Absolute Markets 2025 Review: All You Need to Know

Executive Summary

Absolute Markets is an emerging forex broker established in 2021. It offers competitive trading conditions but struggles with overall user satisfaction. This absolute markets review reveals a concerning pattern of user dissatisfaction, with the broker receiving an average rating of only 2.7 stars from traders. Despite providing competitive spreads starting from 0.0 pips and leverage up to 1:1000, the broker faces significant challenges in customer service and trust-building.

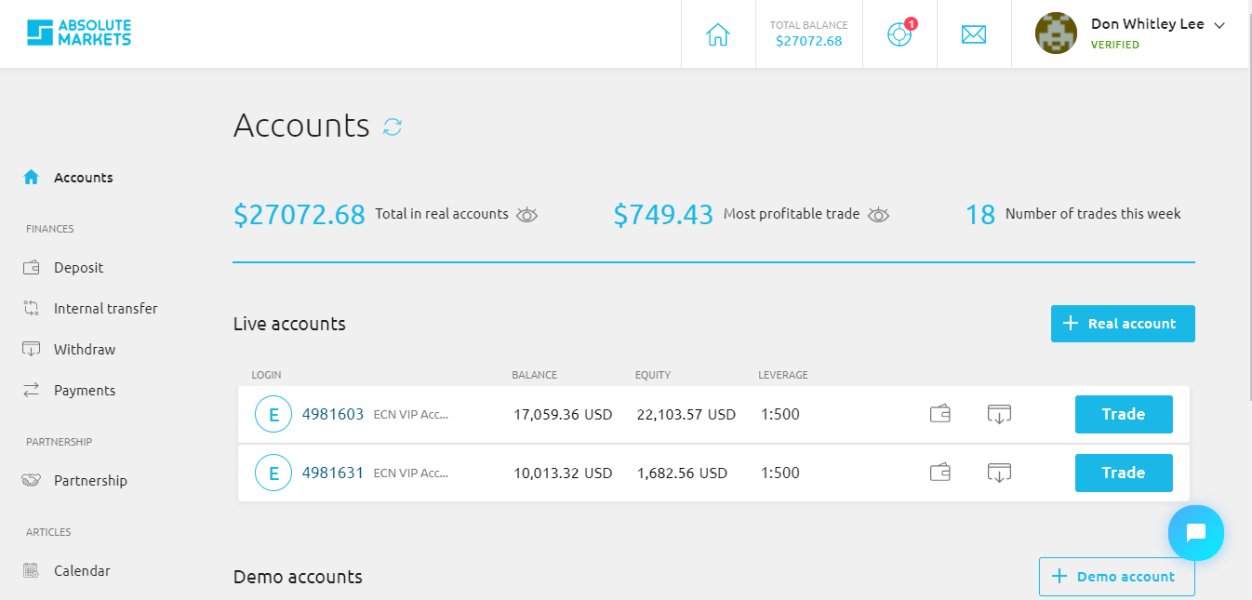

The broker operates primarily through STP and ECN models. It targets the Southeast Asian market with a minimum deposit requirement of just $50 USD. According to ComplaintsBoard and other review platforms, users frequently report issues with customer support responsiveness and overall service quality. While Absolute Markets offers access to multiple asset classes including forex, CFDs, indices, cryptocurrencies, energy, and stocks through the MetaTrader 4 platform, the overall user experience remains problematic. The broker's headquarters in Saint Vincent and the Grenadines, combined with limited regulatory transparency, adds to concerns about its credibility in the competitive forex market.

Important Notice

This review is based on available public information, user feedback, and market analysis as of 2025. Absolute Markets has not provided clear regulatory information, which may affect its legitimacy and trustworthiness across different jurisdictions. Potential traders should exercise caution and conduct thorough due diligence before opening accounts.

The evaluation methodology incorporates user reviews from multiple platforms, trading condition analysis, and assessment of available broker features. Given the limited regulatory transparency and mixed user feedback, this review aims to provide an objective assessment while highlighting areas of concern for potential clients.

Rating Framework

Broker Overview

Absolute Markets entered the forex brokerage scene in 2021. It established its headquarters in Kingstown, Saint Vincent and the Grenadines. The broker operates through STP and ECN models, positioning itself as a competitive player in the Southeast Asian forex market. According to FX-List and other industry sources, the company focuses on providing access to global financial markets through technological solutions and competitive trading conditions.

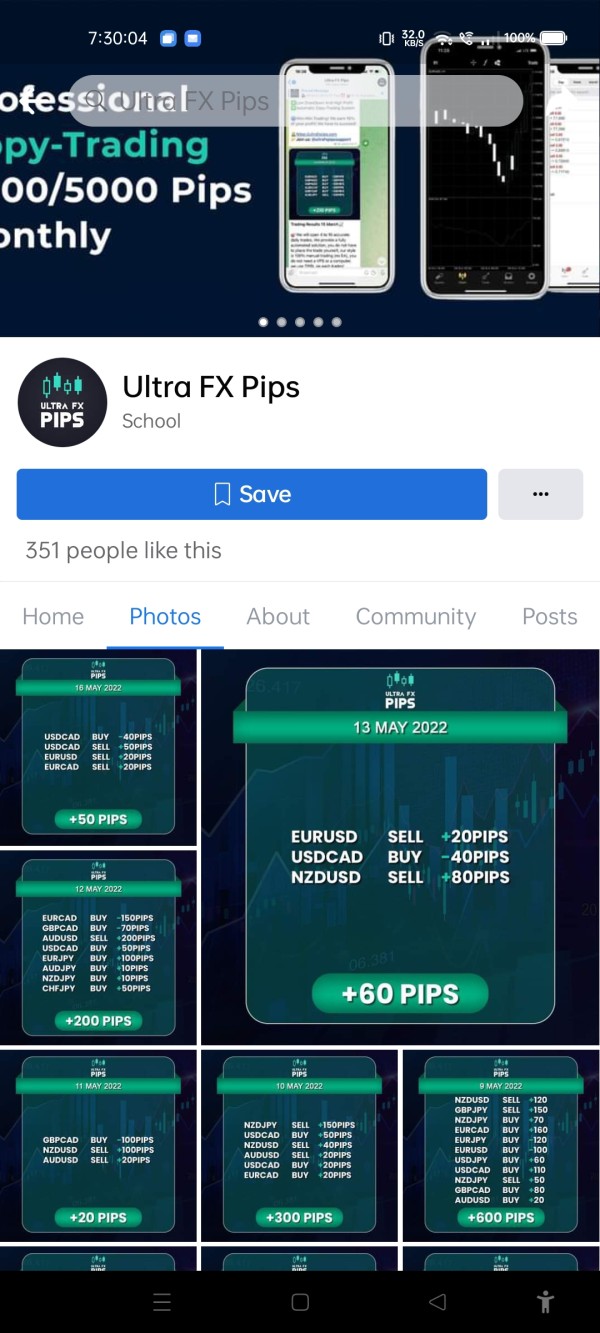

The broker's business model centers around offering multi-asset trading opportunities. These include traditional forex pairs, contracts for difference, stock indices, cryptocurrencies, energy commodities, and individual stocks. This absolute markets review indicates that despite the broker's ambitious scope and modern approach to online trading, the execution of services has fallen short of industry standards, particularly in customer satisfaction and support quality.

