Zhengda 2025 Review: Everything You Need to Know

Zhengda, a brokerage based in Hong Kong, has garnered mixed reviews since its inception. While it is regulated by the Securities and Futures Commission (SFC) of Hong Kong, there are significant concerns regarding user experiences, particularly related to fund withdrawals. This review provides a comprehensive analysis of Zhengda's offerings, user feedback, and expert opinions based on various sources.

Note: Its essential to highlight that Zhengda operates under different entities across regions, which may affect user experiences and regulatory oversight. This review aims to present a balanced perspective based on available information.

Ratings Overview

We rate brokers based on user feedback, regulatory status, and the breadth of services provided.

Broker Overview

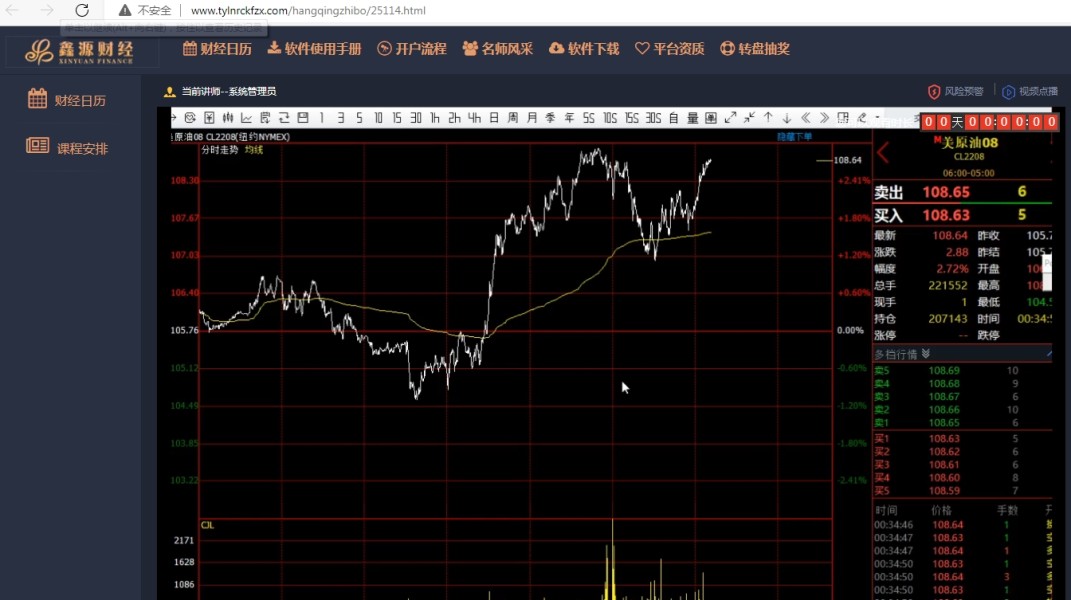

Founded in 2019, Zhengda operates under the regulatory supervision of the SFC, which is responsible for overseeing Hong Kong's financial markets. The brokerage offers a variety of trading services, focusing primarily on futures trading across multiple asset classes, including forex, energy, metals, commodities, and global indices. However, it does not support popular trading platforms like MT4 or MT5, instead using its proprietary Yisheng Jixing trading software.

Detailed Section

Regulatory Status

Zhengda is regulated by the SFC, which lends it a degree of credibility. However, some reviews indicate that despite this regulation, users have reported issues with fund withdrawals, raising questions about the effectiveness of oversight. According to WikiFX, users have faced significant challenges when trying to access their funds, with reports of account managers being unresponsive.

