Funda Markets 2025 Review: Everything You Need to Know

Executive Summary

Funda Markets is an unregulated forex broker that started in 2022. The company offers trading across multiple asset classes including forex, metals, energy, stocks, indices, cryptocurrencies, and commodities. While the broker provides attractive features such as leverage up to 1:500 and supports various trading methods including manual, copy, and algorithmic trading through the cTrader platform, traders should be aware of the inherent risks associated with its unregulated status.

This funda markets review reveals that the broker targets traders with higher risk tolerance who seek diversified asset exposure. With a minimum deposit requirement of just $100, Funda Markets positions itself as accessible to beginners. However, the lack of regulatory oversight raises significant concerns about investor protection. The broker operates under Funda Markets Limited, registered in Saint Vincent and the Grenadines. This location does not provide the same level of regulatory protection as major financial jurisdictions.

Key features include multi-asset trading capabilities, competitive leverage ratios, and support for automated trading strategies. However, user feedback indicates issues with customer support responsiveness and withdrawal processing times. Potential clients should carefully consider these problems before opening an account.

Important Notice

Funda Markets operates as Funda Markets Limited, registered in Saint Vincent and the Grenadines. The company is not regulated by any major financial regulatory authority. This unregulated status means that client funds may not be protected by investor compensation schemes typically available with regulated brokers.

This review is based on publicly available information and user feedback as of 2025. Information may not reflect the complete current state of the broker's services. Potential clients should conduct their own due diligence before making any investment decisions. Trading with unregulated brokers carries additional risks that traders should carefully evaluate.

Rating Framework

Broker Overview

Funda Markets Limited emerged in the forex and CFD trading landscape in 2022 as a relatively new player. The company offers online trading services across various financial instruments. According to available information, the company positions itself as a multi-asset broker focusing on providing flexible trading options for global users. The broker's business model centers on offering access to forex, commodities, and cryptocurrency markets with the goal of serving traders seeking diversified investment opportunities.

Despite its recent establishment, Funda Markets has attempted to stand out by offering high leverage ratios and supporting multiple trading methods. The company operates primarily through digital channels. It targets both novice and experienced traders who are comfortable with higher-risk trading environments.

The broker uses the cTrader platform as its primary trading interface. This platform provides access to multiple asset classes including forex pairs, precious metals, energy commodities, individual stocks, market indices, cryptocurrencies, and various commodities. However, this funda markets review notes that the company operates without oversight from major regulatory authorities. This significantly impacts its credibility and the level of protection available to clients. The absence of regulatory supervision means that standard investor protections and compensation schemes are not available to traders.

Regulatory Status: Funda Markets is registered in Saint Vincent and the Grenadines but operates without regulation from major financial authorities. This creates elevated risk for traders.

Minimum Deposit: The broker requires a minimum deposit of $100, making it accessible to beginning traders and those with limited initial capital.

Available Assets: Trading opportunities span multiple asset classes including major and minor forex pairs, precious metals like gold and silver, energy commodities, individual stocks, market indices, popular cryptocurrencies, and various commodity markets.

Leverage Ratios: Maximum leverage reaches 1:500. This appeals to traders seeking higher position sizes relative to their account balance, though this also amplifies potential losses.

Trading Platform: The broker exclusively uses the cTrader platform, which supports various trading approaches including manual execution, copy trading features, and algorithmic trading capabilities.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs was not detailed in available sources. This may impact traders' ability to accurately assess total trading expenses.

This funda markets review emphasizes that the lack of detailed cost information and regulatory oversight are significant considerations for potential clients evaluating this broker.

Account Conditions Analysis (Score: 6/10)

Funda Markets offers a simplified account structure with a $100 minimum deposit requirement. This makes it relatively accessible to new traders entering the forex market. However, available information does not detail multiple account tiers or specialized features that might cater to different trader segments. This basic approach may appeal to beginners but could limit options for more sophisticated traders seeking premium account benefits.

The low entry threshold demonstrates the broker's intention to attract retail traders, particularly those with limited initial capital. However, the absence of detailed account type information raises questions about whether the broker offers differentiated services for varying client needs. Traditional brokers typically provide multiple account levels with distinct features, spreads, and support levels.

User feedback regarding account conditions appears mixed. Some traders appreciate the low minimum deposit while others express desire for more diverse account options. The simplified structure may benefit traders who prefer straightforward account management, but it may disappoint those seeking more sophisticated account features typically available with established brokers.

