WEX Review 1

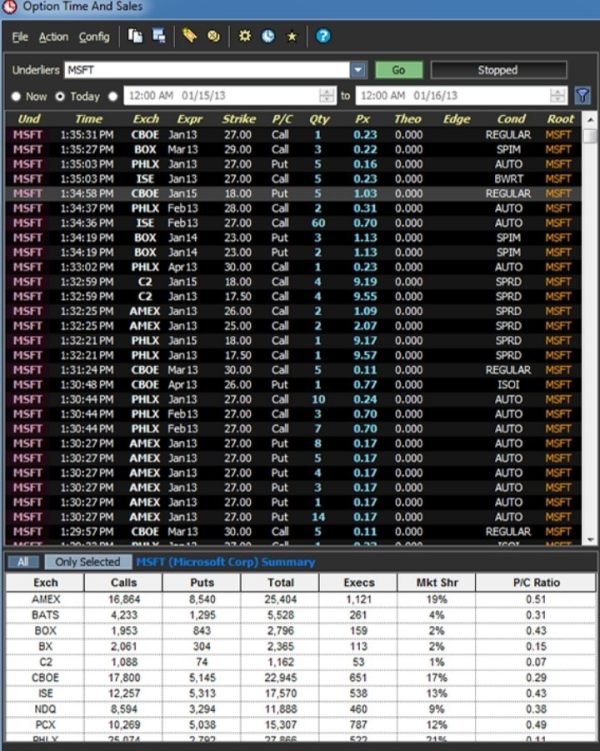

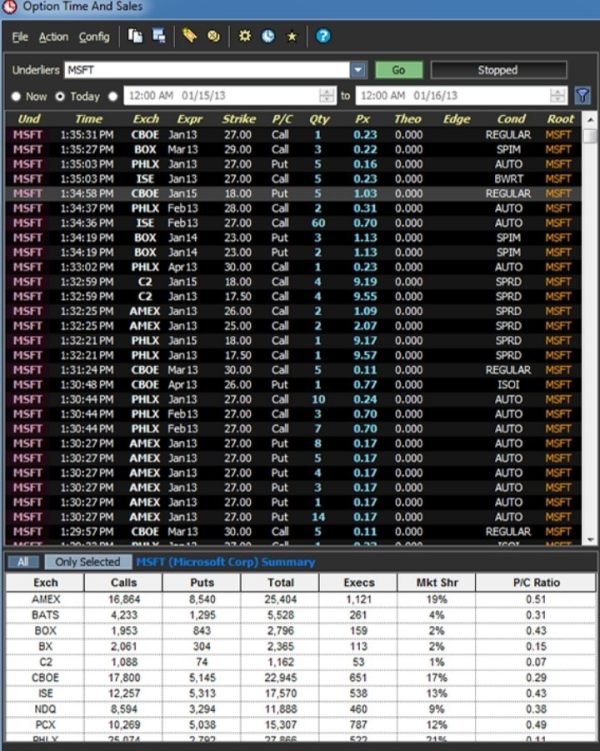

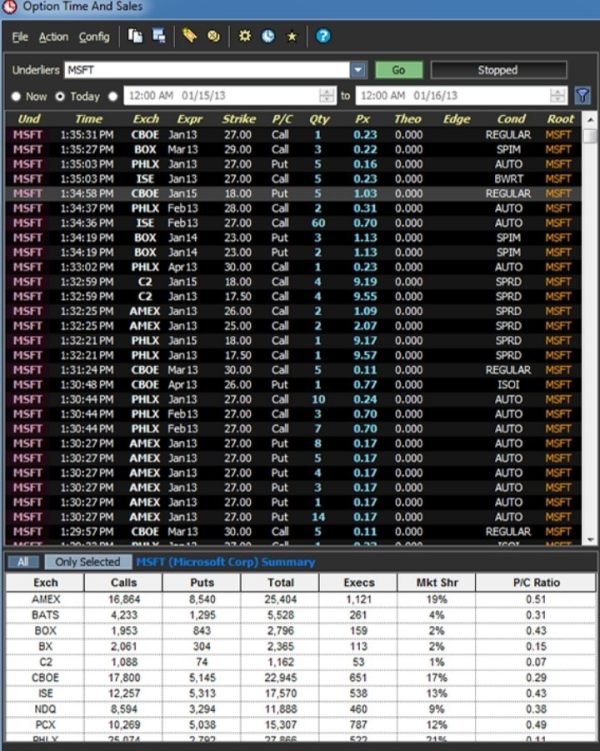

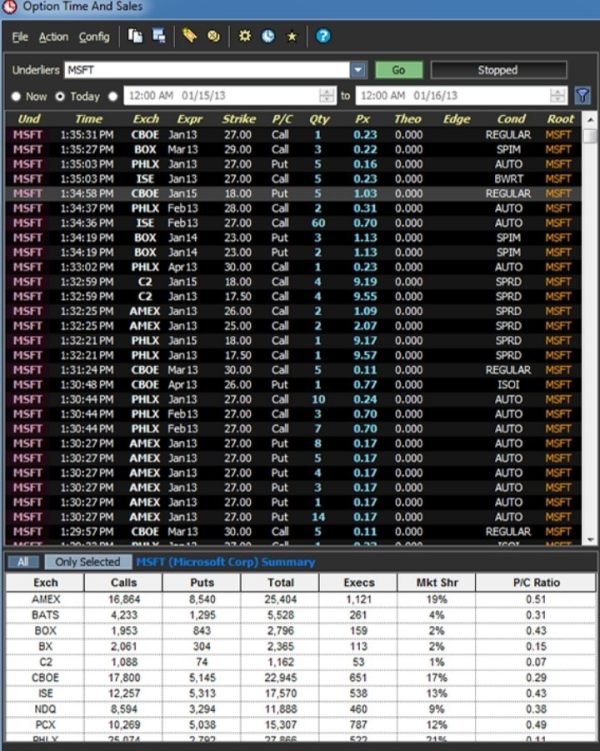

The transaction information was different from the market as the pictures showed, which led to my losses.

WEX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The transaction information was different from the market as the pictures showed, which led to my losses.

This wex review looks at a trading services provider that works in multiple areas within the financial sector. WEX represents both WEX Inc., which started in 2019 and focuses mainly on credit card processing and fleet card services, and Wolverine Execution Services, a subsidiary of Wolverine Trading, LLC that specializes in providing trading execution services to institutional investors.

The platform offers a user-friendly WEX Trading Platform that provides advanced trading tools for equity, options, futures, and ETF execution. With 1,127 user ratings showing strong market engagement, WEX targets institutional investors and traders who want complex trading features. However, our analysis shows major information gaps about regulatory oversight, specific trading conditions, and customer service protocols.

The platform's main strength lies in its complete trading execution capabilities and institutional-grade tools, making it particularly suitable for advanced traders and institutional clients. Still, the lack of clear regulatory information and detailed account conditions creates concerns for potential users seeking complete broker evaluation data.

This evaluation is based on available user feedback, platform feature analysis, and publicly accessible information. Readers should note that specific regulatory details, complete trading conditions, and detailed service specifications were not available in current documentation. Our assessment method includes user ratings analysis, platform functionality review, and industry standard comparisons where applicable.

