GKInvest 2025 Review: Everything You Need to Know

Executive Summary

This gkinvest review looks at GKInvest, which now works as Trive Invest. GKInvest is a forex broker that has helped traders since 2005, and it operates from Jakarta, Indonesia with proper licenses from BAPPEBTI, JFX, and ICDX. The broker stands out because it lets you start trading with just $50, making it perfect for new traders who don't want to risk a lot of money at first.

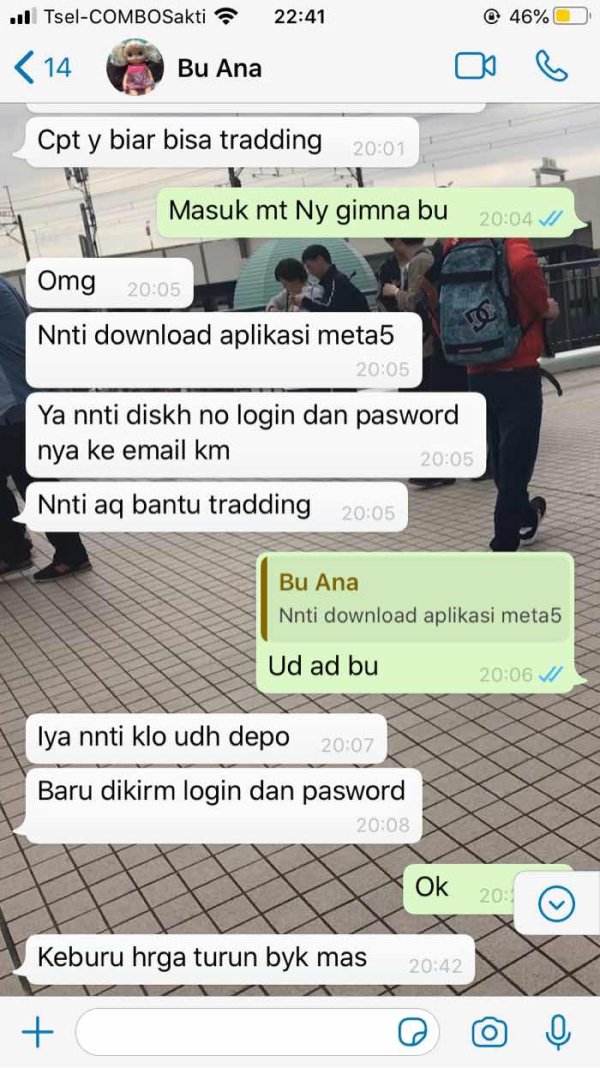

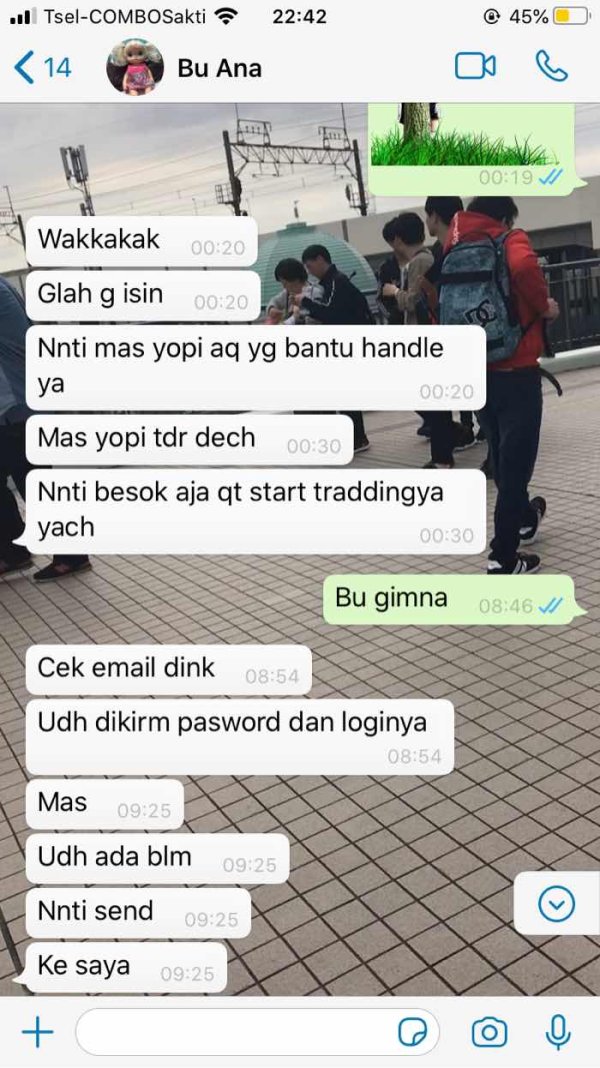

You can trade using the MetaTrader 5 platform, and GKInvest offers many different things to trade like forex pairs, CFDs, and commodities. The platform works well for people who want easy access to trading without big barriers. With leverage up to 1:100 and different account types from basic fixed accounts to premium RAW ZERO accounts, GKInvest tries to help all kinds of traders. However, you should look at everything carefully before you decide to invest your money.

Important Considerations

Regional Entity Differences: GKInvest follows different rules depending on where you live. The main oversight comes from Indonesian groups like BAPPEBTI, JFX, and ICDX, so you should check which rules apply to your account type and location since this affects what services and protections you get.

Review Methodology: This review uses public company information, regulatory files, and market data. We look at six main areas of how well the broker performs, giving scores based on facts and industry standards, and all information is current as of 2025, but you should check the latest terms directly with the broker.

Scoring Framework

Broker Overview

GKInvest started in 2005 in Jakarta, Indonesia. The company has grown into Trive Invest while keeping its main services the same, and it focuses on making trading easy for regular people who want to trade in international markets. GKInvest works as a market maker, giving direct access to forex, commodities, and CFD trading through professional platforms.

