Founded in 2019 by Sam Bankman-Fried and Gary Wang, FTX quickly evolved from a promising startup into a major player in the cryptocurrency exchange landscape, celebrated for its innovative products and approaches. Headquartered in the Bahamas, it positioned itself as a hub for derivatives trading in cryptocurrency. Despite its rapid growth, the lack of regulatory oversight from established agencies became a critical vulnerability in its operational model, triggering its eventual downfall in late 2022.

FTXs repertoire of products included spot trading, futures contracts, options, and unique financial instruments such as leveraged tokens. This extensive offering was complemented by claimed regulatory affiliations with authorities in various jurisdictions. However, scrutiny revealed significant discrepancies in these claims, exacerbating user concerns about the platform's legitimacy and safety.

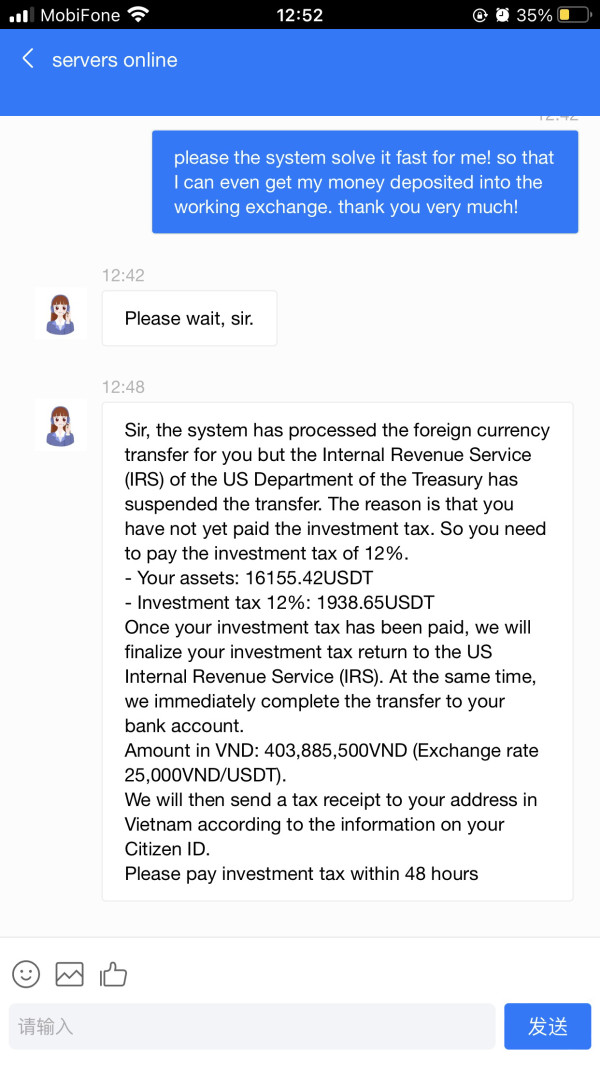

FTX operated without valid financial oversight, which is essential for ensuring the safety of customer funds. Reports indicate that potential regulatory affiliations were either misleading or outright fabricated, inviting scrutiny and fears of unprincipled operations, which significantly undermine user trust.

- Visit Official Regulatory Websites: Check for license and registration status through national and region-based regulatory bodies.

- Search for Official Filings: Review regulatory filings or announcements that pertain to the broker.

- Request Documentation: If possible, ask for proof of regulation from the broker directly to ascertain their claims.

