Global Premier 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive global premier review looks at an online forex broker that works from Saint Vincent and the Grenadines. Global Premier shows itself as a trading platform that offers negative balance protection and keeps client funds separate, going after traders who want forex, CFDs, commodities, and indices trading chances. The broker says it keeps client funds safe through separate accounts and gives negative balance protection for peace of mind, but several worries come up about its regulatory watch and user happiness.

The broker works under the Saint Vincent and the Grenadines Financial Services Authority (FSA) with license number 25800 BC 2020. This represents a less strict regulatory environment compared to major financial areas. User feedback shows mixed experiences, with some traders showing unhappiness with the company's handling of reviews and customer service responses. Despite promotional claims of great customer support and instant execution, the overall user experience seems to fall short of industry standards.

Global Premier mainly targets traders willing to accept higher risk levels in exchange for potentially flexible trading conditions. However, potential clients should carefully think about the regulatory limits and user feedback before putting funds into this platform.

Important Notice

Regulatory Differences Across Jurisdictions: Global Premier operates under the regulatory framework of Saint Vincent and the Grenadines Financial Services Authority. This provides much less investor protection compared to tier-1 regulatory bodies such as the FCA, ASIC, or CySEC. Traders should know that this jurisdiction offers limited recourse options and minimal regulatory oversight compared to more established financial centers.

Review Methodology Statement: This evaluation is based on publicly available information, official broker documentation, user feedback from multiple sources, and regulatory filings. Our assessment considers the broker's claims against industry standards and actual user experiences to provide a balanced perspective on Global Premier's services and reliability.

Rating Framework

Broker Overview

Global Premier operates as an online forex and CFD brokerage. It establishes its corporate presence in Saint Vincent and the Grenadines with registered offices at Beachmont Business Centre, Suite 88, Kingstown. The company positions itself within the competitive online trading sector by offering access to foreign exchange markets, contracts for difference, commodities, and various financial indices. According to available information, Global Premier emphasizes its commitment to client fund security through segregated account structures and negative balance protection mechanisms.

The brokerage targets retail traders seeking exposure to international financial markets. It particularly focuses on those interested in forex trading and derivative instruments. Global Premier's business model appears to focus on providing trading access rather than comprehensive educational or analytical services, though specific details about their operational approach remain limited in publicly available documentation.

Regulatory and Operational Framework: This global premier review reveals that the broker operates under the regulatory supervision of Saint Vincent and the Grenadines Financial Services Authority. It holds license number 25800 BC 2020. This regulatory jurisdiction is known for its relatively relaxed oversight compared to major financial centers, which may impact the level of investor protection available to clients. The company's operational structure emphasizes segregated client funds and negative balance protection as key safety features, though the effectiveness of these measures depends largely on the company's financial stability and operational integrity.

Regulatory Jurisdiction: Global Premier operates under the Saint Vincent and the Grenadines Financial Services Authority (FSA) regulatory framework. This jurisdiction provides basic regulatory oversight but lacks the comprehensive investor protection mechanisms found in tier-1 regulatory environments.