The company offers different account types for different kinds of traders. Some accounts work for beginners who don't have much money, while others serve serious traders who want better execution and lower costs, and GKInvest focuses mainly on Southeast Asian markets while meeting international trading standards. The broker has been around for almost twenty years, which shows it's stable and reliable compared to newer companies.

GKInvest uses the MetaTrader 5 system as its main platform. This gives traders advanced charts, automated trading, and detailed market analysis tools, and you can trade many different things including major and minor forex pairs, commodity CFDs, and other instruments. The broker follows rules from BAPPEBTI, JFX, and ICDX, which helps protect clients, though you should understand what protections Indonesian financial rules actually provide.

Regulatory Jurisdictions: GKInvest works under three main Indonesian regulatory groups: BAPPEBTI, JFX, and ICDX. These groups watch different parts of what the broker does, making sure it follows local financial service rules properly.

Deposit and Withdrawal Methods: The available payment methods, how long processing takes, and what fees apply weren't explained in the materials we found. You should ask the broker directly about funding options and any charges that might apply.

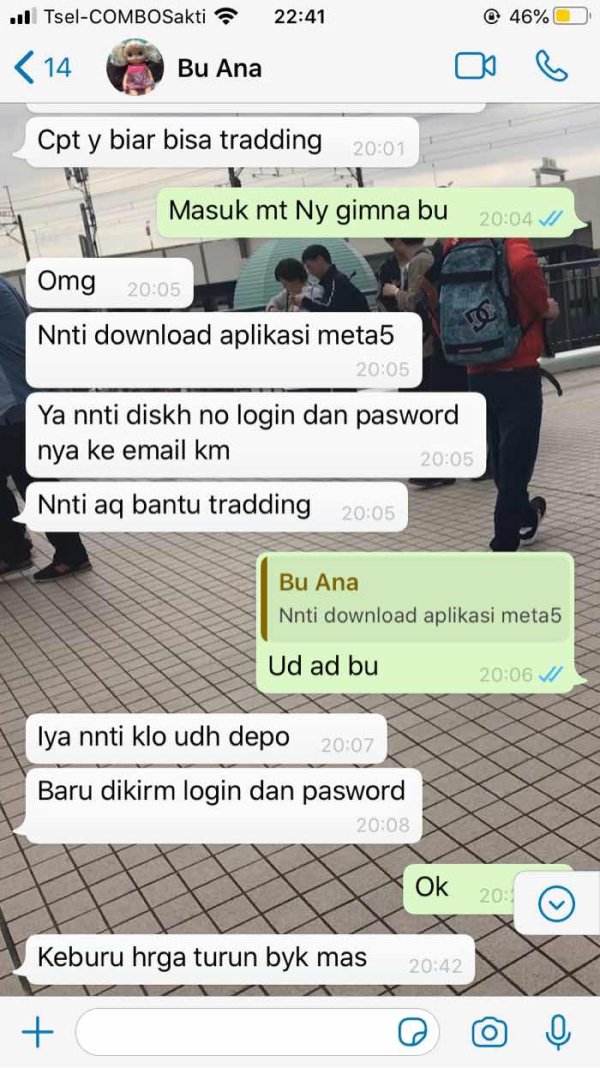

Minimum Deposit Requirements: The broker has several account levels with different minimum deposits: Standard Fixed accounts need $200, entry-level starts at $50, VIP Variable accounts need $2,500, and premium RAW ZERO accounts require $25,000. This gives options for people with different amounts of money to invest.

