stargaze capital 2025 Review: Everything You Need to Know

Below is a complete review of Stargaze Capital based on available data and user feedback. This article has several sections including an executive summary, considerations, a detailed scoring framework, an overview of the broker, specific details on key features, an in-depth analysis of each scoring area, and a final summary. All information comes from available reports such as those by BrokersView and Scamadviser, with focus on data accuracy and transparency.

1. Executive Summary

The Stargaze Capital review shows a troubling picture for this new forex broker. Founded in 2023 and based in Mauritius, Stargaze Capital markets itself as a provider of quality forex trading services but fails in important areas. The broker claims registration in the United Kingdom; however, it lacks approval from the Financial Conduct Authority or any other trusted regulatory body. This lack of regulation has raised serious red flags among traders, and there have been multiple user complaints—most concerning regarding fraudulent funds transfer incidents with losses reported as high as US$3500.

The main target for Stargaze Capital appears to be individual investors seeking forex trading opportunities. Yet the current operational framework lacks transparency, exposing potential clients to high risks. Given the unreliable nature of customer service and the unverified claims regarding trading platforms and account conditions, prospective users are advised to exercise extreme caution.

Overall, the Stargaze Capital review suggests that until the broker addresses these vital issues, its service quality and safety remain highly questionable. Traders should look elsewhere for reliable forex trading services.

2. Important Considerations

Stargaze Capital advertises that it is registered in the United Kingdom, yet it has not secured approval from renowned regulatory bodies such as the FCA. This oversight requires a cautious approach from potential traders.

According to reports from BrokersView, Stargaze Capital is categorized as an unregulated broker, which increases the risks associated with fund security and customer support reliability. Additionally, the available data shows that user experiences have been damaged by complaints regarding the transfer of funds leading to significant financial losses. Therefore, while some traders might be attracted to the promise of diverse forex trading instruments, the lack of regulatory oversight and a transparent operational model means that actual trading conditions may vary drastically among users.

Investors are advised to perform comprehensive due diligence and consider these concerns carefully before engaging with the broker.

3. Scoring Framework

4. Broker Overview

Stargaze Capital entered the forex trading arena in 2023 and is based in Mauritius. As a new player in the competitive world of forex brokers, it positions itself as a provider of comprehensive trading opportunities for retail investors.

Despite these claims, the broker's establishment comes with some critical concerns. The company promotes its background as a specialist in forex transactions, yet it remains significantly underdeveloped in operational transparency. For instance, although the broker claims to be registered in the United Kingdom, a closer look reveals that it is not regulated by any prominent authority such as the FCA.

This glaring omission has already triggered serious trust issues among early adopters. In terms of business operations, Stargaze Capital focuses mainly on the forex market by providing access to diverse trading instruments. However, the specifics regarding the array of tradable assets remain vague, limiting potential investors from making fully informed comparisons against well-established brokers.

The company's promotional literature hints at an ambition to deliver a high-quality trading experience. Nevertheless, the absence of concrete details on trading platforms and the underlying technology poses a major drawback. Furthermore, the lack of disclosure regarding costs—such as spreads, commissions, minimum deposit requirements, and available leverage—adds to the uncertainty.

Various sources, including BrokersView, indicate that its operational framework and business model are still undergoing refinement, which further compounds concerns about the reliability and security of client funds. The second edition of the stargaze capital review notes that while the firm's marketing messages are aggressive and appear designed to attract novice retail traders, the reality for many users has been less than satisfactory.

With limited information about the provided trading interface and the overall technological support, the broker leaves potential clients with more questions than answers. Given these limitations, Stargaze Capital currently seems ill-equipped to offer the robust, transparent, and secure trading conditions expected in the modern forex market.

Below is a breakdown of key operational modules for Stargaze Capital:

• Regulatory Region :

Stargaze Capital claims to be registered in the United Kingdom. However, the broker has not obtained any regulatory approvals from the FCA or similar respected bodies. This means that it operates as an unregulated entity in a highly scrutinized market environment.

According to BrokersView, the lack of regulatory oversight presents significant risk for traders and is a primary point of concern in this stargaze capital review.

