TCM 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Trade Capital Markets (TCM) has positioned itself as a prominent player in the online trading space, effectively offering a variety of trading instruments across multiple asset classes, including forex, CFDs, commodities, and cryptocurrencies. With a low minimum deposit starting at just $10 and leverage reaching up to 1:290, the broker appeals to both new and experienced traders seeking flexible trading options. However, the firm has garnered a reputation marred by complaints regarding withdrawal processes and regulatory issues, casting doubt on its legitimacy and the overall reliability of its platform.

While TCM claims to be regulated by several bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa, there is growing concern about the effectiveness of these regulatory frameworks. Client testimonials often highlight challenges with fund withdrawals and account access, raising red flags for potential investors. This article delves into the core offerings of TCM, assesses its strengths and weaknesses, and ultimately provides insights into whether it is a viable option for trading, or if it presents more risk than reward.

⚠️ Important Risk Advisory & Verification Steps

- Risk Statement: Numerous complaints regarding withdrawal issues from TCM raise significant concerns about fund safety.

- Potential Harms of Trading with TCM: Challenges with securing funds, regulatory legitimacy, and the possibility of encountering clone firms are major risks.

- Guidelines for Self-Verification of TCM's Regulatory Claims:

- Verify on CySEC's Website: Navigate to the official CySEC website and use their register to check TCMs licensing status.

- Check the FSCA Register: Visit the FSCA's official site to confirm TCM's registration details and licensing number.

- Consult the FCA Register: If considering the UK-based firm, verify its status on the FCA's register to ensure compliance.

- Review User Feedback: Search for user experiences and complaints regarding TCM on platforms like TrustPilot or Forex forums.

- Assess Withdrawal Policies: Investigate whether TCM provides transparent details about its withdrawal process and potential fees.

