KKI Review 1

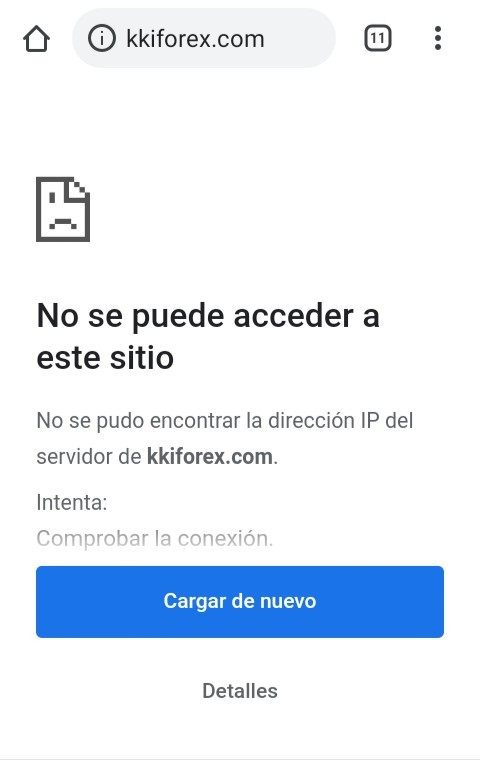

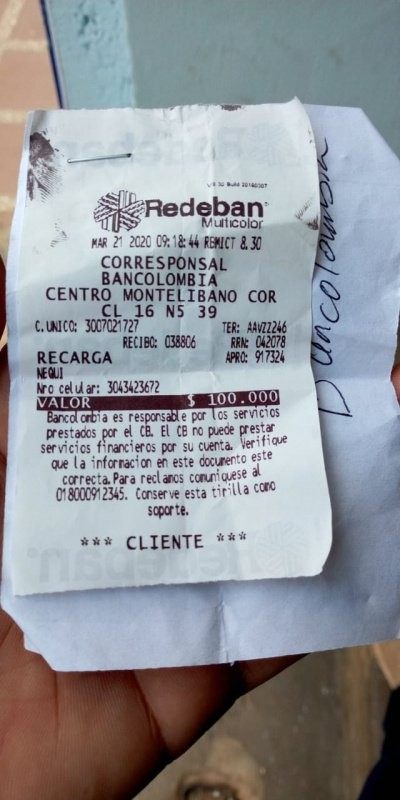

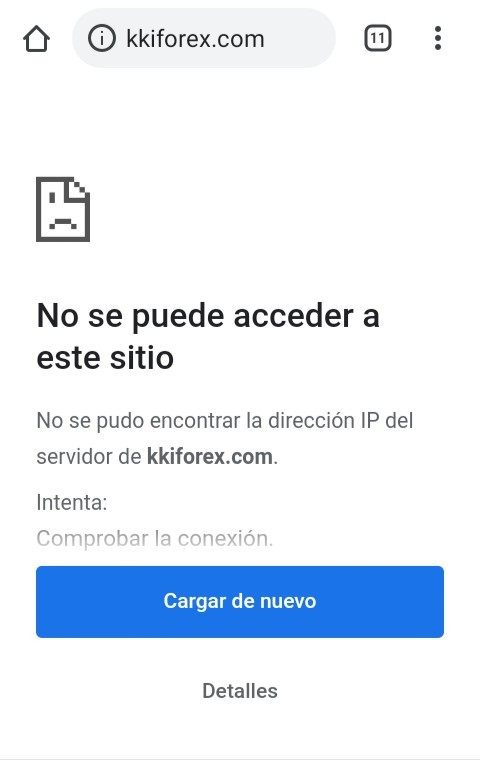

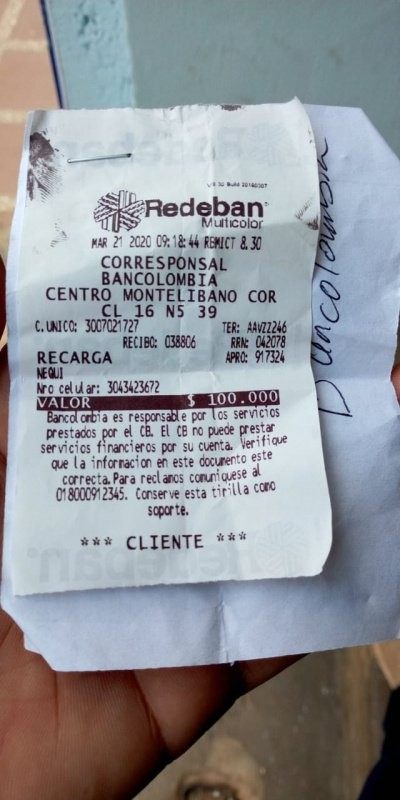

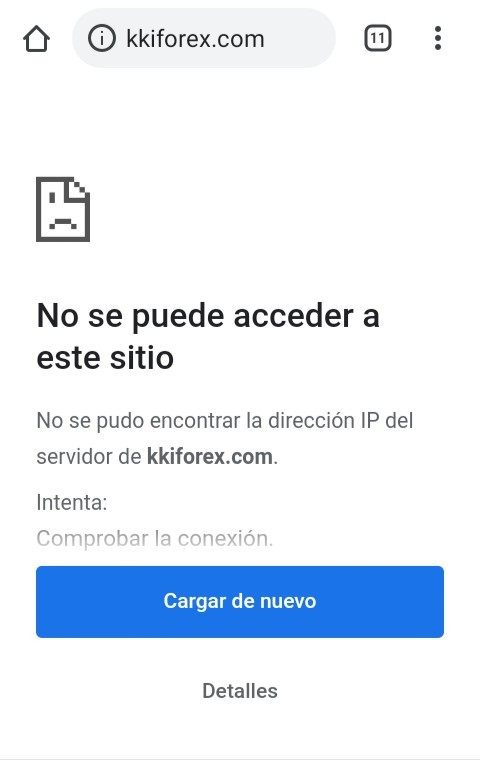

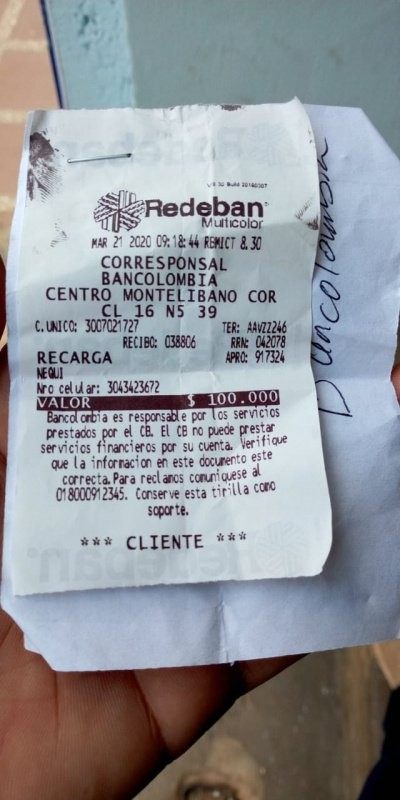

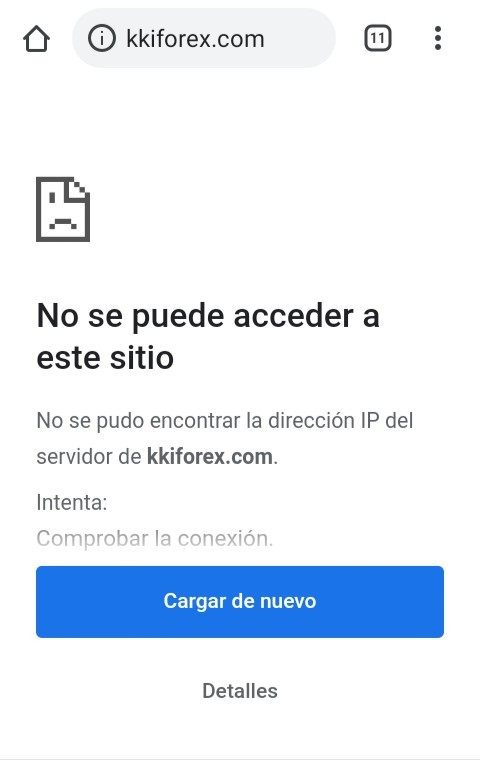

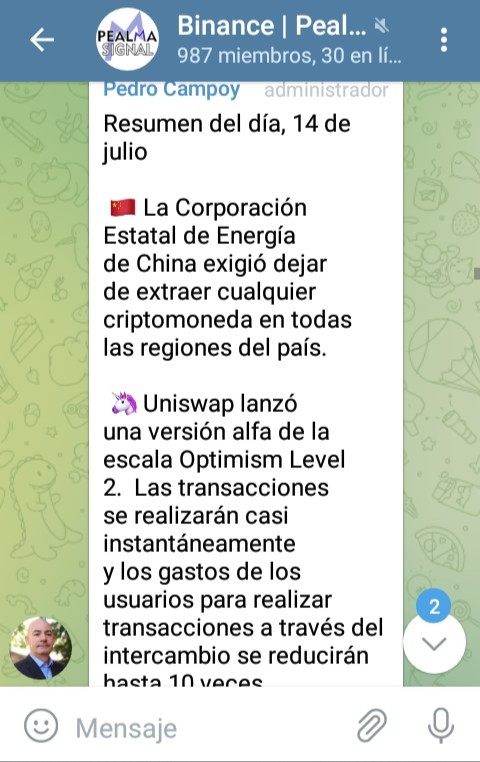

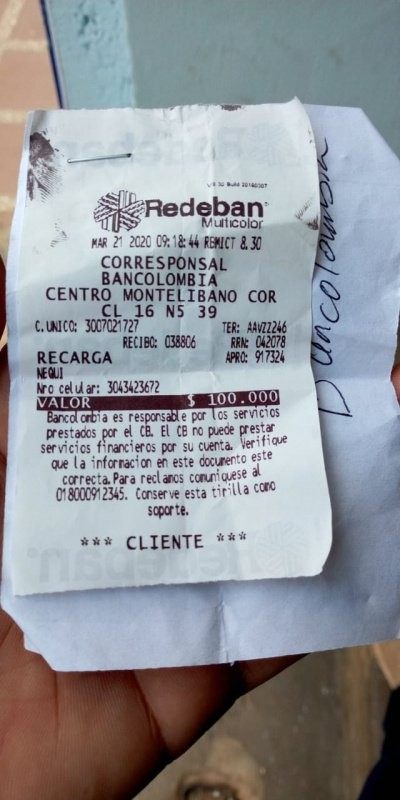

It was a scam. I deposited $100. The broker promised a good profits and added me to a Telegram group. One day, the platform was closed and I lost everything.

KKI Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

It was a scam. I deposited $100. The broker promised a good profits and added me to a Telegram group. One day, the platform was closed and I lost everything.

This complete kki review looks at a broker that has gotten mixed feedback from traders. KKI appears to offer various services based on information from 2022, though specific details about its forex trading operations are hard to find in public sources. The platform has received different user experiences. Some clients are happy with certain programs while others worry about service quality and how the company operates.

The trading environment for KKI uses industry-standard platforms like MetaTrader 4, which is good for traders who know this popular trading software. However, the mixed user feedback means potential clients should research carefully before choosing this broker. This review helps experienced traders who know how important it is to check out brokers thoroughly before putting money in.

The different user experiences show why people need to carefully check any broker's track record, rules, and service quality before trading.

Regional Entity Differences: KKI may work under different rules in different countries. Traders should check the specific rules and licenses in their area before using any services. The rules for forex brokers change a lot between countries. What works in one place might not be allowed in another.

