efx 2025 Review: Everything You Need to Know

In this review, we delve into the offerings and reputation of efx, a relatively new forex broker that has garnered mixed feedback from users and experts alike. While efx markets itself as a competitive trading platform with high leverage and a user-friendly interface, concerns regarding its regulatory status and user experiences raise red flags for potential traders.

Note: It's important to highlight that efx operates under different entities across regions, which may affect the regulatory environment and user experience. We have taken a balanced approach to provide accurate insights based on various sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Founded in 2024, efx is a forex broker that operates primarily from Saint Lucia, with additional offices in Dubai and other regions. The broker is known for its use of the MetaTrader 5 platform, which is popular among traders for its advanced features and functionality. efx offers a limited range of trading instruments, focusing mainly on forex pairs, indices, and some commodities like gold and silver. However, the broker's regulatory status is a significant concern, as it lacks oversight from recognized regulatory authorities, which may put client funds at risk.

Detailed Breakdown

Regulatory Landscape

efx operates without proper regulation, which is a major concern for potential traders. The broker's claims of being regulated by the Financial Services Regulatory Authority (FSRA) in Saint Lucia have been met with skepticism, as many sources indicate that this regulatory body does not provide adequate oversight for forex trading. This lack of regulation raises questions about the safety of client funds and the overall trustworthiness of the broker.

