Atom 2025 Review: Everything You Need to Know

Executive Summary

Atom stands out in the competitive forex brokerage landscape with impressive user satisfaction metrics and a focus on diversified trading opportunities. This atom review reveals that the broker has achieved a remarkable 93% user recommendation rate. It also maintains a strong 4.8 rating on the App Store, demonstrating exceptional user experience quality. The platform caters primarily to small and medium-sized investors seeking diverse investment opportunities across multiple asset classes including forex, commodities, indices, and stocks.

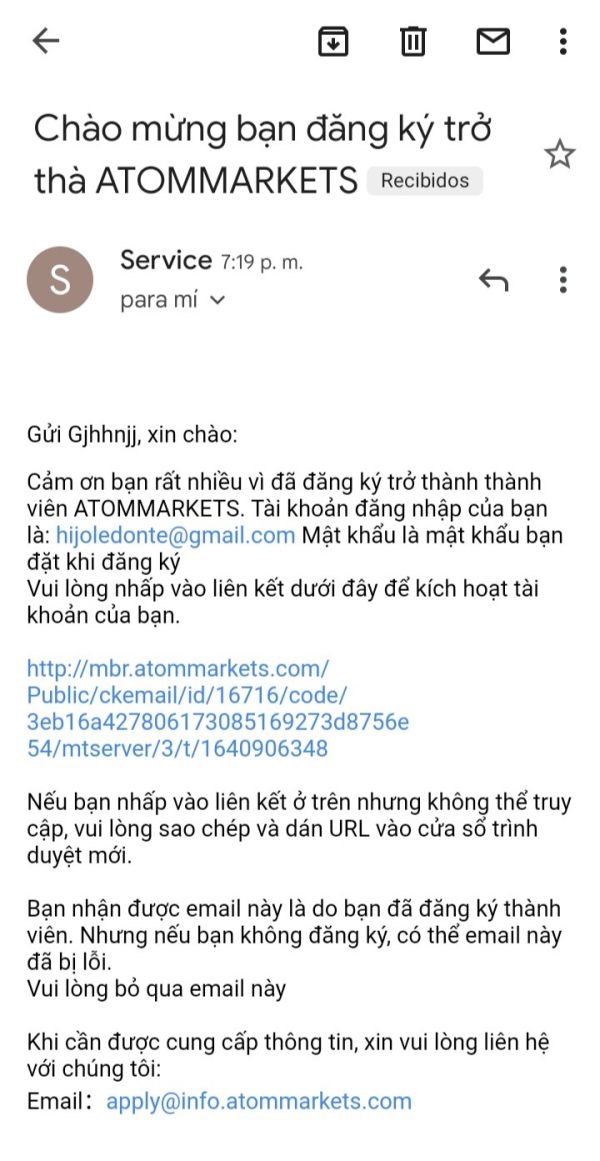

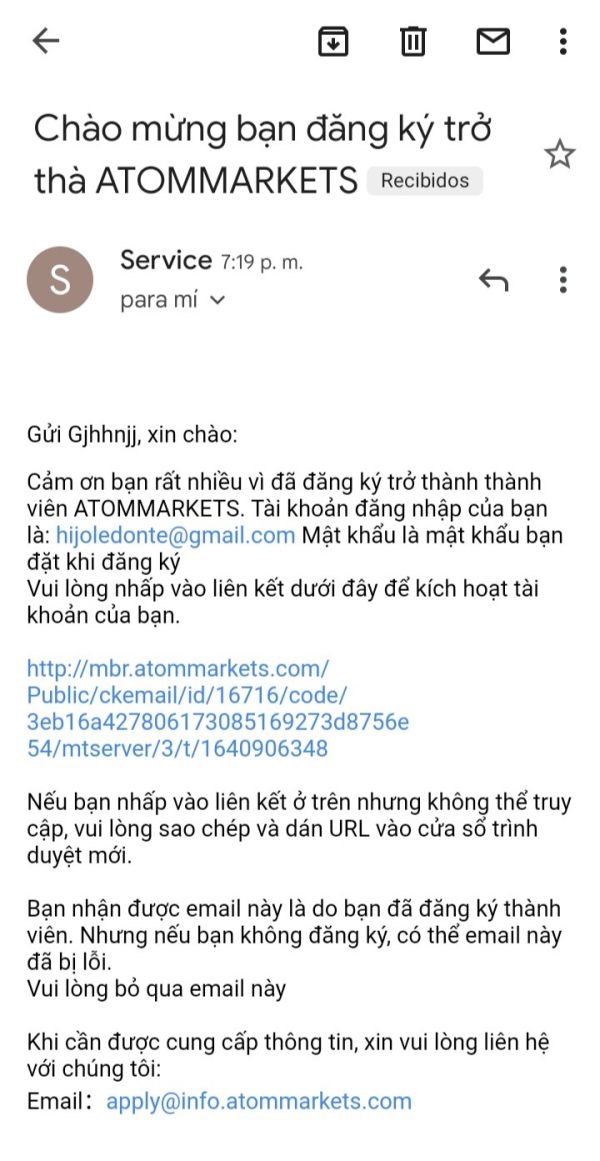

Founded in 2021 and headquartered in Russia, Atom has quickly established itself as a notable player in the online investment services market. The broker's commission structure operates at 20%. However, specific details regarding minimum deposit requirements and comprehensive fee structures remain limited in available documentation. Despite being relatively new to the market, Atom has garnered positive feedback from users. Trustpilot reports 82% positive reviews, indicating strong customer satisfaction across various service aspects.

The platform's appeal lies in its multi-asset approach and user-friendly interface. This makes it particularly suitable for traders looking to diversify their portfolios beyond traditional forex pairs. However, potential users should note that regulatory information and detailed safety measures are not extensively documented in current available materials.

Important Notice

This atom review is based on independent customer satisfaction surveys and user feedback collected in 2025. Readers should be aware that specific regulatory information for different jurisdictions is not comprehensively detailed in current available sources. This may impact trading experiences for users in various regions. The evaluation methodology incorporates user testimonials, platform performance data, and comparative analysis with industry standards.

