Is Global Premier safe?

Pros

Cons

Is Global Premier A Scam?

Introduction

Global Premier is a forex broker that has gained attention in the trading community for its offerings in currency pairs, commodities, indices, and stocks. Established in 2018 and registered in Saint Vincent and the Grenadines, the broker positions itself as a competitive player in the online trading market. However, the lack of regulatory oversight raises concerns among traders about the safety and legitimacy of their operations. In the highly volatile forex market, it is crucial for traders to conduct thorough due diligence when selecting a broker. The financial implications of trading with an unregulated entity can be significant, as traders may find it challenging to recover their funds in case of disputes or mismanagement. This article aims to provide an objective analysis of Global Premier by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation relies on various credible sources, including user reviews and regulatory disclosures, to establish a comprehensive overview of the broker's trustworthiness.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Regulated brokers are subject to strict oversight by financial authorities, which helps ensure transparency and protect traders' interests. In contrast, unregulated brokers operate without such scrutiny, potentially exposing traders to higher risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

Global Premier operates without a license from any reputable regulatory authority. This lack of oversight has led to its classification as an unregulated broker, which raises significant red flags for potential investors. The absence of regulatory protection means that traders have limited recourse in the event of disputes or financial issues. Furthermore, in 2022, the Indonesian Ministry of Trade blocked the broker's website, identifying it as operating without the legal right to provide financial services. Such actions further highlight the broker's questionable legitimacy. The quality of regulation in offshore jurisdictions like Saint Vincent and the Grenadines is often criticized for being lax, making it a haven for brokers that may engage in unethical practices. Consequently, traders should exercise extreme caution when dealing with Global Premier.

Company Background Investigation

Global Premier was founded in 2018 and is registered in Saint Vincent and the Grenadines. The broker claims to offer a diverse range of trading instruments, including forex, commodities, indices, and stocks. However, details about the company's ownership structure and management team are scarce. A lack of transparency regarding the company's leadership raises concerns about accountability and governance.

The absence of publicly available information about the management team is troubling, as it makes it difficult for traders to assess the expertise and experience of those running the broker. A well-structured management team with a proven track record in the financial industry is often a positive indicator of a broker's reliability. In the case of Global Premier, the lack of such information may lead potential clients to question the broker's operational integrity.

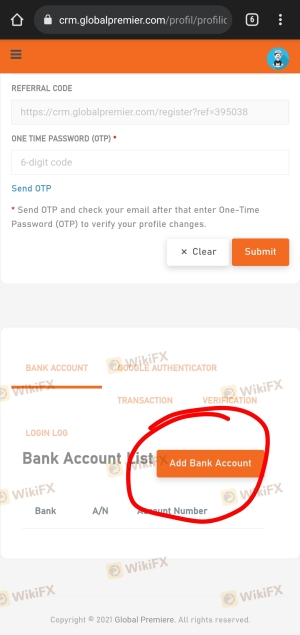

Moreover, the company's website has been criticized for providing minimal information about trading conditions and legal documents. This lack of clarity can be a significant deterrent for potential traders, as it may indicate an unwillingness to provide essential information that ensures a safe trading environment. Overall, the opacity surrounding Global Premier's corporate structure and management team raises several concerns about the broker's credibility.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including costs, fees, and spreads, is essential. Global Premier claims to provide competitive trading conditions; however, the reality appears to be different based on user reviews and feedback.

| Fee Type | Global Premier | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High (up to 2.2 pips) | 1.0 - 1.5 pips |

| Commission Model | Varies | Typically $3 per trade |

| Overnight Interest Range | Unclear | Varies by broker |

Numerous user reviews indicate that Global Premier's spreads, particularly for major currency pairs, are significantly higher than the industry average. High spreads can erode potential profits, making trading less attractive, especially for short-term traders. Additionally, the broker's commission structure appears to lack clarity, with many users reporting unexpected charges that were not clearly outlined during the account setup process. Such practices can be seen as deceptive and may contribute to a negative trading experience.