Bonus and Promotions: Current deals and bonus programs aren't listed in available documents. You need to contact the broker directly for current information about promotions.

Tradeable Assets: GKInvest lets you trade foreign exchange pairs, CFDs, and commodity markets. This gives you ways to diversify across different types of investments for various trading strategies and risk levels.

Cost Structure: While general account types are explained, specific details about spreads, commission rates, overnight charges, and other trading costs need more research. You should contact the broker directly to get this information.

Leverage Ratios: The broker offers leverage up to 1:100. This matches good risk management practices for intermediate traders while staying within reasonable risk limits.

Platform Options: Trading happens through the MetaTrader 5 platform. This gives you access to advanced technical analysis tools, automated trading systems, and complete market data feeds.

Geographic Restrictions: Information about which countries can't use the service wasn't available in the materials we reviewed.

Customer Support Languages: The languages that customer service supports weren't listed in available documents.

This gkinvest review shows that while basic information is available, many details need direct verification with the broker.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 7/10)

GKInvest's account setup shows they thought carefully about helping different types of traders. The broker offers four different account types, and each one is made for specific kinds of traders with different needs. The entry-level option with a $50 minimum deposit really helps new traders get started, while the Standard Fixed account at $200 is a good next step for beginners who are more serious about trading.

The VIP Variable account costs $2,500 to start, and the RAW ZERO account needs $25,000, which helps more advanced traders who want premium features and better execution. This setup shows that the broker understands its clients have different needs, from retail traders testing strategies with small amounts to serious investors who need institutional-level services, but the scoring shows some problems with missing information. Important details like spread differences between account types, commission structures, and exact benefits of higher-tier accounts aren't clear from public sources.

The account opening process, verification requirements, and how long activation takes aren't detailed in available materials. This lack of transparency could affect how traders make decisions, and information about account maintenance fees, inactivity charges, or minimum trading volume requirements wasn't easy to find. These factors really matter for the true cost of keeping an account with the broker.

When compared to industry standards, GKInvest's minimum deposit requirements are competitive, especially for the entry-level offering. However, without complete fee disclosure, traders can't fully judge the total cost across different account types, so this gkinvest review suggests that while the basic account structure looks reasonable, potential clients should get detailed fee schedules before choosing any account type.

