ARIF HABIB LIMITED Review 1

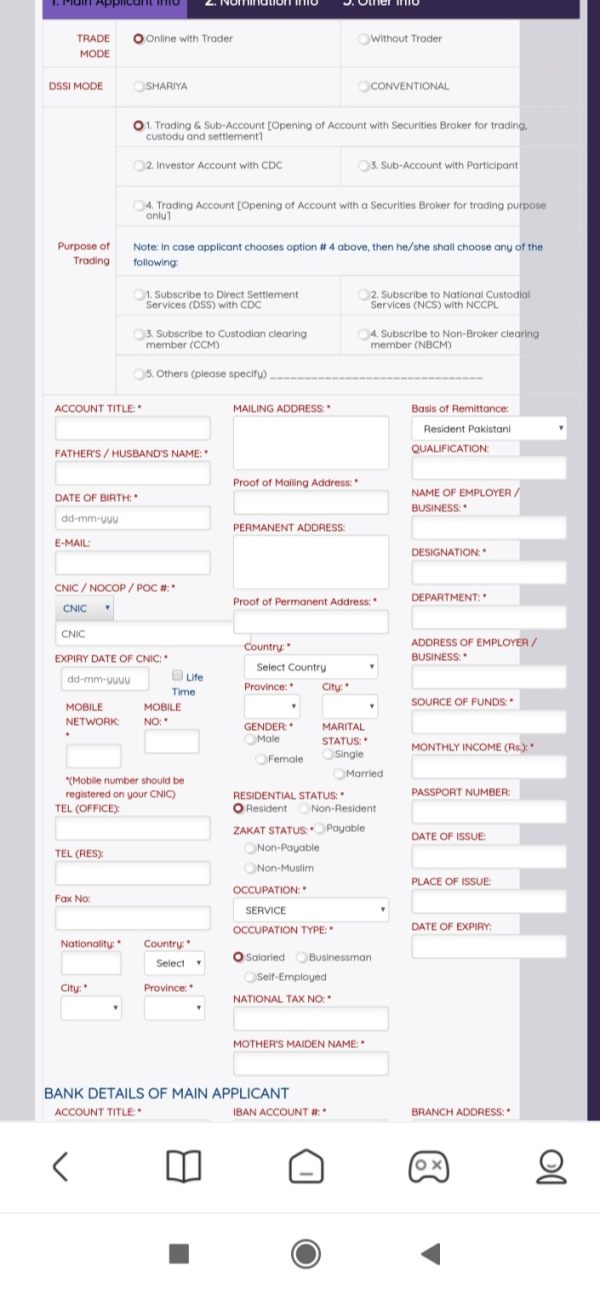

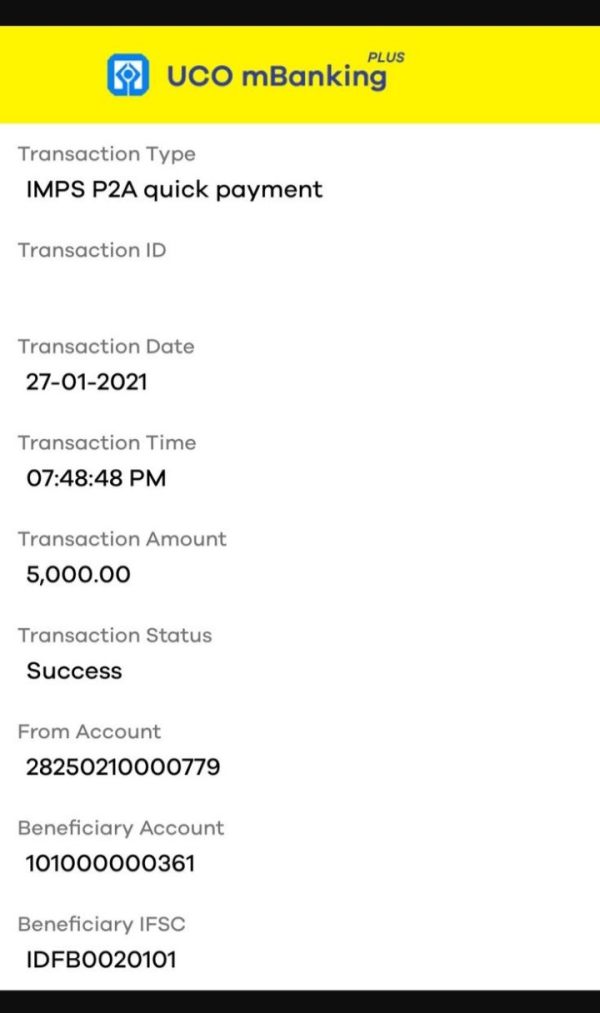

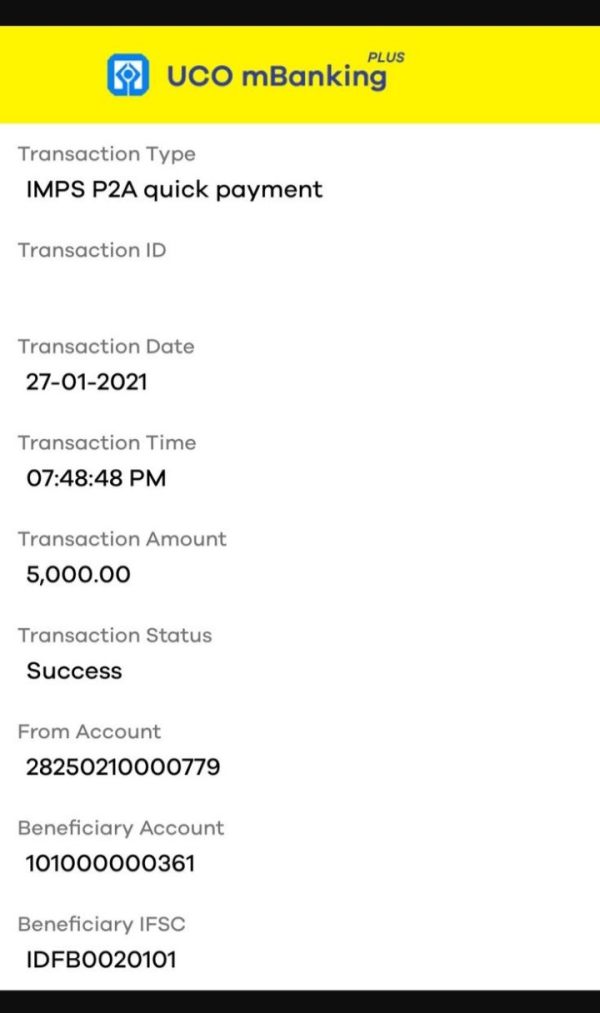

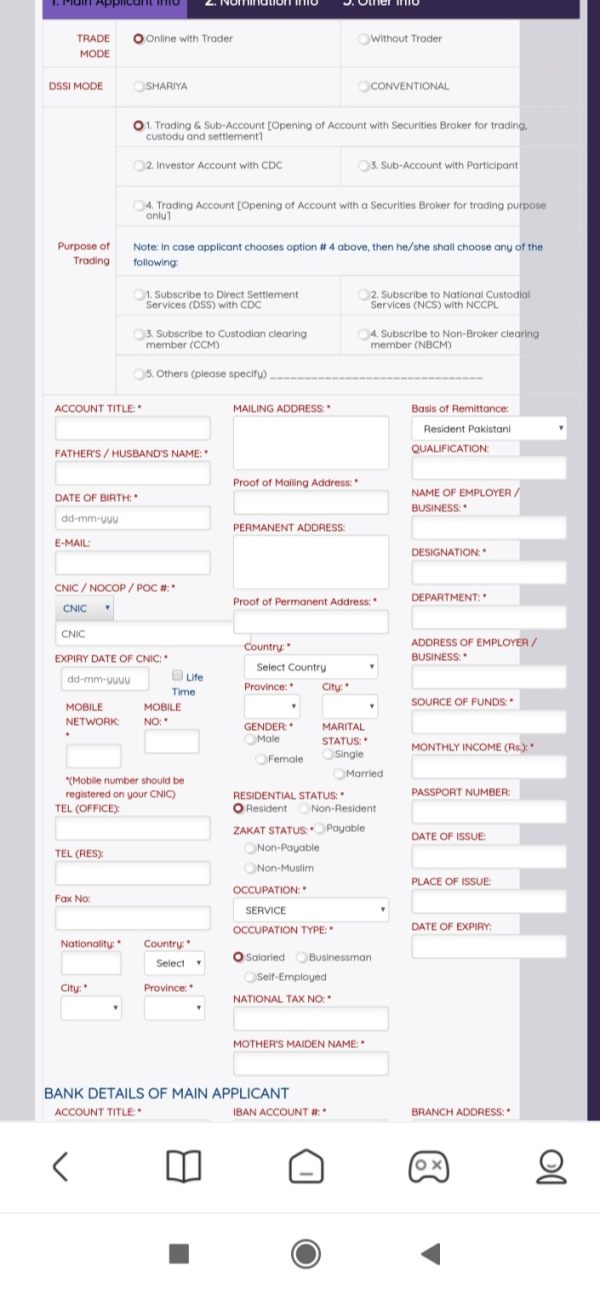

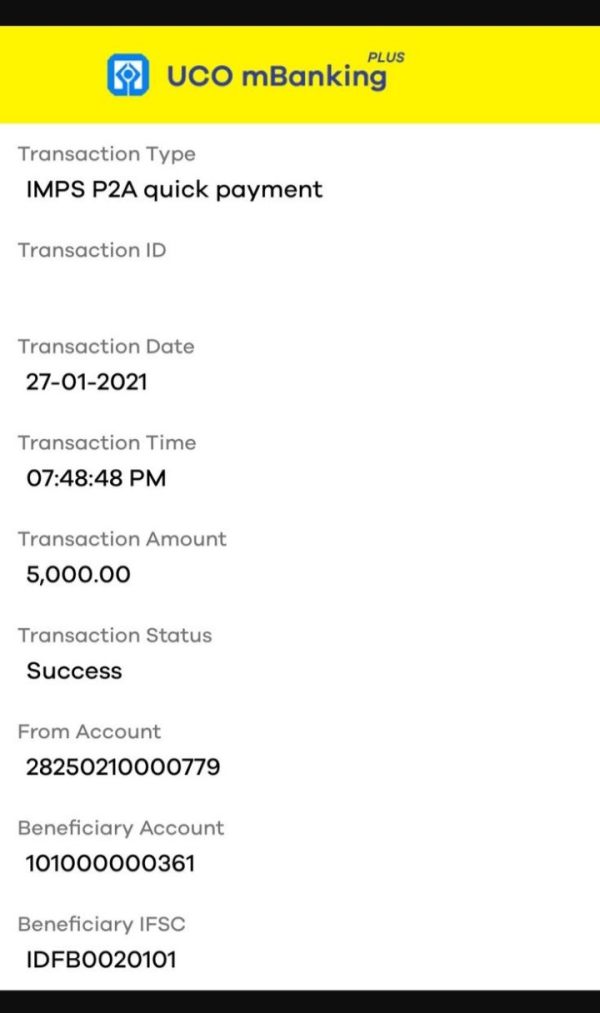

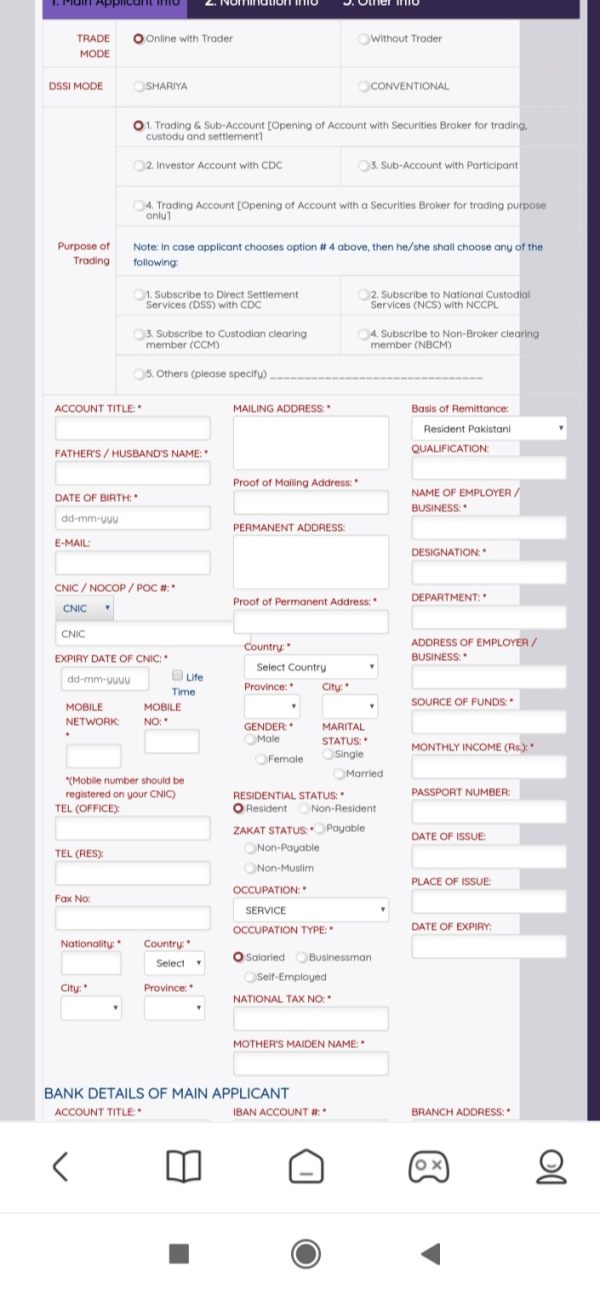