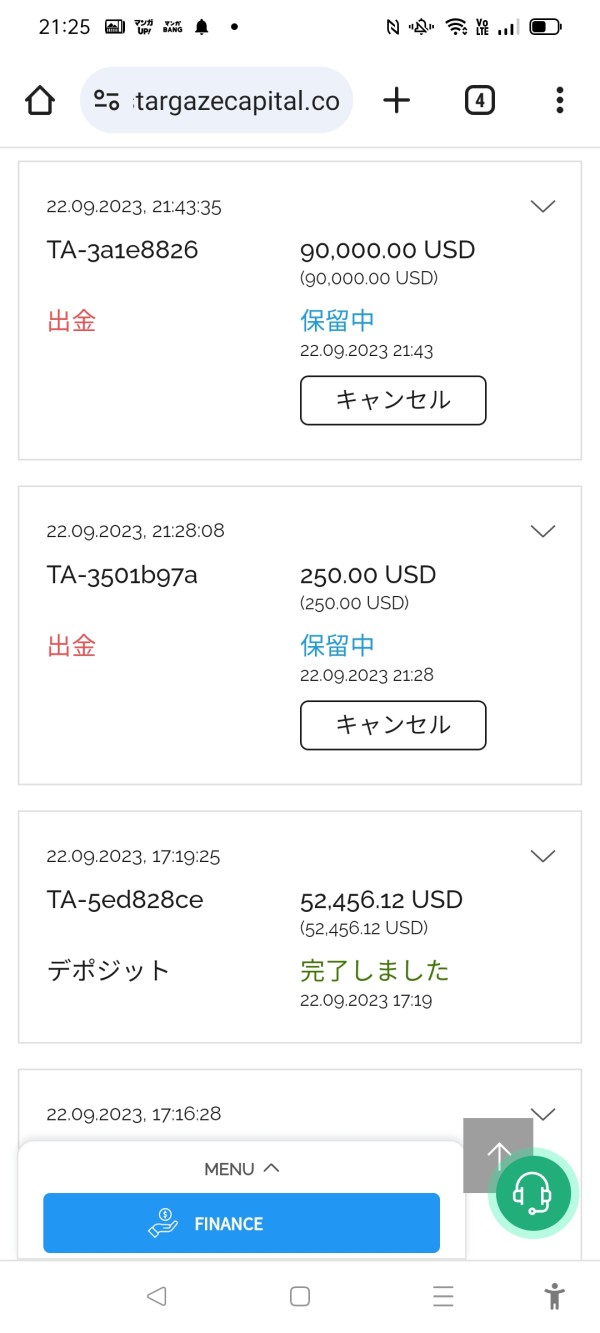

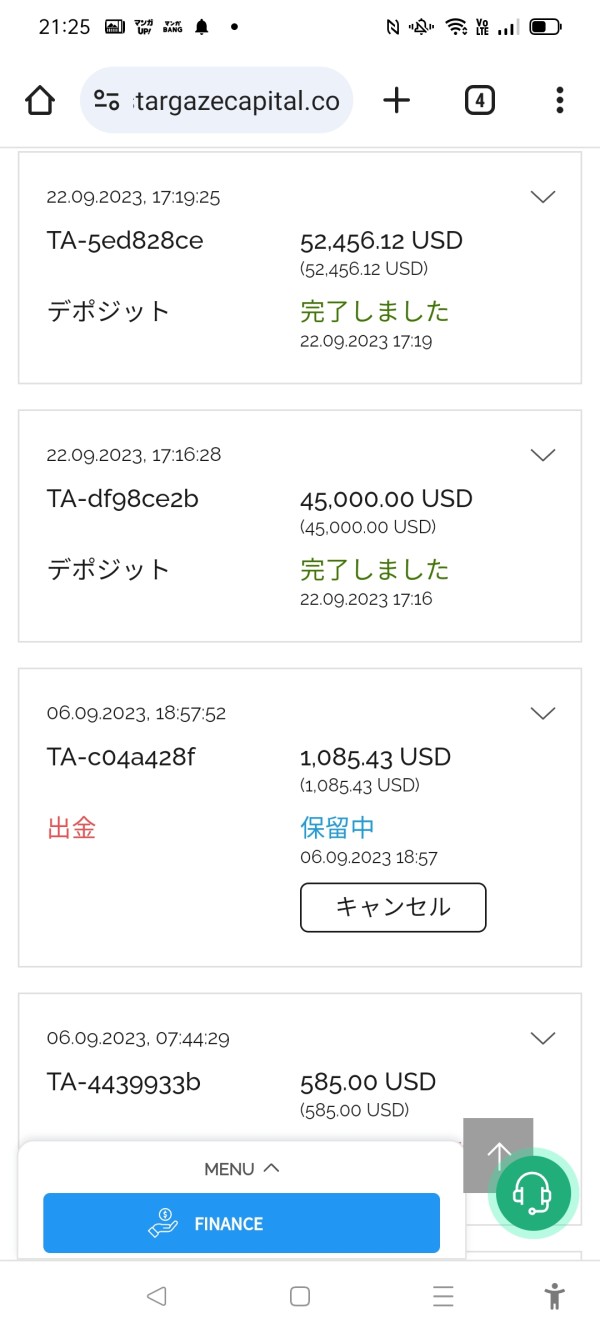

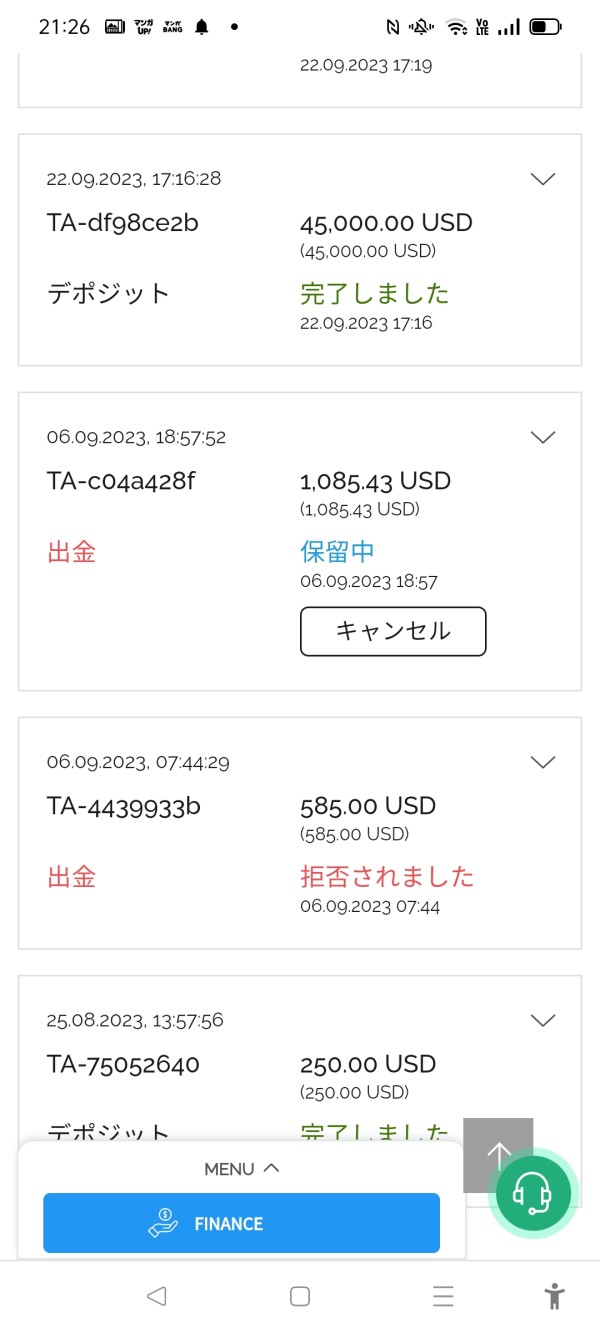

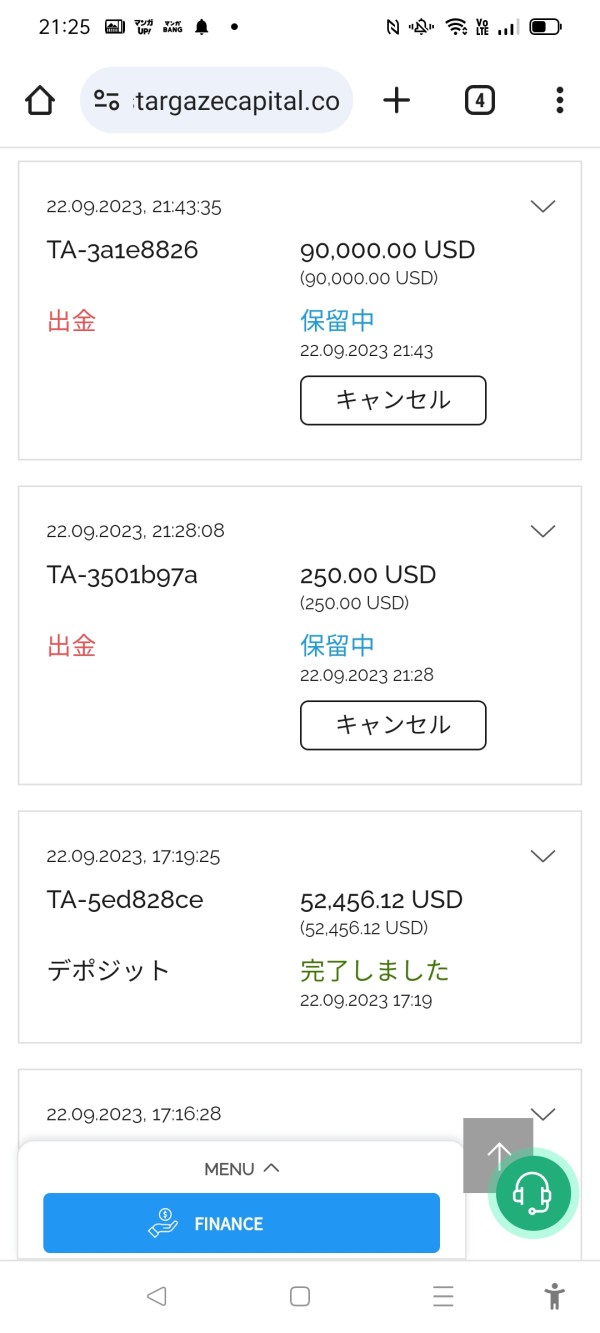