Absolute Markets utilizes the widely-recognized MetaTrader 4 platform as its primary trading interface. It provides traders with familiar tools and functionality. The broker's target demographic appears to be retail traders in Southeast Asia, offering localized banking solutions and region-specific support. However, the lack of comprehensive regulatory oversight and limited transparency regarding company operations has contributed to user skepticism and negative feedback across multiple review platforms.

Regulatory Status: Available information does not specify concrete regulatory oversight, which raises concerns about trader protection and compliance standards. The Saint Vincent and the Grenadines jurisdiction provides limited regulatory framework compared to major financial centers.

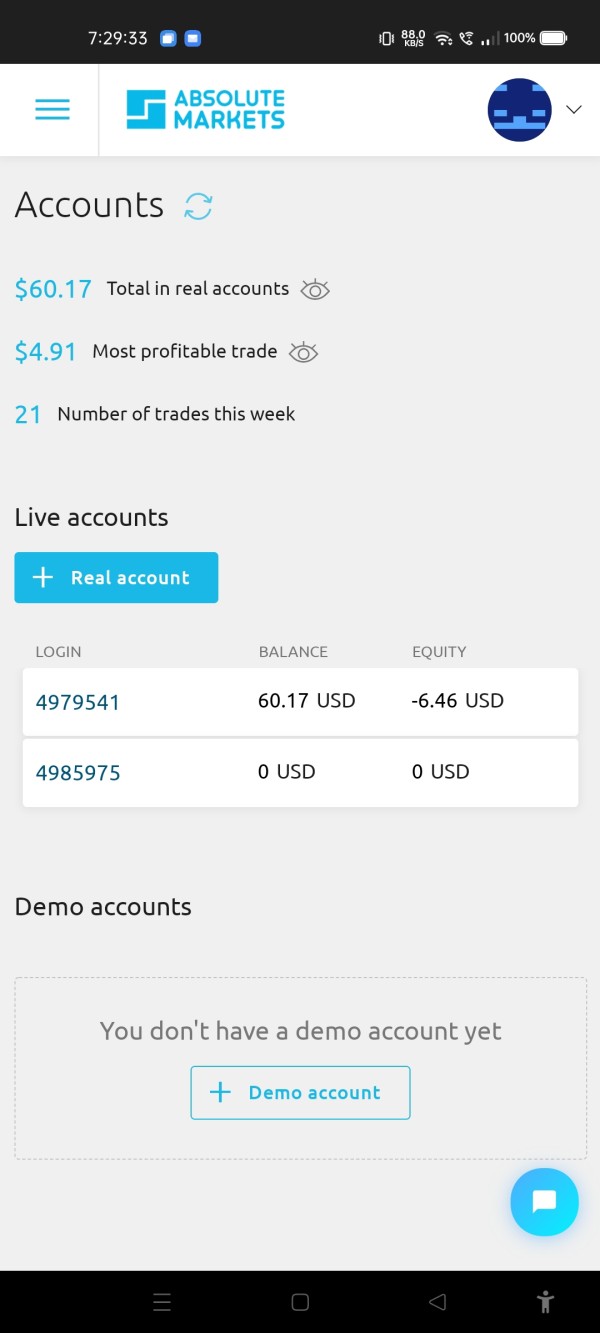

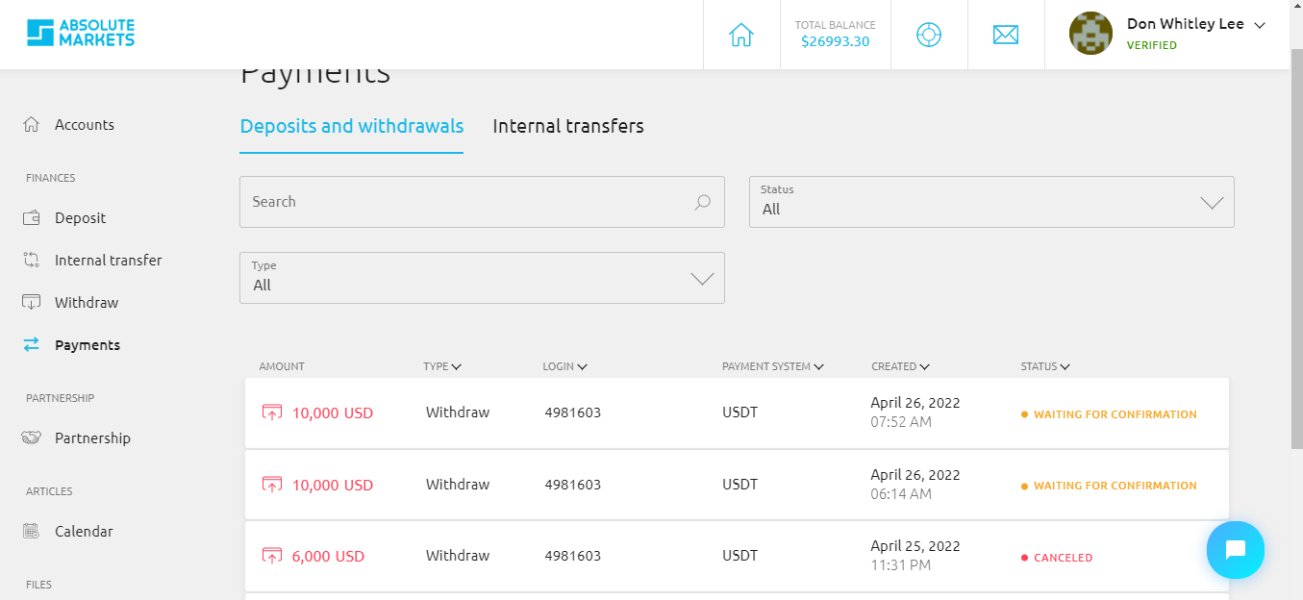

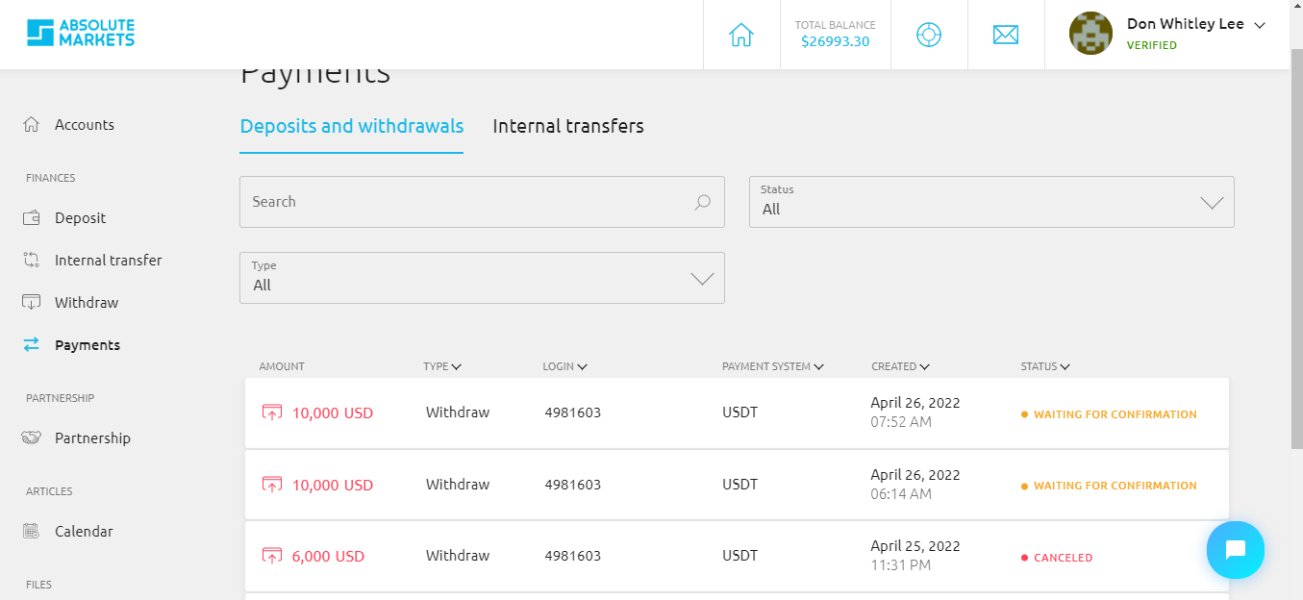

Deposit and Withdrawal Methods: The broker offers local bank transfer options, particularly catering to Southeast Asian markets. The minimum deposit requirement stands at $50 USD, making it accessible to entry-level traders. However, comprehensive details about withdrawal processes, fees, and processing times are not extensively documented in available sources.

Minimum Deposit Requirements: At $50 USD, Absolute Markets sets a relatively low barrier to entry. This could appeal to novice traders or those with limited initial capital. This positioning aligns with the broker's apparent focus on emerging markets.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available documentation. This suggests either limited promotional activities or insufficient marketing transparency.

Tradeable Assets: The broker provides access to six main asset categories: foreign exchange pairs, contracts for difference, stock indices, cryptocurrencies, energy commodities, and individual stocks. This diversification allows traders to build varied portfolios across different market sectors.

Cost Structure: Spreads begin at 0.0 pips, indicating competitive pricing for certain account types. However, commission structures and additional fees are not clearly specified in available materials, which could lead to unexpected costs for traders.

Leverage Options: Maximum leverage reaches 1:1000, providing significant amplification opportunities for experienced traders while potentially increasing risk exposure for inexperienced users.

Platform Selection: MetaTrader 4 serves as the primary trading platform. It offers standard functionality including technical analysis tools, automated trading capabilities, and mobile access.

Geographic Restrictions: Primary focus on Southeast Asian markets may limit accessibility for traders in other regions. However, specific restrictions are not clearly documented.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