They took $5000 from me and the page asked me to fill the information. I worried about that they might do something to me. Please expose it.

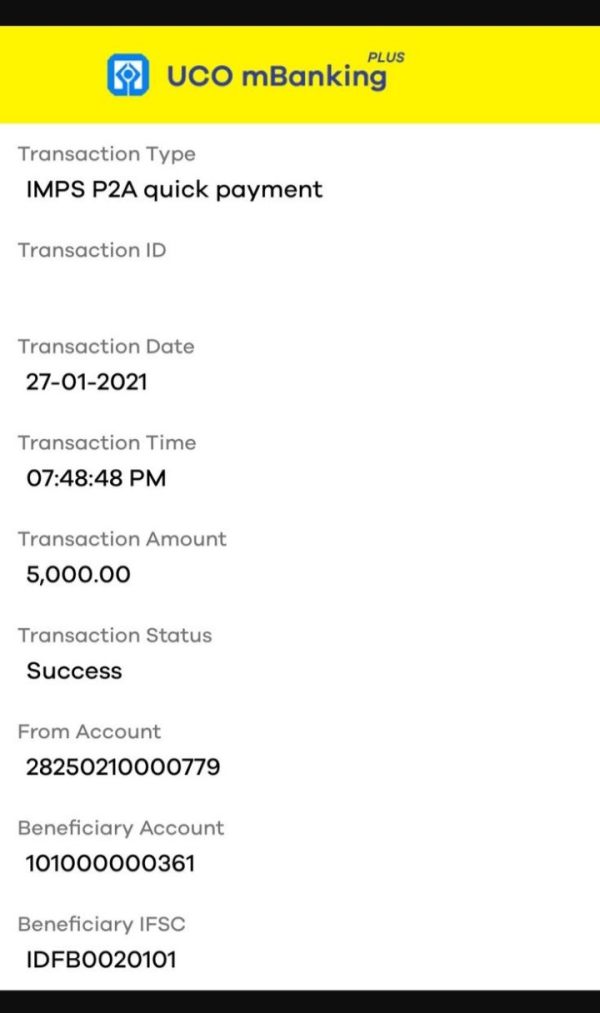

ARIF HABIB LIMITED Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They took $5000 from me and the page asked me to fill the information. I worried about that they might do something to me. Please expose it.

This Arif Habib review examines a financial services firm that has changed a lot since the 2008 financial crisis. Arif Habib Limited works as a top brokerage and financial services company in Pakistan, offering equity trading, investment banking, money market and forex services, commodities trading, and securities research. The firm is part of the larger Arif Habib Group. This group is a diversified business with interests in financial services, fertilizers, cement, steel, renewable energy, and real estate development.

