Is INVAST safe?

Pros

Cons

Is Invast Safe or a Scam?

Introduction

Invast is a prominent player in the forex trading market, known for its comprehensive range of trading services and products. Founded in 1960, the company has built a reputation for providing reliable trading solutions, particularly in the Asian markets. However, with the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The risk of falling victim to scams or unreliable services is ever-present, making it crucial for traders to conduct thorough evaluations of their chosen brokers. This article aims to investigate whether Invast is a safe trading option or a potential scam. Our analysis is based on a review of regulatory compliance, company history, trading conditions, and customer feedback.

Regulation and Legitimacy

Regulation is a vital aspect of any trading platform, as it ensures that the broker adheres to established standards of conduct and provides a level of protection for traders. Invast is regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable regulatory bodies in the world. This regulation is essential as it mandates that brokers maintain a certain level of financial stability and transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 438283 | Australia | Verified |

ASIC requires brokers like Invast to keep client funds in segregated accounts, ensuring that traders' money is protected even in the event of the broker's insolvency. Furthermore, Invast has a history of compliance with regulatory standards, which adds to its credibility. The stringent oversight by ASIC means that Invast is held accountable for its actions, making it less likely to engage in fraudulent practices. Overall, the regulatory framework surrounding Invast suggests that it is a safe broker, and there are no significant red flags indicating that it might be a scam.

Company Background Investigation

Invast has a rich history dating back over six decades. Initially established in Japan, the company has expanded its operations internationally, particularly in Australia, where it is now headquartered. The ownership structure of Invast is noteworthy, as it operates as a wholly-owned subsidiary of Invast Securities Co., Ltd., which is publicly listed on the Japanese stock exchange. This public listing enhances transparency and adds a layer of accountability to its operations.

The management team at Invast comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial in navigating the complexities of the forex market and ensuring that the company adheres to best practices. The level of transparency in Invast's operations is commendable; the company regularly publishes financial reports and updates on its performance, allowing traders to make informed decisions.

Trading Conditions Analysis

When assessing whether Invast is safe, it is essential to examine its trading conditions, including fees and spreads. Invast offers competitive spreads on major currency pairs, typically starting at 0.2 pips. However, the broker does charge commissions, which can vary based on the account type.

| Fee Type | Invast | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | $4 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads are competitive, the commission structure may deter some traders, particularly those with smaller account sizes. Additionally, Invast requires a minimum deposit of AUD 25,000, which is relatively high compared to other brokers. This could limit access for novice traders or those with limited capital. Overall, while the trading conditions at Invast are generally favorable, the high minimum deposit and commission structure may raise concerns for some potential clients.

Client Fund Security

The security of client funds is a paramount concern for any trader. Invast takes several measures to ensure the safety of its clients' investments. As previously mentioned, client funds are held in segregated accounts, which means that they are kept separate from the company's operational funds. This practice is crucial in protecting traders' money in case of financial difficulties faced by the broker.

Invast also employs advanced security measures, including SSL encryption, to protect sensitive client information. However, it is important to note that Invast does not offer negative balance protection, which means that traders could potentially lose more than their initial investment. This lack of protection could be a concern for risk-averse traders.

Historically, there have been no significant reports of fund security issues or disputes involving Invast, further supporting the notion that it is a safe broker. Nevertheless, traders should always be aware of the inherent risks involved in trading, particularly in leveraged markets.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Overall, Invast has received mixed reviews from clients. While many users praise the broker for its competitive spreads and reliable execution, others have pointed out issues related to customer service and responsiveness.

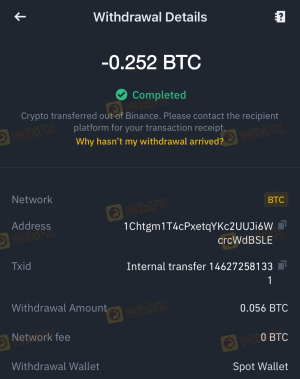

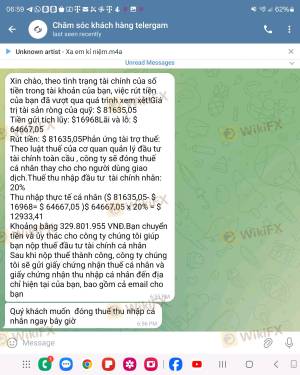

Common complaints include delays in fund withdrawals and difficulties in reaching customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Slow response |

| Customer Support Issues | High | Inconsistent |

For instance, some traders have reported waiting several days for their withdrawal requests to be processed, which can be frustrating, particularly for those who need immediate access to their funds. On the other hand, Invast has made efforts to improve its customer service response times, indicating a willingness to address these concerns.

Platform and Trade Execution

The trading platform offered by Invast is another critical aspect to consider when evaluating its safety. Invast provides access to popular platforms such as MetaTrader 4 (MT4) and IRESS, known for their user-friendly interfaces and robust trading tools.

The execution quality is generally favorable, with low slippage reported by many users. However, there have been occasional reports of order rejections, particularly during high-volatility periods. This could raise concerns about the broker's execution reliability, especially for traders employing high-frequency trading strategies.

Risk Assessment

Using Invast comes with its own set of risks, which potential clients should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by ASIC |

| Financial Risk | Medium | High minimum deposit requirement |

| Execution Risk | Medium | Occasional order rejections |

Overall, while the regulatory framework is solid, the high minimum deposit and occasional execution issues could pose risks for certain traders. It is advisable for potential clients to assess their risk tolerance and trading strategies before committing to Invast.

Conclusion and Recommendations

In conclusion, the evidence suggests that Invast is a legitimate broker rather than a scam. Its regulation by ASIC, coupled with a long history in the financial markets, indicates a commitment to transparency and client safety. However, potential clients should be aware of the high minimum deposit requirement and the absence of negative balance protection.

For traders looking for a reliable forex broker, Invast can be a viable option, especially for those with sufficient capital and a focus on major currency pairs. However, traders with limited funds or those seeking more flexible trading conditions may want to explore alternative brokers.

Overall, while Invast is generally safe, it is essential for traders to conduct their own research and consider their individual needs before choosing a broker.

Is INVAST a scam, or is it legit?

The latest exposure and evaluation content of INVAST brokers.

INVAST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INVAST latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.