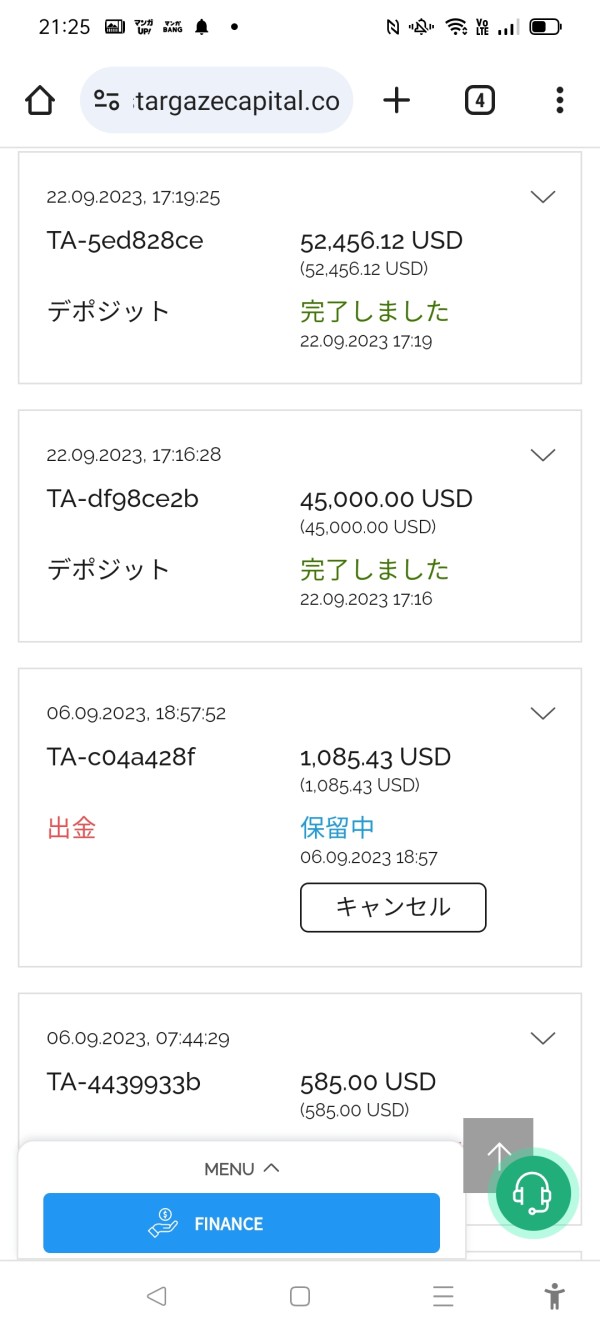

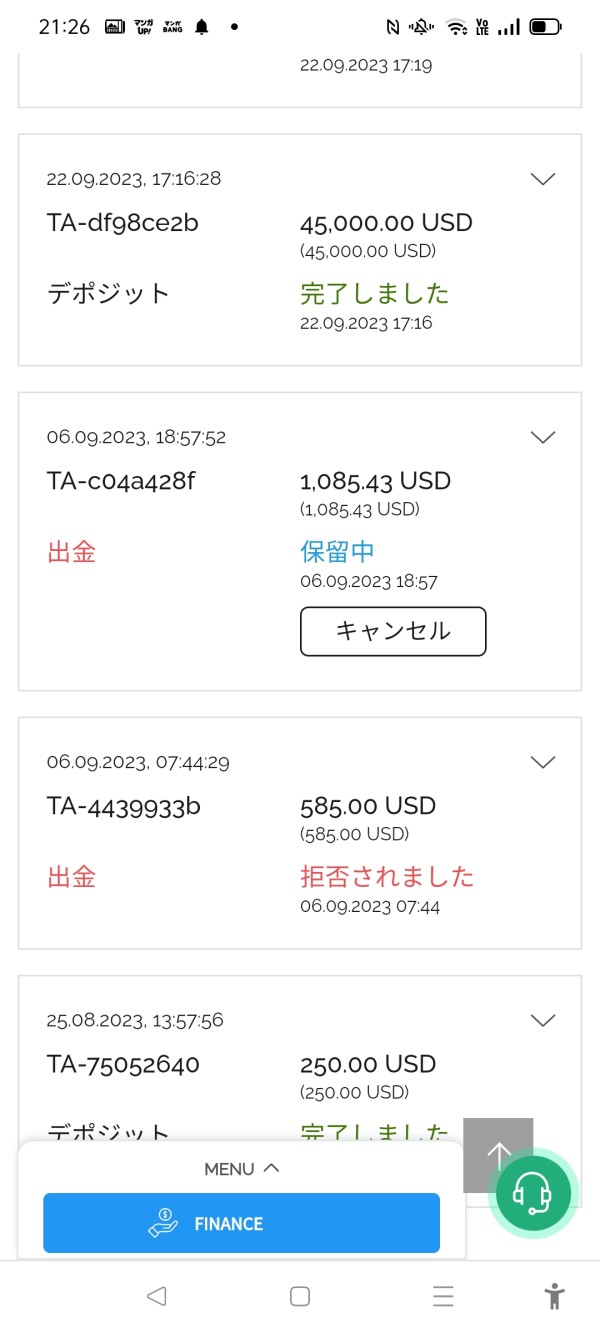

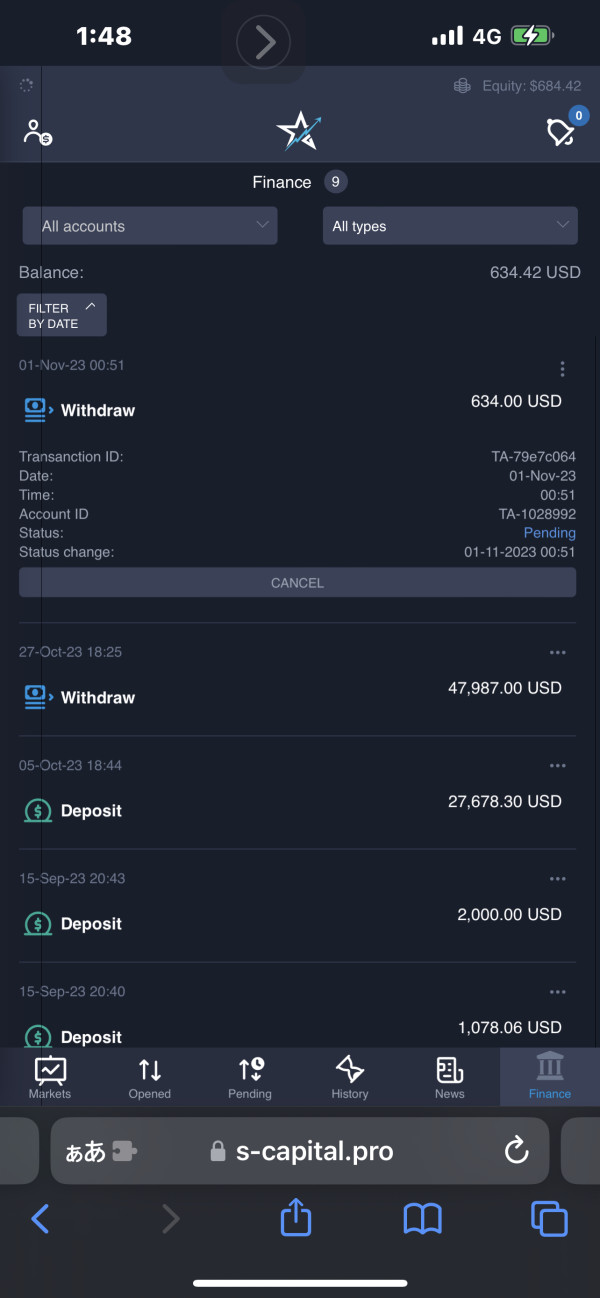

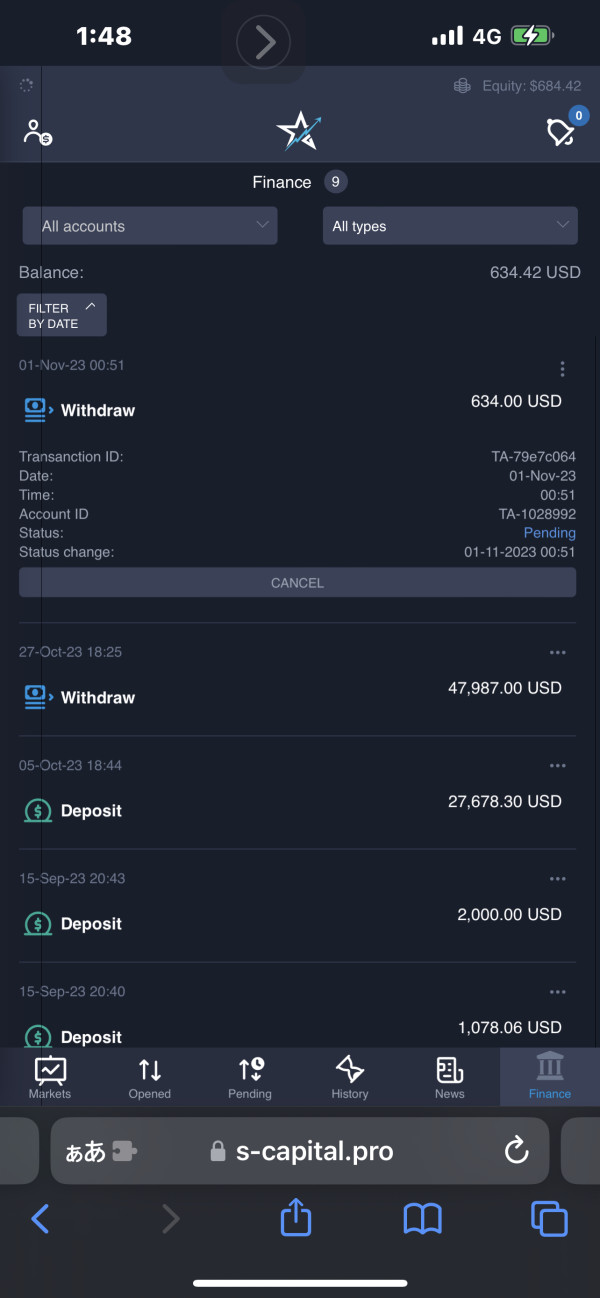

• Deposit and Withdrawal Methods :

The available information does not detail specific deposit or withdrawal methods. In the absence of clear guidelines or a list of supported payment options, users must rely on undocumented processes.

This may further worsen funding and transaction issues reported by past clients.

• Minimum Deposit Requirements :

Details regarding the minimum deposit amount required to open an account with Stargaze Capital are not explicitly provided in the available documentation. This obscurity contributes to the overall lack of transparency in the broker's operations.

