Exnova 2025 Review: Everything You Need to Know

Summary

This exnova review shows big concerns about the broker's legitimacy and how it operates. Multiple regulatory sources and user feedback reveal that Exnova has been flagged as a "SCAM" by various monitoring platforms and lacks proper regulatory authorization from recognized financial authorities. The broker was established in 2015 and claims to be headquartered in London. It offers trading services across forex, options, and cryptocurrencies with a notably low minimum deposit requirement of just $10.

Exnova presents itself as a user-friendly platform suitable for both novice and experienced traders, but it faces serious credibility issues. Customer reviews on platforms like Trustpilot show mixed results, with a 4-star TrustScore but numerous complaints regarding withdrawal problems and slow customer service response times. The broker's lack of regulatory oversight, combined with persistent user reports of fund withdrawal difficulties, raises substantial red flags for potential investors.

Exnova's low entry barrier might appear attractive to new traders. However, the absence of proper licensing and the "SCAM" designation from monitoring services make it a high-risk choice for serious trading activities. According to available information, the platform offers multiple trading instruments including forex pairs, binary options, and cryptocurrency trading. The lack of detailed information about trading costs, spreads, and commission structures adds to the transparency concerns.

Important Notice

Regional Entity Differences: Exnova operates without proper regulatory authorization from recognized financial authorities. Users across all regions should exercise extreme caution when considering this broker. It has been flagged as potentially fraudulent by multiple monitoring platforms.

Review Methodology: This evaluation is based on comprehensive analysis of regulatory databases, user feedback from platforms like Trustpilot, official company communications, and third-party monitoring services. Our assessment prioritizes regulatory compliance, user experience reports, and transparency in business operations to provide an accurate picture of the broker's reliability.

Rating Framework

Broker Overview

Exnova was established in 2015 and positions itself as a London-based online trading platform offering financial services across multiple asset classes. The company operates as a web-based trading platform provider, focusing primarily on forex trading, binary options, and cryptocurrency trading services. According to available company information, Exnova targets both retail and institutional clients, though the majority of its user base appears to consist of individual traders seeking low-barrier entry into financial markets.

The broker's business model centers around providing direct market access through its proprietary trading platform. The company claims this platform is designed with user-friendliness in mind. Exnova markets itself as an accessible option for traders of all experience levels, emphasizing its low minimum deposit requirement and simplified trading interface as key differentiators in the competitive online trading space.

However, the trading platform type remains unclear as Exnova does not explicitly mention support for industry-standard platforms like MetaTrader 4 or MetaTrader 5. Instead, the broker appears to rely on its proprietary web-based platform for all trading activities. The available asset classes include foreign exchange currency pairs, binary options contracts, and various cryptocurrency instruments. Detailed specifications about available instruments within each category are not readily provided in public documentation.

The broker's regulatory status presents the most significant concern. This exnova review finds no evidence of proper licensing from recognized financial regulatory authorities such as the FCA, CySEC, or other major regulatory bodies. This lack of regulatory oversight raises serious questions about client fund protection and operational transparency.

Regulatory Regions: Exnova operates without authorization from any recognized financial regulatory authority and has been flagged as "SCAM" by multiple broker monitoring platforms. The company claims London headquarters but provides no evidence of FCA registration or other UK regulatory compliance.

