GlobTFX 2025 Review: Everything You Need to Know

Executive Summary

This globtfx review shows concerning findings about this new forex broker. GlobTFX claims to work under Australian Securities and Investments Commission (ASIC) rules, but many user reports and outside reviews raise serious questions about whether it's real and how it operates. The company started in 2020. It targets traders who want forex and cryptocurrency markets, offering high leverage up to 500:1 and promoting trading services through "one-click" profit claims.

Several review platforms have flagged GlobTFX as possibly fake, even though it claims to be regulated. Users report big withdrawal problems and bad customer service. The broker doesn't share clear information about who owns the company, detailed fees, and specific trading rules, which makes these concerns worse. The platform might interest traders who want high leverage opportunities. However, the mostly negative feedback and trust problems make it a bad choice for serious investors who want reliable trading services.

Important Notice

This review uses public information and user feedback from various sources as of 2025. Rules and broker services may be very different across different areas. Potential users should check GlobTFX's claimed ASIC regulation on their own, since regulatory status can change and may not apply to all regions or user types. Traders should do their own research and think about talking with financial advisors before making any investment decisions. This evaluation aims to give objective analysis based on available data and should not be considered as investment advice.

Rating Overview

Broker Overview

GlobTFX entered the competitive forex trading market in 2020. The company positioned itself as a modern trading platform offering both traditional forex and cryptocurrency trading opportunities. It promotes its trading services, claiming to give traders sophisticated "one-click" trading solutions designed to generate profits through automated systems. However, the broker's actual headquarters location and detailed company background remain mostly hidden, which raises immediate concerns about transparency.

The platform targets retail traders interested in leveraged trading across forex pairs and digital assets. GlobTFX emphasizes its high leverage offerings, providing ratios up to 500:1, which appeals to traders seeking to maximize their market exposure with limited capital. The broker claims to operate under the regulatory oversight of the Australian Securities and Investments Commission (ASIC). However, checking active regulatory status remains crucial for potential users. This globtfx review finds that while the regulatory claim exists, the actual operational practices and user experiences suggest significant gaps between promised services and delivered results.

Regulatory Status: GlobTFX claims regulation under the Australian Securities and Investments Commission (ASIC). Traders should check current regulatory status on their own, as claims may not reflect active or comprehensive oversight across all operational areas.

Available Assets: The platform focuses mainly on forex currency pairs and cryptocurrency trading. Specific asset lists and trading conditions for individual instruments are not fully detailed in available public information.

Leverage Ratios: Maximum leverage reaches 500:1. This represents high-risk trading conditions that can result in significant losses exceeding initial deposits.