• Bonus Promotions :

There is no reliable information on bonus promotions or incentive programs offered by Stargaze Capital. The omission of promotional details indicates that the broker either does not offer attractive bonuses or chooses not to publicize them.

This leaves potential clients without extra value-added benefits typically expected from competitive forex brokers.

• Tradable Assets :

Stargaze Capital claims to offer multiple tradable asset classes, although the specific asset categories are not comprehensively itemized. This vagueness means investors cannot verify whether they will have access to a comprehensive range of forex pairs, indices, commodities, or other instruments.

This is a significant drawback when comparing performance with other brokers.

• Cost Structure :

The details regarding the cost structure, including explicit information about spreads, commissions, and other trading fees, remain undisclosed in the current information set. This is problematic as transparency in cost is a fundamental expectation from brokers, particularly in a highly competitive market.

Without clear indications of how much traders might be charged per transaction, managing risk and maintaining clarity about potential trading expenses become challenging. This lack of detail is a critical element echoed by user complaints regarding hidden charges and ambiguous fee structures in this stargaze capital review.

• Leverage Ratios :

Information on available leverage ratios is missing. Without explicit leverage details, traders cannot adequately assess the risk-to-reward balance of their trading strategies when engaging with this broker.

• Platform Options :

There is no definitive mention of the trading platform options provided by Stargaze Capital. As such, potential clients are left uncertain about whether they will have access to industry-standard platforms or proprietary trading software.

This uncertainty extends to mobile trading or automated trading features.

• Regional Restrictions :

Details about any geographical restrictions or limitations on account registration are not specified. This lack of disclosure again contributes to the overall opacity surrounding the broker's operational guidelines.

• Customer Service Languages :

No specific information is available regarding the language options for customer support. This could negatively affect non-English speaking users and violates expectations of global broker outreach.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The account conditions for Stargaze Capital remain one of the most problematic areas highlighted in this stargaze capital review. The available data does not offer clear insights into the various account types offered.

There are no details regarding minimum deposit requirements or whether specialized accounts are available. Moreover, the absence of information on spreads, commissions, and leverage further intensifies the opaque nature of the broker's operational terms.

The account opening process also lacks clarity—prospective clients are not provided with step-by-step guidance, and the verification process appears to be unsettled at best. User feedback has consistently cited issues around funds transfer, a serious concern that directly impacts account management and security. Compared to more established brokers, the overall structure at Stargaze Capital is deficient in providing transparency and competitive terms, which are crucial for building trader confidence.

As it currently stands, the broker's account conditions are rated poorly, making new account setups challenging and uncertain. This analysis underscores the need for the broker to develop clearer and more detailed account frameworks to improve customer confidence and attraction.

In the realm of trading tools and resources, Stargaze Capital falls short of industry standards as reported in this stargaze capital review. There is a notable absence of detailed information regarding the types of trading platforms, charting tools, or automated trading options available.

Unlike other brokers that offer a feature-rich environment inclusive of in-depth market analysis, educational content, and real-time data, Stargaze Capital is unable to provide such assurances. Educational materials, if available, are not sufficiently documented, and there is no clarity over whether advanced trading features such as algorithmic trading or risk management tools are supported.

Additionally, the lack of articulation about research resources or market analysis tools further diminishes the broker's appeal for both novice and experienced traders. Expert evaluations, which are sparse based on current reports, suggest that without robust tools and resources, executing informed and timely trading decisions becomes exceedingly difficult.

This shortfall can directly impact the overall trading performance and the investment strategies of its users. Therefore, prospective traders should be aware that the limited toolset contributes significantly to the overall downgrading of the broker's rating in this analysis.

6.3 Customer Service and Support Analysis

Customer service is a pivotal aspect of any forex broker's operational credibility, and unfortunately, Stargaze Capital's performance in this area is suboptimal. One of the recurring themes in user complaints revolves around the unresponsiveness and inadequacies in support when issues arise—most notably in critical matters like funds transfer problems.

Detailed information about available support channels is missing, making it difficult for traders to understand how best to seek assistance. There is no clear evidence that the broker operates a multi-lingual support system or adheres to defined service hours, further complicating customer interactions on a global scale.