Industry Reputation and Summary

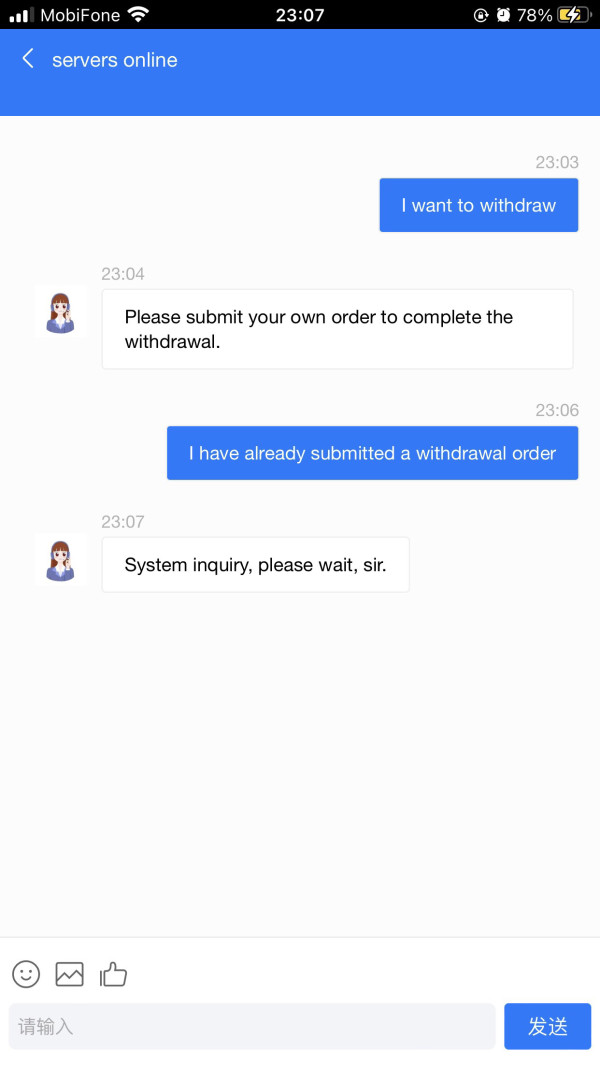

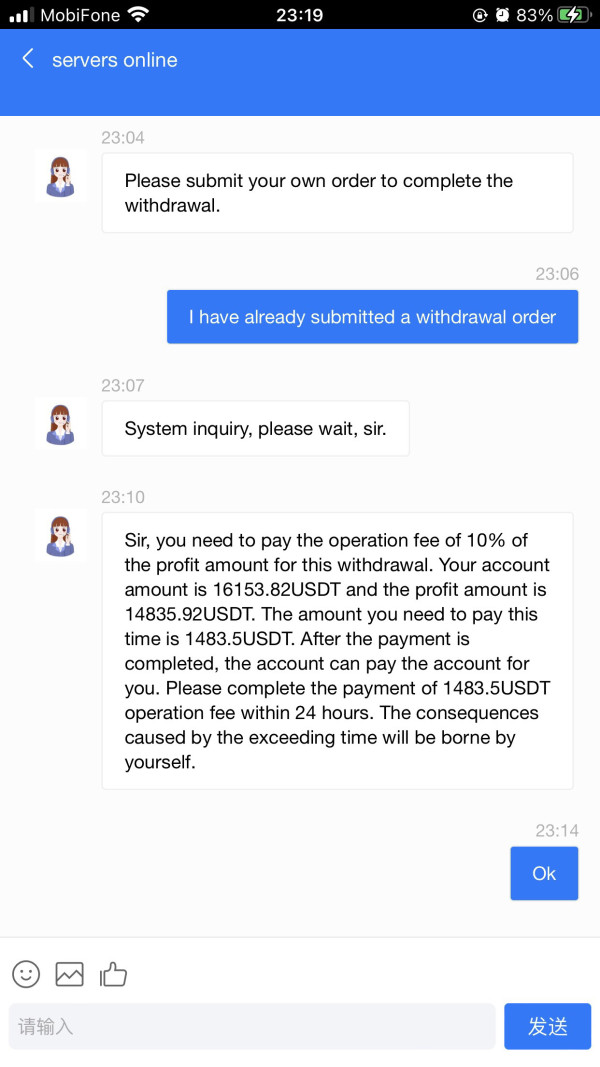

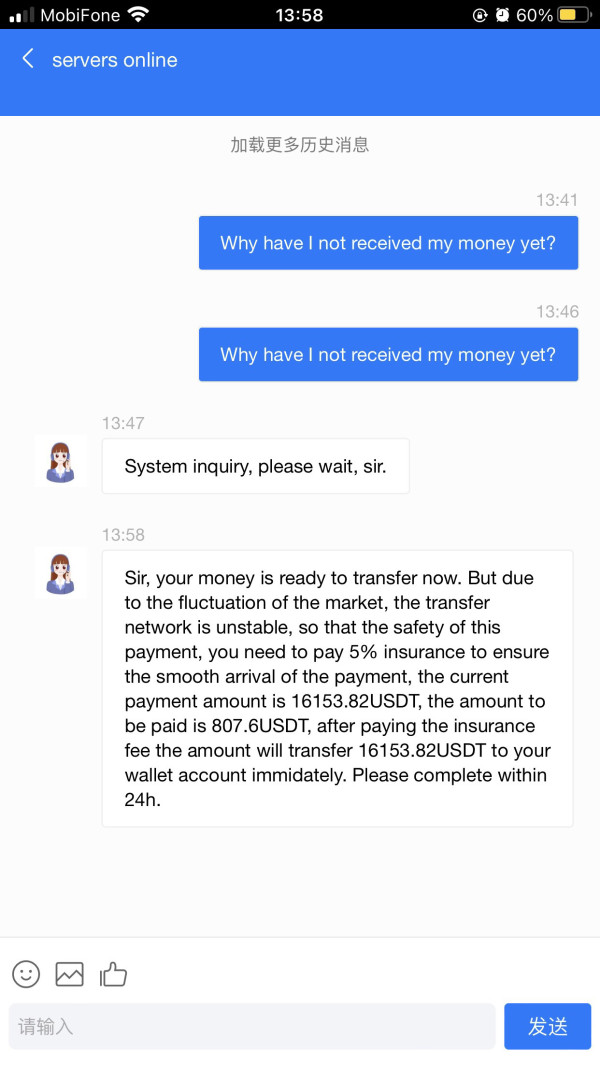

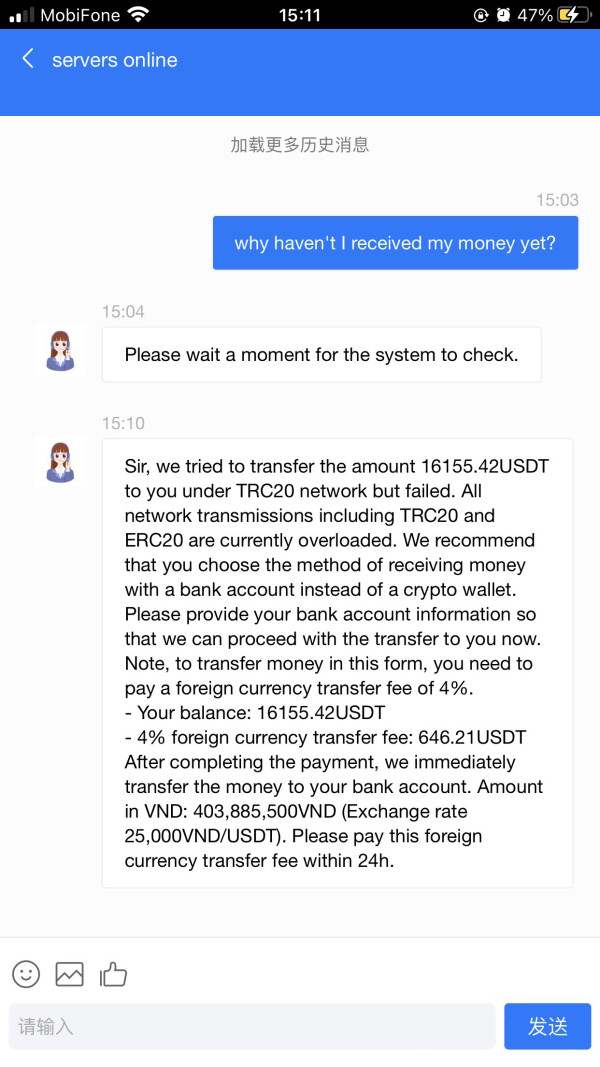

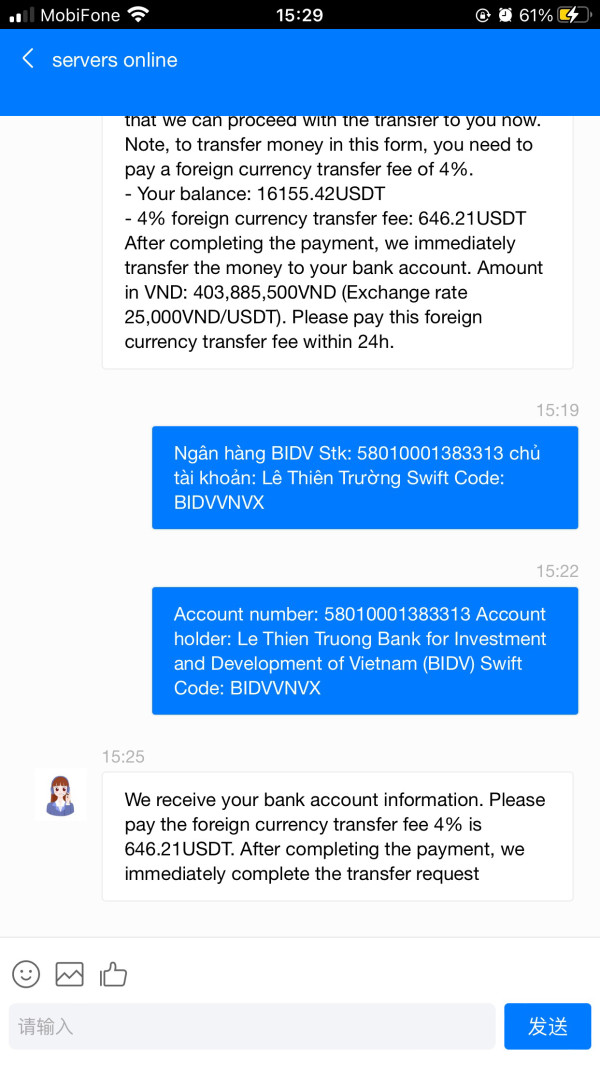

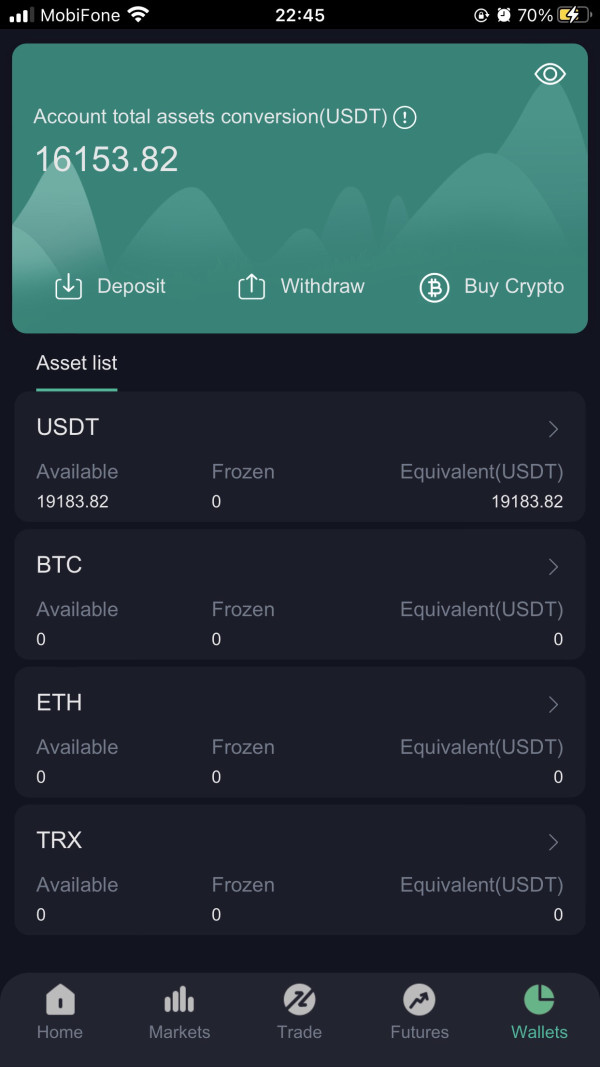

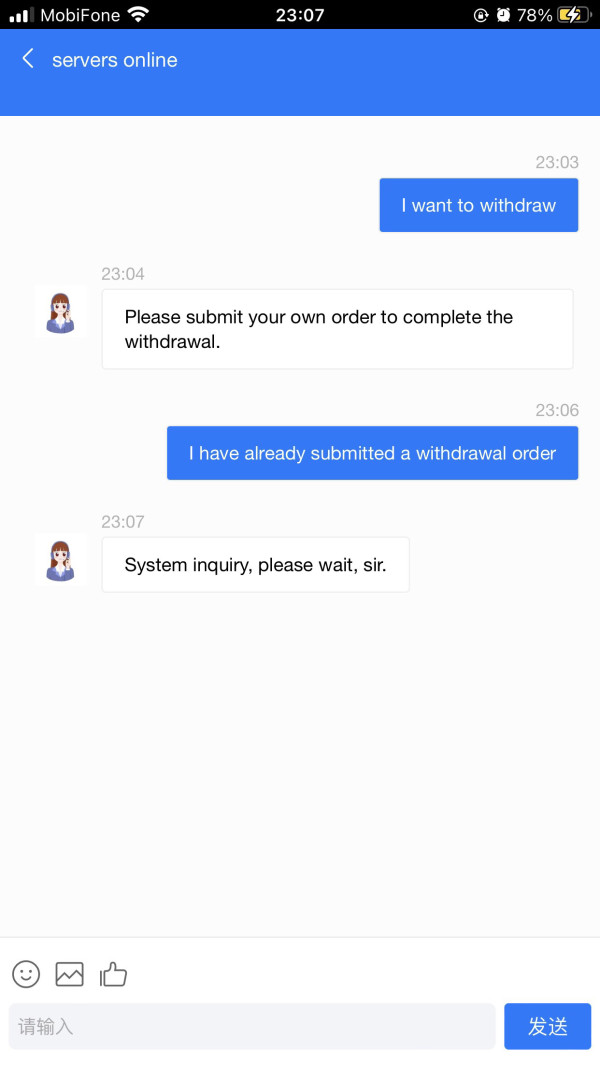

User feedback regarding FTX has been overwhelmingly negative, particularly around withdrawal issues and customer support inadequacies, leading to a significant reduction in its reputation. Many users reported their inability to withdraw funds and cited unresponsive customer service, raising serious alarms about the integrity of the platform.

Trading Costs Analysis

Advantages in Commissions

FTX was known for its competitive trading fees, offering low costs—0.02% for makers and 0.07% for takers—appealing to active traders looking to minimize their expenses. These advantages were a significant draw for users.

The "Traps" of Non-Trading Fees