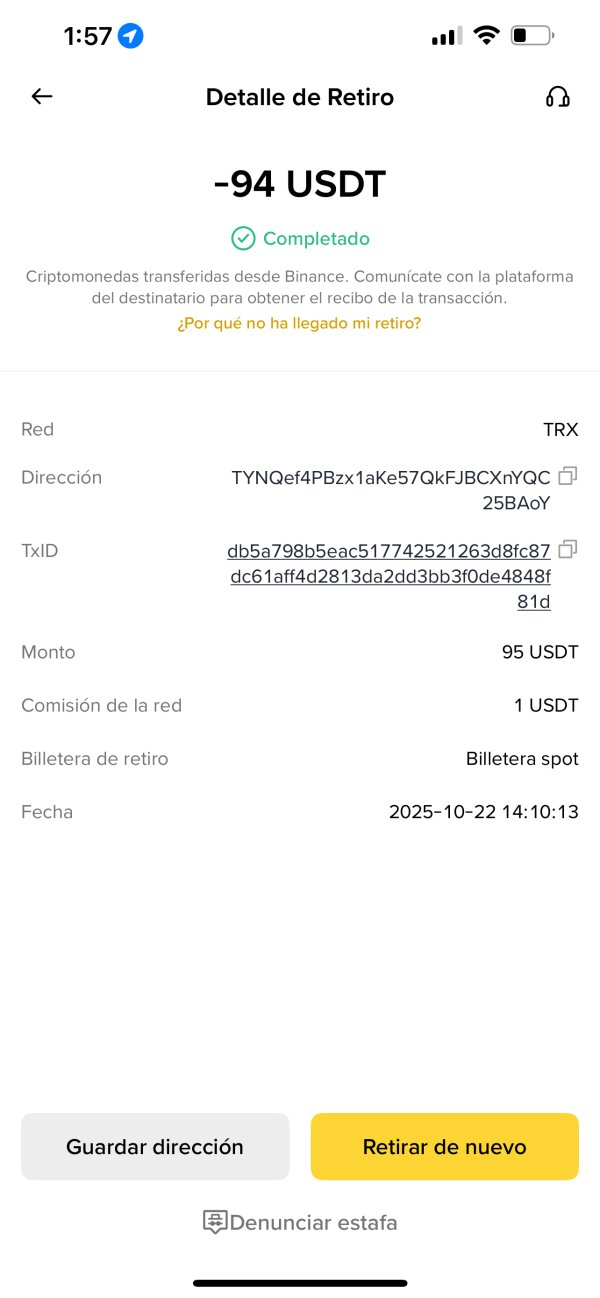

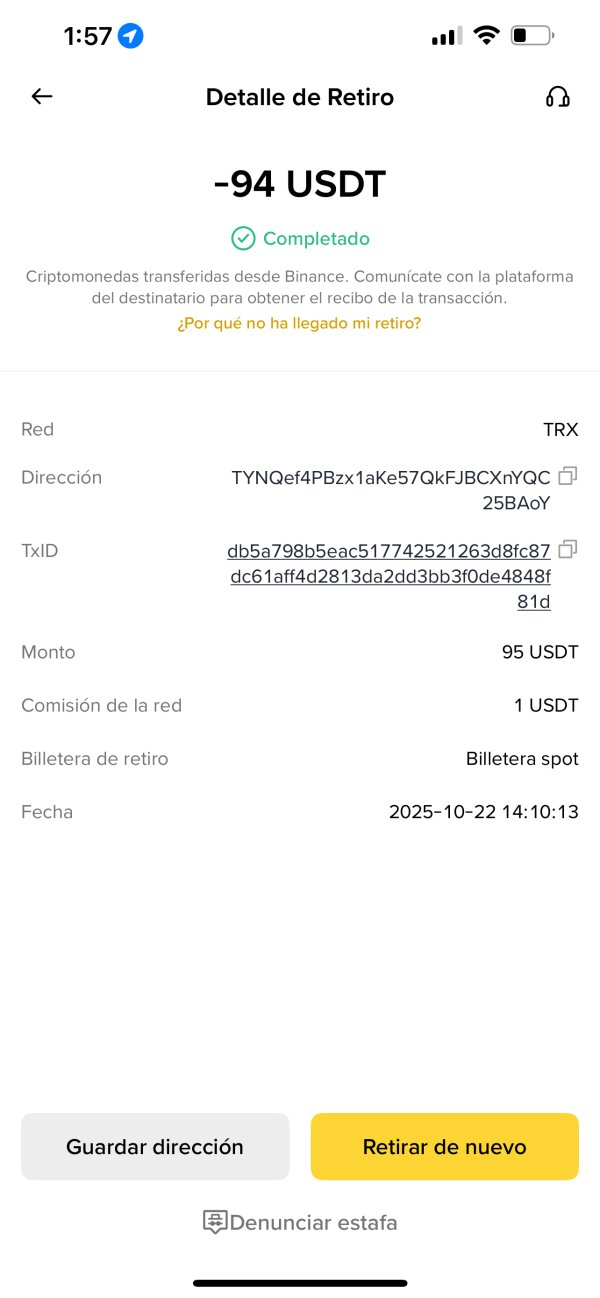

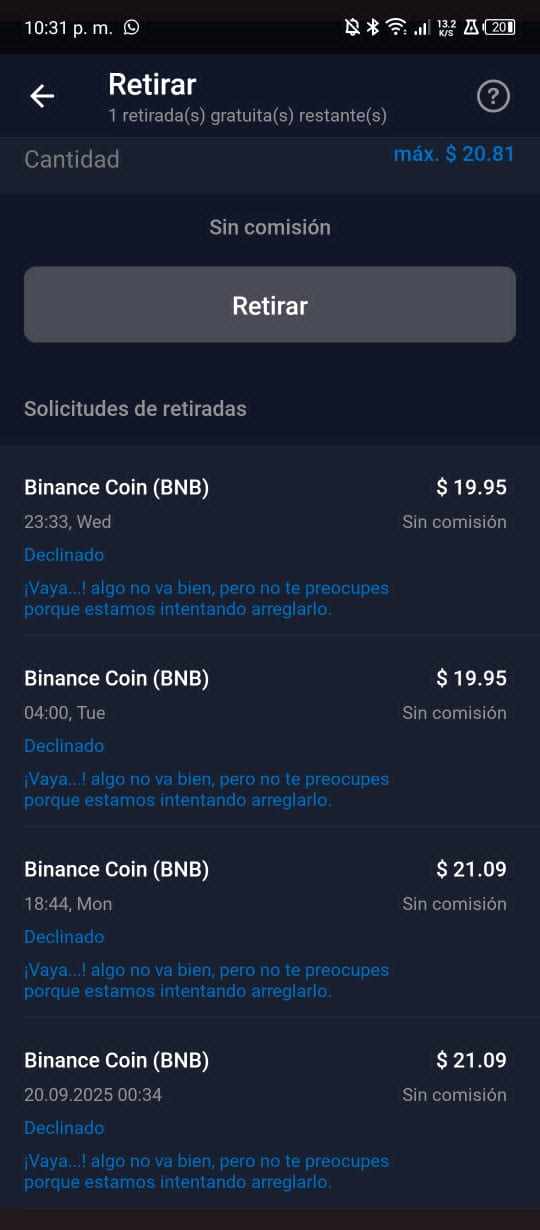

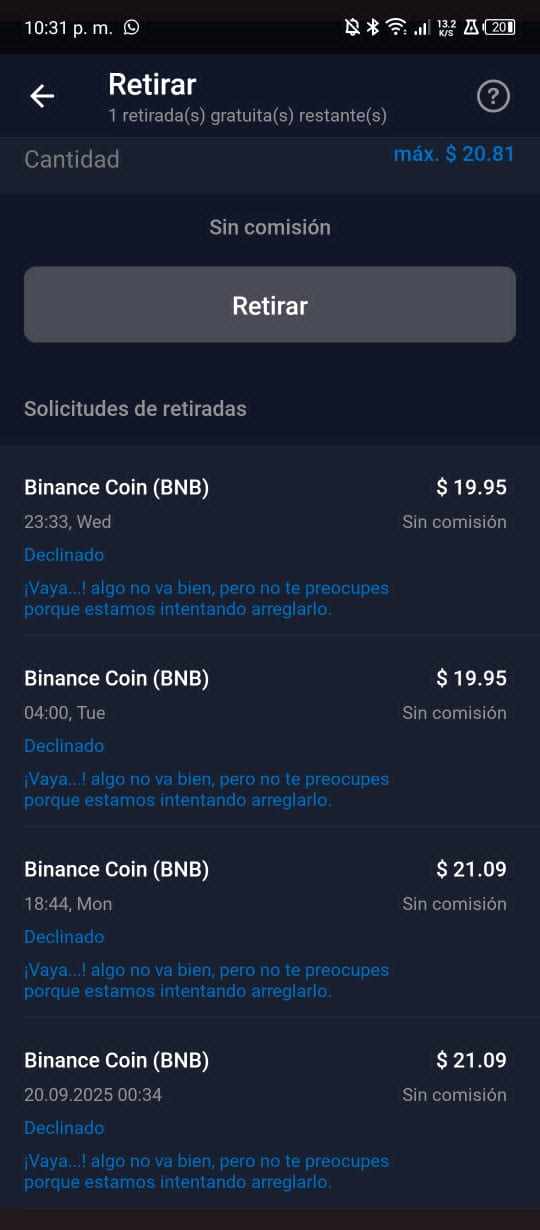

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not clearly disclosed in available public documentation. Users report difficulties with withdrawal processes, suggesting potential issues with fund accessibility.

Minimum Deposit Requirement: The broker advertises a minimum deposit requirement of $10. This is notably lower than most regulated brokers in the industry.

Bonuses and Promotions: Available information does not indicate any specific bonus programs or promotional offers currently available to new or existing clients.

Tradeable Assets: The platform offers access to forex currency pairs, binary options, and cryptocurrency trading instruments. The exact number and variety of available assets within each category remains unclear from public documentation.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not transparently provided. This lack of cost transparency represents a significant concern for potential users seeking to understand true trading expenses.

Leverage Ratios: Specific leverage offerings are not clearly stated in available documentation. This is unusual for forex brokers who typically prominently display their maximum leverage ratios.

Platform Options: Exnova appears to offer primarily web-based trading through a proprietary platform. Details about mobile applications or downloadable software are not clearly specified.

Regional Restrictions: Information about geographical restrictions or prohibited countries is not clearly outlined in available public documentation.