Potential clients should conduct independent verification of regulatory status and trading conditions before engaging with any trading platform. This review reflects information available as of 2025 and may not capture recent platform updates or regulatory changes.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account information not detailed in available sources |

| Tools and Resources | 8/10 | Sophisticated and user-friendly WEX Trading Platform with comprehensive trading capabilities |

| Customer Service | N/A | Customer service information not specified in available documentation |

| Trading Experience | N/A | Detailed trading experience metrics not provided in source materials |

| Trust and Reliability | 5/10 | Limited regulatory transparency and unclear oversight information |

| User Experience | 7/10 | Positive user engagement with 1,127 ratings, but lacking detailed experience feedback |

WEX Inc. was established in 2019, positioning itself primarily in the credit card processing and fleet card services sector. According to Fleet Logging reports, the company has developed a significant presence in the fuel card and fleet management industry, offering specialized payment solutions for business fleets and commercial operations.

Wolverine Execution Services, operating as a subsidiary of Wolverine Trading, LLC, focuses specifically on institutional trading execution services. This entity provides algorithmic trading solutions, direct exchange access, and agency brokerage services to institutional investors. The platform emphasizes advanced trading capabilities designed for complex global market operations.

The WEX Trading Platform serves as the primary trading interface, offering customizable trading environments for equity, options, futures, and ETF execution. The platform includes advanced order management systems, execution management systems, and algorithmic trading capabilities. Users can access basic and crossing order entry functionality, along with volatility and dispersion trading tools that include dynamic risk controls and hedge management features.

