EnclaveFX 2025 Review: Everything You Need to Know

Executive Summary

This EnclaveFX review shows concerning findings about this online forex broker. Traders should carefully consider these issues before opening an account with them. EnclaveFX offers attractive features like high leverage up to 1:500 and access to multiple asset classes including forex, stocks, commodities, indices, bonds, and cryptocurrencies. However, our analysis shows serious red flags that raise questions about the broker's reliability and legitimacy.

The broker claims to be a UK-based company but appears to lack proper oversight. There is no clear evidence of authorization from major financial authorities in any country. User complaints and negative reviews across various platforms suggest poor customer service quality and unresolved issues that persist over time. The platform uses MetaTrader 5 for trading operations, which provides a familiar interface for experienced traders. This alone cannot make up for the basic concerns about regulatory compliance and customer protection.

EnclaveFX targets investors seeking high leverage trading opportunities and diversified asset exposure. The combination of regulatory uncertainty, user complaints, and lack of transparency makes this broker unsuitable for most retail traders, especially those who want safety and regulatory protection for their investments.

Important Notice

Regional Entity Differences: EnclaveFX claims to operate as a UK-based company. However, available evidence suggests the broker does not maintain legitimate operations in the United Kingdom or hold proper authorization from UK financial authorities. Traders should exercise extreme caution when evaluating these claims about their location and legal status.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and industry reports. Due to limited official documentation and regulatory information, some aspects of this review rely on user-reported experiences and third-party assessments that we could verify through multiple sources.

Rating Framework

Broker Overview

EnclaveFX presents itself as an online forex broker established in 2020. Some sources suggest a 2018 founding date, which highlights inconsistencies in the company's background information that raise immediate concerns. The broker claims to be a UK-based entity, but thorough investigation reveals no substantial evidence supporting legitimate UK operations or proper regulatory authorization from UK financial authorities. This discrepancy raises immediate concerns about the broker's transparency and credibility in the competitive forex market where trust is essential.

The company operates as an online trading platform focusing on retail forex trading and CFD services. EnclaveFX positions itself to serve individual traders seeking access to international financial markets through leveraged trading products that can amplify both gains and losses. However, the lack of clear regulatory status and verifiable company information makes it difficult to assess the broker's true operational scope and business legitimacy. This uncertainty creates significant risks for potential clients who cannot verify the company's claims about its services and protections.

EnclaveFX uses the MetaTrader 5 platform for its trading operations. The platform provides access to multiple asset classes including foreign exchange pairs, individual stocks, commodities, market indices, government and corporate bonds, and various cryptocurrencies. The broker offers leverage ratios up to 1:500, which appeals to traders seeking amplified market exposure but also increases potential losses significantly. However, specific information about regulatory oversight remains notably absent from available documentation, with no mention of authorization from recognized financial regulatory authorities such as the FCA, CySEC, or other major supervisory bodies that protect traders.

Regulatory Status: Available information does not specify any regulatory authority overseeing EnclaveFX operations. This represents a significant concern for potential clients seeking regulated broker services with proper oversight and protection.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been detailed in accessible documentation. This limits transparency about funding options that traders need to manage their accounts effectively.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in available materials. This makes it difficult for traders to assess account accessibility and plan their initial investment amounts.

Bonus and Promotional Offers: No information about bonus programs or promotional offers has been identified in current documentation. Many legitimate brokers clearly outline their promotional terms and conditions for transparency.

Tradeable Assets: EnclaveFX provides access to six major asset categories. These include foreign exchange currency pairs, individual company stocks, commodities including precious metals and energy products, market indices, bonds, and cryptocurrency instruments.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs has not been made readily available. This limits cost transparency for potential clients who need to understand total trading expenses.

Leverage Ratios: The broker offers maximum leverage of 1:500 across trading instruments. This high leverage can amplify both profits and losses significantly for traders.

Platform Options: EnclaveFX exclusively uses the MetaTrader 5 trading platform for client operations. This platform is widely recognized in the industry for its advanced features and reliability.