Customer Service Languages: The range of supported languages for customer service is not specified in available materials. This exnova review notes that response times are reportedly slow according to user feedback.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

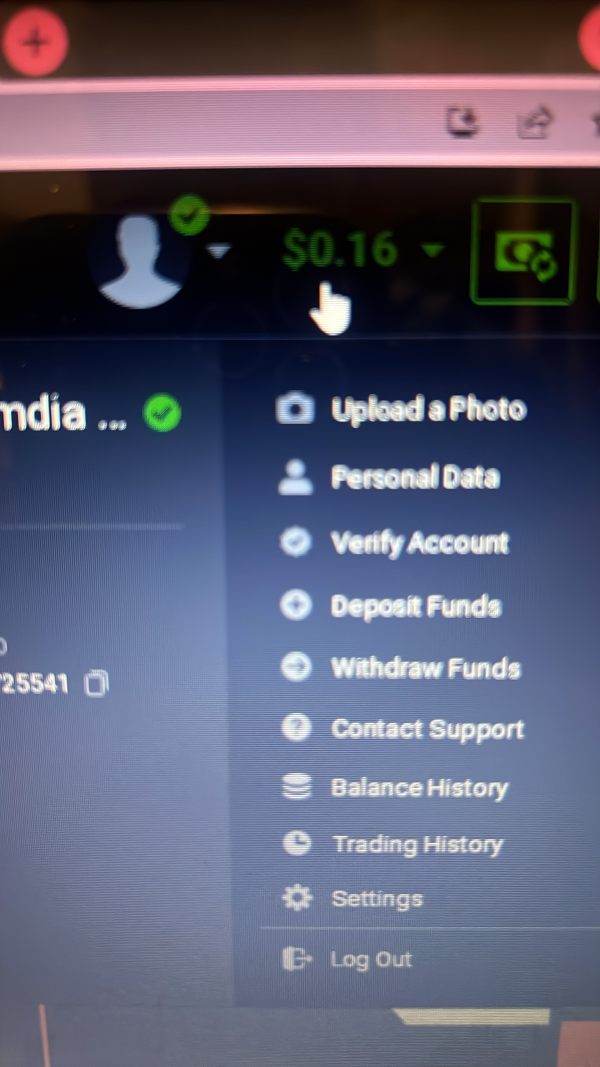

The account conditions offered by Exnova present a mixed picture with significant transparency issues. The broker advertises an attractive minimum deposit requirement of just $10, making it accessible to traders with limited capital. However, the lack of detailed information about account types and their specific features raises concerns about operational transparency.

According to available information, Exnova does not clearly differentiate between various account tiers or provide detailed specifications about the benefits and limitations of different account levels. This absence of clear account structure information makes it difficult for potential clients to understand what services and features they can expect based on their deposit level.

The account opening process details are not readily available in public documentation. This is unusual for legitimate brokers who typically provide clear step-by-step guidance for new client onboarding. Furthermore, there is no mention of specialized account types such as Islamic accounts for Muslim traders, professional accounts for experienced traders, or corporate accounts for institutional clients.

User feedback suggests that while the low minimum deposit requirement is appealing, the overall account conditions are undermined by withdrawal difficulties and unclear terms of service. The lack of regulatory oversight means that standard client protections typically associated with regulated brokers, such as negative balance protection or segregated client funds, cannot be guaranteed.

This exnova review finds that while the low entry barrier might attract new traders, the overall account conditions lack the transparency and regulatory backing that serious traders should expect from a legitimate forex broker.

Exnova's trading tools and resources appear to cover basic trading needs but lack the comprehensive suite typically expected from established brokers. The platform offers access to multiple asset classes including forex, binary options, and cryptocurrencies, providing some diversity for traders interested in different markets.

However, detailed information about specific trading tools such as technical analysis indicators, charting capabilities, or advanced order types is not readily available in public documentation. This lack of detailed tool specifications makes it difficult to assess whether the platform can meet the needs of more sophisticated traders who rely on comprehensive analytical tools.

The broker does not appear to provide substantial research and analysis resources, which are typically important for traders making informed decisions. Educational resources, if available, are not prominently featured or detailed in available materials. This represents a significant gap for novice traders who might benefit from learning materials.

Automated trading support, including Expert Advisors or algorithmic trading capabilities, is not mentioned in available documentation. This limitation could be significant for traders who rely on automated strategies or copy trading services.

User feedback suggests that while the platform interface is user-friendly, the depth of available tools may not satisfy traders who require advanced analytical capabilities or comprehensive market research resources.

