AdvanTrade 2025 Review: Everything You Need to Know

Executive Summary

This AdvanTrade review shows major concerns about this forex broker's reliability and trustworthiness. Market intelligence and user feedback reveal that AdvanTrade has poor overall performance with serious red flags that traders should think about carefully. WikiFX gives the broker a worrying rating of just 1 out of 10. Scam Detector assigns a trust score of 58 points, which shows moderate trust levels at best.

AdvanTrade started in 2021 and has its headquarters in Seychelles. The company claims to serve over 500,000 users through its STP business model. The broker offers multiple trading platforms including the AdvanTrade APP and MetaTrader 4. These platforms provide access to different asset classes such as forex, indices, oil futures, precious metals, and cryptocurrencies. However, serious allegations of fraudulent behavior and operational concerns overshadow these features.

The broker mainly targets investors interested in forex and multi-asset trading. Potential clients must be extremely careful due to documented fraud risks and poor regulatory oversight. User complaints and negative feedback dominate available reviews. This suggests significant operational and ethical issues that make AdvanTrade unsuitable for most traders seeking reliable brokerage services.

Important Notice

This evaluation of AdvanTrade uses available market information and user feedback from various sources. Prospective traders should know that regulatory information for AdvanTrade remains unclear across different jurisdictions. This potentially exposes clients to varying levels of legal and financial risk depending on their location.

The assessment method in this review includes comprehensive analysis of user testimonials, third-party rating platforms, and available operational data. However, traders should conduct their own research and consult with financial advisors before making any investment decisions. This is particularly important given the concerning nature of reports surrounding this broker.

Rating Framework

Based on comprehensive analysis of available information, AdvanTrade receives the following scores across six critical dimensions:

Broker Overview

AdvanTrade entered the forex market in 2021 as a Seychelles-based brokerage firm. The company operates under the Top Wealth Group umbrella. AdvanTrade positions itself as a comprehensive trading solution, claiming to serve an impressive user base exceeding 500,000 traders worldwide. The broker operates through a pure STP business model. AdvanTrade markets itself as offering transparent pricing and direct market access, while also providing copy trading functionality for less experienced traders.

The broker's operational structure centers around providing multi-platform access through both proprietary technology and established third-party solutions. AdvanTrade supports trading through its custom-developed AdvanTrade APP alongside the industry-standard MetaTrader 4 platform. This caters to different trader preferences and experience levels. The company's asset portfolio spans traditional forex pairs, global indices, energy commodities including oil futures, precious metals, and the increasingly popular cryptocurrency market. This positions the company as a one-stop solution for diversified trading strategies.

However, despite these apparent strengths in platform diversity and asset coverage, this AdvanTrade review must emphasize the significant concerns surrounding the broker's regulatory status and operational transparency. These issues remain inadequately addressed in available documentation.

Regulatory Framework: Available information does not specify concrete regulatory oversight from recognized financial authorities. This creates substantial uncertainty about client protection and operational standards.

Deposit and Withdrawal Methods: Specific information regarding available funding methods, processing times, and associated fees remains undisclosed in accessible documentation.

Minimum Deposit Requirements: The broker has not clearly communicated minimum account funding requirements. This makes it difficult for potential clients to assess accessibility.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in available materials.

Tradeable Assets: AdvanTrade provides access to foreign exchange pairs, global stock indices, energy commodities including oil futures, precious metals markets, and cryptocurrency trading opportunities. This offers reasonable diversification potential.

Cost Structure: The broker advertises zero commission trading with no platform fees mentioned. However, specific spread information remains unavailable, making comprehensive cost analysis challenging.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible broker information.

Platform Selection: Traders can choose between the proprietary AdvanTrade APP and the established MetaTrader 4 platform. This provides flexibility in trading interface preferences.

Geographic Restrictions: Information regarding restricted jurisdictions or regional limitations is not clearly communicated.

Customer Support Languages: Available language support for client services is not specified in current documentation.

