Is Moa safe?

Business

License

Is Moa Safe or Scam?

Introduction

Moa is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market. Established in 2017, the broker aims to provide trading services to a diverse clientele. However, with the rise of online trading, the need for traders to meticulously assess the credibility and reliability of forex brokers has never been more crucial. This is due to the prevalence of scams and unregulated entities that can jeopardize traders' investments. In this article, we will delve into the various aspects of Moa, evaluating its safety and legitimacy. Our investigation is based on comprehensive research, including reviews from various financial platforms, regulatory information, and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy. A broker that operates under a reputable regulatory body is typically seen as more trustworthy. Moa is registered with the Financial Service Providers Register (FSPR) in New Zealand, but it has faced scrutiny due to its low score on platforms like WikiFX, which rated it at 1.59 out of 10. This score indicates potential issues with transparency and reliability.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 511366 | New Zealand | Revoked |

The quality of regulation is vital, as it ensures that brokers adhere to strict operational standards, which ultimately protect traders. In Moa's case, the revocation of its license raises concerns about its compliance history and the overall safety of trading with them. Traders should be particularly cautious when dealing with brokers that have faced regulatory actions, as this could indicate underlying issues that may affect their trading experience.

Company Background Investigation

Moa International Limited, the parent company of Moa, was founded in 2017. The company has undergone various developments since its inception, but detailed information about its ownership structure and management team remains sparse. A transparent company should provide comprehensive details about its leadership and operational history.

The management team is crucial in determining a broker's reliability, as experienced professionals can significantly enhance a company's credibility. However, limited information about Moa's management raises questions about the transparency of its operations and the expertise behind its services.

In terms of information disclosure, Moa's website does provide some basic details, but it lacks in-depth insights that traders typically seek. A broker that prioritizes transparency will often share detailed information about its management, operational practices, and financial health, which is essential for building trust with potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to gauge their potential profitability and costs. Moa's fee structure, while not extensively detailed, has raised some concerns. Many brokers often have hidden fees that can significantly impact a trader's bottom line.

| Fee Type | Moa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | 1-3% |

While Moa claims to offer competitive spreads, the lack of clarity regarding commissions and overnight interest can be problematic. Traders should be wary of any broker that does not provide a clear breakdown of its fees, as this can lead to unexpected costs that may not be immediately apparent. The potential for hidden fees is a significant red flag, and traders must ensure they fully understand the cost structure before committing any capital.

Client Fund Safety

The safety of client funds is a critical aspect of any forex broker's operations. Moa claims to implement various security measures to safeguard client funds. However, the effectiveness of these measures is often put to the test in the event of a dispute or financial crisis.

Moa's policies regarding fund segregation, investor protection, and negative balance protection are essential indicators of its commitment to client safety. Unfortunately, there have been reports of clients experiencing issues with fund withdrawals and account management, which raises concerns about the broker's reliability in protecting client assets.

In the past, there have been allegations of forced liquidations and account bans, which further complicate the narrative surrounding Moa's commitment to client fund safety. Traders should always prioritize brokers that offer robust security measures and a proven track record of safeguarding client funds.

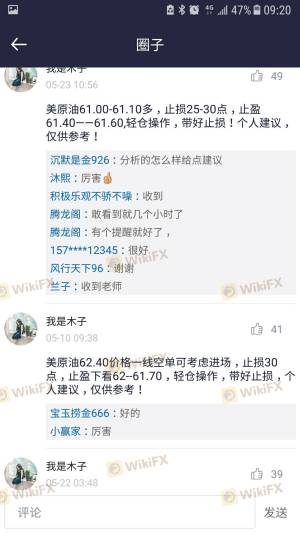

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability and service quality. Reviews of Moa reveal a mixed bag of experiences, with some clients reporting satisfactory trading conditions, while others have expressed dissatisfaction with the broker's responsiveness and handling of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Bans | Medium | Unresponsive |

| Forced Liquidations | High | Ignored Complaints |

Common complaints include difficulties with withdrawals and issues related to account management. The severity of these complaints indicates potential risks for new traders who may encounter similar problems. Moa's response to these complaints has often been criticized as slow or inadequate, which can exacerbate the frustration of affected clients.

One notable case involved a client who lost a significant amount due to forced liquidation, followed by a lack of support from the broker when seeking resolution. Such experiences highlight the importance of selecting a broker with a solid reputation for customer service and responsiveness.

Platform and Trade Execution

The performance of a trading platform is a crucial factor in a trader's overall experience. Moa's platform has been noted for its usability, but there are concerns regarding execution quality and potential slippage. Traders expect timely order execution and transparency in their trades.

Issues such as high slippage rates or frequent order rejections can indicate underlying problems with a broker's operational integrity. While Moa does provide access to trading platforms, the quality and reliability of those platforms are essential for maintaining a positive trading experience.

Risk Assessment

Utilizing Moa as a trading platform comes with inherent risks. Traders must be aware of the various factors that could impact their trading experience, including regulatory issues, customer service responsiveness, and platform reliability.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | License revoked, potential legal issues |

| Customer Service | Medium | Reports of slow response to complaints |

| Platform Reliability | High | Concerns about execution and slippage |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Moa. This includes reading reviews, understanding the fee structure, and being prepared for potential issues with withdrawals or account management.

Conclusion and Recommendations

In conclusion, while Moa presents itself as a forex broker with several offerings, the evidence suggests that traders should exercise caution. The revocation of its regulatory license, coupled with numerous complaints regarding customer service and fund safety, raises significant red flags.

Traders looking for a reliable forex broker should consider alternatives that are well-regulated and have a strong track record of customer satisfaction. Brokers regulated by top-tier authorities such as the FCA or ASIC are generally safer options. Ultimately, the question "Is Moa safe?" leans towards a cautious "no," and potential clients should thoroughly evaluate their options before proceeding with any investments.

Is Moa a scam, or is it legit?

The latest exposure and evaluation content of Moa brokers.

Moa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Moa latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.