Is fpmarkets safe?

Pros

Cons

Is FP Markets A Scam?

Introduction

FP Markets, established in 2005, is an Australian forex and CFD broker that has positioned itself as a significant player in the global trading landscape. Known for its competitive pricing and a wide range of trading instruments, FP Markets caters to both novice and experienced traders. However, given the complexities and risks associated with forex trading, it is crucial for traders to carefully evaluate the legitimacy and safety of any broker they consider. This article aims to provide a comprehensive analysis of FP Markets, examining its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk assessment. The evaluation is based on extensive research, including reviews from industry experts, user testimonials, and regulatory information.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a fundamental indicator of its legitimacy and reliability. FP Markets is regulated by several reputable authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). Regulation by these agencies indicates that FP Markets adheres to strict financial standards and practices designed to protect traders. Below is a summary of FP Markets' regulatory information:

| Regulatory Authority | License Number | Regulated Regions | Verification Status |

|---|---|---|---|

| ASIC | 286354 | Australia | Verified |

| CySEC | 371/18 | Cyprus | Verified |

| FSA (SVG) | 126 LLC 2019 | St. Vincent & Grenadines | Verified |

| FSA (Seychelles) | SD 130 | Seychelles | Verified |

| FSC (Mauritius) | GB 21026264 | Mauritius | Verified |

| FSCA | 50926 | South Africa | Verified |

The quality of regulation is critical, as ASIC is recognized as one of the most stringent regulatory bodies globally. It mandates that brokers maintain sufficient capital reserves, conduct regular audits, and keep client funds segregated from company funds. FP Markets has maintained a clean compliance history since its inception, with no significant regulatory breaches reported.

Company Background Investigation

FP Markets was founded in Sydney, Australia, and has grown to become one of the most recognized names in the forex and CFD trading industry. The company operates under the ownership of First Prudential Markets Pty Ltd, which is dedicated to providing a secure and transparent trading environment. The management team consists of professionals with extensive experience in financial markets, enhancing the broker's credibility and operational integrity.

The company has made significant investments in technology and infrastructure, ensuring that traders have access to advanced trading platforms and tools. Transparency is a core value for FP Markets, as evidenced by its clear communication regarding fees, trading conditions, and regulatory compliance. The broker regularly updates its clients on market developments and provides educational resources to help traders improve their skills and knowledge.

Trading Conditions Analysis

FP Markets offers a variety of trading accounts, including standard and raw ECN accounts, each tailored to meet the needs of different types of traders. The overall fee structure is competitive, with spreads starting from 0.0 pips on the raw account and no commissions on the standard account. However, it is essential to examine the fee policies closely for any potential pitfalls. Below is a comparison of the core trading costs:

| Fee Type | FP Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per side (raw) | $5 per side |

| Overnight Interest Range | Varies by instrument | Varies by instrument |

While the spreads and commission rates are generally favorable, traders should be aware of any potential hidden fees associated with specific account types or withdrawal methods. Transparency in fee structures is crucial for maintaining trust and ensuring that traders can make informed decisions.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. FP Markets implements several protective measures to ensure the security of its clients' funds. One of the key safety features is the segregation of client funds, which means that traders' money is held in separate accounts at top-tier banks, such as the National Australia Bank. This practice helps protect client funds from being used for the broker's operational expenses.

Additionally, FP Markets offers negative balance protection, ensuring that clients cannot lose more than their deposited amount. However, it is essential to note that this protection may not be universally available and can depend on the client's jurisdiction. There have been no significant historical issues regarding fund safety reported by FP Markets, further reinforcing its reputation as a reliable broker.

Customer Experience and Complaints

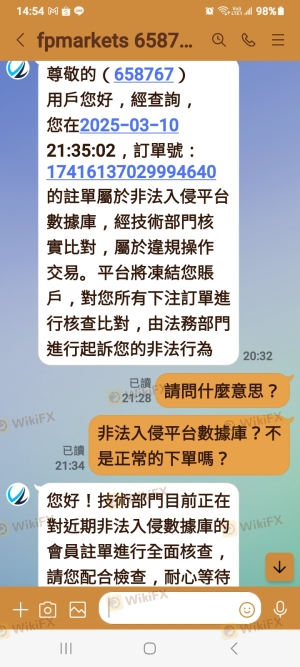

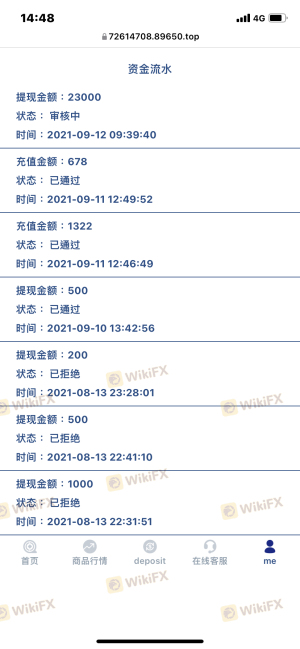

Customer feedback is vital for assessing the overall performance of a broker. FP Markets has garnered a mix of reviews from users, with many praising its competitive pricing, fast execution, and comprehensive support. However, some common complaints have emerged, particularly regarding withdrawal delays and account terminations. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive but varies by case |

| Account Termination | High | Prompt resolution offered, but with some dissatisfaction reported |

| Customer Support Responsiveness | Low | Generally positive feedback on support quality |

One notable case involved a trader who experienced a withdrawal delay after a significant profit. The trader reported that while the support team was initially responsive, the resolution took longer than expected, leading to frustration. Despite this, the majority of users have reported positive experiences with FP Markets' customer service.

Platform and Trade Execution

The trading platforms offered by FP Markets, including MetaTrader 4, MetaTrader 5, and the proprietary Iress platform, are generally well-regarded for their performance and user experience. Traders have access to a wide range of tools, including advanced charting features and automated trading capabilities. The order execution quality is another critical aspect, with FP Markets boasting low latency and minimal slippage during high-volume trading periods.

However, there have been occasional reports of platform glitches and execution issues, particularly during volatile market conditions. Such incidents can impact traders' ability to execute trades efficiently. Overall, the platforms provide a solid trading experience, but users should remain vigilant during high-impact news events.

Risk Assessment

When trading with FP Markets, it is essential to consider the inherent risks involved. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | While regulated by ASIC and CySEC, offshore entities pose risks. |

| Market Risk | High | Forex and CFD trading involve significant market volatility. |

| Operational Risk | Medium | Occasional platform issues can affect trade execution. |

| Fund Safety | Low | Strong measures in place, including fund segregation and negative balance protection. |

To mitigate these risks, traders should ensure they understand the terms and conditions associated with their accounts and maintain a disciplined trading strategy that includes risk management techniques.

Conclusion and Recommendations

In conclusion, FP Markets appears to be a legitimate broker with a solid regulatory framework and a commitment to client safety. The absence of significant historical compliance issues and the implementation of robust safety measures suggest that it is a trustworthy option for traders. However, potential users should remain aware of the risks associated with trading and the occasional complaints regarding withdrawal processes.

For traders considering FP Markets, it is advisable to start with a demo account to familiarize themselves with the trading environment. Additionally, those looking for alternatives may consider brokers with a more extensive range of cryptocurrency offerings or those providing guaranteed stop-loss features.

Overall, FP Markets is a viable choice for both novice and experienced traders seeking competitive pricing and a comprehensive trading experience. As always, it is essential to conduct thorough research and consider individual trading needs before making a decision.

Is fpmarkets a scam, or is it legit?

The latest exposure and evaluation content of fpmarkets brokers.

fpmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

fpmarkets latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.