This AdvanTrade review highlights the concerning lack of transparency in fundamental operational details. Reputable brokers typically disclose these details prominently.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

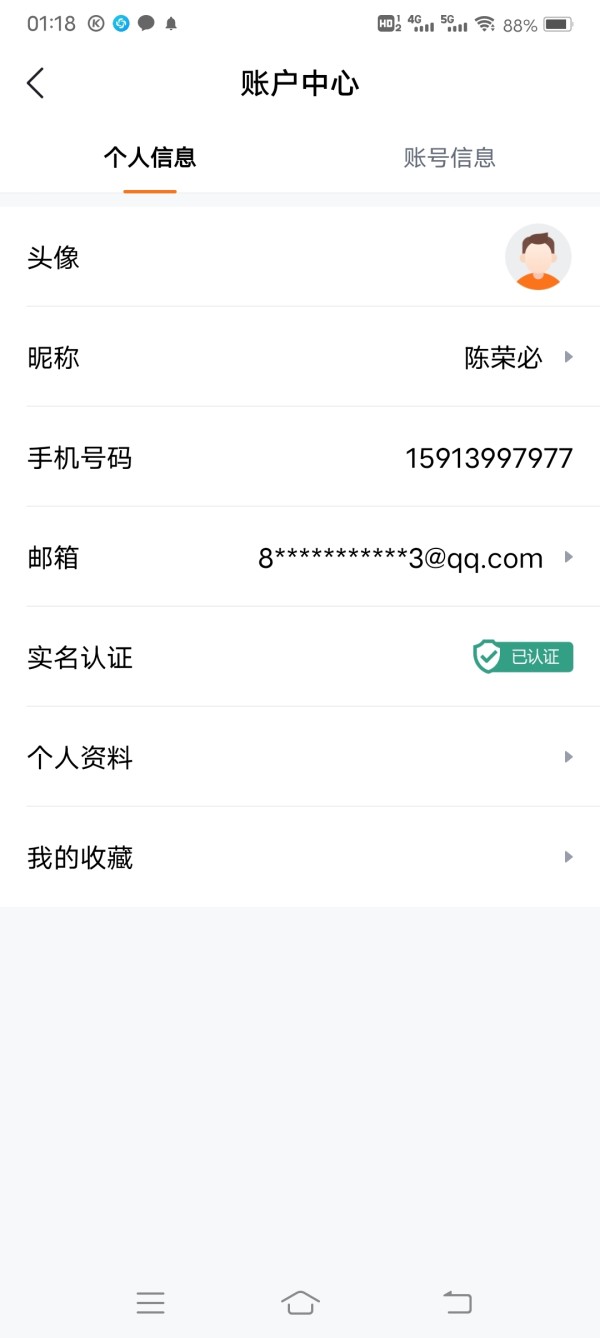

AdvanTrade's account conditions receive a disappointing score due to insufficient transparency and incomplete information disclosure. The broker fails to provide essential details about account types, tier structures, or specific features that differentiate various account offerings. This lack of clarity immediately raises concerns about operational transparency and client communication standards.

The absence of clearly stated minimum deposit requirements makes it impossible for potential traders to assess whether the broker's services align with their capital availability. Professional brokers typically offer detailed account specifications, including deposit thresholds, maintenance requirements, and account-specific benefits. AdvanTrade does not adequately address any of these areas.

Account opening procedures remain undocumented, creating uncertainty about verification requirements, processing times, and documentation needs. The broker also fails to address specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions. This limits accessibility for diverse client needs.

User feedback regarding account conditions is notably sparse, with available reviews focusing more on broader operational concerns rather than specific account features. This AdvanTrade review emphasizes that the lack of detailed account information represents a significant deficiency in the broker's service transparency and client communication standards.

AdvanTrade demonstrates moderate capability in trading tools and platform offerings. The company provides access to both proprietary and established trading solutions. The broker supports MetaTrader 4, the industry's most widely recognized trading platform, alongside their custom-developed AdvanTrade APP. This offers traders flexibility in platform selection based on personal preferences and trading styles.

The availability of multiple asset classes including forex, indices, commodities, and cryptocurrencies through these platforms provides reasonable diversification opportunities for traders seeking exposure across different markets. However, the quality and functionality of the proprietary AdvanTrade APP remains inadequately documented. This makes it difficult to assess its competitive advantages or unique features.