Deposit/Withdrawal Methods

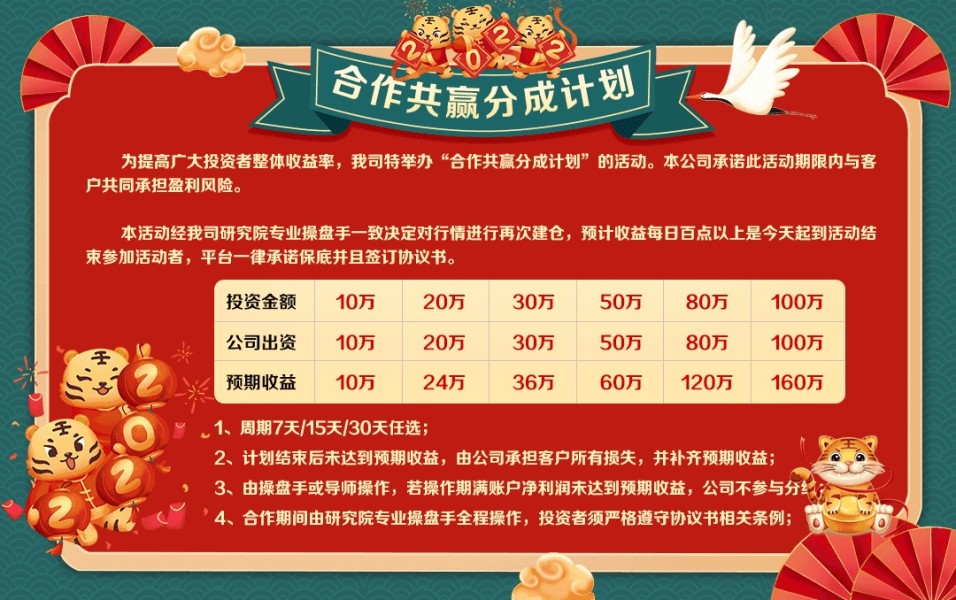

Zhengda allows deposits primarily through bank transfers, which can be cumbersome for some users. There have been complaints regarding the withdrawal process, with some users stating they were unable to withdraw their funds unless they paid a fee of 15% of their balance. This has led to a perception of potential fraudulent practices, as noted in various user reviews.

Minimum Deposit

The exact minimum deposit requirement is not clearly specified across sources, which could lead to confusion for potential clients. This lack of transparency can be a red flag for new traders looking to start with a specific budget.

There are no notable bonuses or promotional offers highlighted in the reviews, which could be a disadvantage compared to other brokers that offer incentives to attract new clients.

Tradable Asset Classes

Zhengda offers a diverse array of asset classes, including forex futures, energy futures, metal futures, and global index futures. This variety may appeal to traders looking to diversify their portfolios. However, the absence of a demo account limits the ability for new traders to practice before committing real funds.

Costs (Spreads, Fees, Commissions)

The reviews did not provide detailed information regarding spreads or commissions, which can significantly impact trading profitability. This lack of clarity could deter potential clients who are sensitive to trading costs.

Leverage

Information on leverage options was not consistently reported across sources. Traders should be cautious and inquire directly with Zhengda to understand the leverage offered on different asset classes.

