GTMX 2025 Review: Everything You Need to Know

Executive Summary

This gtmx review gives you a complete look at GTMX, a forex trading broker. The trading community has mixed feelings about this broker in 2025. We give GTMX a neutral rating because users report both good and bad experiences on different review sites.

The broker has some appealing features like a $100 USD minimum deposit and high leverage up to 1:500. These options make it attractive to traders who want flexible trading conditions. GTMX works mainly through the MetaTrader 5 platform and lets you trade forex, cryptocurrencies, stocks, commodities, and indices.

The platform targets beginner to intermediate traders who want high-leverage trading with lower starting capital. However, WikiBit reports show the broker has received 2 positive reviews, neutral feedback, and 13 exposure complaints. This shows that many users have serious concerns. The broker is registered in Saint Vincent and the Grenadines under SVG FSA, which gives limited protection for forex trading.

This regulatory setup, combined with user complaints about pushy sales tactics, leads to our mixed assessment of this broker's reliability and trustworthiness.

Important Disclaimers

Regional Entity Differences: GTMX is registered in Saint Vincent and the Grenadines and operates under SVG FSA regulation. You need to understand that this regulatory body does not give the same protection as major financial authorities like the FCA, ASIC, or CySEC. The SVG FSA registration does not guarantee compensation schemes or strict oversight that traders might expect from more established regulatory areas.

Review Methodology: This evaluation uses publicly available information, user feedback from multiple review platforms, and regulatory data. The assessment shows the current status as of 2025 and may change as new information becomes available. All ratings and conclusions come from sources we can verify and user testimonials found across various financial review websites.

Overall Rating Framework

Broker Overview

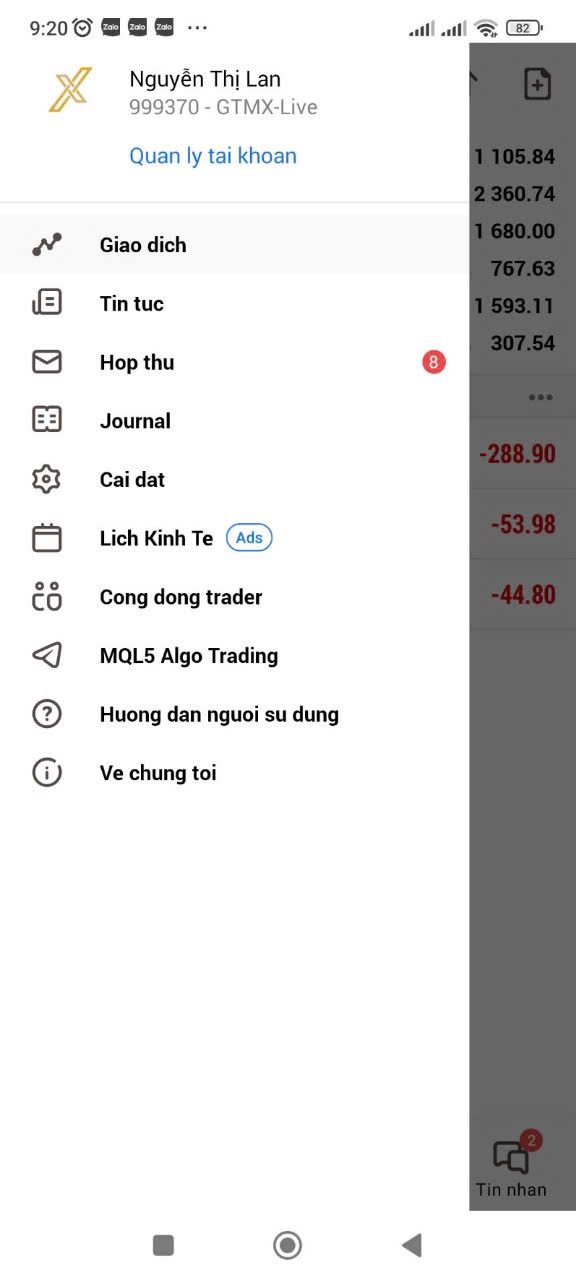

GTMX operates as a forex trading broker with headquarters reportedly located in Bangkok, Thailand. The company focuses on connecting different datasets to find hidden value for traders. It positions itself as a technology-driven trading solutions provider. While we don't know the exact founding year from available documents, the broker has built a presence across multiple international markets.

The company's approach emphasizes building foundations for commercial growth through meaningful engagement with commercial teams. GTMX Consulting Ltd. has helped teams connect various data systems to uncover trading opportunities that might otherwise stay hidden. This technology focus suggests the broker aims to stand out through data analytics and systematic trading support.

GTMX mainly operates through the MetaTrader 5 trading platform, supporting desktop, PC, and mobile device access for complete trading flexibility. The broker offers access to multiple asset classes including foreign exchange pairs, cryptocurrencies, individual stocks, commodities, and market indices. Regulatory oversight comes from the SVG FSA (Saint Vincent and the Grenadines Financial Services Authority), though this gtmx review notes that this regulatory framework provides limited protection compared to major financial jurisdictions. The broker's multi-asset approach and technology infrastructure show an attempt to serve diverse trading needs across different market segments.

Regulatory Jurisdiction: GTMX is registered in Saint Vincent and the Grenadines under SVG FSA supervision. This regulatory framework provides basic operational oversight but lacks the comprehensive investor protection mechanisms found in major financial centers.