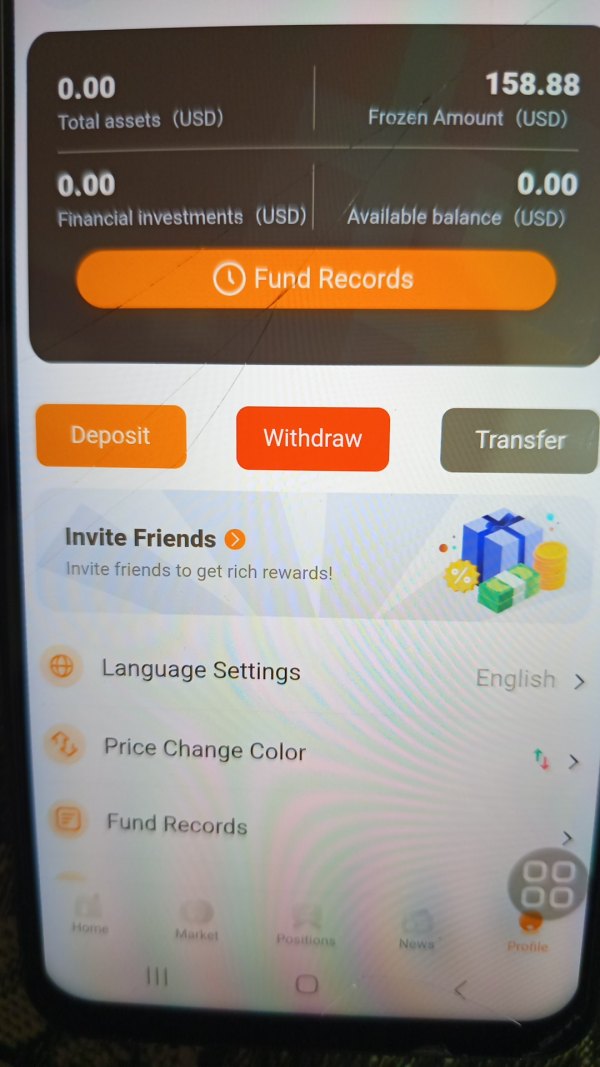

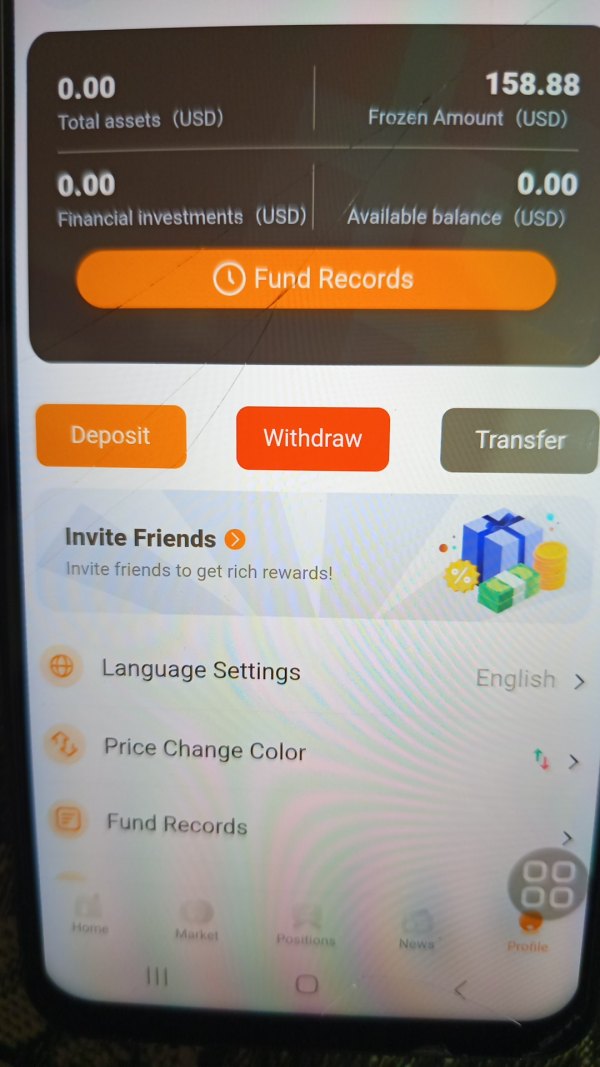

Deposit and Withdrawal Methods: Specific payment methods, processing times, and associated fees are not clearly outlined in available documentation. This contributes to user uncertainty about fund management procedures.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in publicly available information. This makes it difficult for potential traders to plan their initial investment requirements.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not clearly documented in accessible materials.

Trading Platforms: The broker mentions trading platform availability, but specific platform types (such as MetaTrader 4/5 or proprietary systems) are not explicitly confirmed in available resources.

Geographic Restrictions: Information about restricted countries or regional limitations is not fully provided in accessible documentation.

Customer Support Languages: Available support languages and communication channels are not clearly specified in public information.

Fee Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in readily available materials. This globtfx review finds this lack of cost transparency particularly concerning for potential users.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

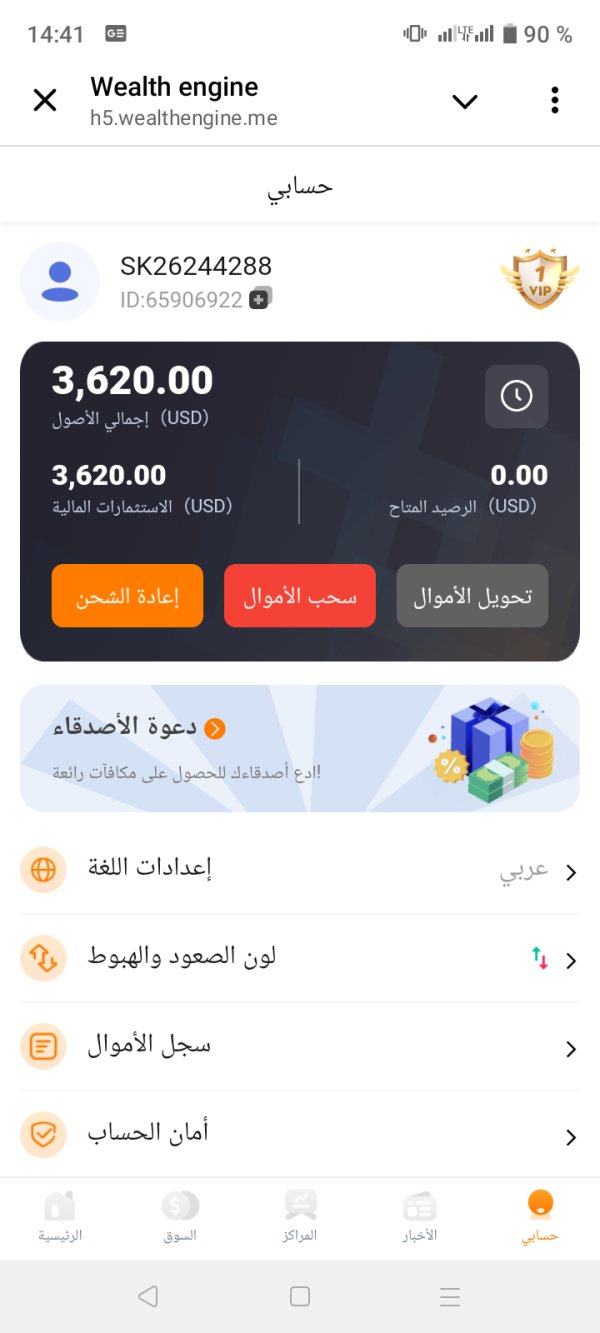

GlobTFX's account conditions present significant transparency issues that contribute to its low rating in this category. The broker fails to provide clear, accessible information about its various account types, if multiple tiers exist, or the specific benefits associated with different account levels. This lack of clarity makes it extremely difficult for potential traders to make informed decisions about which account structure might best suit their trading needs and experience levels.