The company has shown amazing strength. It successfully changed from what looked like potential collapse during the 2008 crisis to becoming a leading industrial group with major financial services operations. With over 40 years of experience in broking and investment banking services, AHL keeps an AA- long-term rating and A-1 short-term rating with a stable outlook from JCR-VIS Credit Rating Company. The firm serves institutional, corporate, high net worth, and retail clients through its established brokerage operations. These operations are among the most well-known and trusted in Pakistan's financial market.

This evaluation is based on available information about Arif Habib Limited and the Arif Habib Group's operations mainly within the Pakistani market. Different subsidiaries may operate under different regulatory frameworks and service offerings across different regions and business sectors. This review focuses on the financial services aspects of the organization. It particularly looks at the brokerage and trading operations of Arif Habib Limited.

The assessment method relies on publicly available information, company disclosures, and regulatory filings. Readers should note that specific trading conditions, current fee structures, and detailed service offerings may vary and should be checked directly with the firm for the most up-to-date information.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited public information on account types and minimum requirements |

| Tools and Resources | 7/10 | Established research capabilities and trading infrastructure |

| Customer Service | 6/10 | Dedicated complaint handling system with zero pending complaints |

| Trading Experience | 7/10 | Over 40 years of market experience with institutional focus |

| Trust and Security | 8/10 | Strong regulatory standing with SBP Category A rating |

| User Experience | 6/10 | Limited information on platform interface and user feedback |

Arif Habib Limited represents a major player in Pakistan's financial services sector. Its origins trace back over four decades. The company operates as a subsidiary of Arif Habib Corporation Limited, which holds majority ownership, and has established itself as a premier brokerage firm specializing in equity trading, investment banking, money market operations, forex services, commodities trading, and comprehensive securities research. The firm's business model centers on serving a diverse client base including institutional investors, corporate entities, high net worth individuals, and retail traders.

The broader Arif Habib Group shows remarkable business spirit and has built a diversified portfolio of businesses that contribute significantly to Pakistan's economy. The group's transformation following the 2008 financial crisis shows its ability to adapt and its strategic vision. From facing potential collapse during the crisis, losing billions of rupees, the organization successfully restructured and emerged with a dramatically different identity. It shifted from primarily financial services to becoming one of the country's leading industrial groups while keeping its financial services expertise.

The company's strategic partnerships with leading international and domestic names including Mitsubishi, Metal One, MCB, Fatima Group, and Dolmen show its credibility and market position. This Arif Habib review reveals an organization committed to transformational business projects that fuel societal and economic growth, with consistent faith in Pakistan's growth potential driving its expansion into emerging business areas.

Regulatory Status: Arif Habib Limited operates under Pakistani financial regulations with an SBP Category A rating. This indicates strong regulatory compliance and financial standing. The firm holds necessary licenses for its brokerage and financial services operations within Pakistan's regulatory framework.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available public documentation. However, as a regulated Pakistani brokerage firm, standard banking transfer methods and local payment systems would typically be supported.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in publicly available information. These would need to be confirmed directly with the firm based on account type and client classification.

Promotional Offers: Current promotional offers and bonus structures are not detailed in available documentation. This suggests the firm may focus more on service quality and established relationships rather than promotional incentives.

Available Assets: The firm provides access to equity trading, money market instruments, forex markets, and commodities trading. It offers a comprehensive range of financial instruments for Pakistani and international markets accessible through Pakistani brokers.

Cost Structure: Specific fee structures, spreads, and commission rates are not publicly disclosed in available documentation. This is common for institutional-focused brokers that may offer customized pricing based on client volume and type.

Leverage Options: Leverage ratios and margin requirements are not specified in available public information. These would be subject to Pakistani regulatory limits and firm-specific risk management policies.

Platform Options: While specific trading platform details are not extensively documented, the firm's long-standing operations suggest established trading infrastructure supporting its diverse client base and service offerings.

This Arif Habib review indicates that detailed trading specifications would require direct consultation with the firm to obtain current and accurate information tailored to specific client needs.