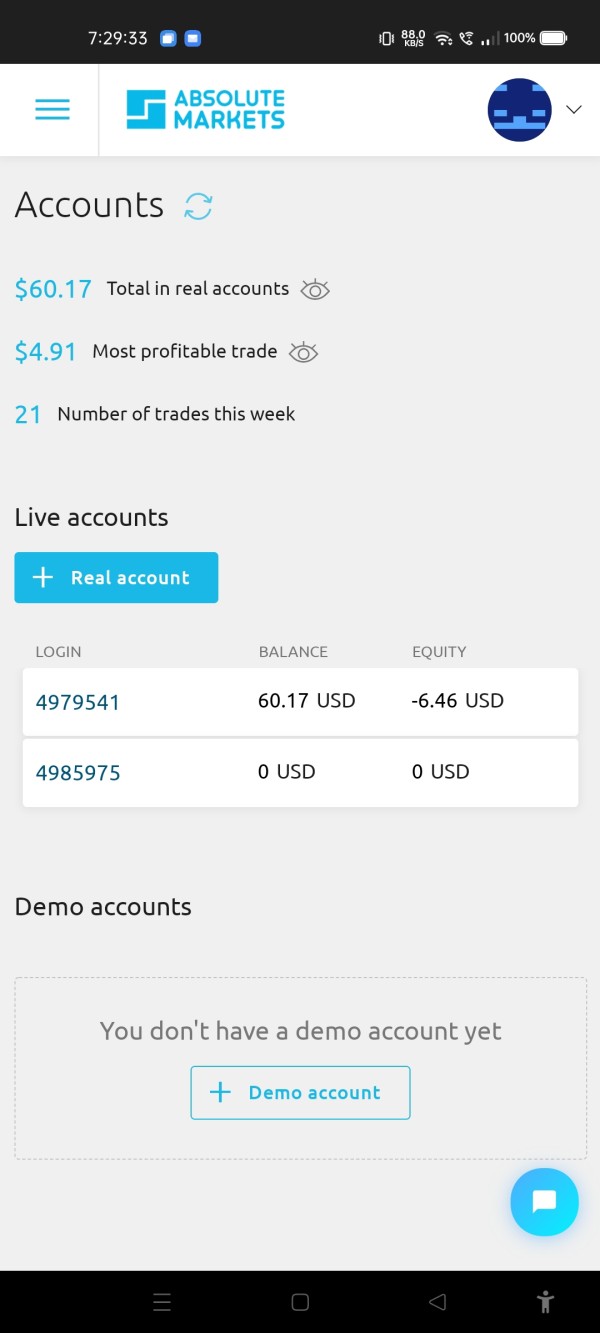

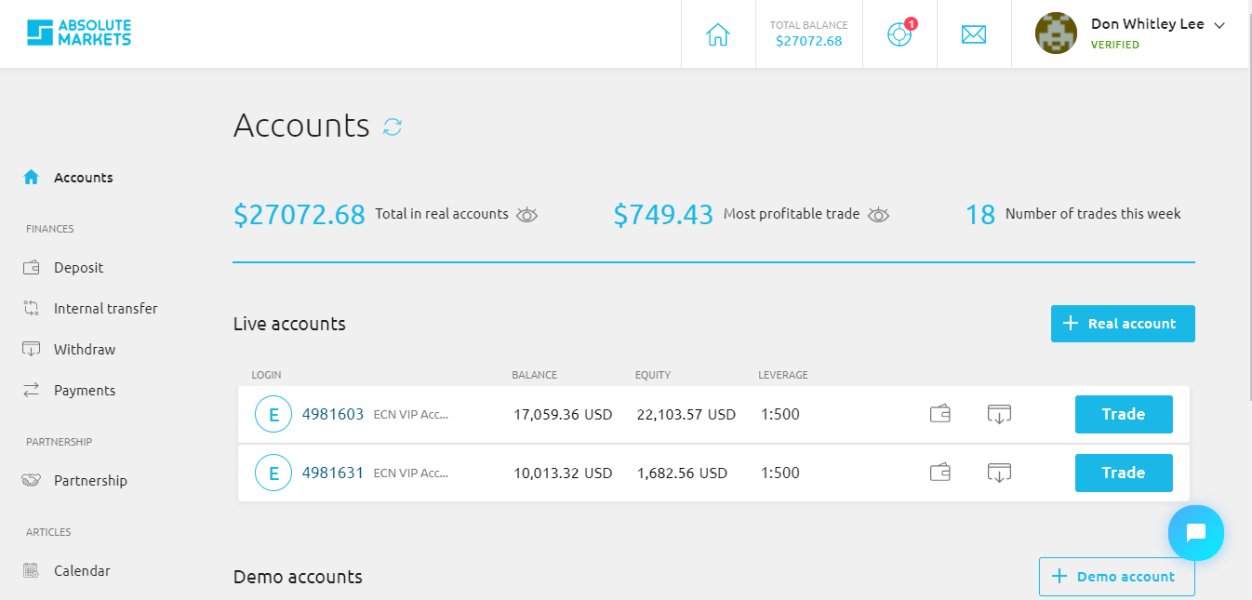

The account conditions offered by Absolute Markets present a mixed picture for potential traders. While the $50 minimum deposit requirement makes the broker accessible to entry-level traders, the lack of detailed information about different account types raises concerns about transparency and options available to traders with varying needs.

According to available sources, the broker does not provide comprehensive details about account tiers, special features, or graduated benefits based on deposit levels. This absolute markets review finds that compared to established brokers offering multiple account types with distinct advantages, Absolute Markets appears to maintain a simplified structure that may limit advanced traders seeking premium services.

The account opening process details are not extensively documented, which could create confusion for new users. Additionally, the absence of information about Islamic accounts or other specialized trading arrangements suggests limited accommodation for diverse trader requirements. User feedback indicates dissatisfaction with account-related services, particularly regarding unclear terms and conditions that may not be fully disclosed during the registration process.

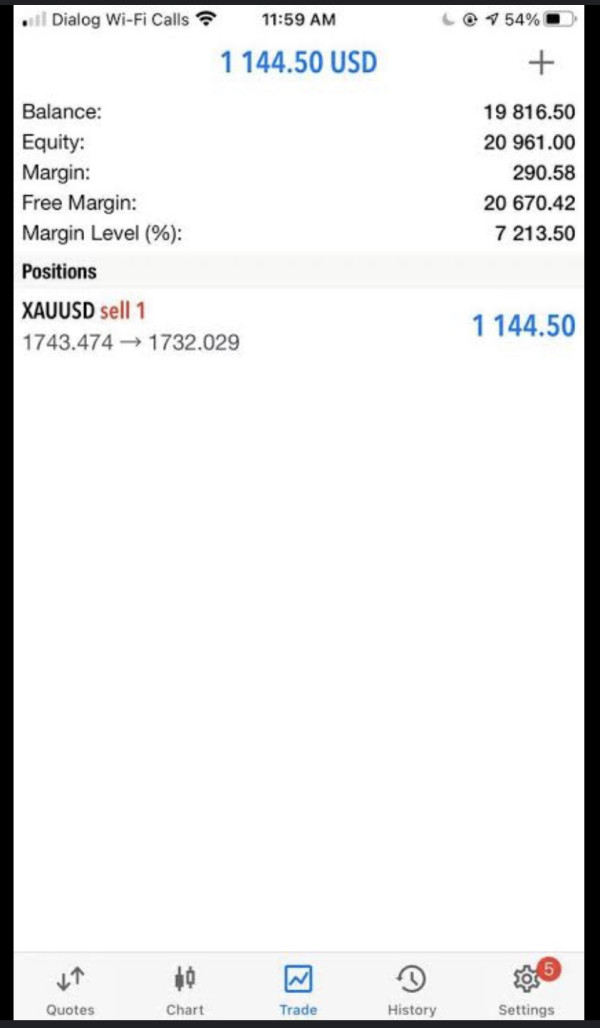

Absolute Markets provides access to the MetaTrader 4 platform, which offers a solid foundation for forex and CFD trading. The platform includes standard technical analysis tools, charting capabilities, and support for automated trading through Expert Advisors. The availability of multiple asset classes including cryptocurrencies and energy commodities expands trading opportunities beyond traditional forex pairs.

However, the broker's offering appears limited in terms of proprietary research and analysis resources. Educational materials, market commentary, and trading guides are not prominently featured in available documentation, which could disadvantage novice traders seeking learning opportunities. The absence of advanced analytical tools or exclusive research content places Absolute Markets at a disadvantage compared to full-service brokers.

User feedback suggests that while the MT4 platform functions adequately, additional resources such as economic calendars, market news integration, and educational webinars are either limited or non-existent. This gap in supplementary services may explain why more experienced traders express dissatisfaction with the overall value proposition offered by the broker.

