Regarding the legitimacy of Trading Pro forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is Trading Pro safe?

Pros

Cons

Is Trading Pro markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADINGPRO INTERNATIONAL (PTY) LTD

Effective Date: Change Record

2019-02-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

OFFICE 106 1ST FLOOR PHAROS HOUSE70 BUCKINGHAM TERRACEWESTVILLE3630Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Trading Pro A Scam?

Introduction

Trading Pro has emerged as a notable player in the online forex trading landscape since its inception in 2017. Operating from St. Vincent and the Grenadines, this broker claims to provide a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies. With the allure of high leverage and low minimum deposits, it attracts both novice and experienced traders alike. However, as with any financial service, the need for caution is paramount. Traders must thoroughly evaluate the credibility of brokers before committing their funds, as the financial market is rife with potential pitfalls. This article aims to provide an objective analysis of Trading Pro, utilizing a comprehensive framework that includes regulatory compliance, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical indicator of a broker's legitimacy. Trading Pro operates under the auspices of several regulatory bodies, including the Financial Sector Conduct Authority (FSCA) in South Africa and the St. Vincent and the Grenadines Financial Services Authority. While regulation is a positive aspect, it is essential to scrutinize the quality of oversight provided by these authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 49624 | South Africa | Verified |

| SVG FSA | 24611 | St. Vincent | Verified |

The FSCA is known for its relatively stringent regulatory framework, focusing on protecting consumer interests and ensuring fair trading practices. However, it is important to note that the regulatory standards in St. Vincent and the Grenadines are often considered less rigorous compared to tier-one regulators such as the Australian Securities and Investments Commission (ASIC) or the UK Financial Conduct Authority (FCA). This disparity raises questions about the level of investor protection available to clients of Trading Pro. Historical compliance data indicates that while there have been no major regulatory breaches reported against Trading Pro, the lack of a robust regulatory framework in its primary operating region could pose risks to traders.

Company Background Investigation

Trading Pro International Ltd. was established in 2017 and is registered in St. Vincent and the Grenadines, with an additional entity, Trading Pro International (Pty) Ltd., registered in South Africa. The company's ownership structure and management team are crucial to understanding its operational integrity. While specific details about the management team are sparse, the company claims to prioritize transparency and trust.

The broker's website offers limited information regarding its history and ownership, which could be a red flag for potential investors. A transparent broker typically provides detailed insights into its management and operational practices. The absence of such information may lead to concerns about the company's reliability and commitment to ethical trading practices. Furthermore, the lack of awards or recognitions from reputable financial institutions may indicate a relatively low profile within the competitive trading industry.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. Trading Pro offers a variety of account types with different fee structures. The broker's overall fee structure appears competitive, but it is essential to identify any unusual or problematic policies.

| Fee Type | Trading Pro | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per lot (for some accounts) | $5 per lot |

| Overnight Interest Range | Varies by account | Varies by broker |

The spreads offered by Trading Pro are notably low, starting from 0.0 pips for certain account types. However, the commission structure may vary, with some accounts incurring a $3 charge per lot. This fee is competitive but may be higher for other brokers that offer commission-free trading. Additionally, the absence of clear information regarding overnight interest rates could be a concern for traders who hold positions for extended periods.

Client Funds Security

The safety of client funds is paramount in the forex trading environment. Trading Pro claims to implement several security measures, including fund segregation and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security.

However, the broker's website lacks comprehensive details about its fund protection policies, which raises questions about the robustness of its security measures. The absence of a compensation scheme, which is commonly offered by more reputable brokers, could leave clients vulnerable in the event of insolvency. Historical data does not indicate any significant security breaches or fund misappropriation, but the lack of transparency in this area is concerning.

