Is Fintxpert safe?

Pros

Cons

Is Fintxpert A Scam?

Introduction

Fintxpert is an emerging player in the forex market, positioning itself as a platform that offers a range of trading options for both novice and experienced traders. As the online trading landscape continues to evolve, it is crucial for traders to exercise caution and conduct thorough evaluations of forex brokers before committing their funds. The prevalence of scams in the financial sector necessitates a careful assessment of a broker's legitimacy, regulatory status, and overall trustworthiness. This article aims to provide a comprehensive analysis of Fintxpert, utilizing a structured framework that encompasses regulatory compliance, company background, trading conditions, client safety, customer experiences, platform performance, risk assessment, and ultimately, a conclusion regarding whether Fintxpert is safe or a scam.

Regulation and Legitimacy

When assessing the safety of any trading platform, the first consideration is its regulatory status. Regulatory bodies play a vital role in ensuring that brokers adhere to strict guidelines that protect traders' interests. In the case of Fintxpert, a review of its regulatory status reveals significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Fintxpert operates without any regulatory oversight, which raises red flags about its legitimacy. The absence of a valid license from recognized authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) indicates that the broker is unregulated. This lack of oversight means that traders have no legal recourse in the event of disputes or issues with fund withdrawals. Furthermore, the absence of verifiable regulatory credentials suggests that Fintxpert does not comply with the necessary legal standards, putting traders at significant risk.

Company Background Investigation

Fintxpert LLC, as it is officially registered, presents itself as a professional trading platform. However, a deeper investigation into its company history and ownership structure reveals a lack of transparency. The company appears to be relatively new, with no substantial information available regarding its founding, management team, or operational history. The anonymity surrounding its ownership raises questions about accountability and trustworthiness.

The management teams background is equally concerning, as there is little to no information available about their professional experience or qualifications in the financial industry. This lack of transparency and information disclosure is concerning for potential investors, as it suggests that the company may not have the expertise or commitment to operate a legitimate trading platform.

Trading Conditions Analysis

A thorough examination of Fintxpert's trading conditions reveals a complex fee structure that may not be favorable for traders. The broker claims to offer competitive spreads and various account types; however, the absence of clear information regarding fees and commissions raises concerns about potential hidden charges.

| Fee Type | Fintxpert | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies (typically $5 per lot) |

| Overnight Interest Range | N/A | Varies by broker |

The lack of transparency regarding trading costs is a significant issue, as traders may encounter unexpected fees that can erode their profits. Additionally, the high leverage ratios offered by Fintxpert, which can reach up to 1:1000, pose substantial risks, particularly for inexperienced traders who may not fully understand the implications of such leverage.

Client Fund Safety

The safety of client funds is paramount when evaluating a trading platform. Fintxpert's approach to fund security raises serious concerns. The broker does not provide clear information about whether client funds are held in segregated accounts, which is a standard practice among reputable brokers to protect traders' funds in the event of insolvency.

Moreover, there is no indication that Fintxpert offers any form of investor protection or negative balance protection policies. This lack of safeguards places traders at a higher risk of losing their investments, especially in volatile market conditions. Historical data does not provide any evidence of past fund security issues, but the absence of transparency in this area is alarming.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's reputation. A review of user experiences with Fintxpert reveals a pattern of complaints, particularly regarding withdrawal issues and customer support responsiveness. Many users report difficulties in accessing their funds, with complaints about delayed withdrawals and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

Typical cases involve users who have experienced prolonged delays in fund withdrawals, with some alleging that their accounts were frozen without explanation. The company's response to these complaints has been largely inadequate, further eroding trust among its users. Such issues are common indicators of a potentially fraudulent operation, leading many to question whether Fintxpert is safe for trading.

Platform and Trade Execution

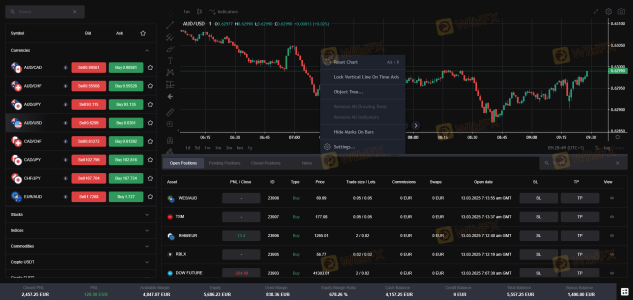

The performance and reliability of a trading platform are crucial for a successful trading experience. Fintxpert's platform has received mixed reviews regarding its functionality and user experience. Users have reported issues with order execution quality, including slippage and rejected orders, which can significantly impact trading outcomes.

The platform's user interface appears outdated and lacks the advanced features typically found in reputable trading platforms. This raises concerns about its ability to provide a seamless trading experience and suggests that the platform may not be designed with the trader's needs in mind.

Risk Assessment

Engaging with Fintxpert entails a range of risks that potential traders should consider. The absence of regulation, coupled with a lack of transparency and poor customer feedback, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for hidden fees and high leverage |

| Operational Risk | Medium | Platform performance issues |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative, regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fintxpert exhibits several characteristics commonly associated with scam operations. The lack of regulation, transparency, and poor customer feedback raises significant concerns about its legitimacy. While the platform may present itself as a viable trading option, potential traders are strongly advised to exercise caution.

For traders seeking reliable and safe trading environments, it is recommended to consider established brokers with solid regulatory frameworks and positive user experiences. Engaging with a reputable broker can help ensure the safety of funds and provide a more secure trading experience. Ultimately, the question of whether Fintxpert is safe remains unanswered, as the risks associated with this broker outweigh any potential benefits.

Is Fintxpert a scam, or is it legit?

The latest exposure and evaluation content of Fintxpert brokers.

Fintxpert Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fintxpert latest industry rating score is 1.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.