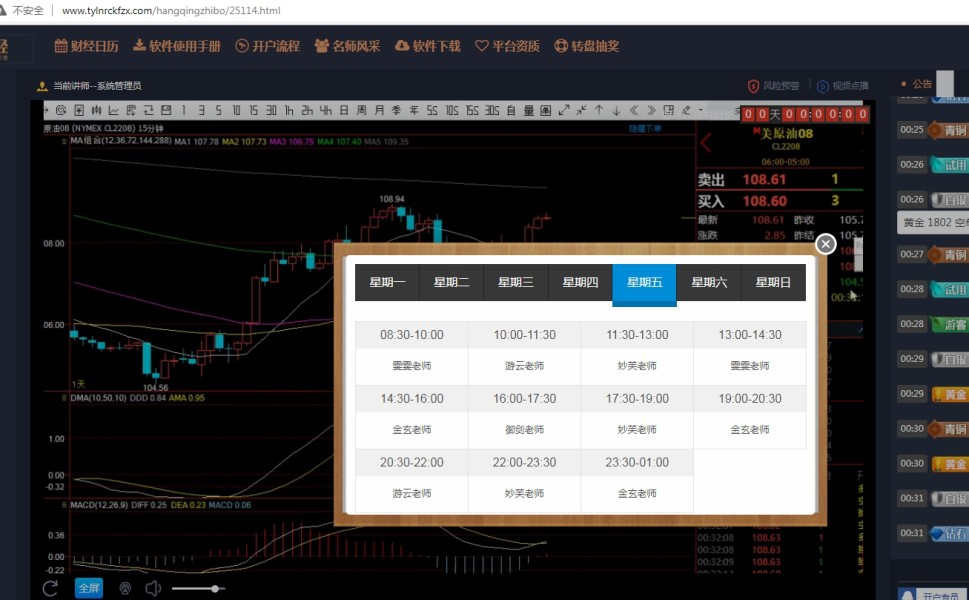

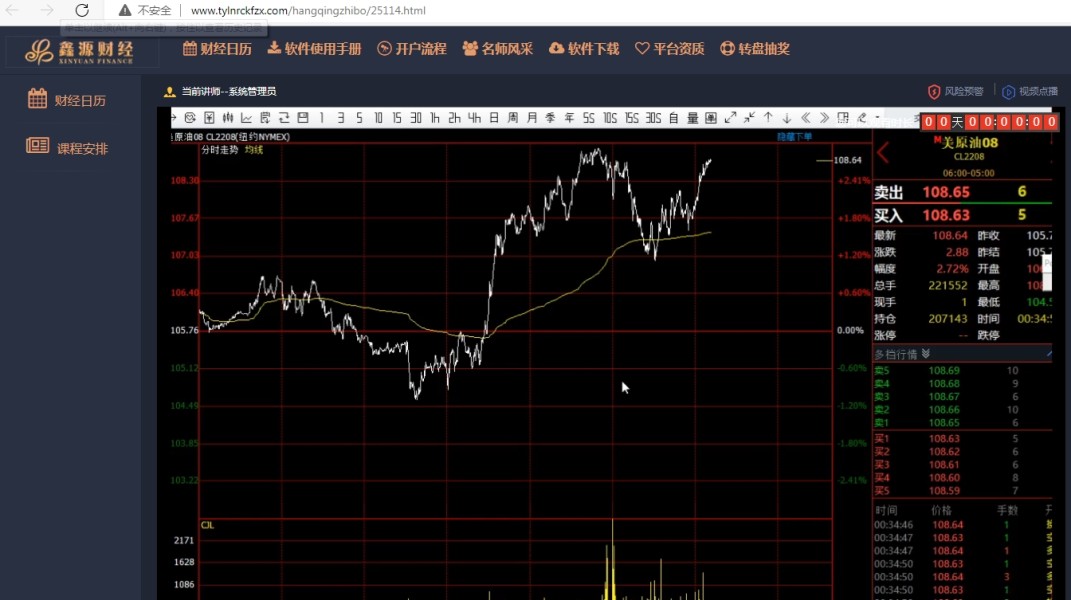

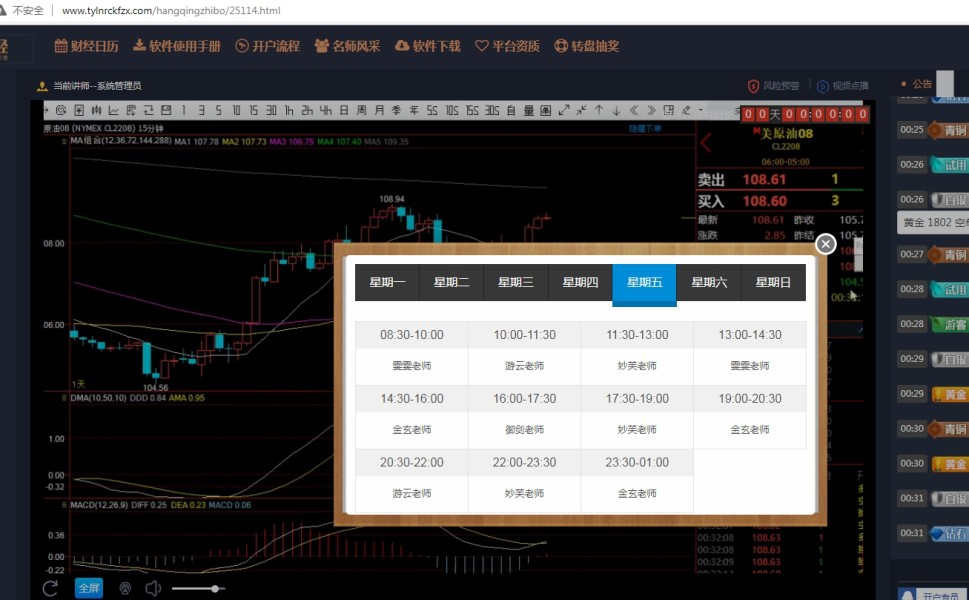

Zhengda utilizes its proprietary trading platform, Yisheng Jixing, which may lack some features found in more established platforms like MT4 or MT5. This could be a disadvantage for traders who prefer more robust trading tools and analytics.

Restricted Regions

While specific restricted regions were not mentioned, potential clients should verify whether their country is supported by Zhengda, especially given the varying regulatory environments.

Available Customer Support Languages

Customer service is available primarily in Chinese, which may limit accessibility for non-Chinese speaking traders. The reviews indicated that response times could be slow, further complicating user experiences.

Repeated Ratings Overview

Detailed Breakdown

Account Conditions

Zhengda's account conditions receive a score of 6. While it offers a variety of futures products, the lack of clarity regarding minimum deposits and withdrawal requirements raises concerns.

With a score of 5, the tools and resources available through Zhengda are limited. The absence of a demo account and educational resources could hinder traders, especially beginners.

Customer Service and Support

Scoring a mere 4, customer service feedback indicates long wait times and unresponsive account managers, which can be frustrating for users needing assistance.

Trading Experience

The trading experience is rated at 5, primarily due to the use of a proprietary platform that may not meet the expectations of experienced traders accustomed to more popular platforms.

Trustworthiness

Despite being regulated by the SFC, the reports of withdrawal issues and unresponsive support lead to a trustworthiness rating of 6. Traders should exercise caution.

User Experience

Overall user experience is rated at 4, reflecting significant concerns regarding withdrawals and customer support.

In conclusion, the Zhengda review reveals a brokerage that offers a range of futures trading options but is marred by user complaints regarding withdrawals and customer service. Potential clients should conduct thorough research and consider their options carefully before engaging with this broker.