Citywealth 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Citywealth is an unregulated forex broker that promises high leverage and minimal initial investment requirements—a combination that may attract inexperienced traders seeking access to the global markets. However, the appeal of low entry costs and seemingly lucrative trading conditions is overshadowed by significant risks. Numerous user complaints highlight serious issues with withdrawal processes and a lack of transparency, raising red flags regarding fund safety and customer support. The broker appears to be a potential trap for novice investors who may not fully comprehend the implications of trading within an unregulated environment.

In summary, while Citywealth may initially appear attractive, the lack of regulatory oversight and documented challenges with withdrawals present substantial dangers to traders. Beginners should carefully consider the potential consequences before engaging with this broker, as the risks might outweigh the potential rewards.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading with Citywealth can expose you to significant risk. Please be aware of the following:

- Lack of Regulatory Oversight: Citywealth operates without any recognized regulatory body, making it challenging for traders to recover funds in case of any disputes.

- Withdrawal Issues: Many users have reported difficulties with processing withdrawals, leading to blocked access to their funds.

- High Leverage: While high leverage can amplify potential profits, it also increases the risk of substantial losses, potentially leading to complete depletion of the initial investment.

How to Self-Verify Before Using Citywealth:

- Research Regulatory Status:

- Check platforms like the NFA's BASIC database or FCA's register to confirm if the broker is regulated.

- Read User Reviews:

- Look for independent reviews on multiple financial websites to gauge user satisfaction (or lack thereof).

- Test Customer Support:

- Reach out to customer service via available contact methods. Assess their responsiveness and quality of assistance.

- Verify Withdrawal Processes:

- Read about other users' experiences specifically related to account fund withdrawal and account closure issues.

- Start with a Demo Account:

- Practice trading using a demo account, if available, to understand the platform without risking real funds.

Rating Framework

Broker Overview

Company Background and Positioning

Established in 2013, Citywealth is a forex broker that is registered in New Zealand and operated by Hortense Holdings Limited. Despite its presence in the market as a trading platform, it lacks any regulatory oversight, which poses risks to traders regarding the safety of their funds. The unregulated status has led to numerous complaints about withdrawal issues, leading to a tarnished reputation in the forex trading community.