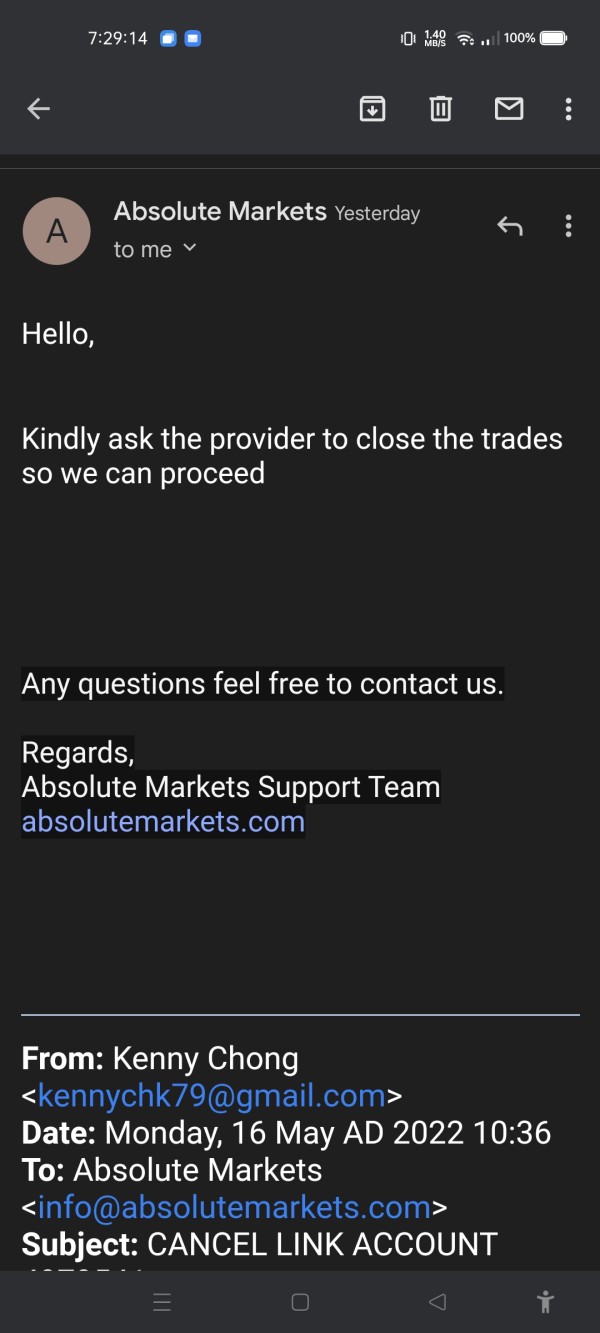

Customer Service and Support Analysis (4/10)