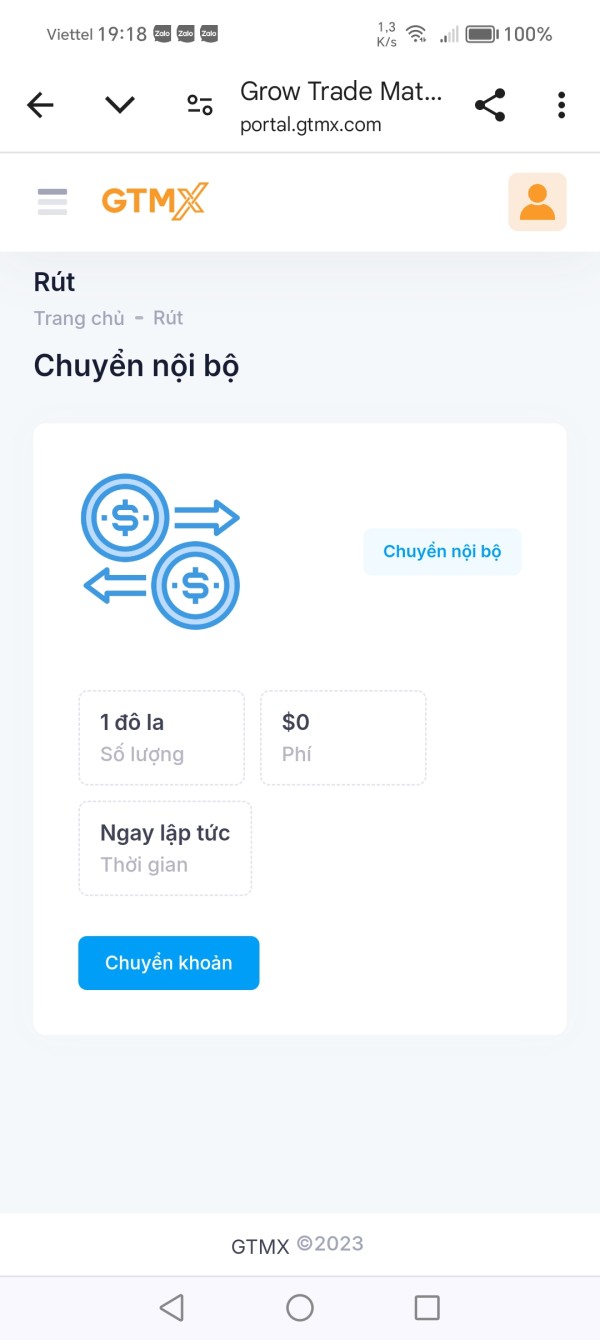

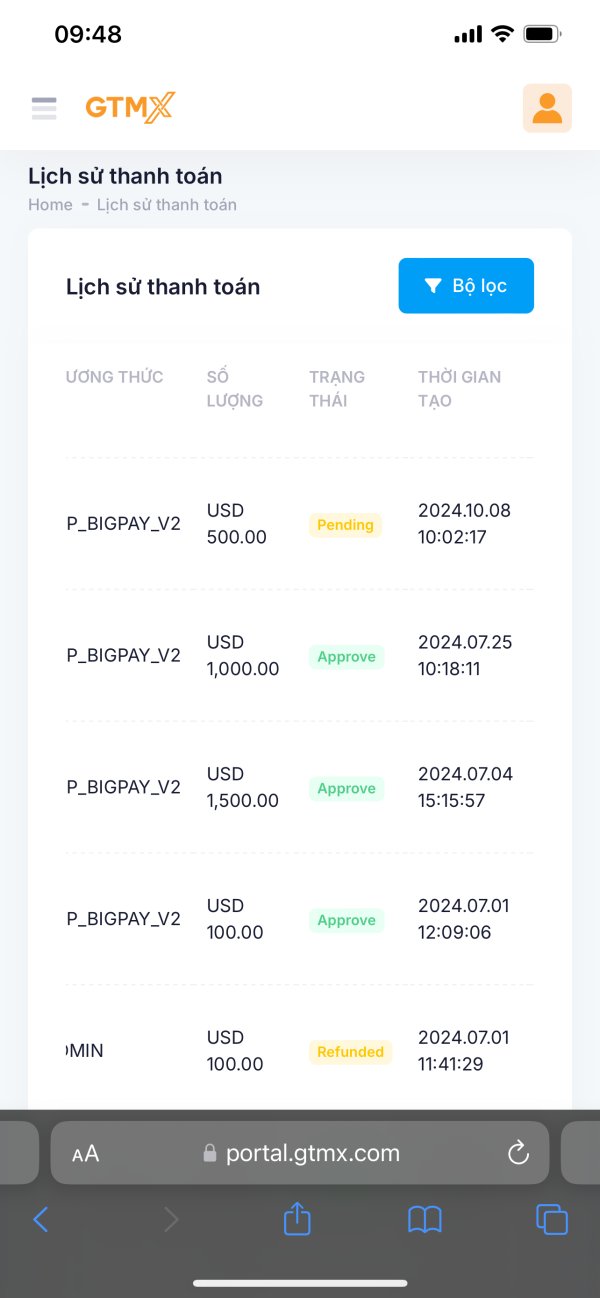

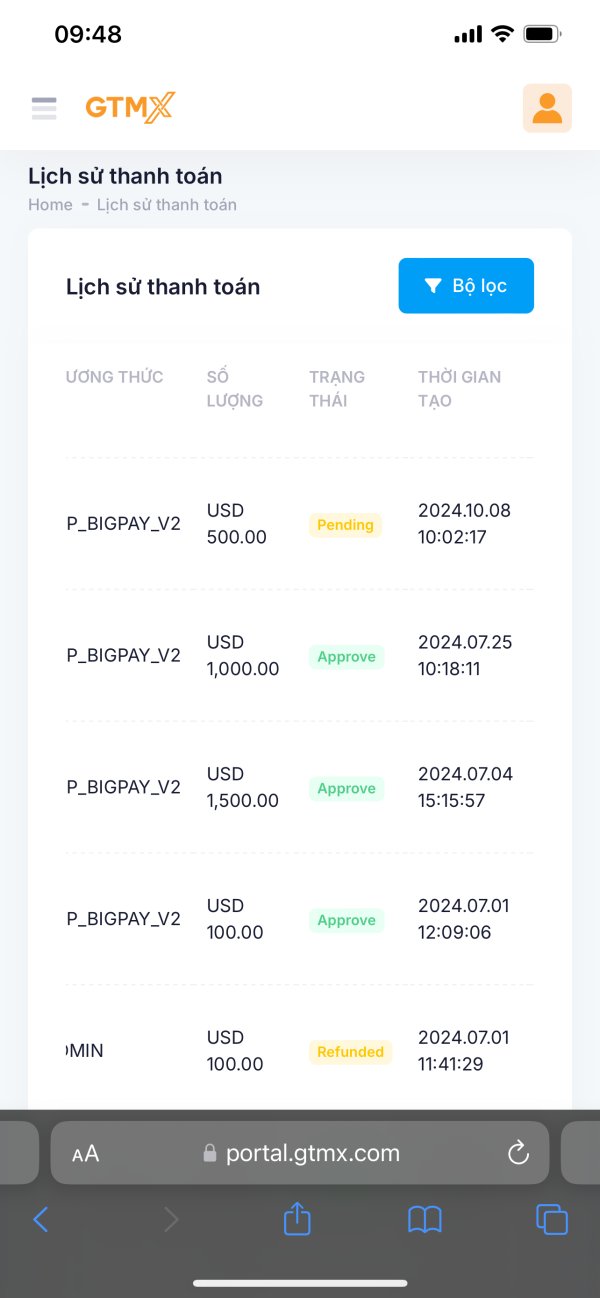

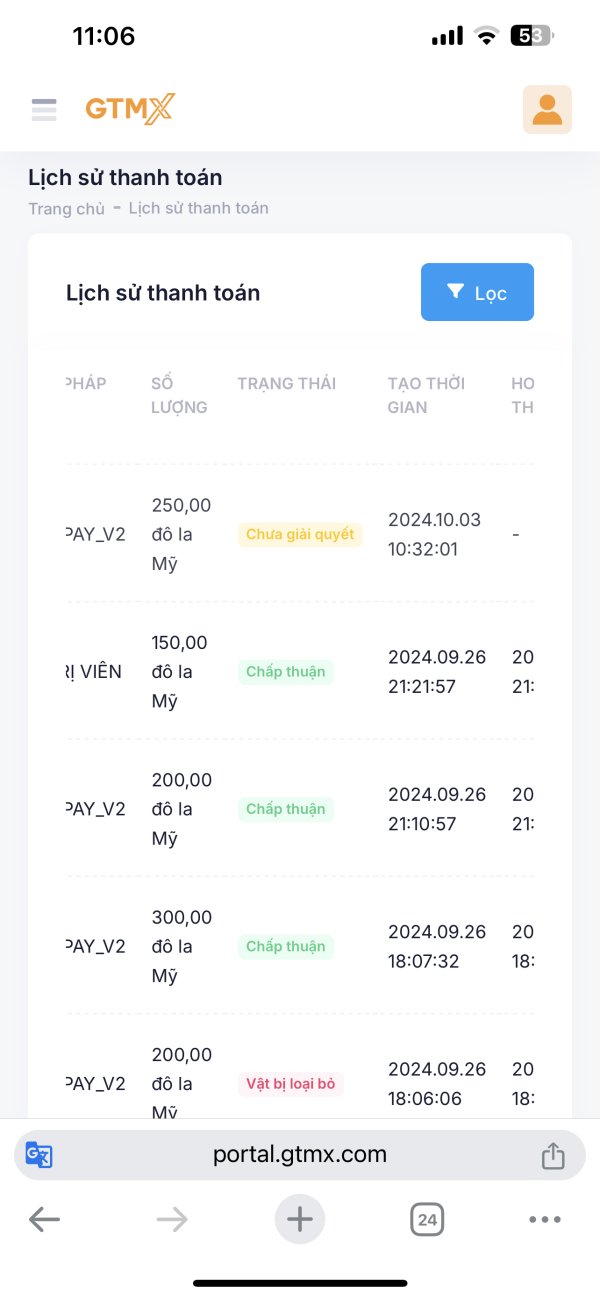

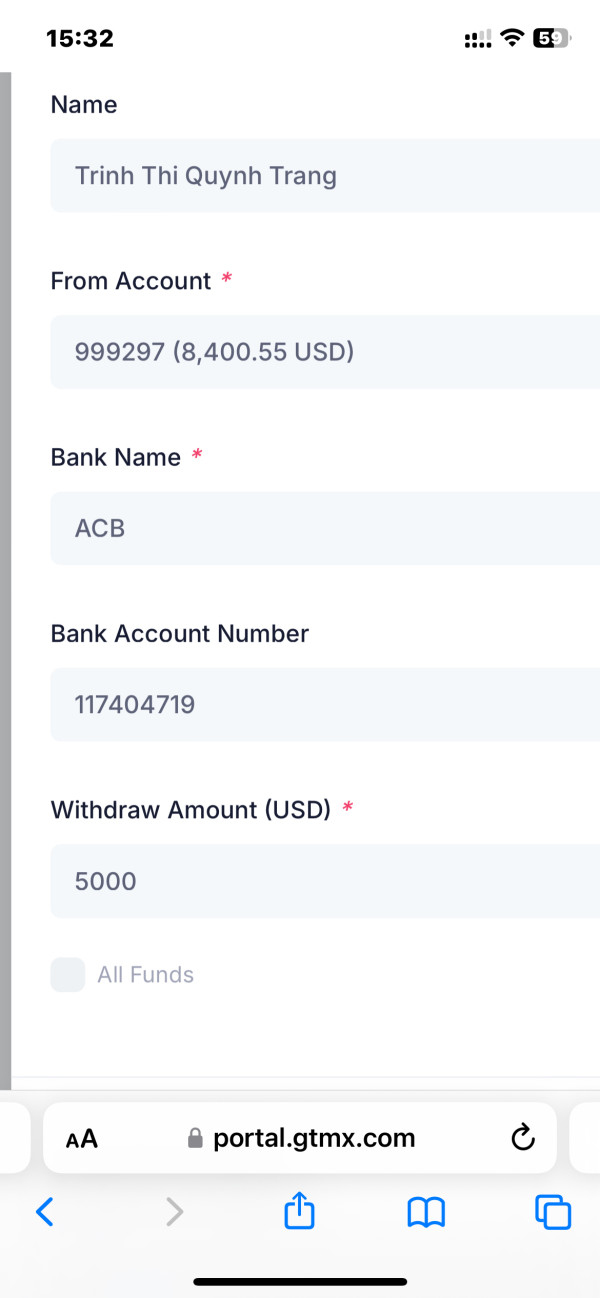

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This represents a transparency gap that potential clients should investigate directly with the broker.

Minimum Deposit Requirements: The broker maintains a minimum deposit threshold of $100 USD. This positions it as accessible to retail traders with limited initial capital.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not specified in available materials. This suggests either limited promotional activity or insufficient public disclosure of such programs.