Geographic Restrictions: Information about geographic trading restrictions or prohibited jurisdictions has not been specified in available documentation. This creates uncertainty for international traders about service availability.

Customer Service Languages: Available customer service language options have not been detailed in accessible materials. This EnclaveFX review highlights the concerning lack of detailed operational information that reputable brokers typically provide to potential clients.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

EnclaveFX's account conditions receive a below-average rating due to significant lack of transparency about basic account parameters. The broker has not provided clear information about available account types, their specific features, or the requirements for different service tiers that traders expect from professional brokers. This absence of basic account information makes it extremely difficult for potential traders to make informed decisions about whether the broker's offerings align with their trading needs and financial capabilities.

The minimum deposit requirement remains undisclosed. This is unusual for legitimate forex brokers who typically provide clear funding requirements to help traders understand accessibility thresholds and plan their investments accordingly. Additionally, the account opening process has not been detailed, leaving potential clients uncertain about verification requirements, documentation needs, and approval timeframes that affect when they can start trading. The lack of information about special account features, such as Islamic accounts for traders requiring swap-free trading conditions, further demonstrates the broker's poor communication about account services.

Without transparent information about account conditions, traders cannot adequately assess the broker's suitability for their specific requirements. This EnclaveFX review emphasizes that reputable brokers typically provide comprehensive account information to build trust and facilitate informed decision-making among potential clients who deserve clear terms and conditions.

EnclaveFX receives a moderate rating for tools and resources primarily based on its provision of the MetaTrader 5 platform. This platform is recognized as professional-grade trading software offering advanced charting capabilities, technical analysis tools, and automated trading support that experienced traders value. The MT5 platform provides traders with access to multiple timeframes, various order types, and comprehensive market analysis features that can support both novice and experienced trading strategies effectively.

However, the broker's score is limited by the lack of detailed information about additional trading tools, research resources, and educational materials. Comprehensive brokers typically offer market analysis, economic calendars, trading signals, and educational content to support trader development and decision-making processes that improve trading outcomes. The absence of information about these supplementary resources suggests either limited offerings or poor communication about available services that could benefit clients.

Furthermore, while MT5 supports automated trading through Expert Advisors, EnclaveFX has not provided specific information about their policies regarding algorithmic trading. The broker lacks details about strategy development resources or technical support for automated systems that many modern traders rely on. The broker also lacks detailed information about research and analysis resources that could help traders make informed market decisions based on current economic conditions and market trends.

Customer Service and Support Analysis (3/10)

