Is Finova trade safe?

Business

License

Is Finova Trade Safe or a Scam?

Introduction

Finova Trade is a relatively new player in the forex market, claiming to offer a wide range of trading services and account types. As with any forex broker, it is crucial for traders to perform thorough due diligence before committing their funds. The forex market is fraught with risks, and choosing an unregulated or poorly regulated broker can lead to significant financial losses. This article aims to investigate the safety and legitimacy of Finova Trade through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and risk factors.

To evaluate Finova Trade, we will analyze information from multiple credible sources, including regulatory databases, user reviews, and expert assessments. This structured approach will help us determine whether Finova Trade is safe for traders or if it raises any red flags.

Regulatory Status and Legitimacy

The regulatory framework within which a forex broker operates is one of the most significant indicators of its legitimacy and safety. Finova Trade currently holds an unauthorized status with the National Futures Association (NFA) in the United States, which raises serious concerns about its regulatory compliance. The absence of a valid regulatory license means that Finova Trade is not subject to the oversight and protection that regulated brokers must adhere to.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not Applicable | United States | Unauthorized |

The lack of regulatory oversight implies that traders have limited recourse in the event of disputes or issues with fund withdrawals. Additionally, the NFA's classification of Finova Trade as unauthorized suggests potential risks associated with trading through this broker. Traders should be wary of engaging with brokers that lack proper regulation, as they may not follow industry best practices or safeguard client funds adequately.

Company Background Investigation

Finova Trade is a relatively new entity in the forex brokerage landscape, having emerged within the last couple of years. However, its rapid establishment raises questions about its ownership structure and operational transparency. Information regarding the company's founders and management team is scarce, which can be a concern for potential investors.

A transparent company typically provides detailed information about its ownership and management, including the experience and qualifications of key personnel. Unfortunately, Finova Trade does not offer much insight into its management team, which makes it difficult to assess the broker's credibility and operational integrity. The lack of transparency is a significant factor that potential traders should consider when evaluating whether "Is Finova Trade safe?"

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for any trader. Finova Trade claims to provide various account types, including standard, zero spread, VIP, and Islamic accounts. While these options may appear appealing, the actual trading costs and conditions warrant further examination.

The broker's fee structure is not entirely clear, and there are indications that some fees may be higher than industry standards. Traders should be vigilant about understanding the complete fee structure to avoid unexpected costs.

| Fee Type | Finova Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.2 pips | 1.0-1.5 pips |

| Commission Model | Not Specified | Typically 0-10 USD per lot |

| Overnight Interest Range | Not Specified | Varies widely |

The spreads offered by Finova Trade, starting at 2.2 pips for major pairs, are higher than the industry average, which can significantly affect a trader's profitability. Additionally, the lack of clarity regarding commissions and overnight interest is concerning. Traders should be cautious and ensure they fully understand all potential costs before opening an account, as this could impact their trading experience.

Client Fund Safety

Client fund safety is a critical concern when evaluating any forex broker. Finova Trade claims to implement various measures to safeguard client funds; however, the absence of regulatory oversight raises questions about these assurances.

The broker does not provide clear information regarding fund segregation, investor protection schemes, or negative balance protection policies. Without these essential safeguards, traders may be exposed to significant risks, including the potential loss of their entire investment.

Historically, unregulated brokers have been involved in fund misappropriation and other fraudulent activities, which further emphasizes the importance of ensuring that a broker has robust client fund protection measures in place. Given the current lack of transparency surrounding Finova Trade's fund safety measures, traders must consider whether "Is Finova Trade safe?" before proceeding.

Customer Experience and Complaints

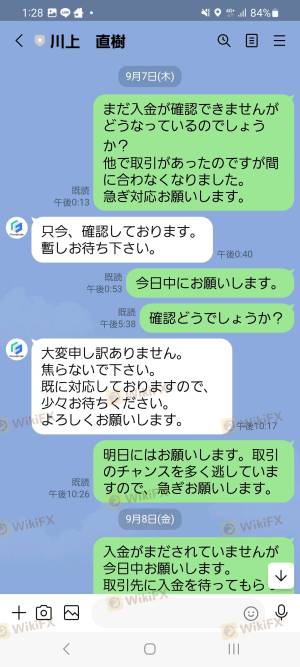

Customer feedback is an essential aspect of assessing a broker's reliability. Finova Trade has received mixed reviews from users, with several complaints highlighting issues such as slow customer support response times and difficulties with fund withdrawals.

Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Poor |

| Account Verification | Medium | Average |

For instance, some users have reported that their accounts were frozen without prior notice, making it difficult to access their funds. In contrast, other users have praised the trading platform's functionality and ease of use. These mixed reviews indicate that while some traders have positive experiences, significant concerns remain that could affect the overall perception of Finova Trade's reliability.

Platform and Trade Execution

The trading platform offered by Finova Trade is described as user-friendly, but the quality of trade execution is a critical factor for traders. Issues such as slippage and order rejections can significantly impact a trader's ability to execute their strategies effectively.

While detailed performance metrics are not readily available, some reviews suggest that users have experienced occasional slippage during high volatility periods. Furthermore, the lack of transparency regarding the platform's operational stability and any potential signs of manipulation raises concerns for traders who prioritize reliable trade execution.

Risk Assessment

Evaluating the risks associated with trading through Finova Trade is essential for informed decision-making. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of authorization from NFA. |

| Fund Safety Risk | High | Unclear fund protection measures. |

| Customer Service Risk | Medium | Complaints about slow responses. |

| Trading Condition Risk | Medium | Higher spreads and unclear fees. |

To mitigate these risks, traders should consider diversifying their investments and only committing funds they can afford to lose. Additionally, seeking out alternative brokers with robust regulatory oversight and transparent practices may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should exercise caution when considering Finova Trade as a potential broker. The lack of regulatory oversight, mixed customer feedback, and insufficient transparency regarding fund safety and trading conditions raise significant concerns.

While some traders may find value in the services offered by Finova Trade, the inherent risks associated with trading through an unregulated broker cannot be overlooked. It is advisable for traders to explore alternative options that offer robust regulatory protections, transparent fee structures, and a proven track record of customer satisfaction.

For those seeking reliable alternatives, brokers regulated by reputable authorities such as the FCA or ASIC may provide a safer trading environment. Ultimately, the question of "Is Finova Trade safe?" leans towards caution, and potential traders should carefully weigh their options before proceeding.

Is Finova trade a scam, or is it legit?

The latest exposure and evaluation content of Finova trade brokers.

Finova trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finova trade latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.