Review Method Disclaimer: This review uses public information and user feedback from various sources. Since there is limited complete data about KKI's current operations, some parts of this review may not cover all details. Readers should do their own research before making any trading decisions.

| Rating Area | Score | Reason for Score |

|---|---|---|

| Account Conditions | N/A | Specific account condition information is not detailed in available materials |

| Tools and Resources | 6/10 | Based on limited information about MetaTrader 4 platform use |

| Customer Service and Support | N/A | Customer service information is not detailed in available materials |

| Trading Experience | N/A | Specific trading experience information is not detailed in available materials |

| Trust Level | 3/10 | Based on mixed user feedback and limited regulatory information |

| User Experience | 4/10 | Based on mixed reviews shown in available user feedback |

KKI is a trading company that has worked in financial services, though complete details about when it started and how it's organized are hard to find in public records. User feedback from 2022 shows the organization has provided various services, with some clients reporting experiences going back to 2020. The company seems to have kept operations running in different service areas. However, the size and scope of its forex trading operations need more explanation.

The broker's business model appears to include multiple service offerings, with trading services being one part of its business structure. User experiences show that KKI has kept client relationships for long periods, with some users reporting relationships lasting multiple years. However, the mixed feedback shows different levels of service satisfaction across different client groups.

From a technical setup perspective, this kki review notes that the platform uses MetaTrader 4 for trading operations. MT4 remains one of the most widely used trading platforms in the forex industry, offering complete charting tools, automated trading abilities, and an easy-to-use interface. The choice to use MT4 shows an understanding of trader preferences for established, reliable trading software. However, specific details about asset classes, trading instruments, and regulatory oversight remain unclear from available sources.

Regulatory Region: Specific regulatory information for KKI is not clearly detailed in available sources, which raises important questions for potential clients about oversight and protection.

Deposit and Withdrawal Methods: Payment and withdrawal methods are not specified in the available documentation, requiring direct contact with the broker for clarification.

Minimum Deposit Requirements: Minimum deposit requirements are not detailed in publicly available information about KKI's trading services.

Bonus Promotions: Information about promotional offers or bonus programs is not available in the current documentation reviewed.

Tradeable Assets: While forex trading appears to be offered, the complete range of tradeable assets and instruments is not fully detailed in available sources.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in the available documentation, which is an important consideration for traders checking cost-effectiveness.

Leverage Ratios: Leverage ratios and margin requirements are not specified in the available information about KKI's trading conditions.

Platform Options: The broker uses MetaTrader 4 as its trading platform, giving users access to this industry-standard software.

Regional Restrictions: Specific geographical restrictions or availability limitations are not detailed in the current kki review materials.

Customer Service Languages: Available customer service languages are not specified in the documentation reviewed.

The evaluation of KKI's account conditions faces big limitations because there isn't enough information in public sources. Standard account evaluation usually includes account type variety, minimum deposit requirements, account opening procedures, and special features such as Islamic accounts for Muslim traders. However, specific details about KKI's account structure, tiering system, or special account features are not clearly documented in available materials.

For potential clients, this lack of clear account information is a big concern. Good forex brokers usually provide clear, detailed information about their account offerings, including different account types designed for various trader profiles, from beginners to professional traders. The absence of such information makes it hard for traders to check whether KKI's account conditions match their trading needs and experience level.

This kki review emphasizes how important it is to get detailed account information directly from the broker before making any commitment. Traders should specifically ask about account minimums, fee structures, and any restrictions that might apply to their trading style or location.

KKI's use of MetaTrader 4 is a positive part of their service offering. MT4 is widely seen as one of the most reliable and feature-rich trading platforms in the forex industry, giving traders complete charting abilities, technical analysis tools, and automated trading support through Expert Advisors. The platform's stability and extensive functionality have made it a preferred choice among both retail and institutional traders worldwide.

However, beyond the MT4 platform, information about additional trading tools and resources is limited. Modern forex brokers usually add to their platform offerings with research materials, market analysis, educational content, and their own trading tools. The absence of detailed information about such extra resources makes it hard to check the full scope of KKI's tool and resource offerings.

