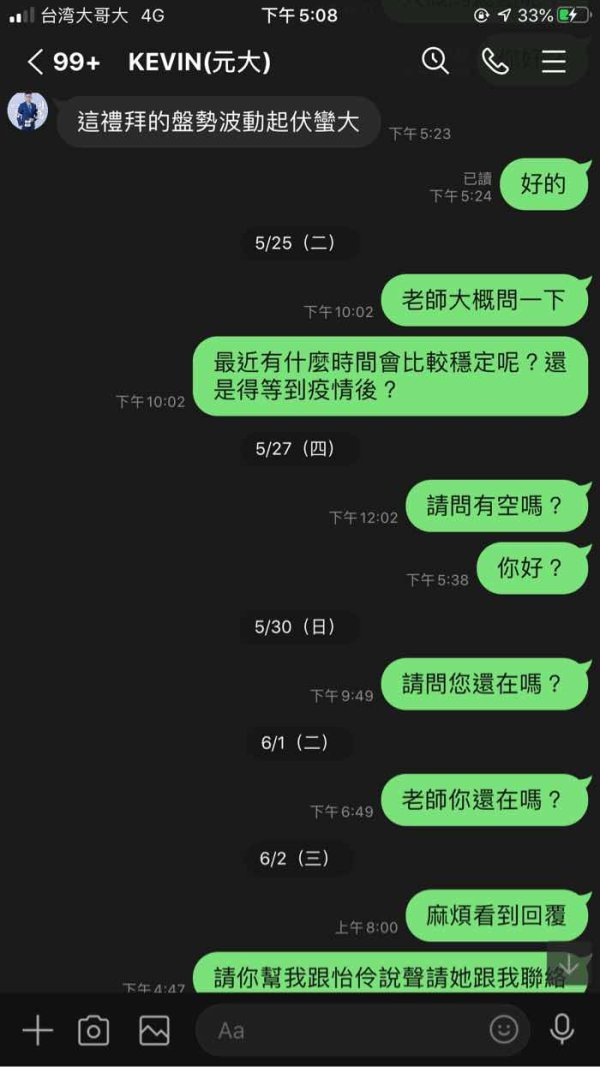

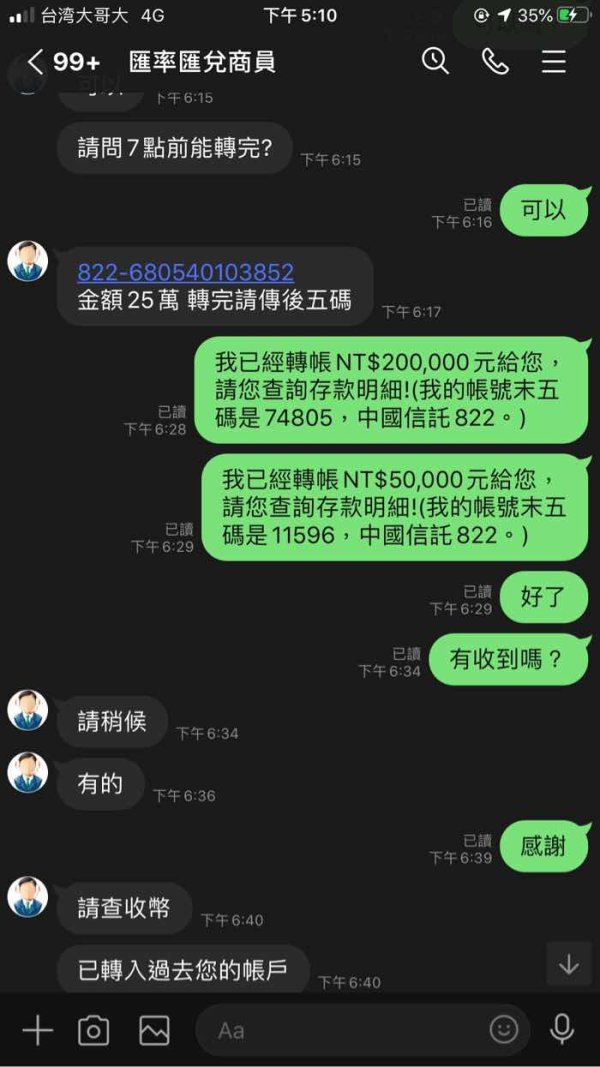

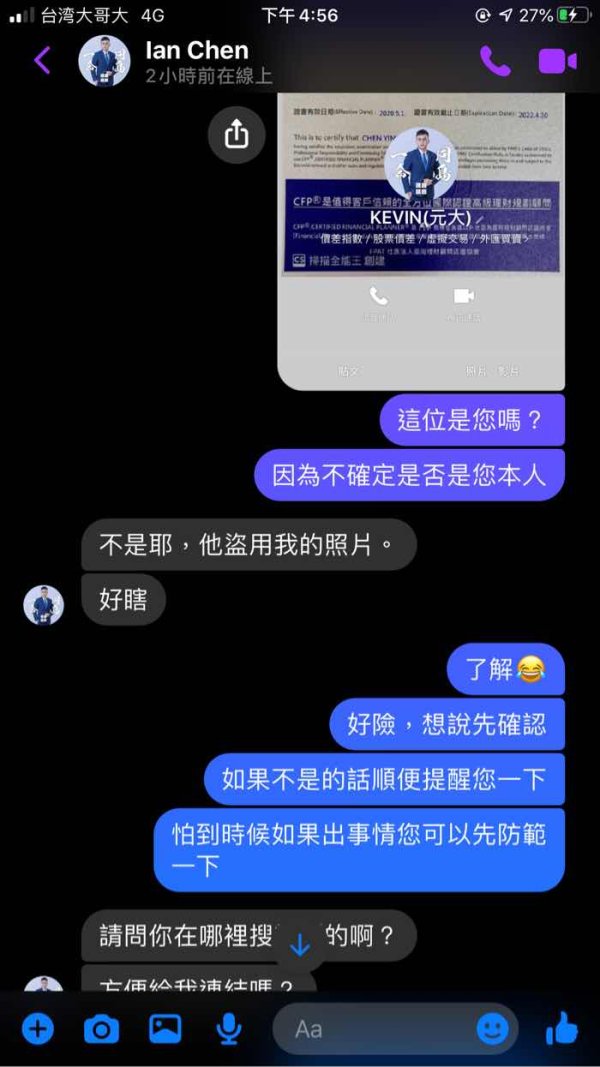

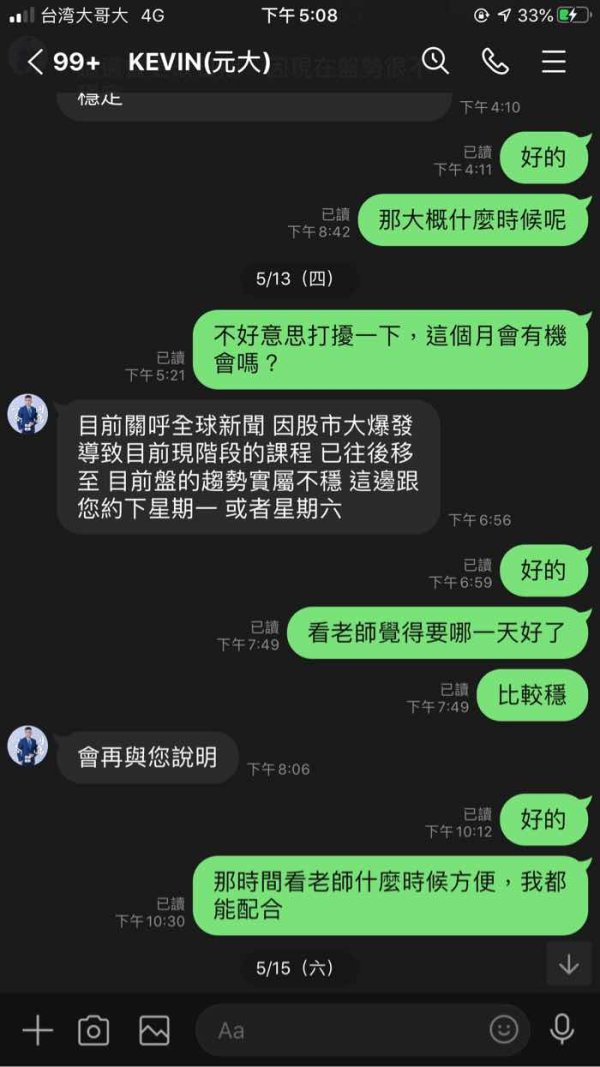

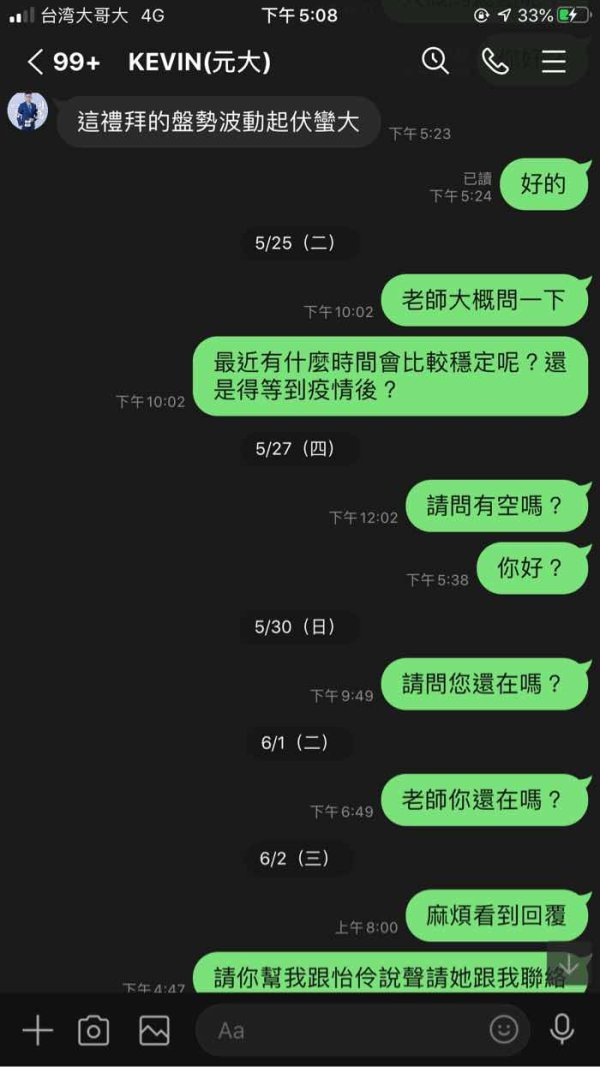

An introduction by a girl I met through an online dating platform, I met a teacher (pirating photos of celebrities, part-time scams

FXD Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

An introduction by a girl I met through an online dating platform, I met a teacher (pirating photos of celebrities, part-time scams

FXD Capital is a specialized brokerage firm that has carved out a unique niche in the financial services sector since its establishment in 2018. The company focuses primarily on cash deposits, money markets, and foreign exchange services, which sets it apart from traditional forex brokers. This fxd review reveals that FXD Capital positions itself as a money broking specialist rather than a conventional retail trading platform.

FXD Capital is based in London, England. Chris Huddleston and Bobby Jackson founded the firm after bringing nearly a decade of combined experience from working at one of the UK's leading specialist banks. The firm's mission centers on improving the efficiency of clients' cash balances through risk reduction, liquidity enhancement, and yield maximization. They achieve this by offering term deposits, notice accounts, and money market funds from a diverse range of banks and asset managers.

FXD Capital has 1,809 followers on professional networks and maintains a team of 11-50 employees. The company targets institutional clients and sophisticated investors seeking to optimize their cash management strategies. The firm's approach differs significantly from typical retail forex brokers because it focuses on wholesale money market operations and deposit brokerage services instead.

This specialized positioning makes FXD Capital particularly attractive to corporate clients, fund managers, and high-net-worth individuals who prioritize cash efficiency over traditional trading activities. The firm's London base and regulatory environment provide a foundation for its operations in the competitive UK financial services market.

Regional Entity Differences: FXD Capital operates primarily from its London headquarters. Specific regulatory information was not detailed in available sources. Potential clients should verify current regulatory status and ensure compliance with their local jurisdictional requirements before engaging with the firm's services.