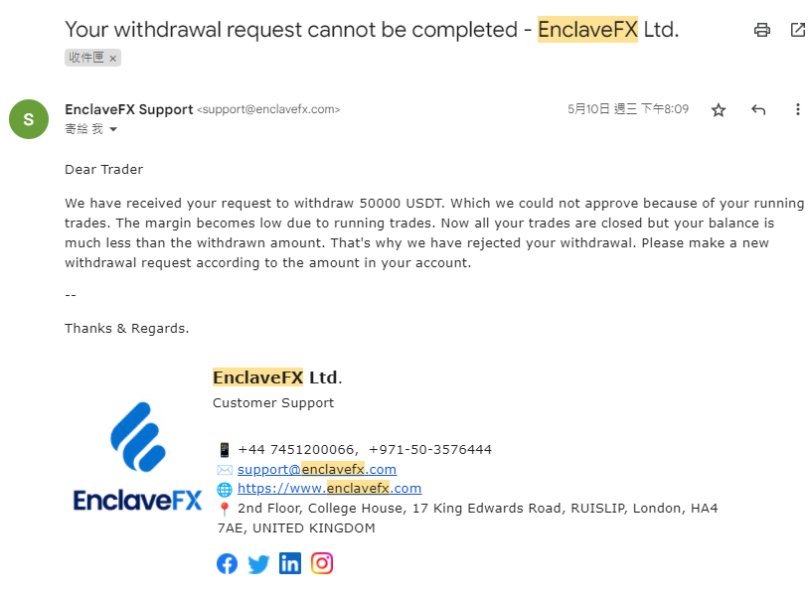

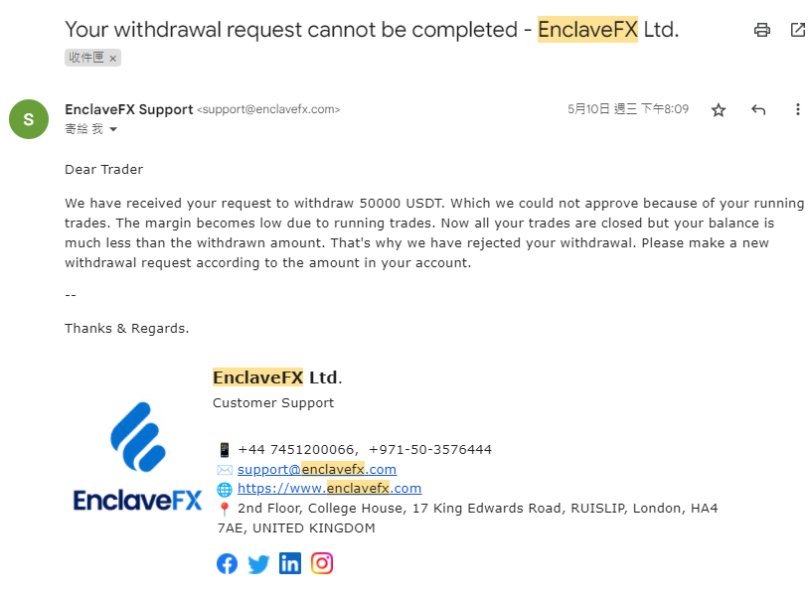

Customer service represents one of EnclaveFX's weakest areas, with multiple user complaints indicating significant deficiencies in support quality and responsiveness. Available user feedback suggests that the broker struggles with timely response to client inquiries and effective resolution of account-related issues that can significantly impact trading activities. This poor service quality raises serious concerns about the broker's commitment to client satisfaction and support when problems arise.

The broker has not provided clear information about available customer service channels, operating hours, or response time commitments. Professional forex brokers typically offer multiple contact methods including live chat, email support, and telephone assistance with clearly defined availability schedules that clients can rely on. The absence of this fundamental information suggests either limited support infrastructure or poor communication about available services that clients need to access help when required.

User complaints specifically highlight concerns about delayed responses to critical account issues. Clients report difficulty reaching support representatives and inadequate resolution of technical problems that can prevent successful trading. The lack of multilingual support information also suggests potential limitations for international clients who may require assistance in languages other than English, which limits the broker's accessibility to global markets.

Trading Experience Analysis (5/10)

The trading experience at EnclaveFX receives a neutral rating based on the availability of the MetaTrader 5 platform. This platform provides a familiar and functional trading environment for experienced forex traders who appreciate its advanced features and reliability. MT5 offers professional-grade features including advanced charting, multiple order types, and comprehensive market access that can support various trading strategies and styles effectively.

However, the overall trading experience rating is limited by the absence of verified user feedback about platform stability, execution quality, and overall performance during different market conditions. Reliable brokers typically demonstrate consistent platform uptime, fast order execution, and minimal technical issues that could disrupt trading activities when markets are moving quickly. The lack of performance data makes it difficult to assess whether EnclaveFX can deliver the reliable execution that active traders require.

The broker has not provided information about execution methods, such as whether they operate as a market maker, ECN, or STP broker. This information affects how orders are processed and filled, which directly impacts trading costs and execution quality for clients. Additionally, there is no available data about average execution speeds, slippage rates, or platform performance metrics that traders typically use to evaluate execution quality before committing funds.

Mobile trading experience information is also lacking, with no details about mobile platform functionality, features, or performance. In today's trading environment, mobile access quality significantly impacts overall trading experience, particularly for active traders who need reliable platform access across different devices throughout the day. This EnclaveFX review notes that while the MT5 platform provides a solid foundation, the lack of performance data and user verification limits confidence in the overall trading experience quality.