Tradeable Assets: GTMX provides access to forex currency pairs, cryptocurrency markets, individual stock trading, commodity markets, and various market indices. This offers diversified trading opportunities across multiple asset classes.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not clearly specified in available documentation. This may impact traders' ability to accurately assess trading costs before account opening.

Leverage Ratios: Maximum leverage reaches 1:500, providing significant capital amplification opportunities for qualified traders. However, this also increases risk exposure substantially.

Platform Options: The primary trading platform is MetaTrader 5. It offers comprehensive charting tools, technical analysis capabilities, and automated trading support across multiple device types.

Geographic Restrictions: Specific regional limitations or restricted territories are not clearly outlined in available documentation. This requires direct verification with the broker for compliance purposes.

Customer Support Languages: Available customer service language options are not specified in current gtmx review materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

GTMX's account conditions present a mixed picture that earns an above-average rating mainly because of the accessible minimum deposit requirement. The $100 USD minimum deposit threshold positions the broker well for retail traders seeking entry-level access to forex markets without substantial initial capital commitments. This low barrier to entry compares well with many established brokers that require much higher minimum deposits.

However, the evaluation is limited by insufficient transparency about specific account types and their respective features. Available documentation does not clearly outline whether multiple account tiers exist, what specific benefits each level provides, or how account conditions may vary based on deposit amounts or trading volumes. The lack of detailed commission structures and fee schedules also impacts the overall assessment, as traders cannot fully evaluate the true cost of account maintenance and trading activities.

The account opening process details are not comprehensively documented, leaving questions about verification requirements, processing times, and documentation needs. Additionally, specialized account options such as Islamic accounts for Muslim traders are not mentioned in available materials. According to user feedback referenced in various review platforms, some traders have expressed concerns about account conditions not meeting their expectations, though specific details vary across different gtmx review sources.

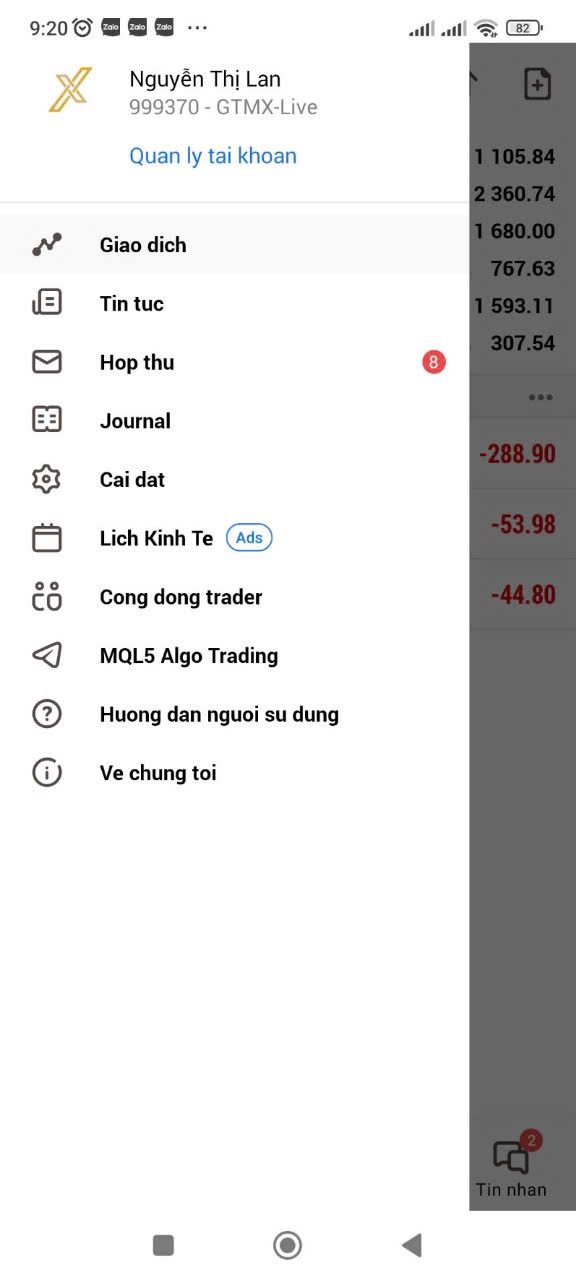

The platform's tools and resources earn a good rating largely because of the implementation of MetaTrader 5. This provides comprehensive technical analysis capabilities and professional-grade trading tools. MT5 offers advanced charting functionality, multiple timeframe analysis, custom indicator support, and automated trading capabilities through Expert Advisors, meeting the technical requirements of most retail and semi-professional traders.

MetaTrader 5's integrated tools include over 80 technical indicators, multiple chart types, and sophisticated drawing tools that support detailed market analysis. The platform's ability to handle multiple asset classes at the same time aligns well with GTMX's multi-market approach, allowing traders to manage forex, cryptocurrency, and equity positions within a single interface. The mobile application extends these capabilities to smartphones and tablets, providing trading flexibility for active market participants.

However, the assessment is limited by insufficient information about proprietary research and analysis resources that GTMX may provide independently of the MT5 platform. Many competitive brokers supplement standard platform tools with daily market analysis, economic calendars, trading signals, and educational webinars. Available documentation does not clearly indicate whether GTMX provides such value-added resources, which could enhance the overall trading experience for clients seeking comprehensive market insights beyond basic platform functionality.

Customer Service and Support Analysis (Score: 5/10)