Review Methodology: This evaluation is based on publicly available company information, professional network data, and industry positioning analysis. Due to the specialized nature of FXD Capital's services, traditional retail trading metrics may not apply to this assessment.

| Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account information not detailed in available sources |

| Tools and Resources | N/A | Trading tools information not specified in available materials |

| Customer Service | N/A | Customer support details not available in current sources |

| Trading Experience | N/A | Traditional trading experience metrics not applicable |

| Trust & Reliability | 7/10 | Based on founders' banking background and London establishment |

| User Experience | N/A | User experience data not available in reviewed sources |

Company Foundation and Leadership

Chris Huddleston and Bobby Jackson established FXD Capital in 2018. This marked their transition from nearly a decade of collaborative work at one of the UK's premier specialist banking institutions. The founding partnership brings significant industry expertise and established professional networks to the firm's operations. The London-based headquarters positions FXD Capital within one of the world's leading financial centers, providing access to sophisticated money markets and institutional client bases.

The company's strategic focus on cash deposits and money markets represents a deliberate departure from traditional retail forex brokerage models. FXD Capital has positioned itself as a specialist intermediary in wholesale money markets instead of targeting individual day traders or small-scale investors. The firm facilitates efficient cash management solutions for institutional and sophisticated private clients.

Business Model and Market Position

FXD Capital's business model centers on improving client cash balance efficiency through three core mechanisms: risk reduction, liquidity enhancement, and yield maximization. The firm achieves these objectives by providing access to term deposits, notice accounts, and money market funds sourced from a diverse network of banks and asset managers. This fxd review indicates that the company operates more as a money broker than a traditional forex platform, focusing on deposit placement and cash management rather than speculative trading services.

The firm's employee count of 11-50 professionals suggests a boutique operation that can provide personalized service while maintaining the expertise necessary for complex money market transactions. FXD Capital has established a meaningful presence within the UK financial services community with 1,809 professional network followers. This indicates recognition among industry peers and potential clients.

Regulatory Environment: Specific regulatory authorization details were not available in reviewed sources. The London-based operation suggests compliance with UK financial services regulations.

Deposit and Withdrawal Methods: Available funding mechanisms were not detailed in accessible company information.

Minimum Deposit Requirements: Entry-level capital requirements were not specified in available materials.

Promotional Offers: Bonus structures or promotional incentives were not mentioned in reviewed sources.

Available Assets: The firm specializes in cash deposits, money market instruments, and foreign exchange services rather than traditional trading assets.

Cost Structure: Fee arrangements and pricing models were not detailed in available company information.

Leverage Options: Leverage ratios were not applicable given the firm's money broking focus.

Platform Selection: Specific trading platforms were not mentioned in this fxd review as the firm operates primarily in wholesale markets.

Geographic Restrictions: Service availability limitations were not specified in available sources.

Customer Support Languages: Supported languages for client communication were not detailed in reviewed materials.

FXD Capital's account structure differs fundamentally from traditional forex brokers due to its specialized focus on money market and deposit brokerage services. The firm appears to operate on a client-specific basis rather than offering standard retail trading accounts with varying leverage levels and minimum deposits. They tailor cash management solutions to individual institutional requirements.

The absence of detailed account information in public sources suggests that FXD Capital likely operates through private client arrangements rather than standardized retail account offerings. This approach aligns with the firm's positioning as a specialist money broker serving sophisticated clients who require bespoke cash management solutions rather than standardized trading accounts.

Potential clients would likely engage through initial consultations to determine appropriate service structures rather than selecting from predetermined account types given the institutional nature of money market operations. This fxd review indicates that traditional account comparison metrics may not apply to FXD Capital's business model.

The firm's focus on term deposits, notice accounts, and money market funds suggests that account structures would be designed around specific client cash management objectives rather than trading activities. This specialized approach may require higher minimum engagement levels compared to retail forex brokers but could offer more sophisticated cash optimization solutions.

The specialized nature of FXD Capital's money broking services suggests that traditional trading tools and resources may not be central to the firm's client offerings. The company likely focuses on market intelligence, deposit placement capabilities, and cash management advisory services instead of providing technical analysis platforms, charting software, or automated trading systems.

Money market operations typically require sophisticated understanding of interest rate environments, credit risk assessment, and liquidity management rather than traditional technical trading tools. FXD Capital's value proposition appears centered on providing access to diverse banking relationships and asset manager networks rather than proprietary trading technology.

The firm's educational resources would likely focus on cash management strategies, money market dynamics, and regulatory considerations rather than trading education typically offered by retail forex brokers. Clients might benefit from institutional-level market insights and advisory services given the founders' extensive banking background.

Research capabilities would presumably center on money market conditions, interest rate forecasting, and credit analysis rather than currency pair technical analysis or trading signals commonly associated with retail forex platforms.