Due to limited regulatory disclosure in available materials, potential clients are advised to conduct additional due diligence regarding compliance and safety measures specific to their jurisdiction. This review reflects information available at the time of writing. It should be supplemented with direct broker consultation for the most current terms and conditions.

Rating Framework

Broker Overview

Established in 2021, Atom represents a new generation of online investment platforms designed to meet the evolving needs of modern traders. The company operates from its headquarters in Russia. It has rapidly gained traction in the competitive online investment services market. Atom's business model centers on providing comprehensive trading opportunities across multiple asset classes. This positions itself as a one-stop solution for traders seeking diversified investment options.

The broker's approach combines traditional forex trading with broader market access, including commodities, indices, and individual stocks. This multi-asset strategy reflects current market trends where traders increasingly demand access to various financial instruments through a single platform. Atom's proprietary trading platform serves as the primary gateway for client trading activities. It is designed to accommodate both novice and experienced traders.

This atom review indicates that the broker's rapid growth since inception demonstrates strong market acceptance and effective service delivery. The platform's focus on user experience, evidenced by high satisfaction ratings, suggests a customer-centric approach that prioritizes usability and functionality. However, as a relatively new entity in the brokerage space, long-term track record data remains limited compared to more established competitors.

Regulatory Framework: Current available documentation does not provide specific details regarding regulatory oversight or licensing jurisdictions. This represents a significant information gap that potential clients should address through direct broker consultation.

