brillant capital Review 1

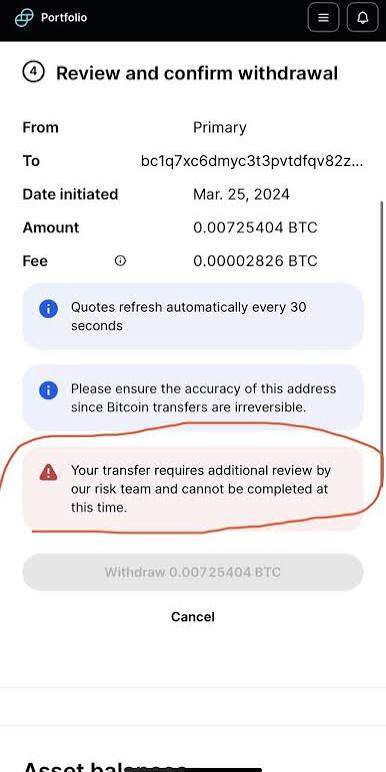

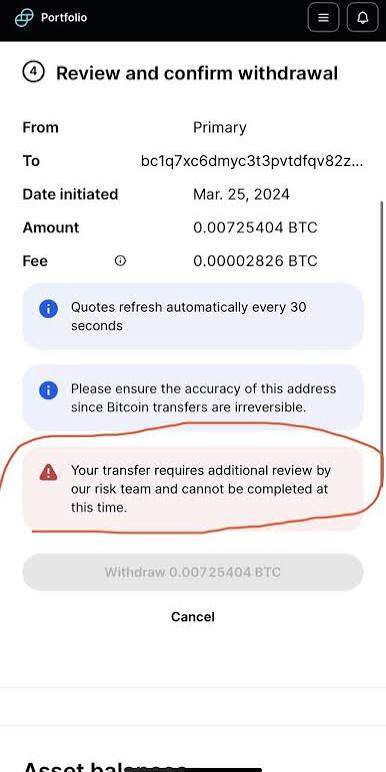

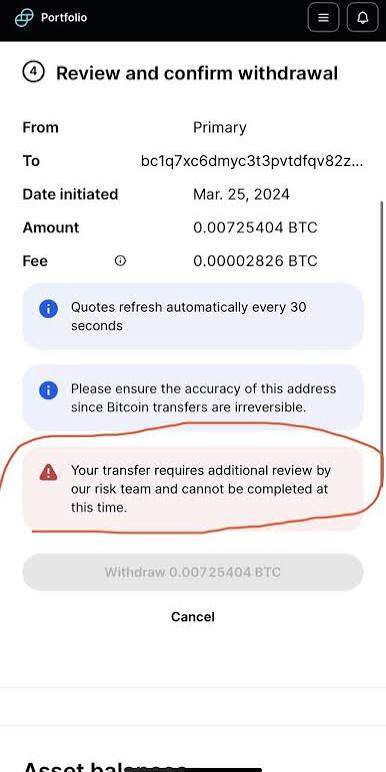

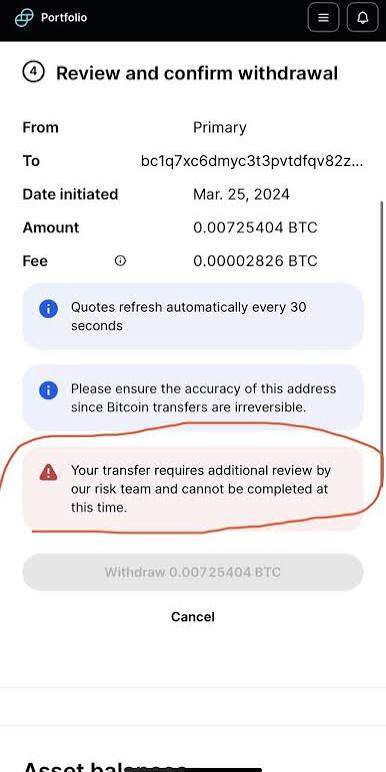

I'm writing to express my frustration and disappointment regarding my withdrawal request. Despite being a long-standing trader with your platform, I've been unexpectedly denied access to my funds.

brillant capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I'm writing to express my frustration and disappointment regarding my withdrawal request. Despite being a long-standing trader with your platform, I've been unexpectedly denied access to my funds.

Brillant Capital has emerged as a significant player within the UAE's volatile investment landscape, distinguishing itself with an impressive trade accuracy rate of 98.3% and 24/5 customer support. The broker appeals primarily to active traders who place a premium on high accuracy and robust support, as well as investors desiring tailored investment strategies informed by local market expertise. However, potential clients should approach with caution. Despite its allure, Brillant Capital is mired in regulatory concerns, with a notable lack of clear oversight and warnings about possible hidden costs. Additionally, mixed user reviews suggest potential issues surrounding fund withdrawals and unexpected fees. Overall, while the platform offers enticing prospects for skilled investors, it is less suitable for those averse to risk or unfamiliar with trading dynamics.

Brillant Capital presents significant risks for prospective investors. Consider the following:

How to Self-Verify:

There is insufficient clarity on regulatory oversight, raising safety concerns for investors.

While commissions are competitively low, users have reported high non-trading fees, including up to $30 per withdrawal.

The broker offers a decent variety of trading platforms including MT5 and educational materials, though usability can vary.

Mixed experiences reported, particularly concerning withdrawal processes.

Support services are generally strong; however, response times can lag during high-demand periods.