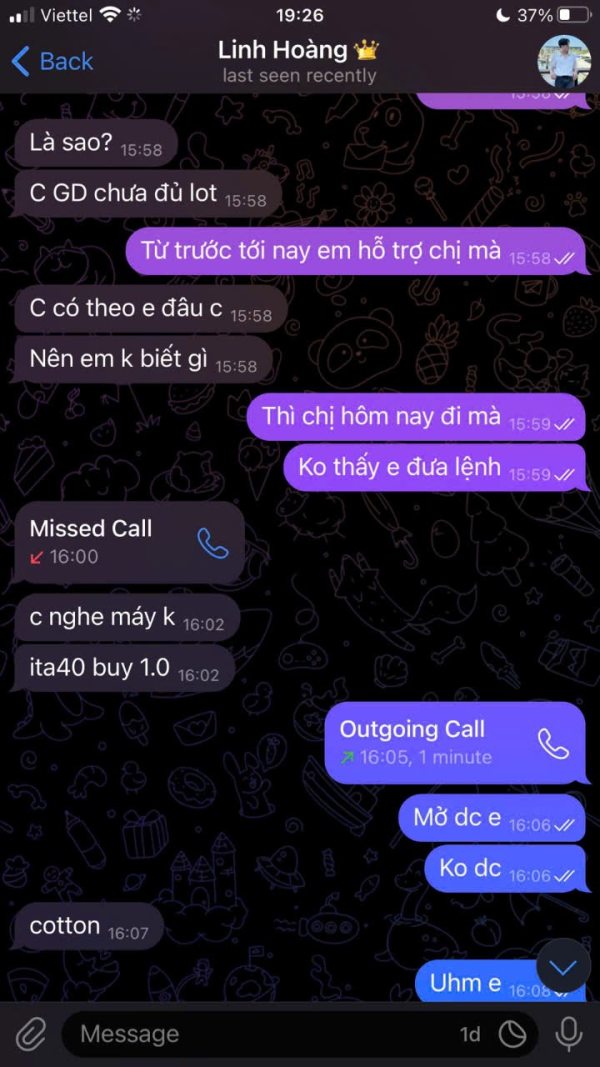

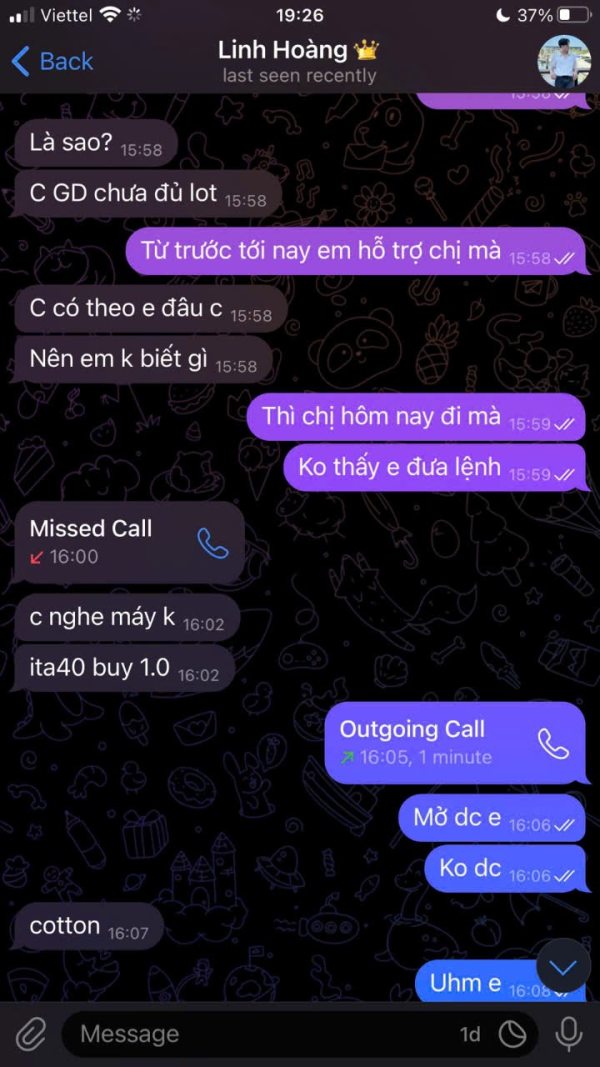

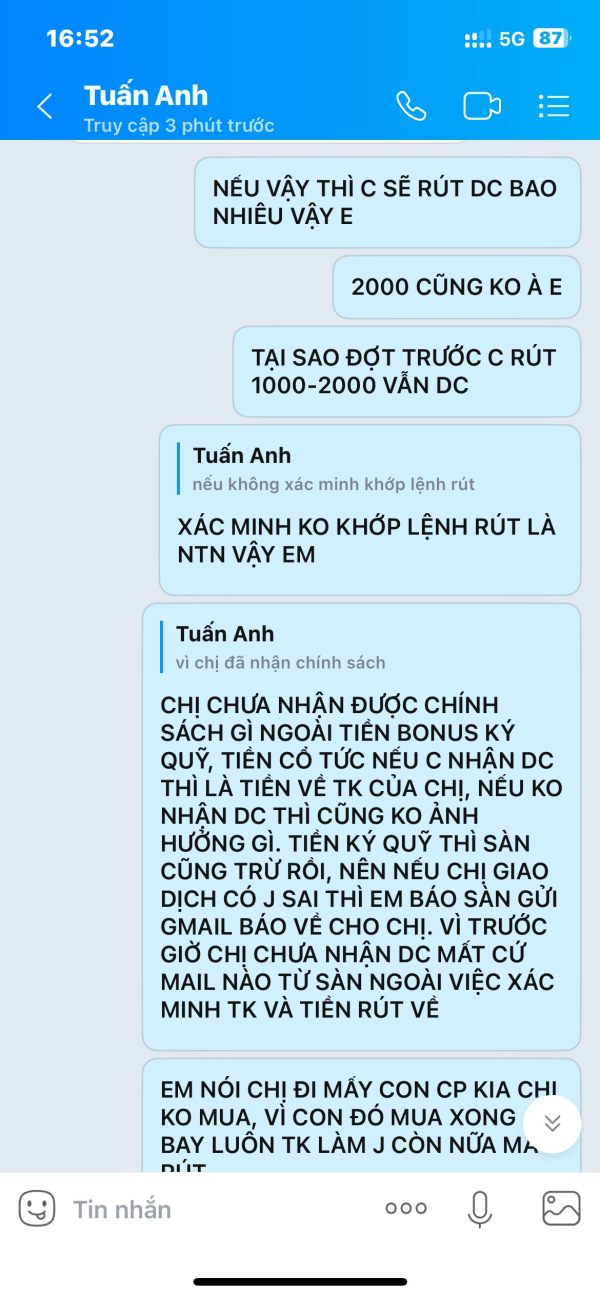

Customer service evaluation reveals significant concerns that result in an average rating, mainly influenced by user reports of high-pressure sales tactics. These tactics negatively impact the overall service experience. According to feedback compiled from various review platforms, some users have reported aggressive marketing approaches that prioritize sales conversions over client education and support, which raises questions about the broker's customer-focused approach.

The specific customer service channels available to clients are not clearly documented in available materials. This leaves uncertainty about whether support is provided through live chat, telephone, email, or dedicated account management. Response times and service quality metrics are not publicly available, making it difficult to assess operational efficiency and problem resolution capabilities. This lack of transparency about customer service infrastructure contributes to the moderate rating.

User feedback indicates mixed experiences with customer support quality, with some clients reporting satisfactory assistance while others express frustration with communication delays and inadequate problem resolution. The absence of clearly defined customer service hours, timezone coverage, and multilingual support options further limits the assessment. According to various review sources, the high-pressure sales environment has led to complaints about post-sale support quality, suggesting that service standards may decline after initial account opening and funding processes.

Trading Experience Analysis (Score: 6/10)

The trading experience assessment reflects above-average capabilities mainly driven by the MetaTrader 5 platform's robust functionality and multi-asset trading access. MT5 provides reliable order execution capabilities, comprehensive charting tools, and support for various trading strategies including scalping, swing trading, and automated system deployment. The platform's stability and performance generally meet industry standards for retail trading applications.

GTMX's multi-asset approach allows traders to diversify across forex pairs, cryptocurrencies, stocks, commodities, and indices within a single trading environment. This consolidated access reduces the complexity of managing multiple accounts across different brokers and platforms. The 1:500 maximum leverage provides significant capital efficiency opportunities for traders with appropriate risk management strategies, though this high leverage also amplifies potential losses substantially.