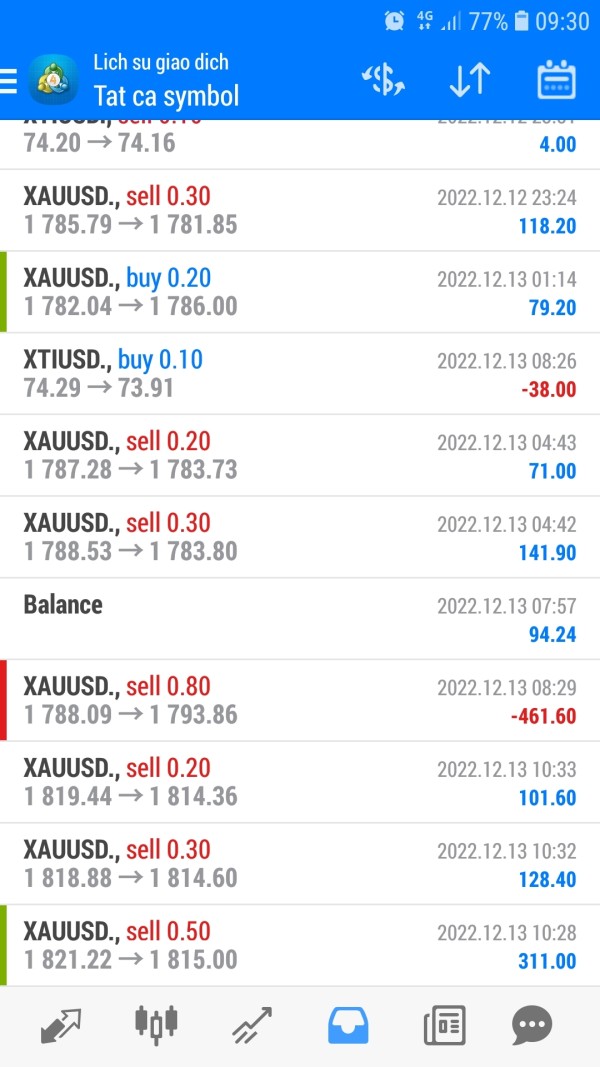

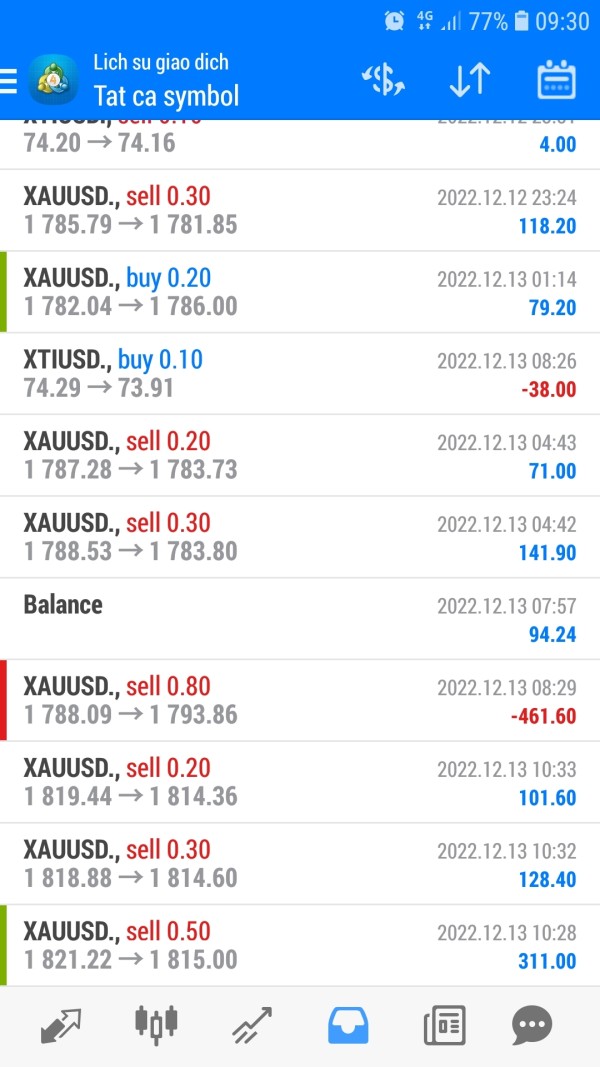

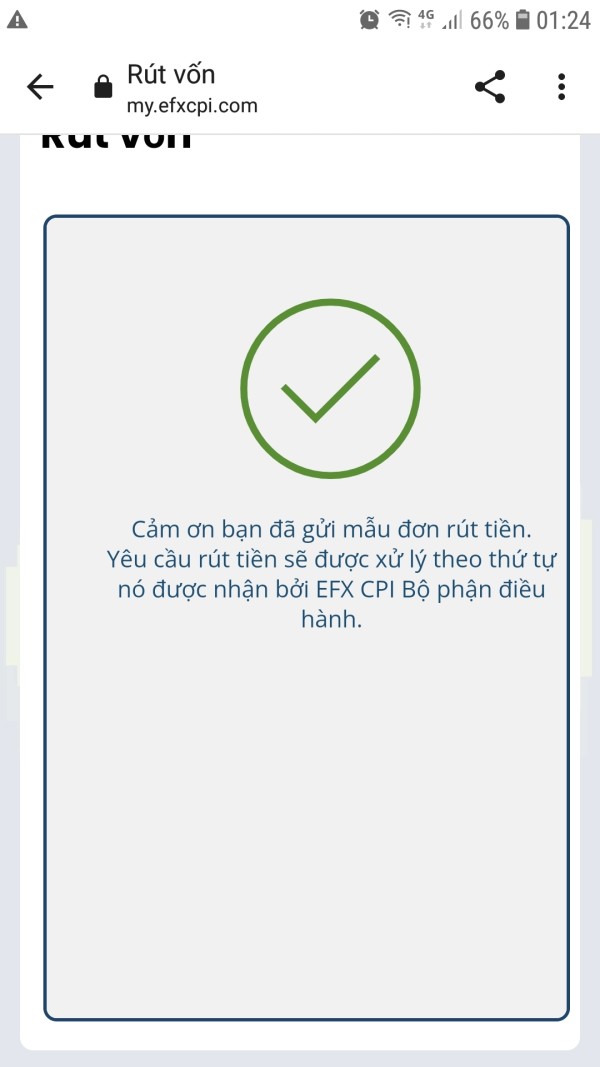

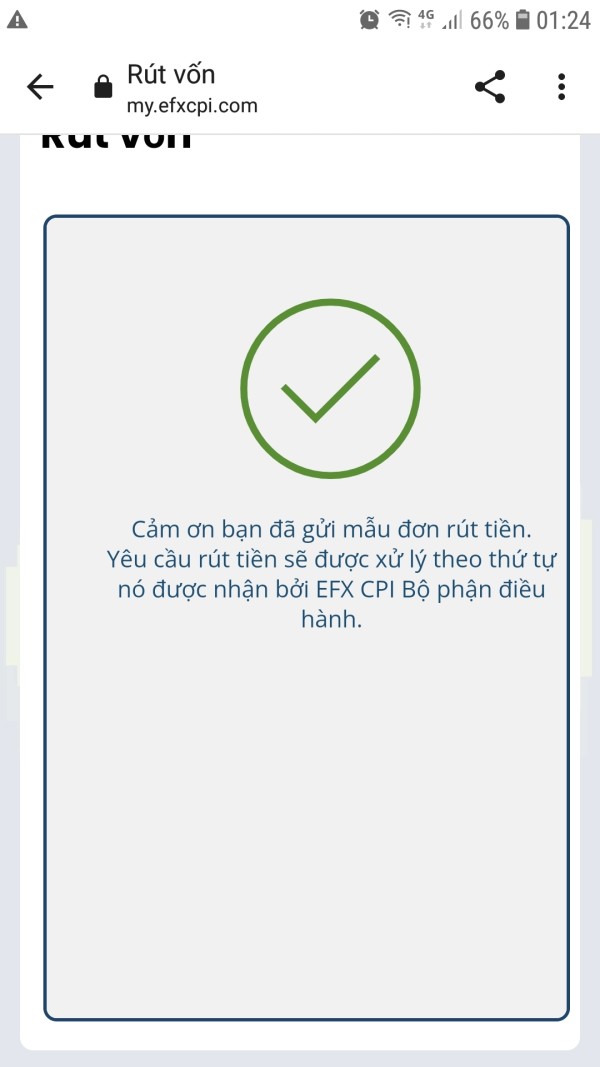

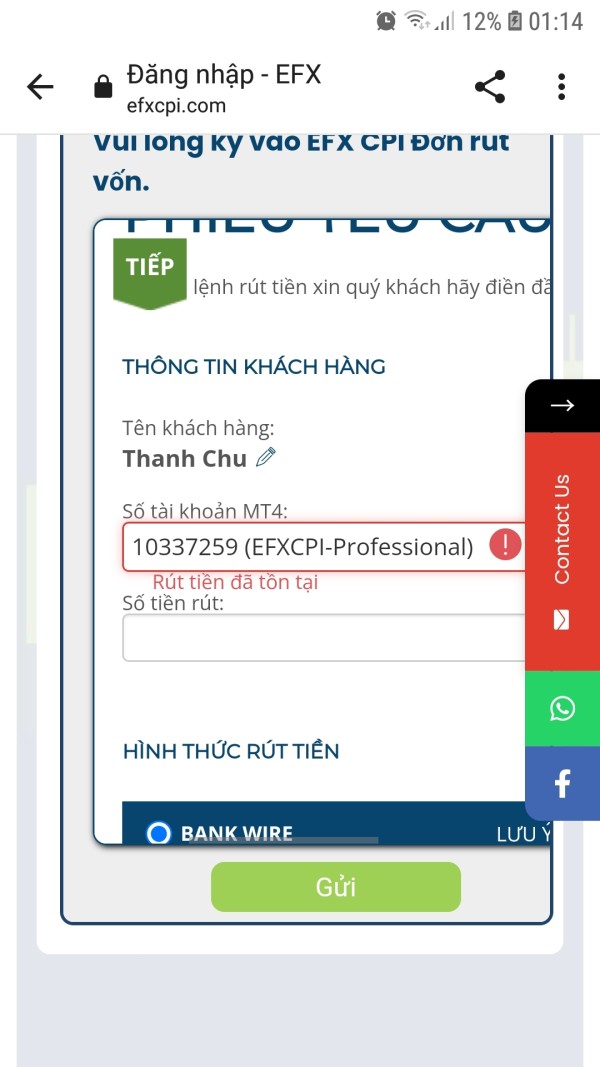

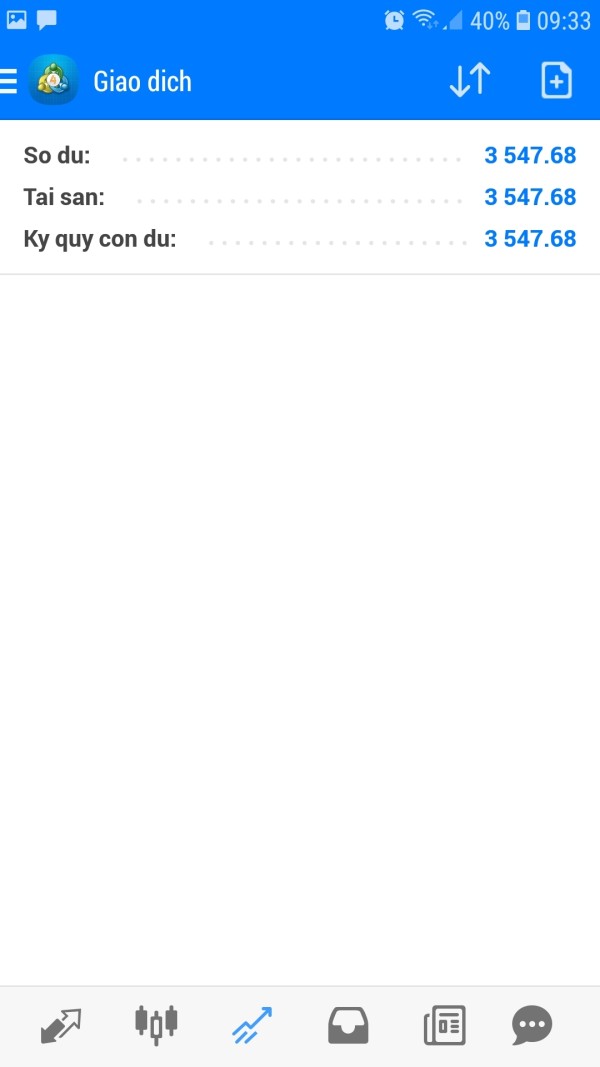

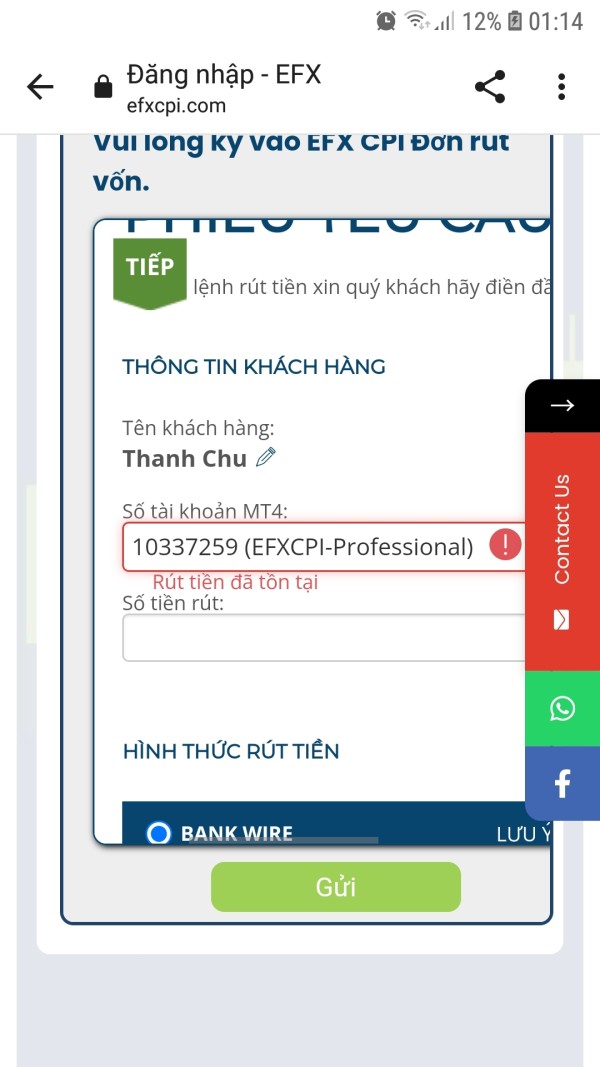