The minimum deposit requirements remain undisclosed in publicly available materials. This prevents traders from properly planning their initial investment. Additionally, the account opening process, required documentation, and verification procedures are not clearly outlined, creating uncertainty about onboarding requirements. The absence of information about special account features, such as Islamic accounts for traders requiring swap-free conditions, further demonstrates the platform's limited transparency.

User feedback consistently highlights confusion about account terms and conditions. Many report unexpected limitations or requirements that were not clearly communicated during the registration process. The lack of detailed account specifications, combined with unclear fee structures, makes it challenging for traders to understand the true cost of maintaining and operating their accounts. This globtfx review finds these transparency issues particularly problematic for traders who need clear, upfront information to make sound financial decisions.

The trading tools and resources offered by GlobTFX receive a modest rating due to insufficient publicly available information about the platform's analytical capabilities and educational offerings. The broker promotes quantitative trading services and "one-click" trading solutions, but detailed specifications about these tools, their functionality, and their effectiveness remain largely undocumented in accessible materials.

Research and market analysis resources, which are crucial for informed trading decisions, are not fully described in available documentation. The absence of detailed information about economic calendars, market news feeds, technical analysis tools, or fundamental analysis resources suggests either limited offerings or poor communication of available features. Educational materials, trading guides, and learning resources that could help traders improve their skills and understanding are similarly absent from public information.

User feedback indicates limited satisfaction with available trading tools. Some report that promised features either underperform or fail to meet expectations. The lack of detailed information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the platform's appeal to more sophisticated traders. Without clear documentation of available tools and their capabilities, traders cannot adequately assess whether the platform meets their analytical and strategic trading requirements.

Customer Service Analysis (2/10)

Customer service represents one of GlobTFX's most significant weaknesses, earning the lowest rating among all evaluated categories. Multiple user reports consistently highlight poor response times, inadequate problem resolution, and general unavailability of support representatives when assistance is needed most. The lack of clearly documented customer service channels, operating hours, and escalation procedures compounds these service quality issues.

Users frequently report difficulties reaching customer support through available channels. Many describe extended waiting periods for responses to critical inquiries, particularly those related to account access and withdrawal requests. When support is eventually provided, users often describe unhelpful responses that fail to address their specific concerns or provide actionable solutions to their problems.