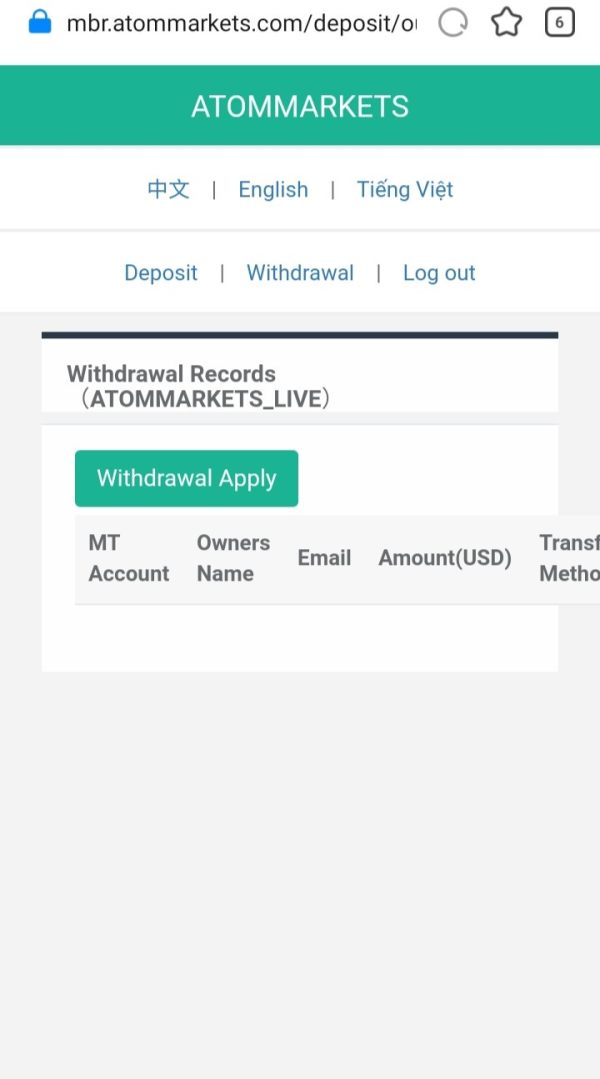

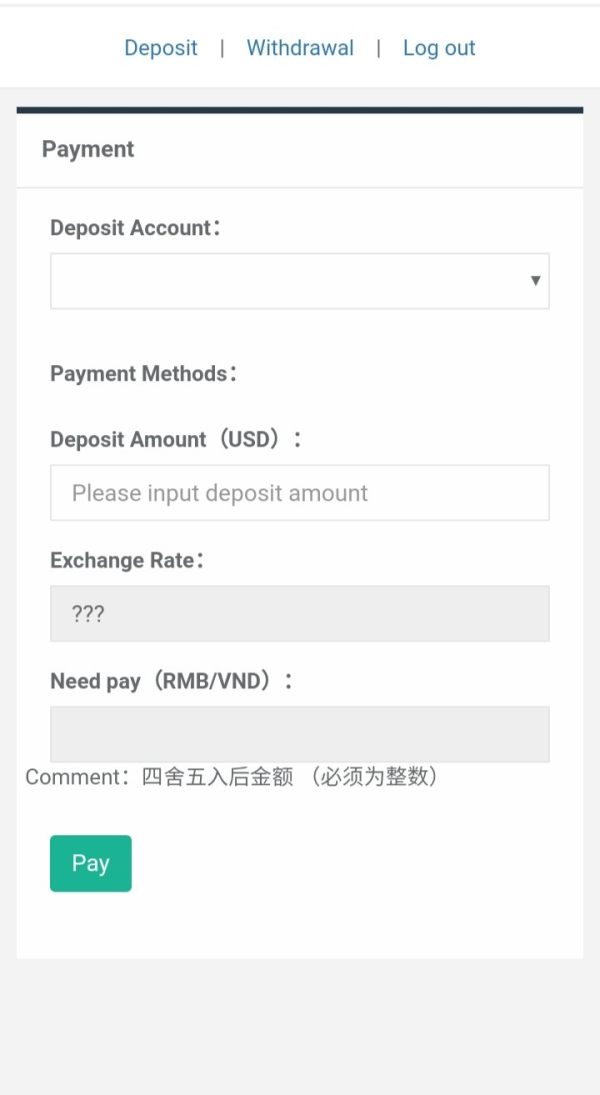

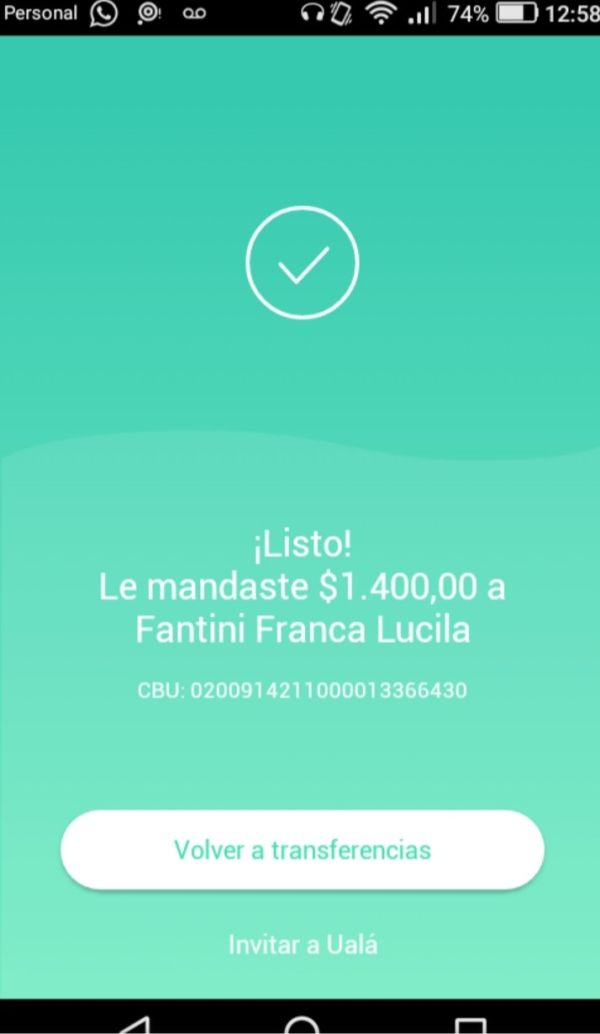

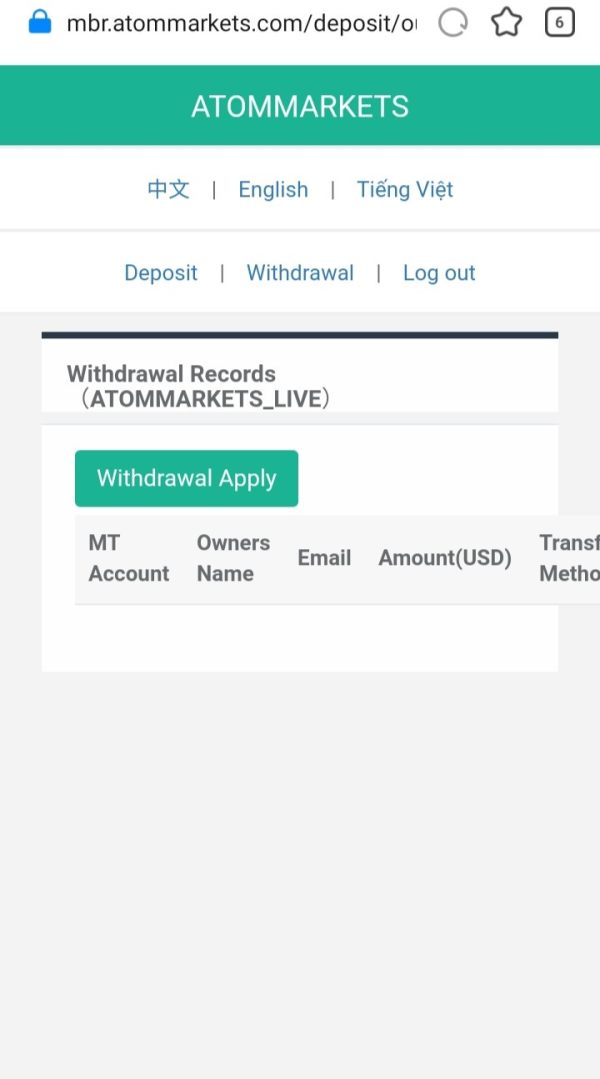

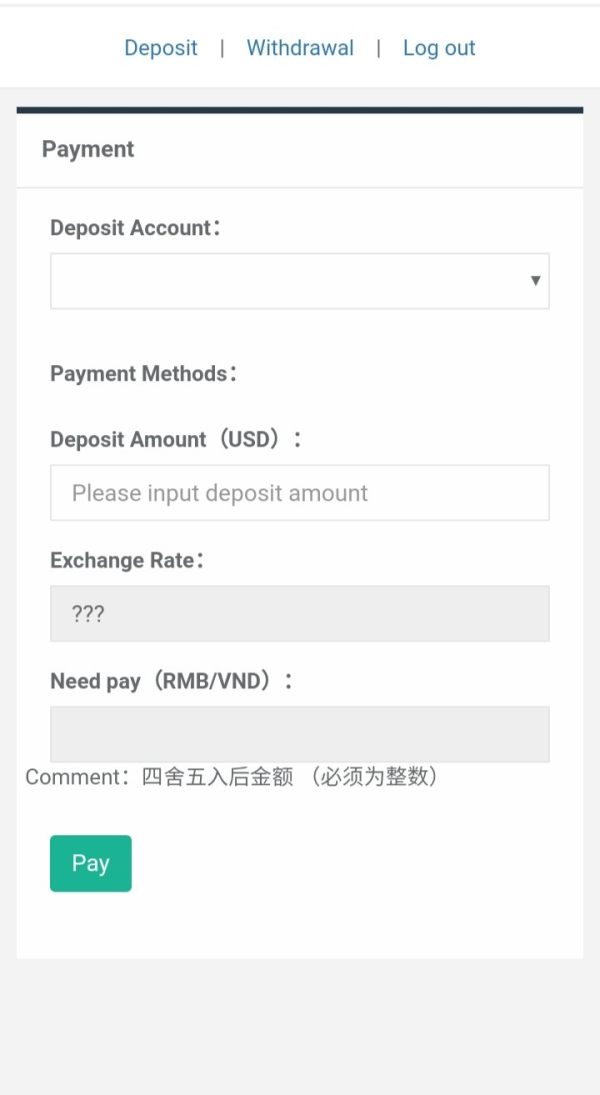

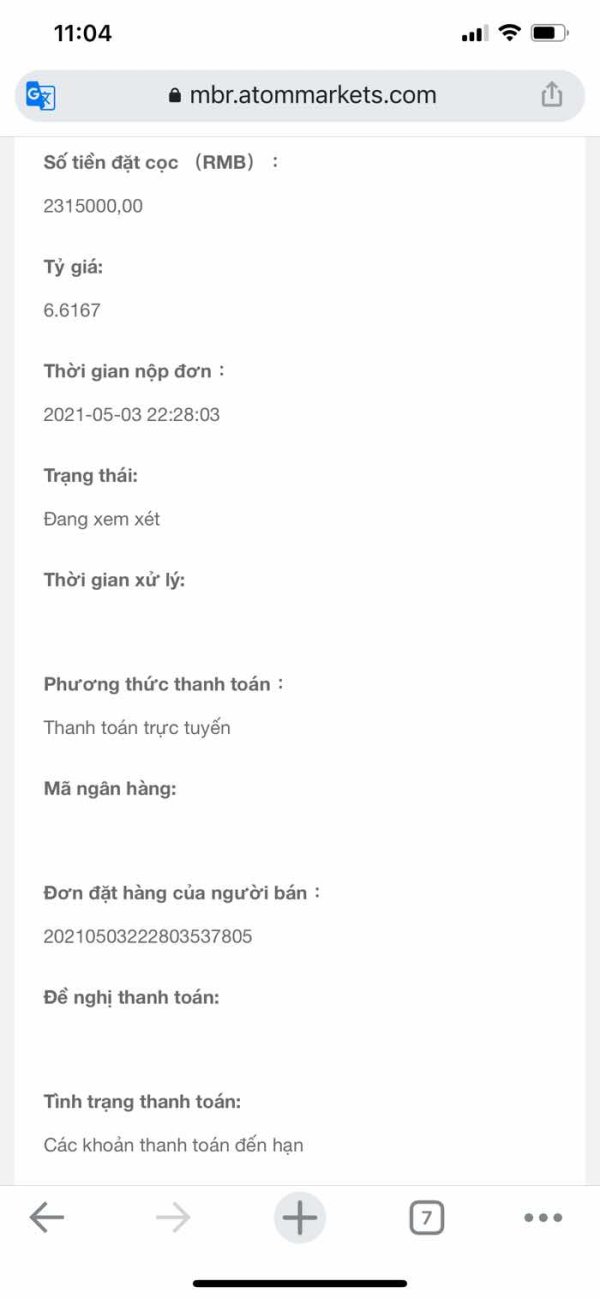

Deposit and Withdrawal Methods: Specific information regarding available funding methods, processing times, and associated fees is not detailed in current available materials.

Minimum Deposit Requirements: The exact minimum deposit amount required to open trading accounts is not specified in available documentation.

Promotional Offers: Details regarding welcome bonuses, promotional campaigns, or loyalty programs are not outlined in current available sources.

Tradeable Assets: Atom provides access to four primary asset categories: foreign exchange pairs, commodities, market indices, and individual stocks. This diversified offering appeals to traders seeking portfolio diversification opportunities.

Cost Structure: The broker operates with a 20% commission structure. However, comprehensive details regarding spreads, overnight fees, and additional charges are not extensively documented in available materials.

Leverage Options: Specific leverage ratios available to different account types and jurisdictions are not detailed in current documentation.

