Is GlobTFX safe?

Pros

Cons

Is GlobTFX Safe or Scam?

Introduction

GlobTFX has emerged as a player in the forex trading landscape, offering a range of financial instruments including forex, cryptocurrencies, indices, and commodities. In an era where online trading platforms are proliferating, traders must exercise caution and due diligence when selecting a broker. The potential for scams and fraudulent activities in the industry necessitates a thorough assessment of any broker's legitimacy. This article aims to provide a comprehensive analysis of GlobTFX, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe platform or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a critical factor in assessing the legitimacy of any trading platform. A broker's regulatory status can provide insights into its operational integrity and the level of protection afforded to traders. GlobTFX claims to be regulated by the Australian Securities and Investments Commission (ASIC) as an appointed representative, which is generally considered a reputable regulatory body. However, the validity of these claims warrants scrutiny.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001312514 | Australia | Verified |

ASIC is known for its stringent regulatory requirements, which include ensuring that brokers maintain adequate capital reserves and adhere to strict operational standards. However, the designation of "appointed representative" raises questions about the level of direct oversight GlobTFX receives. It is crucial to investigate whether the broker operates under a parent company that holds a full license or if it is merely leveraging the regulatory status of another entity. Reports indicate a lack of transparency regarding its licensing, which could signal potential risks for traders.

Company Background Investigation

GlobTFX was established in the United States and has positioned itself as a global trading platform. However, the company‘s history and ownership structure are somewhat opaque, leading to concerns about its operational credibility. The management team’s background is essential in assessing the broker's trustworthiness; however, there is limited information available regarding their qualifications and experience in the financial services sector.

Transparency is a key indicator of a broker's reliability. In the case of GlobTFX, the absence of detailed information about its management team and operational history can be concerning. A reputable broker typically provides insight into its leadership and organizational structure, allowing potential clients to gauge the expertise behind the platform.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders to make informed decisions. GlobTFX presents various trading accounts and claims to provide competitive spreads and execution. However, the specifics of its fee structure and any potential hidden costs require careful examination.

| Fee Type | GlobTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

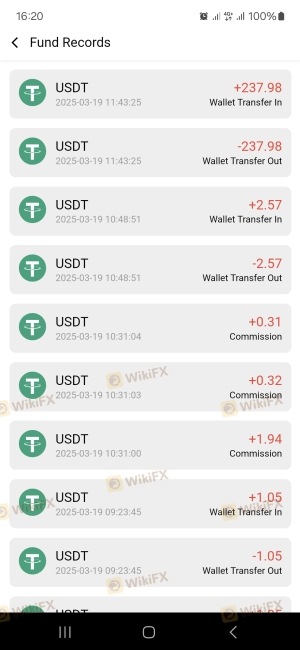

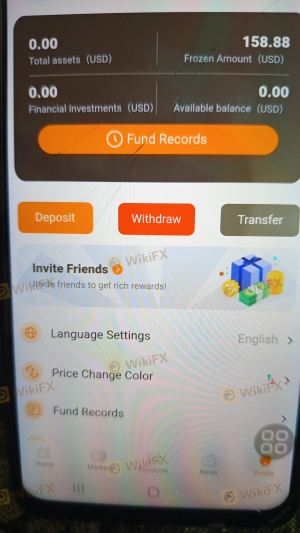

The lack of clear information regarding spreads and commissions raises red flags. Many traders have reported encountering unexpected fees, particularly during withdrawal processes, which can significantly impact profitability. The absence of transparency regarding costs can be indicative of a broker that may not prioritize the interests of its clients.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. GlobTFX claims to implement measures to protect client funds, including the use of segregated accounts. However, the effectiveness of these measures must be evaluated in light of the broker's regulatory status and operational practices.

The presence of investor protection mechanisms, such as negative balance protection, is also essential. Traders should be aware of any historical issues related to fund security or disputes that may have arisen in the past. Reports of delayed withdrawals and blocked accounts have been common complaints among users, suggesting potential vulnerabilities in the broker's handling of client funds.

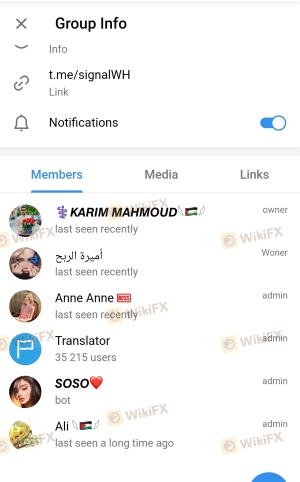

Customer Experience and Complaints

Customer feedback is a crucial element in assessing a broker's reliability. Many users have shared their experiences with GlobTFX, revealing a mixed bag of reviews. While some traders appreciate the platform's user-friendly interface, others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Hidden Fees | Medium | Moderate |

Common complaints include difficulties in withdrawing funds after achieving profits, which is a significant red flag for any trading platform. The overall sentiment suggests that while some users have had positive experiences, the prevalence of negative feedback regarding withdrawals and customer service raises serious concerns.

Platform and Execution

The performance and stability of a trading platform are critical for a seamless trading experience. GlobTFX offers a trading interface that is reportedly user-friendly; however, the quality of order execution and any instances of slippage or rejected orders must be scrutinized.

Traders have reported mixed experiences regarding execution quality, with some indicating satisfactory performance while others have experienced delays during high volatility periods. These inconsistencies can significantly affect trading outcomes, particularly for those employing strategies that rely on precise execution.

Risk Assessment

The overall risk associated with trading through GlobTFX should be carefully evaluated. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unclear licensing status |

| Fund Security | High | Reports of withdrawal issues |

| Customer Service | Medium | Mixed feedback on support responsiveness |

Traders considering GlobTFX should exercise caution and consider implementing risk mitigation strategies, such as starting with a smaller investment or seeking alternative, more established brokers.

Conclusion and Recommendations

In conclusion, while GlobTFX presents itself as a legitimate trading platform, several factors suggest that traders should approach with caution. The lack of clear regulatory oversight, mixed customer feedback, and reports of withdrawal issues raise significant concerns about the broker's reliability.

For traders, especially those new to the forex market, it may be prudent to consider more established platforms with a solid regulatory framework and a track record of positive user experiences. Alternatives such as brokers regulated by top-tier authorities like the FCA or ASIC may offer a more secure trading environment. Always conduct thorough research and consider your risk tolerance before engaging with any trading platform.

Is GlobTFX a scam, or is it legit?

The latest exposure and evaluation content of GlobTFX brokers.

GlobTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GlobTFX latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.