Regarding the legitimacy of xlibre forex brokers, it provides FSCA and WikiBit, .

Is xlibre safe?

Pros

Cons

Is xlibre markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TIPMARKETS (PTY) LTD

Effective Date:

2016-08-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

2ND FLOOR RIVONIA VILLAGECNR MUTUAL ROAD AND RIVONIA BOULEVARDRIVONIA VILLAGE2191Phone Number of Licensed Institution:

063 9392056Licensed Institution Certified Documents:

Is XLibre A Scam?

Introduction

XLibre, a newly established broker in the forex market, has been gaining attention among traders since its inception in 2024. Positioned as a global trading platform, XLibre offers a variety of trading instruments, including forex, commodities, shares, indices, and cryptocurrencies. Given the rapidly evolving nature of the forex industry, it is crucial for traders to carefully evaluate the reliability and safety of brokers before committing their funds. This article aims to provide a comprehensive analysis of XLibre, exploring its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment. Our investigation is based on a thorough review of multiple credible sources and user feedback, ensuring a balanced and objective evaluation.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its trustworthiness. XLibre operates under the oversight of two regulatory bodies: the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Commission (FSC) in Mauritius. Regulatory compliance is essential as it ensures that brokers adhere to strict standards of conduct, safeguarding client funds and promoting fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | FSP 47159 | South Africa | Verified |

| FSC | GB21026537 | Mauritius | Verified |

While both the FSCA and FSC provide a level of oversight, it is important to note that the FSC is considered a tier-3 regulator, which may not offer the same level of protection as tier-1 regulators like the FCA in the UK. However, the presence of dual regulation does enhance XLibre's credibility, as it must comply with the stringent requirements set forth by the FSCA, particularly in terms of fund management and operational integrity.

Company Background Investigation

XLibre is relatively new to the forex brokerage scene, having been established in 2024. The company is registered in Mauritius and operates under the name XLibre SA Pty Ltd in South Africa. The ownership structure and management team of XLibre are crucial aspects to consider when evaluating its legitimacy. The lack of detailed information regarding the management team raises some concerns about transparency. However, the broker's commitment to regulatory compliance suggests a level of professionalism and accountability.

In terms of company transparency, XLibre provides essential information about its operations, including its regulatory licenses and trading conditions. Nevertheless, the broker has been criticized for not offering sufficient educational resources or market research, which can be vital for traders seeking to improve their skills and knowledge.

Trading Conditions Analysis

When assessing a broker's reliability, understanding its trading conditions is essential. XLibre offers a competitive trading environment with various account types, including cent, standard, raw, and pro accounts. The overall fee structure is designed to be accessible for traders at different levels, with a minimum deposit requirement as low as $0 for standard and raw accounts.

However, it is important to scrutinize the broker's fee policies for any unusual or problematic aspects. For instance, while the spreads on major currency pairs are competitive, the commission structure varies significantly across account types, which may lead to confusion among traders.

| Fee Type | XLibre | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.2 pips |

| Commission Model | $0.05 per lot | Varies |

| Overnight Interest Range | Average to High | Varies |

XLibre's commission model, particularly for share CFDs and cryptocurrencies, can be perceived as high, especially for traders engaging in high-volume trading. This aspect requires careful consideration, as it may impact overall profitability.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. XLibre implements several security measures to protect client assets, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice is essential in mitigating the risk of financial difficulties faced by the broker.

Additionally, XLibre offers negative balance protection, which prevents traders from losing more than their deposited funds. This feature is particularly beneficial in volatile markets, providing an added layer of security for traders. However, it is crucial for traders to remain vigilant and employ sound risk management strategies, as no broker can eliminate all risks associated with trading.

Historically, XLibre has not faced any major security issues or controversies regarding customer funds, which adds to its credibility as a trustworthy broker.

Customer Experience and Complaints

User feedback is an important indicator of a broker's reliability. Overall, customer reviews of XLibre are mixed, with some users praising its competitive trading conditions and user-friendly platform, while others have raised concerns regarding customer support and the availability of educational resources.

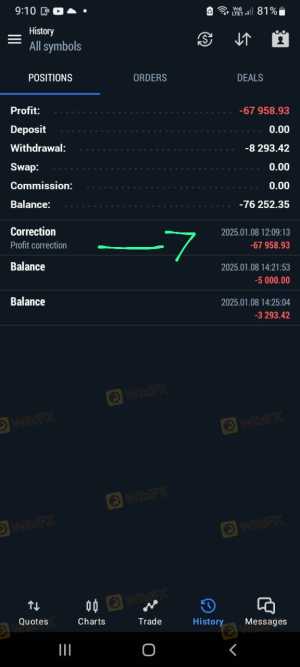

Common complaints include issues with the responsiveness of customer support, particularly regarding withdrawal processing times. The following table summarizes key complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Support Issues | Moderate | Generally responsive |

| Withdrawal Delays | High | Inconsistent response time |

One notable case involved a user who experienced delays in fund withdrawals, leading to frustration and uncertainty. While XLibre's support team was eventually able to resolve the issue, the lack of timely communication highlighted a potential area for improvement.

Platform and Execution

The performance and stability of the trading platform are critical factors for traders. XLibre exclusively offers the MetaTrader 5 (MT5) platform, known for its advanced features, including algorithmic trading capabilities and comprehensive analytical tools. However, the reliance on a single platform may limit options for traders who prefer alternatives such as MetaTrader 4 or cTrader.

In terms of order execution, XLibre boasts an average execution speed of around 50 milliseconds, which is competitive within the industry. However, traders should remain aware of potential slippage and rejection rates, particularly during volatile market conditions.

Risk Assessment

Using XLibre carries certain risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation offers some protection, but not as robust as tier-1 regulators. |

| Market Risk | High | Trading CFDs and forex involves high volatility and potential for significant losses. |

| Customer Support Risk | Medium | Mixed feedback on support responsiveness may impact trader experience. |

To mitigate these risks, traders are advised to employ sound risk management practices, including setting stop-loss orders, diversifying their portfolios, and remaining informed about market conditions.

Conclusion and Recommendations

In conclusion, XLibre appears to be a legitimate broker that offers a range of trading instruments and competitive conditions. However, traders should exercise caution and conduct thorough research before opening an account. While the broker is regulated by the FSCA and FSC, the lack of a top-tier regulatory license may raise concerns for some traders.

Overall, XLibre does not exhibit clear signs of being a scam, but potential clients should be aware of its limitations, particularly regarding customer support and educational resources. For traders seeking reliable alternatives, brokers like Exness and AvaTrade may offer more comprehensive services and support.

In summary, while XLibre has the potential to serve a diverse range of traders, careful consideration of its offerings and potential risks is essential for a successful trading experience.

Is xlibre a scam, or is it legit?

The latest exposure and evaluation content of xlibre brokers.

xlibre Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

xlibre latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.