The account conditions at Arif Habib Limited reflect the firm's focus on serving institutional, corporate, high net worth, and retail clients through its established brokerage operations. While specific details about account types and minimum deposit requirements are not extensively documented in public materials, the firm's 40-year track record and regulatory standing suggest structured account offerings tailored to different client segments.

The company's approach appears to emphasize relationship-based service delivery rather than standardized retail account packages. This is evidenced by their institutional focus and the presence of dedicated sales teams, including specialized international equity sales and trading desks. The firm's SBP Category A rating and AA- credit rating indicate strong financial backing for client accounts and operations.

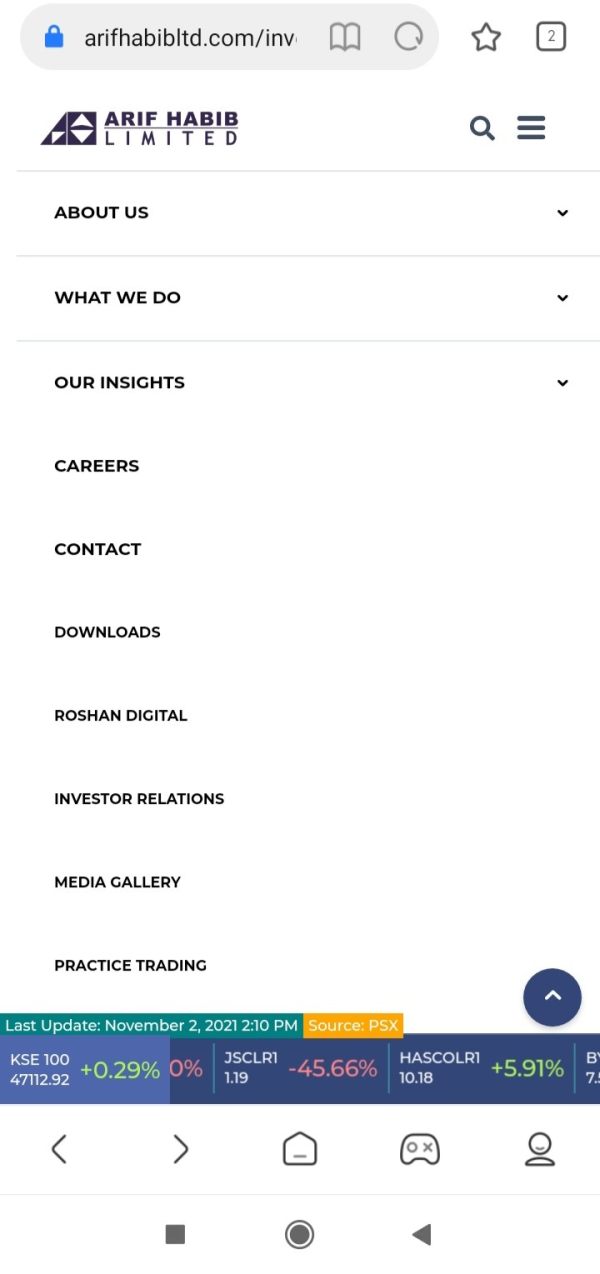

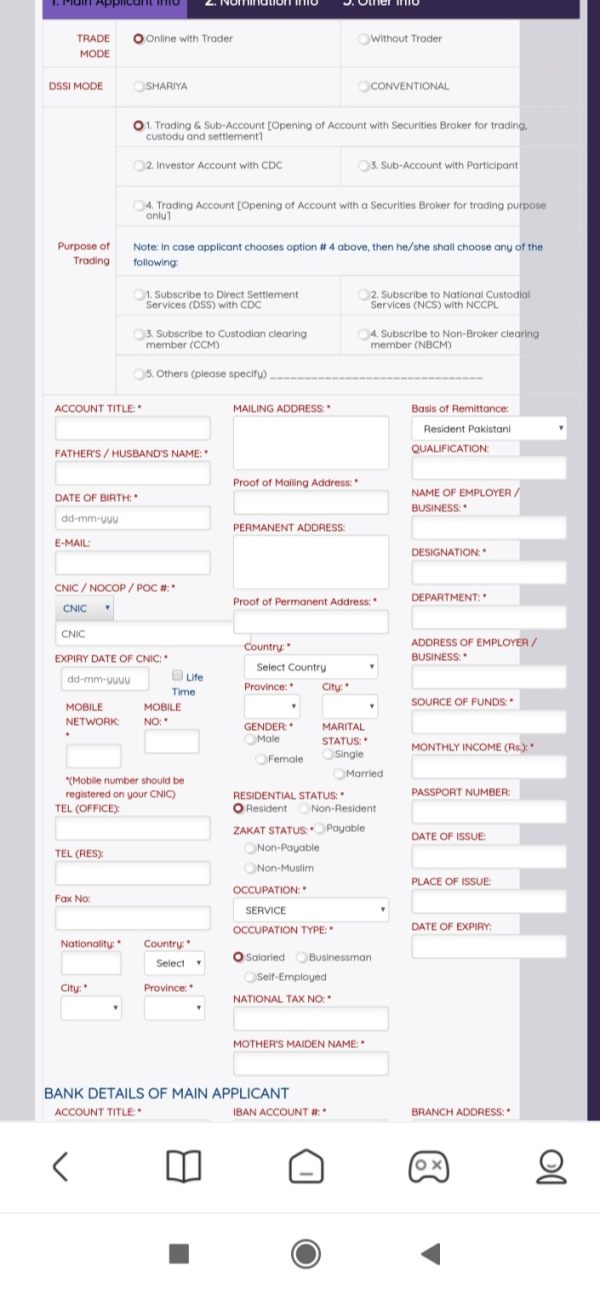

Account opening procedures would likely follow Pakistani regulatory requirements for know-your-customer and anti-money laundering compliance. The absence of pending investor complaints against the firm, as reported in regulatory filings, suggests efficient account management and client service processes. However, prospective clients would need to contact the firm directly for specific information about account types, minimum requirements, and available features.

This Arif Habib review finds that while the fundamental infrastructure for quality account services appears solid, more transparency regarding account specifications would benefit potential clients in their decision-making process.

Arif Habib Limited's tools and resources portfolio centers on securities research and comprehensive financial market analysis capabilities. The firm's established position in investment banking and brokerage services suggests access to professional-grade research tools and market analysis resources that support both institutional and individual client decision-making.

The company's research capabilities are supported by experienced professionals, including specialized teams for international equity sales and trading. With over 15 years of buy-side and sell-side experience among key personnel, the firm maintains analytical depth across various market segments. The presence of dedicated research functions indicates ongoing market analysis and investment recommendation services for clients.