This wex review indicates that the platform supports multiple asset classes and provides institutional-grade trading infrastructure, though specific regulatory jurisdictions and oversight mechanisms remain unclear in available documentation.

Regulatory Jurisdictions: Available sources do not specify the primary regulatory jurisdictions under which WEX operates, presenting a significant information gap for potential clients seeking regulatory clarity.

Deposit and Withdrawal Methods: Specific funding mechanisms and withdrawal procedures are not detailed in current documentation, though the platform's focus on institutional clients suggests traditional wire transfer and institutional funding channels.

Minimum Deposit Requirements: Minimum account funding thresholds are not specified in available materials, likely varying based on institutional client requirements and account types.

Promotional Offers: No specific bonus structures or promotional programs are mentioned in current platform documentation.

Tradeable Assets: The platform supports equity trading, options contracts, futures instruments, and exchange-traded funds, providing complete market access for institutional trading strategies.

Cost Structure: Detailed fee schedules, commission rates, and cost breakdowns are not provided in available sources, representing a critical information gap for cost-conscious traders.

Leverage Options: Leverage ratios and margin requirements are not specified in current documentation.

Platform Selection: Primary trading occurs through the WEX Trading Platform, offering customizable trading environments and advanced order management capabilities.

Geographic Restrictions: Specific regional limitations or service availability restrictions are not detailed in available sources.

Customer Service Languages: Language support options for customer service are not specified in current documentation.

This wex review highlights significant information gaps that potential clients should address through direct platform inquiry.

The evaluation of WEX's account conditions faces substantial limitations due to insufficient detailed information in available sources. Current documentation does not specify account type varieties, tier structures, or specific features that differentiate various account offerings. This represents a significant concern for potential clients seeking complete account comparison data.

Minimum deposit requirements remain unspecified, making it difficult for prospective users to assess accessibility and entry barriers. The platform's institutional focus suggests potentially higher minimum funding requirements compared to retail-oriented brokers, but specific thresholds are not documented.

Account opening procedures and verification processes are not detailed in available materials. For institutional clients, this likely involves complete due diligence and compliance verification, but specific requirements and timelines remain unclear.

Special account features, including Islamic trading accounts, corporate account structures, or managed account options, are not mentioned in current documentation. This wex review cannot provide definitive guidance on specialized account availability without additional platform-specific information.

The absence of detailed account condition information significantly limits the ability to provide complete evaluation guidance, requiring potential clients to seek direct clarification from WEX representatives.

WEX demonstrates significant strength in trading tools and platform capabilities, earning an 8/10 rating based on available information. The WEX Trading Platform offers advanced functionality designed for institutional-grade trading operations, including customizable trading environments that allow users to tailor their trading interface to specific operational requirements.

The platform provides complete order entry capabilities, supporting basic and crossing order execution across multiple asset classes including equity, options, futures, and ETFs. Advanced algorithmic trading tools include volatility and dispersion trading capabilities with user-defined dynamic controls, enabling advanced risk management and hedging strategies.

Execution Management Systems and Order Management Systems provide institutional-level trade processing capabilities, supporting complex trading workflows and multi-asset strategy implementation. The platform's algorithmic trading infrastructure suggests robust technological capabilities designed for high-frequency and advanced trading operations.

However, specific research and analysis resources are not detailed in available documentation. Educational materials, market analysis tools, and fundamental research capabilities remain unspecified, representing potential gaps for users seeking complete trading support resources.

Automated trading support appears robust based on algorithmic trading capabilities, though specific API access, third-party integration options, and custom strategy development tools are not explicitly documented in current materials.

Customer service evaluation faces significant limitations due to insufficient information in available sources regarding support infrastructure, response capabilities, and service quality metrics. Current documentation does not specify available customer service channels, whether phone, email, live chat, or dedicated institutional support lines are provided.

Response time commitments and service level agreements are not detailed in available materials, making it impossible to assess support efficiency or reliability standards. For institutional clients, dedicated relationship management and technical support would typically be expected, but specific service structures remain undocumented.

Service quality indicators, including customer satisfaction metrics, resolution rates, or support team expertise levels, are not provided in current sources. The platform's institutional focus suggests potentially higher-touch support models, but specific service delivery approaches are not confirmed.

Multi-language support capabilities are not specified, potentially limiting accessibility for international institutional clients. Operating hours, geographic coverage, and time zone support options remain unclear based on available documentation.