Platform Selection: Atom utilizes its proprietary trading platform as the primary trading interface. Additional platform options are not specified in available materials.

Geographic Restrictions: Information regarding restricted jurisdictions or regional limitations is not provided in current available documentation.

Customer Support Languages: Available customer service languages are not specifically outlined in current materials. This represents another area requiring direct broker clarification.

This atom review highlights the need for potential clients to obtain comprehensive information directly from the broker regarding these essential trading parameters.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for Atom reveals mixed results, primarily due to limited available information regarding specific account structures and requirements. While the broker offers trading access across multiple asset classes, detailed information about account types, their respective features, and minimum funding requirements remains unclear in current documentation.

The 20% commission structure represents a significant component of the overall cost analysis. However, without comprehensive details about spreads, overnight financing, or additional fees, traders cannot fully assess the total cost of trading. This lack of transparency in fee structure impacts the overall account conditions rating. Traders require clear cost information to make informed decisions.

Account opening procedures and verification requirements are not extensively detailed in available materials. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process. Additionally, information regarding special account features such as Islamic accounts, professional trading accounts, or VIP services is not provided in current documentation.

This atom review emphasizes that while user satisfaction remains high, the limited disclosure of account-specific information represents a significant area for improvement. Potential clients should expect to obtain detailed account information through direct broker consultation rather than relying solely on publicly available materials.

Atom's tools and resources offering demonstrates solid capability in providing multi-asset trading opportunities. However, specific details regarding research tools, analytical resources, and educational materials are not comprehensively documented. The platform's strength lies in its ability to provide access to diverse asset classes including forex, commodities, indices, and stocks through a single interface.

The proprietary trading platform appears to be the primary tool for client trading activities. Detailed information about its features, charting capabilities, technical analysis tools, and customization options is not extensively available in current materials. This limits the ability to fully assess the platform's competitive positioning against industry-standard offerings.

Educational resources, market analysis, and research support are crucial components of a comprehensive brokerage offering. Yet specific information about these services is not detailed in available documentation. The absence of information regarding automated trading support, expert advisors, or API access also limits the assessment of the platform's appeal to more advanced traders.

User feedback suggests satisfaction with available tools. However, the lack of detailed information about specific features and capabilities prevents a more comprehensive evaluation of the broker's tools and resources offering.

Customer Service and Support Analysis

Customer service represents one of Atom's strongest performance areas, with user feedback consistently highlighting positive support experiences. The high user satisfaction rates and positive reviews suggest that the broker has implemented effective customer support systems. However, specific details about support channels, availability, and response times are not extensively documented.