Research and analysis resources appear limited, with no clear indication of market analysis tools, economic calendars, or educational materials that professional traders typically expect from comprehensive brokerage services. The absence of detailed information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the platform's appeal to advanced traders.

While the basic platform infrastructure appears functional, the lack of comprehensive tool documentation and limited user feedback about platform performance prevents a higher rating in this category.

Customer Service and Support Analysis (4/10)

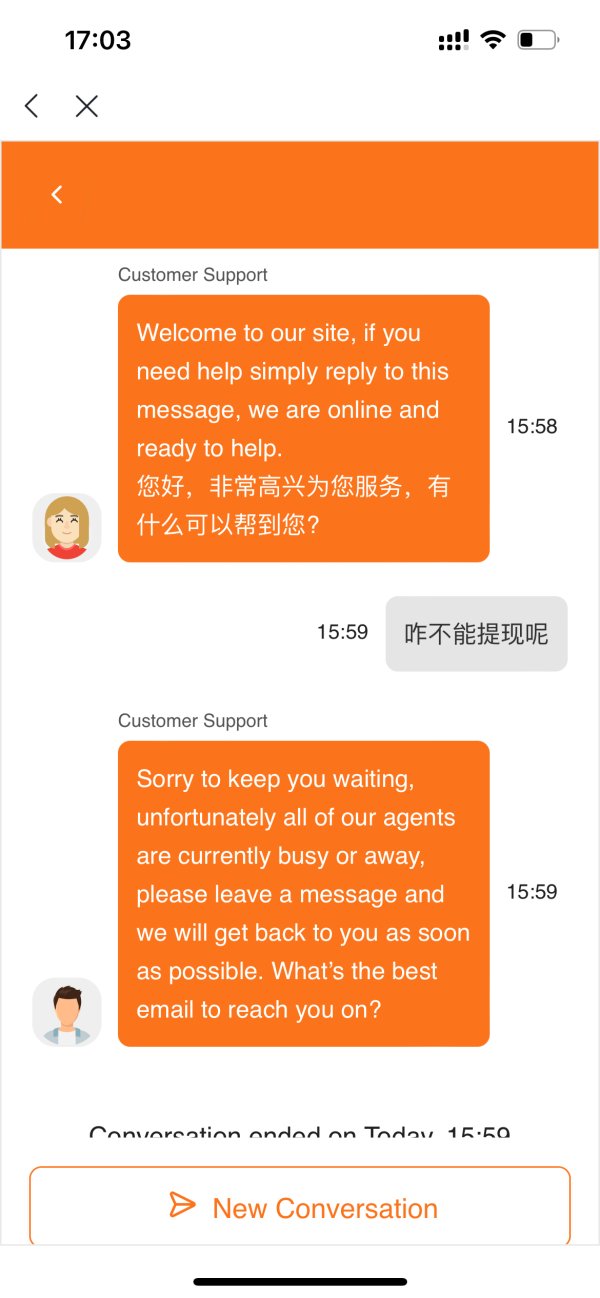

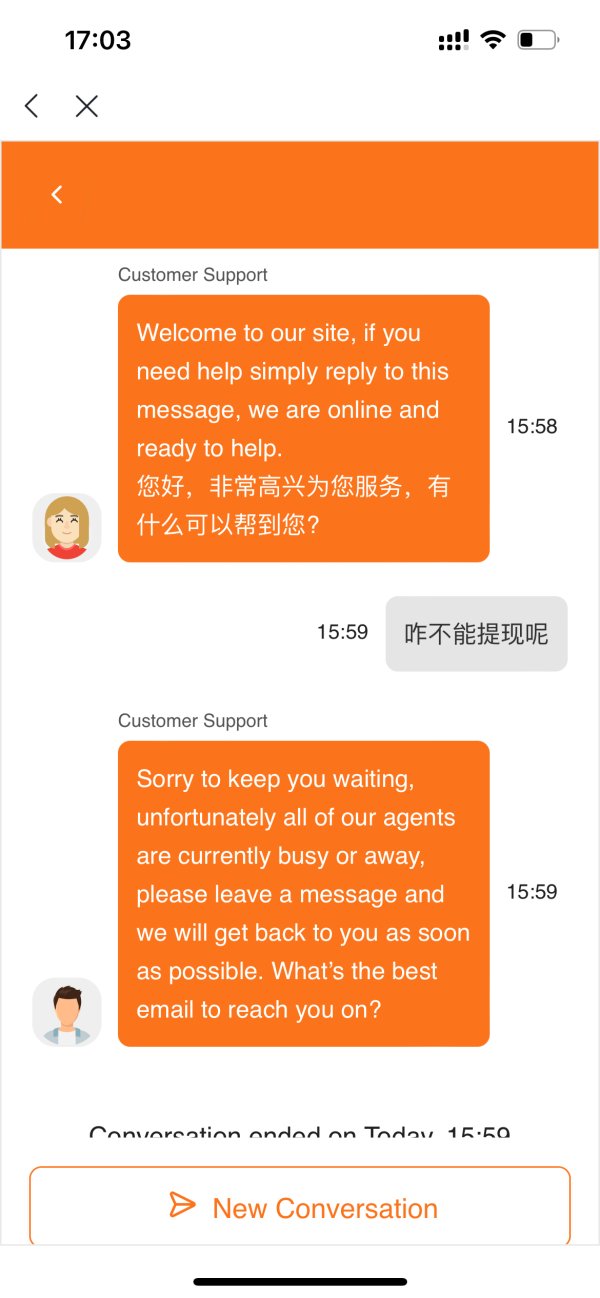

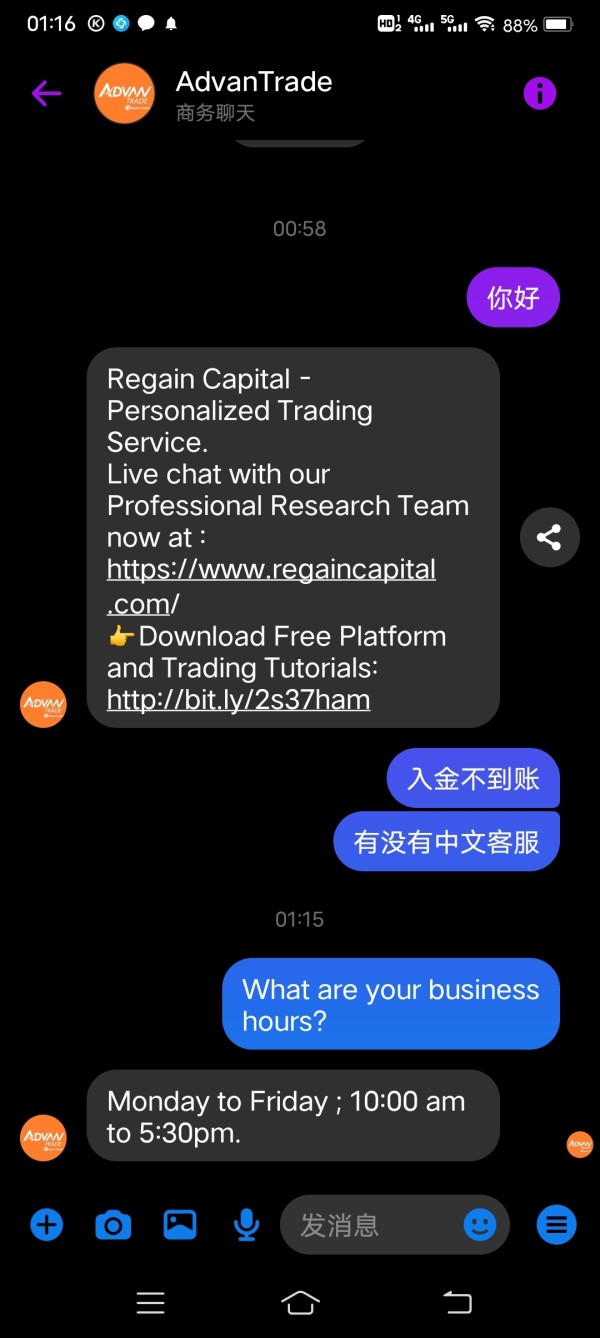

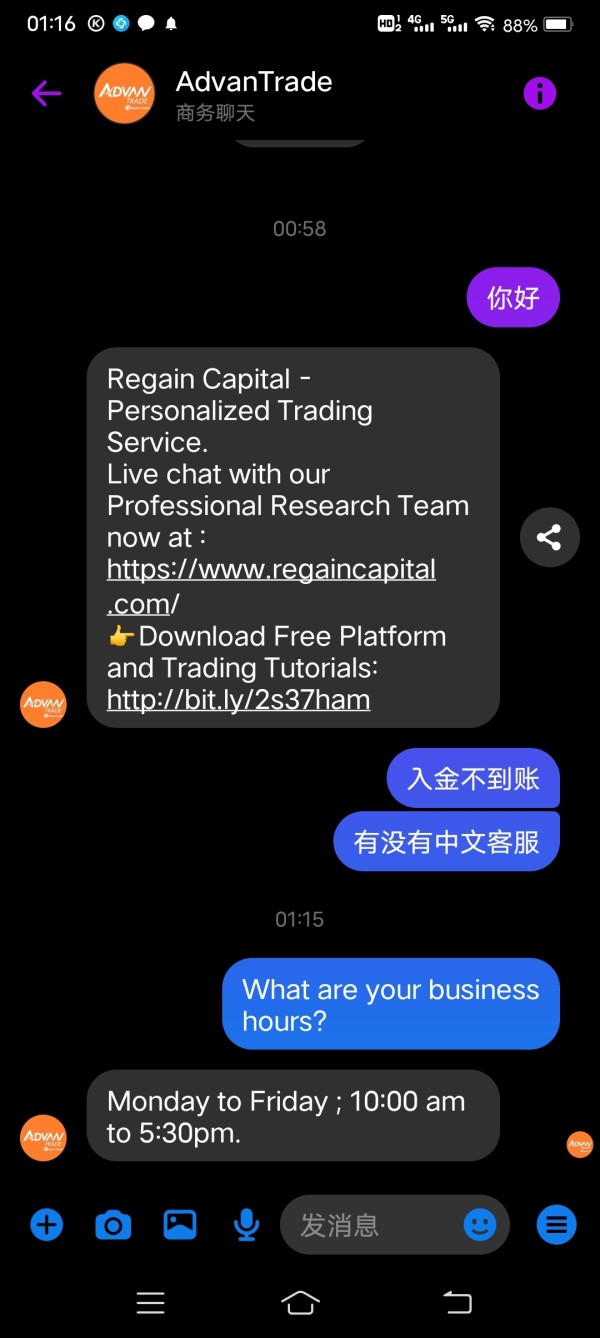

Customer service represents a significant weakness in AdvanTrade's operational framework. The broker provides inadequate information about support channels, availability, and service quality standards. AdvanTrade fails to clearly communicate available contact methods, whether through phone, email, live chat, or other communication channels that traders typically require for urgent assistance.

Response time commitments and service level agreements remain unspecified, creating uncertainty about support availability during critical trading situations. Professional brokers typically guarantee specific response times and maintain 24/7 support during market hours. AdvanTrade has not clearly committed to meeting these standards.

The absence of documented multilingual support capabilities limits accessibility for international clients. This is particularly concerning given the broker's claimed global user base of over 500,000 traders. Quality assurance measures and escalation procedures for complex issues are not addressed in available documentation.

User complaints documented in available reviews suggest ongoing customer service challenges, with some traders reporting difficulties in communication and issue resolution. These concerns, combined with the lack of transparent service standards, contribute to the below-average rating in this critical operational area.

Trading Experience Analysis (5/10)

The trading experience with AdvanTrade presents a mixed picture, with platform diversity offset by concerning user feedback and operational uncertainties. The broker offers access to established platforms like MetaTrader 4 alongside proprietary solutions. However, actual user experiences suggest potential issues with platform stability and execution quality.

