ACTIVE TRADES Review 1

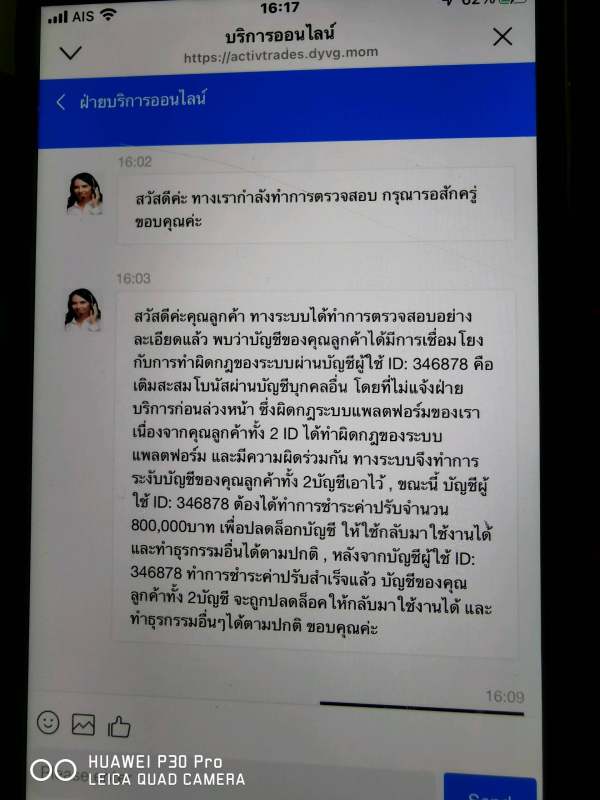

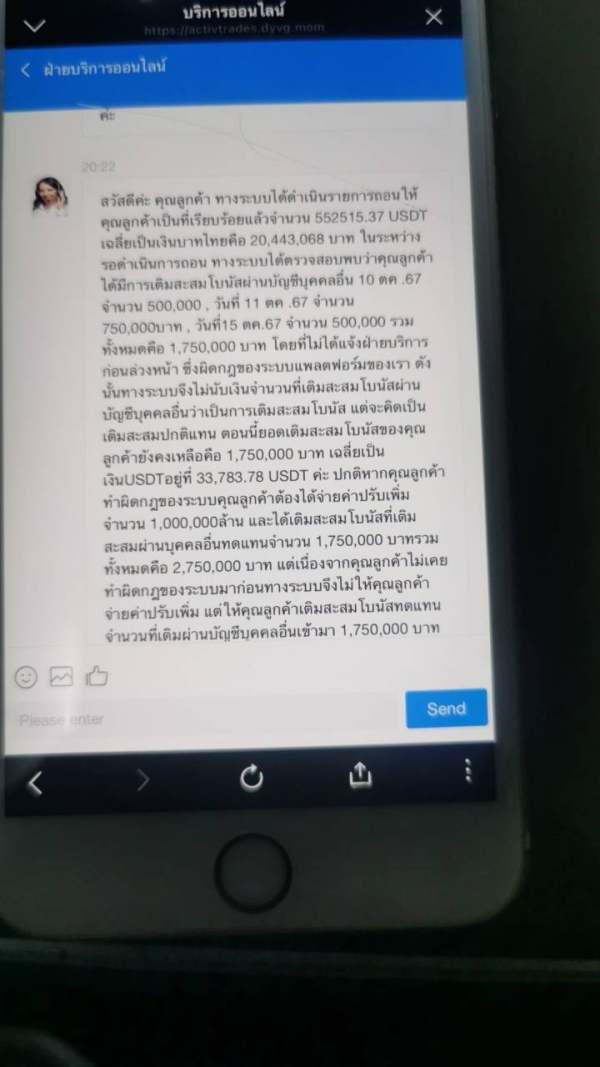

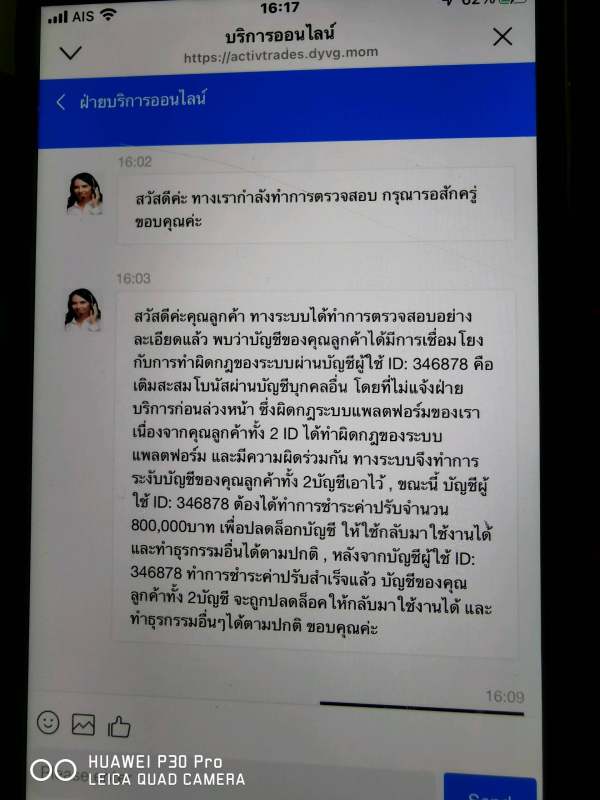

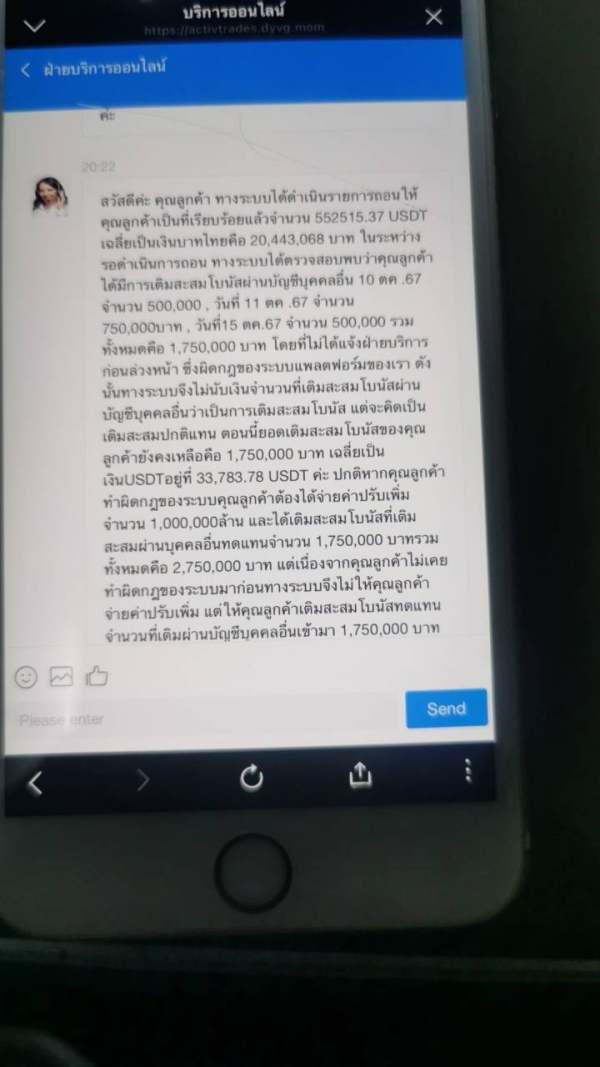

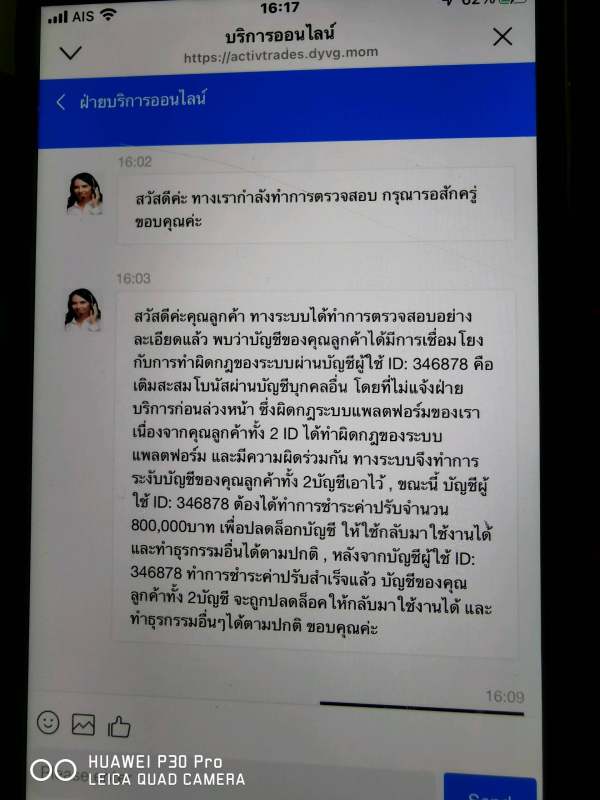

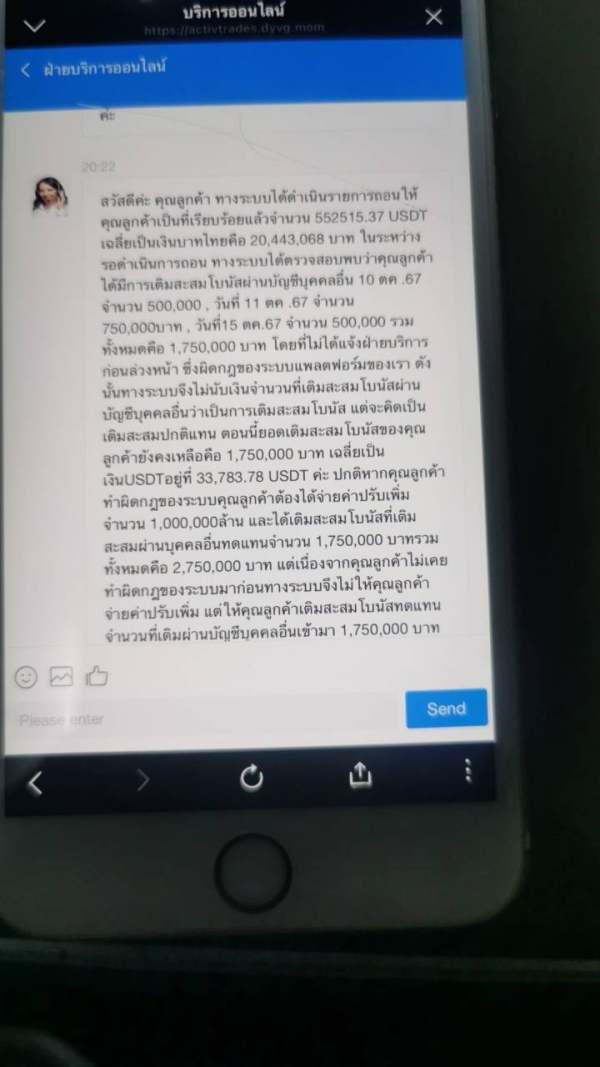

Withdrawals are not possible and access is suspended.

ACTIVE TRADES Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Withdrawals are not possible and access is suspended.

ActivTrades has garnered a reputation as a reliable broker in the online trading space since its inception in 2001. With a focus on forex and CFDs, the platform offers a range of features that appeal to both novice and experienced traders. This review synthesizes various expert opinions and user experiences to provide a comprehensive overview of what ActivTrades has to offer in 2025.

Note: It's important to highlight that ActivTrades operates through multiple entities, each subject to different regulatory environments. This can significantly impact trading conditions, fees, and available services, making it essential for traders to understand which entity they are dealing with.

| Category | Score (out of 10) |

|---|---|

| Account Conditions | 8 |

| Tools and Resources | 7 |

| Customer Service and Support | 8 |

| Trading Experience | 7 |

| Trustworthiness | 9 |

| User Experience | 8 |

| Overall | 8 |

How We Rated the Broker: The ratings are based on a combination of user feedback, expert analysis, and a review of the broker's features and offerings.

Founded in 2001, ActivTrades is headquartered in London and has expanded its operations globally, serving clients from over 140 countries. The broker is regulated by several top-tier authorities, including the UK's Financial Conduct Authority (FCA) and the Securities Commission of the Bahamas (SCB). The platform supports various trading instruments, including forex, commodities, indices, shares, and cryptocurrencies, accessible through its proprietary ActivTrader platform, as well as the widely used MetaTrader 4 and MetaTrader 5.