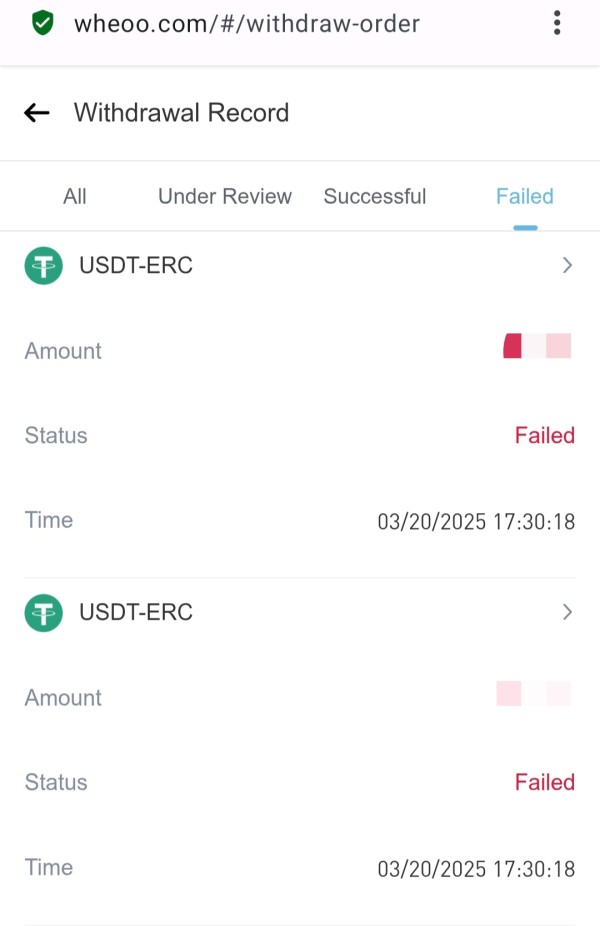

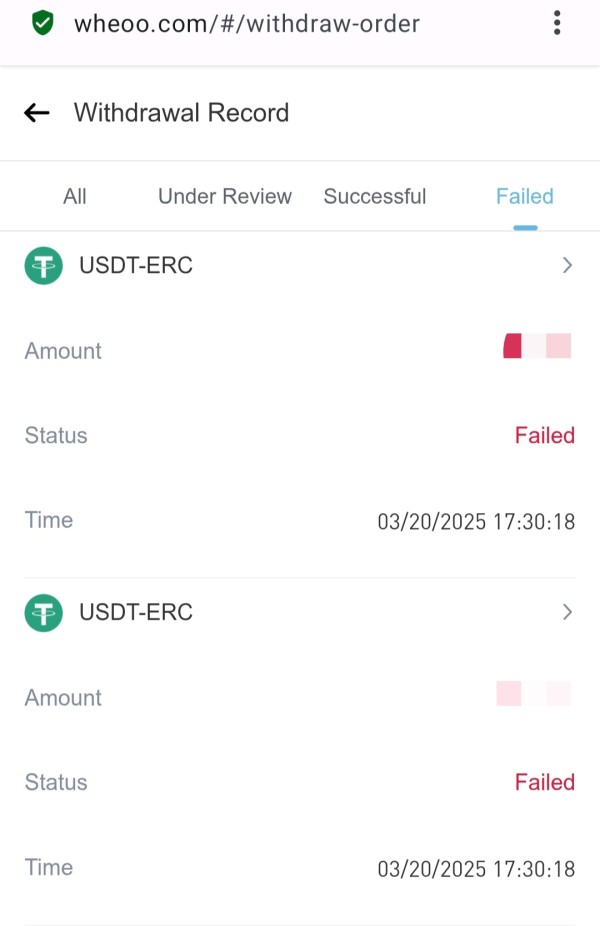

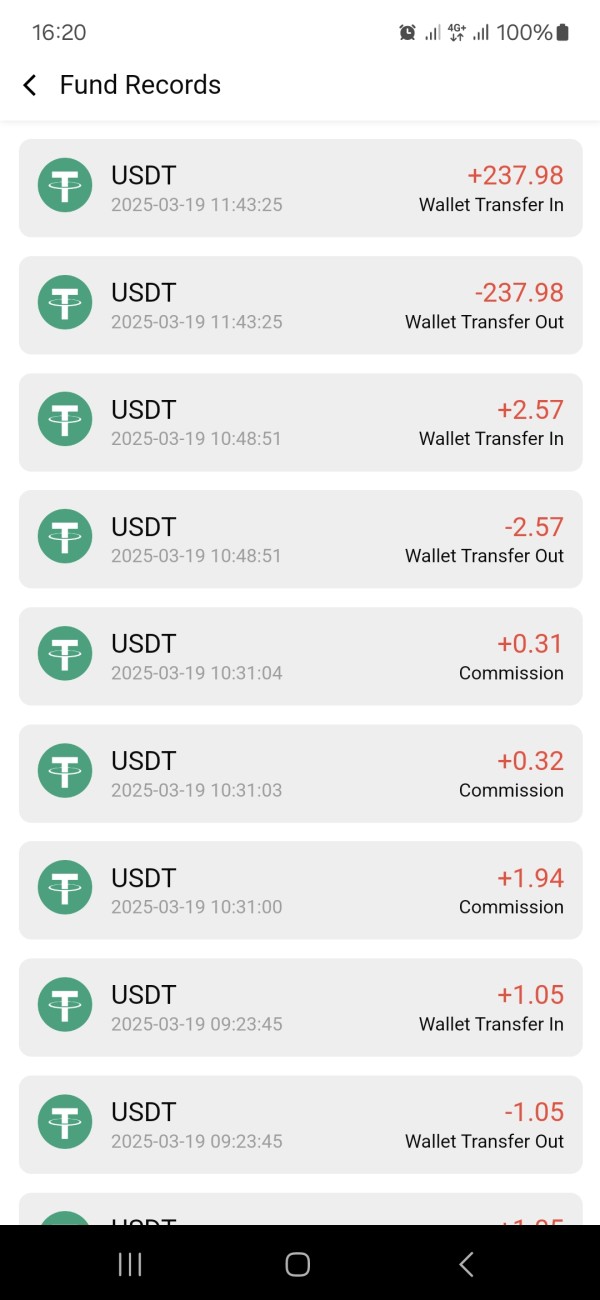

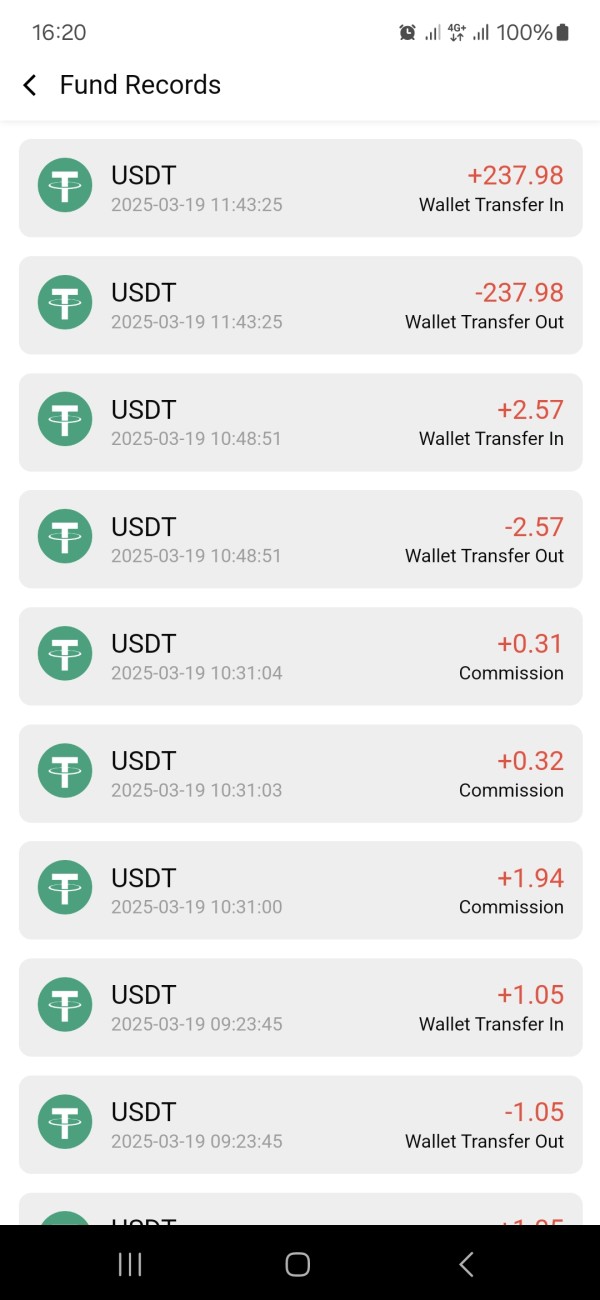

The most concerning aspect of customer service feedback relates to withdrawal issues. Users report prolonged delays, unexplained holds on funds, and inadequate communication about resolution timelines. These service failures have contributed significantly to user distrust and negative platform perception. The absence of multilingual support options and limited availability hours further restrict access to assistance for international users across different time zones.

Trading Experience Analysis (3/10)