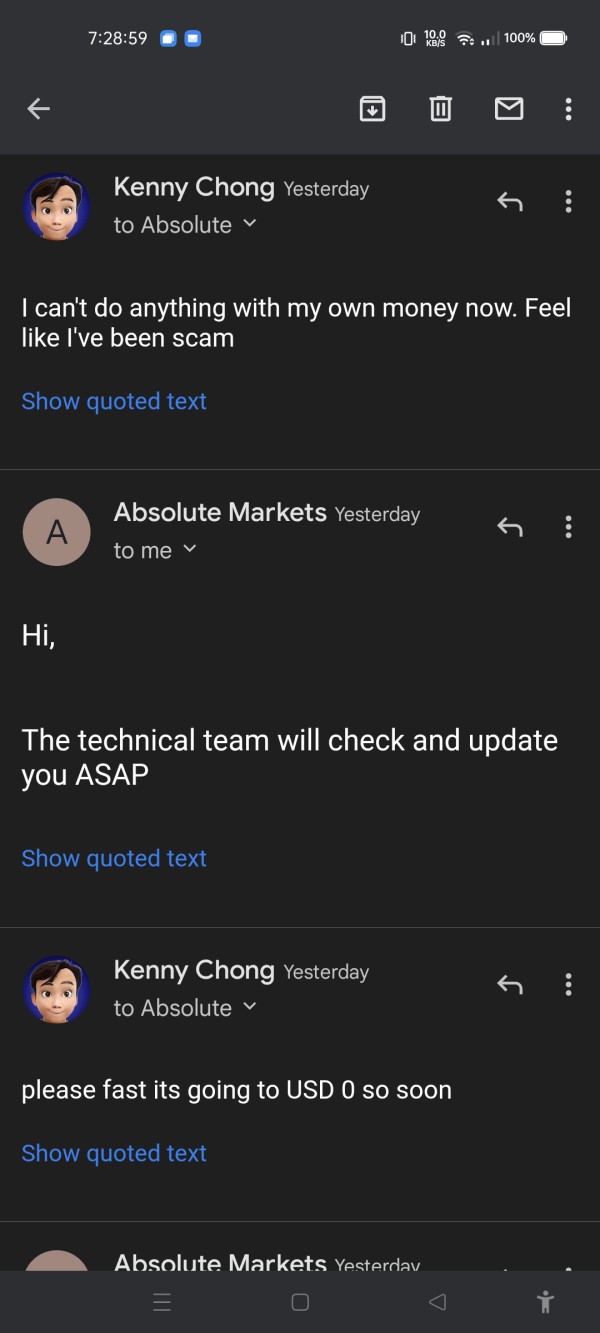

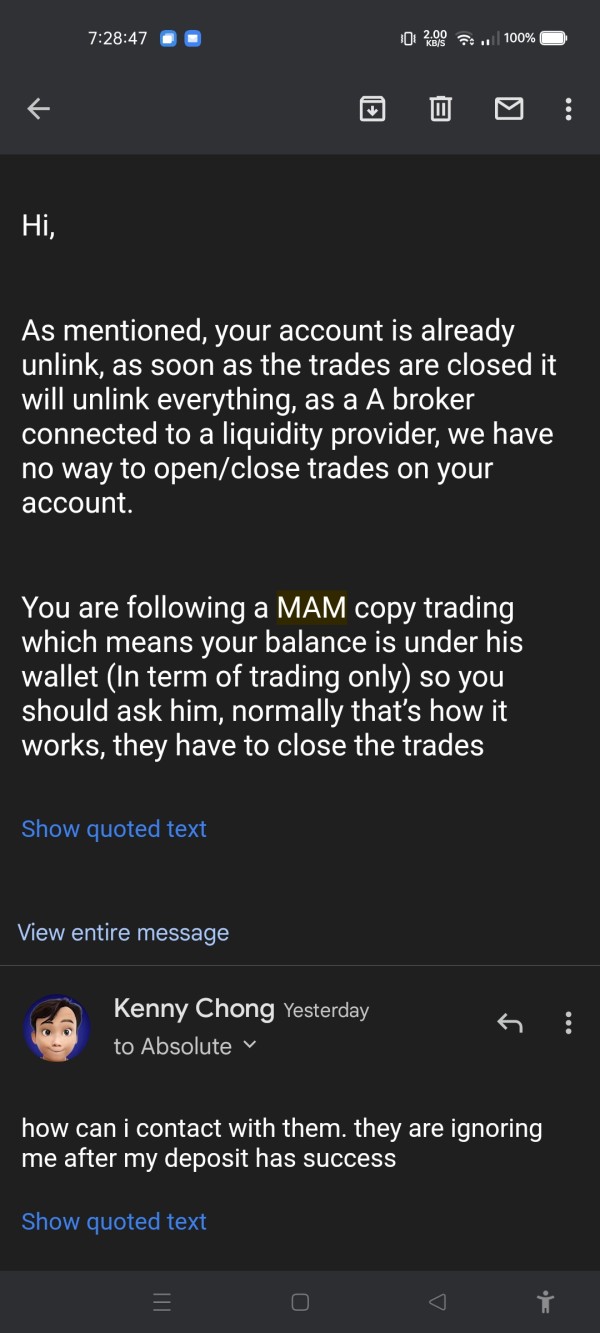

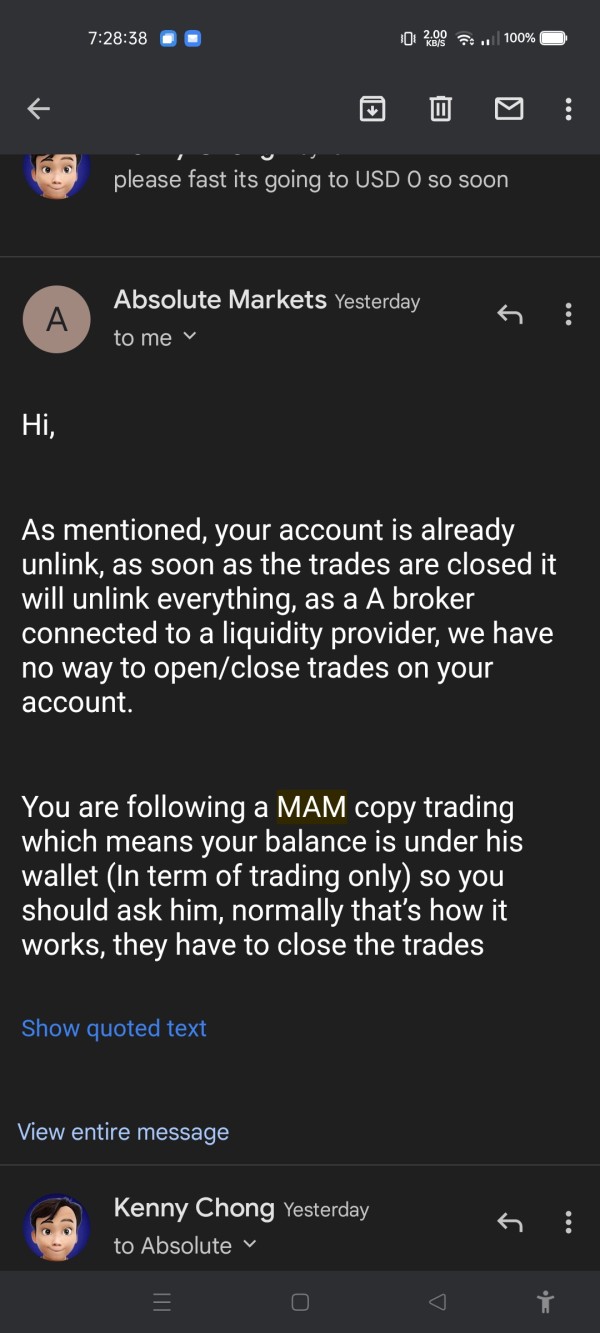

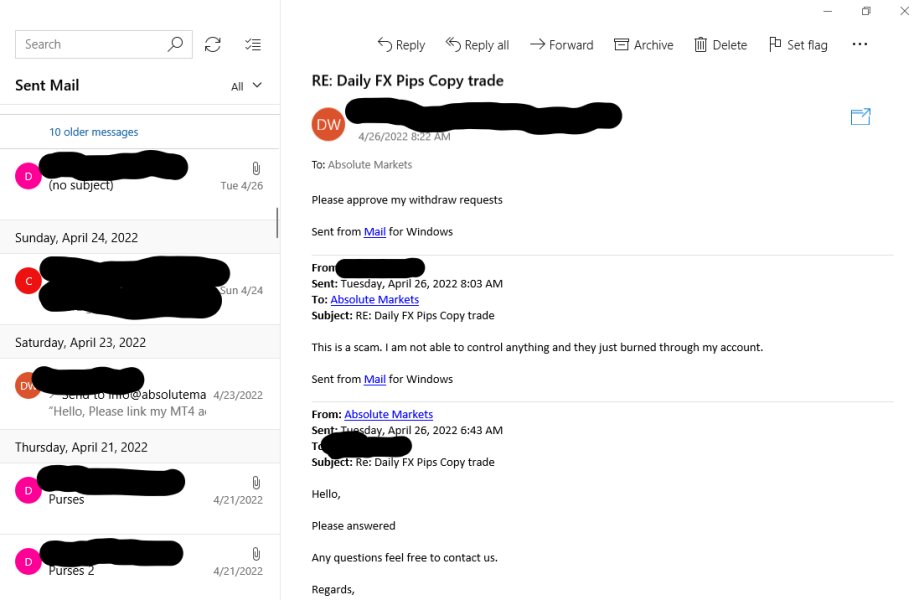

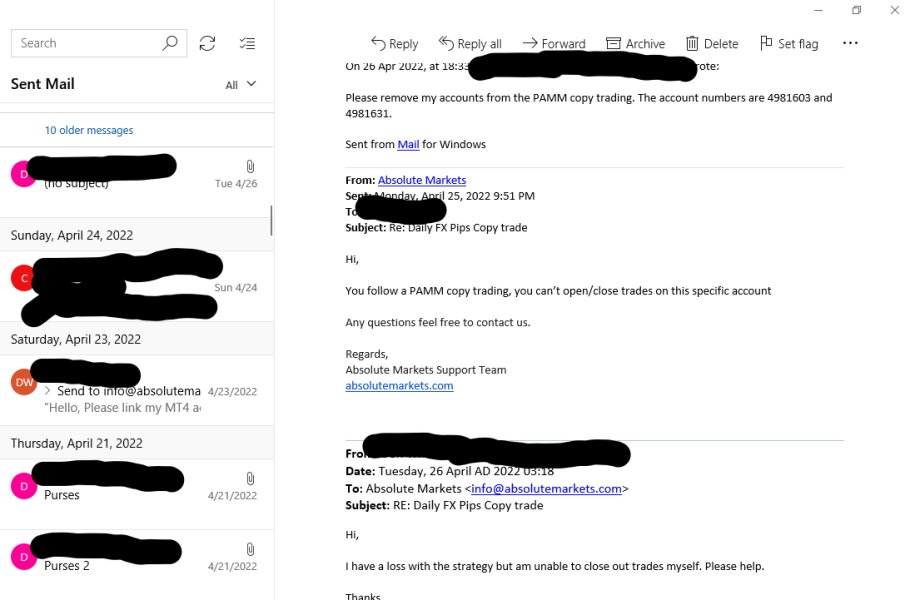

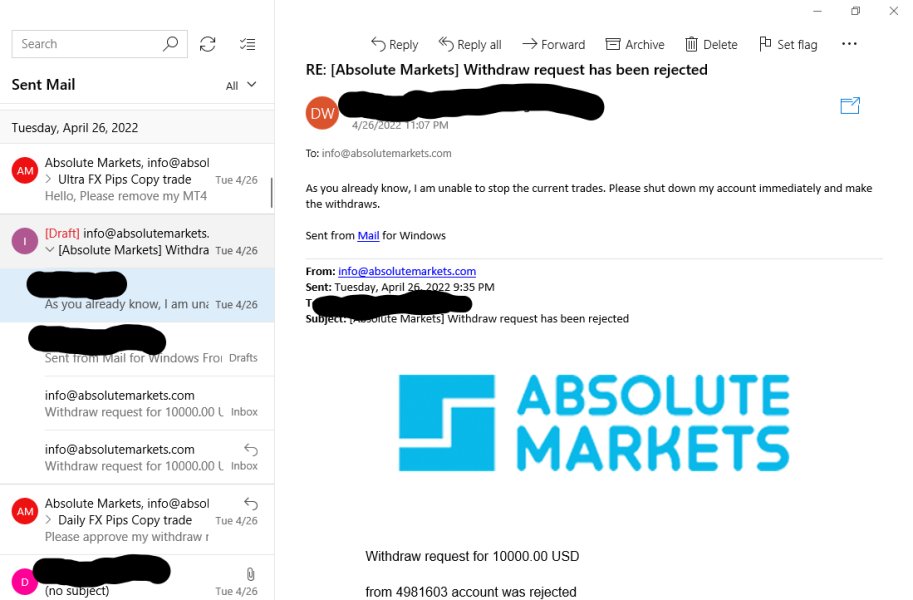

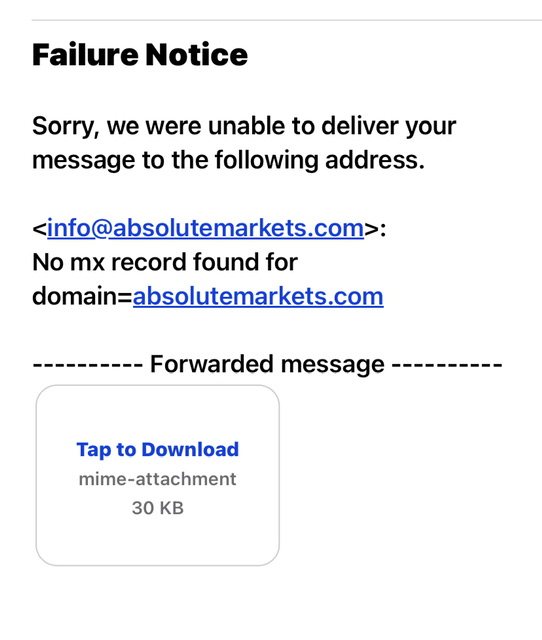

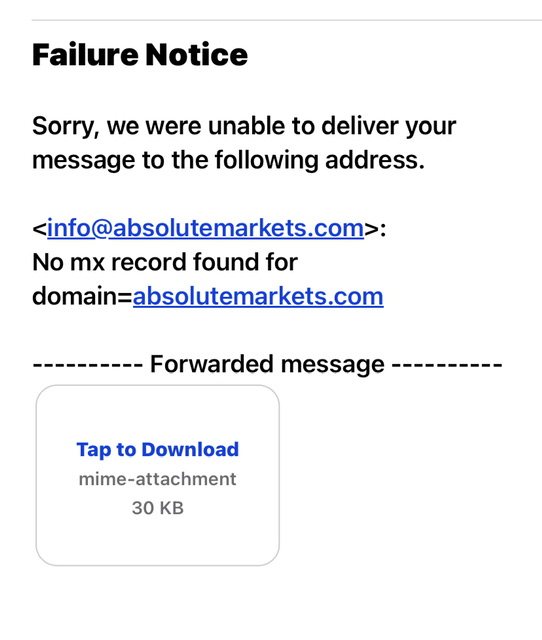

Customer service emerges as a significant weakness in this evaluation. User reviews consistently highlight poor responsiveness, inadequate problem resolution, and limited communication channels. The broker's customer support infrastructure appears insufficient to handle user inquiries effectively, leading to frustration and negative experiences.