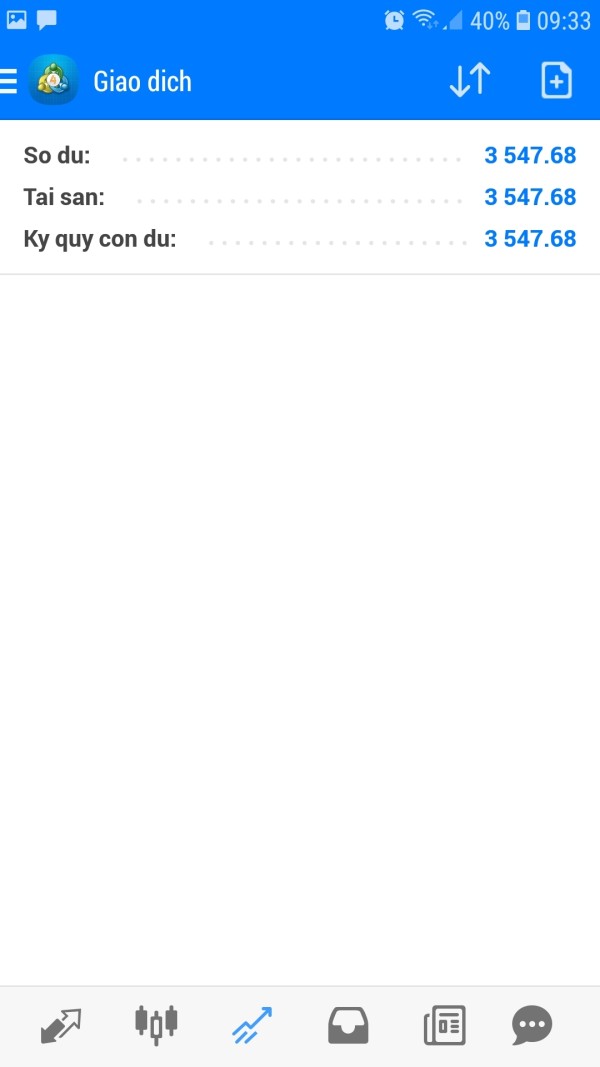

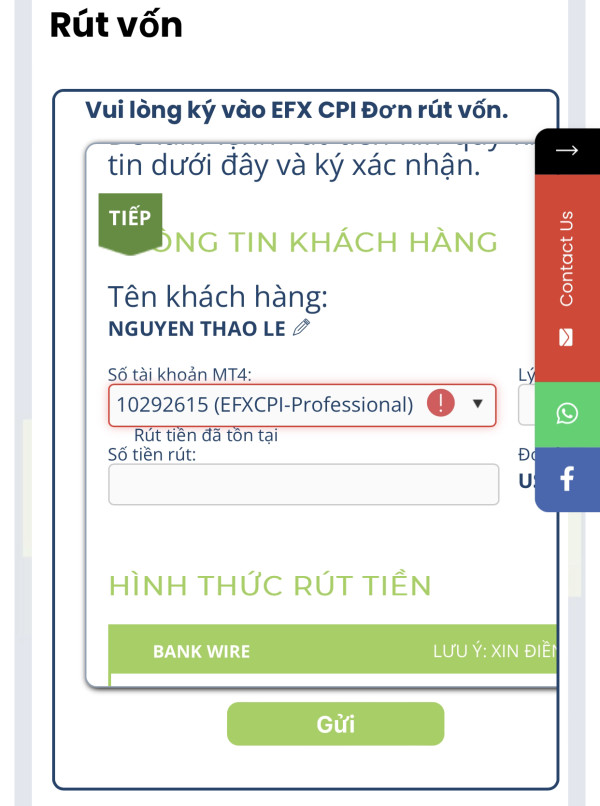

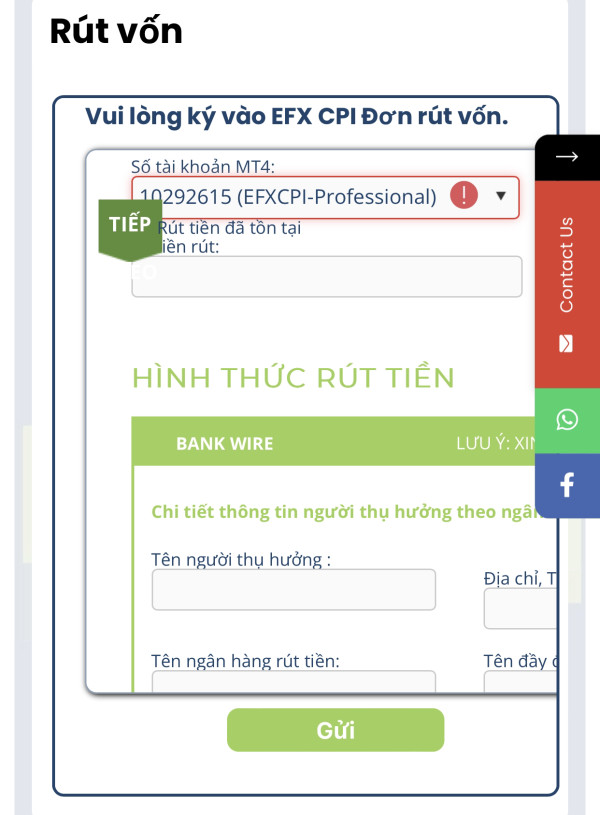

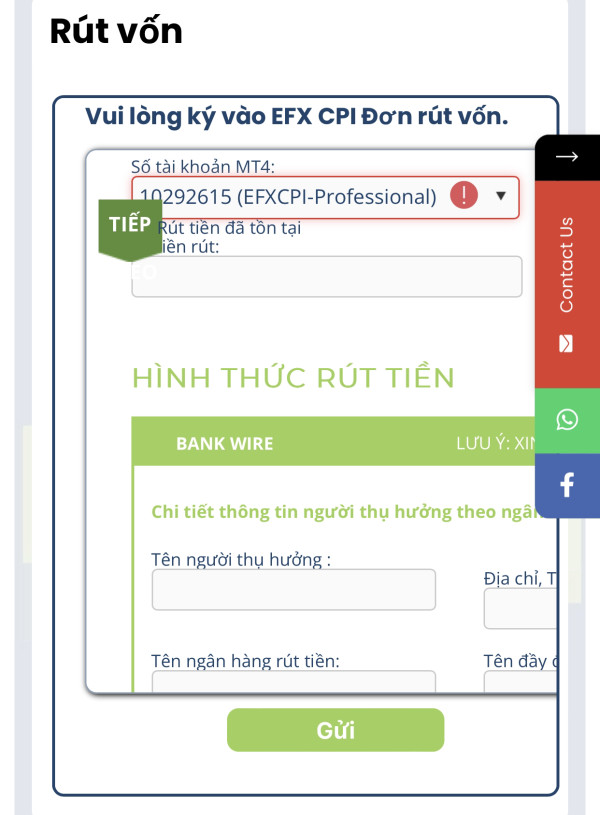

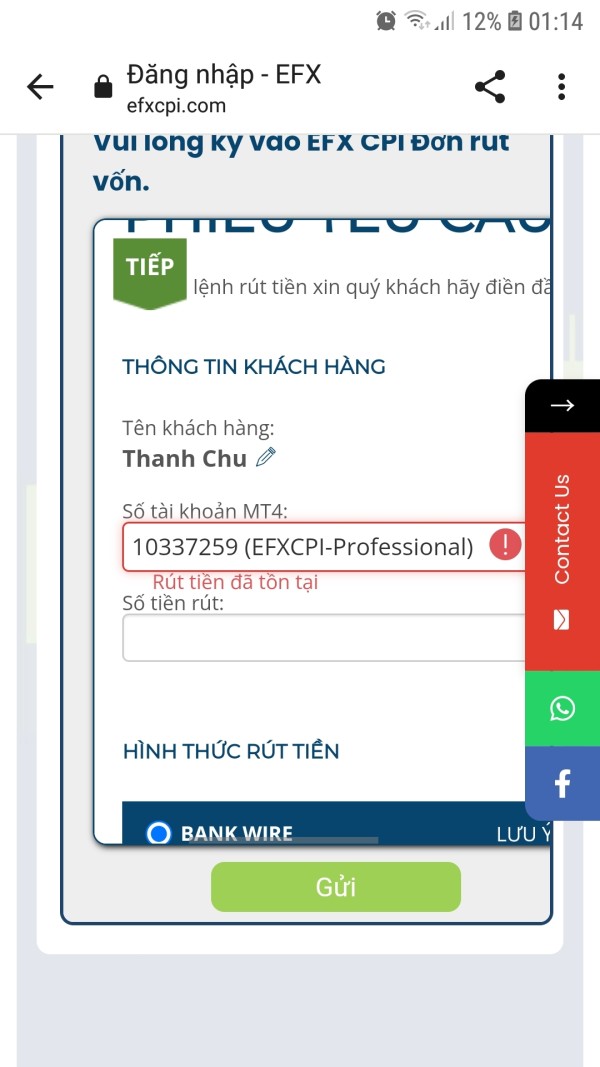

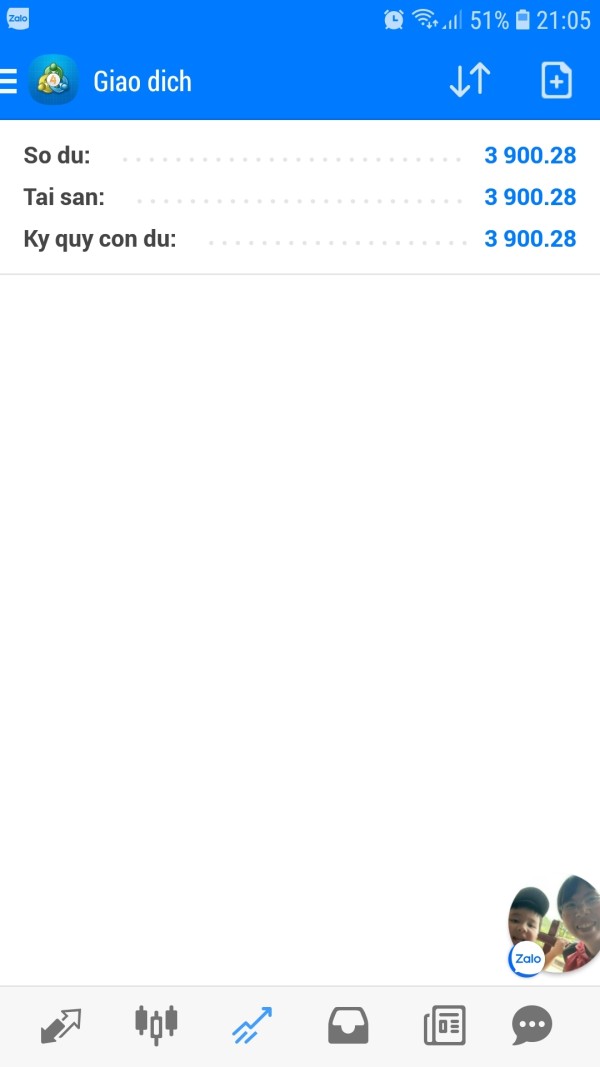

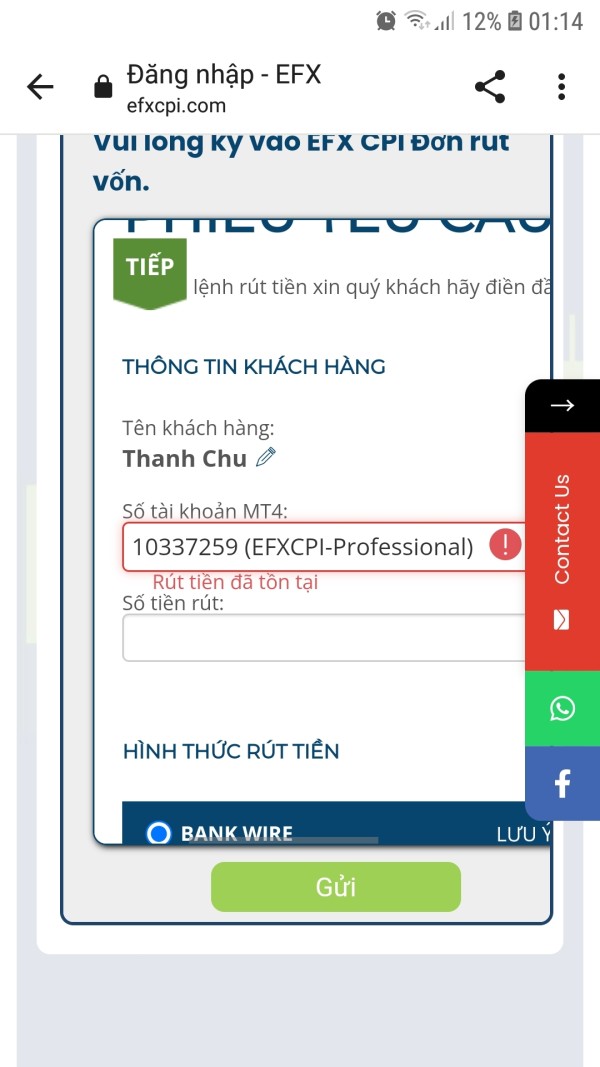