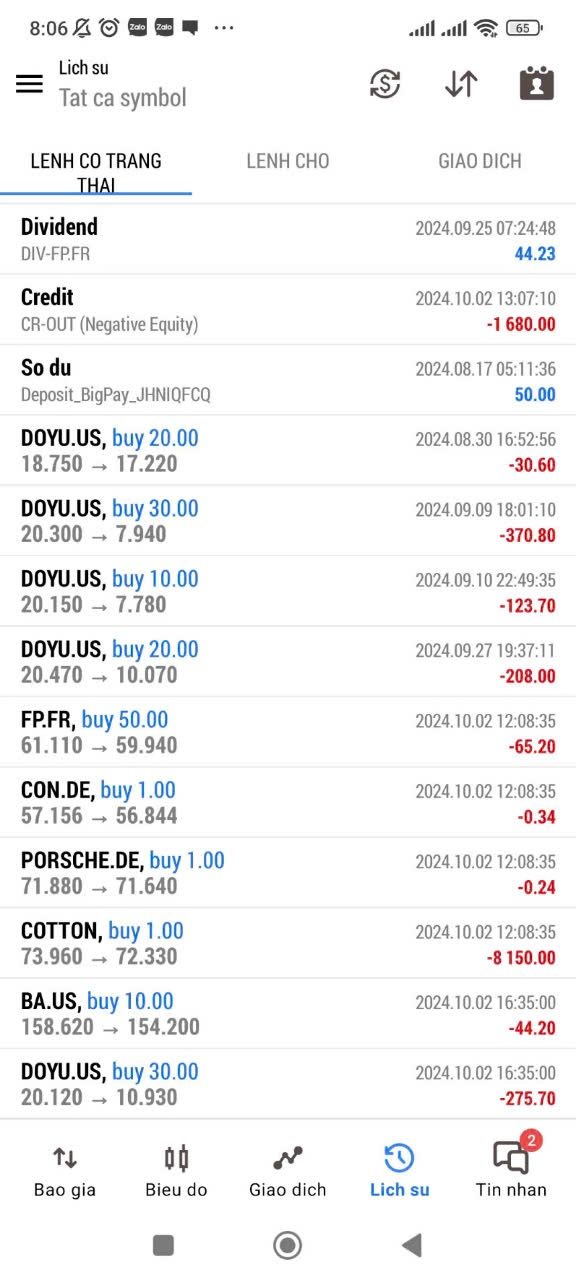

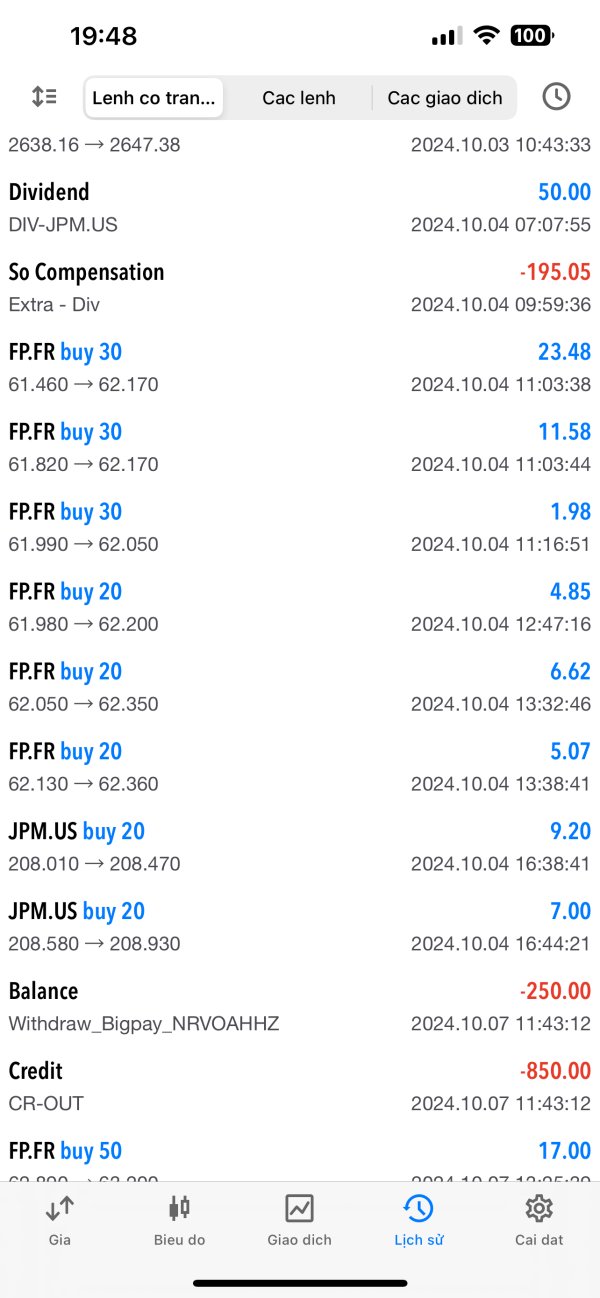

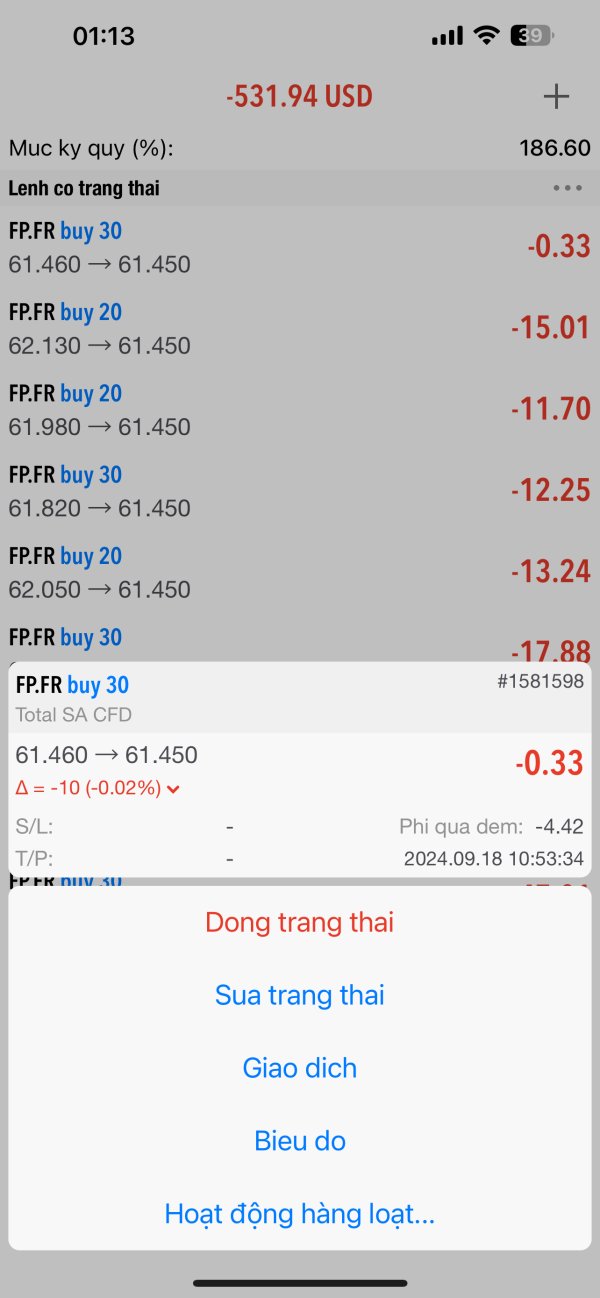

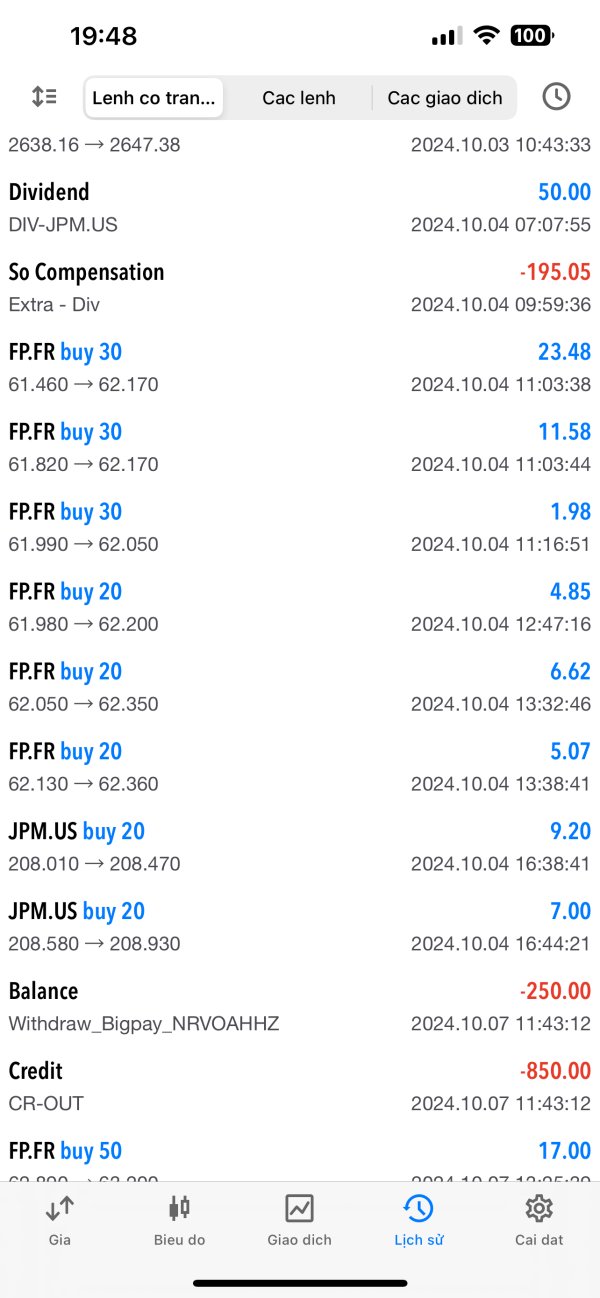

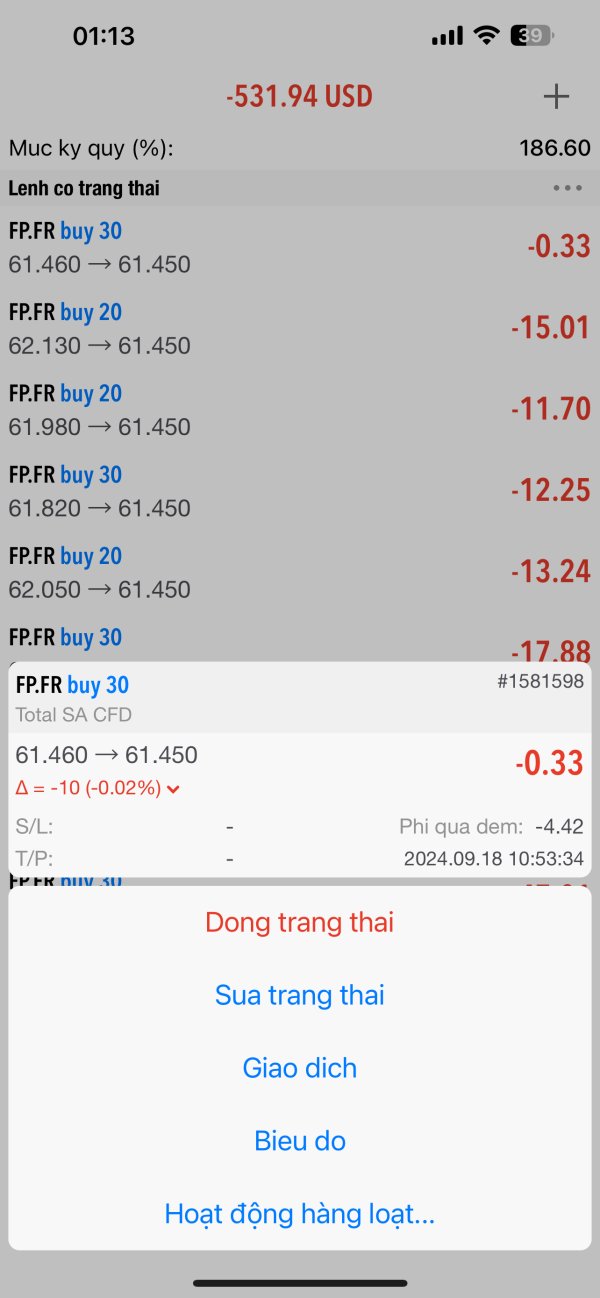

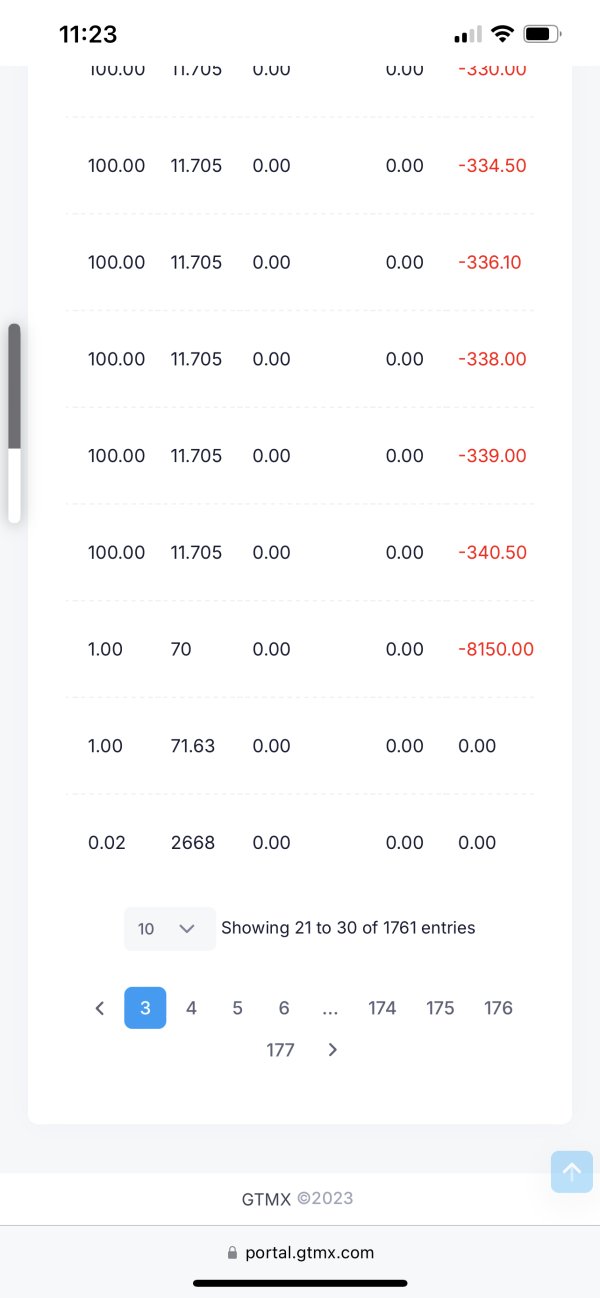

However, the evaluation is limited by insufficient information about critical trading conditions such as typical spreads, commission structures, and execution quality metrics. Details about slippage rates, requote frequency, and order fill speeds are not available in public documentation, making it difficult for traders to accurately assess the true cost and efficiency of trade execution. User feedback about platform performance and execution quality varies, with some gtmx review sources indicating satisfactory experiences while others report concerns about trading conditions that were not clearly disclosed during account opening.

Trustworthiness Analysis (Score: 4/10)

The trustworthiness evaluation results in a below-average rating due to several concerning factors that impact overall credibility and safety assessments. The primary concern stems from the limited regulatory protection provided by SVG FSA registration, which lacks the comprehensive oversight and investor protection mechanisms associated with major financial regulatory authorities such as the FCA, ASIC, CySEC, or FINRA.

Saint Vincent and the Grenadines regulation does not typically include investor compensation schemes, segregated client fund requirements, or stringent operational oversight that traders might expect from more established regulatory jurisdictions. This regulatory gap creates potential risks for client fund security and dispute resolution processes. Additionally, some review sources have raised concerns about the broker's legitimacy, with certain platforms categorizing GTMX as potentially problematic, though these assessments vary across different review sources.