Trust and Reliability Analysis (2/10)

Trust and reliability represent EnclaveFX's most concerning weakness, with multiple factors contributing to significant doubts about the broker's legitimacy and safety. The absence of clear regulatory authorization from recognized financial authorities creates fundamental concerns about client protection, fund security, and operational oversight that legitimate brokers typically provide through regulatory compliance with established standards. This lack of oversight means clients have no regulatory protection if problems arise with their accounts or funds.

The broker's claims about UK-based operations lack supporting evidence, with no verifiable registration or authorization from UK financial authorities. This discrepancy between claimed location and actual regulatory status raises serious questions about the company's transparency and honesty in representing its operational legitimacy to potential clients. Such misrepresentation of regulatory status is a major red flag that suggests potential fraudulent activity.

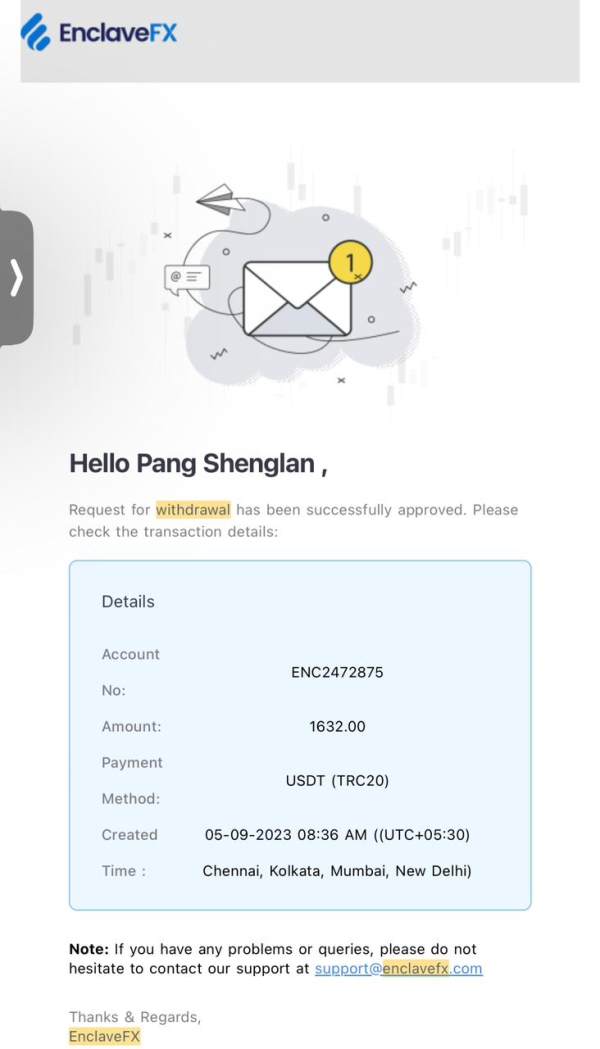

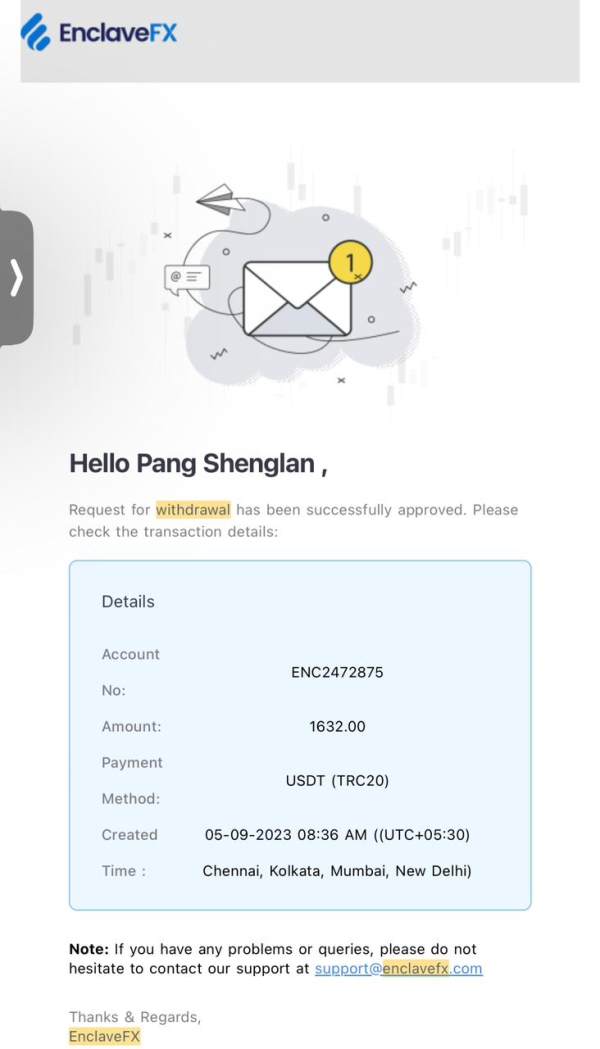

User complaints and negative reviews across various platforms indicate ongoing issues with the broker's service quality and reliability. These complaints, combined with the lack of regulatory oversight, suggest that clients may have limited recourse for dispute resolution or fund recovery in case of problems with their accounts. The absence of segregated client fund information and investor protection scheme participation further amplifies safety concerns that could result in total loss of invested capital.

The broker has not provided financial statements, audit reports, or other transparency measures that established brokers typically use to demonstrate financial stability and operational legitimacy. This lack of corporate transparency makes it impossible to assess the company's financial health and capacity to honor client obligations when withdrawals are requested or market conditions become challenging.

User Experience Analysis (4/10)

Overall user experience at EnclaveFX appears to be significantly below industry standards based on available user feedback and the broker's limited transparency about service offerings. Multiple negative reviews indicate that clients have encountered various issues that detract from satisfactory trading experiences, including poor customer service, technical problems, and unresolved account issues that persist over extended periods. These problems create frustration and financial stress for traders who cannot access their accounts or funds when needed.

