Regarding the legitimacy of ATOM forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is ATOM safe?

Pros

Cons

Is ATOM markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

ATOM MARKETS LTD

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Atom Safe or a Scam?

Introduction

In the ever-evolving landscape of the forex market, Atom has emerged as a noteworthy player, catering to traders seeking a reliable platform for their trading endeavors. As traders navigate through a plethora of options, it becomes imperative to assess the credibility and safety of brokers like Atom. The forex market is fraught with risks, and the potential for scams makes it essential for traders to conduct thorough evaluations before committing their funds. This article aims to investigate whether Atom is a safe platform or a potential scam by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the safety and legitimacy of a forex broker. A well-regulated broker is typically subject to stringent oversight, which provides an additional layer of security for traders. In the case of Atom, it is essential to evaluate its regulatory standing to understand the level of protection afforded to its clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Intelligence Unit (FIU) | FRK 001089 | Estonia | Verified |

Atom operates under the jurisdiction of Estonia and is regulated by the Financial Intelligence Unit (FIU). This regulatory body oversees the operations of cryptocurrency exchanges and brokers, ensuring compliance with anti-money laundering (AML) and know your customer (KYC) regulations. While the FIU provides a level of oversight, it is important to note that the regulatory framework in Estonia may not be as robust as that of other jurisdictions, such as the UK or the US. Therefore, the quality of regulation and historical compliance should be scrutinized further.

Company Background Investigation

Understanding the company behind a trading platform is paramount in assessing its credibility. Atom was established by a group of individuals with a background in the forex industry, aiming to create a user-friendly platform for cryptocurrency trading. Since its inception, Atom has focused on providing a seamless experience for users, emphasizing transparency and accessibility.

The management team comprises professionals with extensive experience in finance, technology, and regulatory compliance. This diverse expertise is crucial for navigating the complexities of the forex market. However, the level of transparency regarding the company's ownership structure and operational practices could be further enhanced. A lack of comprehensive information can raise concerns among potential clients regarding Atom's commitment to ethical practices.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability and overall experience. Atom presents a straightforward fee structure that aims to attract both novice and experienced traders. However, it is essential to dissect these conditions to identify any potential red flags.

| Fee Type | Atom | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Atom's spreads for major currency pairs are reported to be around 1.5 pips, which is slightly higher than the industry average of 1.2 pips. While Atom does not charge a commission per trade, the overall cost structure should be carefully considered, especially for high-frequency traders. Additionally, the variability in overnight interest rates may affect traders' positions, particularly those who hold trades overnight.

Client Fund Security

The safety of client funds is a paramount concern for traders, and Atom appears to prioritize this aspect. The platform employs several security measures to protect users' funds, including the segregation of client accounts and the use of reputable banking institutions for fund management.

Atom also adheres to investor protection regulations, which may include measures such as negative balance protection. However, traders should remain vigilant and inquire about the specifics of these policies, as the effectiveness of such measures can vary. Historical incidents involving fund security should also be examined to gauge Atom's track record in this regard.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability. Reviews of Atom reveal a mixed bag of experiences, with some users praising the platform's ease of use and customer support, while others have raised concerns about withdrawal processes and response times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Customer Support Issues | Medium | Average |

Common complaints include delays in processing withdrawals and difficulties in reaching customer support. These issues can significantly impact a trader's experience and trust in the platform. A closer examination of specific case studies may provide insight into how Atom addresses these concerns and whether they are isolated incidents or indicative of broader systemic issues.

Platform and Trade Execution

The performance of a trading platform is critical for executing trades efficiently. Users report that Atom's platform is generally stable, with a user-friendly interface that caters to both beginners and experienced traders. However, it is essential to assess the quality of order execution, including potential slippage and rejection rates.

Traders have reported minimal instances of slippage, which is a positive sign for those looking to execute trades at specific prices. However, any signs of platform manipulation or irregularities should be investigated thoroughly to maintain transparency and trust.

Risk Assessment

Using Atom as a trading platform involves certain risks that traders should be aware of. A comprehensive risk assessment can help potential users make informed decisions.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight in Estonia |

| Operational Risk | Low | Stable platform performance |

| Financial Risk | Medium | Variable trading costs |

Traders should consider these risks and implement strategies to mitigate them, such as diversifying their trading portfolio and setting strict risk management parameters.

Conclusion and Recommendations

After a thorough investigation, it can be concluded that while Atom demonstrates several positive attributes, including regulatory oversight and a user-friendly platform, there are areas that warrant caution. Traders should be particularly mindful of the mixed customer feedback regarding withdrawal processes and the overall transparency of the company.

In light of these findings, it is advisable for traders to conduct further research and consider their individual trading needs before engaging with Atom. For those seeking alternative options, brokers with stronger regulatory frameworks and proven track records may be more suitable.

In summary, is Atom safe? The answer is nuanced; while it has established itself as a credible platform, potential users should remain vigilant and informed to navigate the complexities of the forex market effectively.

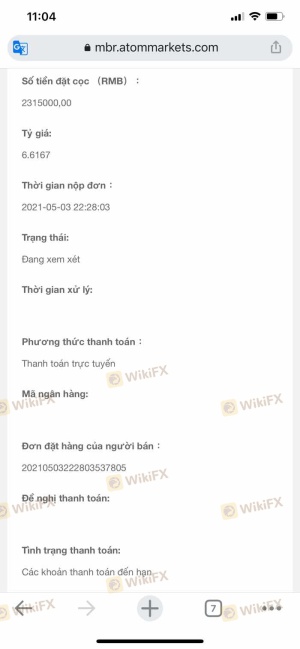

Is ATOM a scam, or is it legit?

The latest exposure and evaluation content of ATOM brokers.

ATOM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ATOM latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.