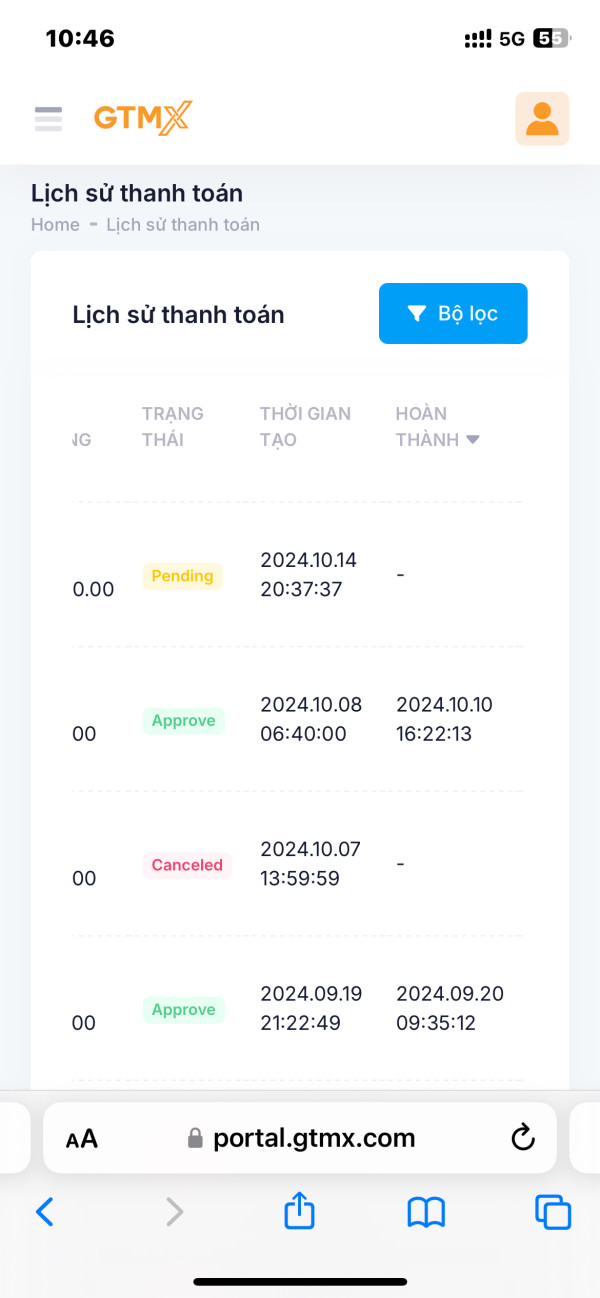

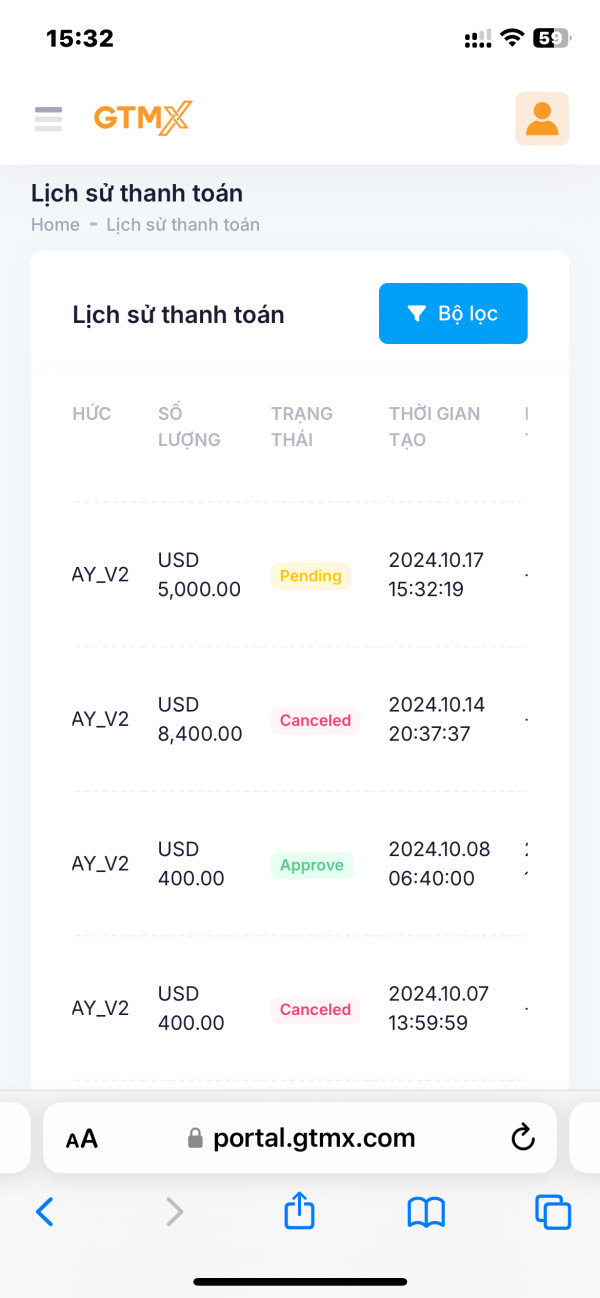

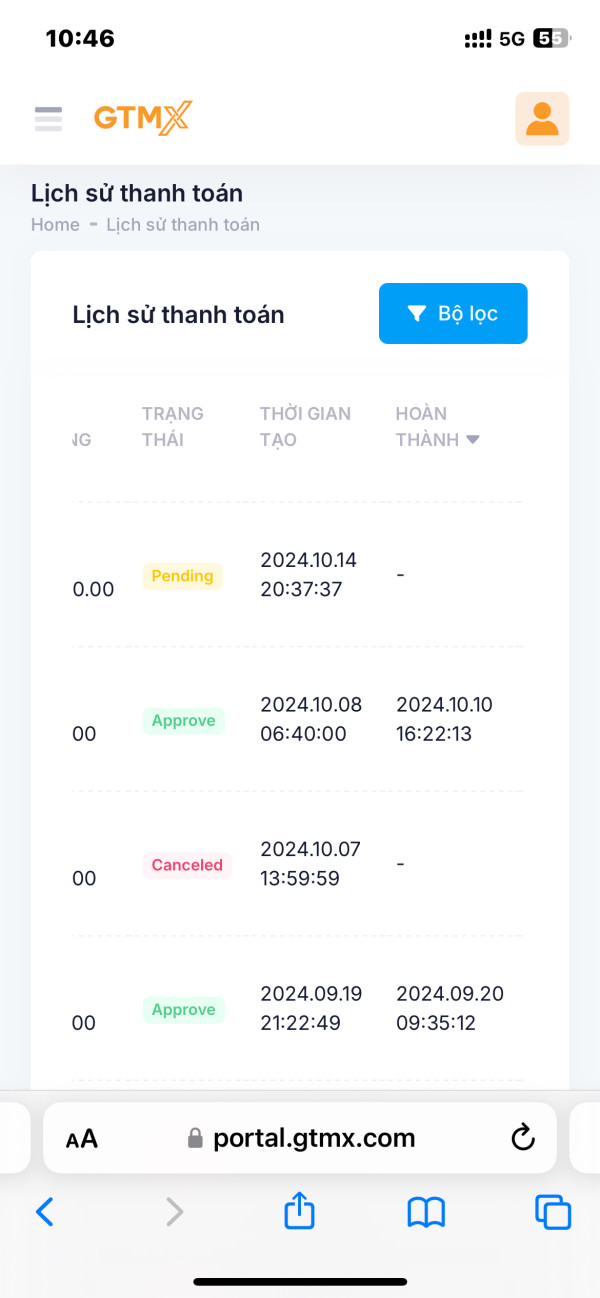

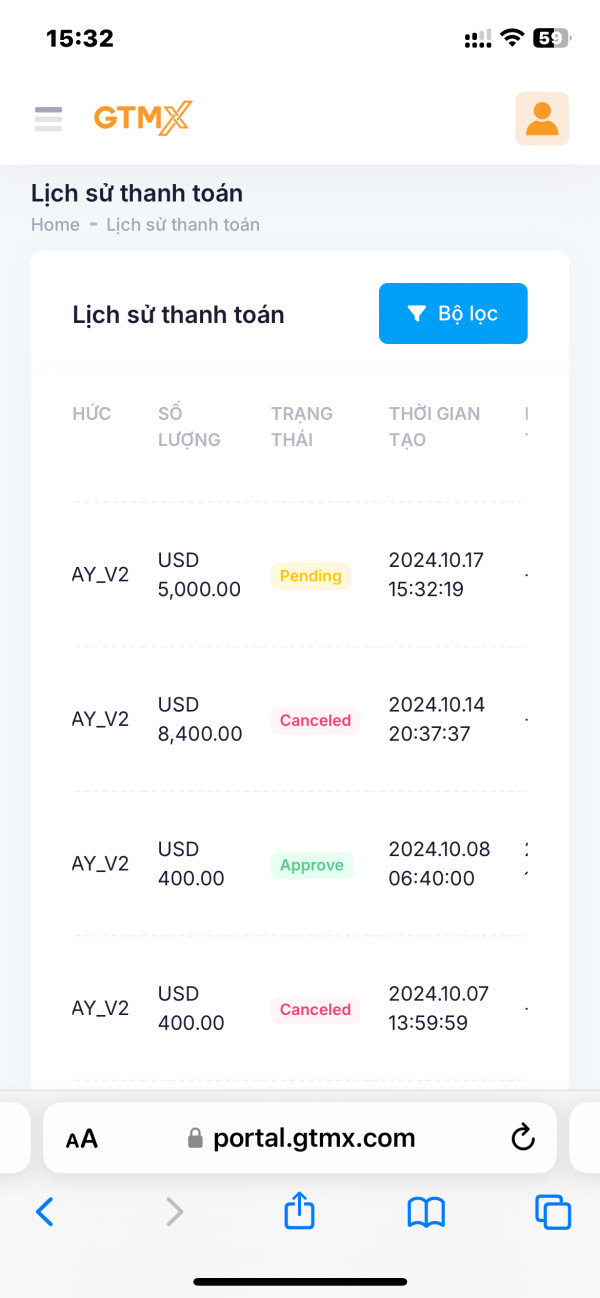

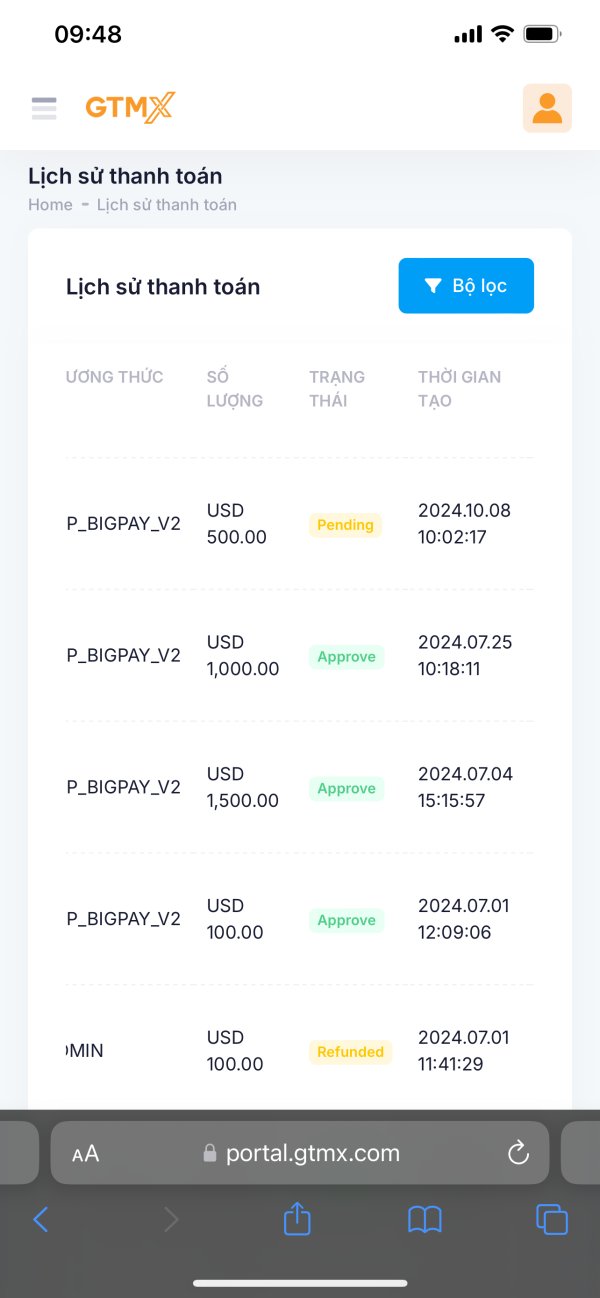

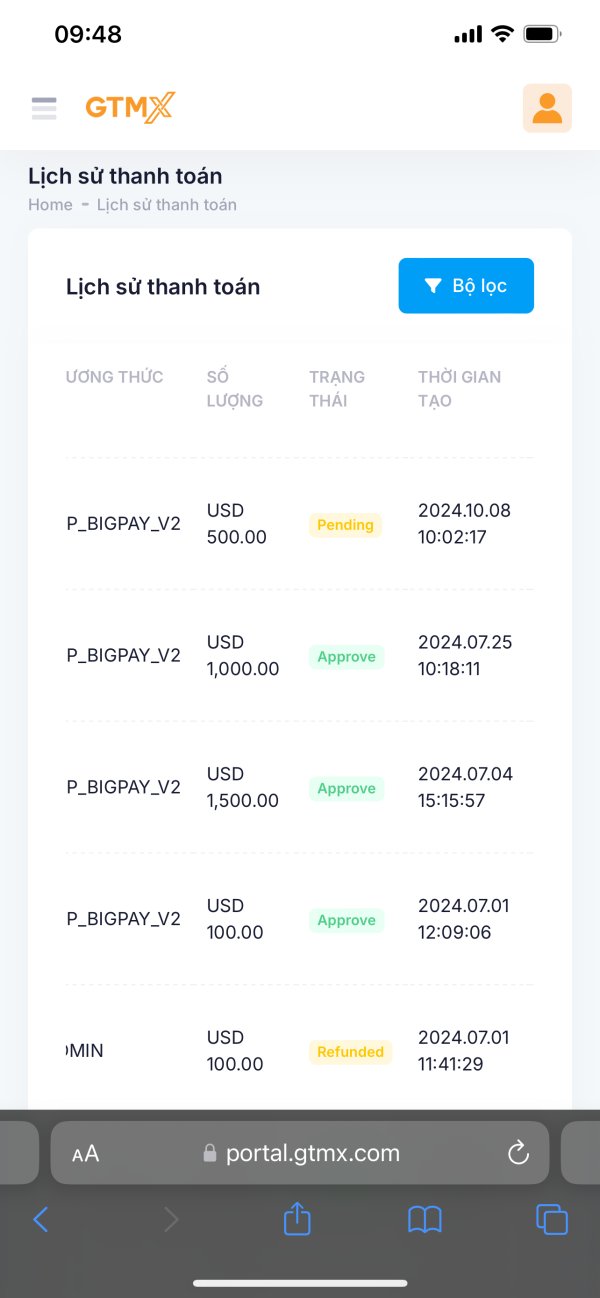

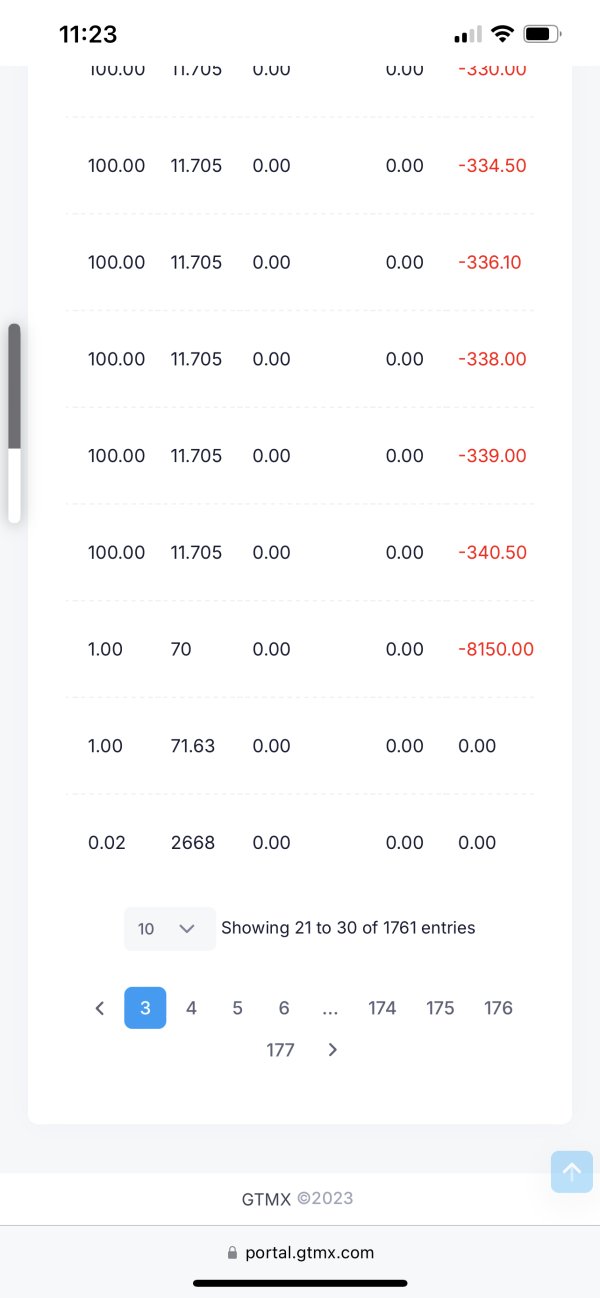

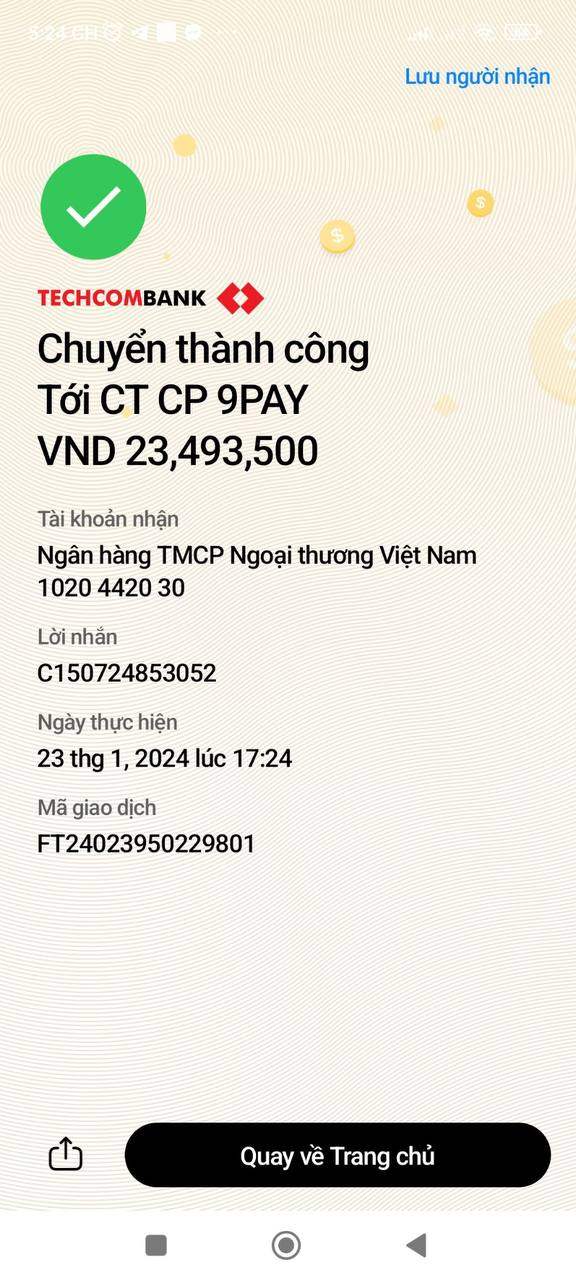

The lack of transparent information about fund security measures, client money segregation policies, and financial reporting standards further contributes to trustworthiness concerns. Established brokers typically provide clear documentation about client fund protection, insurance coverage, and regulatory compliance measures. The absence of such transparency in available GTMX documentation raises questions about operational standards and client protection protocols. User complaints referenced in various review platforms indicate ongoing concerns about fund security and withdrawal processes, though specific details and resolution outcomes are not consistently documented across sources.

User Experience Analysis (Score: 5/10)

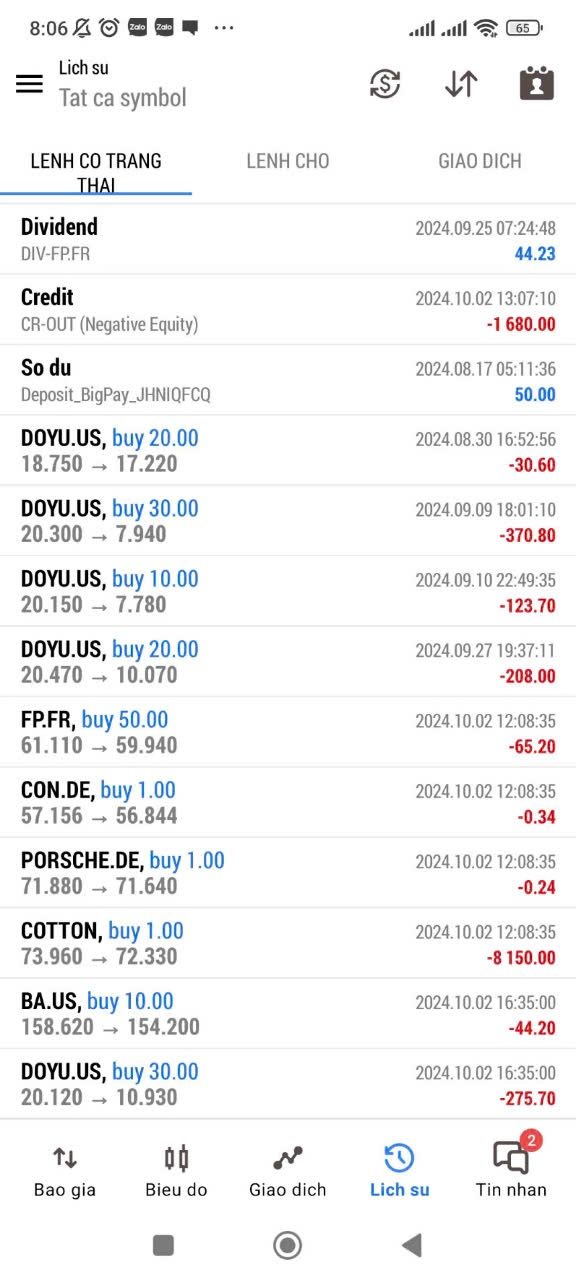

User experience assessment reveals mixed feedback that results in an average rating, reflecting the diverse range of client experiences reported across various review platforms. According to WikiBit data, GTMX has received 2 positive reviews alongside 13 exposure complaints, indicating significant variation in client satisfaction levels. This disparity suggests that user experience may depend heavily on individual circumstances, account types, or service levels that are not consistently applied across all clients.

Positive user feedback typically focuses on the accessibility of the minimum deposit requirement and the comprehensive functionality of the MetaTrader 5 platform. Some traders appreciate the multi-asset trading capabilities and the high leverage options that allow for flexible trading strategies with limited initial capital. The platform's mobile accessibility and technical analysis tools receive favorable mentions from users who prioritize trading flexibility and analytical capabilities.