The lack of specific information about Islamic accounts, professional trader accounts, or other specialized offerings suggests limited accommodation for diverse trading requirements. This funda markets review finds that while the basic account conditions are accessible, the limited variety may restrict the broker's appeal to a broader trader base.

Funda Markets provides access to the cTrader platform. This platform supports multiple trading strategies including manual execution, copy trading, and algorithmic trading capabilities. This technological foundation offers reasonable functionality for traders seeking diverse execution methods and strategy implementation options.

The broker's asset diversity represents a significant strength. It offers exposure to forex markets, metals, energy commodities, stocks, indices, cryptocurrencies, and other commodities. This comprehensive asset selection allows traders to diversify their portfolios and pursue various market opportunities from a single platform.

However, available information does not detail specific research tools, market analysis resources, or educational materials that might support trader decision-making. The absence of detailed information about analytical tools, economic calendars, market commentary, or educational content represents a notable gap in the broker's resource offering.

User feedback indicates general satisfaction with the platform's user-friendliness. However, some traders express disappointment about the lack of comprehensive educational resources. The algorithmic trading support appeals to more sophisticated traders, but the overall resource package appears limited compared to established brokers who typically offer extensive research and educational materials.

Customer Service Analysis (Score: 4/10)

Customer service represents a significant weakness in Funda Markets' offering, based on available user feedback. Multiple sources indicate that response times are slower than industry standards. This negatively impacts the overall client experience and potentially affects trading outcomes when urgent support is needed.

Available information does not specify the customer service channels offered, operating hours, or language support options. This makes it difficult for potential clients to understand support accessibility. This lack of transparency about customer service capabilities raises concerns about the broker's commitment to client support infrastructure.

User feedback consistently highlights slow response times as a primary concern. Some clients also question the professionalism and expertise of support staff. These service quality issues can significantly impact trader satisfaction, particularly in time-sensitive situations requiring immediate assistance with account or trading issues.

The absence of detailed information about multilingual support, 24/7 availability, or specialized support for different account types suggests limited customer service infrastructure. For traders considering this broker, the customer service limitations represent a significant risk factor that could affect their trading experience and problem resolution capabilities.

Trading Experience Analysis (Score: 6/10)

The trading experience at Funda Markets centers around the cTrader platform. This provides a foundation for various trading activities. User feedback regarding platform stability and performance appears mixed, with some traders reporting satisfactory experiences while others note concerns about reliability during peak trading periods.

Order execution quality information is limited in available sources. There is no specific data about slippage rates, requotes, or execution speeds. This lack of transparency about execution quality makes it difficult for traders to assess whether the broker can provide competitive trading conditions, particularly during volatile market periods.

Platform functionality appears adequate for basic trading needs. It supports manual trading, copy trading, and algorithmic strategies. However, detailed information about advanced features, charting capabilities, or technical analysis tools is not comprehensively documented, limiting traders' ability to evaluate the platform's full capabilities.

Mobile trading experience details are not specified in available information. This is increasingly important for traders who need flexibility to manage positions while away from desktop computers. The absence of mobile platform performance data represents a gap in understanding the complete trading experience.

This funda markets review finds that while the basic trading infrastructure exists, the limited transparency about execution quality and platform performance creates uncertainty about the overall trading experience quality.

Trust and Regulation Analysis (Score: 3/10)

Trust represents the most significant concern with Funda Markets due to its unregulated status. Operating without oversight from major financial regulatory authorities creates substantial risks for client fund protection and dispute resolution. The absence of regulatory supervision means that standard investor protection measures and compensation schemes are not available.

Fund security measures are not detailed in available information. This raises questions about client money segregation, insurance coverage, and protection protocols. Established regulated brokers typically provide clear information about fund protection measures, but such transparency is absent in Funda Markets' case.

Company transparency is limited. There is minimal information available about corporate structure, financial stability, or operational procedures. This lack of transparency contrasts sharply with regulated brokers who must provide detailed disclosures about their operations and financial condition.