Customer Service and Support Analysis (Score: 5/10)

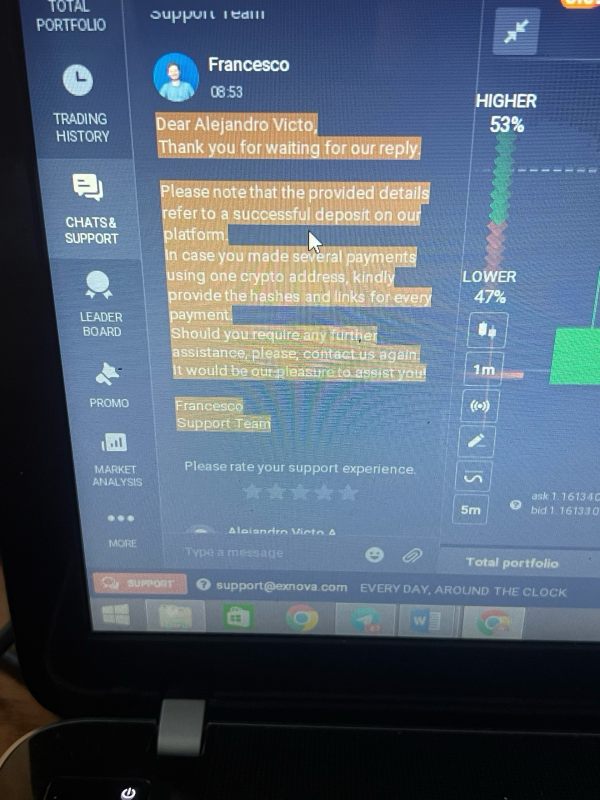

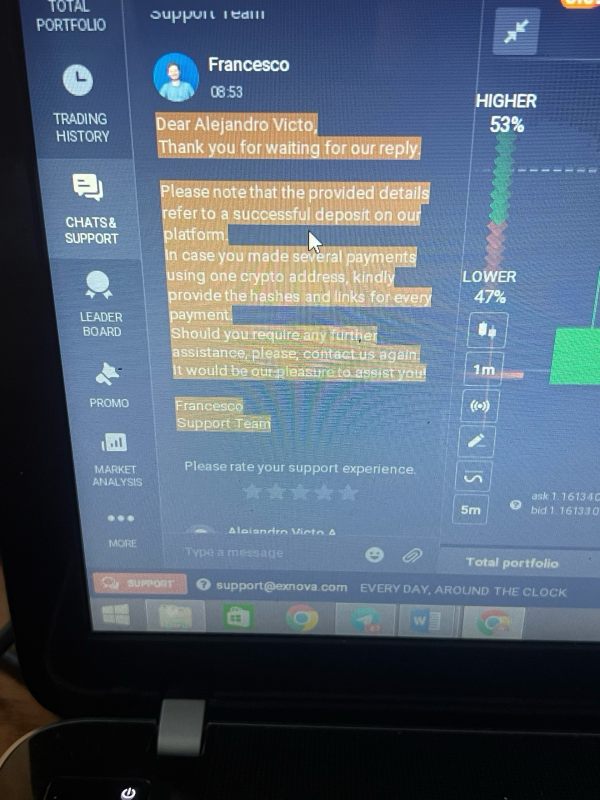

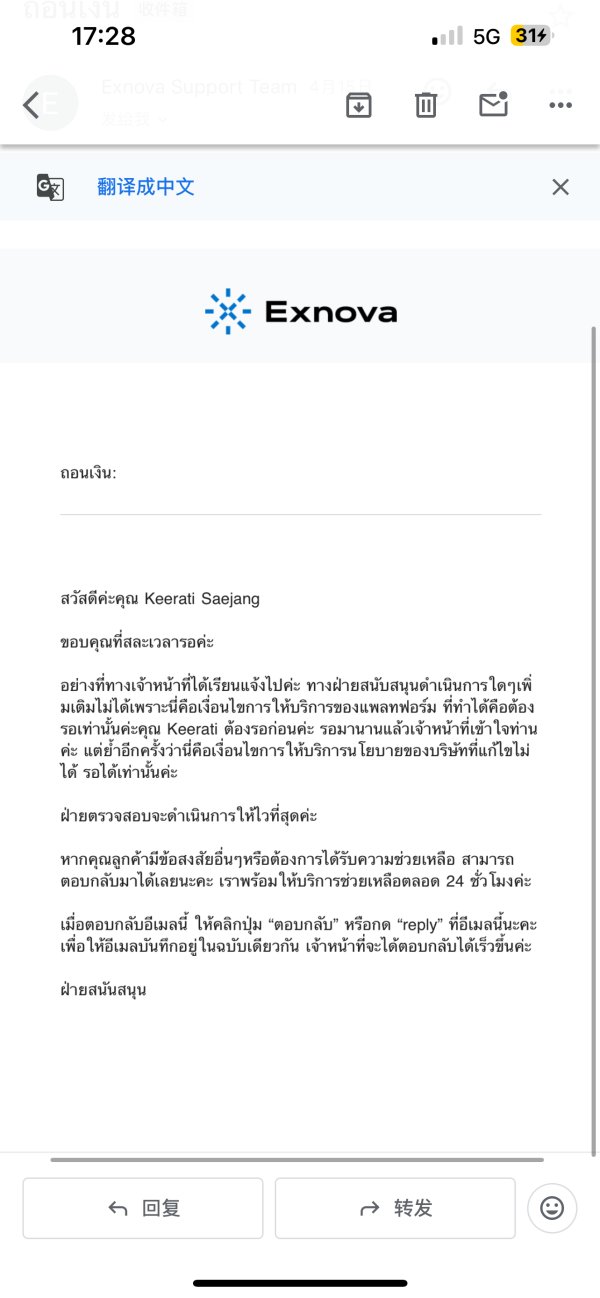

Customer service represents a significant weak point for Exnova based on available user feedback and review data. According to Trustpilot reviews, the broker's customer service receives a 3-star rating, with users frequently citing slow response times and inadequate problem resolution as primary concerns.

The specific customer service channels available are not clearly outlined in public documentation. This itself represents a transparency issue. Most legitimate brokers prominently display their contact methods, including phone numbers, email addresses, live chat availability, and support hours.

User reports consistently mention delayed responses to inquiries, particularly regarding account issues and withdrawal requests. This slow response time becomes particularly problematic given the serious nature of many user complaints, especially those related to fund accessibility and account functionality.

The availability of multilingual support is not clearly specified. This could present barriers for international clients. Additionally, customer service hours and timezone coverage are not transparently communicated, making it difficult for users to know when they can expect assistance.

The quality of support provided appears inconsistent based on user feedback, with some clients reporting helpful interactions while others describe frustrating experiences with unresolved issues. The lack of regulatory oversight means that clients have limited recourse when customer service fails to adequately address their concerns.

Trading Experience Analysis (Score: 6/10)

The trading experience on Exnova's platform receives mixed reviews from users. Some positive feedback about interface usability is balanced against concerns about transparency and functionality. Users generally describe the platform as user-friendly and accessible to both novice and experienced traders, suggesting that the basic trading interface is well-designed.

However, platform stability and execution speed data are not readily available. This makes it difficult to assess the technical quality of the trading environment. Order execution quality information is notably absent from public documentation, which is concerning given its importance for trading performance.

The platform's functionality appears to cover basic trading needs. Detailed information about advanced features such as one-click trading, multiple order types, or sophisticated risk management tools is not readily available. This lack of detailed feature information suggests that the platform may be more suited to basic trading rather than advanced strategies.

Mobile trading experience details are not clearly specified. This represents a significant gap given the importance of mobile access in modern trading. The absence of information about mobile app availability or mobile web platform functionality could be a limitation for active traders.

The trading environment lacks transparency regarding costs, with spread information, commission structures, and other fees not clearly disclosed. This opacity makes it difficult for traders to accurately calculate their trading costs and compare the broker's competitiveness against regulated alternatives.

This exnova review finds that while the basic trading experience may be adequate for simple strategies, the lack of detailed information and cost transparency creates uncertainty about the true quality of the trading environment.

Trustworthiness Analysis (Score: 2/10)