The broker's failure to provide comprehensive information about user interface design, account management features, and platform usability suggests either limited functionality or poor communication about available services. Professional brokers typically highlight user-friendly features, intuitive navigation, and comprehensive account management tools that enhance the overall client experience and make trading more efficient. The absence of such information raises concerns about the quality of the user interface and available features.

Registration and verification process information remains undisclosed, leaving potential clients uncertain about account opening requirements, documentation needs, and approval timeframes. Similarly, the lack of information about funding and withdrawal processes creates uncertainty about the practical aspects of account management that significantly impact user satisfaction and the ability to access funds. These basic operational details are essential for traders to understand before opening accounts.

The absence of user testimonials, case studies, or positive feedback contrasts sharply with the negative reviews and complaints available online. This suggests that EnclaveFX has struggled to maintain satisfied clients or build a positive reputation within the trading community, which is essential for long-term success in the competitive forex industry.

Conclusion

This comprehensive EnclaveFX review reveals significant concerns that make this broker unsuitable for most retail traders seeking safe and reliable forex trading services. While the broker offers potentially attractive features such as high leverage up to 1:500 and access to multiple asset classes through the MetaTrader 5 platform, these benefits are overshadowed by fundamental issues regarding regulatory compliance, transparency, and customer service quality that create unacceptable risks. The lack of proper oversight means traders have no protection if problems arise with their accounts or funds.

The primary advantages include high leverage ratios for traders seeking amplified market exposure and diversified asset access spanning forex, stocks, commodities, indices, bonds, and cryptocurrencies. However, these potential benefits are severely undermined by the lack of regulatory authorization, user complaints about poor service quality, and concerning gaps in operational transparency that reputable brokers typically provide to build trust with clients. The combination of these issues creates a high-risk environment that most traders should avoid.

EnclaveFX may only be suitable for highly experienced traders who fully understand the risks associated with unregulated brokers and can afford potential total loss of invested capital. For the majority of retail traders, especially those prioritizing safety, regulatory protection, and reliable customer service, this broker presents unacceptable risks that far outweigh any potential trading advantages offered through their platform or asset selection.