Is Profit Pulse safe?

Pros

Cons

Is Profit Pulse A Scam?

Introduction

Profit Pulse is a relatively new player in the forex trading market, claiming to offer a wide range of trading services, including forex, cryptocurrencies, precious metals, and indices. Established in May 2024, the platform has quickly garnered attention, but not all of it is positive. As the forex market continues to grow, it becomes increasingly important for traders to exercise caution and thoroughly evaluate the brokers they choose to work with. Unscrupulous brokers can pose significant risks, including loss of funds and inadequate customer support. This article aims to assess the legitimacy of Profit Pulse by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on a review of multiple sources, including user feedback, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when evaluating its legitimacy. Profit Pulse claims to be based in New York, USA, and offers trading services without clear regulatory oversight. The absence of regulation raises significant red flags, as it suggests a lack of accountability and transparency in the broker's operations. Below is a table summarizing the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Profit Pulse is not registered with any recognized financial authority, such as the U.S. Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). This lack of regulation poses a substantial risk to investors, as it implies that there are no safeguards in place to protect client funds or ensure fair trading practices. The absence of oversight also means that traders have limited recourse in the event of disputes or fraudulent activities. Given these factors, it is essential for potential investors to exercise extreme caution when considering this broker.

Company Background Investigation

Profit Pulse's history and ownership structure are shrouded in ambiguity. The company emerged in May 2024, with little to no verifiable information regarding its founders or management team. This lack of transparency raises concerns about the broker's credibility. A thorough background check reveals that the domain for Profit Pulse was registered recently, and there is no evidence of a well-established company history.

The management team behind Profit Pulse is not publicly disclosed, which is a significant drawback. A reputable broker typically provides information about its team members, including their qualifications and experience in the financial industry. This absence of information not only diminishes the broker's credibility but also leaves potential clients in the dark regarding who is managing their investments.

Moreover, the companys website lacks detailed information about its operations, further contributing to the overall opacity. Legitimate brokers often provide comprehensive disclosures about their business practices, regulatory compliance, and customer support channels. In contrast, Profit Pulse's website appears to be generic and poorly designed, which is often a warning sign of a fraudulent operation.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for making informed investment decisions. Profit Pulse claims to offer competitive trading conditions, including access to various financial instruments. However, the lack of transparency regarding fees and spreads is concerning. Below is a comparison table of core trading costs:

| Fee Type | Profit Pulse | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Floating | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

Profit Pulse does not provide clear information about its spread, commission structure, or overnight interest rates. The mention of "floating spreads" without specific values makes it difficult for traders to estimate their trading costs accurately. This lack of clarity can lead to unexpected expenses, especially during volatile market conditions. Furthermore, the absence of a defined commission model raises concerns about potential hidden fees that could significantly impact profitability.

Additionally, the broker does not specify minimum deposit requirements or account types, which are crucial for traders to understand their investment options. The overall opacity in trading conditions suggests that Profit Pulse may not be operating with the best interests of its clients in mind.

Customer Funds Safety

The safety of customer funds is a paramount concern for traders. Profit Pulse lacks clear information regarding its fund security measures, which raises significant red flags. A reputable broker typically employs stringent measures to safeguard client funds, such as segregating client accounts and offering investor protection schemes. Unfortunately, Profit Pulse does not provide any details about these critical safety features.

Without regulatory oversight, there is no assurance that client funds are held in secure accounts or that the broker adheres to anti-money laundering (AML) and know-your-customer (KYC) policies. The absence of these measures increases the risk of funds being misused or misappropriated. Historical data regarding any past incidents of fund mismanagement or security breaches is also lacking, further contributing to the uncertainty surrounding this broker.

In the absence of clear policies on fund security, potential investors should be wary of the risks associated with trading through Profit Pulse. The lack of transparency regarding these measures indicates that the broker may not prioritize the safety of its clients' investments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Profit Pulse reveal a troubling pattern of negative experiences among users. Many traders report difficulties in withdrawing their funds, with some claiming that their accounts were blocked or emptied without explanation. Below is a summary table of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Access | Medium | Poor |

| Transparency Concerns | High | None |

The most common complaint revolves around withdrawal issues, where users have experienced significant delays or outright refusals to process their requests. This is a hallmark of fraudulent brokers, who often create barriers to prevent clients from accessing their funds. Additionally, the quality of customer support has been criticized, with many users reporting unresponsive or inadequate assistance when issues arise.

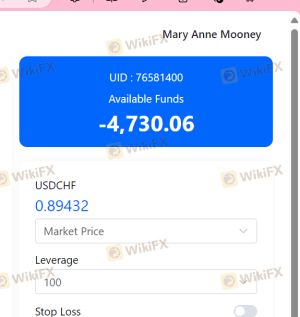

A typical case involves a user who deposited a substantial amount but faced challenges when attempting to withdraw their funds. After numerous attempts to contact customer support, the user was met with silence, leading to frustration and distrust. Such experiences highlight the potential risks associated with trading on the Profit Pulse platform.

Platform and Execution

The trading platform offered by Profit Pulse is another area of concern. While the broker claims to provide a user-friendly interface, reviews indicate that the platform is slow and prone to glitches. Traders have reported issues with order execution, including delays and slippage, which can significantly impact trading performance.

The quality of order execution is critical for traders, as any delays can result in missed opportunities or increased losses. Additionally, there are allegations of potential manipulation within the trading platform, raising questions about the integrity of the broker's operations. A reliable broker should offer a stable and transparent trading environment, which appears to be lacking in the case of Profit Pulse.

Risk Assessment

Utilizing a broker like Profit Pulse comes with inherent risks that traders must carefully consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases vulnerability. |

| Fund Safety Risk | High | Lack of transparency in fund security measures. |

| Trading Condition Risk | Medium | Opaque fee structures and unclear trading conditions. |

| Customer Support Risk | High | Poor response to customer complaints and withdrawal issues. |

The overall risk profile of Profit Pulse suggests that it may not be a suitable choice for most traders, particularly those who prioritize safety and transparency. To mitigate these risks, potential investors are advised to conduct thorough research and consider using brokers with established regulatory oversight and a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence gathered in this assessment strongly indicates that Profit Pulse exhibits numerous characteristics of a potentially fraudulent broker. The absence of regulatory oversight, lack of transparency in trading conditions, and alarming customer feedback all point to significant risks for potential investors.

For traders seeking reliable options, it is advisable to consider brokers that are well-regulated and have a solid reputation within the industry. Some reputable alternatives may include brokers such as OANDA, IG, or Forex.com, which offer robust regulatory oversight and transparent trading conditions.

Ultimately, traders should prioritize their safety and conduct comprehensive due diligence before engaging with any broker. Profit Pulse, given its numerous red flags, should be approached with extreme caution.

Is Profit Pulse a scam, or is it legit?

The latest exposure and evaluation content of Profit Pulse brokers.

Profit Pulse Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profit Pulse latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.