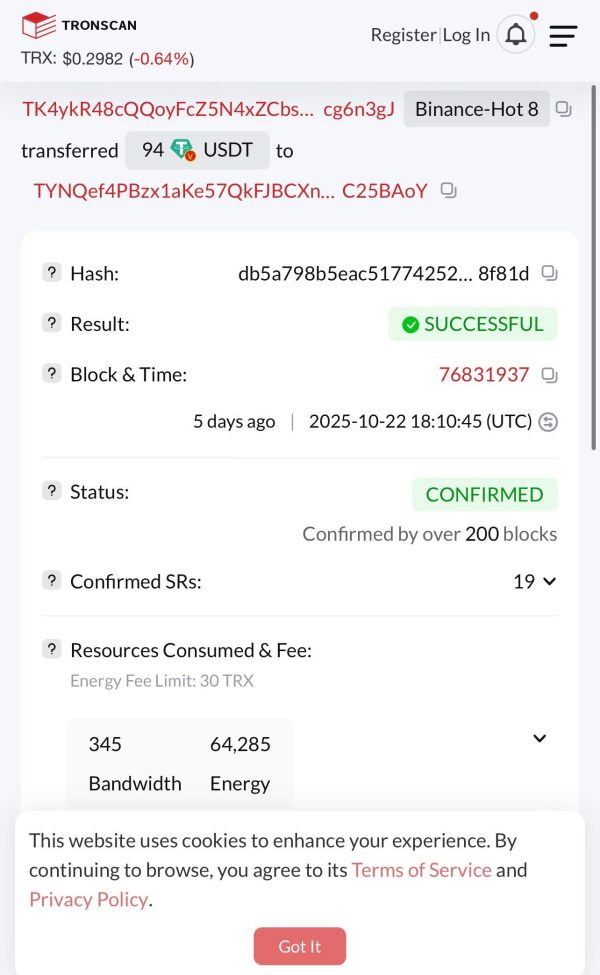

Trustworthiness represents Exnova's most significant weakness, with multiple red flags that should concern potential clients. The broker operates without proper regulatory authorization from any recognized financial authority. This immediately raises questions about client protection and operational legitimacy.