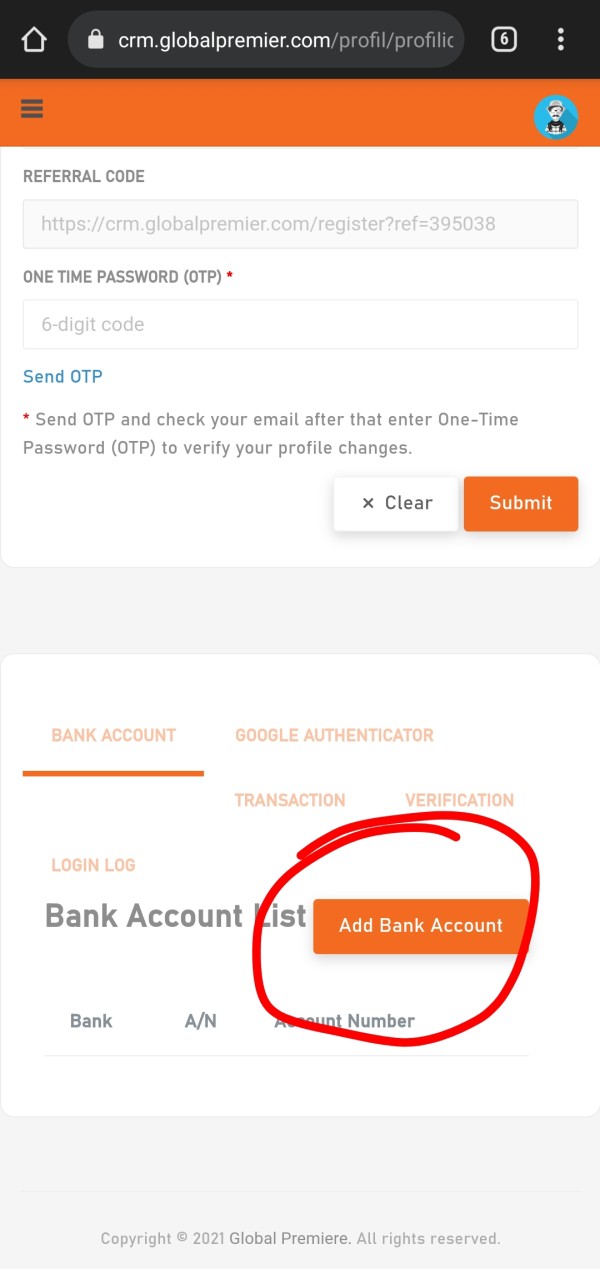

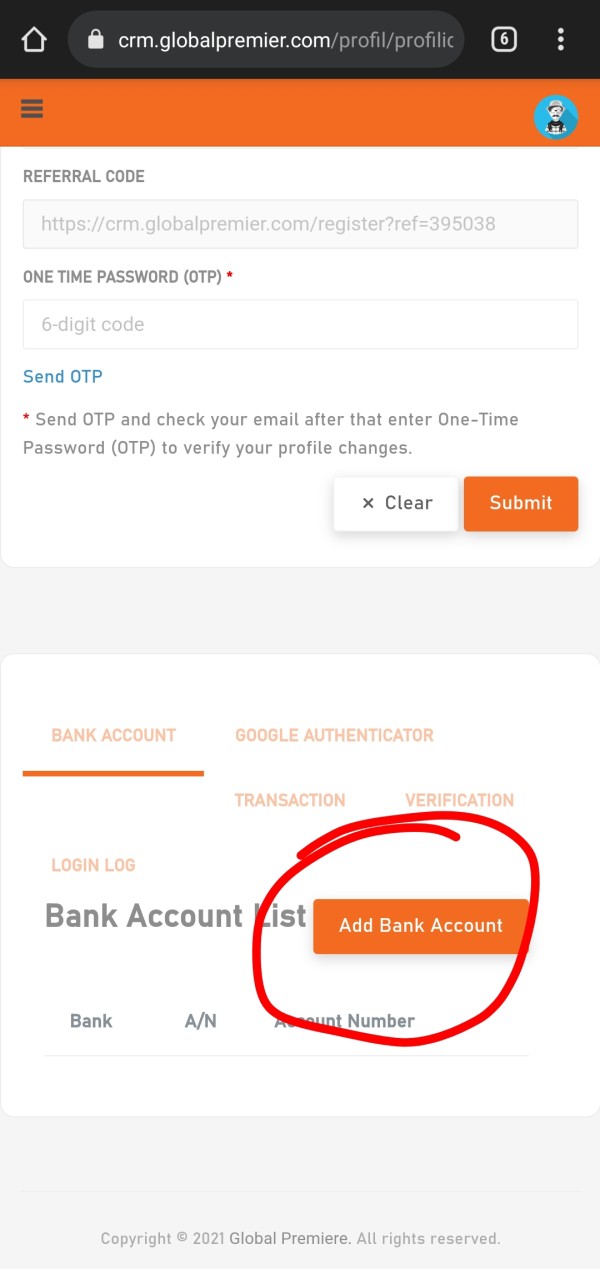

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available documentation. This represents a transparency gap that potential clients should investigate before account opening.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds. This makes it difficult for potential clients to assess accessibility and account tier structures.