The firm's long-standing relationships with major international and domestic partners, including Mitsubishi and Metal One, suggest access to global market insights and research resources. This international connectivity potentially enhances the quality and scope of research materials available to clients.

However, specific details about proprietary research platforms, automated trading tools, educational resources, or retail client research access are not extensively documented in available materials. The institutional focus of the firm suggests that advanced tools and resources may be primarily designed for professional and high-net-worth clients rather than retail traders seeking comprehensive educational materials or automated trading solutions.

Arif Habib Limited demonstrates a structured approach to customer service and support, as evidenced by their formal complaint handling system and regulatory compliance record. The firm maintains zero pending investor complaints according to regulatory filings, indicating effective resolution of client issues and concerns. This track record suggests robust customer service processes and timely response to client needs.

The company has established designated contact persons for handling investor complaints and grievances, showing organizational commitment to client support infrastructure. The presence of specialized sales teams, including dedicated heads of sales and international sales, indicates personalized service delivery for different client segments.

The firm's customer service approach appears to align with its institutional and high-net-worth client focus, emphasizing relationship management and direct communication channels. With experienced professionals leading client-facing operations, the service quality likely reflects industry expertise and market knowledge.

However, specific information about customer service hours, response time commitments, available communication channels, or multi-language support capabilities is not detailed in available documentation. The firm's established presence and regulatory standing suggest professional service standards, but prospective clients would need to inquire directly about specific service level commitments and support availability.

The trading experience at Arif Habib Limited benefits from over 40 years of market presence and established expertise in Pakistani financial markets. The firm's comprehensive service portfolio spanning equity trading, investment banking, money market and forex operations, and commodities trading indicates deep market infrastructure and execution capabilities.