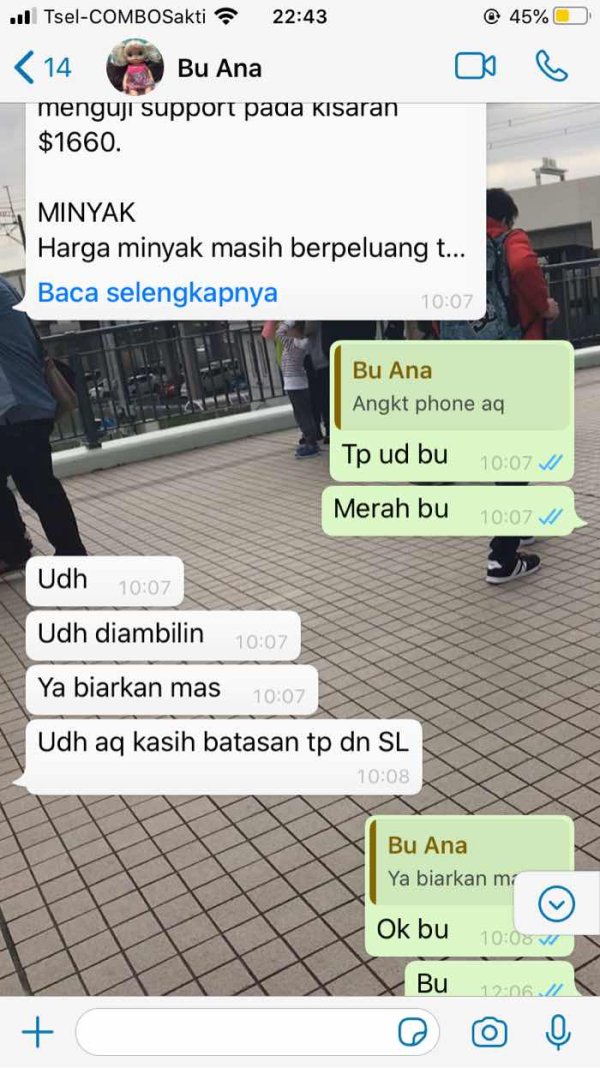

GKInvest's trading setup centers on the MetaTrader 5 platform, which is a solid foundation for both new and experienced traders. MT5 provides complete charting capabilities, technical analysis tools, and support for automated trading systems, meeting the essential requirements for serious forex and CFD trading, and the platform's ability to handle multiple assets works well with GKInvest's offering of forex, CFDs, and commodity trading. This gives you one interface for managing a diversified portfolio.

The broker's asset selection covers multiple categories, including major and minor forex pairs, commodity CFDs, and other derivative instruments. This variety lets traders use different strategies, from simple currency speculation to complex multi-asset approaches, and including commodity trading is especially valuable for traders who want to hedge currency positions or profit from global economic trends affecting raw materials markets.

However, the scoring shows some gaps in available information about additional trading resources. Research and analysis services, market commentary, economic calendars, and educational materials weren't clearly detailed in reviewed sources, and these extra resources often separate superior brokers from basic service providers because they help traders make informed decisions and improve their market understanding.

The platform's support for automated trading through Expert Advisors gives sophisticated traders chances to use algorithmic strategies. However, specific limitations or restrictions on EA usage weren't detailed, and mobile trading capabilities, while standard with MT5, should be checked for full functionality across different devices and operating systems.

This gkinvest review suggests that while the core trading platform and asset selection are strong, the broker could potentially improve its value through more comprehensive educational and research offerings. This assumes such services aren't already provided but simply not well-documented in available materials.

Customer Service and Support Analysis (Score: 6/10)

Evaluating GKInvest's customer service faces big limitations because there isn't enough public information about support channels, response times, and service quality. This lack of transparency about customer support is a notable concern for potential clients who may need help with technical issues, account management, or trading questions.

Industry best practices usually include multiple contact methods like live chat, email support, phone help, and comprehensive FAQ sections. Support in multiple languages would be expected, especially given the broker's Southeast Asian focus, but this can't be confirmed from available sources, and response time commitments, support hours, and procedures for complex issues are critical factors that remain unknown.

The absence of easily available user testimonials or reviews specifically about customer service quality makes it hard to assess real-world support experiences. Factors like staff knowledge, how well problems get solved, and overall customer satisfaction can't be evaluated without access to user feedback or independent service quality assessments.

For a broker operating since 2005, the lack of visible customer service information may indicate either inadequate transparency in marketing materials or potentially limited support infrastructure. Modern traders expect responsive, knowledgeable support, especially when dealing with technical platform issues or urgent account matters that could affect trading activities.

The scoring reflects this uncertainty, as effective customer support is crucial for trader confidence and satisfaction. Potential clients should specifically ask about available support channels, typical response times, and support quality before opening accounts, and the broker would benefit from providing clearer information about its customer service capabilities and commitment to client assistance.

Trading Experience Analysis (Score: 7/10)

The trading experience evaluation focuses on how GKInvest uses the MetaTrader 5 platform and the overall execution environment they provide. MT5 is a mature, feature-rich trading platform that supports advanced order types, comprehensive technical analysis, and sophisticated trading tools, and the platform's stability and functionality have been proven across many broker implementations. This provides a solid foundation for trading activities.

Order execution quality, while not specifically documented in available sources, usually depends on the broker's technology infrastructure, liquidity provider relationships, and internal risk management systems. The availability of different account types suggests varying execution models, with the RAW ZERO account likely offering different execution characteristics compared to standard accounts, though specific details need clarification.

Platform customization options, including the ability to install custom indicators, Expert Advisors, and trading scripts, provide flexibility for traders with specific analytical or automation requirements. The multi-asset capability allows for portfolio diversification within a single platform environment, streamlining the trading process for users managing multiple instrument types.

Mobile trading functionality, while standard with MT5, should provide full access to trading features, account management, and market analysis tools. The quality of mobile implementation can significantly impact trading flexibility, particularly for active traders who need to monitor and adjust positions while away from desktop computers.