Without user feedback specifically addressing customer service experiences, this evaluation cannot provide definitive assessment of support quality or effectiveness. The absence of detailed customer service information represents a significant gap for potential clients evaluating platform suitability, particularly for institutional users requiring reliable support infrastructure.

Trading experience evaluation encounters substantial limitations due to insufficient specific information regarding platform performance, execution quality, and user interface functionality. Available sources indicate advanced trading capabilities through the WEX Trading Platform, but detailed performance metrics remain unspecified.

Platform stability and execution speed data are not provided in current documentation, making it impossible to assess system reliability or latency performance. For institutional trading operations, these factors represent critical evaluation criteria that require direct platform testing or vendor-provided performance specifications.

Order execution quality metrics, including fill rates, slippage statistics, and price improvement data, are not detailed in available materials. The platform's institutional focus suggests professional-grade execution capabilities, but specific performance benchmarks remain undocumented.

Platform functionality completeness appears robust based on described capabilities, including advanced order types, algorithmic trading tools, and multi-asset support. However, specific feature sets, customization options, and workflow efficiency measures are not fully detailed.

Mobile trading experience information is not provided in current sources, potentially limiting assessment for users requiring mobile trading capabilities. The institutional focus may prioritize desktop functionality, but mobile access options remain unclear.

This wex review cannot provide definitive trading experience assessment without additional performance data and user experience metrics from actual platform usage.

Trust and reliability assessment reveals significant concerns due to limited regulatory transparency and unclear oversight mechanisms. The 5/10 rating reflects substantial information gaps regarding regulatory compliance, supervision, and financial protection measures that are essential for complete broker evaluation.

Regulatory credentials and licensing information are not specified in available documentation, representing a critical transparency issue for potential clients. Institutional trading platforms typically operate under specific regulatory frameworks, but WEX's regulatory status remains unclear based on current sources.

Fund safety measures, including client fund segregation, deposit protection schemes, and custodial arrangements, are not detailed in available materials. For institutional clients managing substantial assets, these protections represent fundamental security requirements that require clear documentation.

Company transparency regarding ownership structure, financial stability, and operational governance is limited in current sources. While Wolverine Trading, LLC is identified as the parent company for Wolverine Execution Services, detailed corporate information and financial disclosures are not provided.

Industry reputation and third-party validation information are not available in current documentation. Professional recognition, regulatory compliance history, and industry awards or certifications that could support credibility assessment are not mentioned.

The absence of complete regulatory and transparency information significantly impacts trust assessment, requiring potential clients to conduct independent due diligence regarding platform reliability and regulatory compliance.

User experience evaluation indicates generally positive engagement based on available metrics, earning a 7/10 rating despite limited detailed feedback information. The platform demonstrates substantial user participation with 1,127 user ratings, suggesting significant market engagement and active user base.

Overall user satisfaction appears positive based on rating volume, though specific satisfaction scores and detailed user feedback content are not provided in current sources. The sustained user engagement suggests acceptable platform performance, but detailed satisfaction metrics remain unavailable.

Interface design and usability receive positive assessment based on descriptions of the WEX Trading Platform as "user-friendly" and offering "customizable trading environments." The institutional focus suggests professional-grade interface design, though specific usability testing results or user interface reviews are not documented.

Registration and account verification processes are not detailed in available sources, making it difficult to assess onboarding efficiency or user experience during account establishment. Institutional platforms typically involve complete verification procedures, but specific workflow experiences remain undocumented.

Funding operation experiences and transaction processing efficiency are not specified in current materials. User feedback regarding deposit, withdrawal, and account management experiences would provide valuable insight but are not available in current documentation.

The platform appears well-suited for users seeking advanced trading tools and institutional-grade capabilities, though specific user demographics and satisfaction details require additional research for complete assessment.

This wex review reveals a trading platform with advanced institutional capabilities but significant information transparency gaps. WEX offers advanced trading tools through the WEX Trading Platform, supporting multiple asset classes and providing algorithmic trading capabilities suitable for institutional investors and advanced traders.

The platform's primary strengths include complete trading execution services, user-friendly interface design, and robust technological infrastructure supporting complex trading strategies. However, critical limitations include unclear regulatory oversight, unspecified trading conditions, and insufficient customer service documentation.

WEX appears most suitable for institutional investors and experienced traders seeking advanced trading tools and execution capabilities, particularly those comfortable operating with limited regulatory transparency. Potential users should conduct thorough due diligence regarding regulatory compliance, account conditions, and service specifications before platform engagement.

FX Broker Capital Trading Markets Review