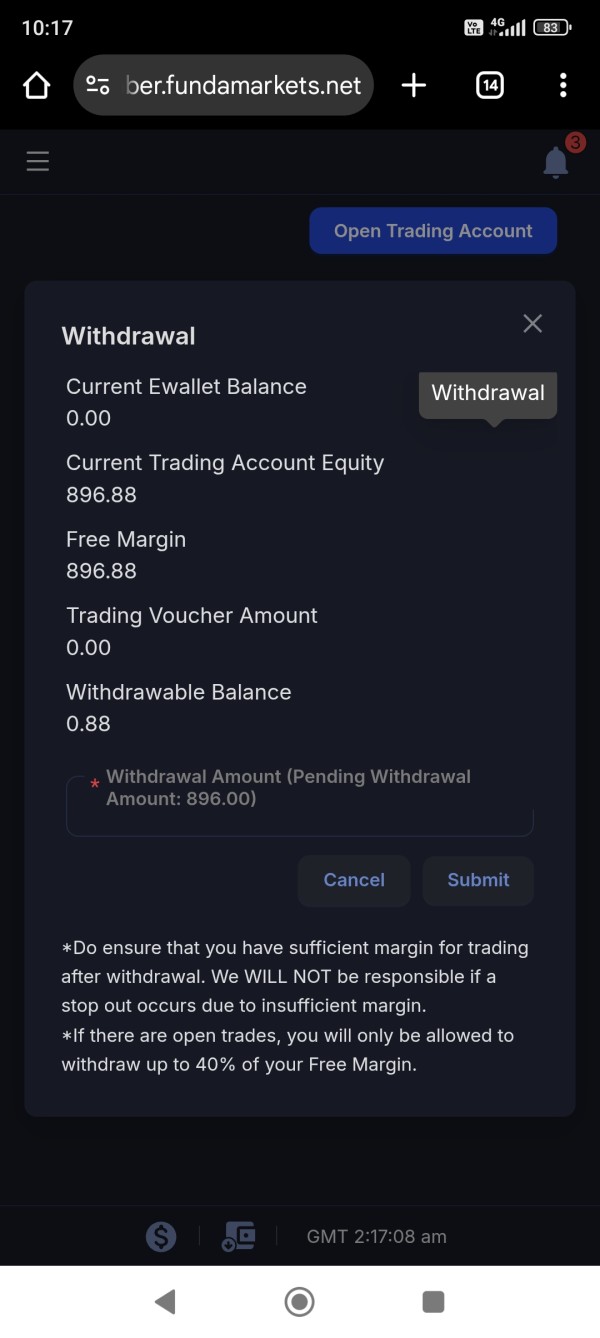

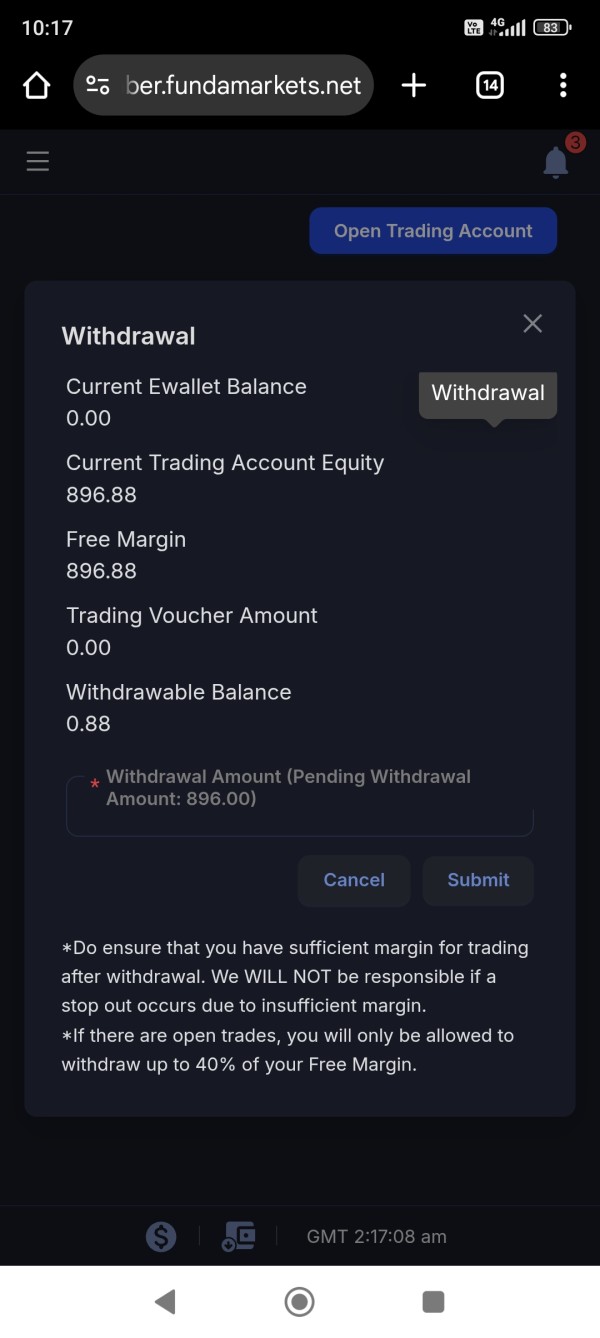

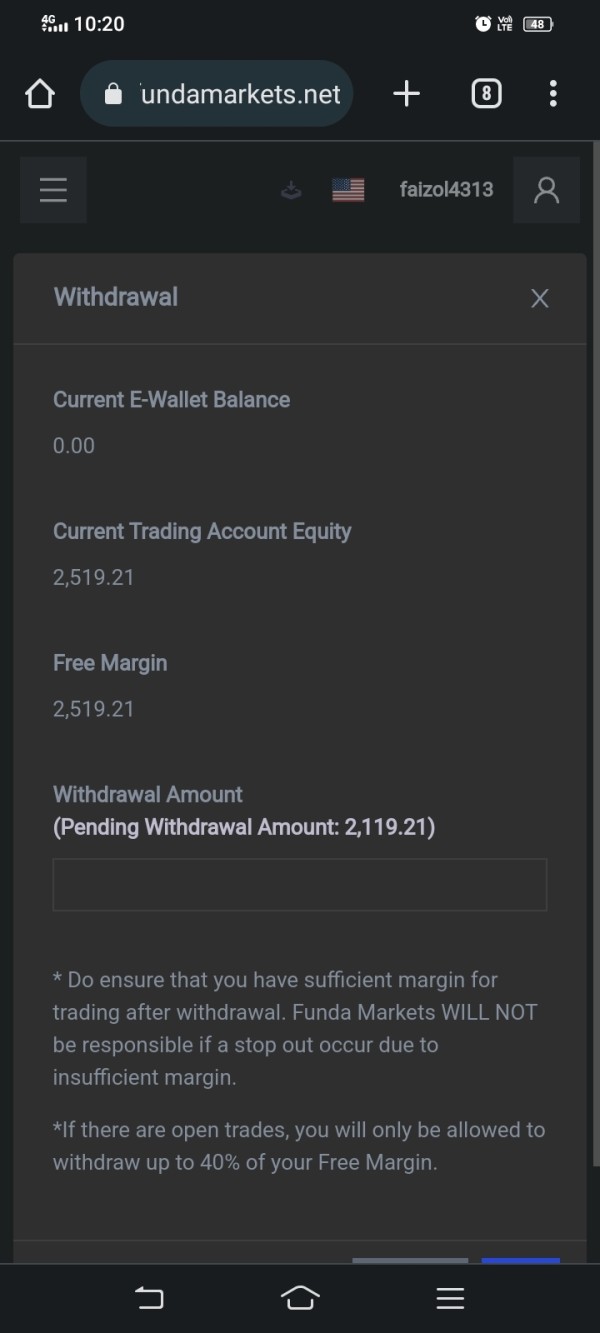

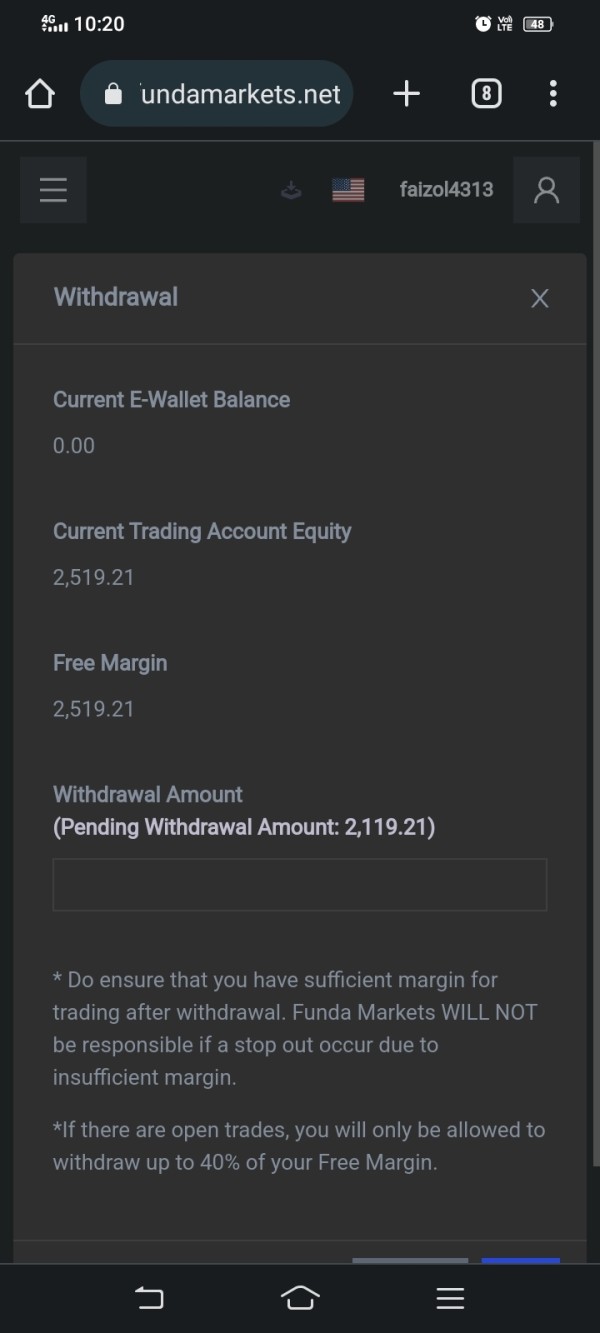

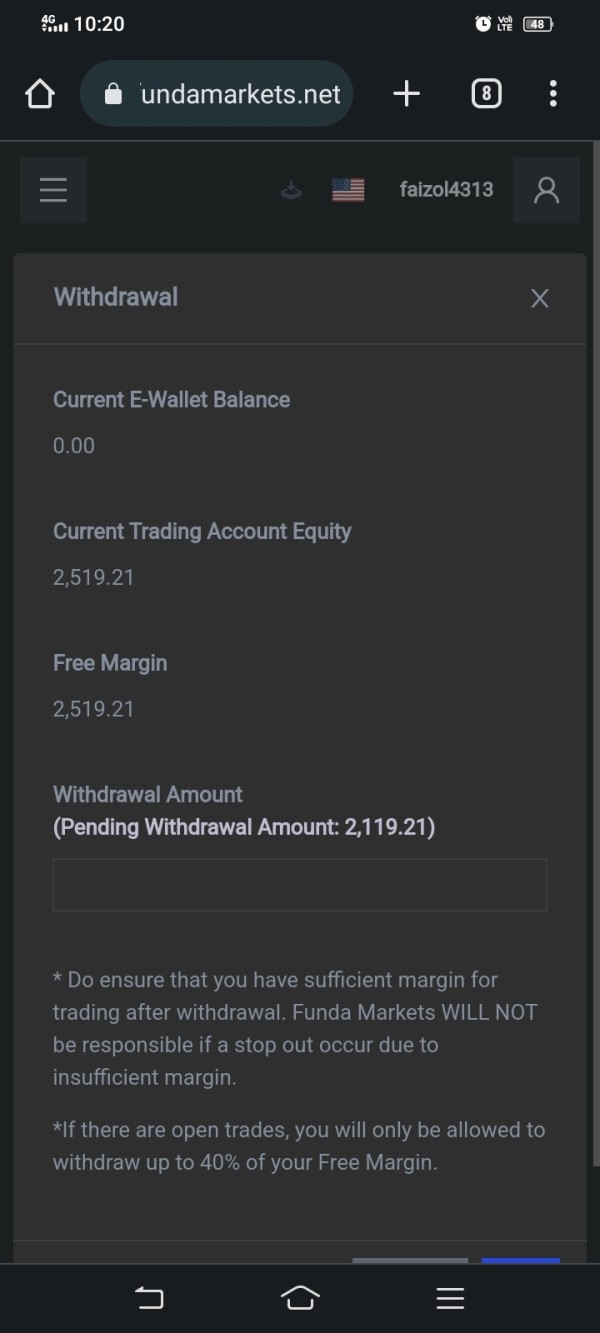

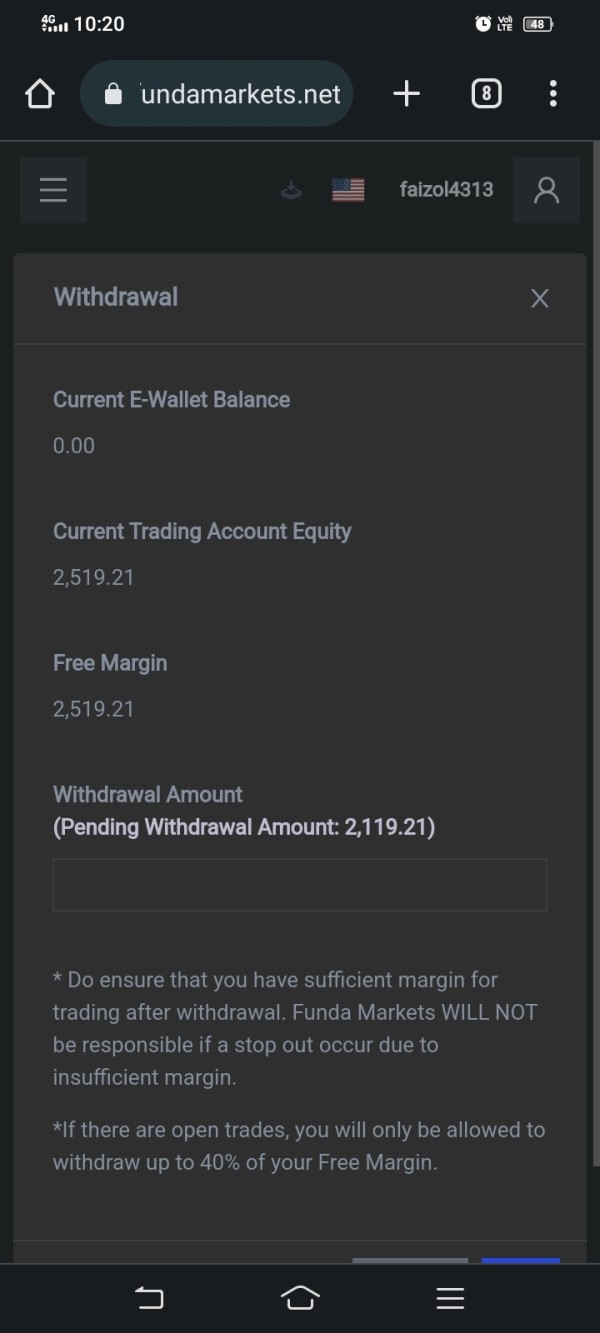

User feedback regarding withdrawal experiences includes reports of slow processing times. This further undermines confidence in the broker's operational reliability. The combination of unregulated status and reported withdrawal issues creates significant trust concerns for potential clients.

Industry recognition or awards are not mentioned in available sources. This suggests limited peer acknowledgment or third-party validation of the broker's services. The absence of regulatory oversight and industry recognition significantly impacts the broker's credibility in the competitive forex market.