Furthermore, the broker does not provide a transparent overview of overnight interest rates, which can significantly impact the overall cost of trading, especially for positions held overnight. Traders often rely on this information to assess the potential profitability of their trades, and the lack of clarity on this aspect raises further concerns about the broker's transparency.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Traders need to feel confident that their investments are secure and protected from potential fraud or mismanagement. Global Premier's lack of regulatory oversight raises significant concerns about the safety of client funds.

Global Premier does not appear to have implemented robust safety measures for client funds. There is no information available regarding segregated accounts, investor protection schemes, or negative balance protection policies. Segregated accounts are crucial for ensuring that client funds are kept separate from the broker's operational funds, providing an additional layer of security in the event of financial difficulties.

Additionally, the absence of any historical data regarding funds security issues or disputes involving Global Premier further emphasizes the need for caution. Traders should be particularly wary of brokers that do not have a proven track record of safeguarding client investments, as this can lead to severe financial losses.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a forex broker's reliability. Reviews and testimonials from existing clients can provide insights into the broker's operational practices and customer service quality. Unfortunately, Global Premier has received a significant number of negative reviews, particularly concerning fund withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Fees | Medium | Unresponsive |

| Poor Customer Service | High | Unresponsive |

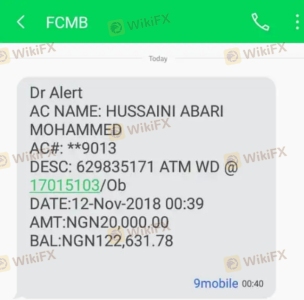

Common complaints include difficulties in withdrawing funds, with many users reporting that their withdrawal requests were either delayed or outright denied. This trend is alarming, as it raises concerns about the broker's financial stability and willingness to honor withdrawal requests. Additionally, customers have expressed frustration with the quality of customer service, citing long response times and a lack of helpfulness when issues arise.

Several users have shared their experiences of being unable to access their funds for extended periods, leading to feelings of mistrust toward the broker. For example, one user reported waiting for over a month for a withdrawal to process, only to receive no communication from the broker during that time. Such experiences paint a troubling picture of Global Premier's commitment to customer satisfaction and transparency.

Platform and Trade Execution

The trading platform's performance and reliability are critical components of a trader's experience. Global Premier utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust analytical tools. However, user feedback suggests that the platform may have stability issues.

Traders have reported experiencing frequent glitches and system downtimes, which can hinder effective trading and lead to missed opportunities. Additionally, concerns about order execution quality, including slippage and rejected orders, have been highlighted by users. Such issues can significantly impact trading outcomes and contribute to an overall negative experience.

Moreover, there are allegations that the broker may manipulate trades or employ practices that disadvantage traders. While these claims are difficult to substantiate, they highlight the need for vigilance when trading with Global Premier. A reliable broker should provide a transparent and efficient trading environment, free from any potential manipulation.

Risk Assessment

Engaging with an unregulated broker like Global Premier comes with inherent risks that traders must consider. The lack of regulatory oversight, combined with numerous complaints about fund withdrawals and poor customer service, raises serious concerns about the overall safety and reliability of the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, exposing traders to potential fraud. |

| Financial Risk | High | Complaints about fund withdrawal issues suggest financial instability. |

| Operational Risk | Medium | Reports of platform glitches and order execution problems. |

To mitigate these risks, traders should consider alternative options that offer regulatory protection and a proven track record of customer satisfaction. Engaging with well-regulated brokers can provide a safer trading environment and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that Global Premier operates as an unregulated broker with significant red flags that warrant caution. The lack of regulatory oversight, combined with numerous complaints about fund withdrawal issues and poor customer service, raises serious concerns about the broker's legitimacy and reliability. Traders should be particularly wary of engaging with Global Premier, as the risks associated with unregulated brokers can lead to substantial financial losses.

For traders looking for safer alternatives, it is advisable to consider well-regulated brokers that offer a transparent trading environment, competitive pricing, and robust customer support. Brokers regulated by reputable authorities, such as the FCA, ASIC, or CySEC, can provide the necessary protections and assurances that traders need to feel secure in their investments.

Is Global Premier a scam, or is it legit?

The latest exposure and evaluation content of Global Premier brokers.

Global Premier Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global Premier latest industry rating score is 2.12, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.12 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.