Rating Framework

Broker Overview

Company Background and Positioning

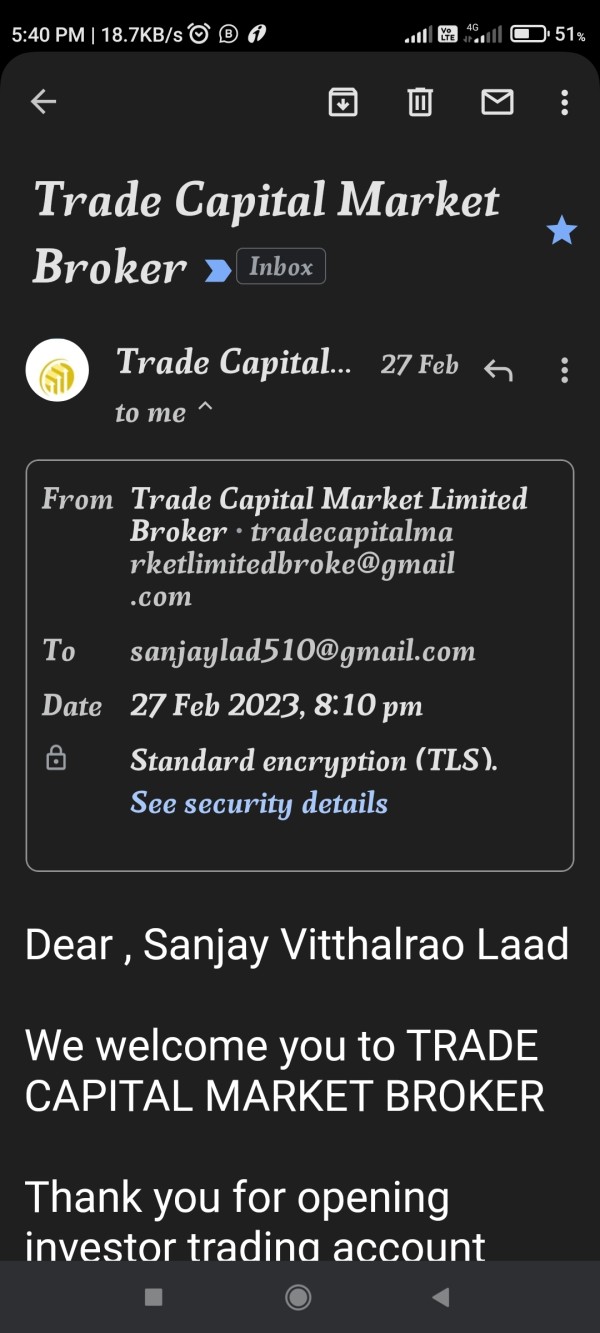

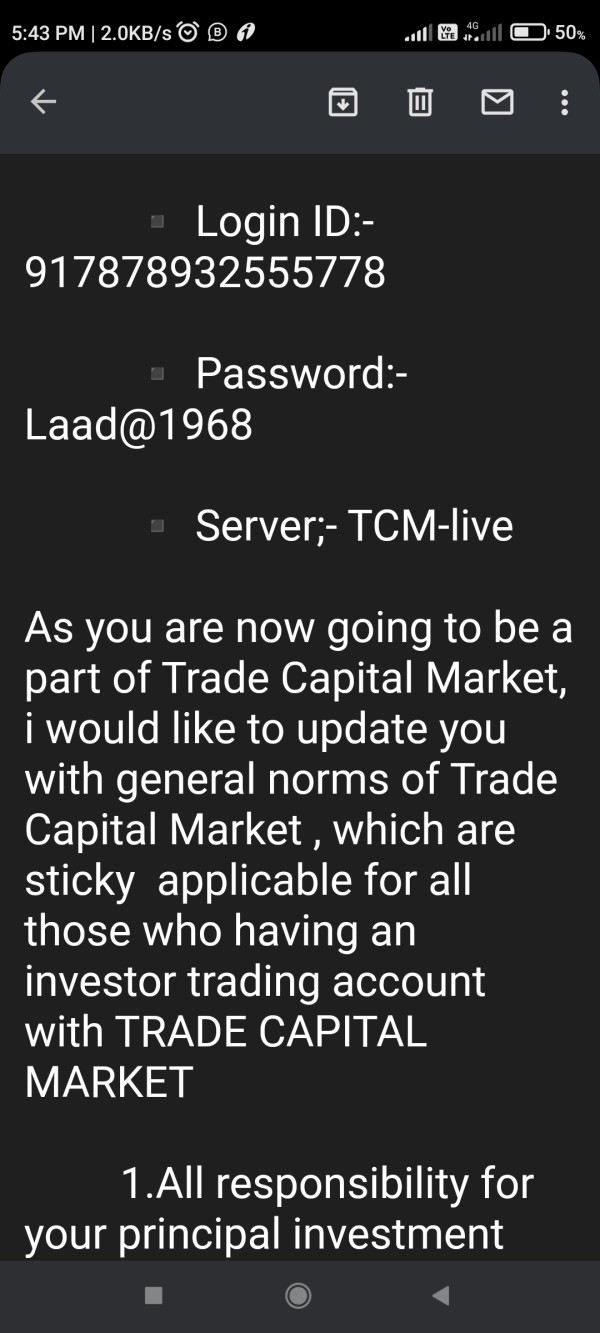

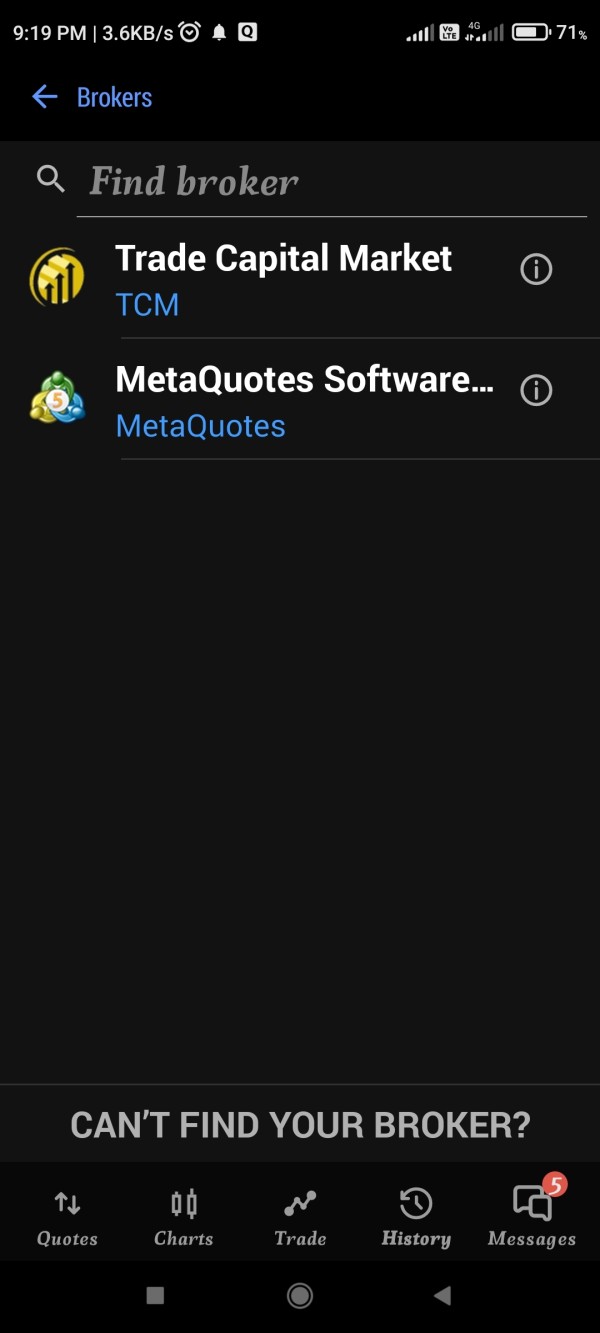

Trade Capital Markets Ltd. (TCM) was established in 2013, with its headquarters located in Nicosia, Cyprus. As a regulated investment firm, TCM claims to adhere to the guidelines set forth by the CySEC, FCA, and FSCA, among other regional authorities. Despite these claims, reports indicate that TCM operates primarily through offshore entities that may not adhere to the same regulatory standards, creating significant concerns regarding fund safety and trustworthiness.