However, the scoring acknowledges limitations in available performance data. Specific numbers like average execution speeds, slippage rates during volatile market conditions, and platform uptime statistics weren't available in reviewed materials, and user feedback about platform stability, execution quality, and overall trading satisfaction would provide valuable insights but remains limited in accessible sources.

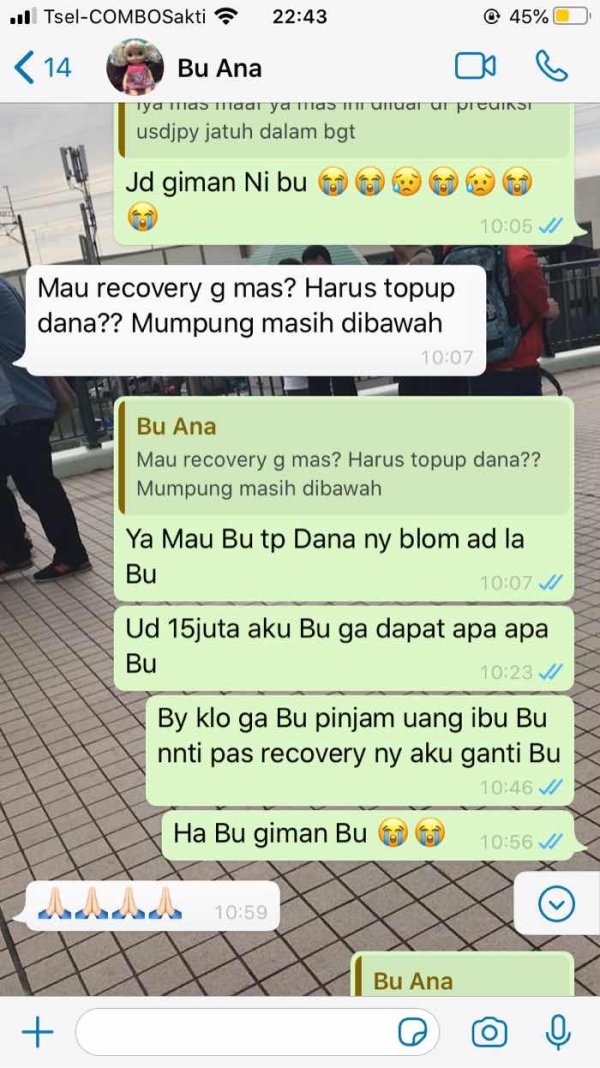

Trustworthiness Analysis (Score: 7/10)

GKInvest's trustworthiness assessment benefits from several positive factors, starting with its establishment in 2005. This shows nearly two decades of operational continuity in the competitive forex market, and this longevity suggests the broker has successfully navigated various market cycles and regulatory changes. This indicates operational stability and business sustainability.

The regulatory framework provides another foundation for trust, with oversight from BAPPEBTI, JFX, and ICDX representing legitimate Indonesian financial regulatory authorities. BAPPEBTI, in particular, serves as the primary commodity futures trading regulator in Indonesia, providing a framework for client protection and operational standards, but traders should understand that Indonesian regulatory protections may differ from those available in other major financial centers.

The broker's evolution to operate under the Trive Invest brand while maintaining GKInvest operations suggests ongoing business development and potentially enhanced service offerings. This rebranding or expansion could indicate growth and modernization efforts, though the specific implications for existing and new clients require clarification.

However, several factors limit a higher trustworthiness score. The availability of detailed financial information, such as audited financial statements, capital adequacy ratios, or client fund protection mechanisms, wasn't evident in reviewed materials, and modern traders increasingly expect transparency regarding broker financial health and client asset protection measures.

Additionally, the absence of readily available user reviews, testimonials, or independent ratings makes it difficult to assess real-world client satisfaction and trust levels. Third-party evaluations from recognized industry sources would provide valuable validation of the broker's reputation and service quality.

The scoring reflects a cautiously positive assessment based on regulatory status and operational history. It also acknowledges the need for enhanced transparency in areas critical to client trust and confidence.

User Experience Analysis (Score: 6/10)

The user experience evaluation for GKInvest faces challenges due to limited publicly available feedback from actual users. This makes it difficult to assess real-world satisfaction levels and common user experiences, but the MetaTrader 5 platform foundation provides a familiar interface for experienced traders while offering sufficient functionality for newcomers to forex trading.