Regulated Geographic Areas: ActivTrades operates under multiple jurisdictions, with its main regulatory body being the FCA in the UK. Other regulatory entities include the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg and the Comissão do Mercado de Valores Mobiliários (CMVM) in Portugal. The broker also has a presence in the Bahamas and Mauritius, which may offer different trading conditions.

Deposit/Withdrawal Currencies/Cryptocurrencies: ActivTrades allows clients to fund their accounts in several major currencies, including USD, GBP, EUR, and CHF. While there are no deposit fees for most methods, credit/debit card deposits outside the UK and EEA incur a fee of 1.5%. Withdrawals are generally free, although bank transfers to certain institutions may incur a fee. The platform also supports cryptocurrency deposits and withdrawals, adding versatility for traders interested in digital assets.

Minimum Deposit: One of the standout features of ActivTrades is its low barrier to entry; there is no minimum deposit requirement for most accounts, making it accessible for traders of all experience levels. However, certain accounts (like professional or Islamic accounts) may have different requirements, such as a minimum deposit of $500.

Bonuses/Promotions: ActivTrades offers a referral program where existing clients can earn bonuses by introducing new traders. However, there are no significant promotional offers or bonuses for new account holders, which could be a drawback for some traders.

Tradable Asset Classes: The broker provides access to a wide range of asset classes, including over 1,000 CFDs on forex, commodities, indices, shares, and cryptocurrencies. However, it is worth noting that the selection of cryptocurrencies is somewhat limited compared to other brokers, focusing mainly on major coins like Bitcoin and Ethereum.

Costs (Spreads, Fees, Commissions): ActivTrades offers competitive spreads starting from 0.5 pips for major forex pairs, which is favorable compared to industry averages. However, there are additional commissions for trading CFDs on shares, which can vary based on the market. An inactivity fee of £10 per month is charged after one year of inactivity, which can add up for less active traders.

Leverage: The maximum leverage offered by ActivTrades varies by jurisdiction; it is capped at 1:30 for clients in the UK and EU, while clients under the Bahamian entity may access leverage up to 1:400. This flexibility is appealing to traders looking to maximize their trading potential.

Allowed Trading Platforms: ActivTrades supports multiple trading platforms, including its proprietary ActivTrader, MetaTrader 4, MetaTrader 5, and TradingView. This variety allows traders to choose the platform that best suits their trading style, whether they prefer automated trading or manual strategies.

Restricted Regions: While ActivTrades serves clients globally, it does not accept residents from the United States, Canada, Japan, and a few other countries due to regulatory restrictions. This limitation could affect traders looking for a broker with a broader reach.

Available Customer Support Languages: ActivTrades offers customer support in multiple languages, including English, Spanish, German, French, Italian, Russian, Chinese, and more. This multilingual support is beneficial for its diverse client base.

| Category | Score (out of 10) |

|---|---|

| Account Conditions | 8 |

| Tools and Resources | 7 |

| Customer Service and Support | 8 |

| Trading Experience | 7 |

| Trustworthiness | 9 |

| User Experience | 8 |

| Overall | 8 |

Account Conditions: ActivTrades scores well in account conditions due to its low minimum deposit requirement and competitive spreads. However, the inactivity fee may deter some traders.

Tools and Resources: The broker provides a solid range of trading tools, including unique features like smart order types. However, educational resources could be improved, as they are not as comprehensive as those offered by some competitors.

Customer Service and Support: ActivTrades has received positive feedback for its customer support, which is available through various channels. The multilingual support is a significant advantage for international clients.

Trading Experience: The trading experience is generally smooth, with fast execution times. However, some users have reported issues with platform responsiveness during peak trading hours.

Trustworthiness: With strong regulatory oversight and negative balance protection, ActivTrades is considered a trustworthy broker. The additional insurance coverage enhances its credibility.

User Experience: The user experience is rated highly, thanks to the intuitive design of the ActivTrader platform and the availability of popular trading platforms like MetaTrader.

In conclusion, ActivTrades stands out as a reliable broker with a strong regulatory framework, competitive trading conditions, and a user-friendly platform. While it has some limitations in terms of asset variety and educational resources, its strengths make it a solid choice for traders looking to engage in forex and CFD trading.

FX Broker Capital Trading Markets Review