Promotional Offers: Available materials do not specify current bonus structures or promotional campaigns. However, traders should be cautious of any offers that may impact withdrawal conditions.

Available Trading Assets: Global Premier provides access to forex pairs, contracts for difference (CFDs), commodities, and market indices. This offers a standard range of instruments for retail traders.

Cost Structure: Detailed information about spreads, commissions, and additional trading costs is not readily available in public documentation. This creates uncertainty about the true cost of trading with this broker.

Leverage Ratios: Specific leverage offerings are not disclosed in available materials. However, regulatory constraints in Saint Vincent and the Grenadines may allow for higher leverage ratios than those permitted in more regulated jurisdictions.

Platform Options: The broker has not clearly specified which trading platforms are available to clients. This represents a significant information gap for potential users evaluating technical capabilities.

Geographic Restrictions: Information about regional limitations and restricted countries is not explicitly provided in available documentation.

Customer Service Languages: Available support languages and communication channels are not detailed in publicly accessible materials. However, this global premier review notes claims of "exceptional customer support" that appear to conflict with user experiences.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Global Premier's account structure remains largely unclear. It has minimal public disclosure about available account types, tier benefits, or specific trading conditions. The lack of transparent information about minimum deposit requirements, account features, and progression criteria significantly hampers potential clients' ability to make informed decisions. This opacity contrasts sharply with industry standards where reputable brokers provide detailed account specifications.

User feedback suggests dissatisfaction with account management processes. However, specific details about account opening procedures, verification requirements, or special account features like Islamic accounts are not available in public documentation. The absence of clear account condition information raises concerns about the broker's commitment to transparency and client education.

The broker's failure to provide comprehensive account information may indicate either poor marketing communication or deliberate opacity. Both of these negatively impact the client experience. Without clear account structures, traders cannot adequately assess whether Global Premier's offerings align with their trading needs and financial capabilities. This global premier review finds that the lack of detailed account information significantly undermines the broker's credibility and user confidence.

The evaluation of Global Premier's trading tools and educational resources reveals significant information gaps. These gaps impact trader decision-making. Available documentation does not specify which trading platforms are offered, what analytical tools are provided, or whether clients have access to market research and educational materials. This lack of transparency about technological capabilities represents a major deficiency in the broker's public presentation.

User feedback indicates suboptimal experiences with available tools. However, specific complaints about platform functionality, research quality, or educational resource availability are not detailed in accessible reviews. The absence of information about automated trading support, third-party platform integration, or proprietary tool development suggests limited technological investment.

Professional traders typically require comprehensive analytical tools, real-time market data, and educational resources to make informed trading decisions. Global Premier's failure to clearly communicate these offerings may indicate either inadequate tool provision or poor marketing communication, both of which negatively impact the overall trading experience and limit the broker's appeal to serious traders.

Customer Service and Support Analysis (Score: 3/10)

Despite Global Premier's claims of providing "exceptional customer support from dedicated professionals," user feedback reveals significant dissatisfaction. Users report problems with the company's customer service quality and responsiveness. Multiple reports indicate that clients have experienced poor handling of complaints and inadequate responses to service inquiries, contradicting the broker's promotional statements about support excellence.

The specific customer service channels, response times, and support availability hours are not clearly documented in available materials. This creates uncertainty about when and how clients can access assistance. This lack of transparency about support infrastructure raises concerns about the broker's commitment to client service and operational professionalism.

User complaints about the company's handling of reviews and feedback suggest a defensive approach to criticism rather than constructive engagement with client concerns. This pattern indicates potential systemic issues with customer service culture and may reflect broader operational challenges within the organization that could impact client satisfaction and retention.

Trading Experience Analysis (Score: 4/10)

The assessment of Global Premier's trading experience is hampered by limited information about platform performance, execution quality, and overall trading conditions. Available documentation does not provide specific data about order execution speeds, platform stability, or mobile trading capabilities, making it difficult to evaluate the technical quality of the trading environment.