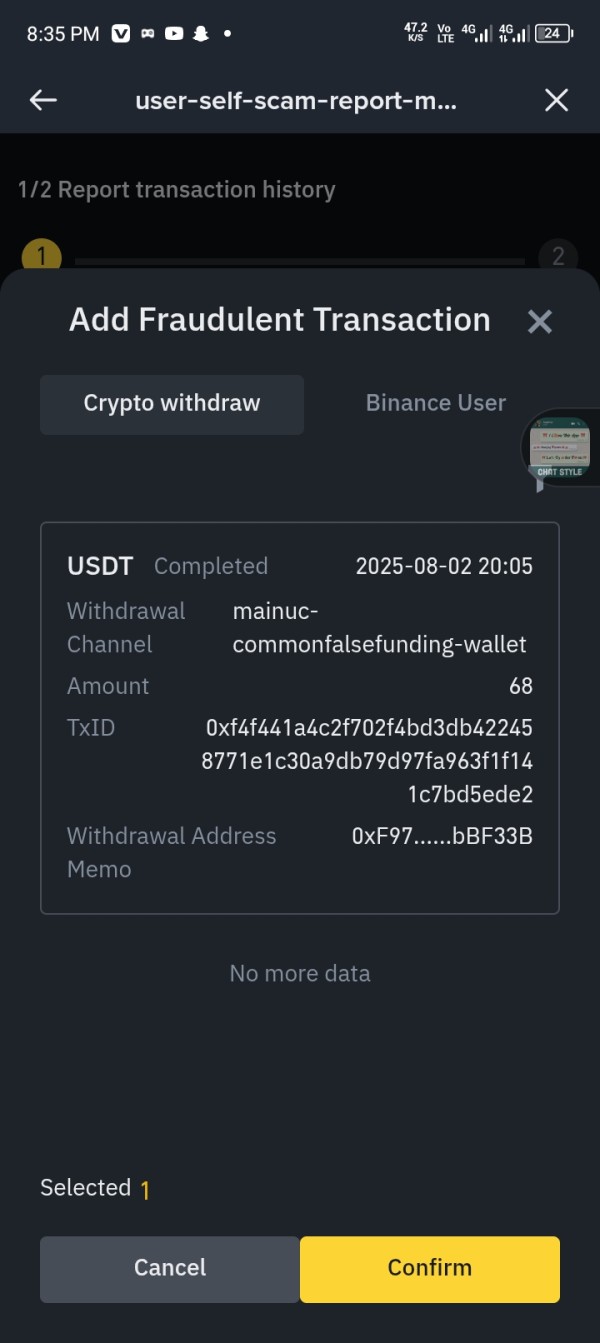

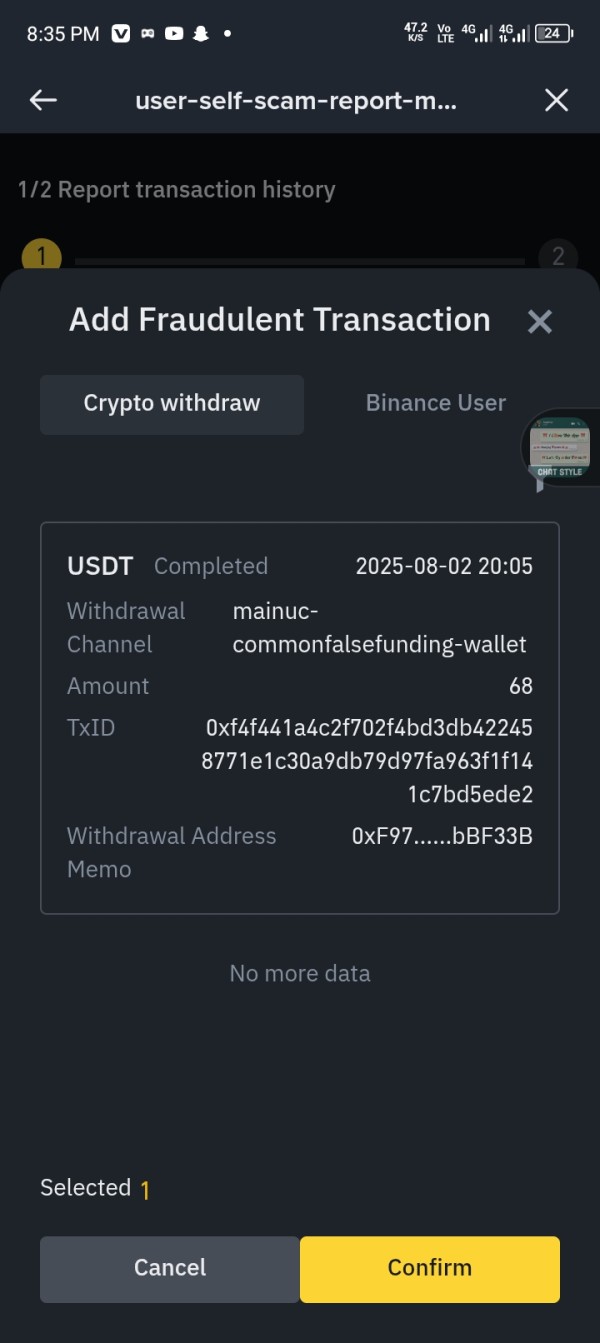

The "SCAM" designation from multiple broker monitoring platforms represents a severe warning about the broker's reliability. This classification typically results from evidence of fraudulent practices, regulatory violations, or consistent patterns of client complaints that suggest systematic problems.

Fund security measures are not transparently disclosed. The lack of regulatory oversight means that standard protections such as deposit insurance or segregated client accounts cannot be verified. This absence of verified fund protection represents a significant risk for client capital.

Company transparency is severely lacking, with no publicly available financial reports, regulatory filings, or detailed company information that would typically be expected from legitimate financial services providers. The claimed London headquarters cannot be verified through regulatory databases.

User withdrawal problems represent perhaps the most serious trust concern, with multiple reports of clients experiencing difficulties accessing their funds. These withdrawal issues, combined with the lack of regulatory recourse, create a high-risk environment for client capital.

Industry reputation is notably poor, with warnings from multiple review platforms and broker monitoring services advising potential clients to avoid the broker entirely due to legitimacy concerns.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Exnova shows mixed results, reflected in the 4-star TrustScore on Trustpilot. This rating is significantly impacted by serious negative feedback regarding core functionality. The positive aspects of user experience appear to center around interface design and ease of use for basic trading activities.

Users generally report that the interface design is intuitive and accessible, particularly for newcomers to online trading. The platform's simplicity appears to be appreciated by traders who prefer straightforward functionality over complex feature sets.

However, the registration and verification process details are not clearly documented. This makes it difficult for potential users to understand account opening requirements and timelines. This lack of process transparency can create uncertainty for new clients.