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Funda Markets appears divided. Feedback ranges from positive comments about platform accessibility to significant concerns about customer service and operational issues. This mixed response suggests inconsistent service delivery that may depend on individual circumstances or account types.

Interface design and usability details are not comprehensively documented. This makes it difficult to assess the overall user experience quality. While some users report satisfaction with platform friendliness, the lack of detailed interface information limits understanding of the complete user journey.

Registration and verification processes are not specifically detailed in available sources. The low minimum deposit suggests a streamlined onboarding approach. However, without clear information about verification requirements and timeframes, potential clients cannot accurately anticipate the account opening experience.

Fund operation experiences represent a significant concern. User reports of slow withdrawal processing affect overall satisfaction. These operational issues can significantly impact trader confidence and practical account management, particularly for active traders who need reliable fund access.

Common user complaints center on slow customer service responses and withdrawal delays. This indicates systemic operational challenges that affect the overall user experience. The broker would benefit from addressing these core operational issues to improve client satisfaction and retention.

Conclusion

Funda Markets presents a mixed proposition in the forex broker landscape. It offers attractive features such as diverse asset classes and high leverage ratios, but carries significant risks due to its unregulated status and operational challenges. While the $100 minimum deposit and cTrader platform access may appeal to some traders, the lack of regulatory oversight creates substantial protection concerns.

This broker may suit experienced traders who can accept the elevated risks associated with unregulated brokers. These traders must prioritize asset diversity and leverage flexibility over regulatory protection. However, the customer service issues and withdrawal delays reported by users suggest operational challenges that could affect trading outcomes.

The primary advantages include multi-asset trading opportunities and competitive leverage ratios. The main disadvantages center on unregulated status, limited customer service quality, and operational reliability concerns. Potential clients should carefully weigh these factors against their risk tolerance and trading requirements before considering this broker for their trading activities.