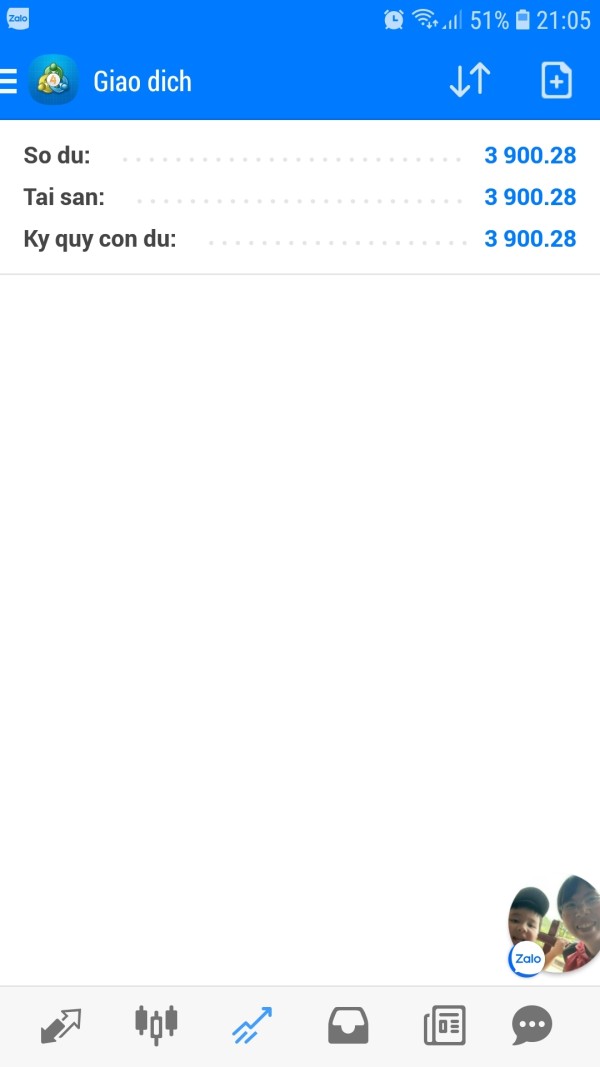

Deposit and Withdrawal Options

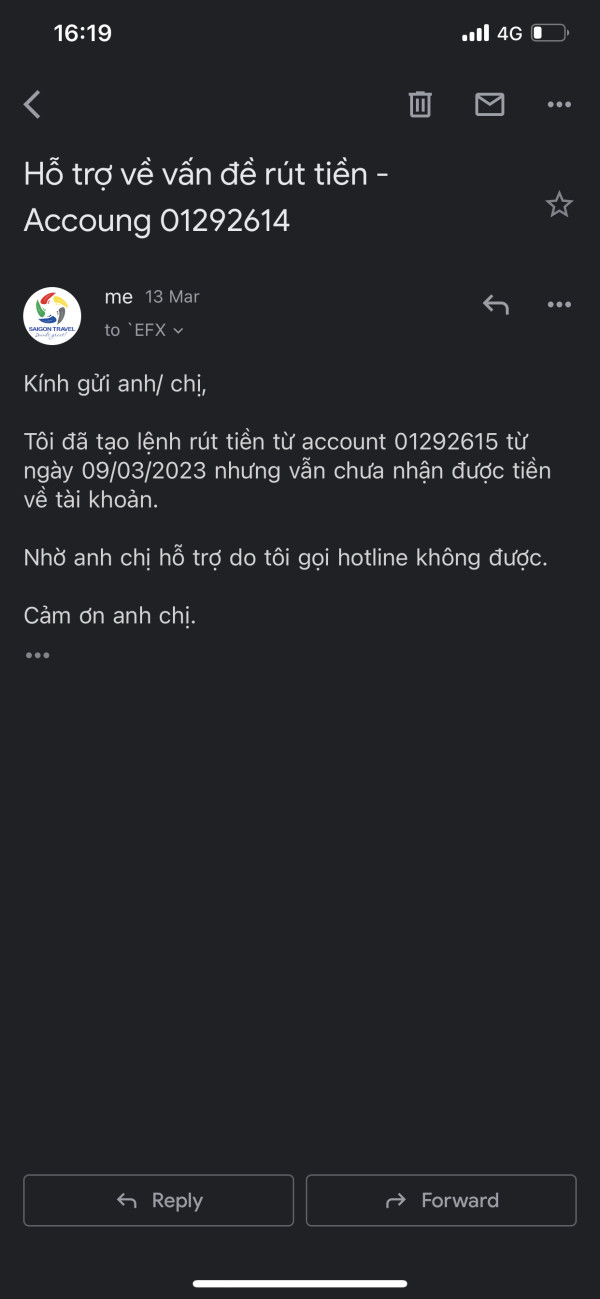

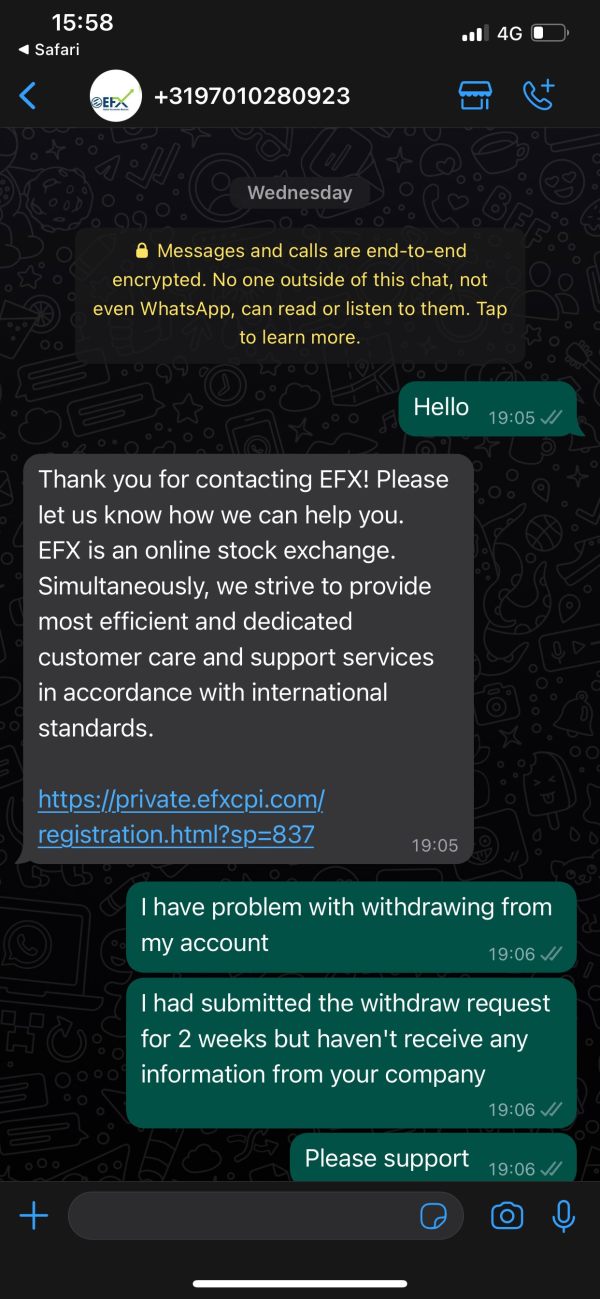

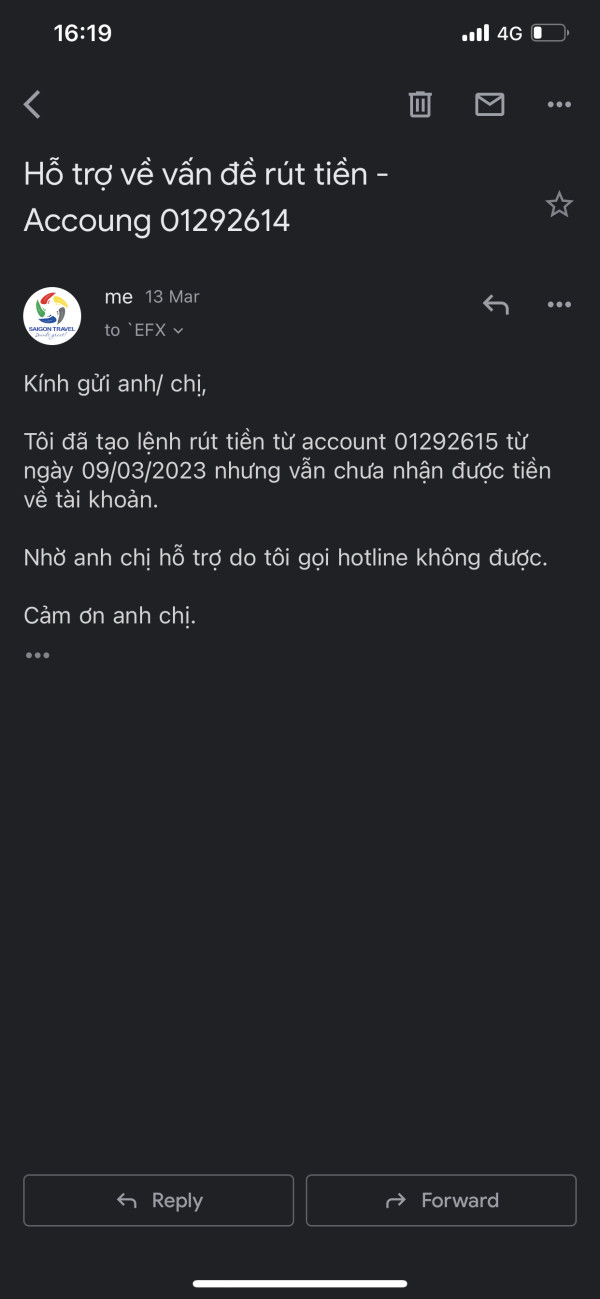

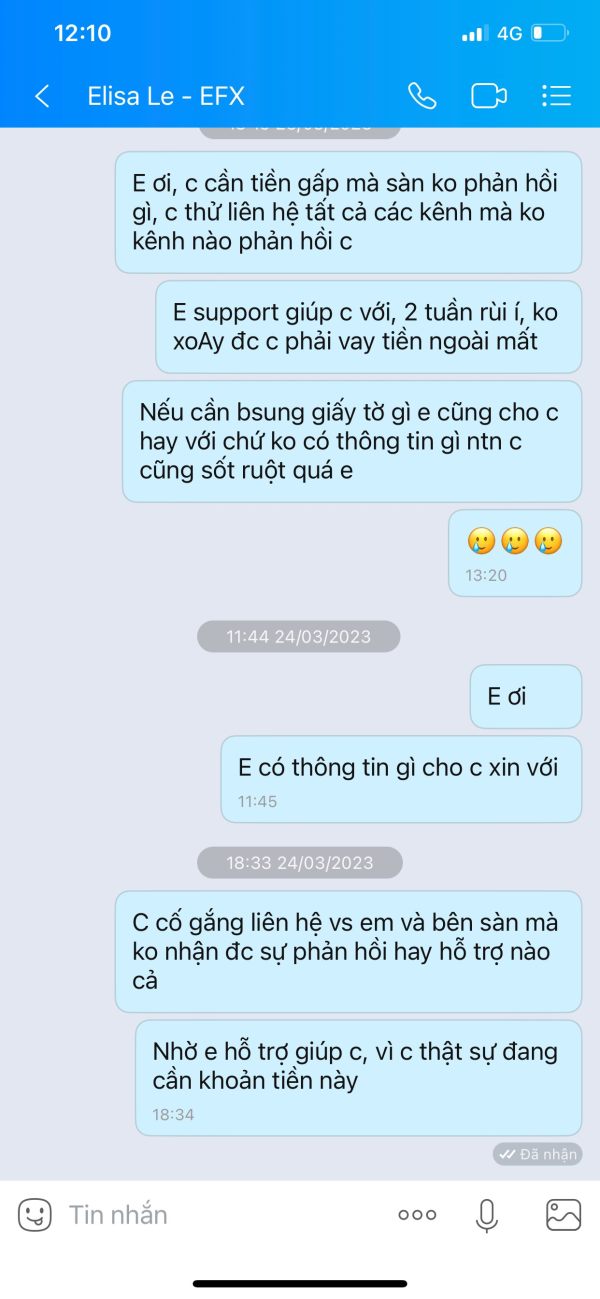

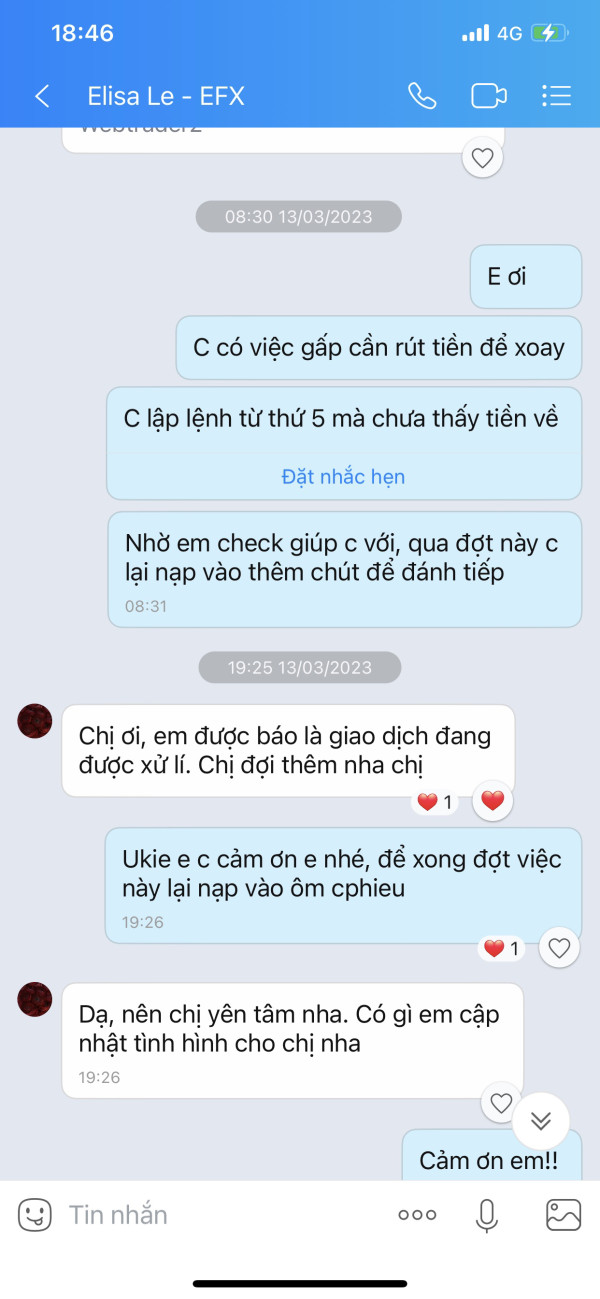