Account opening and verification processes, while not detailed in available sources, represent critical touchpoints that significantly impact initial user impressions. Modern traders expect streamlined registration, efficient document verification, and clear communication throughout the onboarding process, and the absence of specific information about these procedures makes it difficult to evaluate this crucial aspect of user experience.

The tiered account structure suggests an attempt to match services with different user needs and experience levels. This potentially provides appropriate pathways for traders to advance as their skills and capital grow, but the criteria for account upgrades, associated benefits, and any restrictions or limitations across account types require clarification.

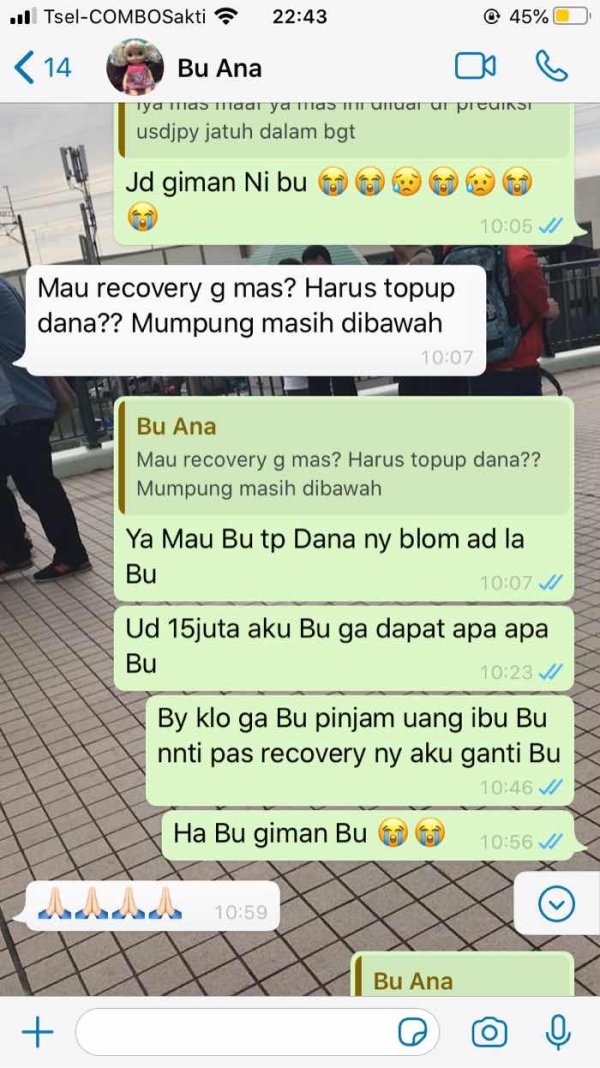

Funding and withdrawal experiences represent another critical component of user satisfaction. Processing times, available payment methods, associated fees, and the overall efficiency of financial transactions directly impact trader convenience and satisfaction, and the lack of detailed information about these processes in reviewed materials represents a significant gap in user experience assessment.

Platform customization options, educational resources, and ongoing support for trader development could significantly enhance user experience but remain undocumented in available sources. The broker's approach to helping users maximize platform capabilities and improve trading skills would distinguish it from purely transactional service providers.

The moderate scoring reflects the uncertainty surrounding many aspects of user experience while acknowledging that the basic platform infrastructure appears sound. Enhanced transparency and user feedback availability would enable a more comprehensive evaluation of GKInvest's user experience quality.

Conclusion

This comprehensive gkinvest review reveals a broker with solid foundational elements but limited transparency in several critical areas. GKInvest demonstrates regulatory compliance through oversight by Indonesian authorities and offers accessible entry points for new traders through reasonable minimum deposit requirements, and the MetaTrader 5 platform provides professional-grade trading tools while the multi-asset offering enables portfolio diversification across forex, CFDs, and commodities.

The broker appears most suitable for beginning to intermediate traders seeking regulated access to international markets without substantial capital requirements. The tiered account structure accommodates growth from novice to more sophisticated trading approaches, potentially providing a long-term relationship framework for developing traders.

However, significant information gaps regarding fees, customer service quality, and user experiences limit the ability to provide a complete assessment. Prospective clients should conduct thorough due diligence, including direct communication with the broker to clarify cost structures, support capabilities, and service quality before making account opening decisions, and while GKInvest shows promise as a regulated, accessible broker option, the lack of comprehensive public information suggests the need for careful evaluation of individual trading needs against available services.