Eufm Review 1

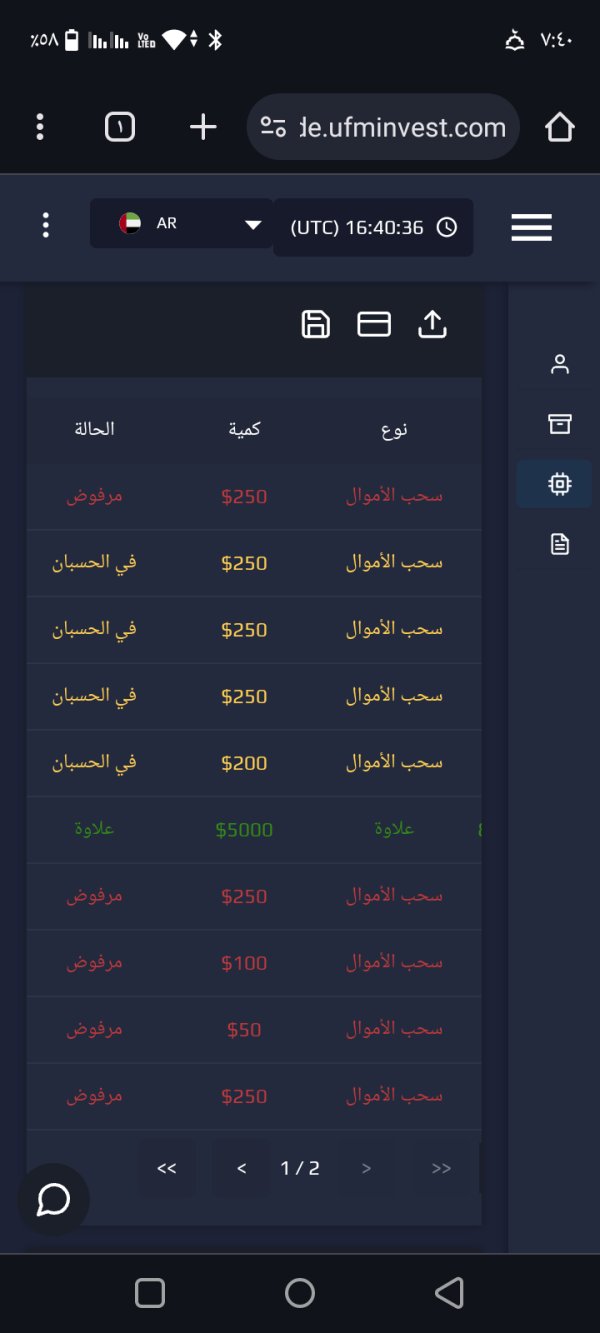

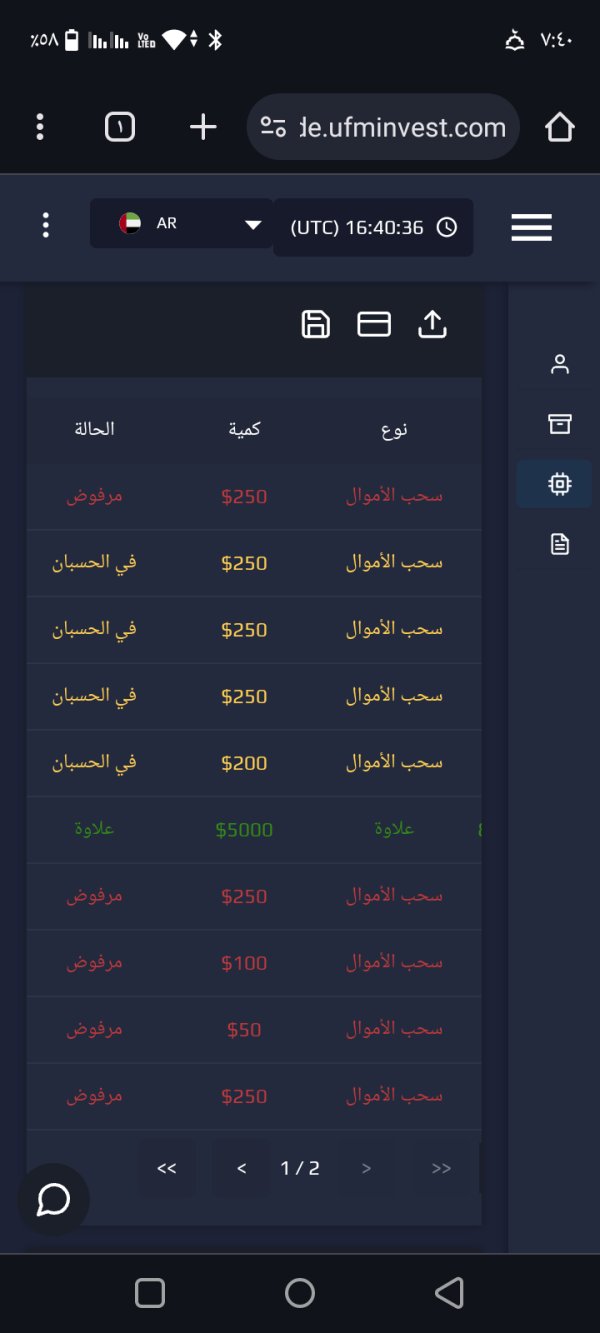

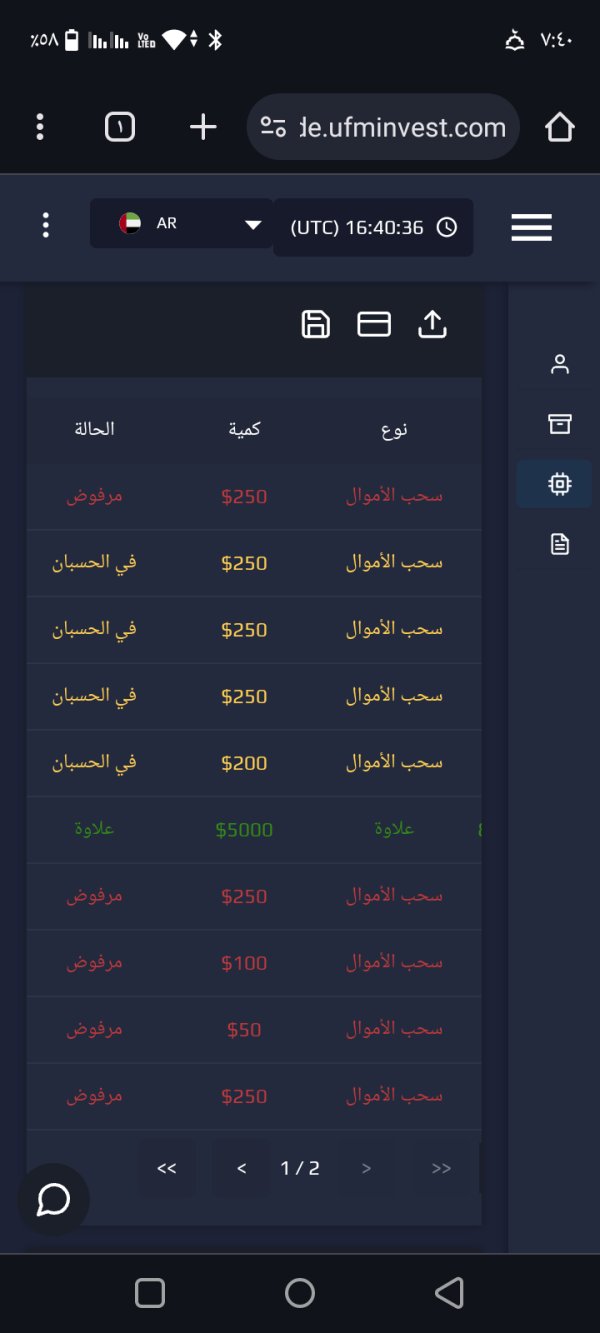

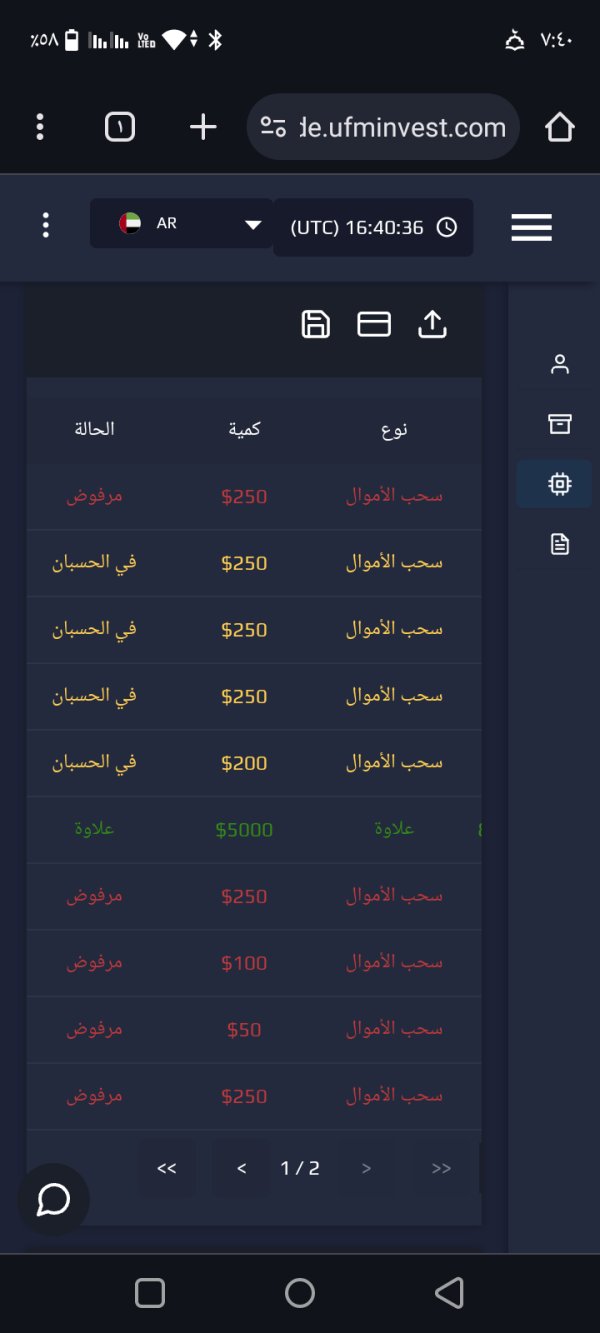

I came to withdraw money and they told me I had to pay a tax on the withdrawal.

Eufm Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I came to withdraw money and they told me I had to pay a tax on the withdrawal.

EUFM, short for European Financial Markets, is an unregulated offshore broker based in the Marshall Islands, an area notorious for its lack of financial oversight. Designed to lure novice traders with the promises of high leverage (up to 1:500) and minimal initial deposits (starting at $250), EUFM markets itself as a portal to a wide range of trading instruments, including forex, cryptocurrencies, and commodities. However, the absence of regulation poses significant risks, particularly in fund safety and withdrawal practices. The broker has attracted negative attention from various financial authorities, leading to a consolidation of user complaints focused on withdrawal difficulties and unexpected fees. Consequently, while EUFM may appear appealing to inexperienced traders seeking low barriers to entry, it serves as a cautionary tale for experienced investors who prioritize security and regulatory oversight.

Investing with EUFM carries significant risks, including:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Unregulated status raises serious safety concerns. |

| Trading Costs | 2 | Competitive commissions overshadowed by high hidden fees. |

| Platforms & Tools | 2 | Basic web trader lacks features compared to industry standards. |

| User Experience | 1 | Numerous complaints highlight poor operational practices. |

| Customer Support | 1 | Limited responsiveness reported by many users. |

| Account Conditions | 2 | High minimum deposit requirements without clarity on terms. |

Founded in 2021, EUFM operates its trading business under EUFM Ltd., headquartered in the Marshall Islands. The broker markets itself aggressively to attract both novice and inexperienced traders by advertising high leverage ratios and diverse asset classes. However, its lack of regulatory oversight is a significant concern, compounded by a multitude of warnings issued by various financial authorities, including the Spanish CNMV and German BaFin.