Minimum deposit is high at $1,000, which can be prohibitive for some new traders.

Founded in recent years, Brillant Capital is headquartered in Dubai, positioning itself as a key player in the ever-competitive UAE investment sector. The broker promotes its unique selling proposition as a combination of advanced technology and local market expertise, offering tools to navigate the complexities of trading and investing effectively. The firm continually emphasizes its commitment to user success and wealth growth through its offerings of fast trading and market insights, reinforcing a narrative of trust and reliability.

Brillant Capital primarily operates as a Contract for Difference (CFD) broker, allowing users to trade various asset classes, including forex, commodities, and indices. The broker claims affiliation with several regulatory bodies, although scrutiny of its actual compliance with stringent regulatory standards raises questions. Traders can access multiple platforms, prominently featuring MetaTrader 5 (MT5), alongside supplemental educational resources designed to enhance trading proficiency and market understanding.

| Category | Details |

|---|---|

| Regulation | Limited transparency, no major oversight available |

| Minimum Deposit | $1,000 |

| Max Leverage | 1:500 |

| Commission | 0.5 pips |

| Withdrawal Fees | Up to $30 |

| Trading Platforms | MT5, proprietary app |

In the realm of online trading, trust becomes a cornerstone for decision-making. The current narrative surrounding Brillant Capital suggests a landscape fraught with uncertainty due to lack of clear regulatory oversight. Industry experts note that the absence of specific regulations raises potential red flags, particularly for investors unfamiliar with high-risk environments.

Analysis of Regulatory Information Conflicts:

Regulatory claims made by Brillant Capital clash with third-party assessments highlighting suspicious licensing and the absence of major regulatory affiliations. This dissonance can significantly undermine investor confidence.

User Self-Verification Guide:

User feedback has been mixed. A notable comment states:

"Working with Brillant Capital has been an incredibly rewarding experience, but be cautious about the withdrawal process."

This highlights the importance of self-verification in assessing fund safety.

The allure of low trading costs can quickly become a double-edged sword if non-trading fees catch traders off-guard.

Advantages in Commissions:

Users benefit from remarkably low commission fees compared to industry standards, pegged around 0.5 pips for forex trades. This competitive structure positions Brillant Capital favorably against traditional brokers.

The "Traps" of Non-Trading Fees:

Users have reported experiencing substantial non-trading fees that significantly undermine potential profits. Complaints highlight sudden charges, such as withdrawal fees reported at $30, which can compound frustration among traders seeking transparency.

"I didn't expect such high withdrawal fees; it really hit my overall returns" — User Feedback.

Overall, Brillant Capital's pricing structure is attractive for active traders focused on commission costs, although the surprise withdrawal fees present a challenge that risks alienating potential clients, particularly beginners.

The effectiveness of a trading platform can dramatically impact the user's trading experience, bridging the gap between professional depth and usability.

Platform Diversity:

Brillant Capital offers a range of platforms, including the robust MetaTrader 5. The platform is noted for its advanced charting tools and analytics designed for serious traders, allowing users to execute trades with speed and precision.

Quality of Tools and Resources:

Users have access to a wide array of educational resources, from live market insights to analytical tools that can empower them to trade like professionals. The broker's commitment to continuous learning is echoed in its user support materials.

Platform Experience Summary:

General feedback about usability is positive; however, some traders indicated that navigation could be less intuitive for newcomers.

"Initially, I found the platform complex, but I grew into it with time."

User experience encompasses various factors, crucial for retaining active traders in a competitive market.

User Interface & Navigation:

While many users praise the platform's advanced features, new traders often report a steep learning curve. Ensuring an intuitive interface for beginners could enhance overall satisfaction and retention.

Account Management Features:

Brillant Capital offers robust features for account management, including rapid registration processes and real-time monitoring of trades and investments, allowing users to stay connected while trading on-the-go.

Feedback Summary:

Similar to the platform experience, the overall user experience is commendable but suggests room for improvement in introductory guides for new traders.

Customer support forms the backbone of investor confidence, influencing perceived reliability.

Availability of Support Channels:

Brillant Capital provides a commendable array of support channels, including live chat and dedicated customer service representatives who ensure that inquiries are addressed promptly.

Feedback from Users:

Reviews often reinforce the broker's dedication to customer care.

"Customer service is fast and efficient, providing support whenever I needed it."

The overall effectiveness of customer support reflects positively on the broker, although some users note that response times can lag during peak trading hours.

The conditions associated with opening an account play a crucial role in potential clients' decision-making.

Minimum Deposit Requirements:

The minimum deposit of $1,000 is a barrier for many novice traders, potentially stifling broader market accessibility.

Variety of Account Types:

Brillant Capital offers various account types tailored to different investment needs, although differentiating features may require more clarification in promotional materials to entice new entrants.

Account Conditions Summary:

While account conditions present consistent features, the elevated minimum deposit could deter a significant demographic of beginner traders who might benefit most from accessible platforms.

Brillant Capital presents an attractive opportunity for experienced traders capitalizing on advanced toolsets and solid customer support. However, regulatory concerns and unanticipated costs may overshadow its many offerings. Prospective investors should conduct thorough due diligence, assess their own risk profiles, and replace any assumptions with verified information sourced from community feedback and regulatory checks. Ultimately, as the broker operates within a complex financial environment, discerning the true value it offers against its associated risks is vital for maintaining safe and rewarding trading practices.

FX Broker Capital Trading Markets Review