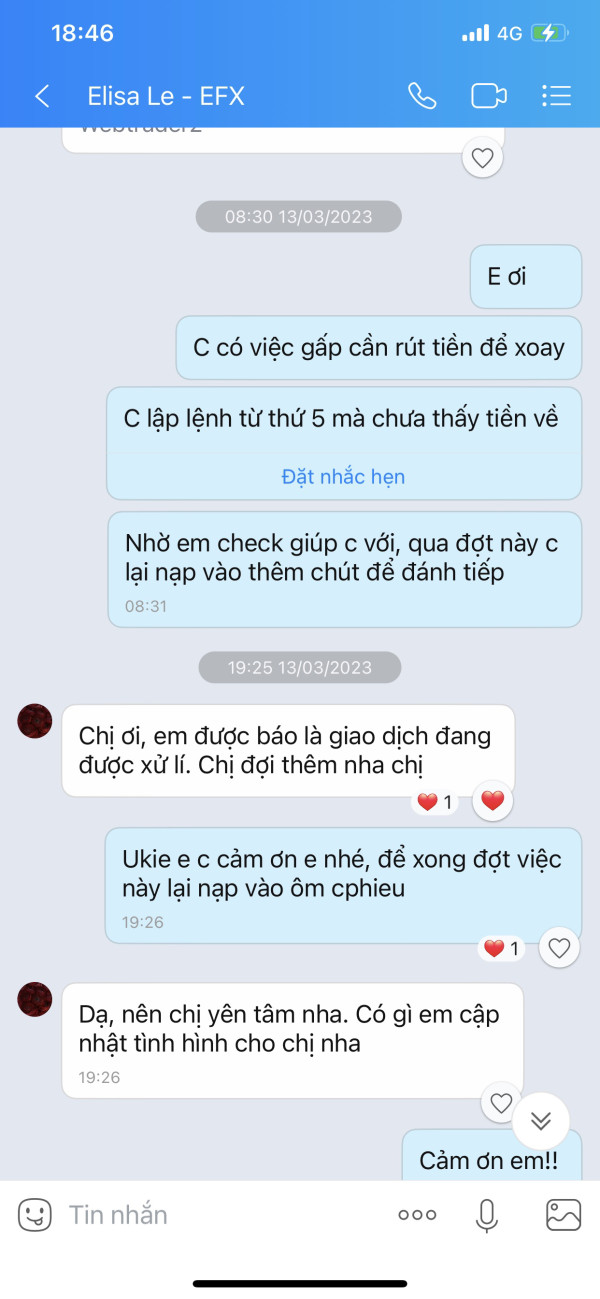

efx supports a variety of deposit and withdrawal methods, including bank transfers and credit cards, with a minimum deposit requirement of $200. Notably, the broker accepts Bitcoin for transactions, which may appeal to crypto-savvy traders. However, the absence of support for third-party transactions and reports of withdrawal issues have led to negative user experiences, as some clients have reported difficulties in accessing their funds.

The broker offers a 20% deposit bonus for new clients, which can be enticing for traders looking to boost their initial capital. However, bonus structures often come with stringent withdrawal conditions that can complicate the trading experience. Users should approach such promotions with caution, as they can sometimes lead to unexpected restrictions on fund access.