FXD Capital's customer service approach likely reflects its institutional client focus, emphasizing personalized relationship management over high-volume retail support structures. The firm can presumably provide dedicated account management and direct access to senior professionals with a team of 11-50 employees serving specialized money market clients.

The institutional nature of money broking typically requires more sophisticated client communication, including regular market updates, customized reporting, and strategic consultation services. FXD Capital's client base would likely expect direct access to experienced professionals capable of addressing complex cash management requirements unlike retail forex brokers that may rely on automated support systems or junior staff.

Response times and service quality expectations in institutional money markets are typically higher than retail trading environments. Clients often require immediate assistance with time-sensitive deposit placements or market opportunities. The firm's London location provides access to global time zones and major financial market operating hours.

Customer support would likely be provided during standard business hours when money markets are most active given the specialized nature of services. This differs from the 24/7 support common in retail forex trading.

Traditional trading experience metrics are not directly applicable to FXD Capital's business model. The firm operates primarily in money markets and deposit brokerage rather than speculative trading environments. The client experience would focus on efficiency of deposit placement, competitive rate achievement, and seamless transaction processing however.

The firm's emphasis on improving cash balance efficiency suggests that client experience is measured through successful yield enhancement, risk mitigation, and liquidity optimization rather than trading platform functionality or execution speed. This fxd review indicates that success metrics would center on achieving client cash management objectives rather than trading performance.

Money market transactions typically involve larger transaction sizes and longer settlement periods compared to retail forex trading. This requires different operational capabilities and client communication protocols. The institutional focus suggests that transaction processing would be handled through established banking networks rather than proprietary trading platforms.

Client experience quality would likely be evaluated based on market access, competitive pricing, and advisory value rather than platform features or trading tools commonly associated with retail forex brokers.

FXD Capital's trustworthiness foundation rests primarily on the professional backgrounds of its founders and its establishment within the regulated London financial services environment. Chris Huddleston and Bobby Jackson's nearly decade-long experience at a leading UK specialist bank provides credibility and industry knowledge that supports client confidence in the firm's capabilities.

The London-based operation suggests compliance with UK financial services regulations. Specific regulatory authorization details were not available in reviewed sources however. The UK's robust financial regulatory framework provides a foundation for client protection and operational oversight, even for specialized money market operations.

The firm's focus on institutional clients and sophisticated money market services typically involves higher due diligence standards and regulatory compliance requirements compared to retail trading operations. This institutional focus can enhance trust through demonstrated capability to meet sophisticated client requirements and regulatory standards.

The company's professional network presence with 1,809 followers indicates recognition within the UK financial services community. This suggests peer acknowledgment of the firm's legitimacy and market position.

User experience evaluation for FXD Capital must be considered within the context of its specialized money broking services rather than traditional retail trading platforms. The institutional client base would prioritize efficiency, reliability, and advisory value over user interface design or platform functionality typically associated with retail forex brokers.

Client interaction would likely occur through direct communication with account managers and senior professionals rather than self-service platforms or automated systems. This personalized approach can enhance user experience through tailored service delivery but may require more active client engagement compared to standardized retail platforms.

The absence of traditional user experience feedback in available sources reflects the private nature of institutional client relationships and the specialized market segment served by FXD Capital. Client satisfaction would likely be measured through continued business relationships and referrals rather than public reviews or ratings.

Money market clients typically value discretion, professionalism, and results over user interface design or platform features. This suggests that FXD Capital's user experience focus aligns with industry expectations for institutional financial services.

This fxd review reveals that FXD Capital operates in a specialized niche within the financial services sector. The firm focuses on money market and deposit brokerage services rather than traditional retail forex trading. FXD Capital's unique positioning, experienced leadership, and institutional focus differentiate it significantly from conventional forex brokers.

FXD Capital appears most suitable for institutional clients, fund managers, and sophisticated investors seeking to optimize cash management strategies rather than engage in speculative trading activities. The company's emphasis on improving cash balance efficiency through professional money market access represents a valuable service for clients with substantial cash holdings requiring strategic management.

The primary strengths identified include experienced leadership with relevant banking backgrounds, specialized market focus, and London-based operations within a robust regulatory environment. Limited public information regarding specific service terms, regulatory details, and client feedback represents areas where potential clients would need to conduct additional due diligence before engagement however.

FX Broker Capital Trading Markets Review