Core Business Overview

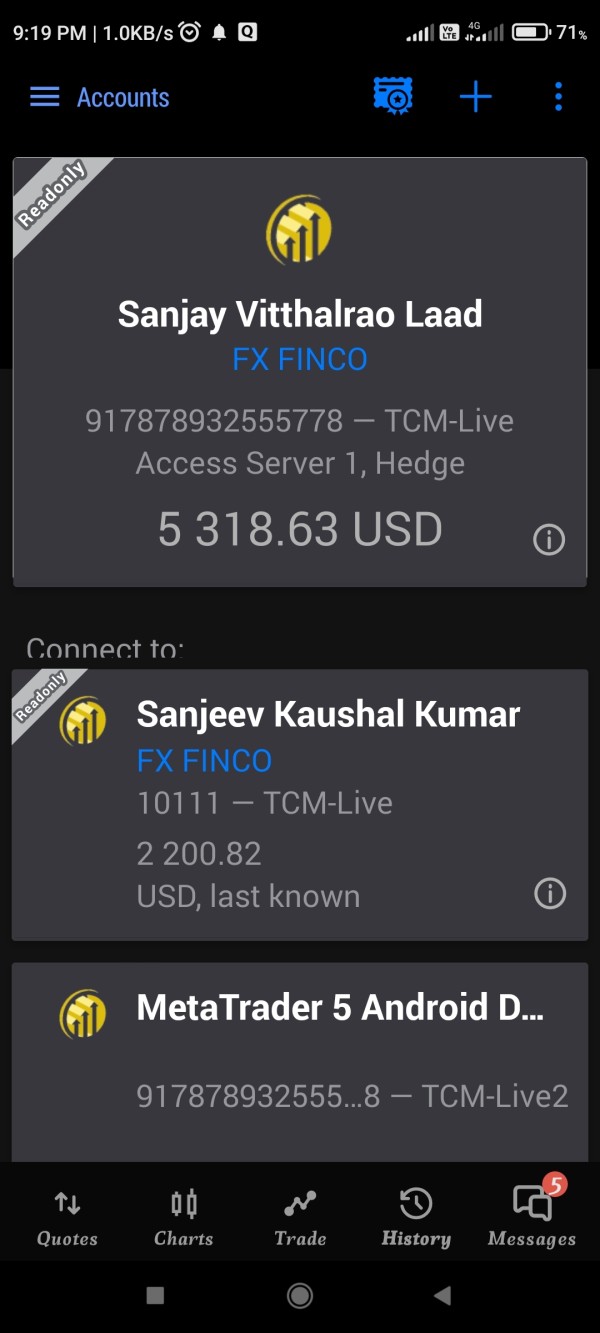

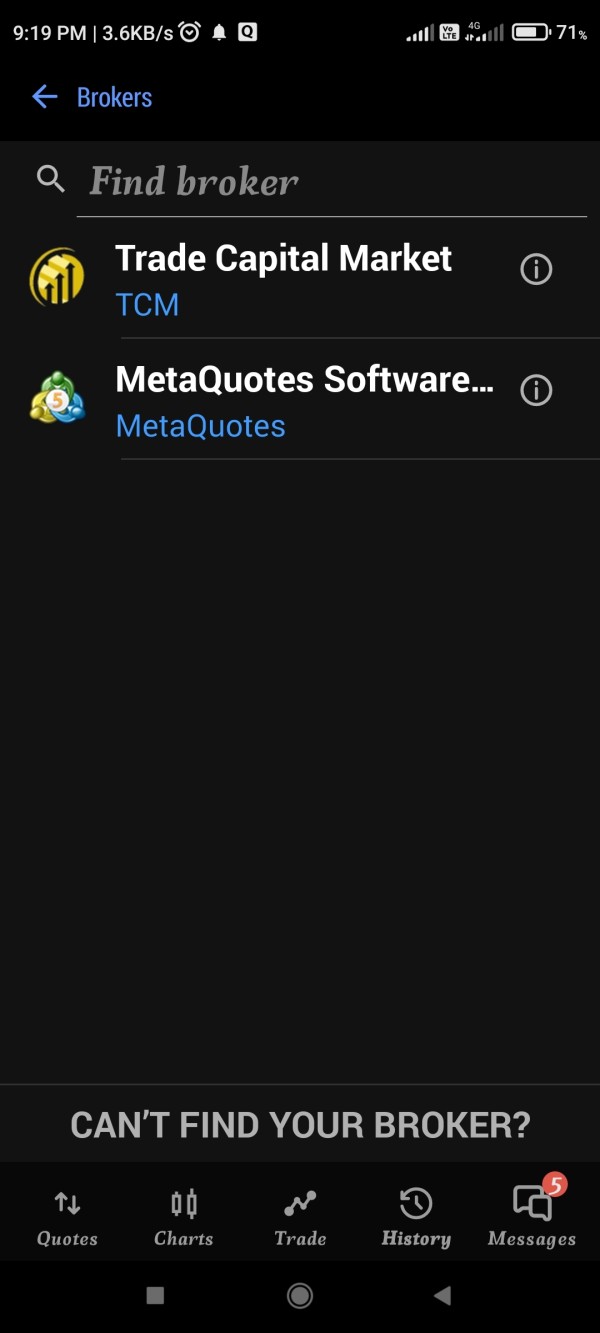

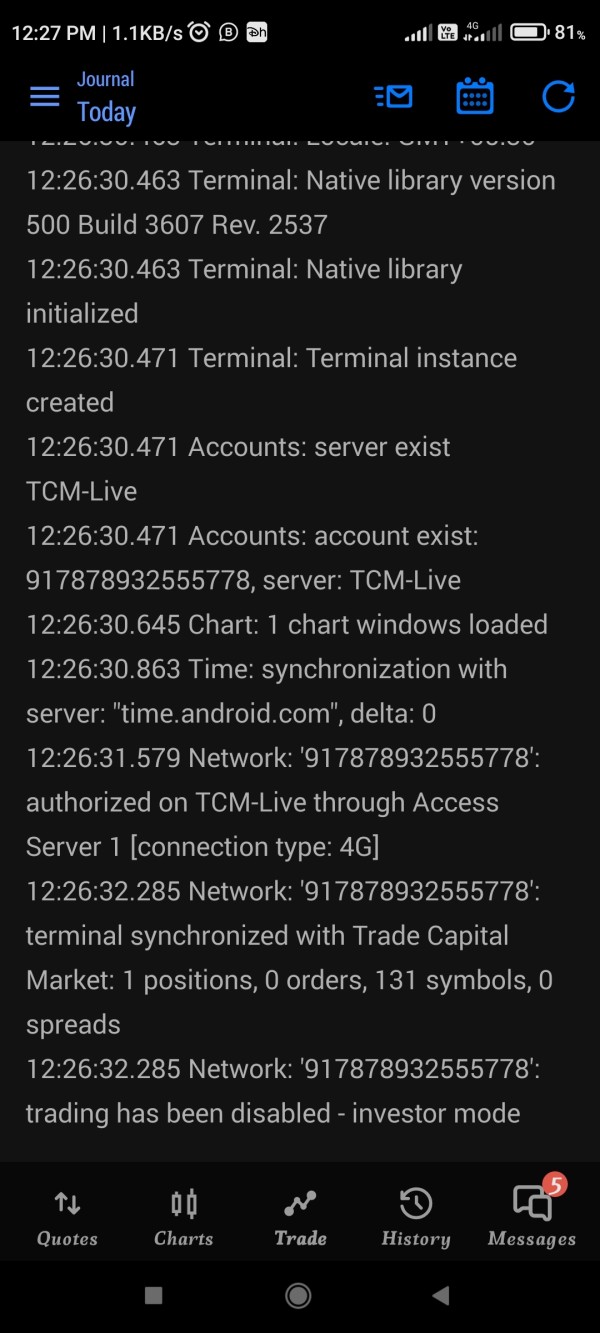

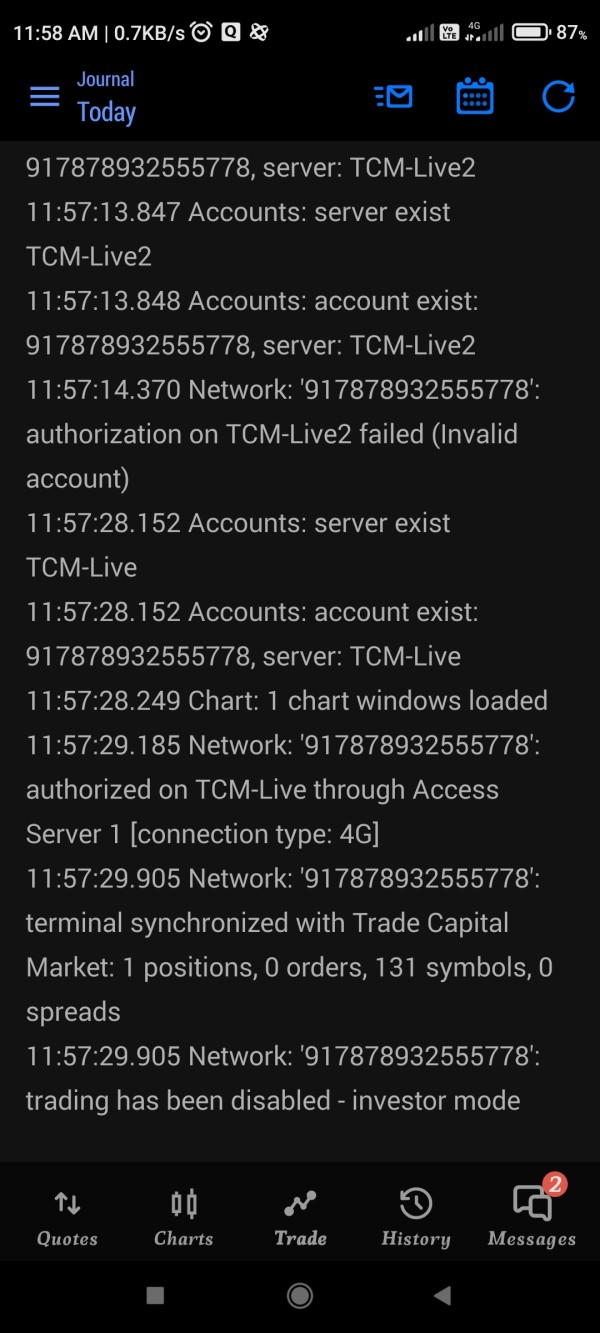

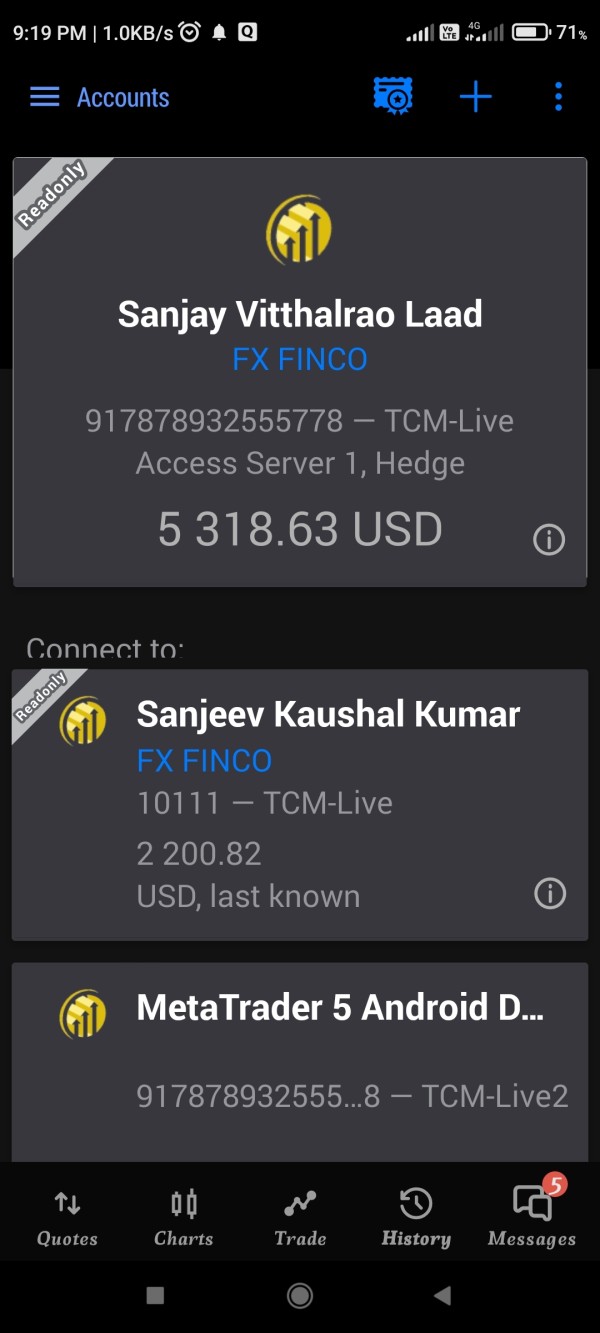

TCM specializes in online trading across a spectrum of asset classes, which includes forex pairs, cryptocurrencies, commodities, shares, indices, and ETFs. The broker provides access to popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary WebTrader. Claiming to house several international regulatory licenses, TCM markets itself as a versatile trading solution; however, there is skepticism over the legitimacy of these claims.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

-

Analysis of Regulatory Information Conflicts: TCM asserts its regulatory compliance with CySEC and FSCA; however, the legitimacy and enforcement capacity of these bodies, particularly concerning their offshore entities, have been questioned. Reports suggest that the South African FSCA license is tied to potential clone operations, heightening the risk for investors wishing to engage with the broker.

User Self-Verification Guide:

- Visit CySEC‘s Official Site and navigate to their registry for licensed entities.

- Access the FSCA Website and verify TCM's registration details.

- Cross-check licensing on the FCA Register to enforce its jurisdictional claims.

- Consult user feedback on platforms like TrustPilot for direct experiences with TCM.

- Investigate TCM's stated withdrawal policies for transparency and potential hidden fees.

- Industry Reputation and Summary: While TCM has been established in the trading market, user feedback highlights a reputation for problematic withdrawals—