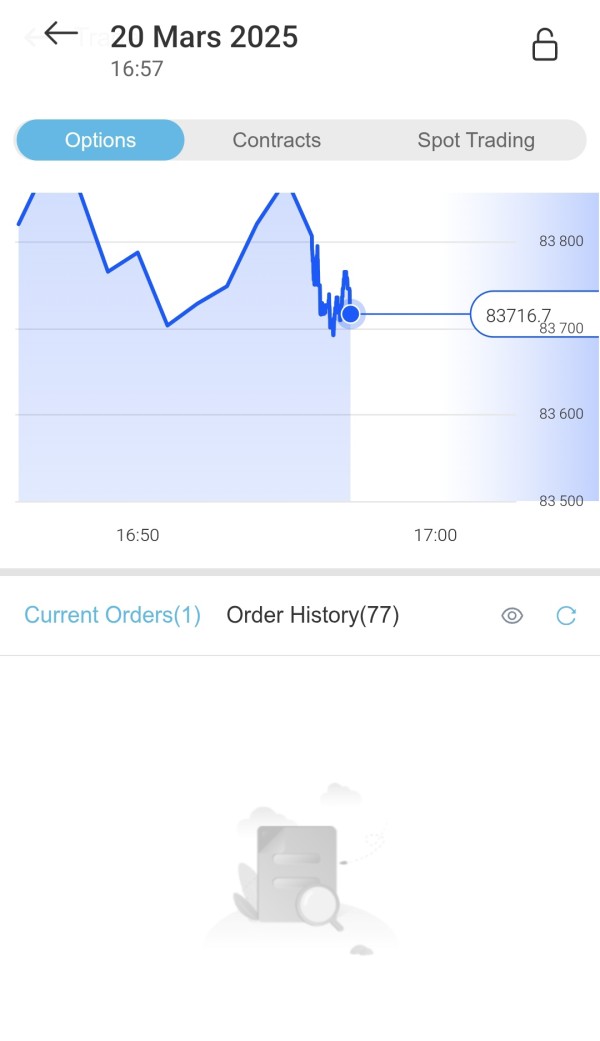

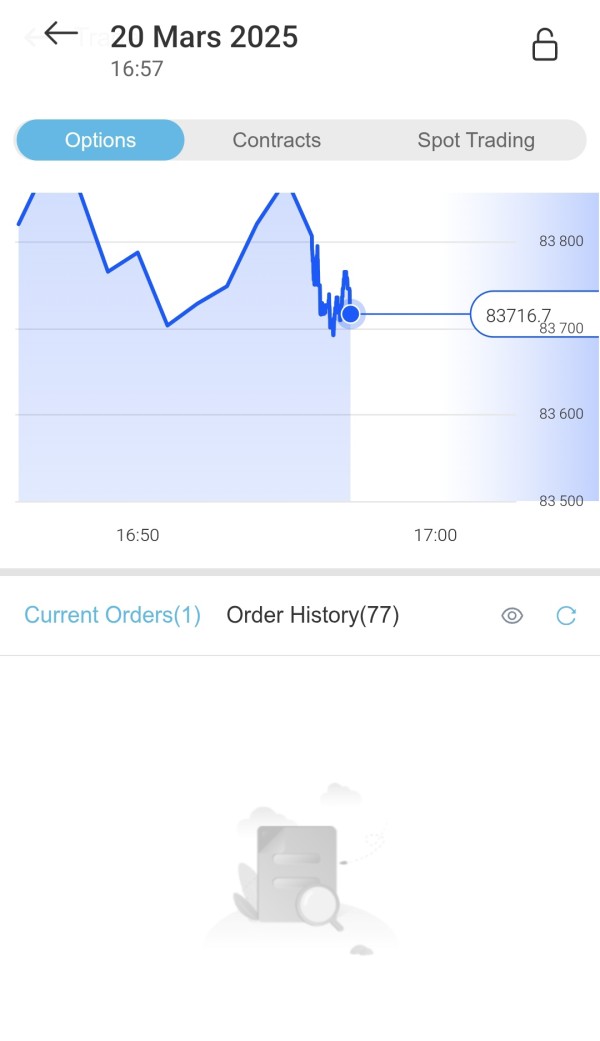

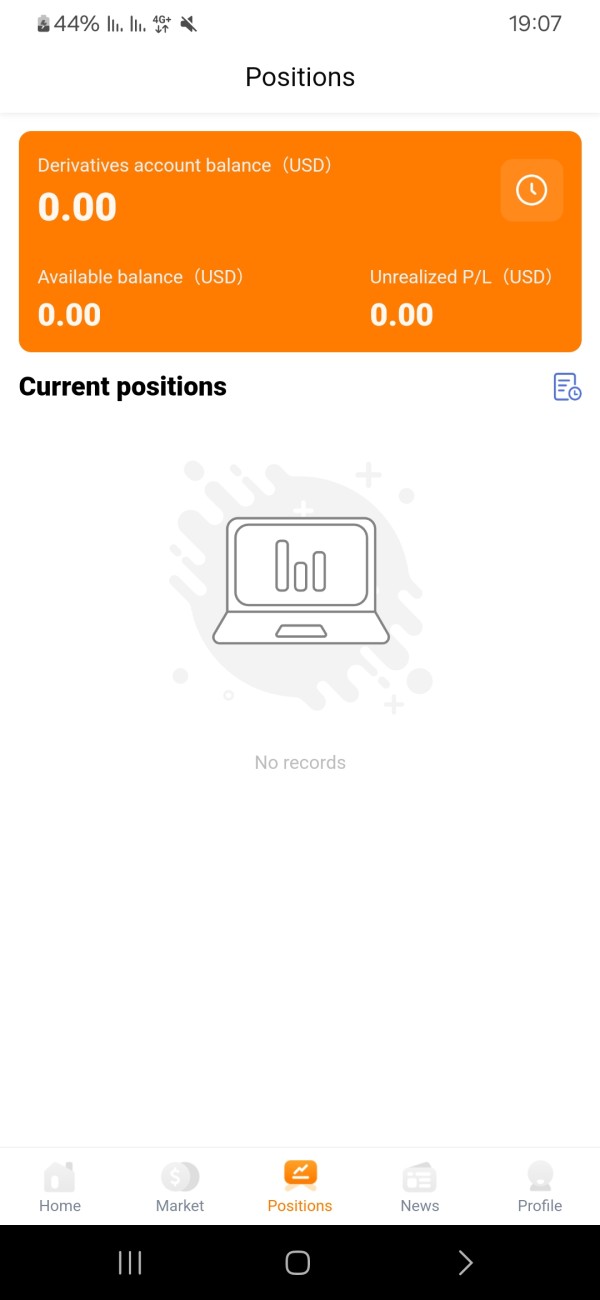

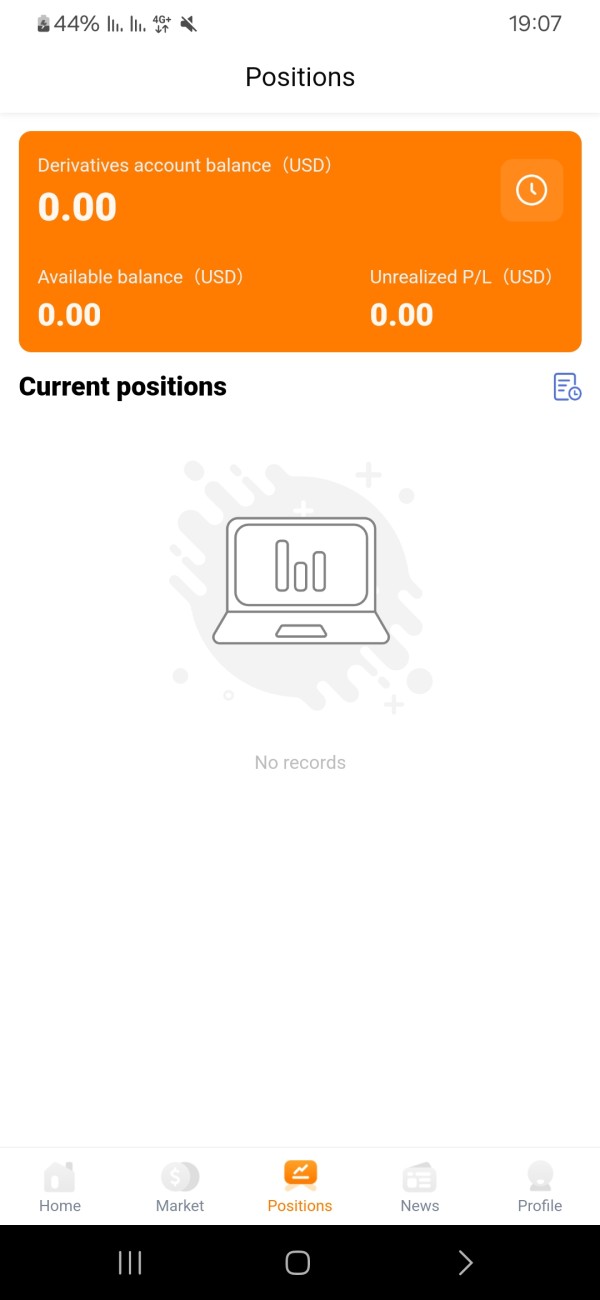

The trading experience on GlobTFX receives a low rating based on consistent user feedback about platform stability, execution quality, and overall trading environment issues. Users report frequent connectivity problems, unexpected platform downtime, and technical glitches that interfere with order placement and position management during critical market moments.