Moreover, the absence of documented resolution processes or exemplary case studies where customer issues were effectively managed casts further doubt on the broker's commitment to client satisfaction. Reports from investors indicate stark differences in service quality compared with more reputable brokers, where timely and professional responses are the norm.

Clearly, improvements in transparency regarding support processes and responsiveness metrics are critical. This deficiency in customer service serves as a major deterrent for potential clients, ultimately impacting the overall trustworthiness of the broker.

6.4 Trading Experience Analysis

The trading experience on Stargaze Capital's platform is hampered by several inadequacies that are critical in this stargaze capital review. There is no detailed information concerning the nature of the trading platform, its stability, or execution speeds—all of which are key performance indicators for any brokerage service.

Users have expressed dissatisfaction in various forums, particularly citing slow order execution and an overall lack of technological sophistication that one would expect from a modern forex broker. Furthermore, the interface details—such as the availability of mobile trading applications and display clarity of market data—remain ambiguous.

Without clear documentation on whether the trading platform supports real-time analytics or customizable functionalities, traders are left uncertain about the efficiency and ease of trade execution. The lack of transparency on the order execution process, combined with reported instances of delayed or problematic transactions, raises concerns about the reliability of the trading environment.

Given these factors, the quality of the trading experience is notably compromised. Prospective traders should be advised to proceed with caution, considering that the current state of the platform may not provide the competitive edge or the reliability that is essential for executing swift and informed trading decisions.

6.5 Trust Analysis

Trust forms the foundation of any successful broker-client relationship, and unfortunately, Stargaze Capital has significant issues in this regard. One of the most prominent red flags in this stargaze capital review is the broker's lack of regulatory oversight.

Despite its claims of being registered in the United Kingdom, no validation from reputable bodies such as the FCA can be found. This absence of regulation raises serious doubts about client fund security and the overall integrity of the operator.

Additionally, there is limited transparency regarding the corporate structure, management details, or the internal processes that ensure accountability. The occurrence of user-reported scams related to fund transfers further worsens these concerns, with several incidents reporting substantial financial losses.

In contrast to established brokers who routinely publish annual audits, risk management protocols, and clear regulatory compliance statements, Stargaze Capital remains largely opaque. The difference between its marketing messages and actual performance metrics results in a very low trust score.

Until substantial improvements are made—such as obtaining proper regulation, enhancing fund security measures, and increasing overall transparency—investors are right to harbor significant skepticism regarding this broker's reliability.

6.6 User Experience Analysis

The overall user experience offered by Stargaze Capital is a mixed yet predominantly negative landscape as observed in this stargaze capital review. From registration to daily usage, users have encountered consistent issues that detract greatly from satisfaction levels.

The platform's website and interface lack comprehensive information on fundamental aspects such as fund management, transaction processing, and account verification, leading to confusion and mistrust. Furthermore, the registration process appears to be cumbersome, with insufficient guidance provided during verification or when initiating deposits and withdrawals.

Negative experiences particularly revolve around delayed funds transfer and ambiguous fee structures which have been a common source of grievance among users. In contrast, many well-established brokers place strong emphasis on intuitive design, seamless navigation, and robust customer support, all of which create a positive user experience.

The absence of these features in Stargaze Capital creates a significant barrier for potential clients, particularly novice investors who value clarity and efficiency. Until the broker addresses these critical shortcomings—by improving site usability, providing clear instructional resources, and streamlining transaction processes—the overall user experience is likely to remain unsatisfactory for many prospective users.

7. Conclusion

In conclusion, the comprehensive stargaze capital review reveals that Stargaze Capital faces significant challenges in almost every aspect of its operations. Central issues include a lack of regulatory oversight, opaque account conditions, insufficient tools and resources, substandard customer service, and an overall problematic trading and user experience.

These factors collectively render the broker an unattractive option, especially for novice traders who prioritize security and transparency. Until Stargaze Capital addresses these fundamental concerns—particularly around regulation and transparency—it is advisable for potential investors to seek more reliable and established forex brokers.

The current landscape suggests that caution is paramount when considering engagement with Stargaze Capital.

All information in this article is based on available data as of the latest reports from BrokersView, Scamadviser, and similar platforms. Different sources may have slight discrepancies; however, this review emphasizes the most consistently reported issues surrounding Stargaze Capital.