For traders who rely heavily on research and analysis, the lack of information about market research, economic calendars, or educational materials could be limiting. Successful trading often requires access to complete market information and learning resources, particularly for developing traders seeking to improve their skills and market understanding.

Customer service quality is a critical factor in broker evaluation, yet specific information about KKI's customer support setup is not detailed in available sources. Standard customer service evaluation usually covers support channel availability, response times, service quality, multilingual support abilities, and operating hours. The absence of such information makes it challenging to check KKI's commitment to customer support.

Good customer service becomes particularly important during account setup, technical issues, or urgent trading situations. Traders often need quick help with platform issues, account questions, or transaction problems. Without clear information about KKI's customer service abilities, potential clients cannot properly check whether the broker can provide necessary support when needed.

The lack of customer service information also raises questions about transparency and accessibility. Good brokers usually highlight their customer support abilities as a key difference, providing clear contact information, support hours, and service level commitments. The absence of such information in this review suggests potential clients should directly verify customer service abilities before working with the broker.

Checking KKI's trading experience faces limitations because there isn't enough detailed information about platform performance, order execution quality, and overall trading environment. While the use of MT4 provides a foundation for reliable trading functionality, the overall trading experience includes factors beyond platform choice, including execution speed, slippage rates, server stability, and order processing quality.

Modern forex trading requires fast, reliable order execution, particularly for strategies involving scalping or high-frequency trading. Without specific performance data or user feedback about execution quality, it's hard to check whether KKI provides the trading environment necessary for serious forex trading activities.

The mobile trading experience, which has become increasingly important for modern traders, is also not detailed in available information. Many traders need strong mobile trading abilities to manage positions and respond to market movements while away from their primary trading setup. This kki review cannot properly check mobile trading quality because of limited available information.

Trust is perhaps the most critical factor in broker selection, and KKI's trust profile presents several areas of concern based on available information. The mixed user feedback and limited regulatory transparency raise important questions about the broker's reliability and trustworthiness. User reviews from 2022 include both positive experiences and significant concerns, with some feedback suggesting operational issues that could impact client confidence.

Regulatory oversight provides the foundation for broker trustworthiness, offering client protection, fund separation requirements, and operational standards. The lack of clear regulatory information about KKI is a significant trust concern for potential clients. Good forex brokers usually highlight their regulatory status as a key trust indicator, providing license numbers, regulatory body information, and compliance details.

The mixed nature of user feedback further complicates the trust assessment. While some users report positive experiences with certain services, others have expressed concerns about operational practices. This different feedback pattern suggests potential inconsistencies in service delivery that could impact client confidence and satisfaction.

User experience evaluation for KKI reveals a complex picture based on available feedback from 2022. The user community appears divided, with some clients expressing satisfaction with certain aspects of service while others have raised concerns about operational quality and service delivery. This mixed feedback pattern suggests that user experience may vary significantly depending on individual circumstances and service areas.

The overall user satisfaction appears to be moderate at best, with experiences ranging from positive to concerning. Some users have reported multi-year relationships with KKI, suggesting that certain clients have found value in the services provided. However, other feedback shows frustration with service quality and operational practices, pointing to potential inconsistencies in user experience delivery.

For potential clients, this mixed user experience profile suggests the importance of careful evaluation and perhaps starting with limited exposure to check service quality personally. The varied feedback shows that while some users may find KKI suitable for their needs, others may encounter service issues that could impact their trading activities.

This complete kki review reveals a broker with limited publicly available information and mixed user feedback that requires careful consideration from potential clients. While KKI offers MetaTrader 4 platform access, which provides a solid technical foundation for forex trading, the lack of detailed information about regulatory status, account conditions, and service features presents significant evaluation challenges. The mixed nature of user experiences suggests that KKI may be suitable for experienced traders who can do thorough research and are comfortable with limited transparency.

However, the absence of clear regulatory information and detailed service documentation makes this broker less suitable for new traders or those seeking complete broker transparency. Potential clients should prioritize direct communication with KKI to get detailed information about services, costs, and regulatory status before making any trading commitments.

FX Broker Capital Trading Markets Review