Is LOCUS safe?

Business

License

Is Locus Safe or Scam?

Introduction

Locus is a forex broker that claims to offer a wide range of trading services, including forex, CFDs, and cryptocurrencies. With a polished website and a variety of trading products, it positions itself as a global player in the forex market. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with unregulated brokers, and the potential for scams is significant. In this article, we will investigate whether Locus is a trustworthy broker or if it raises red flags that suggest it may be a scam. Our analysis is based on a comprehensive review of available online resources, including regulatory information, customer feedback, and expert evaluations.

Regulation and Legitimacy

One of the most significant indicators of a broker's reliability is its regulatory status. Regulatory bodies ensure that brokers adhere to specific standards, providing a level of protection for traders. Unfortunately, Locus does not have any legitimate licenses or regulatory oversight.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation is a major concern. It means that Locus operates without any oversight, which can lead to various risks for traders. Unregulated brokers often engage in questionable practices, including manipulating trades and making it difficult for clients to withdraw their funds. In this case, Locus appears to be operating in a grey area, which places traders' investments at significant risk. The Financial Conduct Authority (FCA) in the UK has issued warnings about Locus, advising traders to stay away due to its unregulated status.

Company Background Investigation

Locus is operated by Locus Market Int Ltd, a company that lacks transparency regarding its ownership structure and management team. The company's website does not provide any information about its founders or key personnel, raising questions about its legitimacy. A broker's transparency is critical; it allows traders to understand who is managing their funds and whether they have the requisite experience in the financial industry.

Moreover, the lack of a physical address or contact information further compounds the issue. Legitimate brokers typically provide clear contact details, including a customer support phone number and an email address. The absence of such information suggests that Locus may not be fully committed to maintaining transparency with its clients. This lack of information is a significant red flag, as it indicates that traders may be dealing with an anonymous entity that could disappear at any moment.

Trading Conditions Analysis

Locus offers various trading products, including forex pairs, cryptocurrencies, and commodities. However, the trading conditions associated with these products appear to be less than favorable. Traders have reported high spreads and commissions, which can significantly eat into potential profits.

| Fee Type | Locus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Unspecified | Specified |

The lack of clarity regarding fees and commissions is concerning. Many traders have reported experiencing unexpected charges when attempting to withdraw funds, leading to frustration and financial loss. Locus's trading conditions may not align with industry standards, which raises questions about its overall reliability. Traders should be cautious and fully understand the fee structure before engaging with Locus.

Customer Funds Safety

When it comes to trading, the safety of customer funds is paramount. Unfortunately, Locus does not provide adequate information regarding its fund security measures. The absence of segregated accounts, investor protection, and negative balance protection policies raises significant concerns.

Traders should always ensure that their funds are kept in segregated accounts, which are separate from the broker's operational funds. This ensures that even if the broker faces financial difficulties, clients' funds remain protected. Additionally, the lack of any historical compliance records or security issues reported by Locus further exacerbates the risk associated with trading on this platform.

Customer Experience and Complaints

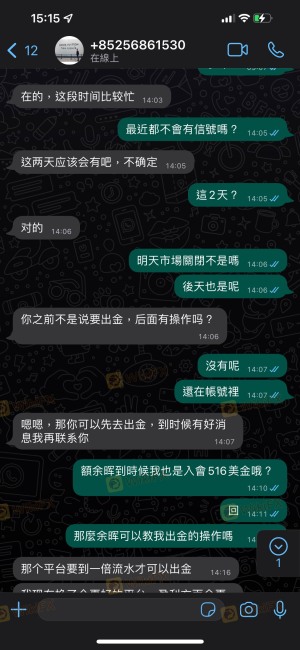

Customer feedback about Locus has been overwhelmingly negative. Many users have reported difficulties in withdrawing their funds, with some stating that their requests were ignored altogether. Common complaints include poor customer service, high-pressure sales tactics, and a lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Indifferent |

One notable case involved a trader who reported being unable to withdraw their funds after several attempts. The trader claimed that customer service representatives were unhelpful and dismissive, leaving them feeling trapped. Such experiences highlight the risks associated with trading with Locus and the potential for significant financial loss.

Platform and Trade Execution

The trading platform offered by Locus is reportedly based on MetaTrader 5, a widely used trading platform known for its robust features. However, user experiences suggest that the platform may not be as stable as advertised. Traders have reported issues with order execution, including slippage and rejected orders, which can lead to losses in volatile market conditions.

The potential for platform manipulation is also a concern. Traders should be wary of any signs that suggest their trades are being manipulated or that the broker is engaging in unethical practices.

Risk Assessment

The overall risk associated with trading through Locus is high. The lack of regulation, transparency, and customer support, combined with negative customer experiences, paints a concerning picture for potential traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated and lacks oversight |

| Financial Risk | High | Difficulty in fund withdrawals |

| Operational Risk | Medium | Platform stability issues |

Traders should consider these risks carefully and explore mitigation strategies, such as limiting their investment or seeking regulated alternatives.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Locus raises multiple red flags that suggest it may be a scam. The lack of regulation, transparency, and poor customer feedback all point to significant risks for traders.

If you are considering trading with Locus, it is advisable to reconsider your decision. Instead, look for regulated brokers that offer better trading conditions and customer protection. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment and better overall experiences for their clients.

In summary, Locus is not a safe trading option. It is essential for traders to conduct thorough research and choose brokers that prioritize transparency, regulation, and customer support.

Is LOCUS a scam, or is it legit?

The latest exposure and evaluation content of LOCUS brokers.

LOCUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LOCUS latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.