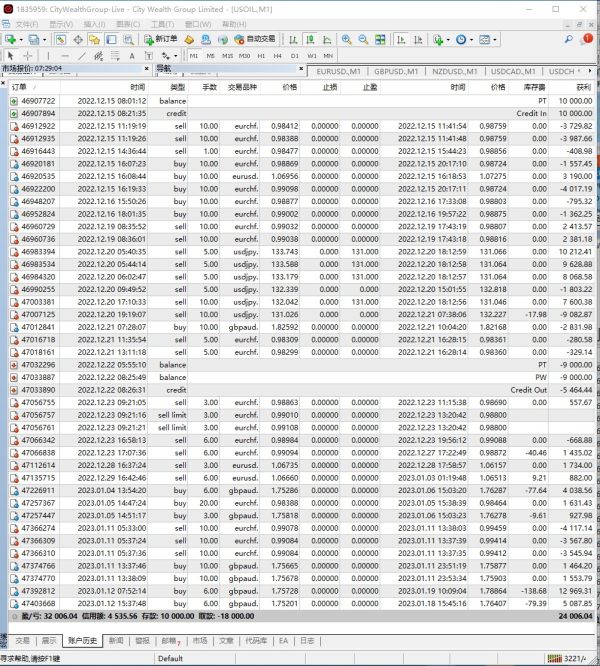

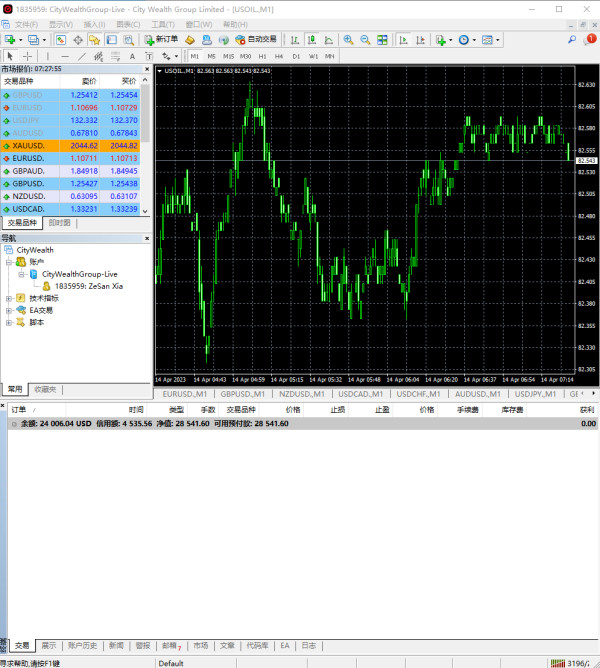

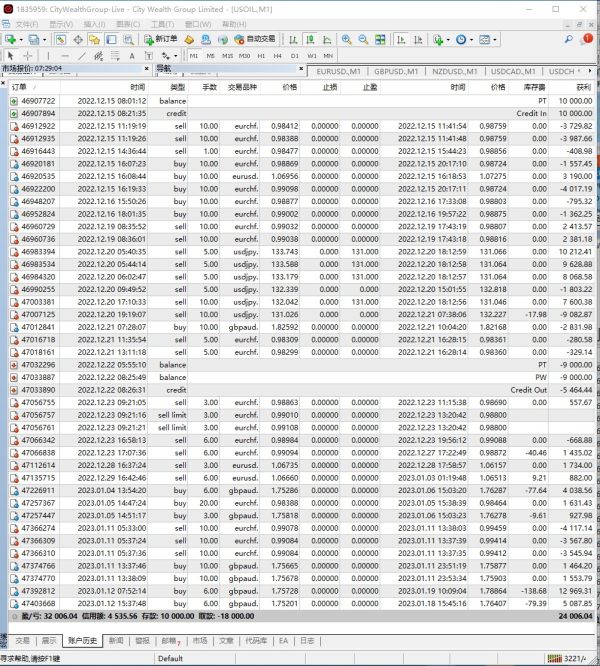

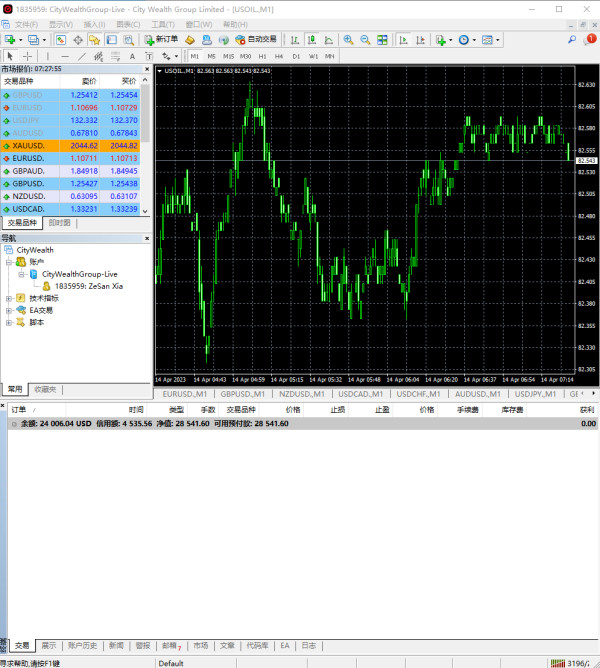

Core Business Overview

Citywealth primarily deals in forex trading but also offers various financial products, including commodity contracts and CFDs on gold and silver. The broker supports trading through popular platforms like MetaTrader 4 (MT4), which is accessible on desktop and mobile devices. However, its lack of a solid reputational foundation due to the absence of regulation should be a primary concern for potential users.

Quick-Look Details Table

In-depth Analysis of Each Dimension

6.1 Trustworthiness Analysis

Citywealth's lack of regulatory oversight places it in a precarious position within the trading market, rendering it potentially dangerous for investors. The absence of regulation means traders have no external body to turn to in case of issues regarding their funds or trading practices.

Analysis of Regulatory Information Conflicts:

Various sources indicate that Citywealth does not possess any legitimate operational licenses. This unregulated status is a significant risk factor, as it implies the company isnt beholden to any accountability processes typically enforced by recognized financial authorities.

User Self-Verification Guide:

To mitigate risks when considering Citywealth, follow these steps:

Use regulatory websites such as the NFAs BASIC database to check for registration.

Look for reviews on reputable financial websites about user experiences related to regulatory practices.

Engage with trial accounts (if available) to test the broker's reliability before investing.

Industry Reputation and Summary:

As assessed by numerous reviews, the consensus is generally negative due to issues regarding fund safety. Users have reported instances such as:

"I submitted withdrawals many times but was not given access to my funds."