Response times for customer inquiries reportedly exceed industry standards, with users experiencing delays in receiving assistance for both technical and account-related issues. The quality of support provided has been criticized for lacking depth and failing to address complex trading concerns adequately.

Language support options and customer service hours are not clearly specified in available documentation, which could create additional barriers for international traders. The concentration on Southeast Asian markets suggests possible language limitations that may affect service quality for traders from other regions. User testimonials frequently cite customer service inadequacy as a primary reason for dissatisfaction with the broker.

Trading Experience Analysis (5/10)

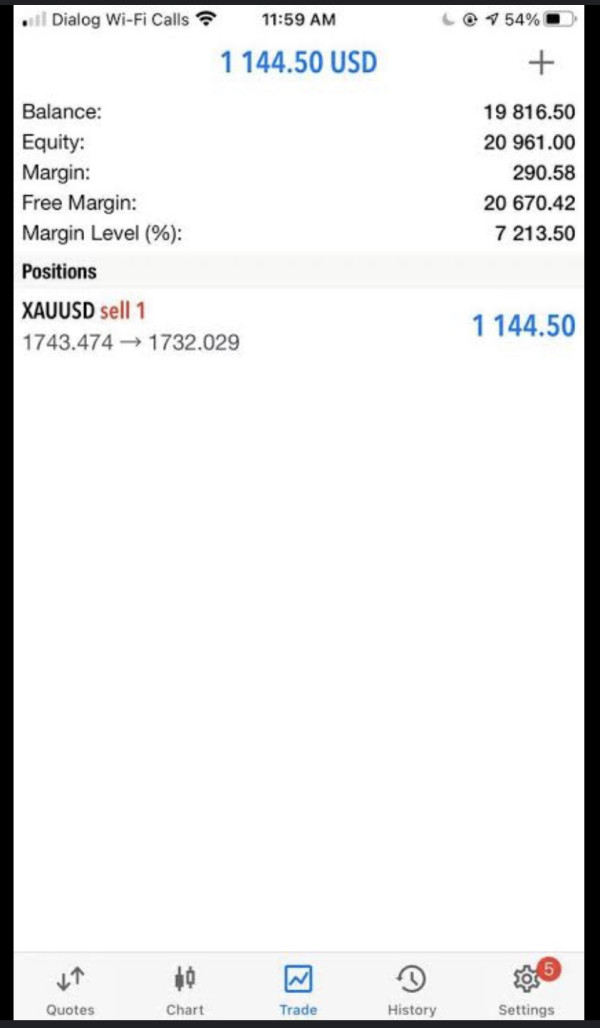

The trading experience with Absolute Markets receives mixed reviews from users, with particular concerns about platform stability and order execution quality. While the MetaTrader 4 platform provides familiar functionality, users report issues with connection stability and occasional execution delays that can impact trading outcomes.

