Regarding the legitimacy of CITYWEALTH forex brokers, it provides FSPR and WikiBit, .

Is CITYWEALTH safe?

Pros

Cons

Is CITYWEALTH markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

CITY WEALTH MARKETS LIMITED

Effective Date:

2013-06-17Email Address of Licensed Institution:

admin@citywealth.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2018-08-16Address of Licensed Institution:

153a Parnell Road, Parnell, Auckland, 1052, New ZealandPhone Number of Licensed Institution:

6493544859Licensed Institution Certified Documents:

Is Citywealth Safe or Scam?

Introduction

Citywealth is a relatively new player in the forex market, established in 2013, and claims to offer a wide range of trading services, including forex, commodities, and CFDs. As the forex market continues to grow, traders are increasingly faced with the challenge of selecting a reliable broker. Evaluating a broker's legitimacy is crucial to safeguarding investments, as the market is rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of Citywealth, assessing its safety and legitimacy based on regulatory status, company background, trading conditions, customer safety, and user experiences. The investigation is based on a review of the first ten results from Google searches related to the query "Is Citywealth safe," focusing on credible sources and user feedback.

Regulation and Legitimacy

Citywealth operates under the auspices of Hortense Holdings Limited and is registered in New Zealand. However, it is important to note that the broker is not regulated by any significant financial authority, raising concerns about its legitimacy. Regulation serves as a critical safeguard for traders, ensuring that brokers adhere to strict operational standards and provide a level of protection for client funds. Below is a summary of the regulatory information regarding Citywealth:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | New Zealand | Unverified |

The lack of regulation is a significant red flag. Unregulated brokers can operate with minimal oversight, which can lead to unethical practices and potential fraud. Furthermore, the absence of a regulatory body means that traders have limited recourse in the event of disputes or financial losses. Historical compliance issues and the absence of a regulatory framework further exacerbate concerns regarding Citywealth's safety. Therefore, the question "Is Citywealth safe?" leans towards a negative response due to these regulatory shortcomings.

Company Background Investigation

Citywealth's history and ownership structure reveal a lack of transparency that is concerning for prospective traders. The broker was founded in 2013, but detailed information about its management team and operational history is scarce. The anonymity surrounding its ownership raises questions about accountability and trustworthiness. A transparent organization typically provides clear information about its leadership and operational practices, which is crucial for building trust with clients. The absence of such information at Citywealth is a significant concern.

Moreover, the company's transparency regarding its financial practices and customer service policies is notably lacking. This opacity can lead to a sense of unease among traders, who may question the broker's motives and reliability. In light of these factors, the question "Is Citywealth safe?" becomes increasingly relevant, as the lack of information may indicate potential risks associated with engaging with this broker.

Trading Conditions Analysis

Citywealth presents a trading environment that includes a variety of financial instruments, but its fee structure raises eyebrows. The broker offers competitive spreads and leverage options, but the overall cost structure is not transparent. Traders should be wary of any hidden fees or unusual charges that could erode their profits. Below is a comparison of Citywealth's trading costs against industry averages:

| Fee Type | Citywealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads appear attractive, the lack of clarity regarding commissions and overnight fees is concerning. Unusual fees can often be a tactic used by unscrupulous brokers to extract more money from traders. Therefore, potential clients should exercise caution and thoroughly investigate all costs associated with trading at Citywealth. This lack of clarity contributes to the growing skepticism around the question, "Is Citywealth safe?"

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Citywealth's approach to fund security is questionable, as it lacks robust measures such as segregated accounts and investor protection schemes. In regulated environments, client funds are typically held in separate accounts to ensure they are not misappropriated by the broker. However, Citywealth's unregulated status means that it is not obligated to follow such practices, putting traders' funds at risk.

Furthermore, there have been reports of difficulties in withdrawing funds from Citywealth, which is a common issue with unregulated brokers. Traders have reported being unable to access their funds despite multiple withdrawal requests, which raises alarms about the broker's reliability. Historical incidents involving fund security and withdrawal issues further underscore the risks associated with trading at Citywealth. Therefore, the question "Is Citywealth safe?" is met with serious concerns regarding the security of client funds.

Customer Experience and Complaints

Customer feedback regarding Citywealth paints a troubling picture. Many users have reported negative experiences, particularly concerning withdrawal issues and poor customer support. Complaints often revolve around the inability to withdraw funds and the lack of responsive customer service. Below is a summary of the most common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Lack of Transparency | High | Minimal |

For instance, one user reported being unable to withdraw a significant amount of money despite making several requests. Another complaint highlighted the unavailability of customer support when issues arose, leading to frustration and distrust. These patterns of complaints raise serious concerns about the broker's operational integrity and commitment to customer service. Thus, the question "Is Citywealth safe?" is increasingly answered with caution based on user experiences.

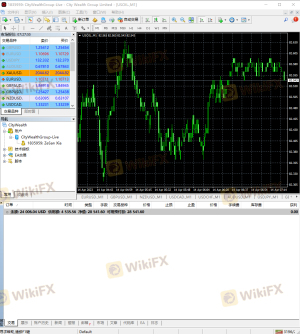

Platform and Trade Execution

Citywealth offers a trading platform that is claimed to be user-friendly, but the execution quality has come under scrutiny. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. A reliable trading platform should provide consistent execution and minimal slippage, but user feedback suggests that Citywealth may fall short in this regard.

Additionally, there are concerns about potential platform manipulation, which can be a red flag for traders. If a broker is found to be manipulating prices or executing trades in a manner that is not transparent, it can lead to significant financial losses for clients. Therefore, it is crucial for traders to assess the platform's performance and execution quality before committing their funds. The question "Is Citywealth safe?" is further complicated by these concerns surrounding trade execution.

Risk Assessment

Engaging with Citywealth presents a range of risks that potential traders should be aware of. The absence of regulation, combined with reports of withdrawal issues and poor customer support, contributes to a high-risk environment. Below is a summary of the key risk areas associated with trading at Citywealth:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of segregation and protection for client funds. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

| Execution Risk | High | Reports of slippage and rejected orders. |

To mitigate these risks, traders should consider using regulated brokers that offer similar trading conditions but with the added security of regulatory oversight. Additionally, conducting thorough research and reading user reviews can help traders make informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Citywealth raises several red flags regarding its safety and legitimacy. The lack of regulation, poor customer feedback, and issues related to fund security and withdrawal processes indicate that traders should approach this broker with caution. The question "Is Citywealth safe?" is met with concerning answers that highlight potential risks.

For traders seeking a reliable trading environment, it is advisable to consider regulated alternatives that provide greater transparency and protection for client funds. Brokers regulated by reputable authorities, such as the FCA or ASIC, typically offer better security measures and customer support. In light of the findings, it's prudent for prospective traders to avoid Citywealth and seek more trustworthy options in the forex market.

Is CITYWEALTH a scam, or is it legit?

The latest exposure and evaluation content of CITYWEALTH brokers.

CITYWEALTH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CITYWEALTH latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.