However, negative feedback consistently highlights concerns about high-pressure sales tactics, inadequate post-sale support, and transparency issues regarding trading conditions and fees. Some users report difficulties with the account opening process, unclear communication about costs and conditions, and challenges with customer service responsiveness. The target user profile appears to be beginner to intermediate traders seeking high-leverage opportunities, though user feedback suggests that actual experiences may not consistently meet expectations. Improvement recommendations from user feedback emphasize the need for enhanced transparency, better customer service training, and clearer communication about all aspects of the trading relationship.

Conclusion

This comprehensive gtmx review concludes that GTMX operates as an unregulated forex broker that requires careful consideration before engagement. While the broker offers some attractive features including a low minimum deposit of $100 USD and high leverage up to 1:500, significant concerns about regulatory protection and user satisfaction substantially impact the overall assessment.

The broker appears most suitable for beginner to intermediate traders who prioritize high-leverage trading opportunities and multi-asset access through the established MetaTrader 5 platform. However, potential clients should carefully weigh the limited regulatory protection against their risk tolerance and trading objectives. The mixed user feedback and regulatory limitations suggest that GTMX may not be appropriate for traders seeking maximum security and comprehensive investor protection. Prospective clients are advised to conduct thorough due diligence and consider alternative brokers with stronger regulatory oversight if fund security and investor protection are primary concerns.