The 93% user recommendation rate and positive Trustpilot reviews indicate that clients generally receive satisfactory assistance when needed. Information about specific support channels such as live chat, phone support, email ticketing systems, or callback services is not detailed in current available materials.

Multi-language support capabilities, support desk operating hours, and regional support availability are not specified in current documentation. This represents an information gap that could be important for international clients or those requiring support in specific languages or time zones.

Despite limited specific information about support infrastructure, user feedback consistently indicates positive experiences with customer service interactions. This suggests that Atom has prioritized customer support quality in its service delivery model.

Trading Experience Analysis

The trading experience evaluation shows positive results based on user satisfaction metrics. However, specific technical performance data is not extensively available. High user satisfaction rates suggest that the platform provides a generally positive trading environment. Detailed information about execution quality, platform stability, and order processing is not comprehensively documented.

Platform functionality appears adequate based on user feedback. Specific information about advanced trading features, order types, risk management tools, and platform customization options is not detailed in available materials. The multi-asset approach provides traders with diversification opportunities. This enhances the overall trading experience for those seeking portfolio variety.

Mobile trading capabilities and cross-device synchronization are increasingly important for modern traders. However, specific information about mobile platform features and performance is not extensively documented. The high App Store rating suggests positive mobile user experiences. Detailed feature comparisons are not available.

This atom review indicates that while user satisfaction with trading experiences remains high, the limited availability of technical performance data and specific feature information prevents a more comprehensive assessment of the platform's trading capabilities and competitive positioning.

Trust and Safety Analysis

Trust and safety represent areas of concern primarily due to limited available information regarding regulatory oversight, safety measures, and compliance frameworks. The absence of specific regulatory information in current documentation creates uncertainty about the broker's oversight and compliance status across different jurisdictions.

Fund safety measures, including client fund segregation, deposit protection schemes, and financial reporting transparency, are not detailed in available materials. This lack of information about safety protocols represents a significant concern for potential clients prioritizing fund security and regulatory protection.

Company transparency regarding ownership structure, financial backing, and operational history is limited in current available documentation. For a broker established in 2021, building trust requires clear communication about regulatory compliance, safety measures, and operational transparency.

The absence of information about negative incident handling, dispute resolution procedures, and regulatory compliance history further impacts the trust assessment. While user satisfaction remains high, the limited regulatory and safety information disclosure represents a significant area requiring improvement for enhanced client confidence.

User Experience Analysis

User experience represents Atom's strongest performance area, with exceptional satisfaction metrics including a 93% recommendation rate and 4.8 App Store rating. These metrics indicate that the broker has successfully prioritized user interface design, platform usability, and overall client experience in its service delivery approach.

The high satisfaction rates suggest effective interface design and intuitive navigation. However, specific information about platform aesthetics, customization options, and user interface features is not extensively detailed in available materials. The strong mobile app performance indicates successful cross-platform user experience optimization.

Registration and account verification processes appear to meet user expectations based on satisfaction feedback. Detailed information about onboarding efficiency and verification timelines is not provided in current documentation. The positive user feedback suggests that operational processes are generally smooth and user-friendly.

The broker's appeal to small and medium-sized investors suggests that the platform successfully balances functionality with accessibility. It avoids complexity that might deter less experienced traders while maintaining sufficient capability for more active users.

Conclusion

This atom review reveals a broker with strong user satisfaction metrics but limited transparency in key operational areas. Atom demonstrates exceptional performance in user experience and customer service. This makes it appealing for traders prioritizing platform usability and support quality. The broker's multi-asset approach and high satisfaction rates indicate effective service delivery for its target market of small to medium-sized investors.

However, significant information gaps regarding regulatory oversight, detailed fee structures, and safety measures represent areas of concern that potential clients must address through direct broker consultation. While user feedback remains consistently positive, the limited disclosure of essential trading information impacts overall assessment confidence.

Atom appears most suitable for traders seeking diversified investment opportunities through a user-friendly platform and who prioritize customer service quality. However, clients requiring comprehensive regulatory transparency and detailed cost information may need to seek additional clarification before committing to the platform.