Order execution quality appears inconsistent, with some users experiencing slippage during volatile market conditions. The broker's STP and ECN models should theoretically provide competitive execution, but user feedback suggests that practical implementation may not meet expectations. Platform performance during peak trading hours has been questioned by some users.

Mobile trading capabilities through MT4 mobile applications are available, though specific user experience feedback for mobile platforms is limited in available sources. The overall trading environment, including spread stability and liquidity quality, receives moderate ratings from users who have provided detailed feedback about their trading experiences with the broker. This absolute markets review indicates that while basic trading functionality is present, the execution quality and reliability concerns may deter serious traders.

Trust and Reliability Analysis (3/10)

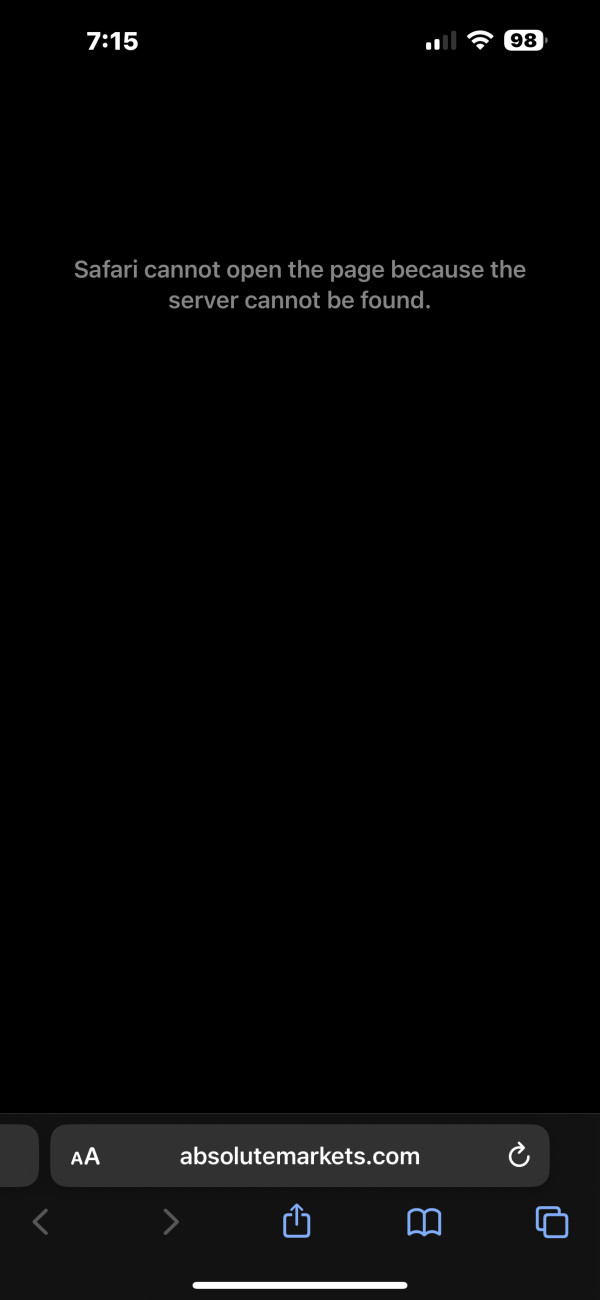

Trust and reliability represent the most concerning aspects of Absolute Markets' operations. The absence of clear regulatory oversight from recognized financial authorities creates significant uncertainty about trader protection and fund security. Operating from Saint Vincent and the Grenadines provides limited regulatory framework compared to major financial centers like the UK, Australia, or Cyprus.

User reports suggesting potential fraudulent behavior are particularly alarming and contribute to the low trust rating. The lack of transparency regarding company ownership, financial backing, and operational procedures further undermines confidence in the broker's reliability. Fund security measures and client money protection protocols are not clearly documented, raising concerns about asset safety.

The broker's relatively recent establishment in 2021, combined with predominantly negative user feedback, suggests insufficient time to build industry reputation and credibility. Third-party verification of the broker's claims and operational standards is limited, making it difficult for potential clients to assess actual reliability. The accumulation of user complaints across multiple review platforms indicates systemic issues that affect trust and long-term viability.

User Experience Analysis (4/10)

Overall user satisfaction with Absolute Markets remains significantly below industry standards, reflected in the 2.7-star average rating from user reviews. The predominance of negative feedback across multiple review platforms indicates systemic issues affecting the user experience across various aspects of the service.

Interface design and platform usability receive moderate ratings, primarily due to the familiar MetaTrader 4 environment. However, users frequently complain about aspects beyond the trading platform, including account management procedures, communication clarity, and service reliability. The registration and verification processes are not well-documented, potentially creating confusion for new users.

Common user complaints center around customer service responsiveness, unclear fee structures, and difficulties with account-related procedures. The concentration of negative feedback suggests that improvements in multiple operational areas would be necessary to enhance user satisfaction significantly. Users consistently recommend caution when considering this broker, with many suggesting alternatives that provide better overall service quality and reliability.

Conclusion

This comprehensive absolute markets review reveals a broker that, despite offering competitive trading conditions such as low spreads and high leverage, faces significant challenges in customer satisfaction, trust, and service quality. While the $50 minimum deposit and access to multiple asset classes may appeal to entry-level traders, the concerning pattern of user complaints and lack of regulatory transparency create substantial risks for potential clients.

The broker appears most suitable for experienced traders who prioritize low costs over comprehensive service, particularly those familiar with the Southeast Asian market. However, the poor customer service ratings, trust concerns, and limited regulatory oversight make Absolute Markets a questionable choice for most traders seeking reliable, long-term brokerage relationships.

The main advantages include competitive spreads starting from 0.0 pips, high leverage up to 1:1000, and low minimum deposit requirements. However, these benefits are significantly outweighed by poor customer service, negative user feedback, and concerns about fraudulent practices. Potential traders should exercise extreme caution and consider well-established alternatives with stronger regulatory oversight and better user satisfaction records.