Regarding the legitimacy of FXROAD.com forex brokers, it provides FSA and WikiBit, .

Is FXROAD.com safe?

Pros

Cons

Is FXROAD.com markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

4 Square SY Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@4squaresy.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxroad.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXRoad A Scam?

Introduction

FXRoad is a relatively new player in the forex market, positioned as a broker that offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. As a broker regulated by the Seychelles Financial Services Authority (FSA), it aims to attract both novice and experienced traders with its competitive trading conditions and user-friendly platform. However, the forex trading landscape is rife with potential pitfalls, making it essential for traders to carefully evaluate the legitimacy and reliability of any broker before committing their funds.

In this article, we will conduct a thorough investigation into FXRoad's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our methodology involves analyzing data from various reputable sources and user feedback to provide a balanced perspective on whether FXRoad is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a crucial factor when assessing the safety and reliability of a forex broker. FXRoad operates under the oversight of the Seychelles Financial Services Authority (FSA). While Seychelles is considered an offshore jurisdiction, the presence of regulation can provide some level of assurance to traders regarding the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 052 | Seychelles | Verified |

The FSA requires brokers to adhere to specific guidelines, including maintaining client funds in segregated accounts and implementing anti-money laundering (AML) and know your customer (KYC) policies. FXRoad claims compliance with these regulations, which is a positive sign. However, the quality of regulation in offshore jurisdictions is often questioned compared to that of more stringent regulators like the UKs Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC).

Historically, brokers regulated in Seychelles have experienced varying degrees of compliance, and there have been instances of regulatory breaches. Therefore, while FXRoad is technically regulated, potential clients should be aware of the inherent risks associated with trading with an offshore broker.

Company Background Investigation

FXRoad is operated by 4 Square SY Ltd, a company registered in Seychelles. However, specific details about the company's history, ownership structure, and management team are somewhat limited. The lack of transparency regarding the founders and their experience in the financial industry raises questions about the broker's credibility.

The management teams background is essential for establishing trust in a broker, as experienced professionals are more likely to ensure that the company adheres to best practices and ethical trading standards. Unfortunately, FXRoad does not provide substantial information about its management or their qualifications, which could lead to skepticism among potential traders.

Moreover, the broker's website is relatively new, having been updated in 2023, which raises concerns about its operational history and reliability. Traders should consider the implications of engaging with a broker that lacks a proven track record in the industry.

Trading Conditions Analysis

FXRoad presents a competitive trading environment with several account types, including Silver, Gold, Platinum, and Islamic accounts. Each account type is designed to cater to different trading styles and experience levels. However, its crucial to examine the overall fee structure to determine the broker's cost-effectiveness.

The following table summarizes FXRoad's core trading costs:

| Fee Type | FXRoad | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2.6 pips | From 1.0 pips |

| Commission Model | No commissions | Varies (often present) |

| Overnight Interest Range | Standard fees | Varies widely |

FXRoad's spreads start at 2.6 pips for its Silver account, which is relatively high compared to industry averages. While the absence of commissions may seem attractive, the elevated spreads can erode potential profits, especially for high-frequency traders. Additionally, the broker charges overnight interest, which can vary based on account type, potentially adding to trading costs.

Traders should also be aware of inactivity fees that FXRoad imposes on dormant accounts after 30 days without trading. This practice can further diminish account balances and should be considered when evaluating the broker's overall cost structure.

Client Fund Security

The security of client funds is paramount in the forex trading environment. FXRoad claims to implement several safety measures to protect traders' investments. These include keeping client funds in segregated accounts with reputable banks, negative balance protection, and adherence to AML and KYC regulations.

Segregated accounts ensure that client funds are kept separate from the broker's operational funds, thereby reducing the risk of misuse. Negative balance protection is another critical feature that prevents traders from losing more than their initial deposit, offering an additional layer of security during volatile market conditions.

However, it is essential to note that while FXRoad presents these security measures, the effectiveness of such policies can vary. Historical incidents involving other offshore brokers have shown that regulatory oversight may not always guarantee fund safety. Therefore, potential traders should exercise caution and consider the risks involved when trading with FXRoad.

Customer Experience and Complaints

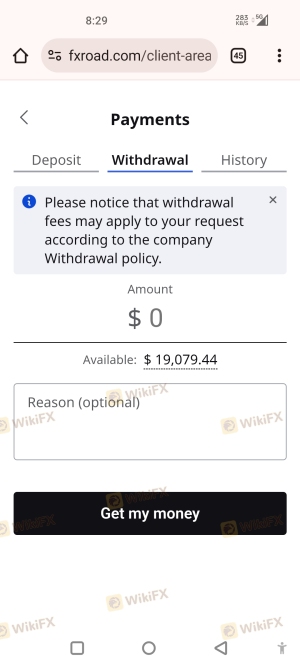

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of FXRoad reveal a mix of experiences among users. While some traders appreciate the platform's user-friendly interface and customer support, others have raised concerns regarding withdrawal delays and high spreads.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal delays | High | Mixed responses |

| High spreads | Medium | Acknowledged |

| Customer support quality | Low | Generally positive |

A notable complaint involves withdrawal processing times, with some users reporting delays of up to several days. This can be a significant concern for traders who require timely access to their funds. Additionally, while customer support is generally responsive, there have been instances where traders felt their issues were not adequately addressed.

One example involved a trader who experienced difficulty withdrawing funds after a period of inactivity. The broker's response was slow, leading to frustrations and a lack of trust. Such experiences highlight the importance of evaluating a broker's responsiveness and reliability in addressing client concerns.

Platform and Trade Execution

FXRoad offers a proprietary trading platform that is accessible via web and mobile devices. While the platform is designed to be user-friendly and incorporates advanced charting tools, it lacks compatibility with popular platforms like MetaTrader 4 or 5. This limitation may deter traders who prefer the features and functionalities offered by these established platforms.

In terms of trade execution, user reports indicate that FXRoad generally provides reliable performance. However, some traders have experienced slippage during high volatility periods, which can impact trading outcomes. Additionally, instances of order rejections have been reported, raising concerns about the platform's execution quality.

Overall, while FXRoad's platform may be adequate for some traders, those accustomed to more advanced trading environments may find it lacking.

Risk Assessment

Trading with any broker inherently carries risks, and FXRoad is no exception. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may not provide adequate protection. |

| Fund Security Risk | Medium | While measures are in place, historical incidents raise concerns. |

| Execution Risk | Medium | Reports of slippage and order rejections could impact performance. |

| Cost Structure Risk | High | High spreads and inactivity fees may erode profits. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a demo account, and remain vigilant regarding their trading practices. Additionally, maintaining a diversified trading portfolio can help manage exposure to any single broker.

Conclusion and Recommendations

In conclusion, while FXRoad is a regulated broker operating under the Seychelles FSA, potential traders should approach with caution. The broker's offshore regulation, combined with a lack of transparency regarding its management and operational history, raises some red flags.

Traders should be particularly mindful of the high spreads, inactivity fees, and mixed customer feedback regarding withdrawal processes. While the broker offers features like negative balance protection and segregated accounts, historical concerns about offshore brokers warrant a careful evaluation.

For traders seeking reliable alternatives, consider brokers regulated by top-tier authorities, such as the FCA or CFTC, which offer robust protections and a proven track record. Overall, FXRoad may be suitable for some traders, particularly those interested in Islamic accounts, but thorough due diligence is essential before committing any funds.

Is FXROAD.com a scam, or is it legit?

The latest exposure and evaluation content of FXROAD.com brokers.

FXROAD.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXROAD.com latest industry rating score is 3.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.