Order execution standards and slippage policies remain undocumented, making it difficult for traders to assess whether the broker maintains professional execution standards during various market conditions. The claimed STP business model suggests direct market access. However, without transparent execution statistics or third-party verification, these claims cannot be independently validated.

Platform functionality appears to support multi-asset trading across forex, commodities, and cryptocurrency markets, providing reasonable diversification opportunities. However, the mobile trading experience through the AdvanTrade APP lacks detailed user reviews or feature documentation. This prevents comprehensive assessment of its capabilities and reliability.

Negative user feedback documented in various sources raises concerns about overall trading experience quality, with some traders reporting operational difficulties that impact their ability to execute trading strategies effectively. This AdvanTrade review notes that while basic trading functionality appears available, the combination of limited documentation and negative user reports prevents a more favorable assessment.

Trust and Reliability Analysis (2/10)

Trust and reliability represent AdvanTrade's most significant weaknesses, with multiple red flags indicating serious concerns about the broker's operational integrity and client safety. The WikiFX rating of just 1 out of 10 points represents an extremely poor assessment from a respected industry evaluation platform. This suggests fundamental issues with the broker's operations and regulatory compliance.

Regulatory oversight remains unclear, with no specific mention of authorization from recognized financial authorities such as the FCA, CySEC, or other major regulatory bodies. This regulatory ambiguity creates substantial risk for client funds and legal recourse options. Traders may lack protection typically provided by established regulatory frameworks.

The broker's transparency regarding corporate structure, ownership, and operational procedures remains inadequate. There is limited information about fund segregation, client money protection, or insurance coverage that reputable brokers typically maintain and prominently advertise.

User allegations of fraudulent behavior documented in available sources represent extremely serious concerns that potential clients must carefully consider. The Scam Detector trust score of 58 points, while moderate, still indicates significant risk factors that professional traders would typically avoid. Third-party evaluations consistently highlight concerns about the broker's reliability and operational standards.

User Experience Analysis (4/10)

Overall user experience with AdvanTrade appears significantly below industry standards. Documented complaints and negative feedback dominate available user testimonials. The broker's claimed user base of over 500,000 traders contrasts sharply with the limited positive feedback available through independent review platforms and user forums.

Interface design and usability information for both the proprietary AdvanTrade APP and MetaTrader 4 implementation remains inadequately documented. This makes it difficult for potential users to assess platform ergonomics and functionality. Registration and account verification processes lack clear documentation, creating uncertainty about onboarding experience and requirements.

Funding operations experience, including deposit and withdrawal procedures, processing times, and associated fees, remains largely undocumented. This prevents comprehensive assessment of the complete user journey. Professional brokers typically provide detailed information about all operational procedures to ensure client understanding and satisfaction.

Common user complaints focus on broader operational concerns rather than specific interface or functionality issues, suggesting that fundamental service quality problems overshadow any potential platform advantages. The concentration of negative feedback across multiple evaluation platforms indicates systematic issues rather than isolated incidents. This warrants serious caution from potential clients.

Conclusion

This comprehensive AdvanTrade review reveals a broker with significant operational and trust concerns that outweigh any potential advantages in platform diversity or asset coverage. AdvanTrade offers access to multiple trading platforms and diverse asset classes. However, the fundamental issues surrounding regulatory oversight, transparency, and user satisfaction create substantial risks for potential clients.

The broker may theoretically appeal to traders interested in forex and multi-asset trading through established platforms like MetaTrader 4. However, the documented concerns about fraudulent behavior, poor customer service, and lack of regulatory clarity make it unsuitable for serious traders seeking reliable brokerage services.

AdvanTrade's primary advantages lie in platform variety and asset diversification, but these benefits are overshadowed by critical weaknesses. These include regulatory ambiguity, poor trust ratings, inadequate customer service, and documented user complaints. Professional traders should prioritize regulated, transparent brokers with established track records rather than risk exposure to the documented concerns surrounding AdvanTrade's operations.