User feedback suggests suboptimal trading experiences. However, detailed complaints about specific platform issues, execution problems, or technical difficulties are not comprehensively documented in accessible reviews. The absence of performance metrics or third-party platform assessments limits the ability to objectively evaluate trading quality.

Professional traders require reliable platform performance, fast execution, and comprehensive trading tools to operate effectively in financial markets. This global premier review finds that the lack of detailed information about trading infrastructure and negative user experiences raise concerns about the broker's ability to provide competitive trading conditions that meet professional standards.

Trust and Safety Analysis (Score: 2/10)

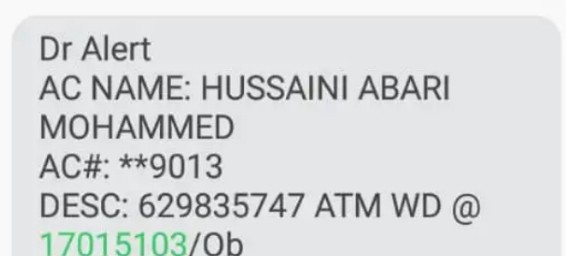

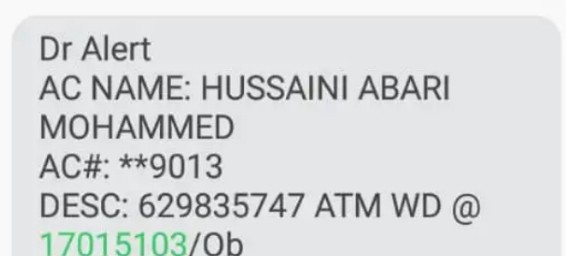

Global Premier's trustworthiness faces significant challenges due to regulatory limitations and user feedback concerns. Operating under Saint Vincent and the Grenadines FSA regulation provides minimal investor protection compared to major regulatory jurisdictions, creating inherent risks for client fund safety and dispute resolution capabilities.

While the broker claims to maintain segregated client accounts and provide negative balance protection, these safety measures are only as reliable as the company's financial stability and regulatory compliance. The weak regulatory framework in Saint Vincent and the Grenadines offers limited oversight and enforcement mechanisms, reducing the effectiveness of these protective measures.

User feedback indicating dissatisfaction with the company's handling of complaints and reviews suggests potential transparency and accountability issues. These further undermine trust. The combination of weak regulatory oversight, limited transparency, and negative user experiences creates a concerning profile for potential clients considering fund deposits with this broker.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Global Premier appears significantly below industry standards. This is based on available feedback and operational transparency. Users have expressed concerns about various aspects of the service, including customer support quality, complaint handling, and general operational responsiveness, indicating systemic issues with user experience management.

The broker's target demographic appears to be traders willing to accept higher risk levels. However, the lack of detailed service information makes it difficult for potential clients to assess whether Global Premier aligns with their specific trading needs and risk tolerance. Limited transparency about platform features, account conditions, and trading costs creates barriers to informed decision-making.

Common user complaints focus on the company's handling of feedback and customer service interactions. This suggests a reactive rather than proactive approach to client satisfaction. Improvements in transparency, customer service quality, and operational communication would be necessary to enhance user experience and build stronger client relationships.

Conclusion

This comprehensive analysis reveals that Global Premier operates as a forex and CFD broker with significant limitations. These include problems with regulatory oversight, transparency, and user satisfaction. While the company promotes features like negative balance protection and segregated client funds, the weak regulatory environment in Saint Vincent and the Grenadines provides minimal investor protection compared to established financial jurisdictions.

The broker may be suitable for high-risk tolerance traders who prioritize flexible trading conditions over regulatory security. However, the lack of detailed information about trading conditions, costs, and platform capabilities makes informed decision-making challenging. Potential clients should carefully weigh the limited regulatory protection and negative user feedback against any perceived benefits before considering account opening with Global Premier.

The primary advantages include claimed negative balance protection and segregated fund storage. However, significant disadvantages encompass weak regulatory oversight, poor user feedback, limited transparency, and inadequate customer service quality. Traders seeking reliable, well-regulated brokerage services would likely find better options with brokers operating under tier-1 regulatory frameworks.