“I can’t withdraw funds at all. How can I get my principal back?” - User Review

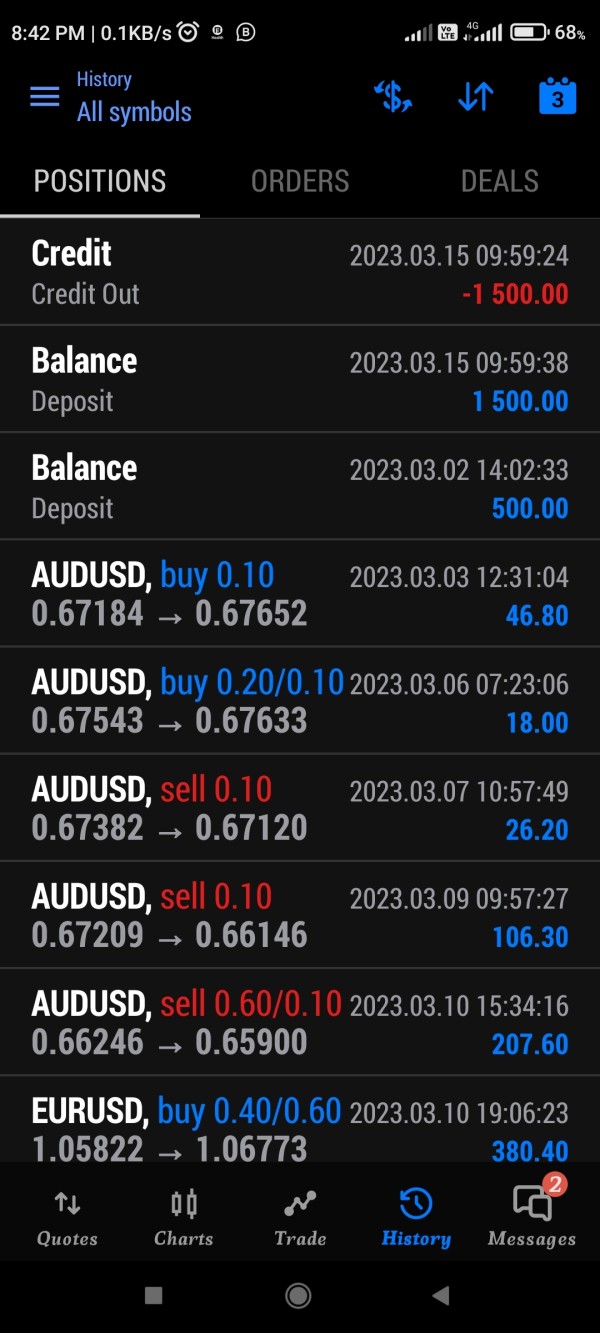

Trading Costs Analysis

-

Advantages in Commissions: TCM offers a competitive commission framework, especially appealing with a minimum deposit requirement that allows access to forex and CFD trading. For instance, users can find spreads starting at 1.4 pips on the Micro account, which is an industry standard.

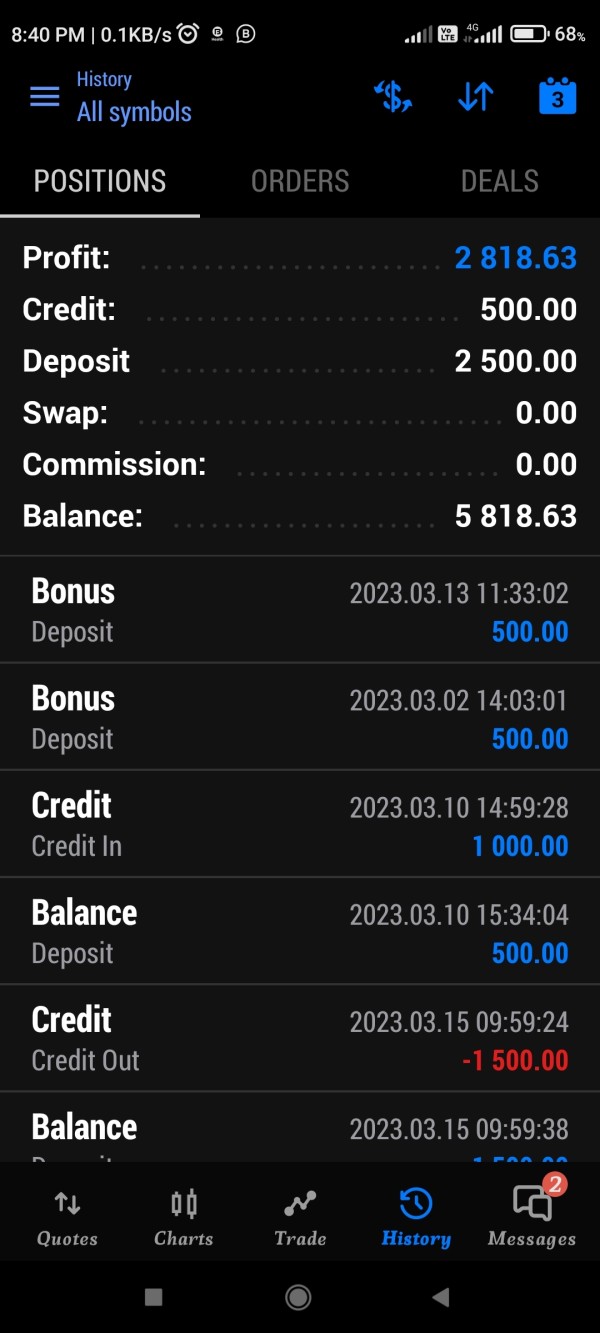

The "Traps" of Non-Trading Fees: Despite attractive trading conditions, TCM has received complaints regarding high withdrawal fees and associated processing difficulties.

“I couldnt get my money back when it was time to withdraw; please stop now!” - User Complaint, withdrawal fees of $30 highlighted.

- Cost Structure Summary: The broker appears to balance its offering well for seasoned traders, with low trading fees, but non-transparent withdrawal fees could trap new traders unversed in managing these costs.

-

Platform Diversity: TCMs array of trading platforms—MT4, MT5, and WebTrader—provides a versatile trading environment, catering to both novice and experienced traders. MT4 and MT5 are renowned for their advanced tools and features that support automated trading and in-depth analysis.

Quality of Tools and Resources: The broker provides decent charting software, albeit lacking educational support materials that some traders may find necessary for holistic skill development.

Platform Experience Summary: User feedback indicates a spectrum of experiences. Some users appreciate the usability of MT4/MT5, while others find the overall experience lacking compared to other brokers.