The fund operation experience represents the most significant negative aspect of user experience, with numerous reports of withdrawal difficulties and account access problems. These issues fundamentally undermine user confidence and satisfaction regardless of other platform features.

Common user complaints consistently focus on slow customer service response times and withdrawal processing problems. These core operational issues significantly impact overall user satisfaction and create frustration even among users who appreciate other aspects of the platform.

The user base appears to consist primarily of newer traders attracted by the low minimum deposit requirement. Experienced traders generally express concerns about the lack of advanced features and regulatory protection. User feedback suggests that while the platform may be suitable for very small-scale trading or learning purposes, it lacks the reliability and protection needed for serious trading activities.

Conclusion

This exnova review concludes that Exnova presents significant risks that outweigh any potential benefits for serious traders. The broker offers an attractive low minimum deposit requirement of $10 and claims to provide user-friendly trading access to forex, options, and cryptocurrency markets. However, the fundamental issues surrounding regulatory compliance and operational transparency make it unsuitable for most trading needs.

The broker's "SCAM" designation from multiple monitoring platforms, combined with persistent user reports of withdrawal difficulties and the complete absence of regulatory authorization, creates an unacceptably high-risk environment for client funds. The lack of transparency regarding trading costs, platform features, and company operations further undermines confidence in the broker's legitimacy.

For traders seeking low-barrier entry into financial markets, numerous regulated alternatives offer similar accessibility with proper client protections and regulatory oversight. The risks associated with Exnova's unregulated status and problematic user feedback far outweigh the appeal of its low minimum deposit requirement.

Potential users should prioritize regulated brokers that offer transparent operations, verified client fund protection, and reliable customer service over unregulated platforms that may compromise fund security and trading reliability.