It is evident that potential clients of Citywealth should prioritize self-verification when engaging with this broker.

6.2 Trading Costs Analysis

Citywealth presents a dual perspective when analyzing its trading costs, making it crucial for traders to discern the implications carefully.

Advantages in Commissions:

The broker features a relatively low-cost commission structure, which may appeal to new traders. For currency pair trading, spreads begin at approximately 0.6 pips, a competitive rate compared to other unregulated brokers.

The "Traps" of Non-Trading Fees:

However, beneath the surface lies the risk of hidden fees that may deter traders. For example, users have reported aggressive push efforts from brokers to make further deposits instead of processing withdrawals, where fees can spike as high as **$30** for withdrawal transactions.

"I attempted to withdraw $18,000, but $24,000 remains inaccessible after several communications with the broker."

- Cost Structure Summary:

While the cost of entry is lower than many competitors, this minimal investment landscape is shrouded in operational opacity, which could lead to fewer trading benefits relative to costs incurred over time.

Citywealths offerings in platforms and tools represent both strengths and limitations.

Platform Diversity:

Citywealth primarily operates on an MT4 platform—which is well-regarded in trading circles due to its robust functionalities. This platform facilitates diverse trading strategies and access to technical analysis tools, beneficial for traders at various stages.

Quality of Tools and Resources:

While the tools provided are adequate for basic needs, there is a noticeable lack of deeper educational resources and tools that experienced traders might seek. Advanced features may be required by more seasoned participants, which are not currently available on this platform.

Platform Experience Summary:

Users generally report usability issues with the trading platform, often due to the broker's performance deficiencies. Feedback reflects:

"Some features felt sluggish; I struggled to execute trades swiftly."

Hence, while Citywealth offers acceptable fundamental tools, it lacks an advanced suite that could better serve a professional trader's needs.

6.4 User Experience Analysis

User experience when interacting with Citywealth can be a significant determinant factor for investor success.

Ease of Use:

New traders might initially find the interface intuitive; however, the absence of robust customer support can lead to frustration, particularly for those who encounter operational difficulties.

Engagement and Learning Resources:

The broker does not offer adequate instructional materials to new traders, which may hinder their understanding of the platform and its trading nuances.

User Feedback Summary:

The community feedback reveals a mix of sentiments regarding user experience. As highlighted:

"The platform seems friendly at first, but when problems arise, help feels unreachable."

Thus, if user guidance and support are essential to your trading style, Citywealth may present challenges that are hard to navigate.

6.5 Customer Support Analysis

Quality customer support is non-negotiable in a trading environment rife with complexities.

Support Accessibility:

Citywealth provides two primary points of contact: an email and a phone number. However, the feedback regarding responsiveness tends to be negative, indicating long wait times and insufficient resolutions of issues.

Quality of Assistance:

Many users express frustration over the limited support options, highlighting instances of unresolved issues, particularly regarding fund withdrawals.

Customer Support Summary:

The reliability of a broker is heavily reliant on customer support, as illustrated by reviews:

"Reaching customer service has been more frustrating than trading itself!"

As such, a lack of dedicated, timely support could serve as a significant deterrent for potential clients.

6.6 Account Conditions Analysis

When evaluating account conditions, Citywealth offers several competitive features, but with caveats.

Minimum Deposit Requirements:

The broker requires a minimum deposit of $250, which is reasonable for beginner traders. This lower bar of entry is appealing compared to other brokers with higher thresholds.

Leverage Options:

Potentially enticing, Citywealth offers leverage up to 1:400. Still, this high leverage poses dangers for inexperienced traders and could lead to quick losses, underscoring the need for prudent risk management strategies.

Account Conditions Summary:

Citywealths account conditions can be attractive to beginners, but the inherent risks associated with unregulated trading make it crucial for traders to proceed with caution.

Conclusion

In summary, Citywealth presents itself as a low-cost entry point for forex trading with an enticing leverage structure. However, the absence of regulatory oversight creates serious risks, particularly for inexperienced traders who may find themselves entrapped by promises of high returns, paired with significant challenges regarding fund access and support. The blend of appealing trading conditions alongside rampant user complaints suggests that for many, Citywealth might be more of a trap than an opportunity. Interested traders are urged to conduct thorough due diligence, monitoring regulatory statuses and often troubling user feedback before investing any capital in this broker.