EUFM's offerings primarily include trading in forex pairs, commodities, cryptocurrencies, and CFDs. The broker claims to provide a variety of trading platforms, including a web-based trading solution. However, the absence of any regulatory framework raises red flags regarding its operational integrity and financial management. Caution is advised when considering this broker for trading.

| Feature | Details |

|---|---|

| Regulation | Not regulated |

| Minimum Deposit | $250 |

| Leverage | 1:500 |

| Spread | Starting from 0.1 pips |

| Major Fees | High withdrawal charges and inactivity fees |

| Trading Platforms | Basic web-based platform |

Managing uncertainty is crucial in trading, and understanding EUFM's operational legitimacy is essential for potential investors.

The information regarding EUFM's regulatory status is conflicting. Reports indicate that EUFM operates without any regulation, with multiple financial watchdogs having blacklisted it for fraudulent practices. The absence of proper licensing drastically increases the risks associated with fund safety.

To verify the broker's legitimacy:

“I faced numerous issues trying to withdraw my funds. It felt like a scam from the beginning.” - User Review

This user experience underscores the significant dangers of trading with a broker that lacks regulatory compliance.

Investors must understand the complete cost structure associated with trading on EUFM to gauge their potential profitability.

EUFM advertises low-cost commissions on trades and high leverage options, enticing traders searching for accessible entry points. However, these advantages come with significant caveats.

The traps associated with trading here include:

“Withdrawing my funds incurred multiple hidden fees, and I didn't see that coming.” - User Review

This hidden cost structure can severely affect overall trading profitability, particularly for novice traders who may lack the experience to navigate such situations effectively.

The balance between professional trading depth and beginner-friendliness can influence a trader's overall experience.

EUFM claims to provide a web-based trading platform, yet feedback suggests it lacks the modern features expected in today's trading environment. Compared to industry standards like MetaTrader 4 or 5, the usability and functionality of EUFM's platform are reportedly below par.

Users describe the platform as lacking advanced analytical tools, educational resources, and automated trading features.

“I found the platform basic and not as intuitive as others I have used.” - User Review

This feedback reiterates the need for traders to thoroughly research and choose a platform that meets their operational requirements.

User experience is vital, especially for traders engaging with a new broker for the first time.

Feedback from past and current users of EUFM indicates widespread discontent with the broker's service. Many users express frustration regarding unresponsive support channels and extreme delays in fund withdrawals. This level of dissatisfaction raises alarms about the quality of customer service and the overall trading experience.

Investors are advised to consider these factors thoroughly as they reflect the broker's operational transparency and integrity.

Evaluating customer support channels is essential for traders, who often need immediate assistance.

EUFM appears to have limited customer support options, leading to numerous complaints from users claiming they have received inadequate assistance. As traders often encounter issues requiring prompt solutions, this shortcoming could result in significant distress.

Understanding the account conditions can help traders decide if they align with their needs and strategies.

EUFM offers multiple account tiers, each requiring substantial minimum deposits. The basic account begins at €3,500 and escalates to €100,000 for the VIP account. This high threshold could deter many potential traders and raises questions regarding the accessibility of its offerings.

To handle conflicting information, the article maintains objectivity by presenting factual conflicts, encouraging prospective users to independently verify the claims made regarding fees and regulation.

Potential information gaps include precise withdrawal processing times, user testimonials about the trading experience, and updates on regulatory investigations. Ensuring your financial safety should always come first; therefore, researching brokers thoroughly is advisable before making a commitment.

While EUFM may present itself as an attractive option for novice traders, it is crucial to approach with caution. The absence of regulation alongside numerous complaints serves as vital warnings for potential investors. Prioritize brokers that exhibit transparency, regulatory compliance, and proven track records of service integrity.

FX Broker Capital Trading Markets Review