Although initially attractive, users reported unexpected withdrawal fees and issues that countered the perceived low costs. Specific complaints indicated withdrawal delays and significant charges not initially advertised. For instance:

“I was charged $30 to withdraw my funds, which I thought were free.”

Cost Structure Summary

While the trading environment seemed economically favorable, the hidden costs coupled with the trading complexities added layers of risk, especially to novice users who may not fully grasp the total expenses involved.

FTX offered a range of platforms designed for high-capacity trading environments, including web-based and mobile applications. While these platforms were intuitive for seasoned traders, they proved daunting for beginners due to the overwhelming array of options and settings.

FTXs platform included sophisticated charting tools and analytics that competitors offered. However, there was a noted lack of educational resources for beginner traders, which limits their ability to navigate the complexities of such an advanced trading environment.

User experiences remained varied, with seasoned traders appreciating the platform's capabilities while newcomers expressed frustration with the steep learning curve—often finding customer support to be inadequate when assistance was needed.

User Experience Analysis

Overall Assessment

The user interface was designed to be streamlined and effective for those familiar with trading, yet reports indicate a disparity in customer satisfaction, with usability concerns stemming from complicated features and insufficient support channels.

Customer Support Analysis

Analysis of Available Support

User reviews reveal that the customer support system was inefficient, with many users facing prolonged response times and inadequate assistance to resolve issues, particularly regarding withdrawals, creating an erosion of trust.

Account Conditions Analysis

Complexity and Transparency

FTX's account conditions were criticized for their convoluted verification processes and unclear terms, which left users feeling uncertain about their financial safety. Furthermore, users expressed frustrations regarding withdrawal limits and additional fees encountered unexpectedly.

Conclusion

The saga of FTX serves as a critical cautionary tale in the world of cryptocurrency trading. While it once positioned itself as an innovative, leading platform, its operational failures, regulatory oversights, and ethical implications culminated in its collapse. Users are strongly advised against engaging with FTX, particularly in light of the significant risks involved with unregulated platforms lacking substantive oversight.

Final Thoughts

Investors looking to navigate the cryptocurrency landscape should prioritize safety, regulatory compliance, and transparency. Relying on reputable brokers is essential for safeguarding financial interests in a marketplace fraught with volatility and potential fraud. Always conduct thorough research and remain vigilant in safeguarding your investments.