Asset Classes Available

efx provides access to over 40 forex pairs, 10 indices, and a couple of commodities like gold and silver. However, the absence of stocks and cryptocurrencies in their trading offerings may limit appeal for traders looking for a more diversified portfolio. This narrow focus could deter potential clients who prefer brokers that offer a broader range of financial instruments.

Cost Structure

The cost structure at efx includes floating spreads that start from 1.5 pips for standard accounts, which is relatively high compared to industry standards. The broker does not provide clear information on commissions for all account types, which can create uncertainty for traders regarding their overall trading costs. Additionally, the leverage offered is up to 1:400, which may attract high-risk traders but also increases the potential for significant losses.

efx primarily utilizes the MetaTrader 5 platform, known for its advanced analytical tools and user-friendly interface. The platform is accessible on various devices, including desktop and mobile, enhancing the trading experience for users who prefer flexibility. However, some users have reported technical issues with the platform, which can hinder trading performance.

Restricted Regions

The broker accepts clients from various regions globally, excluding countries like the USA, Cuba, Iraq, Myanmar, North Korea, and Sudan. This broad acceptance may appeal to international traders, but the lack of regulation raises concerns about the quality of service offered.

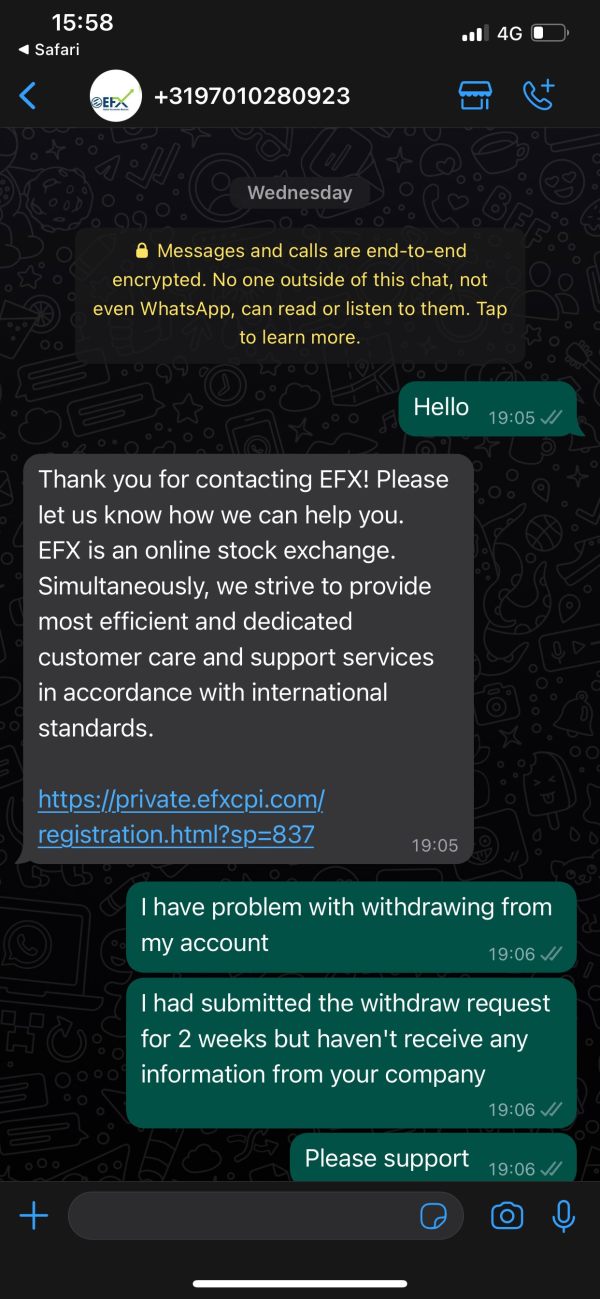

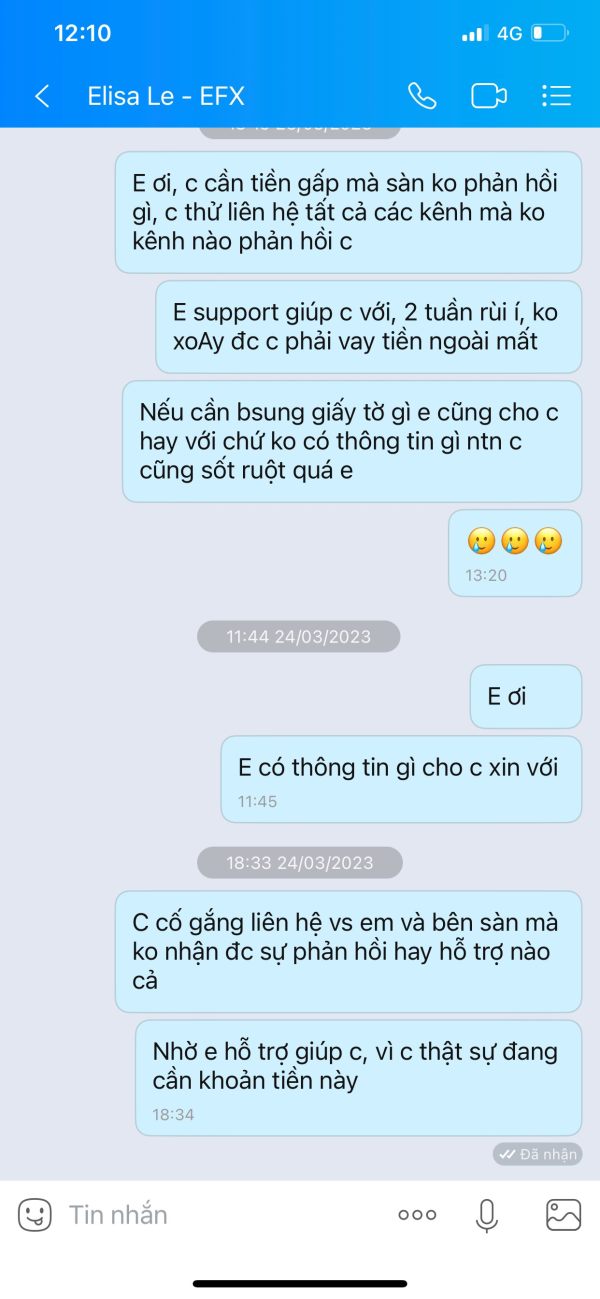

Customer Service Languages

Customer support at efx is available through multiple channels, including email and live chat, but reports indicate that the support may not be reliable. Users have expressed dissatisfaction with the response times and the effectiveness of the support team, which can be a significant drawback for traders requiring timely assistance.

Final Ratings Overview

In conclusion, while efx presents some attractive features such as high leverage and a familiar trading platform, the significant concerns regarding its regulatory status and user experiences cannot be overlooked. Potential traders should conduct thorough research and consider alternative brokers that offer stronger regulatory protections and a more comprehensive range of trading instruments.