The company's institutional focus and strong relationships with major market participants suggest robust trading infrastructure capable of handling significant transaction volumes. The presence of experienced trading professionals, including international equity sales and trading desk personnel with extensive buy-side and sell-side experience, indicates sophisticated execution capabilities and market knowledge.

The firm's transformation and survival through the 2008 financial crisis demonstrates operational resilience and adaptability in challenging market conditions. This experience likely contributes to risk management expertise and crisis handling capabilities that benefit client trading experiences.

However, specific information about trading platform features, execution speeds, order types, mobile trading capabilities, or real-time market data access is not extensively documented. The institutional nature of the firm suggests professional-grade trading infrastructure, but retail clients would need to evaluate platform usability and features based on direct experience or consultation with the firm.

This Arif Habib review indicates that while the fundamental trading expertise and market access appear strong, more detailed information about platform specifications and user experience would help potential clients assess suitability for their trading needs.

Arif Habib Limited demonstrates strong trust and security credentials through its regulatory compliance and financial ratings. The firm holds an SBP Category A rating, indicating high regulatory standing with Pakistan's central bank. Additionally, the AA- long-term rating and A-1 short-term rating with stable outlook from JCR-VIS Credit Rating Company reflect strong financial stability and creditworthiness.

The company's regulatory record shows zero pending investor complaints and no penal actions taken by exchanges or the Securities and Exchange Commission of Pakistan. This indicates clean compliance history and adherence to regulatory standards. This track record suggests effective internal controls and risk management systems that protect client interests.

The firm's ownership structure, with majority control by Arif Habib Corporation Limited, provides corporate stability and clear accountability. The group's diversified business portfolio across multiple industries offers additional financial stability and reduces concentration risk that might affect client funds or operations.

The company's survival and successful transformation through the 2008 financial crisis demonstrates operational resilience and management capability in challenging conditions. The firm's established partnerships with reputable international and domestic organizations further validate its market credibility and operational standards.

However, specific information about client fund segregation, insurance coverage, cybersecurity measures, or data protection protocols is not detailed in available public documentation. While the regulatory framework and ratings suggest appropriate security measures, prospective clients may wish to inquire about specific fund protection and security protocols directly with the firm.

The user experience at Arif Habib Limited appears designed primarily for institutional and professional clients, reflecting the firm's market positioning and service focus. The company's 40-year track record and zero pending complaints suggest effective client relationship management and satisfaction with service delivery among its target client base.

The firm's organizational structure, including dedicated sales teams and specialized personnel for different market segments, indicates personalized service delivery rather than standardized retail platform experiences. This approach likely benefits clients seeking customized solutions and direct professional relationships but may be less suitable for self-directed retail traders expecting standardized online platforms.

The company's established market presence and strong financial ratings suggest reliable service delivery and operational stability that contribute positively to client experience. The firm's successful navigation of market challenges, including the 2008 crisis, demonstrates operational continuity that benefits long-term client relationships.

However, specific information about platform interface design, account opening procedures, funding processes, mobile application availability, or user interface features is not extensively documented. The institutional focus suggests that user experience priorities may emphasize professional functionality and relationship management over retail-oriented platform features and self-service capabilities.

Prospective clients, particularly retail traders, would benefit from direct consultation or platform demonstration to assess whether the firm's user experience approach aligns with their expectations and trading style preferences.

This Arif Habib review reveals a well-established financial services firm with strong regulatory credentials and significant market experience. The company's 40-year track record, combined with its successful transformation following the 2008 crisis, demonstrates operational resilience and adaptability. With SBP Category A rating and strong credit ratings, Arif Habib Limited offers institutional-quality services backed by solid financial foundations.

The firm appears best suited for institutional investors, corporate clients, and high-net-worth individuals seeking personalized financial services and professional relationship management. The company's comprehensive service portfolio spanning equity trading, investment banking, and research capabilities provides substantial value for clients requiring sophisticated financial solutions.

However, retail traders seeking transparent pricing, detailed platform specifications, and self-service trading capabilities may find limited public information about specific trading conditions and user experience features. The firm's institutional focus, while representing a strength for professional clients, may present barriers for retail participants expecting standardized online brokerage experiences and comprehensive educational resources.

FX Broker Capital Trading Markets Review