Order execution quality appears problematic. Multiple reports show significant slippage, requotes during volatile market conditions, and delays in order processing that can negatively impact trading results. The lack of detailed information about execution policies, average execution speeds, and liquidity providers makes it difficult for traders to set appropriate expectations about trade execution quality.

Platform functionality concerns extend to mobile trading experiences, where users report limited features, poor interface design, and reduced reliability compared to desktop versions. The absence of advanced order types, inadequate charting capabilities, and limited customization options further diminish the overall trading experience. These technical and functional limitations, combined with poor customer support for resolving platform issues, create a challenging environment for traders seeking reliable, professional trading conditions. This globtfx review finds these execution and platform issues particularly concerning for active traders who depend on consistent, high-quality trading infrastructure.

Trust and Reliability Analysis (2/10)

Trust and reliability represent GlobTFX's most critical weaknesses, with multiple factors contributing to serious concerns about the broker's legitimacy and operational integrity. The platform claims ASIC regulation, but independent verification of active regulatory status remains essential, as regulatory claims do not always reflect current or comprehensive oversight of all business operations.

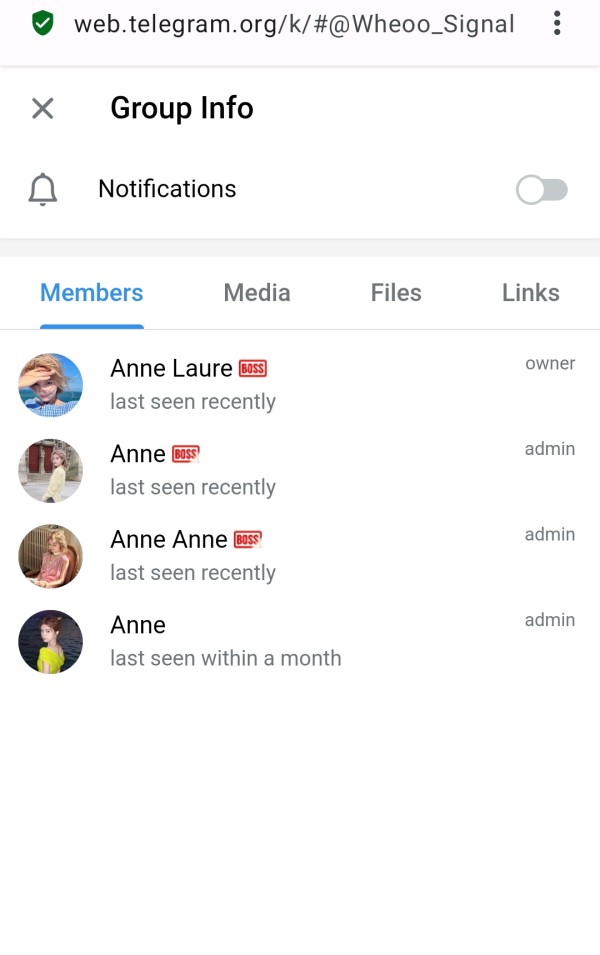

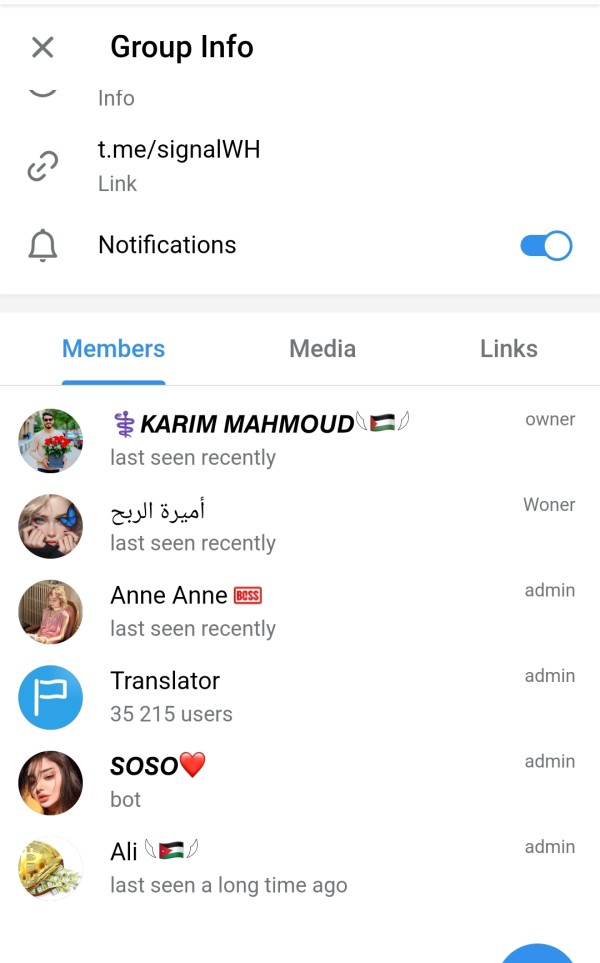

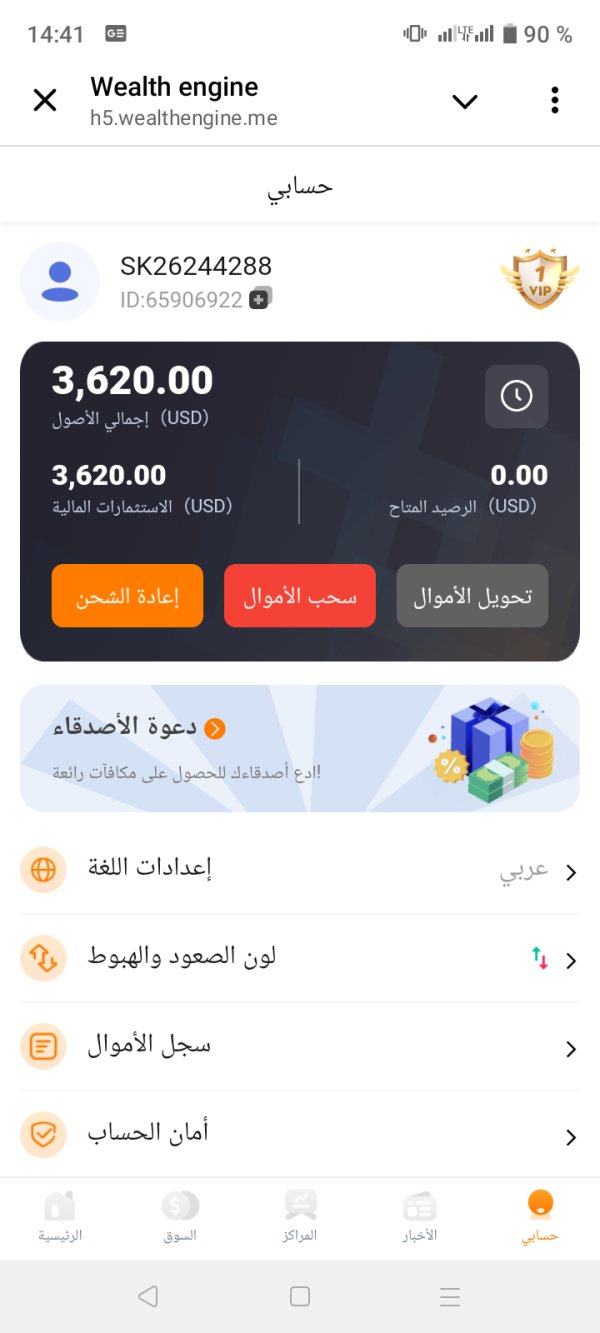

The company's lack of transparency regarding ownership structure, management team, and operational headquarters raises immediate red flags about corporate accountability and regulatory compliance. Third-party review platforms, including WikiFX, have flagged GlobTFX as potentially fraudulent, citing user complaints and operational irregularities that suggest systematic issues with the broker's business practices.

Fund safety measures, such as segregated client accounts, deposit insurance, or compensation schemes, are not clearly documented or verified through independent sources. This absence of transparent fund protection information, combined with widespread user reports of withdrawal difficulties, creates significant concerns about capital security. The broker's handling of negative publicity and user complaints appears inadequate, with little evidence of systematic efforts to address legitimate user concerns or improve operational transparency.