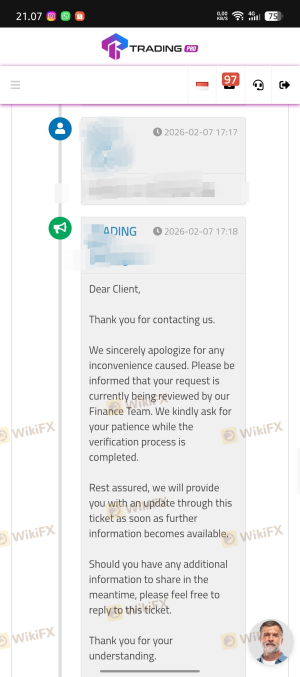

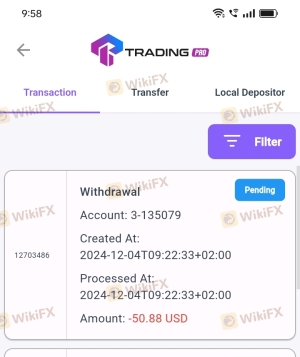

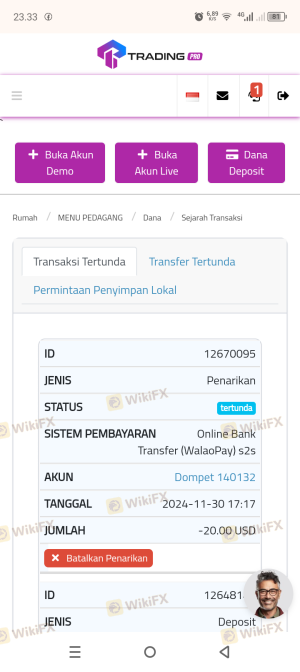

Customer Experience and Complaints

Customer feedback serves as a valuable resource for assessing a broker's reliability. Reviews of Trading Pro reveal a mixed bag of experiences, with some users praising its low fees and responsive customer service, while others express frustration over withdrawal issues and platform stability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Stability Issues | Medium | Addressed slowly |

Common complaints include difficulties in withdrawing funds and issues with platform performance, particularly during high volatility periods. Some users have reported that their withdrawal requests were delayed or denied without adequate explanations. In contrast, the broker's customer service has received positive feedback for its responsiveness, although the quality of the responses can vary.

Platform and Trade Execution

The trading platforms offered by Trading Pro, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are well-regarded in the industry for their reliability and extensive features. However, the performance of these platforms is critical to the trading experience. Users have reported occasional glitches and execution delays, particularly during high-impact news events.

The broker's order execution quality is generally satisfactory, but instances of slippage have been noted, which can impact trading outcomes. Traders should be aware of the potential for slippage, especially when utilizing high leverage.

Risk Assessment

Using Trading Pro involves several risks that traders should consider. The regulatory environment, the company's operational transparency, and customer feedback all contribute to the overall risk profile of this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operates under weaker regulations in some regions. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals. |

| Platform Stability Risk | Medium | Occasional glitches and execution delays. |

To mitigate these risks, traders are advised to conduct thorough due diligence, utilize risk management tools, and avoid committing significant funds until they are comfortable with the broker's reliability.

Conclusion and Recommendations

In conclusion, while Trading Pro presents itself as a competitive option for forex trading, several factors warrant caution. The broker is regulated, but the quality of oversight may not be as robust as that offered by tier-one regulators. Additionally, customer feedback indicates potential issues with fund withdrawals and platform performance.

For traders seeking a reliable broker, it is crucial to weigh the benefits against the risks. Those who prioritize stringent regulatory oversight and robust customer support may wish to consider alternative brokers with a proven track record. Recommended alternatives include brokers regulated by ASIC or FCA, which typically offer higher levels of investor protection and more transparent operational practices.

Ultimately, traders should exercise caution, conduct thorough research, and prioritize their financial security when choosing a broker like Trading Pro.

Is Trading Pro a scam, or is it legit?

The latest exposure and evaluation content of Trading Pro brokers.

Trading Pro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trading Pro latest industry rating score is 2.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.