"The web trading platform is basic at best, lacking functionalities I need." - User Review

User Experience Analysis

-

Navigational Ease and Usability: Traders have reported that although TCM offers an extensive range of tools, navigating their proprietary platform can be somewhat clunky particularly when retrieving crucial trading data, indicating a need for improvement in user interface design.

Feedback on Experience: Many users appreciate having a demo account for practice but express frustration when serious issues arise during the withdrawal process.

Customer Support Analysis

- Quality of Support Representatives: Support representatives have generally been noted as knowledgeable and pleasant to deal with; however, traders have expressed concerns about response times during high-volume inquiries. An example of a concern stated in user reviews follows:

“After sending numerous emails, I received no replies regarding my withdrawal issues.” - User Experience

- Support Channels and Availability: TCM offers customer support via phone and email across multiple regions, which is essential for addressing client concerns in a timely manner. Nonetheless, the lack of a live chat feature has been a setback for users seeking rapid assistance.

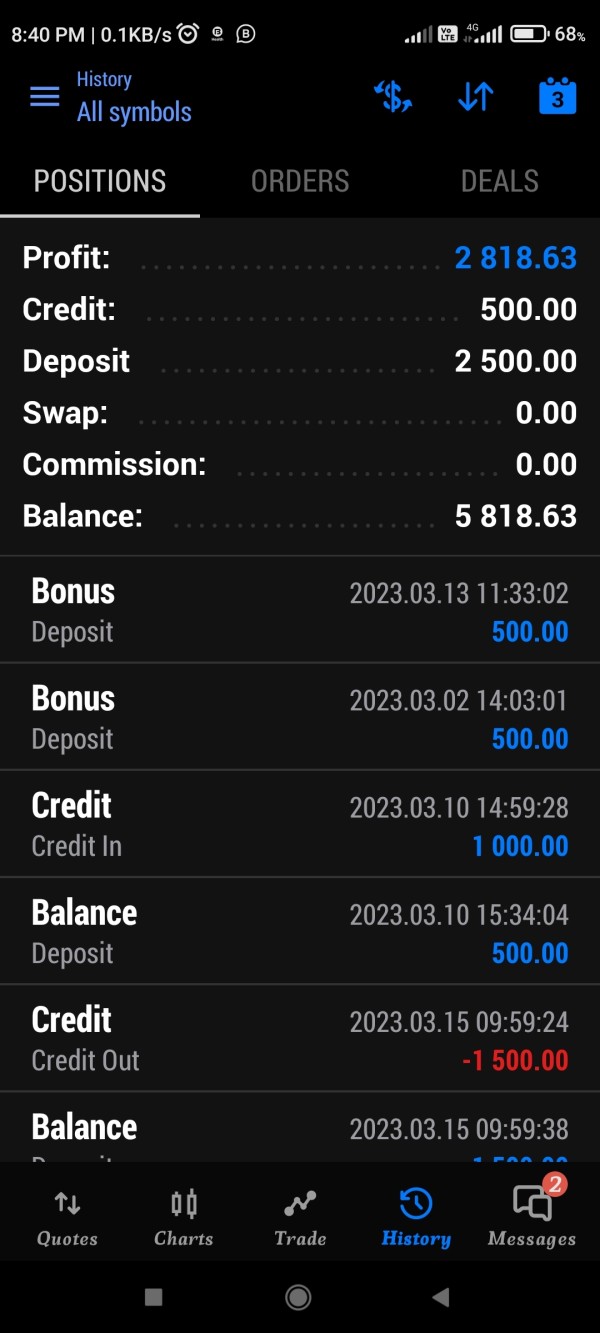

Account Conditions Analysis

-

Diversity of Account Types: TCM caters to varied trading needs with accounts from Micro to ECN Pro, providing low entry points suitable for novice traders while offering high leverage, which could expose users to significant risk.

User Thresholds and Experience: The diverse account structures ensure that users can find options that match their trading strategies but may also present risks due to high leverage allowances, particularly for inexperienced traders.

Conclusion

Trade Capital Markets (TCM) presents itself as a broker with significant offerings and trading instruments aimed at various traders. However, potential users should approach with caution due to highlighted withdrawal issues, regulatory concerns, and mixed reputational feedback. While TCM can provide attractive trading conditions and a wide range of asset options, the fundamental risk associated with fund safety and regulatory uncertainty cannot be understated. Interested traders should conduct thorough due diligence and consider alternative, more transparent brokers if fund security and clear withdrawal processes are a primary concern.