User Experience Analysis (3/10)

Overall user satisfaction with GlobTFX remains consistently low, with negative feedback dominating user reviews across multiple platforms and evaluation sources. The primary user complaints center on withdrawal difficulties, poor customer service responsiveness, and general dissatisfaction with platform reliability and performance.

Interface design and platform usability receive mixed feedback. Some users note acceptable basic functionality while others report confusing navigation, limited customization options, and poor mobile optimization. The registration and account verification processes appear problematic, with users reporting unclear requirements, extended verification delays, and inadequate communication about account status updates.

Fund management experiences represent the most significant source of user dissatisfaction. Widespread reports show withdrawal delays, unexpected fees, and inadequate explanation of fund processing procedures. These operational issues significantly impact user confidence and overall platform satisfaction. The absence of responsive customer service to address these concerns compounds user frustration and contributes to negative platform perception. User recommendations consistently advise caution or suggest alternative brokers, indicating widespread dissatisfaction with the overall GlobTFX experience.

Conclusion

This comprehensive globtfx review reveals significant concerns about the broker's legitimacy, operational practices, and user satisfaction levels. GlobTFX offers high leverage ratios that may appeal to some traders, but the overwhelming negative feedback regarding withdrawal issues, customer service quality, and platform reliability makes it difficult to recommend for serious trading activities.

The broker's lack of transparency regarding fee structures, company ownership, and operational procedures, combined with third-party fraud allegations, creates substantial trust issues that overshadow any potential benefits. Users seeking reliable, transparent, and professionally managed trading services would be better served by exploring established brokers with verified regulatory status and positive user track records.

Numerous alternative platforms offer similar asset access with better documented regulatory compliance, transparent fee structures, and superior customer service standards for traders specifically interested in forex and cryptocurrency trading.